Analyst Says Bitcoin Halving Influence Is No Longer Driving Price, Here’s What Is

10 Aprile 2024 - 5:00PM

NEWSBTC

Analysts from CryptoQuant have revealed that the influence of the

2024 Bitcoin halving on the price of BTC has notably diminished.

According to the crypto analytics firm, the highly anticipated

halving event is no longer the key driver for a bullish momentum in

BTC. Bitcoin Halving Effects On Prices Is Fading CryptoQuant

wrote in a recent research report that the upcoming Bitcoin halving

event scheduled this April may not deliver the desired price shock

expected by most crypto analysts and investors in the space.

According to the analytics firm, the influence of the Bitcoin

halving event has been dwindling over time, with the price of the

cryptocurrency and a potential bullish rally being driven by a new

change in market dynamics. Related Reading: VeChain On The Edge:

Insider Says VET Will Reach The Finish Line Notably, CryptoQuant

disclosed that the demand from long-term and large-scale investors,

whales, has become one of the primary factors pushing the price of

BTC upward. The Head of Research at CryptoQuant, Julio Monero

disclosed on Tuesday, April 9, that the demand for Bitcoin from

permanent holders has recently outpaced issuance for the first time

in history. In its report, CryptoQuant also highlighted an

11% month-on-month increase in large-scale Bitcoin investors

holding between 1,000 to 10,000 BTC, reaching unprecedented levels.

This elevated demand is in sharp contrast with BTC’s supply

dynamics and is poised to increase further after the halving event

concludes. Currently, long-term Bitcoin holders are

accumulating more tokens than the new investors entering the

market. CryptoQuant revealed that permanent holders have also been

adding as much as 200,000 BTC to their portfolio every month while

long-term holders are amassing seven times more BTC per

month. “We argue that the effect of the halving has been

diminishing, as the new issuance of Bitcoin gets smaller relative

to the amount of Bitcoin selling from long-term holders,” the

analytics firm wrote. Analysts Remain Optimistic About

Halving Influence Despite CryptoQuant’s report on Bitcoin’s supply

and demand dynamics, numerous analysts still expect a significant

uptick in Bitcoin’s price following the halving event. Analysts

like Joe Consorti have predicted BTC’s price to rise to $100,000

following the Bitcoin halving. Additionally, he has expressed

optimism about a potential bullish rally for the cryptocurrency

during this period. Related Reading: Solana Open Interest Drops

$370 Million Amid Network Troubles, $200 Still Possible?

Moreover, due to historical trends revealing a correlation between

the Bitcoin halving event and a price surge for the cryptocurrency,

various crypto investors have predicted a similar bullish outlook

for the cryptocurrency this year. Recently, open interest in

Bitcoin surged to new all-time highs above $18 billion. This

increase suggests that traders and investors are still bullish on

Bitcoin’s future value, seeing any price dips as buying

opportunities before a potential rally. BTC bulls lose out to

bears | Source: BTCUSD on Tradingview.com Featured image from

Earth.org, chart from Tradingview.com

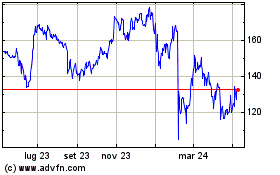

Grafico Azioni Monero (COIN:XMRUSD)

Storico

Da Gen 2025 a Feb 2025

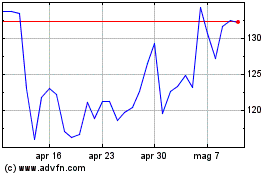

Grafico Azioni Monero (COIN:XMRUSD)

Storico

Da Feb 2024 a Feb 2025