Ethereum In 2021 Vs. 2024: Fractal Suggests Major Breakout In Q4

19 Settembre 2024 - 2:00AM

NEWSBTC

Recent Ethereum price action saw ETH reaching another low of $2,150

on September 6, raising concerns of a more severe drop towards the

$2,000 price level. Although these concerns were eased with a

subsequent bounce to $2,460 on September 13, Ethereum remains

largely in a downtrend, with a triple-bottom price formation now

shaping up. Interestingly, this triple bottom formation is not new

for Ethereum. As technical analysis points out, the current price

action seems to repeat a similar playout in mid-2021.

Ethereum Fractal Suggests Rally In Q4 According to a technical

analysis by crypto analyst CryptoBullet on social media platform X,

Ethereum is shaping up to form a triple bottom price formation on

the 1D candlestick time frame. While the third bottom has yet to be

fully completed, the analyst draws attention to a similar pattern

that unfolded between June and August 2021. Related Reading:

Analyst Identifies $0.75 As Most Crucial Target For XRP Price In

The Campaign For $1 During those three months, Ethereum’s price

fluctuated up and down to create three distinct lows just above the

$1,675 mark. After the third low was established, Ethereum

experienced a significant bullish rally that propelled it to break

through and establish its current all-time high. This upward

movement became even more pronounced after a fractal pattern

emerged in August 2021, signaling a strong momentum shift. Recent

market dynamics have prompted Ethereum to create two bottoms of

around $2,150 in August and September. Interestingly, a recent

rejection at the $2,450 resistance has seen Ethereum pushing on a

decline. This has prompted analyst CryptoBullet to highlight the

possibility of a third low in October, thereby completing the

triple bottom formation. Price formations in cryptocurrency markets

are known to repeat over time, often following patterns that can

help traders anticipate future movements. While no two market

conditions are exactly the same, studying past price movements

provides valuable insights into what may happen in the future. A

similar playout of the 2021 price action puts on a similar surge

for Ethereum in Q4 2024. Notably, the analyst envisioned a rally

towards the $3,700 price level. What’s Next For ETH? At the

time of writing, Ethereum is trading at $2,320 and continues to

exhibit a weak short-term outlook. If Ethereum fails to clear the

$2,340 resistance, it could start another decline towards

$2,150. Related Reading: Shiba Inu Competitor FLOKI Forms

Falling Wedge That Could Trigger 54% Breakout This weak performance

and outlook are even more pronounced compared with Bitcoin. As

such, Ethereum/Bitcoin is now at its lowest level since April 2021,

a staggering 41-month low. Most of this lackluster action has also

been exacerbated by selloffs from a few large holders. For

instance, Ethereum co-founder Vitalik Buterin recently came under

scrutiny for selling $2.2 million worth of Ethereum. Featured

image created with Dall.E, chart from Tradingview.com

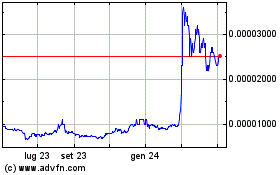

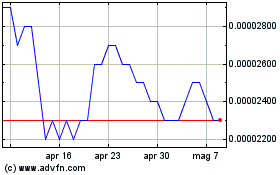

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Dic 2023 a Dic 2024