- 2023 sales at €26.7 million, up +10% vs. 2022

- Growth in 2023 order intake by +39% vs. 2022, to €36.1

million

- Increase of direct sales to 58% of 2023 order intake vs. 37%

in 2022

- Rise in backlog1 to €21.9 million, up +73% vs. 2022

- Gross margin drop to 35% from 43% in 2022

- Implementation of a €12 million shareholder loan, extending

financial visibility

Regulatory News:

BALYO (FR0013258399, Ticker: BALYO), technology leader in

the design and development of innovative robotic solutions for

industrial trucks, today announces its full year 2023 results, as

approved by the Board of Directors on March 18, 2024.

Pascal Rialland, CEO of BALYO, states: “The 2023 results

demonstrate the resilience of BALYO's business model, marked by a

rebound in sales momentum, with revenues up by +10% and gross

margin decrease due to a large share of direct project sales vs.

OEM kit sales. Most of our resources were focused on the transition

to the Company's new business model to direct sales, aimed at

ensuring its commercial autonomy. With 58% of order intake placed

through direct sales in 2023, BALYO is close to achieving the 65%

target announced a year ago. Another highlight over the past year

was the search for financing to secure the Company's development.

As part of this process, BALYO welcomed SoftBank Group as its

majority shareholder. BALYO has also just obtained from his

majority shareholder a €12 million shareholder loan in March 2024,

extending its financial visibility. The year 2024 should thus

enable BALYO to pursue its commercial ambitions, driven by growth

in direct sales, while maintaining very tight control over its

costs in order to preserve its cash position.”

2023 financial results*

In €m

2023

2022

Change

Sales revenue

26.67

24.14

+10%

Cost of sales

-17.38

-13.79

+26%

Gross margin

9.28

10.35

-10%

Gross margin rate

35%

43%

-19%

Research and Development

-4.35

-4.55

-4%

Sales and Marketing

-2.99

-2,91

+3%

General and administrative expenses

-7.12

-7,12

-

Share-based payment expense

-0.11

-0.24

-54%

Other non-current operating income and

expenses

-2.71

-

-

Operating income

-8.00

-4.45

-80%

Financial expense

-1.73

-0.11

n.s.

Net income

-9.76

-4.56

-114%

Cash position as of December

31st

8.6

8.2

* The audit procedures have been carried out by the Statutory

Auditor’s and the corresponding report is about to be issued.

In 2023, BALYO recorded an increase in sales by +10% to €26.7

million. This growth was driven by the recovery in business in APAC

(+426%) and sales growth in the United States (+17%).

Regarding sales momentum, 2023 order intake rose by +39%,

reaching €36.1 million. BALYO signed a significant order worth $7.8

million in the United States in the fourth quarter, leading to a

strong rebound in 2023 order intake. Overall, 58% of the 2023 order

intake was placed through direct sales orders, compared with 37% in

2022.

The backlog stands at €21.9 million as of December 31, 2023, up

by 73% over the year, with substantial growth both in the United

States and the APAC region.

Over the course of the 2023 financial year, cost of sales

increased by €3.6 million to €17.4 million. With this increase,

gross margin amounted to €9.3 million, compared with €10.3 million

in 2022. The 2023 gross margin rate dropped to 35%, compared with

43% in 2022. The increase of cost is on the one hand linked to the

change in sales model (project sales including base trucks) and on

the other hand related to higher-than-expected execution cost

partly due to subcontracting.

Operating expenses amounted to €17.3 million, up 17% compared

with 2022. Current operating expenses (R&D, Sales and

Marketing, G&A) remained stable, demonstrating BALYO's ability

to control its cost structure. However, the Company recorded other

non-recurring operating income and expenses totaling €2.7 million,

partly related to SoftBank Group's takeover bid for BALYO

shares.

After taking these items into account, operating loss was -€8.0

million, compared with -€4.5 million in 2022. In total, and after

including the financial income of -€1.7 million, net loss set at

-€9.8 million for 2023.

At the end of December 2023, BALYO had 169 employees, compared

with 146 employees as of December 31, 2022.

Financial position and outlook

As of December 31, 2023, BALYO’s cash position stood at €8.6

million. Following the agreement reached in June 2023 with its

senior creditors regarding the extension of existing financing, for

which the Company was unable to meet upcoming payment deadlines,

BALYO ultimately obtained a payment exemption until December 31,

2023.

In order to extend its financial visibility, BALYO has entered

into a Shareholder Loan Agreement with SoftBank Group Corp., its

majority shareholder, for a total amount of up to €12 million. The

terms and conditions of such shareholder loan, which are further

described in the notice published on BALYO's website2, have been

approved by the Board of Directors on March 18, 2024.

Given its cash position at the date of this press release and

after taking into account the remaining convertible bonds issuances

with SoftBank Group (pursuant to the fulfilment of the required

conditions), the postponement of payment deadlines to 2024 granted

to BALYO by one of its main suppliers, the record of a $7.8 million

order intake, which generated a down payment of 50% of this amount

end of 2023, and the shareholder loan up to €12 million granted by

SoftBank Group Corp. to the Company (subject to certain covenants

and which may be repaid by offsetting of receivables as part of a

capital increase), BALYO is now confident in the funding of its

activities.

Next BALYO financial announcement: first quarter 2024

sales revenue, on April 23, 2024 after market closing.

About BALYO

Humans around the World deserve enriching and creative jobs. At

BALYO, we believe that pallet movements in DC and manufacturing

sites should be left to fully autonomous robots. To execute this

ambition, BALYO transforms standard forklifts into intelligent

robots thanks to its breakthrough Driven by Balyo™ technology. Our

leading geo guidance navigation system enables robots to locate

their position and navigate autonomously inside buildings - without

the need for any additional infrastructure. To accelerate the

material handling market conversion to autonomy, BALYO has entered

into two global partnerships with KION (Fenwick-Linde's parent

company) and Hyster-Yale Group. A full range of globally available

robots has been developed for virtually all traditional warehousing

applications; Tractor, Pallet, Stackers, Reach and VNA-robots.

BALYO and its subsidiaries in Boston and Singapore serve clients in

the Americas, Europe and Asia-Pacific. The company has been listed

on EURONEXT since 2017 and its sales revenue reached €26.7 million

in 2023. For more information, visit www.balyo.com.

________________________ 1 The backlog refers to all orders for

projects received but not yet fulfilled. The backlog evolves every

quarter following the taking into account of new orders, the

revenue generated by projects during the period and the

cancellation of orders. 2 BALYO’s investors’ website,

“Documentation” section

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240321049488/en/

BALYO investors@balyo.com

NewCap Financial Communication and Investor Relations Thomas

Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

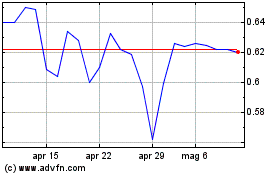

Grafico Azioni Balyo (EU:BALYO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Balyo (EU:BALYO)

Storico

Da Apr 2023 a Apr 2024