Believe has received a proposal from a consortium to make an offer

for all outstanding shares at 15 euros per share

Believe has received a proposal from a

consortium to make an offer for all outstanding shares at 15 euros

per share

- TCV, EQT, together with Denis Ladegaillerie have agreed

to form a consortium to make an offer for all Believe outstanding

shares;

- Offer Price of €15 per share representing a premium of

+21.0% over the last closing price before announcement of the

offer, and a premium of +43.8% and +52.2% respectively over the

volume-weighted 30 and 120-day average share prices;

- The Board of Directors of Believe, acting unanimously,

favorably welcomes the proposal and has set up an

ad-hoc committee made up of 3 independent

directors and appointed Ledouble as an independent

expert;

- Tender offer expected to be filed with the AMF during

the second quarter of 2024;

- Believe takes the opportunity of this announcement to

reiterate its 2023 outlook.

Paris, 12 February 2024 – Funds

managed by TCV and EQT, together with Denis Ladegaillerie, the

Chairman and CEO of Believe (the “Company”), have

agreed to form a consortium with a view to make an offer for all

Believe outstanding shares at 15 euros per share (the

“Offer Price”) upon having acquired an additional

stake in Believe from TCV Luxco BD S.à r.l., Ventech and XAnge.

Transaction detailsThe

consortium has agreed to acquire the stakes of TCV Luxco BD S.à

r.l., Ventech and XAnge, historical shareholders of Believe,

representing respectively 41.14%, 12.03% and 6.29% of Believe

shares at the Offer Price (the “Blocks

Acquisitions”). In addition, it is contemplated that Denis

Ladegaillerie, the founder, would contribute a portion of his

Company shares (representing 11.17% of the share capital) and sell

the remaining portion (representing 1.29% of the share capital) to

the consortium. Such acquisitions and contributions would bring the

consortium’s ownership at 71.92% of the capital. The Consortium has

also obtained from other shareholders of the Company undertakings

to tender their shares in the Offer (representing 3% of the capital

of the Company). Following the consummation of the Blocks

Acquisitions and the contribution, the consortium1 would file a

mandatory tender offer for the remaining Believe shares at the

Offer Price (the “Offer”), with a view to take the

company private should the consortium reach the levels to implement

a squeeze-out.

The Blocks Acquisitions and the ensuing Offer

are subject to, on the one hand, obtaining the necessary regulatory

approvals, and, on the other hand, on the Board of Directors of

Believe giving its positive recommendation of the Offer notably

following issuance of the independent expert report relating to the

Offer stating that the take private Offer is fair from a financial

standpoint, and consultation of the social and economic committee

of Believe, the Board stating that the Offer is in the interest of

Believe, its shareholders and its employees and recommending to all

shareholders to tender the shares they hold in Believe into the

Offer.

Proposal submission to Believe's Board

of Directors

The Board of Directors of Believe has taken note

of this proposal, including of its conditions precedent. It notes

that the Offer Price of €15 per share represents a premium of

+21.0% over the last closing price before announcement of the

offer, and a premium of +43.8% and +52.2% respectively over the

volume-weighted 30- and 120-day average share prices.

The Board of Directors of Believe, acting

unanimously, favorably welcomes the proposal, without prejudice to

the outcome of its detailed study of its terms, notably with the

benefit of the report of the independent expert on the fairness of

the Offer Price and the absence of ancillary arrangements affecting

the equal treatment of shareholders.

The Board of Directors of Believe has created an

ad-hoc committee composed of 3 independent directors2, to review

the work of the independent expert and prepare a draft reasoned

opinion (“avis motivé”) on the Offer. Such reasoned opinion will be

provided in the reply document prepared by Believe.

Acting upon the proposal of the ad-hoc

committee, and in accordance with article 261-1 of the AMF General

Regulations, the Board of Directors of Believe has appointed

Ledouble, represented by its partners Agnès Piniot and Romain

Delafont, to act as the independent expert and establish a report

on the financial conditions of the Offer (including in the context

of a possible squeeze-out) and the absence of ancillary

arrangements which could be contrary to the principle of equal

treatment of shareholders. The conclusion of the report shall be

presented as a fairness opinion.

Believe has appointed Citigroup Global Markets

Europe AG and Gide Loyrette Nouel as financial and legal advisers

to assist the Company and the ad-hoc committee of the Board of

Directors in their evaluation of the Offer.

Next steps

It is contemplated that the tender offer will be

filed with the AMF during the second quarter of 2024, should the

Blocks Acquisitions be consummated in the event that the conditions

precedent are satisfied.

2023 Outlook

Believe posted a strong performance in 2023, and

the company takes the opportunity of this communication to

reiterate its 2023 outlook:

- Organic growth of +14% for FY’23, or an adjusted3 organic

growth of c. +19%.

- Adjusted EBITDA margin slightly above 5.5%.

- Positive free cash flow in H2’23. The generation was above

expectations for the second half, and therefore free cash flow will

be negative by only a few million euros on an annual basis.

*****

About BelieveBelieve is one of

the world’s leading digital music companies. Believe’s mission is

to develop independent artists and labels in the digital world by

providing them the solutions they need to grow their audience at

each stage of their career and development. Believe’s passionate

team of digital music experts around the world leverages the

Group’s global technology platform to advise artists and labels,

distribute and promote their music. Its 1,919 employees in more

than 50 countries aim to support independent artists and labels

with a unique digital expertise, respect, fairness and

transparency. Believe offers its various solutions through a

portfolio of brands including Believe, TuneCore, Nuclear Blast,

Naïve, Groove Attack, AllPoints, Ishtar and Byond. Believe is

listed on compartment B of the regulated market of Euronext Paris

(Ticker: BLV, ISIN: FR0014003FE9). www.believe.com

Citigroup Global Markets Europe AG (“Citi”),

which is regulated by the European Central Bank and the German

Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht – BaFin), is acting as financial

adviser exclusively for the Company and no one else in connection

with the Offer, and will not regard any other person as its client

in relation to the Offer and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of Citi or its affiliates, nor for providing advice in

relation to the Offer or any other matters or arrangements referred

to herein

Forward Looking statement This

press release contains forward-looking statements regarding the

prospects and growth strategies of Believe and its subsidiaries

(the “Group”). These statements include statements relating to the

Group’s intentions, strategies, growth prospects, and trends in its

results of operations, financial situation and liquidity. Although

such statements are based on data, assumptions and estimates that

the Group considers reasonable, they are subject to numerous risks

and uncertainties and actual results could differ from those

anticipated in such statements due to a variety of factors,

including those discussed in the Group’s filings with the French

Autorité des Marchés Financiers (AMF) which are available on the

website of Believe (www.believe.com). Prospective information

contained in this press release is given only as of the date

hereof. Other than as required by law, the Group expressly

disclaims any obligation to update its forward-looking statements

in light of new information or future developments. Some of the

financial information contained in this press release is not IFRS

(International Financial Reporting Standards) accounting

measures.

|

Press contacts:believe@brunswickgroup.com Hugues

Boëton |+33 6 79 99 27 15 Benoit Grange |+33 6 14 45 09

26 |

Investor Relations

contact:Emilie.megel@believe.comEmilie MEGEL| +33 6 07 09

98 60 |

1 Through a special purpose company controlled by the

consortium

2 The other Board members are linked either to the consortium or

to shareholders having agreed to sell their shares in Believe to

the consortium.

3 Adjusted organic growth aims at providing a view on Believe’s

organic revenue growth after neutralizing embedded market forex

impact: Believe assesses the forex impact on each digital market

served by the Group to estimate the market forex embedded into its

digital revenues collected from its digital partners. Digital sales

embed currency translation effects as the amounts collected from

Subscriptions and Ad-funded by digital stores are in local

currencies and perceived by Believe mainly in euros.

- Press release - Believe - Announcement - 12.02.2024

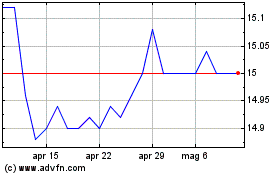

Grafico Azioni Believe (EU:BLV)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Believe (EU:BLV)

Storico

Da Apr 2023 a Apr 2024