LECTRA: Lectra announces the acquisition of the majority of the

capital of Launchmetrics

Lectra announces the acquisition of the

majority of the capital of Launchmetrics

The Group significantly expands its

activities into marketing for fashion, strengthening its position

as an essential Industry 4.0 player

Paris, January 9, 2024 – Lectra

announces the signature of an agreement to acquire the

majority of the capital and voting rights of the American

company

Launchmetrics.

As a major player in the fashion,

automotive and furniture markets, Lectra contributes to the

Industry 4.0 revolution by providing software, cutting equipment,

data analytics solutions and associated services to brands,

manufacturers and retailers.

Founded in 2015, Launchmetrics develops and

sells an innovative cloud-based SaaS platform, composed of seven

modules, dedicated to brand performance, for marketing and

communications professionals in the Fashion, Lifestyle and Beauty

markets.

In a complex and constantly changing environment

– the boom in artificial intelligence usage, development of

multi-channel distribution, emergence of new consumer behaviors,

and changing regulatory and CSR constraints – brands must create a

strong identity, develop a differentiating position to gain

visibility, and optimize the identification and retention of

consumers.

To support their customers during the launch of

collections and at all key moments of communication with their

ecosystem, Launchmetrics has developed a cloud-based platform which

– by harnessing aggregated marketing data – enables its customers

to orchestrate the launch of their brand campaigns, precisely

measure their effectiveness, and maximize their return on

investment.

Launchmetrics is a world-renowned technology

company with an unparalleled marketing data asset in the Fashion,

Lifestyle and Beauty markets, thanks to its mastery of Industry 4.0

technologies such as data, the cloud, and, in particular,

artificial intelligence.

In 2023, Launchmetrics’ revenues are expected to

be around 45 million dollars – including more than 40 million

dollars in recurring revenues – and an adjusted EBITDA of around 5

million dollars generated from close to 1,700 customers in around

20 countries, including prestigious fashion brands.

“Launchmetrics wanted to join forces with the

Lectra Group in order to accelerate the development of its offering

on a global scale, alongside a fashion technology leader,” declares

Michael Jaïs, Founder and Chief Executive Officer of Launchmetrics.

“The alliance of Launchmetrics and Lectra will enable us to enrich

our respective offers with even more artificial intelligence and

complementary data – both product and marketing – to provide our

customers with a unique value proposition.”

“This acquisition naturally fits with Lectra’s

approach to expanding its presence in the Fashion market, by

covering additional strategic links of its customers’ value chain.

Combining our existing solutions with those of Launchmetrics

establishes the Group as the only technological actor to support

its customers from product development to production, then from

collection management to marketing, e-commerce, and traceability,”

adds Daniel Harari, Chairman and Chief Executive Officer of Lectra.

“After seven acquisitions over the past six years, this new

strategic step enables Lectra to continue to push the boundaries by

defining a new framework for Industry 4.0 in Fashion and is fully

aligned with the 2023-2025 strategic roadmap, presented in February

2023,” he concludes.

The transaction concerns the acquisition of

about 50.3% of Launchmetrics in January 2024 for about 85 million

dollars, this amount will depend on recurring revenues and EBITDA

for 2023. Acquisition of the remaining capital and voting rights is

planned in five stages: in 2025, 2026, 2027, 2028 and 2030. The

total acquisition price should be between 200 and 240 million

dollars, based on expected double-digit growth in both recurring

revenues and EBITDA over the 2024-2029 period.

Bpifrance, being a shareholder of reference of

Launchmetrics, will sell part of its shares during this transaction

and will remain into the company’s capital until 2027.

About Lectra:

A major player in the fashion, automotive and

furniture markets, Lectra contributes to the development of

Industry 4.0 with boldness and passion, fully integrating Corporate

Social Responsibility (CSR) into its global strategy.

The Group offers industrial intelligence

solutions - software, cutting equipment, data analysis solutions

and associated services - that facilitate the digital

transformation of the companies it serves. In doing so, Lectra

helps its customers push boundaries and unlock their potential. The

Group is proud to state that its 2,500 employees are driven by

three core values: being open-minded thinkers, trusted partners and

passionate innovators.

Founded in 1973, Lectra reported revenues of 522

million euros in 2022. The company is listed on Euronext, where it

is included in the following indices: SBF 120, CAC Mid 60, CAC

Mid&Small, CAC All Shares, CAC All-Tradable, CAC Technology, EN

Tech Leaders and ENT PEA-PME 150.

For more information, visit lectra.com .

Media contacts:

Hotwire for Lectra Alexis

Bletsas - t: +33 (0)1 43 12 55

71Laura Bandiera - t: +33 (0)1 43

12 55 70Elise Martin - t: +33

(0)1 43 12 77email: lectrafr@hotwireglobal.com

- pr-Launchmetrics-acquisition-en-01-9-2024

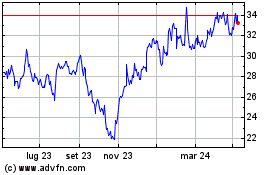

Grafico Azioni Lectra (EU:LSS)

Storico

Da Nov 2024 a Dic 2024

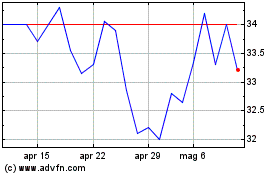

Grafico Azioni Lectra (EU:LSS)

Storico

Da Dic 2023 a Dic 2024