PRESS

RELEASE

| |

|

|

|

February 23, 2017 |

|

| |

|

|

2016 Annual

Results

Strong growth in earnings

EBIT up to a record high |

|

|

| |

| |

|

| |

|

|

| |

Issue volume

€19,814 million |

+10.0% |

|

Operating revenue

€1,073 million |

+8.3% |

|

| |

Operating EBIT

€304 million |

+17.3% |

|

Funds from operations[1]

€299 million |

+15.4% |

|

| |

-

Operating EBIT margin up

1.1 points to 28.3%

-

EBIT at an all-time high of

€370 million despite a €32 million negative currency effect

-

Net profit, Group share up

1.9% to €180 million

-

Recommended dividend of €0.62

per share, representing a payout ratio of

80%[2]

-

Net debt reduced by €49

million to €588 million

-

Significant achievements paving

the way for success with the Fast Forward strategic plan:

-

A good performance in the Employee Benefits business, with an 8.5% rise in issue volume (like-for-like) driven by

commercial success, innovative initiatives in mobile payment

solutions and new value-added services.

-

A sharp rise in Expense

Management as a percentage of Edenred's total business,

accounting for 18% of consolidated operating

revenue versus 14% in 2015. This reflects the two-fold increase in the size of the business in Brazil

following the acquisition of Embratec assets, and double-digit organic growth in operating revenue (up

13% like-for-like).

-

Ongoing shift to digital

solutions, which accounted for 70% of total issue volume in

2016 compared to 65% in 2015.

|

|

Bertrand Dumazy,

Chairman and Chief Executive Officer of Edenred, said:

"In 2016, Edenred proved that it has set itself on

a course of profitable and sustainable growth, with EBIT at an

all-time high and cash flow generation up sharply. We delivered

solid performances in Europe and a good level of growth in

Latin America despite a difficult economic environment in

Brazil. In the Employee Benefits business line, we continued to

enhance our offering and to develop innovative new digital and

mobility solutions. On the corporate vehicle fleet management

market, we became market leader in Latin America following our

acquisition of Embratec in Brazil. We also recently increased our

stake in UTA to 51%, becoming the number two issuer of multi-brand

Europe-wide solutions."

"We are confident

as we move into 2017 and will pursue our Fast Forward strategic

plan with the aim of developing new sources of growth, especially

in corporate payment solutions. Value creation is at the heart

of our strategy as we focus on growth in operating revenue and

operating EBIT. We intend to continue generating strong levels of

cash flow so that we can return a high dividend to our shareholders

while retaining enough financial flexibility to leverage external

growth opportunities and maintain our 'Strong Investment Grade'

credit rating".

2016 ANNUAL

RESULTS

The consolidated financial

statements for 2016[3] were

approved by the Board of Directors on February 22, 2017.

2016 key

financial metrics

| (in € millions) |

2016 |

2015 |

% change |

| Reported |

Like-for-like[4] |

| Issue volume |

19,814 |

18,273 |

+8.4% |

+10.0% |

Operating

revenue

Financial revenue

Total revenue |

1,073

66

1,139 |

1,000

69

1,069 |

+7.3%

-4.2%

+6.5% |

+8.3%

+0.2%

+7.8% |

Operating

EBIT

Financial EBIT

Total EBIT |

304

66

370 |

272

69

341 |

+11.6%

-4.2%

+8.4% |

+17.3%

-0.2%

+13.8% |

| Net profit, Group share |

180 |

177 |

+1.9% |

|

| Earnings

per share, Group share[5]

(in €) |

0.78 |

0.78 |

+0.8% |

|

Issue volume up

10.0% like-for-like at €19.8 billion

In line with the Group's historic

medium-term target of 8%-14% annual organic growth, issue volume

for the year was up 10.0% like-for-like to

€19,814 million, driven in particular by 12.7%

like-for-like growth in the fourth quarter. Reported growth stood

at 8.4% for the year, after taking into account:

-

The 5.8% positive impact from changes in the

scope of consolidation relating to the acquisition of Embratec

assets in Brazil, which were transferred to a joint venture

65%-owned by Edenred and fully consolidated over an eight-month

period, and that of La Compagnie des Cartes Carburants (LCCC) in

France, which is 69.2% owned and was fully consolidated over the

12-month period.

-

The negative 7.4% currency effect, primarily due

to the depreciation of the Brazilian real (down 4.3%), Mexican peso

(down 14.8%) and Venezuelan bolivar fuerte (down 63.6%)

against the euro.

-

Issue volume by type of

solution

| |

Employee

Benefits |

Expense

Management |

Incentive & Rewards |

Public Social

Programs |

TOTAL |

Issue volume

(in € millions) |

14,731 |

3,842 |

824 |

416 |

19,814 |

| % of total IV[6] |

75% |

19% |

4% |

2% |

100% |

| Like-for-like growth |

+8.5% |

+15.1% |

+15.4% |

nm |

+10.0% |

The year saw 8.5% like-for-like

growth in the issue volume of Employee

Benefits associated with meals and food and quality of life,

which represented 75% of 2016 issue volume. Expense Management, Edenred's second growth engine,

delivered robust 15.1% like-for-like growth and now accounts for

19% of total issue volume versus 16% in 2015. Incentive &

Rewards and Public Social Programs both posted strong growth in the

year, accounting now for 4% and 2%, respectively, of total issue

volume.

| Like-for-like growth |

First

quarter |

Second quarter |

Third

quarter |

Fourth

quarter |

2016 |

| Latin America |

+7.5% |

+8.7% |

+14.3% |

+19.4% |

+12.4% |

| Europe |

+6.9% |

+9.7% |

+6.4% |

+6.8% |

+7.4% |

| Rest of the

World |

+12.1% |

+11.1% |

+6.0% |

+11.8% |

+10.3% |

| TOTAL |

+7.4% |

+9.3% |

+10.2% |

+12.7% |

+10.0% |

In Latin

America, issue volume for the year was up

12.4% like-for-like at €9.7 billion, or

49% of the Group's total issue volume.

In Brazil,

issue volume for 2016 rose by 4.2% like-for-like despite a very

weak economic environment. Issue volume for the Employee Benefits

business line continued to increase slightly, up 1.2% like-for-like

despite the ongoing rise in the unemployment rate[7].

Expense Management solutions continued to record strong

like-for-like growth, gaining 14.0%.

In Hispanic Latin

America, issue volume was up 23.8% like-for-like, reflecting

strong growth for Expense Management solutions (up 14.9%

like-for-like) and Employee Benefits (up 30.5% like-for-like, aided

partly by Venezuela on account of rising inflation). Like-for-like

growth in Mexico, Edenred's biggest market in

the region, was 13.3%, with an acceleration in the second half of

the year.

In Europe,

2016 issue volume was €9.4 billion (or 47% of

the Group's total issue volume), up 7.4%

like-for-like.

Europe (excluding

France) posted like-for-like growth of 8.9%. Issue volume rose

3.0% in Italy. In Germany, Edenred recorded growth of more than 50%

for its Ticket Plus® Card

solution. In the UK, childcare vouchers were up 5.9% like-for-like.

Issue volume rose 9.7% like-for-like in Central Europe, driven by a

good sales performance in an improved economic environment. All

other European countries delivered double-digit like-for-like

growth in issue volume.

France

recorded solid 4.6% like-for-like growth in issue volume,

reflecting a further 3.4% increase in the Ticket

Restaurant® meal voucher

solution. Edenred leads the digital meal voucher market in France,

wirh around 300,000 users of its Ticket Restaurant®

card solution. The Group also benefited from 7.1% growth in Ticket

Kadéos® gift vouchers

and cards during the year.

Lastly, issue volume in the

Rest of the World was up by 10.3% like-for-like over the year, led mainly by strong

growth in Turkey, the region's primary

contributor.

Total revenue up

7.8% like-for-like to €1,139 million

| Like-for-like growth |

First

quarter |

Second quarter |

Third

quarter |

Fourth quarter |

2016 |

| Operating revenue with IV |

+5.8% |

+7.8% |

+9.6% |

+10.2% |

+8.3% |

| Operating revenue without IV |

+6.6% |

+5.2% |

+12.2% |

+9.3% |

+8.2% |

| Operating

revenue |

+5.9% |

+7.3% |

+9.9% |

+10.0% |

+8.3% |

| Financial

revenue |

-3.1% |

+0.1% |

-2.5% |

+6.8% |

+0.2% |

| Total revenue |

+5.2% |

+6.9% |

+9.1% |

+9.9% |

+7.8% |

Total revenue

for 2016 amounted to €1,139 million,

representing a like-for-like increase of 7.8%

on the previous year. Total revenue comprises operating revenue

with issue volume (80% of total revenue), operating revenue without

issue volume (14% of total revenue), and financial revenue

(6% of total revenue).

On a reported basis, the year-on-year change was a rise of

6.5%, after taking into account the

5.3% positive impact from changes in the scope of

consolidation and the 6.5% negative currency effect.

Operating revenue

with issue volume increased by 8.3%

like-for-like to €918 million. This reflects

an acceleration in growth in Latin America during the second half

and continued strong like-for-like gains in Europe over the last

three quarters.

Growth in

operating revenue with issue volume by region

(like-for-like)

| Like-for-like growth |

First

quarter |

Second quarter |

Third

quarter |

Fourth

quarter |

2016 |

| Latin America |

+6.2% |

+6.6% |

+12.5% |

+14.1% |

+9.7% |

| Europe |

+5.1% |

+8.9% |

+7.3% |

+8.0% |

+7.4% |

| Rest of the World |

+7.9% |

+8.6% |

+2.4% |

+0.4% |

+4.8% |

| TOTAL |

+5.8% |

+7.8% |

+9.6% |

+10.2% |

+8.3% |

Operating revenue

without issue volume was up 8.2%

like-for-like at €155 million, driven in

particular by a good performance from ProwebCE in France.

Total operating

revenue climbed 8.3% like-for-like, mainly reflecting a 7.6%

rise in operating revenue in the Employee Benefits business line,

where the take-up rate[8] remained

stable in 2016 (up 2 basis points), and a 13.1% increase in

operating revenue for the Expense Management business line (on a

like-for-like basis).

While growth in the float

accelerated[9], rising

€165 million in 2016 to €2,619 million, financial revenue remained virtually stable

like-for-like (up 0.2%) at €66 million. This

reflects a solid increase in Latin America (up

11.0% like-for-like) and in the Rest of the World (up 13.3%),

offsetting the 12.8% like-for-like decline in Europe attributable to the fall in interest rates.

EBIT up 13.8%

like-for-like to a record high of €370 million

Total EBIT

rose 8.4% on a reported basis in 2016, reaching an all-time high of

€370 million. Like-for-like, total EBIT

advanced by €47 million, or 13.8%. Changes in the scope of

consolidation had a positive €14 million impact, while the

currency effect was a negative €32 million. Total EBIT comprises

operating EBIT and financial EBIT, which corresponds to financial

revenue.

2016 operating

EBIT by region

| (in € millions) |

2016

|

2015

|

% change |

| Reported |

Like-for-like |

|

| Latin America |

166 |

169 |

-1.8% |

+9.6% |

| Europe |

144 |

118 |

+22.5% |

+23.7% |

| Rest of the World |

8 |

8 |

-3.7% |

-3.4% |

| Worldwide

structures |

(14) |

(23) |

-37.9% |

-13.9% |

| TOTAL |

304 |

272 |

+11.6% |

+17.3% |

Operating

EBIT (which excludes financial revenue) rose 17.3% like-for-like to €304 million, a good performance that reflected an

operating flow-through ratio[10] of

56.5%, in line with the historic medium-term

target of more than 50%.

Latin America

posted like-for-like growth of 9.6% in

operating EBIT, as the operating EBIT margin remained at a high

level despite the morose economic climate in Brazil, the region's

biggest market. In Europe, operating EBIT rose

by a strong 23.7% like-for-like, driving a

significant improvement in the operating EBIT margin.

The Group's operating EBIT margin

gained 1.1 points to stand at 28.3%, reflecting a 2.2-point

improvement in the like-for-like operating margin, offset by a

1.1-point decline resulting from a positive scope impact coupled

with an unfavorable geographical mix effect. This mix effect

relates to fluctuations in exchange rates in the Group's different

regions, which operates with different levels of profitability.

Locally however, the operating margins of the Group's subsidiaries

are not affected by exchange rate fluctuations since their income

and expenses are denominated in local currencies.

Net

profit

Net profit, Group

share rose 1.9% in 2016 to €180 million,

up from €177 million in 2015.

Net profit includes €26 million in

net non-recurring costs. These consist of fees (€9 million),

primarily relating to acquisitions carried out, impairment of

assets (€15 million), the cost of additional initiatives rolled out

to optimize the Group's organization (€19 million), and the

residual balance of other non-recurring items (€17 million income)

- relating mainly to the accounting recognition of compensation due

following the decision handed down on December 13, 2016 by the

International Centre for Settlement of Investment Disputes (ICSID)

in the dispute opposing Edenred and the Hungarian State.

Net profit also includes net

financial expense (€58 million versus €47 million in 2015),

the share of profit of associates and joint ventures

(€8 million), income tax expense (€102 million) and minority

interests (an expense of €12 million in 2016 versus

€5 million in 2015, with the increase attributable to the

creation of the Ticket Log joint venture in Brazil).

Strong cash flow

generation

The Edenred business model

generates significant cash flow. In 2016, funds from operations

before non-recurring items (FFO) came in at a

record €299 million, up

15.4% like-for-like and in line with the

Group's annual growth target of more than 10%.

The free cash

flow generated over the year totaled €352

million. A total net amount of €149 million was allocated to the payment of

dividends and the share buyback program, and €196 million to acquisitions.

After taking into account the

above, along with the positive currency effect and non-recurring

items for a total of €42 million, the Group's net debt stood

at €588 million at December 31, 2016

(versus €637 million at end-2015). The ratio of net debt to

EBITDA improved, at 1.4 versus 1.6 in 2015.

Active management

of debt

During the year, Edenred began to

prepare the refinancing for its €510 million bond maturing in

October 2017, issuing a €250 million Schuldschein loan - a German form of private

placement - consisting of fixed- and floating-rate coupons

with an average maturity of 6.1 years, and an average financing

cost of 1.2%.

In 2016, Edenred also set up two

bank loans, each for BRL 250 million[11] and

falling due in 2018 and 2019 respectively, and took advantage of

more favorable financing conditions to extend its €700 million

(undrawn) revolving credit facility for a further two years through

to July 2021.

These transactions helped further

strengthen the Group's debt profile. The average cost of debt was

2.5% (1.6% excluding the Brazilian loans, versus 2.0% in

2015). Excluding the bond issue maturing in October 2017,

almost half of which has already been refinanced, Edenred has no

major debt repayments due before 2020. The average maturity of the

Group's debt is 4.4 years. These transactions also helped Edenred

diversify its sources of financing and extend its investor

base.

KEY ACHIEVEMENTS

IN 2016 AND EARLY 2017

Further digital

development

The shift to

digital continued at a rapid pace, with digital issue volume

representing 70% of the total issue volume at end-2016, up

5 points versus last year.

In Europe,

the transition launched in 2010 is accelerating and digital issue

volume now represents 43% of the region's

total issue volume (up 7 points from 36% at end-2015). In Latin America, digital solutions accounted for

96% of total issue volume at end-2016, up 2

points on end-2015. In the Rest of the

World region, digital solutions represented 73% of total issue volume, a 3-point increase

year-on-year.

Development of

digital mobile and web solutions for the Employee Benefits business

line

Edenred is

currently the only meal voucher issuer to offer Apple

Pay[12]. Edenred

has been offering this service to the 300,000 holders of its Ticket

Restaurant® cards in

France since July 2016 and to the 90,000 Ticket

Restaurant® card holders

in Spain since December 2016. Payment can be made directly with an

iPhone or Apple Watch at all Ticket Restaurant®-affiliated

restaurants and merchants equipped with a contactless payment

terminal.

In May 2016, Edenred launched

the first mobile payment app for meal vouchers in

Italy. This Ticket Restaurant® app allows

employees to pay for their lunch in restaurants and supermarkets

using either contactless payment or a code sent to their

smartphone. As well as being fast, personalized and user-friendly,

this interactive app has a location search function developed in

partnership with TripAdvisor.

In August 2016, Edenred teamed up

with the Carrefour group to launch Carrefour

Ticket Xpress, an e-voucher service in Taiwan, allowing

Carrefour Taiwan to replace the 8 million+ paper gift vouchers it

issues each year with a mobile payment solution. Carrefour Ticket

Xpress is available on all major banks' online loyalty program

channels. Consumers can use their reward points to get Carrefour

Ticket Xpress delivered directly to their mobile devices and spend

them by simply scanning the barcode at any of Carrefour's 87 Taiwan

stores.

Edenred

number 1 for Expense Management solutions in Latin

America

In May 2016, Edenred finalized the

combination of its Expense Management operations in Brazil with

those of Embratec in a new company called Ticket Log, 65%-owned by

Edenred and 35%-owned by Embratec's founding shareholders. This

transaction enabled Edenred to double the size of its Expense

Management business in Brazil, creating the leading supplier of

fuel card and maintenance solutions for light vehicles and number

two for heavy vehicles.

Ticket Log serves around 27,000

clients, representing more than one million active cards that can

be used at more than 24,500 affiliated service stations and

maintenance workshops, or 58% of Brazil's national network. With

approximately 60 billion liters of fuel consumed in 2014 and a low

penetration rate (between 15% and 20%), the Brazilian B2B fuel card

segment has significant growth potential.

Edenred financed the deal mainly

by contributing assets to the new entity, with an additional cash

payment of BRL 810 million, financed locally. At end-December

2016, the transaction had unlocked cost and business synergies of

around BRL 16 million[13] since May

1, 2016 (the date Embratec's assets were consolidated), in line

with the target of BRL 60 million in annual synergies within

three years.

Launch of new

Expense Management solutions

In Latin America, besides its

Ticket Log joint venture with Embratec, Edenred leveraged its

number one position in Mexico to deliver vigorous growth in the

country, while accelerating its development in other markets such

as Argentina.

In Mexico during the year, Edenred

launched Ticket Car Go, a new contactless payment solution that can

be used to pay for fuel costs. Based on Near Field Communication

(NFC) technology, this solution is currently being tested by a

company operating one of the largest vehicle fleets in Latin

America. In all, 30,000 vehicles have been fitted with NFC Ticket

Car Go stickers. Also in Mexico, Edenred launched Ticket Car Pro, a

mobile app allowing fleet managers to consult information remotely

about use of the cards or to block card use.

In Europe, Edenred stepped up its

cooperation with UTA throughout the year. Ticket Fleet Pro was

launched in France, a solution designed by La Compagnie des Cartes

Carburant (LCCC) in partnership with UTA. Ticket Fleet Pro is

especially aimed at the light vehicle fleet market. Holders of the

Ticket Fleet Pro card have access to a multi-brand network of over

2,500 service stations. The card also offers a number of related

services. For example, Ticket Fleet Pro can be linked up with a

badge for paying toll charges or certain car park and car washing

station fees, with all such expenses consolidated in a single

invoice.

In June 2016, Edenred launched its

Spendeo solution in Romania to manage and optimize employee

business trips before, during and after traveling. Revolving around

a shared web platform, user portal and a MasterCard payment card,

this solution allows companies to credit, customize and monitor

funding for their employees' business trips (amount, location,

hotel rating, etc.). Employees also benefit from an easy and

effective way of managing their expenses and claims.

In November 2016, Edenred expanded

its solutions for SMEs in Spain with the launch of its Ticket

Gasolina fuel card, the product of an alliance with Solred, Spain's

largest network of service stations (Repsol, Campsa and Petronor).

Ticket Gasolina enables companies to benefit from a discount of

between 3% and 5% depending on their fuel consumption. The card

also simplifes administration, since VAT is deducted directly and

clients only have to settle one monthly invoice. Users of the card

are offered secure payment and no longer have to pay for fuel they

need for professional purposes out of their own pockets.

Lastly, through Cardtrend, a

Malaysian company acquired in 2014, Edenred has an ideal platform

from which to develop its software offering across South-East Asia,

particularly with local and regional oil companies, and to develop

multi-brand solutions.

Presentation of

Fast Forward, Edenred's three-year strategic plan

In October 2016, Edenred unveiled

its new Fast Forward strategic plan, designed to accelerate the

Group's transformation over the next three years while laying the

foundations for new sources of profitable and sustainable growth.

The plan leverages the Group's unique expertise in designing and

managing value-added solutions within transactional

ecosystems.

These ecosystems have solid fundamentals and the Group's aim is to

continue unlocking the strong growth potential they offer. Edenred

will look to leverage the growth opportunities that result from

increased digitalization of Employee Benefits solutions,

consolidate its position among the global leaders of the Expense

Management market following the acquisition of Embratec in Brazil

in 2016 and of a controlling interest in UTA in 2017, and

capitalize on the Group's expertise to develop value-added

solutions for new ecosystems such as Corporate Payments.

The Fast Forward plan has resulted

in ambitious new organic growth targets for the coming three years

(see the "2017 Outlook" section at the end of this press release).

Edenred's aim is to maximize value creation for its shareholders

through a balanced deployment of capital between investments and

shareholder return which led the Group to revise its dividend

policy (see the "Dividend policy" section).

Edenred increased its stake in UTA to 51% to

become a world leader in Expense Management

The Group took a further step to

develop its Expense Management business line in January 2017 when

it increased its stake in Union Tank Eckstein (UTA) from 34% to

51%. UTA is the number two Europe-wide player specialized in

multi-brand fuel cards, toll solutions and maintenance services.

Thanks to this transaction, Edenred now manages 2.6 million fuel

cards and toll solutions worldwide and close to 6.3 billion liters

of fuel. The Group's cards are accepted at 70,000 affiliated

service stations.

Edenred intends to speed up the

development of UTA solutions for heavy vehicle fleets, particularly

in Central and Eastern Europe, while gradually rolling out to its

own clients its offer of new solutions in the light vehicle fleet

segment such as Ticket Fleet Pro launched in France.

UTA is fully consolidated as from

January 1, 2017. The acquisition of an additional 17% of UTA's

capital for around €83 million[14] should

have an accretive impact of around 5% on 2017 net profit, Group

share, before the impact of purchase accounting

adjustments.[15] UTA's

minority shareholders[16] have put

options in Edenred's favor covering the remaining 49% of capital.

Edenred will record a liability of around €200 million (gross) in

its consolidated financial statements in respect of these

options.

DIVIDEND

POLICY

As part of its strategic plan Fast

Forward, the Group asserted its commitment to favour a balanced

deployment of capital between investments and shareholder return,

in line with Edenred's growth profile. Drawing on its strong

balance sheet, tight rein on debt and sound liquidity, Edenred

wishes to leverage growth opportunities in line with its goals.

This led it to revise its dividend policy which, from now on, will

aim at paying out at least 80% of net profit, Group share.

In that respect, the recommended

dividend for 2016 amounts to €0.62 per share, representing a payout ratio of 80% of

net profit, Group share (versus 108% in 2015). Shareholders may opt

to receive the entire dividend in cash or to receive half in cash

and half in shares[17]. The

dividend will be put to the vote at Edenred's Annual Shareholders'

Meeting to be held on May 4, 2017.

Regarding investments in 2017,

Edenred already exercised its call option on an additional 17% of

UTA's capital, leading to a cash outflow of €83 million. It should

also be noted that UTA's minority shareholders hold put options on

the remaining 49% of the capital, to be recognized as a liability

in Edenred's financial statements for approximately €200

million.

2017

OUTLOOK

The Group expects its performance

in 2017 to be in line with the medium-term targets of its

three-year strategic plan Fast Forward:

-

Like-for-like growth of more

than 7% in operating revenue, driven by a mid-single-digit rise

in operating revenue for the Employee Benefits business line and a

double-digit increase in Expense Management operating revenue (on a

like-for-like basis).

-

Like-for-like growth of more

than 9% in operating EBIT.

-

Like-for-like growth of over

10% in funds from operations before non-recurring items

(FFO).

The Group expects continued strong

growth of its business in Europe in 2017. Latin America should

evolve broadly in line with 2016, with robust growth in Mexico

despite emerging macroeconomic uncertainties and a continued

contrasted performance in Brazil, shaped by weak growth in Employee

Benefits owing to rising unemployment but strong double-digit

growth in Expense Management.

In line with its strategic goals,

the Group will focus on delivering growth in operating revenue and

in operating EBIT while continuing to generate high levels of cash

flow and maintaining its "Strong Investment Grade" rating.

UPCOMING

EVENTS

April 12, 2017: First-quarter 2017

revenue

May 4, 2017: Annual Shareholders' Meeting

July 25, 2017: First-half 2017 results

October 13, 2017: Third-quarter 2017 revenue

___

Edenred, which invented the Ticket

Restaurant® meal voucher

and is the world leader in prepaid corporate services, designs and

manages solutions that improve the efficiency of organizations and

purchasing power to individuals.

By ensuring that allocated funds are used

specifically as intended, these solutions enable companies to more

effectively manage their:

-

Employee benefits (Ticket

Restaurant ®, Ticket

Alimentación, Ticket CESU, Childcare Vouchers, etc.)

-

Expense management process (Ticket

Car, Ticket Clean Way, Repom, etc.)

-

Incentive and reward programs (Ticket Compliments, Ticket Kadéos, etc.)

The Group also

supports public institutions in managing their social programs.

Listed on the Euronext Paris stock exchange,

Edenred operates in 42 countries, with close to 8,000 employees,

750,000 companies and public sector clients, 1.4 million affiliated

merchants and 43 million beneficiaries. In 2016, total issue volume

amounted to almost €20 billion.

Ticket

Restaurant® and all other

tradenames of Edenred products and services are registered

trademarks of Edenred SA.

Follow Edenred on

Twitter: www.twitter.com/Edenred

___

CONTACTS

Media

Relations

Anne-Sophie Sibout

+33 (0)1 74 31 86 11

anne-sophie.sibout@edenred.com

Jehan O'Mahony

+33 (0)1 74 31 87 42

jehan.omahony@edenred.com |

Investor and

Shareholder Relations

Aurélie Bozza

+33 (0)1 74 31 84 16

aurelie.bozza@edenred.com

|

APPENDICES

Glossary and list of references

needed for a proper understanding of financial information

-

Main terms

Like-for-like or organic growth

corresponds to comparable growth, i.e., growth at constant

exchange rates and scope of consolidation. This indicator reflects

the Group's business performance.

Changes in activity (like-for-like

or organic growth) represent changes in amounts between the current

period and the comparative period, adjusted for currency effects

and for the impact of acquisitions and/or disposals.

The impact of acquisitions is

eliminated from the amount reported for the current period and

changes in activity are calculated in relation to this adjusted

amount for the current period. The impact of disposals is

eliminated from the amount reported for the comparative period and

changes in activity are calculated in relation to this adjusted

amount for the comparative period. The sum of these two amounts is

known as the impact of changes in the scope of

consolidation or the scope effect.

The calculation of changes in

activity is translated at the exchange rate applicable in the

comparative period and divided by the adjusted amount for the

comparative period.

The currency effect is the

difference between the amount for the reported period translated at

the exchange rate for the reported period and the amount for the

reported period translated at the exchange rate applicable in the

comparative period

Issue volume corresponds to the

face value of prepaid checks and paper vouchers issued during the

period, plus the amount loaded on prepaid cards.

It is tracked for all vouchers and cards in circulation that are

managed by Edenred.

-

Alternative Performance

Measurement indicators included in the 2016 Annual Financial

Report

The alternative performance measurement indicators

outlined below are presented and reconciled with accounting data in

the Annual Financial Report.

| Indicator |

Reference note in Edenred's 2016 consolidated financial

statements in the Annual Financial Report |

| Operating revenue with issue volume |

Note

4.3 |

| Operating revenue without issue volume |

Note

4.3 |

| Operating revenue (total) |

Note

4.3 |

| Financial revenue |

Note

4.3 |

| EBIT |

Note

4.5 |

| Net debt |

Note

6.5 |

| Funds from operations (FFO) |

Consolidated statement of cash flows (Note 1.4) |

-

Alternative Performance

Measurement indicators not included in the 2016 Annual Financial

Report

| Indicator |

Definitions and reconciliations with Edenred's 2016

consolidated financial statements |

| Operating EBIT |

Corresponds

to EBIT adjusted for financial revenue.

As per the published consolidated financial statements, operating

EBIT for 2016 was €304 million, comprising:

|

| Financial EBIT |

Corresponds

to financial revenue.

As per the published consolidated financial statements, financial

EBIT for 2016 was €66 million. |

| Free cash flow |

Corresponds

to funds from operations minus cash used in recurring capital

expenditure.

At December 31, 2016, based on the consolidated statement of cash

flows:

- €410 million in net cash from operating

activities

- minus €58 million in cash outflows for recurring

capital expenditure

|

-

Method used to calculate the

main management ratios

| Indicator |

Definitions and reconciliations with Edenred's 2016

consolidated financial statements |

Operating

flow-through ratio |

This ratio

reflects the operating EBIT margin arising on changes in activity

(like-for-like basis).

It corresponds to: (Like-for-like growth in operating

EBIT)/(Like-for-like growth in operating revenue).

At December 31, 2016, the operating flow-through ratio was 56.5%,

based on:

- Like-for-like operating EBIT growth: €47

million

- Like-for-like operating revenue growth: €83

million

|

| Operating EBIT margin |

This ratio

reflects the operating EBIT margin based on reported

figures.

It corresponds to: (operating EBIT)/(operating revenue).

At December 31, 2016, the operating EBIT margin was 28.3%, based

on:

- Operating EBIT: €304 million

- Operating revenue: €1,073 million

|

Issue

volume

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

767 |

735 |

806 |

696 |

676 |

614 |

1,054 |

965 |

|

3,303 |

3,010 |

| Rest of

Europe |

1,452 |

1,346 |

1,536 |

1,395 |

1,399 |

1,353 |

1,662 |

1,559 |

|

6,049 |

5,653 |

| Latin

America |

1,872 |

2,284 |

2,252 |

2,274 |

2,564 |

2,030 |

2,978 |

2,264 |

|

9,666 |

8,852 |

| Rest of

the world |

193 |

188 |

200 |

192 |

194 |

183 |

209 |

195 |

|

796 |

758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

4,284 |

4,553 |

4,794 |

4,557 |

4,833 |

4,180 |

5,903 |

4,983 |

|

19,814 |

18,273 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

4.4% |

4.2% |

15.8% |

6.2% |

10.0% |

3.4% |

9.3% |

4.5% |

|

9.7% |

4.6% |

| Rest of

Europe |

7.9% |

8.4% |

10.1% |

11.5% |

3.4% |

7.7% |

6.6% |

8.1% |

|

7.0% |

8.9% |

| Latin

America |

-18.0% |

7.5% |

-1.0% |

8.7% |

26.3% |

14.3% |

31.5% |

19.4% |

|

9.2% |

12.4% |

| Rest of

the world |

2.7% |

12.1% |

4.2% |

11.1% |

5.8% |

6.0% |

7.2% |

11.8% |

|

5.0% |

10.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

-5.9% |

7.4% |

5.2% |

9.3% |

15.6% |

10.2% |

18.5% |

12.7% |

|

8.4% |

10.0% |

Operating revenue

with issue volume

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

32 |

31 |

33 |

30 |

28 |

26 |

49 |

45 |

|

142 |

132 |

| Rest of

Europe |

73 |

68 |

77 |

71 |

70 |

66 |

84 |

78 |

|

304 |

283 |

| Latin

America |

83 |

104 |

104 |

105 |

118 |

91 |

129 |

95 |

|

434 |

395 |

| Rest of

the world |

9 |

10 |

10 |

9 |

9 |

10 |

10 |

9 |

|

38 |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

197 |

213 |

224 |

215 |

225 |

193 |

272 |

227 |

|

918 |

848 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

1.4% |

1.9% |

11.0% |

5.6% |

4.8% |

2.7% |

9.7% |

5.7% |

|

7.0% |

4.1% |

| Rest of

Europe |

6.3% |

6.6% |

9.2% |

10.3% |

6.9% |

9.2% |

6.9% |

9.3% |

|

7.3% |

8.9% |

| Latin

America |

-20.1% |

6.2% |

-0.8% |

6.6% |

29.4% |

12.5% |

36.2% |

14.1% |

|

10.0% |

9.7% |

| Rest of

the world |

-2.2% |

7.9% |

1.6% |

8.6% |

2.4% |

2.4% |

-3.4% |

0.4% |

|

-0.5% |

4.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

-7.7% |

5.8% |

4.2% |

7.8% |

17.0% |

9.6% |

19.2% |

10.2% |

|

8.2% |

8.3% |

Operating revenue

without issue volume

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

13 |

6 |

14 |

20 |

12 |

11 |

14 |

13 |

|

53 |

50 |

| Rest of

Europe |

10 |

11 |

9 |

8 |

9 |

9 |

16 |

17 |

|

44 |

45 |

| Latin

America |

5 |

6 |

5 |

7 |

6 |

6 |

6 |

4 |

|

22 |

23 |

| Rest of

the world |

8 |

8 |

9 |

9 |

9 |

8 |

10 |

9 |

|

36 |

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

36 |

31 |

37 |

44 |

36 |

34 |

46 |

43 |

|

155 |

152 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

129.0% |

4.4% |

-32.0% |

2.6% |

14.7% |

14.7% |

11.9% |

11.9% |

|

7.7% |

7.7% |

| Rest of

Europe |

0.7% |

8.7% |

1.6% |

5.1% |

-8.7% |

0.0% |

-4.2% |

1.7% |

|

-3.0% |

3.5% |

| Latin

America |

-23.6% |

4.4% |

-20.9% |

0.8% |

15.0% |

29.1% |

3.7% |

19.9% |

|

-8.3% |

12.3% |

| Rest of

the world |

3.2% |

7.5% |

7.7% |

15.1% |

9.9% |

12.5% |

16.6% |

14.9% |

|

9.3% |

12.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

20.0% |

6.6% |

-16.0% |

5.2% |

6.7% |

12.2% |

5.5% |

9.3% |

|

2.4% |

8.2% |

Total operating

revenue

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

45 |

37 |

47 |

50 |

40 |

37 |

63 |

58 |

|

195 |

182 |

| Rest of

Europe |

83 |

79 |

86 |

80 |

79 |

75 |

100 |

95 |

|

348 |

328 |

| Latin

America |

88 |

110 |

109 |

111 |

124 |

97 |

135 |

99 |

|

456 |

418 |

| Rest of

the world |

17 |

18 |

19 |

18 |

18 |

18 |

20 |

18 |

|

74 |

72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

233 |

244 |

261 |

259 |

261 |

227 |

318 |

270 |

|

1,073 |

1,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

21.1% |

2.2% |

-6.5% |

4.4% |

7.5% |

6.0% |

10.2% |

7.1% |

|

7.2% |

5.1% |

| Rest of

Europe |

5.6% |

6.9% |

8.3% |

9.7% |

4.9% |

8.0% |

4.9% |

7.9% |

|

5.9% |

8.1% |

| Latin

America |

-20.3% |

6.1% |

-2.0% |

6.3% |

28.6% |

13.4% |

34.7% |

14.3% |

|

9.0% |

9.8% |

| Rest of

the world |

0.3% |

7.7% |

4.5% |

11.7% |

6.0% |

7.3% |

5.7% |

7.0% |

|

4.1% |

8.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

-4.2% |

5.9% |

0.8% |

7.3% |

15.5% |

9.9% |

17.0% |

10.0% |

|

7.3% |

8.3% |

Financial

revenue

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| In €

millions |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

3 |

4 |

3 |

3 |

2 |

3 |

2 |

3 |

|

10 |

13 |

| Rest of

Europe |

4 |

4 |

4 |

5 |

5 |

6 |

4 |

4 |

|

17 |

19 |

| Latin

America |

7 |

10 |

8 |

8 |

9 |

7 |

10 |

8 |

|

34 |

33 |

| Rest of

the world |

2 |

1 |

1 |

1 |

1 |

0 |

1 |

2 |

|

5 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

16 |

19 |

16 |

17 |

17 |

16 |

17 |

17 |

|

66 |

69 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| France |

-25.1% |

-25.1% |

-22.1% |

-22.1% |

-14.1% |

-14.1% |

-17.4% |

-17.4% |

|

-20.1% |

-20.1% |

| Rest of

Europe |

-9.8% |

-9.1% |

-10.9% |

-8.9% |

-8.9% |

-5.2% |

-11.5% |

-7.4% |

|

-10.3% |

-7.7% |

| Latin

America |

-19.4% |

7.1% |

-1.5% |

13.0% |

10.3% |

2.0% |

32.3% |

23.0% |

|

4.2% |

11.0% |

| Rest of the

world |

2.5% |

14.3% |

5.1% |

14.4% |

5.6% |

8.4% |

9.4% |

16.3% |

|

5.7% |

13.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

-17.0% |

-3.1% |

-7.8% |

0.1% |

0.3% |

-2.5% |

9.6% |

6.8% |

|

-4.2% |

0.2% |

Total

revenue

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

48 |

41 |

50 |

53 |

42 |

40 |

65 |

61 |

|

205 |

195 |

| Rest of

Europe |

87 |

83 |

90 |

84 |

84 |

81 |

104 |

99 |

|

365 |

347 |

| Latin

America |

95 |

120 |

117 |

120 |

133 |

104 |

145 |

107 |

|

490 |

451 |

| Rest of

the world |

19 |

19 |

20 |

19 |

19 |

18 |

21 |

20 |

|

79 |

76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

249 |

263 |

277 |

276 |

278 |

243 |

335 |

287 |

|

1,139 |

1,069 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

Q4 |

|

FY |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France |

16.7% |

-0.3% |

-7.5% |

2.7% |

5.9% |

4.5% |

8.8% |

5.9% |

|

5.4% |

3.4% |

| Rest of

Europe |

4.7% |

6.0% |

7.3% |

8.7% |

4.1% |

7.3% |

4.2% |

7.2% |

|

5.0% |

7.3% |

| Latin

America |

-20.3% |

6.2% |

-1.9% |

6.7% |

27.2% |

12.6% |

34.5% |

15.0% |

|

8.6% |

9.9% |

| Rest of

the world |

0.5% |

8.0% |

4.5% |

11.8% |

6.0% |

7.3% |

5.9% |

7.6% |

|

4.2% |

8.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

-5.2% |

5.2% |

0.2% |

6.9% |

14.5% |

9.1% |

16.6% |

9.9% |

|

6.5% |

7.8% |

EBIT

| |

2016 |

2015 |

|

Change reported |

Change L/L |

| In € millions |

|

| |

|

| |

|

|

|

|

|

|

France |

44 |

42 |

|

5.9% |

3.7% |

| Rest of

Europe |

127 |

108 |

|

18.0% |

20.6% |

| Latin

America |

200 |

202 |

|

-0.8% |

9.8% |

| Rest of

the world |

13 |

12 |

|

-0.1% |

2.9% |

| Worldwide

structures |

(14) |

(23) |

|

-37.9% |

-13.9% |

|

|

|

|

|

|

|

| Total |

370 |

341 |

|

8.4% |

13.8% |

[1] Before

non-recurring items.

[2] Total

dividend as a percentage of net profit, Group share.

[3] The audit

has been completed and the auditors will issue their opinion before

the Registration Document is filed.

[4] At constant

scope of consolidation and exchange rates (corresponding to organic

growth).

[5] Shares

outstanding: 230,113 thousands of shares in 2016 versus 227,773

thousands of shares in 2015.

[7] The

unemployment rate in Brazil was around 12% at end-December 2016

compared to around 9% at end-2015 (source: Banco centrale do

Brasil).

[8] Ratio of

operating revenue with issue volume to total issue volume.

[9] The float

corresponds to the working capital requirement, or service vouchers

in circulation less trade receivables.

[10] Ratio of

the like-for-like change in operating EBIT to the like-for-like

change in operating revenue.

[11] BRL 500

million, equivalent to €146 million based on the closing EUR/BRL

exchange rate of 3.43 at December 31, 2016.

[12] Apple Pay

is compatible with the iPhone 6s, iPhone 6s Plus,

iPhone 6, iPhone 6 Plus, iPhone SE and Apple

Watch.

[13] Around

€4.1 million at the average 2016 exchange rate of BRL 3.861 for one

euro.

[14] The

transaction values UTA at €385 million (enterprise value on a

100% basis), or market capitalization of around €480 million

(100% basis).

[15] Around 2%

after the impact of purchase accounting adjustments.

[16] The

founders of UTA (the Eckstein and Van Dedem families) and Daimler

hold 34% and 15% of UTA's share capital respectively.

[17] With a 10%

discount.

Edenred 2016 Annual results_PR

EN

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: EDENRED S.A. via Globenewswire

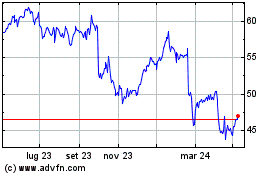

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Set 2024 a Ott 2024

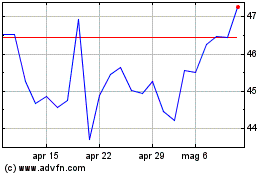

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Ott 2023 a Ott 2024