Stablecoins Total Market Cap Breaches $179 Billion Mark – Can It Go Higher?

09 Febbraio 2022 - 5:00PM

NEWSBTC

Stablecoins, the digital currency that is the talk of the town, are

gradually taking over the crypto world as more users and

corporations vie for its benefits. Such news doesn’t come as a

surprise anymore. As the total value of the world’s 12,333 digital

currencies approaches $1.8 trillion, the stablecoin economy has

recently grown to $179 billion, or nearly 10% of the total crypto

economy. This record has been much quicker to attain compared to

last year, where it took around two months to see the transfer

volume surpass $150 billion. In 2020, it took nine months to

surpass this milestone. As for 2019, it lasted an entire year. What

Are Stablecoins? The volatility of tokens has always been one of

the major challenges to cryptocurrency investing. Bitcoin, for

example, can drastically change in value by the minute. Stablecoins

are established to tackle that problem surrounding blockchains; it

aims to keep track and match the value of the fiat currency US

dollars (USD). Tether (USDT), the first established stablecoin and

still the most successful to this day, was merely introduced as a

digital token with “a stable price.” This works as the Tether

Foundation keeps 1 USD in reserve for every USDT issued, keeping

its price stabilized around $1 since each unit of USDT could be

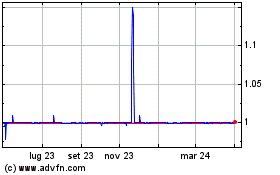

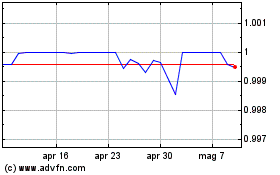

redeemed for one of the US dollars in the reserve. USDTUSD trading

at 1.00080000 on the daily chart | Source: TradingView.com Related

Reading | On-Chain Data Shows Surge In Stablecoins Supply Pouring

Into Bitcoin Tether began with very little resources, having gotten

little exposure from the public. However, as Bitcoin’s price began

to rise in 2017 and the risk brought by volatility became greater,

Tether was also catapulted to the mainstream. From its $1

million-mark in 2016, it surpassed a little less than $10 million

in January 2017. By January 2018, as bitcoin’s price was

skyrocketing to $20K, the Tether coin supply had ballooned to more

than $1.4 billion. Projected Growth Many crypto enthusiasts and

analysts point out that stablecoins are gaining momentum because

their total supply is increasing marginally. Most stablecoins are

issued and backed by third parties, guaranteeing legitimacy on the

side of customers. Some of the popular stablecoins along with

Tether are Center’s USD Coin (USDC) and Binance’s BUSD, accounting

for a little less than the entire supply of the digital token. USDT

is the leading stablecoin with a market cap of almost $78 billion,

followed by USDC at almost $51 billion market cap. It is

because of stablecoins’ cryptographic security and programmability

that the robust use cases currently driving the use of stablecoins

are supported. We can expect to see more innovation and growth in

payment systems as a result of the use of stablecoins in the

future. Related Reading | Tethered Up: How Stablecoins Plan To

Stay Stable Image from CoinGeek, chart from TradingView.com

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Apr 2023 a Apr 2024