Crypto Exchanges Trading Volume Hit $10.3T in 2023, New Data Shows

18 Gennaio 2024 - 3:00AM

NEWSBTC

CoinGecko’s 2023 Annual Crypto Industry Report has been released.

It covers crypto exchanges and their current state, Bitcoin’s

+155.2% and Ethereum’s +90.5% growth, analyzing NFT trading volume

throughout the year, and more. Related Reading: HODLing Rewards:

Average Bitcoin Long-Term Holder Now Carries 55% Profit Among the

report’s highlights is the comprehensive review of the crypto

trading volume in 2023 through the performance of centralized

crypto exchanges (CEX) and decentralized exchanges (DEX).

Centralized Crypto Exchanges Dominated Crypto saw a $36.6 trillion

trading volume in 2023, with a volume increase of +53.1% from Q3

($6.7 trillion) to Q4 ($10.3 T). The Q4 increase marked the first

quarter-on-quarter (QoQ) growth of 2023 and could be attributed to

the “growing bullish sentiment” in the crypto market due to the

anticipation of spot Bitcoin ETFs’ approval by the SEC. Despite the

market’s challenges, such as the aftermath of FTX’s collapse, the

worldwide banking crisis, or Binance’s regulatory difficulties in

2023, the data presented in the report shows an overall market

recovery. In December 2023, the trading volume increased sharply to

$4.3 trillion, a volume not seen since March 2023. Overall 2023,

centralized exchanges dominated the year despite the challenges,

especially when compared to decentralized exchanges (DEX). The

report details: CEXto DEX spot trading volume ratio hovered around

91.5% in Q4. CEX to DEX derivatives trading volume ratio dropped to

97.3% from 98.5%. CEX to DEX spot ratio stood at 91.4% in 2023. CEX

to DEX derivatives ratio was 98.1% in 2023. Binance, Upbit, OKX,

Bybit, and Coinbase are among the Top 10 centralized exchanges by

trading volume. Binance managed to dominate the list despite

dropping to a yearly low market share of 41% in November, following

a continued loss throughout 2023. There was a +98.1% increase QoQ,

after the top 10 CEXes recorded $2.20 trillion in spot trading

volume in 2023 Q4. Previously, the trading volume had failed to

reach above $2 trillion for two consecutive quarters. Altogether,

the top 10 CEXes recorded $7.2 trillion in spot trading volume in

2023 compared to $9.4 trillion in 2022, representing a -23.4%

year-on-year (YoY) decline. Monthly Top Cryptocurrencies Exchanges

Trading Volumen, 2023. Source: CoingGecko.com Deep Dive Into The

Spot Decentralized Exchanges (DEX) Trading Volume In 2023 The Top

10 DEXes recorded $205.3 billion in spot trading volume in 2023 Q4,

indicating a +87.1% Total Trading Volume Increase QoQ. Uniswap,

Pancakeswap, Orca, Curve, and THORSwap dominate the DEXes in 2023’s

Top 10 spot DEX trading volume. Notably, the report names Orca and

THORSwap as the biggest gainers amongst the DEXes in 2023 Q4, with

Orca increasing 1,079% ($12.2 billion), while THORSwap saw a surge

of 422.4% ($10.1 billion) When breaking down the 2023 spot DEX

trading volume breakdown by chain, the report details that Ethereum

had $99.3 billion of DEX trading volume in 2023 Q4, displaying an

increase of +38.3% from 2023 Q3. However, it ended with a low 41%

dominance, dropping below 50% for the first time in 2023 in

November and December. Related Reading: QCP Capital Forecasts ETH’s

Dominance Over Bitcoin To Persist, Ethereum ETFs In Focus It’s

worth noting that Solana was the biggest gainer, with a 985.5%

increase in QoQ, while THORChain took second place with a 422.4%

trading volume increase in Q4. The data shows that the two chains

ranked #3 and #5 in December 2023. Bitcoin is trading at $42,423.7

in the hourly chart. Source: TradingView.com Featured image from

Unsplash.com, Chart from TradingView.com

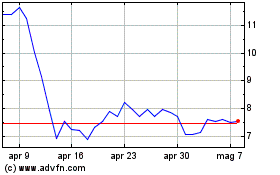

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Lug 2023 a Lug 2024