Lido (LDO) Sheds 58% Of Its All-Time High TVL At $11 Billion

23 Maggio 2022 - 6:00PM

NEWSBTC

Lido TVL or total value locked, toppled over to new high lows seen

in the third week of this month following the bearish movement of

the DeFi market. LDO has shaved off over 58% of its TVL, which

registered an all-time high of $20.4 billion on April 6 but dropped

down to roughly $8.6 billion on May 22. Suggested Reading | Ripple

(XRP) Plunges To $0.43 With Bears In Full Swing Lido, a liquidity

staking solution, targets orienting people towards staking. It has

zero minimum staking requirements which is a great feature, to

begin with. The users can freely stake assets in exchange for daily

rewards. A couple of applications and services connected with Lido

comprise Anchor Protocol, Curve, MakerDao, 1inch, StakeEther,

Ledger, and SushiSwap Onsen. Lido TVL Down 17% LDO’s TVL has been

dramatically slipping due to the overall crypto market crisis going

on for several months now. Its TVL on Ethereum was at $10.32

billion on April 6. After reducing investor interest, its TVL

decreased 17% or equivalent to $8.47 billion on May 22. Meanwhile,

its TVL on its all-time high on Terra was at roughly $9.66 billion.

However, the figures dropped 99% on May 22, or approximately

$14,870 in six weeks. LDO TVL on Solana used to

be hovering at $417.17 million, but it went down by nearly 70% or

roughly $126.24 million on May 22. LDO total market cap at $395

million on the daily chart | Source: TradingView.com Lido TVL on

Moonriver was at $2.57 million during the height of dApps

popularity. However, when investor interest waned, the values also

crashed by 27%, equivalent to $1.86 million seen in that same

period. After crashing by more than $11 billion, LDO has been

demoted from the ranks close to MakerDAO and Curve. LDO Still

Superior In TVL On the flip side, despite Lido’s drop in terms of

TVL, it still is superior in TVL compared to Convex Finance,

JustLend, Aave, SushiSwap, Uniswap, Instadapp, PancakeSwap,

Compound, and Just Lend. It opened on April 6, trading at $4.27.

However, the coin dropped on May 12 at $1.23 and seems to be not

going over the $1.33 mark today. Looking at those figures, this

would give you as much as a 68% loss in LDO price in just six

weeks. Suggested Reading | Bitcoin Reclaims $30K Territory After

Recent Weeks’ Struggle – Analysts Weigh In Polygon Launch This

Month Lido is currently the leading Ethereum liquid staking

solution that comprises a large share of over 80% in that space.

Moreover, assets staked on Lido are divided into 76,000 crypto

wallets and worth $10 billion based on prevailing prices. Lido also

promotes liquid staking on Terra, Kusama, and Solana blockchains.

Lido’s launch this month on Polygon is in the works. Lido is

governed by a DAO or equivalent to all the holders of Lido’s token,

which collectively makes decisions in the blockchain. Featured

image from BitRss.com, chart from TradingView.com

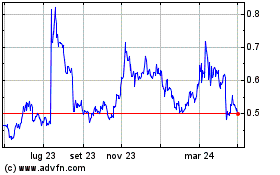

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Dic 2024 a Gen 2025

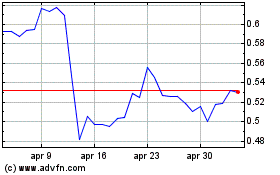

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Gen 2024 a Gen 2025