How To Buy Sell and Trade Tokens On The Arbitrum Network

21 Gennaio 2024 - 3:00PM

NEWSBTC

The Arbitrum (ARB) network is a Layer 2 scaling solution for

Ethereum that aims to address the scalability and high transaction

fees. It is developed by Offchain Labs and utilizes a technology

called Optimistic Rollups to achieve its objectives. Optimistic

Rollups work by processing most transactions off-chain and then

periodically submitting a summary of those transactions to the

Ethereum mainnet. This approach reduces the transaction costs

significantly and increases the throughput of the network while

maintaining the security guarantees of the Ethereum

mainnet. In other words, the optimistic rollup feature

allows Ethereum smart contracts to scale by passing messages

between smart contracts on the Ethereum main chain and those on the

Arbitrum second layer chain. Much of the transaction processing is

completed on the second layer, and the results of this are recorded

on the main chain — drastically improving speed and

efficiency. One of the key features of the Arbitrum network

is its compatibility with existing Ethereum smart contracts.

Developers can deploy their contracts on the Arbitrum network with

minimal modifications, allowing for easy migration of decentralized

applications (dApps) from Ethereum to Arbitrum. Related Reading:

How To Buy, Sell, And Trade Tokens On The BSC Network Also, the

arrival of the Ethereum network introduced a groundbreaking

transformation in the realm of blockchain technology, providing a

platform for the creation of decentralized applications (dApps) and

propelling the growth of decentralized finance (DeFi).

Nevertheless, as Ethereum’s preeminence soared, it encountered

hurdles related to scalability and exorbitant transaction

fees. This is where the Arbitrum network enters the picture

as a Layer 2 scaling solution, poised to tackle these challenges

while ensuring seamless integration with Ethereum’s ecosystem. In

this article, we will explore the core features of the Arbitrum

network and examine its immense potential in the Ethereum

ecosystem. Features Of Arbitrum Network The promise of Scalability:

Scalability has long been a bottleneck for Ethereum, causing

network congestion and skyrocketing transaction fees during times

of high demand. Arbitrum tackles this challenge by implementing

Optimistic Rollups, a technology that allows for most transactions

to be processed off-chain. By aggregating multiple transactions

into a single summary, ARB achieves significant scalability

improvements, enabling faster confirmation times and a higher

throughput. This scalability boost unlocks the potential for a more

efficient and seamless user experience on the Ethereum network.

Related Reading: How To Buy And Trade Tokens On The SEI Network

Ecosystem and Adoption: The Arbitrum network has garnered

significant attention and interest within the Ethereum ecosystem.

Several prominent projects and protocols have announced plans to

deploy on Arbitrum or explore integrations. This growing ecosystem

includes decentralized exchanges (DEXs), lending platforms, gaming

applications, and more. The increased adoption of Arbitrum

provides users with a wider range of options for interacting with

decentralized applications (DApps) and accessing various DeFi

services. Smart Contract Execution: Arbitrum Network makes use of a

technique called optimistic execution to process smart contracts.

It assumes that most transactions are valid and executes them

off-chain. This enables the network in providing fraud

proofs, which allows anyone to challenge invalid transactions by

submitting evidence to the Ethereum mainnet. This approach enables

efficient and secure smart contract execution. Related Reading:

Celestia Network: How To Stake TIA And Position For 5-Figure

Airdrops Decentralization and Security: While Arbitrum relies

on the Ethereum mainnet for final settlement and security, it

maintains a high level of decentralization and security. By

leveraging Ethereum’s robust consensus mechanism, Arbitrum benefits

from the security guarantees of the Ethereum network. The periodic

submission of transaction summaries to Ethereum ensures that any

potential fraudulent activity can be detected and resolved.

Seamless User Experience: Using the Arbitrum(ARB) network is

designed to be seamless for users. They can continue using their

existing Ethereum wallets, such as MetaMask, to interact with the

Arbitrum network. This familiarity and compatibility make it easier

for users to transition from Ethereum to Arbitrum and enjoy the

benefits of improved scalability and reduced transaction fees

without significant changes to their workflows. What Makes Arbitrum

Unique? The Arbitrum (ARB) network is designed to provide an

easy-to-use platform developers can use to launch highly efficient

and scalable Ethereum-compatible smart contracts. It offers a range

of exciting possibilities for developers and users alike. Some

examples of what can be done on the network include: High EVM

compatibility Arbitrum(ARB) is considered to be one of the most

EVM-compatible rollups. It’s compatible with the EVM at the

bytecode level, and any language that can compile to EVM works out

of the box — such as Solidity and Vyper. This makes it easy to

build on since developers do not need to get to grips with a new

language before building on Arbitrum. Related Reading: How To

Bridge And Trade On The Injective (INJ) Network Decentralized

Finance (DeFi) applications: The Arbitrum (ARB) network can be used

to build and run DeFi applications, such as decentralized exchanges

(DEXs), lending and borrowing platforms, and stablecoin systems.

These applications can benefit from the network’s fast transaction

processing times and low gas fees, enabling efficient and

affordable transactions. Low transaction fees As a Layer 2

scaling solution for Ethereum, Arbitrum isn’t just designed to

boost Ethereum’s transactional throughput, it also minimizes

transaction fees at the same time. Thanks to its extremely

efficient roll-up technology, Arbitrum is able to cut fees down to

just a tiny fraction of what they are on Ethereum, while still

providing sufficient incentives for validators. Well-developed

ecosystem Arbitrum is already working with a wide variety of

Ethereum DApps and infrastructure projects, including the likes of

Uniswap. Cross-Chain Interoperability The Arbitrum (ARB) network

can also be used to enable cross-chain interoperability between

different blockchains. This could allow for the seamless transfer

of assets and data between different blockchain ecosystems,

enabling greater interoperability and connectivity across the

entire blockchain space. The Arbitrum network’s fast transaction

processing times, low fees, and security and decentralization

features make it a compelling choice for a wide range of use cases.

Related Reading: Solana Meme Coins: A Guide to Buying, Trading, And

Profiting From SOL Investments How To Get Started on The Arbitrum

Network To buy and sell tokens on the Arbitrum (ARB) network, you

must first get a metamask wallet. MetaMask is a popular browser

extension wallet commonly used for interacting with blockchain

networks like Ethereum. It is available as a browser extension for

popular browsers such as Google Chrome. Ensure your Metamask Wallet

has been added to your browser as an extension by clicking on the

‘Add to Chrome” icon on the top right as shown below: Once

installed and set up, MetaMask allows users to manage their

cryptocurrency wallets, interact with decentralized applications

(DApps), and securely execute transactions on supported blockchain

networks directly from their browsers. (Make sure to write down

your seed phrase on a piece of paper and keep it in a safe place.

Do not store it online or on your device). Next, add the ARB

network to your Metamask wallet by following the instructions

provided on the Metamask website here. Trading On the Arbitrum

(ARB) Network In order to execute trades on the ARB network, you

will need to fund your wallet with Ethereum (ETH) so as to enable

you to cover gas fees even though the majority of the trading

activity takes place on the Arbitrum layer 2 solution. This is

because the Arbitrum network periodically submits transaction

summaries and proofs to the Ethereum mainnet, which requires paying

Ethereum gas fees. Related Reading: How To Buy, Sell, And

Trade Tokens On The BSC Network You can buy ETH on centralized

exchanges such as Binance, copy your wallet address from Metamask,

and then send the ETH from Binance to your Metamask wallet.

You can also purchase ETH directly within the Metamask wallet using

traditional payment methods such as credit or debit cards, etc.

Just click on the “Buy/Sell” button within Metamask to open the

interface. Here, you can put how much ETH (or any other token) you

want to buy in terms of dollar terms, pick your payment method, and

then click “Buy”. Note that to buy crypto directly within Metamask,

you will need to provide info such as your country and state.

However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your ETH to arrive

in your wallet. Once the ETH arrives, you are all set to begin

trading tokens on the ARB network. So, head over to UniSwap to get

started on your trading journey. How To Trade Tokens On The ARB

Network Using UniSwap Uniswap is a decentralized exchange (DEX)

protocol built on the Ethereum blockchain. It allows users to trade

Ethereum-based tokens directly from their wallets without the need

for intermediaries or traditional order books. Uniswap offers users

a simple and straightforward way to buy and sell a wide variety of

tokens. Related Reading: How To Buy And Trade Tokens On The SEI

Network Endeavour to be on the right Uniswap website to protect

your wallet from any fraudulent activity. The first step is

clicking on the “launch app” button at the top right corner, as

shown in the image below: The next step is clicking on the connect

wallet option on UniSwap at the top right corner, as shown in the

image below: Connect to your preferred wallet as shown below. (In

this case, it’s Metamask): Once connected, switch Metamask to the

ARB network. (If you’re already on the ARB network, you do not need

to switch): After connecting MetaMask to the ARB network, go to

UniSwap, and then you can start trading on the ARB network using

UniSwap. The next step is to select your preferred tokens on

the UniSwap interface and since Uniswap operates on a token to

token trading model, click on the “select token” button to select

the trading pair you want to trade against. For example, if

you want to buy USDT using ETH, select ETH – USDT,

enter the amount, then click on “swap” or “trade now” and confirm

the transaction in your Metamask wallet. You can view the tokens in

your wallet’s asset list. Related Reading: Celestia Network: How To

Stake TIA And Position For 5-Figure Airdrops Buying and Selling

Tokens with the Metamask Wallet ARB Network users can also buy and

sell tokens using the Metamask extension wallet already connected

to the ARB network. To do this, make sure you’re connected to

the ARB network and have ETH to swap and pay for gas fees. Then,

navigate to the “Swap” button as shown below. This will take you to

the Swap interface inside Metamask. Using the image above as a

guide, you can also search for tokens using the name or the

contract address, just like on UniSwap. Input the amount of ETH you

want to swap, confirm that you have the correct token, and then

click “Swap.” Once the transaction is confirmed, the tokens you

just bought will be sent to your wallet. Tracking Token Prices on

The Arbitrum Network Users of the Arbitrum (ARB) network can

take advantage of on-chain tools like Dexscreener to gain access to

comprehensive market insights for specific tokens. These insights

include price data and contract information, empowering users to

make well-informed trading decisions based on reliable and

up-to-date information. Related Reading: How To Bridge And

Trade On The Injective (INJ) Network With Dexscreener on the

Arbitrum network, users can stay informed about token metrics and

market dynamics, enhancing their trading strategies and overall

trading experience. Dexscreener offers a variety of advantageous

features tailored to users on the Arbitrum network. Among these

features, an exceptional one is the charting functionality, which

delivers both real-time and historical price data for a wide range

of tokens. By utilizing these charts, users gain valuable

insights into price trends, trading volumes, and other pertinent

metrics. This enables them to pinpoint potential entry or exit

points for their trades with precision and confidence. Take a

look at the example below: Conclusion In conclusion, the Arbitrum

network offers a compelling ecosystem for buying, selling, and

trading tokens, providing several notable advantages over other

platforms. With its seamless integration of on-chain tools like

Dexscreener, users gain access to detailed market insights,

real-time price data, and historical charts, enabling them to make

informed trading decisions with confidence. Related Reading: Solana

Meme Coins: A Guide to Buying, Trading, And Profiting From SOL

Investments Additionally, Arbitrum’s scalability and low

transaction fees enhance the overall trading experience, ensuring

quicker and more cost-effective transactions. By leveraging the

power of the Arbitrum network, traders can enjoy a secure,

efficient, and feature-rich environment that empowers them to

navigate the world of token trading with ease. Featured image from

CoinMarketCap

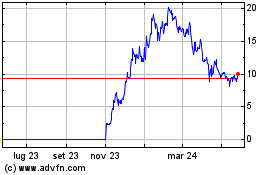

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Dic 2024 a Gen 2025

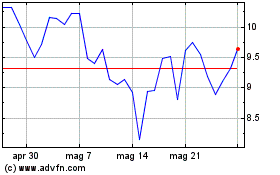

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Gen 2024 a Gen 2025