Eurobio Scientific: FIRST HALF 2024, A SOLID START TO THE FINANCIAL YEAR IN AN UNCERTAIN ENVIRONMENT // PROPOSED TENDER OFFER

31 Luglio 2024 - 9:01PM

UK Regulatory

Eurobio Scientific: FIRST HALF 2024, A SOLID START TO THE FINANCIAL

YEAR IN AN UNCERTAIN ENVIRONMENT // PROPOSED TENDER OFFER

NOT FOR DISTRIBUTION, PUBLICATION OR

RELEASE, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES OR TO ANY US PERSON, OR TO ANY OTHER JURISDICTION IN WHICH

THE DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE

UNLAWFUL.

FIRST HALF 2024,

A SOLID START TO THE FINANCIAL YEAR IN AN

UNCERTAIN ENVIRONMENT

PROPOSED TENDER OFFER

- Half-year revenue growth of +24% (+12% excluding the effects of

changes in the scope of consolidation linked to the acquisitions of

DID and Alpha Biotech)

- Maintaining the Group's strategic focus:

- Proprietary products: 29% of revenues

- Internationalization: 42% of revenues generated outside

France

- Conclusion of an agreement between Eurobio Scientific and a

consortium led by Eurobio Scientific's team of entrepreneurs and

managers, IK Partners and Nextstage AM, with a view to filing a

voluntary tender offer

Paris, July

31st, 2024 – 9:00

pm

Eurobio Scientific

(FR0013240934, ALERS), a leading French group in in vitro

specialty medical diagnostics and life sciences, today presents its

consolidated first-half revenues for the period ended on June 30,

2024.

Solid revenues growth of

+24%

At the end of June 2024, Eurobio Scientific

recorded revenues of €73.4m, compared with €59.1m at the end of

June 2023, i.e. an increase of +24%. On a like-for-like basis, i.e.

excluding the effects of acquisitions, growth remains solid at

+12%.

The perimeter effects for the first half are as

follows: DID's revenues amounted to €6.1m, while Alpha Biotech's

revenues amounted to €1.3m.

Excluding the effect of changes in the scope of

consolidation, the €6.9m increase in revenues came mainly from

GenDx, where sales amounted to €3.6m (+32%), and from France, where

sales amounted to €3.1m (+8%). The rest of the Group's activities

posted limited growth of around 2%.

GenDx grew in all territories (Europe, the

United States and internationally), with a number of one-off

international distribution contracts contributing to +€0.8m to this

growth. Adjusted for this non-recurring effect, GenDx grew by

around 25% over the first half.

The Group’s French activities reported

significant growth over the first half, also driven by a number of

non-recurring factors, such as the Covid and Pertussis epidemics,

and the extension for several months of certain calls for tender in

Transplantation, which maintained business volumes in this segment.

Excluding these effects, revenues were stable.

Update on the deployment of the Group's

strategy

The Group is pursuing its strategy of targeted

geographic and technological expansion, with the ambition of

becoming a leading international company in the speciality

diagnostics market, offering to its customers a complete range of

molecular diagnostic solutions based on its own products and those

of its partners.

- Stable share of

proprietary products

The share of proprietary products is stable,

despite the integration of DID's distribution activities, and

reached around 29% of revenues (compared with 30% of revenues in

the first half of 2023).

- International

in progress

Revenues outside France grew to 42% of total

revenues (compared with 35% in the first half of 2023). This

increase is mainly due to new acquisitions, but also to the

development of cross-sales of the Group's proprietary products.

Outlook

The Eurobio Scientific Group is continuing to

implement the strategic directions it has been developing for

several years: the development of proprietary products, the

internationalization and the opening up of new markets. Over the

next 5 years, the Group's ambition is for proprietary products to

account for around 50% of its sales.

Proposed tender offer

Funds managed by NextStage AM and IK Partners,

together with Mr. Denis Fortier, CEO, and other members of the

Company's Board of Directors and senior management, have decided to

form a consortium (the "Consortium") to launch a

voluntary tender offer for all outstanding Eurobio Scientific

shares. A press release, published jointly by the Company and the

Consortium, presenting this project and its main preliminary

features is available on the Company's website

eurobio-scientific.com.

Next financial meeting

H1 2024 results: date to be announced

Disclaimer:

This press release has been prepared for information purposes

only. It does not constitute a public offering. The distribution of

this press release may be subject to specific regulations or

restrictions in certain countries. This press release is not

intended for persons subject to such restrictions, either directly

or indirectly. This press release is not for release, publication

or distribution, directly or indirectly, in the United States of

America or in any other jurisdiction in which such release,

publication or distribution is unlawful or subject to any specific

procedures or requirements. Accordingly, persons in possession of

this press release are required to inform themselves about and to

observe any local restrictions that may apply. Failure to comply

with legal restrictions may constitute a violation of applicable

securities laws and regulations in any of these countries. Eurobio

Scientific S.A. and the members of the Consortium accept no

liability for any breach by any person of such

restrictions.

About Eurobio Scientific

Eurobio Scientific is a key player in the field of specialty in

vitro diagnostics. It is involved from research to manufacturing

and commercialization of diagnostic tests in the fields of

transplantation, immunology and infectious diseases, and sells

instruments and products for research laboratories, including

biotechnology and pharmaceutical companies. Through many

partnerships and a strong presence in hospitals, Eurobio Scientific

has established its own distribution network and a portfolio of

proprietary products in the molecular biology field. The Group has

approximately 290 employees and four production units based in the

Paris region, in Germany, in the Netherlands and in the United

States, and several affiliates based in Dorking UK, Sissach

Switzerland, Bünde Germany, Antwerp Belgium, Utrecht in The

Netherlands and Milan in Italy.

Eurobio Scientific's reference shareholder is the EurobioNext

holding company which brings together its two directors,

Jean-Michel Carle and Denis Fortier, alongside the "Pépites et

Territoires" by AXA & NextStage AM investment program, managed

by NextStage AM.

For more information, please visit: www.eurobio-scientific.com

The company is publicly listed on the Euronext Growth market in

Paris

Euronext Growth BPI Innovation, PEA-PME 150 and Next Biotech

indices, Euronext European Rising Tech label.

Symbol: ALERS - ISIN Code: FR0013240934 - Reuters: ALERS.PA -

Bloomberg: ALERS:FP

|

Contacts |

Groupe Eurobio Scientific

Denis Fortier, Chairman and CEO

Olivier Bosc, Deputy CEO / CFO

Tel. +33(0) 1 69 79 64 80 |

Calyptus

Mathieu Calleux

Investors Relations

Tel. +33(1) 53 65 68 68 - eurobio-scientific@calyptus.net |

- PR_Eurobio Scientific_CA_S1_24_OPA_EN (1)

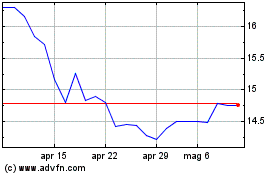

Grafico Azioni Eurobio Scientific (EU:ALERS)

Storico

Da Ott 2024 a Nov 2024

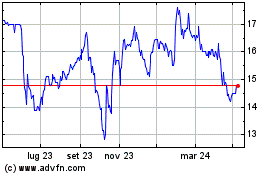

Grafico Azioni Eurobio Scientific (EU:ALERS)

Storico

Da Nov 2023 a Nov 2024