Celestia (TIA) Emerges As The Market Leader With 16% Surge, Catalysts Revealed

10 Luglio 2024 - 2:30AM

NEWSBTC

After experiencing a significant price drop of 68% from its

all-time high of $20.85 on February 10th, the native token of the

modular data availability (DA) network Celestia TIA has experienced

a notable price recovery. On Tuesday, it emerged as the market’s

top performer with a 16.4% increase in the last 24 hours, currently

trading at $6.78. TIA Price Analysis Last Friday, July 5, the TIA

token hit an 8-month low of $4.16, influenced by the declining

prices of major cryptocurrencies and the cautious sentiment among

bullish investors. However, recent developments have reignited

interest in Celestia, allowing it to regain key indicators that

have prevented a more substantial surge. Related Reading: Bitcoin

Crash: Here’s What The Data Says About Buying The Dip A significant

resistance wall for TIA is its 200-day exponential moving average

(EMA) at $7.74, marked by the yellow line on the TIA/USD daily

chart below, which will be a crucial milestone for the token in the

coming days if the bullish trend continues, with the potential to

extend the price surge. However, before reaching this level,

Celestia will have to overcome another resistance level at $7.26,

which will act as an 8-month threshold for bearish investors to

prevent a potential continuation of the current rally. Orderly

Network Boosts Celestia Dominance Of On-Chain Perps Market expert

and technical analyst DeFiSquared highlights the nature of

Celestia’s recent uptrend, noting that despite current market

conditions driven by a perceived lack of utility in

cryptocurrencies, Celestia stands out as a blockchain

infrastructure that facilitates “real and useful activity.”

In a recent social media post, the expert noted that a significant

portion of the data posted on Celestia comes from the Orderly

Network, which provides permissionless liquidity for on-chain perps

markets – a sector with consistent and significant demand. The

Orderly Network handles a significant portion of the market’s

volume, exceeding half a billion daily trades and growing.

According to the analyst, the need for a data availability layer to

facilitate secure and permissionless liquidity for on-chain perps

markets has become apparent. Celestia’s role as a core piece of

infrastructure in this context positions it favorably for a strong

market bottom. Related Reading: Massive Mt. Gox Bitcoin Shift

Unlikely To Disrupt Prices, Says CryptoQuant CEO In addition, the

ongoing Modular Summit, with Celestia at the forefront, adds to the

positive sentiment surrounding the project, as evidenced by a 40%

increase in trading volume for the token over the past 24 hours,

amounting to $206 million, according to CoinGecko data. DeFiSquared

further explained that traders attempting to short the current

upward movement, negative funding rates on perpetual trading, and

indicators suggesting a potential market bottom contribute to

optimism. The analyst also highlighted that insiders cannot

sell their holdings due to their vesting cliff being 100+ days

away, providing additional stability to the market. Featured image

from DALL-E, chart from TradingView.com

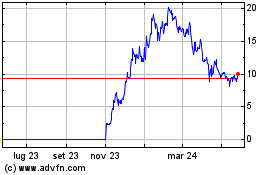

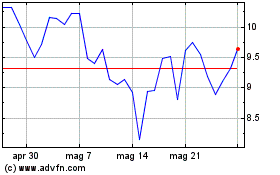

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Gen 2024 a Gen 2025