Kering: VERY STRONG PERFORMANCES IN THE FIRST HALF OF 2022

|

PRESS RELEASE |

|

July 27, 2022 |

VERY STRONG

PERFORMANCES IN THE FIRST HALF OF

2022

Group revenue: €9,930

millionup 23% as reported and up 16% on a

comparable basis

Recurring operating income: €2,820

million, up 26%Recurring operating margin of 28.4%, up 60

basis pointsNet income attributable to the Group: €1,988

million, up 34%

“The Group delivered sharply higher sales in the

first half of 2022, sustaining last year’s topline momentum—solid

performances in retail around the world more than offset the impact

of Covid-related measures in China in the second quarter. We

intensify our engagement with local customers across all markets,

and we are also leveraging the nascent rebound in tourism in

Europe. Each of our Houses contributed to the strong double-digit

increase in Group operating income, leading to expanded margin for

Kering as a whole. In a period of heightened macro uncertainty,

Kering is in great shape to surmount short-term challenges, take

advantage of new opportunities, and support the ambitious

strategies and tremendous prospects of all our brands.”

François-Henri Pinault,

Chairman & CEO

- Group revenue in the first half of

2022 grew 23% as reported and 16% on a comparable basis compared to

the first six months of 2021. Group revenue also rose sharply

compared to the first half of 2019, up 28% on a comparable basis.

- In the second quarter of 2022,

sales rose by 20% as reported and 12% on a comparable basis, the

difference being mainly due to currency effects.

- Sales from the directly operated

retail network, including e-commerce, were up 12% year-on-year on a

comparable basis in the second quarter and up 32% compared to the

second quarter of 2019, driven by the success of Kering’s Houses

with local customers and the resumption of tourism in Western

Europe.

- Recurring operating income grew 26%

in the first half, with all Houses contributing to growth.

Recurring operating margin was 28.4%, up 60 basis points compared

to the first half of 2021.

- Net income attributable to the

Group hit a new record of €1,988 million, an increase of 34%.

- The Group generated substantial

Free cash flow from operations of more than €2 billion.

Financial indicators

Operating performance

|

Revenue(in € millions) |

|

H1 2022 |

H1 2021 |

Reported change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Gucci |

|

5,173 |

4,479 |

+15.5% |

+8.3% |

|

Yves Saint Laurent |

|

1,481 |

1,046 |

+41.7% |

+34.2% |

|

Bottega Veneta |

|

834 |

708 |

+17.9% |

+12.8% |

|

Other Houses |

|

1,955 |

1,485 |

+31.7% |

+29.3% |

|

Kering Eyewear and Corporate |

|

591 |

396 |

+49.2% |

+25.7% |

|

|

|

|

|

|

|

|

Eliminations |

|

(104) |

(67) |

+59.1% |

+57.3% |

|

|

|

|

|

|

|

|

KERING |

|

9,930 |

8,047 |

+23.4% |

+16.2% |

| (1) On a

comparable scope and exchange rate basis. |

|

|

Revenue(in € millions) |

|

H1 2022 |

H1 2021 |

Reported change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Gucci |

|

5,173 |

4,479 |

+15.5% |

+8.3% |

|

Yves Saint Laurent |

|

1,481 |

1,046 |

+41.7% |

+34.2% |

|

Bottega Veneta |

|

834 |

708 |

+17.9% |

+12.8% |

|

Other Houses |

|

1,955 |

1,485 |

+31.7% |

+29.3% |

|

Kering Eyewear and Corporate |

|

591 |

396 |

+49.2% |

+25.7% |

|

|

|

|

|

|

|

|

Eliminations |

|

(104) |

(67) |

+59.1% |

+57.3% |

|

|

|

|

|

|

|

|

KERING |

|

9,930 |

8,047 |

+23.4% |

+16.2% |

|

Revenue(in € millions) |

|

H1 2022 |

H1 2021 |

Reported change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Gucci |

|

5,173 |

4,479 |

+15% |

+8% |

|

Yves Saint Laurent |

|

1,481 |

1,046 |

+42% |

+34% |

|

Bottega Veneta |

|

834 |

708 |

+18% |

+13% |

|

Other Houses |

|

1,955 |

1,485 |

+32% |

+29% |

|

Kering Eyewear and Corporate |

|

591 |

396 |

+49% |

+26% |

|

|

|

|

|

|

|

|

Eliminations |

|

(104) |

(67) |

- |

- |

|

|

|

|

|

|

|

|

KERING |

|

9,930 |

8,047 |

+23% |

+16% |

|

Recurring operating income(in € millions) |

|

H1 2022 |

H1 2021 |

Change |

|

|

|

|

|

|

|

Gucci |

|

1,886 |

1,694 |

+11% |

|

Yves Saint Laurent |

|

438 |

275 |

+59% |

|

Bottega Veneta |

|

168 |

130 |

+29% |

|

Other Houses |

|

337 |

197 |

+71% |

|

Kering Eyewear and Corporate |

|

(7) |

(63) |

+90% |

|

|

|

|

|

|

|

Eliminations |

|

(2) |

4 |

- |

|

|

|

|

|

|

|

KERING |

|

2,820 |

2,237 |

+26% |

Gucci: ongoing brand elevation strategy

In the first half of 2022,

Gucci’s revenue amounted to €5,173 million, an increase of 15% as

reported and 8% on a comparable basis. Sales from the directly

operated retail network rose 8% on a comparable basis, while

Wholesale was up 9%.

In the second quarter of 2022,

revenue was up 12% as reported and up 4% on a comparable basis.

Growth in sales in the directly operated retail network were robust

in Western Europe, Japan, and North America, more than offsetting

the impact of lockdowns in China. Momentum was also very strong in

Southeast Asia.

In the first half of 2022, Gucci’s

recurring operating income totaled €1,886 million.

Recurring operating margin was solid at 36.5%, as

the House continues to invest to advance its brand elevation

strategy.

Yves Saint Laurent: hitting new highs

Yves Saint Laurent’s revenue in the

first half of 2022 totaled €1,481 million, up 42% as

reported and up 34% on a comparable basis, reflecting the perfect

execution of its strategy. Sales from the House’s directly operated

retail network rose by 41% on a comparable basis. Revenue from

Wholesale, currently being streamlined, grew by 10% on a comparable

basis due to a very high level of orders.

Sales in the second quarter of

2022 rose by 40% as reported and by 31% on a comparable

basis, driven by Western Europe, Japan and North America, while

revenue in Asia-Pacific was stable compared to 2021. Growth was

particularly strong in the directly operated retail network

(revenue up 35% on a comparable basis), due to the success of all

product categories.

Yves Saint Laurent’s recurring operating

income was €438 million in the first half of 2022.

Recurring operating margin was 29.6%, a first-half

record level, up 3.3 points compared to the year-earlier

period.

Bottega Veneta: exclusivity and solid

growth

In the first half of 2022,

Bottega Veneta’s revenue amounted to €834 million, an increase of

18% as reported and 13% on a comparable basis. Sales from the

directly operated retail network were up 19% year-on-year.

Wholesale revenue was down 4%, in line with Bottega Veneta’s

strategy to streamline its wholesale distribution.

In the second quarter of 2022,

Bottega Veneta’s revenue was €438 million, up 15% as reported and

up 10% on a comparable basis. Sales momentum in the directly

operated retail network remained very strong (revenue up 19% on a

comparable basis), even though the number of stores was

unchanged.

Bottega Veneta’s recurring operating

income for the first half of 2022 totaled €168 million,

and its recurring operating margin rose markedly to return to the

20% level.

Other Houses: outstanding results and exceptional

potential

Kering’s Other Houses continued to achieve very

strong growth, with revenue close to €2 billion in the

first half of 2022, up 32% as reported and up 29% on a

comparable basis. Sales from the Other Houses’ directly operated

retail network rose by 38%, while Wholesale was up 16% on a

comparable basis relative to the first half of 2021.

In the second quarter of 2022,

sales of the Other Houses rose 28% as reported and 24% on a

comparable basis. The revenue increase from the directly operated

retail network remained strong (+33% on a comparable basis), with

progress across regions. Both Balenciaga and Alexander McQueen

maintained their very strong growth trajectories, and Brioni

confirmed its rebound. While Qeelin was affected by the situation

in China in the second quarter, Boucheron and Pomellato delivered

very solid performances.

The Other Houses contributed significantly to

the increase in the Group’s recurring operating income. They

generated record recurring operating income of

€337 million in the first half of 2022, an increase of 71%.

Recurring operating margin was strong at 17.3%, an

increase of 4.0 points.

Kering Eyewear and Corporate*

Revenue of the Kering Eyewear and Corporate

segment in the first half of 2022 amounted to €591

million. Kering Eyewear’s revenue totaled €576 million, up 50% as

reported including the integration of Lindberg, and up 26% on a

comparable basis.

In the second quarter, growth

in Kering Eyewear revenue continued, up 17% on a comparable basis,

driven by the momentum of the brands in its portfolio. The

acquisition of Maui Jim will be completed in the second half of

2022.

In the first half, Kering Eyewear’s

recurring operating income more than doubled

relative to the first half of 2021, reaching €111 million. The

House benefited from the integration of Lindberg and from the

seasonality of its sales, a majority of which occur in the first

half of the year.

Corporate costs were stable.

* The “Corporate and other” segment was renamed

“Kering Eyewear and Corporate” in the first quarter of 2022.

Intragroup eliminations are now reported on a separate line.

Financial performance

Kering’s financial

result, at just (€19 million), improved

sharply in the first half of 2022.

The effective tax rate on recurring income was

27.5% during the period.

Net income attributable to the Group was strong

at €1,988 million.

Earnings per share were up 36%.

Cash flow and financial position

The Group’s free cash flow from

operations totaled €2,049 million in the first half of 2022.

As of June 30, 2022, Kering had a very robust

financial position, with net debt of €942 million.

Outlook

A major player in a fast-growing market around

the world, Kering enjoys solid fundamentals and a balanced

portfolio of complementary brands with strong potential. Its

strategic priorities are straightforward. The Group and its Houses

seek to achieve same-store revenue growth while ensuring the

targeted and selective expansion of their retail networks. Kering

aims to grow its Houses in a sustainable manner, enhance the

exclusivity of their distribution and secure their profitable

growth trajectories. The Group is also investing proactively to

develop cross-business growth platforms in the areas of e-commerce,

omnichannel distribution, logistics and technological

infrastructure, digital expertise and innovative tools.The 2020

public health crisis and subsequent economic disruption have had

major consequences on consumption trends, tourism flows and global

economic growth. More favorable trends, which emerged in the second

half of 2020, were confirmed in 2021 and in early 2022. Although

these trends remain conditioned by developments in the public

health situation and associated restrictions across countries, the

luxury market has witnessed a significant rebound, driven by

consumer appetite for premium goods and a gradual upturn in tourist

flows, particularly in Europe.In an increasingly uncertain

macroeconomic context, the Group is continuing to implement its

strategy with determination and will continue to manage and

allocate its resources to best support its operating performance,

continue generating significant cash flow, and optimize its return

on capital employed.Thanks to its strong business and

organizational model, along with its robust financial position,

Kering remains confident in its growth potential for the medium and

long term.

***

In its meeting on July 27, 2022, Kering’s Board

of Directors, chaired by François-Henri Pinault, approved the

consolidated financial statements for the first half of 2022

following a limited review.

The Board of Directors also noted Jean Liu’s

resignation from her role as Director. François-Henri Pinault

offered her his sincere thanks for her contribution to the Board’s

work (see “Meeting of the Board of Directors” on page 9).

AUDIOCAST

An

audiocast for analysts and investors will be held

from 6:00pm to 7:00pm (CEST) on Wednesday,

July 27, 2022. It may be accessed here.

The slides (PDF) will be available ahead of the audiocast at

https://www.kering.com/en/finance/.

A replay of the

audiocast will also be available at www.kering.com.

About Kering

A global Luxury group, Kering manages the

development of a series of renowned Houses in Fashion, Leather

Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta,

Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo,

Qeelin, as well as Kering Eyewear. By placing creativity at the

heart of its strategy, Kering enables its Houses to set new limits

in terms of their creative expression while crafting tomorrow’s

Luxury in a sustainable and responsible way. We capture these

beliefs in our signature: “Empowering Imagination”. In 2021, Kering

had over 42,000 employees and revenue of €17.6 billion.

Contacts

PressEmilie Gargatte

+33 (0)1 45 64 61

20 emilie.gargatte@kering.comMarie

de

Montreynaud +33

(0)1 45 64 62

53 marie.demontreynaud@kering.com

Analysts/investorsClaire Roblet

+33

(0)1 45 64 61

49 claire.roblet@kering.comLaura

Levy

+33 (0)1 45 64 60

45 laura.levy@kering.com

|

APPENDICES EXCERPTS FROM THE

CONSOLIDATED INTERIM FINANCIAL STATEMENTS AND

ADDITIONAL INFORMATION FOR THE SIX MONTHS ENDED JUNE 30,

2022 |

| |

|

|

|

|

| |

|

|

|

|

| |

Contents |

|

Pages |

|

| |

|

|

|

|

| |

Announcements since January 1, 2022

andMeeting of the Board

of Directors on July 27,

2022 |

8-9 |

|

| |

Consolidated income statement |

10 |

|

| |

Consolidated statement of comprehensive

income |

11 |

|

| |

Consolidated balance sheet |

12 |

|

| |

Consolidated statement of cash flows |

13 |

|

| |

Breakdown of revenue |

14 |

|

| |

Main definitions |

15 |

|

| |

|

|

|

| |

|

|

|

ANNOUNCEMENTS SINCE JANUARY 1,

2022

Sale of Girard-Perregaux and Ulysse

Nardin to their managementJanuary 24, 2022 – Kering

announced the signature of an agreement to sell its entire stake

(100%) in Sowind Group SA, which owns the Swiss watch manufacturers

Girard-Perregaux and Ulysse Nardin, to its current management. The

transaction was completed on May 31, 2022, according to the agreed

terms.

Stock Repurchase Program: launch of the

second trancheFebruary 22, 2022 – Pursuant to the Stock

Repurchase Program announced on August 25, 2021, covering up to

2.0% of its share capital over a 24-month period, Kering has signed

a new share buyback agreement with an investment service

provider.

Kering Eyewear agrees

to acquire the iconic U.S. eyewear brand Maui

JimMarch 14, 2022 - Kering Eyewear has signed an agreement

to acquire Maui Jim, Inc. Founded in 1987 in Hawaii, Maui Jim is

the world’s largest independent high-end eyewear brand, rooted in

exceptional design and industry-leading technology. The transaction

is subject to clearance by the relevant competition authorities and

is expected to be completed in the second half of 2022.

Gianfilippo Testa appointed CEO of

Alexander McQueenMarch 21, 2022 - Kering announced the

appointment of Gianfilippo Testa as CEO of Alexander McQueen,

effective May 2022. Mr. Testa will report to François-Henri

Pinault. He succeeds Emmanuel Gintzburger, who has decided to leave

the Group to pursue new professional challenges outside Kering.

Partnership agreement in support of

integrating young, vulnerable and disabled peopleApril 22,

2022 – On April 19, 2022, Kering and the French Ministry of Labor,

Employment and Economic Inclusion signed a charter through which

they will partner to help integrate and support young, vulnerable,

and disabled people in the labor market. Kering has undertaken to

take practical action to help young people gain employment and make

roles accessible to disabled people through recruitment, work/study

programs, mentoring and immersive work experience through the

Contrat d’Engagement Jeune (youth commitment contract).

Dual-tranche bond issue for a total

amount of €1.5 billionApril 28, 2022 – Kering issued €1.5

billion of new bonds, comprising one tranche of €750 million with a

three-year maturity and a coupon of 1.25% and a €750 million

tranche with an eight-year maturity and a coupon of 1.875%. This

issue, which forms part of the Group’s active liquidity management,

enhances its funding flexibility by enabling it to refinance

existing debt and, in part, finance the Maui Jim acquisition.

Kering launches an employee share

ownership planMay 4, 2022 – Kering

announced the launch of its first employee share ownership plan,

entitled KeringForYou. The program gave eligible employees the

opportunity to become Kering shareholders on preferential terms.

The price for subscribing shares under the program was set at €394,

corresponding to Kering’s average opening share price on Euronext

Paris during the 20 trading sessions from April 19 to May 16, 2022,

less a 20% discount and rounded up to the nearest cent.

Stock Repurchase Program: launch of the

third trancheMay 17, 2022 – Pursuant to the Stock

Repurchase Program announced on August 25, 2021, covering up to

2.0% of its share capital over a 24-month period, Kering has signed

a new share buyback agreement with an investment service

provider.

Capital increase as part of the employee

share ownership planJuly 7, 2022 – On July 7, 2022, the

Group Managing Director, following decisions by the Board of

Directors on December 9, 2021, and May 23, 2022, with respect to

the employee share ownership plan, increased Kering SA’s share

capital by €411,448 through the issue of 102,862 new ordinary

shares. This increased the overall share capital to €499,183,112,

divided into 124,795,778 shares with a par value of €4 each.

MEETING OF THE BOARD OF

DIRECTORS ON JULY 27,

2022

Changes in the membership of Board of

DirectorsJean Liu tendered her resignation from her role

as a member of Kering’s Board of Director with effect from July 27,

2022, and the Board accepted her resignation. Ms. Liu had been an

independent Director since June 16, 2020.Vincent Schaal was

appointed as Director representing employees by the Social and

Economic Committee, replacing Claire Lacaze whose term of office

comes to an end on July 31, 2022.As a result, Kering’s Board of

Directors now consists of 13 members, including: Six independent

directors (55% of Board members excluding Directors representing

employees in accordance with the AFEP-MEDEF code);Five women (45%

of Board members excluding Directors representing employees in

accordance with the AFEP-MEDEF code);Five different nationalities

(British, French, Italian, Ivorian and Turkish).

Completion of the third tranche of the

stock repurchase programThe third tranche of the Stock

Repurchase Program (announced on August 25, 2021, with the aim of

repurchasing up to 2.0% of Kering’s share capital over a 24-month

period) was completed on July 19, 2022. Between May 18 and July 19,

2022, 650,000 shares were repurchased at an average price of

€485.53 per share, representing around 0.5% of the share capital.

The Board of Directors decided at its meeting of July 27, 2022, to

cancel 400,000 of the shares repurchased in this tranche by the end

of 2022.The first two tranches of the program had been completed on

November 3, 2021, and April 6, 2022, respectively:

|

|

Tranche 1 |

Tranche 2 |

|

Repurchase period |

August 25 to November 3, 2021 |

February 23 to April 6, 2022 |

|

Number of shares repurchased |

650,000, representing around 0.5% of the share capital |

650,000, representing around 0.5% of the share capital |

|

Average price of shares repurchased |

€643.70 per share |

€578.71 per share |

|

Allocation of repurchased shares |

325,000 shares were canceled on December 10, 2021, pursuant to a

decision by the Board of Directors at its meeting on December 9,

2021. |

The Board of Directors decided in its meeting of April 28, 2022, to

cancel 325,000 shares by the end of 2022. |

CONSOLIDATED INCOME STATEMENT

|

(in € millions) |

First half 2022 |

First half 2021 |

|

CONTINUING OPERATIONS |

|

|

|

Revenue |

9,930 |

8,047 |

|

Cost of sales |

(2,552) |

(2,105) |

|

Gross margin |

7,378 |

5,942 |

|

Personnel expenses |

(1,376) |

(1,163) |

|

Other recurring operating income and expenses |

(3,182) |

(2,542) |

|

Recurring operating income |

2,820 |

2,237 |

|

Other non-recurring operating income and expenses |

(13) |

(17) |

|

Operating income |

2,807 |

2,220 |

|

Financial result |

(19) |

(126) |

|

Income before tax |

2,788 |

2,094 |

|

Income tax expense |

(747) |

(595) |

|

Share in earnings (losses) of equity-accounted companies |

2 |

1 |

|

Net income from continuing operations |

2,043 |

1,500 |

|

o/w attributable to the Group |

1,987 |

1,462 |

|

o/w attributable to minority interests |

56 |

38 |

|

DISCONTINUED OPERATIONS |

|

|

|

Net income (loss) from discontinued

operations |

1 |

17 |

|

o/w attributable to the Group |

1 |

17 |

|

o/w attributable to minority interests |

- |

- |

|

TOTAL GROUP |

|

|

|

Net income of consolidated companies |

2,044 |

1,517 |

|

o/w attributable to the Group |

1,988 |

1,479 |

|

o/w attributable to minority interests |

56 |

38 |

|

(in € millions) |

First half 2022 |

First half 2021 |

|

Net income attributable to the Group |

1,988 |

1,479 |

|

Basic earnings per share (in €) |

16.09 |

11.85 |

|

Diluted earnings per share (in €) |

16.08 |

11.85 |

|

Net income from continuing operations attributable

to the Group |

1,987 |

1,462 |

|

Basic earnings per share (in €) |

16.08 |

11.71 |

|

Diluted earnings per share (in €) |

16.07 |

11.71 |

|

Net income from continuing operations

(excluding non‑recurring items) attributable to the

Group |

1,977 |

1,477 |

|

Basic earnings per share (in €) |

15.99 |

11.84 |

|

Diluted earnings per share (in €) |

15.99 |

11.84 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

(in € millions) |

First half 2022 |

First half 2021 |

|

Net income |

2,044 |

1,517 |

|

o/w attributable to the Group |

1,988 |

1,479 |

|

o/w attributable to minority interests |

56 |

38 |

|

Change in currency translation adjustments relating

to consolidated subsidiaries: |

142 |

87 |

|

change in currency translation adjustments |

142 |

87 |

|

amounts transferred to the income statement |

- |

- |

|

Change in foreign currency cash flow hedges: |

(84) |

(116) |

|

change in fair value |

(212) |

(66) |

|

amounts transferred to the income statement |

123 |

(56) |

|

tax effects |

5 |

6 |

|

Change in other comprehensive income (loss) of

equity-accounted companies: |

- |

- |

|

change in fair value |

- |

- |

|

amounts transferred to the income statement |

- |

- |

|

Gains and losses recognized in equity, to be transferred

to the income statement |

58 |

(29) |

|

Change in provisions for pensions and other post-employment

benefits: |

13 |

8 |

|

change in actuarial gains and losses |

15 |

9 |

|

tax effects |

(2) |

(1) |

|

Change in financial assets measured at fair

value: |

(207) |

56 |

|

change in fair value |

(249) |

36 |

|

tax effects |

42 |

20 |

|

Gains and losses recognized in equity, not to be

transferred to the income statement |

(194) |

64 |

|

Total gains and losses recognized in equity |

(136) |

35 |

|

o/w attributable to the Group |

(160) |

30 |

|

o/w attributable to minority interests |

24 |

5 |

|

COMPREHENSIVE INCOME |

1,908 |

1,552 |

|

o/w attributable to the Group |

1,828 |

1,509 |

|

o/w attributable to minority interests |

80 |

43 |

CONSOLIDATED BALANCE SHEET

Assets

|

(in € millions) |

June 30, 2022 |

Dec. 31, 2021 |

|

Goodwill |

2,921 |

2,891 |

|

Brands and other intangible assets |

7,021 |

7,032 |

|

Lease right-of-use assets |

4,696 |

4,302 |

|

Property, plant and equipment |

3,054 |

2,967 |

|

Investments in equity-accounted companies |

31 |

31 |

|

Non-current financial assets |

884 |

1,054 |

|

Deferred tax assets |

1,517 |

1,352 |

|

Other non-current assets |

2 |

6 |

|

Non-current assets |

20,126 |

19,635 |

|

Inventories |

4,065 |

3,369 |

|

Trade receivables and accrued income |

1,077 |

977 |

|

Current tax receivables |

927 |

822 |

|

Current financial assets |

84 |

22 |

|

Other current assets |

1,128 |

975 |

|

Cash and cash equivalents |

5,790 |

5,249 |

|

Current assets |

13,071 |

11,414 |

|

Assets held for sale |

- |

19 |

|

TOTAL ASSETS |

33,197 |

31,068 |

Equity and liabilities

|

(in € millions) |

June 30, 2022 |

Dec. 31, 2021 |

|

Equity attributable to the Group |

13,474 |

13,347 |

|

Equity attributable to minority interests |

443 |

389 |

|

Equity |

13,917 |

13,736 |

|

Non-current borrowings |

4,029 |

2,976 |

|

Non-current lease liabilities |

4,231 |

3,826 |

|

Non-current financial liabilities |

- |

- |

|

Non-current provisions for pensions and other post-employment

benefits |

80 |

89 |

|

Non-current provisions |

23 |

16 |

|

Deferred tax liabilities |

1,465 |

1,452 |

|

Other non-current liabilities |

216 |

198 |

|

Non-current liabilities |

10,044 |

8,557 |

|

Current borrowings |

2,703 |

2,442 |

|

Current lease liabilities |

716 |

675 |

|

Current financial liabilities |

333 |

743 |

|

Trade payables and accrued expenses |

2,347 |

1,742 |

|

Current provisions for pensions and other post-employment

benefits |

12 |

12 |

|

Current provisions |

136 |

138 |

|

Current tax liabilities |

1,438 |

1,148 |

|

Other current liabilities |

1,551 |

1,826 |

|

Current liabilities |

9,236 |

8,726 |

|

Liabilities associated with assets held for

sale |

- |

49 |

|

TOTAL EQUITY AND LIABILITIES |

33,197 |

31,068 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in € millions) |

First half 2022 |

First half 2021 |

|

Net income from continuing operations |

2,043 |

1,500 |

|

Net recurring charges to depreciation, amortization and provisions

on non-current operating assets |

797 |

714 |

|

Other non-cash (income) expenses |

(264) |

(102) |

|

Cash flow received from operating activities |

2,576 |

2,112 |

|

Interest paid (received) |

127 |

115 |

|

Dividends received |

(4) |

(2) |

|

Current tax expense |

804 |

670 |

|

Cash flow received from operating activities before tax,

dividends and interest |

3,503 |

2,895 |

|

Change in working capital requirement |

(476) |

12 |

|

Income tax paid |

(617) |

(209) |

|

Net cash received from operating activities |

2,410 |

2,698 |

|

Acquisitions of property, plant and equipment and

intangible assets |

(361) |

(345) |

|

Disposals of property, plant and equipment and intangible

assets |

- |

1 |

|

Acquisitions of subsidiaries and associates, net of cash

acquired |

(11) |

19 |

|

Disposals of subsidiaries and associates, net of cash

transferred |

- |

(1) |

|

Acquisitions of other financial assets |

(119) |

(90) |

|

Disposals of other financial assets |

3 |

823 |

|

Interest and dividends received |

6 |

2 |

|

Net cash received from (used in) investing

activities |

(482) |

409 |

|

Dividends paid to shareholders of Kering SA |

(1,483) |

(998) |

|

Dividends paid to minority interests in consolidated

subsidiaries |

(22) |

(9) |

|

Transactions with minority interests |

(22) |

(81) |

|

(Acquisitions) disposals of Kering treasury shares |

(648) |

(118) |

|

Issuance of bonds and bank debt |

1,708 |

39 |

|

Redemption of bonds and bank debt |

(348) |

(220) |

|

Issuance (redemption) of other borrowings |

223 |

156 |

|

Repayment of lease liabilities |

(395) |

(372) |

|

Interest paid and equivalent |

(128) |

(130) |

|

Net cash received from (used in) financing

activities |

(1,115) |

(1,733) |

|

Net cash received from (used in) discontinued operations. |

(8) |

4 |

|

Impact of exchange rates on cash and cash equivalents |

(11) |

10 |

|

Net increase (decrease) in cash and cash

equivalents |

794 |

1,388 |

|

|

|

|

|

Cash and cash equivalents at opening |

4,516 |

3,000 |

|

Cash and cash equivalents at closing |

5,310 |

4,388 |

REVENUE FOR THE FIRST AND SECOND QUARTERS

OF 2022

|

(in € millions) |

|

H1 2022 |

H1 2021 |

Reported change |

Comparable

change(1) |

Q2 2022 |

Q2 2021 |

Reported change |

Comparable

change(1) |

Q1 2022 |

Q1 2021 |

Reported change |

Comparable

change(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gucci |

|

5 173 |

4 479 |

+15% |

+8% |

2 582 |

2 312 |

+12% |

+4% |

2 591 |

2 168 |

+20% |

+13% |

|

Yves Saint Laurent |

|

1 481 |

1 046 |

+42% |

+34% |

742 |

529 |

+40% |

+31% |

739 |

517 |

+43% |

+37% |

|

Bottega Veneta |

|

834 |

708 |

+18% |

+13% |

438 |

379 |

+15% |

+10% |

396 |

328 |

+21% |

+16% |

|

Other Houses |

|

1 955 |

1 485 |

+32% |

+29% |

982 |

766 |

+28% |

+24% |

973 |

719 |

+35% |

+35% |

|

Kering Eyewear and Corporate |

|

591 |

396 |

+49% |

+26% |

283 |

204 |

+39% |

+17% |

308 |

192 |

+60% |

+35% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations |

|

(104) |

(67) |

- |

- |

(53) |

(33) |

- |

- |

(51) |

(34) |

- |

- |

|

KERING |

|

9 930 |

8 047 |

+23% |

+16% |

4 974 |

4 157 |

+20% |

+12% |

4 956 |

3 890 |

+27% |

+21% |

(1) On a comparable scope and exchange rate basis.

MAIN DEFINITIONS

“Reported”

and

“comparable”

growthThe Group’s “reported” growth corresponds to

the change in reported revenue between two periods.The Group

measures “comparable” growth (also referred to as “organic” growth)

in its business by comparing revenue between two periods at

constant Group structure and exchange rates.Changes in Group

structure are dealt with as follows for the periods concerned:• the

portion of revenue relating to acquired entities is excluded from

the current period;• the portion relating to entities divested or

in the process of being divested is excluded from the previous

period.Currency effects are calculated by applying the average

exchange rates for the current period to amounts in the previous

period.

Recurring operating incomeThe

Group’s operating income includes all revenues and expenses

directly related to its activities, whether these revenues and

expenses are recurring or arise from non-recurring decisions or

transactions.Other non-recurring operating income and expenses

consist of items that, by their nature, amount or frequency, could

distort the assessment of the Group’s operating performance as

reflected in its recurring operating income. They include changes

in Group structure, the impairment of goodwill and brands and,

where material, of property, plant and equipment and intangible

assets, capital gains and losses on disposals of non-current

assets, restructuring costs and disputes.“Recurring operating

income” is therefore a major indicator for the Group, defined as

the difference between operating income and other non-recurring

operating income and expenses. This intermediate line item is

intended to facilitate the understanding of the operating

performance of the Group and its Houses and can therefore be used

as a way to estimate recurring performance. This indicator is

presented in a manner that is consistent and stable over the long

term in order to ensure the continuity and relevance of financial

information.

EBITDAThe Group uses EBITDA to

monitor its operating performance. This financial indicator

corresponds to recurring operating income plus net charges to

depreciation, amortization and provisions on non-current operating

assets recognized in recurring operating income.

Free cash flow from operations,

available cash flow from operations and available cash

flowThe Group uses an intermediate line item, “Free cash

flow from operations”, to monitor its financial performance. This

financial indicator measures net operating cash flow less net

operating investments (defined as acquisitions and disposals of

property, plant and equipment and intangible assets).The Group has

also defined a new indicator, “Available cash flow from

operations”, in order to take into account capitalized fixed lease

payments (repayments of principal and interest) pursuant to IFRS

16, and thereby reflect all of its operating cash flows.“Available

cash flow” therefore corresponds to available cash flow from

operations plus interest and dividends received, less interest paid

and equivalent (excluding leases).

Net debtNet debt is one of the

Group’s main financial indicators, and is defined as borrowings

less cash and cash equivalents. Consequently, the cost of net debt

corresponds to all financial income and expenses associated with

these items, including the impact of derivative instruments used to

hedge the fair value of borrowings. Borrowings include put options

granted to minority interests.

Effective tax rate on recurring

incomeThe effective tax rate on recurring income

corresponds to the effective tax rate excluding tax effects

relating to other non-recurring operating income and expenses.

- Kering Press release - First half results - July 27, 2022

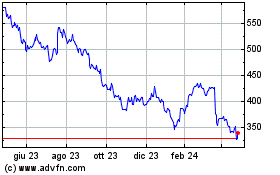

Grafico Azioni Kering (EU:KER)

Storico

Da Mar 2024 a Apr 2024

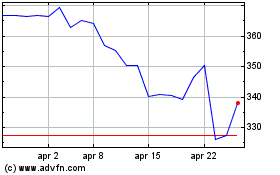

Grafico Azioni Kering (EU:KER)

Storico

Da Apr 2023 a Apr 2024