Kering Shares Slide After Gucci Sales Disappoint

22 Aprile 2022 - 10:07AM

Dow Jones News

By Cristina Roca and Joshua Kirby

Shares in French luxury-goods conglomerate Kering traded sharply

lower on Friday despite a strong rise in headline revenue after

sales at its main brand Gucci fell short of expectations amid

Covid-19 lockdowns in China.

Kering on Thursday reported first-quarter revenue of 4.96

billion euros ($5.38 billion), up 21% on a comparable basis from

the previous-year period. Analysts had expected revenue of EUR4.74

billion, according to FactSet.

Revenue at its flagship Gucci brand rose 13%. The performance

fell short of consensus expectations of an 18% increase, Stifel

analyst Rogerio Fujimori said in a note.

At 0722 GMT, shares in Kering were down 5.7% at EUR521.50.

As with the overall group, Gucci's sales growth was strong among

local consumers in North America and Western Europe but took a hit

from new pandemic-related measures in mainland China notably,

Kering said.

Among the group's other brands, Yves Saint Laurent was the

stand-out performer, with a 37% increase.

Secondary brands helped Kering beat expectations at group level,

but while Kering gradually becomes less dependent on Gucci,

investor and market focus will remain on the performance of the

leading brand, Bernstein analyst Luca Solca said in a note.

Write to Cristina Roca at cristina.roca@wsj.com and Joshua Kirby

at joshua.kirby@dowjones.com

(END) Dow Jones Newswires

April 22, 2022 03:52 ET (07:52 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

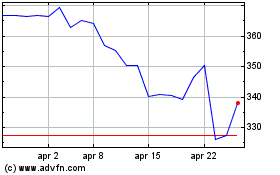

Grafico Azioni Kering (EU:KER)

Storico

Da Mar 2024 a Apr 2024

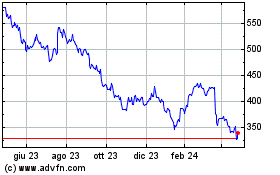

Grafico Azioni Kering (EU:KER)

Storico

Da Apr 2023 a Apr 2024