- Achievement of the 2022 revenue target of €22.1

million

- Improvement in gross margin rate by 9 points to 60% in

2022

- Achievement of operating profitability with an EBITDA of

€3.1 million in 2022

- Strong cash position: €6.4 million at December 31,

2022

Regulatory News:

ALCHIMIE (FR0014000JX7 - ALCHI - PEA-PME eligible)

(Paris:ALCHI), a video streaming platform and creator of

subscription-based and ad-supported video-on-demand channels (SVOD

and FAST1 ) serving brands and companies as well as the general

public, today announced its consolidated annual results for the

year ended December 31, 2022, as approved by the Board of Directors

on April 20, 2023.

Pauline Grimaldi d'Esdra, CEO of Alchimie, said: "The

year 2022 marks the successful restructuring of the Company with,

on the one hand, the achievement of our financial objectives and,

on the other hand, the diversification of our offer in order to

develop new growth drivers. Indeed, we have achieved our revenue

target and have reached operational profitability, with an EBITDA

of more than €3 million. In 2023, while preserving a healthy cost

structure, our ambition is to capitalize on the Tech assets of our

platform. We are marketing our solution to companies to create

their internal and partner communication media, and we are offering

them SaaS access to technological bricks (via API) enabling them to

exploit the full spectrum of video and streaming functions within

their applications”.

Consolidated income statement (IFRS)

In thousands of euros

31.12.2022

31.12.2021

% change

Revenues

22,070

32,223

-31.5%

Cost of sales

-8,844

-15,639

-43.4%

Gross margin

13,226

16,584

-20.2%

Technology and development costs

-4,436

-4,669

-5.0%

Marketing and sales expenses

-2,833

-15,083

-81.2%

General and administrative expenses

-5,946

-5,405

+10.0%

Operating income

11

-8,574

-99.9%

Financial result

-648

-168

Consolidated net income

-700

-9,038

-92.3%

EBITDA

3,061

(6,792)

Cash position end of period

6,403

7,061

-9.3%

Business activity and financial results 2022

As announced at the time of the 2022 revenue release, the

concentration of the Company's resources on high-potential channels

has paid off, enabling Alchimie to exceed its revenues target of

€20 million with revenues of €22.1 million. This good level of

activity was mainly generated by the results of the subscriber

bases in France and Germany.

Cost of sales fell sharply to €8.8 million, compared with €15.6

million in the previous year. This decline was due to the

rationalization of content licensing costs, particularly in the

United Kingdom, and technical costs incurred in the Video

segment.

With a gross margin of €13.2 million at the end of December

2022, the gross margin rate is 60%, up 9 points compared to the

previous year.

Operating expenses fell sharply (-48%), reflecting the

restructuring completed in May and the decision to reduce marketing

expenses. As a result, the Company reduced its fixed costs by 32%

(excluding severance costs) and marketing and sales expenses fell

by 81% in FY 2022. General and administrative expenses increased by

10% due to the impairment of goodwill on certain assets.

All the measures taken in 2022 have enabled Alchimie to achieve

a 2022 EBITDA of €3.1 million compared to €-6.8 million a year

earlier, and a positive operating result at €11k, compared to an

operating loss of €8.6 million in 2021.

The financial result for 2022 amounts to €-648k and includes in

part the interest on the HLD Europe current account and a negative

exchange rate difference.

In total, the consolidated net loss for the year 2022 is reduced

to €-700k, compared to €-9.0 million in 2021.

Financial situation of the Group

Consolidated shareholders' equity is negative and amounts to

€-1.0 million as of December 31, 2022, impacted by the loss for the

year 2021 of €9.0 million.

The cash position at the end of December 2022 will be €6.4

million in 2022, compared with €7.1 million at December 31,

2021.

In terms of financial resources, Alchimie maintains a rigorous

management of its costs to preserve its cash and does not plan to

call on the market given its cash position at the end of December

2022.

Strategy and outlook 2023

In 2023, Alchimie is evolving its offering with the objective of

further monetizing its Tech assets.

The Company has developed a SaaS (Software-as-a-Service)

offering to enable companies to improve their image through a

single video streaming platform. The offer is intended to cover

their internal communication needs (HR, CSR, integration and

retention of talents, knowledge sharing, etc.) or with their

partners (presentation of strategies, products, collections, etc.).

This all-in-one solution brings together all the know-how of

Alchimie's platform (video storage, encoding of streams, content

editorialization, multi-terminal broadcasting, etc.), allowing

companies to use it completely independently without an IT team,

with real-time monitoring of use.

At the same time, Alchimie is preparing the launch of its SaaS

offer via API named VideoBricks dedicated to companies and

professionals willing to enrich their applications with video and

streaming functionalities. The agile solution removes the

technological complexity of video and is deployed without any

infrastructure investment. The full range of video functionality in

Alchimie's platform will be made available "off-the-shelf" via

APIs; the VideoBricks offering will be launched by the end of the

first half of 2023.

The objectives for 2023 are to start marketing

Software-as-a-Service offers to take over the subscriber bases of

existing services, the promotion of which was stopped at the

beginning of 2022, and to build an efficient sales organization

adapted to the new value proposition and the new distribution.

At the same time, the Company will continue to manage its

activities by maintaining rigorous cost control and is targeting a

break-even EBITDA by the end of 2023.

Alchimie is publishing its 2022 Annual Financial Report today,

available on its website:

https://www.alchimie-finance.com/en/documentation-gb/financial-report

***

Annual General Meeting: June 7, 2023, the terms of

participation will be communicated later.

Next financial release: H1 2023 results, October 17, 2023

after market close.

About Alchimie

Alchimie is a unique video streaming platform allowing companies

and creators to build their own video channel, their internal

communication media and partners. Alchimie also offers VideoBricks,

the SaaS access to the technological bricks (via API) of

exploitation of the video and streaming functions. Alchimie has a

catalog of video content from more than 300 prestigious partners

(Arte, France TV distribution, ZDF Entreprises or Zed).

For more information: www.alchimie-finance.com /

www.alchimie.com

1 FAST: Free Ad-supported Streaming TV, linear OTT channels

financed by advertising

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230425005579/en/

Alchimie Stéphane Taillefer Financial Director

investors@alchimie.com

NewCap Thomas Grojean/Louis-Victor Delouvrier Investor

Relations alchimie@newcap.eu 01 44 71 94 94

NewCap Nicolas Merigeau Media Relations

alchimie@newcap.eu 01 44 71 94 98

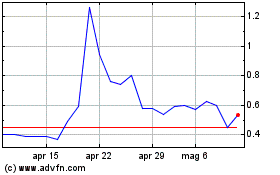

Grafico Azioni Alchimie (EU:ALCHI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Alchimie (EU:ALCHI)

Storico

Da Apr 2023 a Apr 2024