Limited fall in current operating margin

thanks to strict cost controls Roll-out of new cost-cutting

plan totaling over €50 million 2024-25 objectives confirmed

and quantified

- Sales down -15.9% on an organic basis

- Gross margin: -1.4 pts on an organic basis, at a high

72.5%, i.e. +3.0 points compared to 2019-20

- Roll-out of new cost-cutting plan totaling over

€50m

- COP: €147.3m (-17.6% on an organic basis), setting

margin at 27.6% (+1.0 pts as reported, including -0.5 pts

organically)

- 2024-25 objectives confirmed and quantified:

- Organic sales decline of between -15% and -18%

- COP margin of between 21% and 22%, on an organic

basis

- 2029-30 strategic plan confirmed

Regulatory News:

Rémy Cointreau (Paris:RCO) generated consolidated sales

of €533.7 million in the first half of 2024-25, a fall of -15.9% on

an organic basis. On a reported basis, the figure was down -16.2%,

including a negative currency effect of -0.3% due primarily to

trends in the renminbi.

Current Operating Profit stood at €147.3 million, down

-17.6% on an organic basis. This trend reflects a marked decline in

sales, most offset by a sharp reduction in costs. Current

operating margin thus rose by +1.0 points as reported, to 27.6%

(including -0.5 points on an organic basis).

Sales - in € million (unless

otherwise stated)

H1 2024-25

H1 2023-24

Reported change

Organic change

vs. H1 23-24

vs. H1 19-20

Sales

533.7

636.7

-16.2%

-15.9%

+1.5%

Gross margin (%)

72.5%

72.2%

+0.3 pts

-1.4 pts

+3.0 pts

Current Operating Profit

147.3

169.1

-12.9%

-17.6%

-2.8%

Current operating margin (%)

27.6%

26.6%

+1.0 pts

-0.5 pts

-1.2 pts

Net profit – Group share

92.0

113.0

-18.6%

-24.2%

-9.6%

Net margin (%)

17.2%

17.7%

-0.5 pts

-1.8 pt

-2.0 pts

Net profit – Group share excl.

non-recurring items

91.6

113.0

-19.0%

-24.6%

-4.0%

Net margin excl. non-recurring items

(%)

17.2%

17.7%

-0.6 pt

-1.8 pts

-0.9 pts

EPS – Group share (€)

1.80

2.24

-19.4%

-24.9%

-11.7%

EPS – Group share excl.

non-recurring items (€)

1.80

2.24

-19.7%

-25.3%

-6.2%

Net debt /EBITDA ratio

1.90x

1.57x

+0.33x

+0.33x

+0.51x

Éric Vallat, CEO,

commented:

"In a complex economic and geopolitical context, Rémy Cointreau

was able to hold margins steady in the first half of the year

through rigorous cost management and our now more agile

organization. While the US recovery is expected to be very slow,

recent encouraging signs for Cognac plus resilience observed in

Liqueurs & Spirits confirm the relevance of our strict pricing

strategy. In China, despite uncertain conditions, we continued to

gain market share thanks to the desirability of our brands, our

ability to innovate, and our strong presence in e-commerce. Looking

ahead, the second half will see continued efforts to rein in costs

as part of our €50m full-year savings plan. But it’s essential that

we not lose sight of our goals—and in that respect the time has

come to prepare for recovery. We thus plan to begin reintroducing

targeted investments in marketing as early as H2, to support peak

activity in both the United States and China. Thanks to the quality

of our brands and our teams’ engagement and talent, we can look to

the future with confidence as we press ahead. I would like to take

this opportunity to extend my warmest thanks to all our employees,

whose responsiveness and creativity are critical assets as we

prepare for recovery and work to achieve our medium-term

goals."

Current Operating Profit by

division

In €m (unless otherwise stated)

H1 2024-25

H1 2023-24

Reported change

Organic change

vs. H1 2023-24

vs. H1 2019-20

Cognac

126.5

145.3

-13.0%

-17.9%

-9.1%

As % of sales

37.0%

34.9%

+2.1 pts

-0.2 pts

+0.5 pts

Liqueurs & Spirits

30.0

30.3

-1.1%

-3.3%

+34.3%

As% of sales

16.5%

14.7%

+1.8 pts

+1.5 pts

-0.5 pts

Subtotal: Group brands

156.5

175.6

-10.9%

-15.4%

-2.9%

As % of sales

29.9%

28.2%

+1.7 pts

+0.1 pts

-1.4 pts

Partner brands

(0.6)

0.2

-408.6%

-431.0%

+14.5%

Holding Company costs

(8.6)

(6.7)

+27.9%

+27.8%

-4.9%

Total

147.3

169.1

-12.9%

-17.6%

-2.8%

As % of sales

27.6%

26.6%

+1.0 pts

-0.5 pts

-1.2 pts

Cognac

Cognac division sales fell -17.5% on an organic

basis, including a -14.2% slide in volume and -3.3% of price mix.

This primarily reflected ongoing inventory adjustments in the

Americas, where the market was shaped by normalization of

consumption, high interest rates, and a fiercely promotional

environment. At the same time, the APAC1 region reported a limited

fall thanks to growth in sales of Rémy Martin CLUB and e-commerce

in China. Lastly, the EMEA2 region showed a marked decline in sales

that was affected by the intensely promotional market in Europe and

destocking effects in Africa.

Current Operating Profit fell -17.9% on an organic basis

to total €126.5 million, with current operating margin all but

unchanged at -0.2 points on an organic basis, and up +2.1 points to

37.0% as reported. These trends reflect a steep fall in sales and a

-1.0-point decline in gross margin on an organic basis (down from a

high basis of comparison) due to rising production costs and an

unfavorable mix effect. At the same time, the Group cut back its

marketing and communication spend, taking a more targeted approach.

Even so, outlays were higher than in 2019-20. Lastly, the

implementation of strict controls on overhead costs helped mitigate

the impact of lower sales.

Liqueurs & Spirits

In the Liqueurs & Spirits division, sales fell

-12.0% on an organic basis, including a -12.6% decline in volume

and an +0.6% rise due to price mix. These trends reflected a

tougher market in the Americas, despite resilient

depletions3 in the United States, a slowdown in the whisky

category in China, and lower consumption in Southeast Asia. By

contrast, growth in the EMEA region bounced back in the second

quarter, driven by a number of activations over the summer.

Current Operating Profit edged down -3.3% on an organic

basis to total €30.0 million, with a sharp rise in margin—up +1.5

points on an organic basis, and up +1.8 points to 16.5% as

reported. This trend reflected a lower gross margin (-2.0 points on

an organic basis) due to rising production costs and a negative mix

effect, entirely offset by a more selective approach to investment

in marketing and communications and a reduction in overheads.

However, after several years of overweighting the marketing and

communications investment in Liqueurs & Spirits (compared with

the Cognac division’s spend) to boost brand awareness, current

outlays are still well above levels observed in 2019-20.

Partner Brands

Sales of Partner Brands were down -25.0% on an organic

basis.

Current Operating Profit stood at -€0.6 million in the

first half of 2024-25, compared with €0.2 million in the first half

of 2023-24.

Consolidated results

Current Operating Profit (COP) stood at €147.3 million,

down -12.9% as reported (-17.6% on an organic basis). This includes

a -15.4% organic decline in Current Operating Profit for Group

brands, a negative contribution from Partner Brands, and a slight

increase in holding company costs, as most cost optimizations were

achieved in the first half of 2023-24.

These figures include a positive currency effect of +€7.9

million, primarily linked to trends in the US dollar. The average

euro/dollar exchange rate stood at 1.09 in H1 2024-25, unchanged

from H1 2023-24, while the average collection rate improved from

1.12 in H1 2023-24 to 1.07 in H1 2024-25.

Current Operating Margin stood at 27.6%, down -0.5 points

on an organic basis (-1.2 points compared to H1 2019-20) and up

+1.0 points as reported. This reflects the combined impact of:

- a 1.4-pt organic decline in gross margin (nonetheless up

+3.0 pts compared to 2019-20) to a persistently high 72.5%, due to

high production costs and, to a lesser extent, a negative mix

effect.

- A lower marketing and communications spend (an organic

decrease of 3.4 pts in ratio to sales), to a level that nonetheless

remains well above that observed in 2019-20 (up 3.5 pts).

- A controlled rise in the overhead cost ratio (an organic

increase of 2.6 pts in ratio to sales, i.e. up 0.7 pts compared to

2019-20) despite a 6.8% reduction in the cost base on an organic

basis.

- A favorable currency effect of +1.6 pts.

Operating profit totaled €147.5 million in H1 2024-25,

down -12.8% as reported. This includes +€0.2 million in other

operating income and expense.

Financial expense totaled -€21.1 million in H1 2024-25

(vs. -€15.7 million in H1 2023-24). This reflects the full-year

impact of the €380 million bond issue made in September 2023.

Taxes came to €34.8 million, for an effective tax rate of

27.5% in H1 2024-25 (27.7% excluding non-recurring items), compared

with 26.6% in H1 2023-24 (unchanged when adjusted for non-recurring

items). This marginal difference was due primarily to changes in

the geographical mix of business.

Net profit – Group share stood at €92.0 million, down

-18.6% as reported, setting net margin at 17.2%, down -0.5 points

as reported.

EPS – Group share was €1.80, down 19.4% as reported

compared with H1 2023-24.

Net debt totaled €644.3 million, down €5.4 million from

31 March 2024. The trend in free cash flow reflects the drop in

EBITDA, which was partially offset by efforts to optimize working

capital requirement and capital expenditures.

As a result, the ratio of net debt/EBITDA came to 1.90x

at 30 September 2024, compared to 1.68x on 31 March 2024 and 1.57x

on 30 September 2023.

Outlook confirmed and

quantified

In light of a persistent lack of visibility on the timing of

recovery in the United States, and worsening market conditions in

China, Rémy Cointreau has assumed the following trends in

2024-25:

- Americas: no return to growth before the fourth quarter

of 2024-25 at the earliest

- APAC: sequential sales deterioration in the second half

compared with the first half

- EMEA: continued subdued consumer trends in the second

half of the year

In this worsening economic environment, Rémy Cointreau remains

determined to protect as much as possible its current operating

margin (in organic terms), through continued tight cost controls

and implementation of a new cost-cutting plan totaling more than

€50 million.

As a result, for full-year 2024-25, Rémy Cointreau

expects:

- An organic sales decline of between -15% and -18%

- Current operating margin to stand between 21% and 22% on

an organic basis.

Rémy Cointreau expects exchange rates to have the following

full-year impact:

- Sales: between -€4m and -€8m (primarily in

H2)

- COP: between +€5m and +€10m (primarily in

H1)

The Group has also taken note of the provisional decision of

the Chinese Ministry of Commerce (MOFCOM) to apply additional

duties of 38.1% on cognac imports coming into China starting

October 11, 2024. If this decision is confirmed, the impact would

be marginal for the 2024-25 fiscal year, and the Group would

activate its action plan to mitigate the effects from 2025-26.

2024-25 will be a year of transition, with highlights including

finalization of destocking in the Americas, and 2025-26 will mark a

resumption of the trajectory set for 2029-30:

- high single-digit annual growth in sales on average and on an

organic basis

- a gradual organic improvement in Current Operating Profit

margin

Rémy Cointreau reiterates its financial targets for

2029-30: a gross margin of 72% and a Current Operating

Margin of 33% based on 2019-20 consolidated scope and exchange

rates.

A webcast for investors and analysts will be held today,

starting at 9.00 (CET) with Marie-Amélie de Leusse, Chairwoman;

Eric Vallat, CEO; and Luca Marotta, CFO. Presentation slides are

available online at www.remy-cointreau.com under “Finance”.

Post-closing events

Anti-dumping investigation into imports

of European brandy entering China

Since 5 January 2024, Rémy Martin has been the target of

anti-dumping proceedings as part of an investigation launched by

the Ministry of Commerce of the People’s Republic of China

(MOFCOM). This investigation concerns all European producers of

distilled grape exported to China.

On 8 October 2024, MOFCOM announced that a deposit would be

required, based on provisional anti-dumping duties, for all

products entering China after 11 October 2024. For Rémy Martin

cognacs, it set this provisional additional duty at 38.1%.

On 11 November 2024, MOFCOM announced that a bank guarantee

would be an acceptable means of meeting the deposit requirement.

Based on the schedule for anti-dumping proceedings, the final

amount due will be confirmed by 5 January 2025, with a possible

6-month extension (anti-dumping proceedings cannot exceed 18

months).

Rémy Cointreau contests the methodology used to calculate these

duties, which do not reflect its export model focusing on the

premium end of the market. Proceedings are currently underway and

concern all players in the sector in France and in the European

Union. The outcome is uncertain. There was no impact on financial

statements at 30 September 2024 beyond external legal and

administrative expenses recorded under “Other non-recurring income

and expenses”.

If these provisional duties are confirmed, the full-year impact

would be marginal for the 2024-25 fiscal year, and the Group would

activate its action plan to mitigate the effects from 2025-26

on.

Rémy Cointreau acquires stake in

ecoSPIRITS, first investment for RC Ventures

RC Ventures, Rémy Cointreau’s new corporate venture capital

fund, has made its first investment by taking a minority stake in

ecoSPIRITS. The start-up has just closed a strategic financing

round, with RC Ventures joining other key investors.

EcoSPIRITS is a circular economy start-up which specializes in

low carbon distribution technology for premium spirits and wines.

Its closed loop packaging system fully replaces the single use

glass bottle, eliminating virtually all packaging waste in the

supply chain and significantly reducing carbon emissions.

Becoming a shareholder cements the existing operational

relationship between ecoSPIRITS and Rémy Cointreau, which began in

2022.

RC Ventures was created to support the growth of high-potential,

innovative start-ups that share Rémy Cointreau’s vision and values

in the wider world of wines and spirits. Rémy Cointreau works

through the fund to offer these young companies financial support

and to share its operational expertise. Yet while the start-ups

will tap into the experience of its global teams, the Group is keen

to preserve the autonomy and fierce entrepreneurial spirit that are

vital to their ability to create value.

At the same time, RC Ventures will help Rémy Cointreau

anticipate and test new market trends, reinforce its innovative

capacity and explore new product categories, client experiences,

and technologies within the wine and spirits ecosystem. RC Ventures

will be fully operational from 2025-26.

Appendices

Sales and Current Operating Profit by

division

€m (unless otherwise stated)

H1 2024-25

H1 2023-24

Change

Reported

A

Organic

B

Reported

C

Reported

A/C-1

Organic

B/C-1

Sales

Cognac

341.5

343.0

416.1

-17.9%

-17.5%

Liqueurs & Spirits

181.7

181.8

206.7

-12.1%

-12.0%

Subtotal: Group Brands

523.2

524.9

622.7

-16.0%

-15.7%

Partner Brands

10.5

10.5

14.0

-24.7%

-25.0%

Total

533.7

535.3

636.7

-16.2%

-15.9%

Current Operating Profit

Cognac

126.5

119.3

145.3

-13.0%

-17.9%

As % of total sales

37.0%

34.8%

34.9%

+2.1 pts

-0.2 pts

Liqueurs & Spirits

30.0

29.3

30.3

-1.1%

+3.3%

As% of total sales

16.5%

16.1%

14.7%

+1.8 pts

+1.5 pts

Subtotal: Group Brands

156.5

148.6

175.6

-10.9%

-15.4%

As % of total sales

29.9%

28.3%

28.2%

+1.7 pts

+0.1 pts

Partner Brands

(0.6)

(0.6)

0.2

-408.6%

-431.0%

Holding Company costs

(8.6)

(8.6)

(6.7)

+27.9%

+27.8%

Total

147.3

139.4

169.1

-12.9%

-17.6%

As % of total sales

27.6%

26.0%

26.6%

+1.0 pts

-0.5 pts

Summary income statement

€m (unless otherwise stated)

H1 2024-25

H1 2023-24

Change

Reported

Organic

Reported

Reported

Organic

A

B

C

A/C-1

B/C-1

Sales

533.7

535.3

636.7

-16.2%

-15.9%

Gross margin

386.9

379.3

459.9

-15.9%

-17.5%

Gross margin (%)

72.5%

70.9%

72.2%

+0.3 pts

-1.4 pts

Current Operating Profit

147.3

139.4

169.1

-12.9%

-17.6%

Current operating margin (%)

27.6%

26.0%

26.6%

+1.0 pts

-0.5 pts

Other non-current income and expenses

0.2

0.2

-

-

-

Operating profit

147.5

139.5

169.1

-12.8%

-17.5%

Net financial result

(21.1)

(21.9)

(15.7)

+34.4%

+39.8%

Profit before Tax

126.4

117.6

153.4

-17.6%

-23.3%

Corporate income tax

(34.8)

(32.4)

(40.8)

-14.7%

-20.6%

Tax rate (%)

(27.5%)

(27.5%)

(26.6%)

-1.0 pts

-1.0 pts

Share in profit (loss) of

associates/minority interests

0.4

0.4

0.4

+4.8%

+4.8%

Net profit – Group share

92.0

85.6

113.0

-18.6%

-24.2%

Net margin (%)

17.2%

16.0%

17.7%

-0.5 pts

-1.8 pts

Net profit – Group share excl.

non-recurring items

91.6

85.2

113.0

-19.0%

-24.6%

Net margin excl. non-recurring items

(%)

17.2%

15.9%

17.7%

-0.6 pts

-1.8 pts

EPS – Group share (€)

1.80

1.68

2.24

-19.4%

-24.9%

EPS – Group share, excluding

non-recurring items (€)

1.80

1.67

2.24

-19.7%

-25.3%

Cash-Flow statement

As of September 30 (in €m)

2024

2023

Change

Opening net financial debt (April

1st)

(649.7)

(536.6)

-113.1

Gross operating profit (EBITDA)

174.3

195.4

-21.2

WCR for eaux-de-vie and spirits in ageing

process

(3.4)

(0.8)

-2.6

Other working capital items

(115.3)

(172.1)

+56.8

Capital expenditure

(26.8)

(45.8)

+19.1

Financial expenses

(28.8)

(13.9)

-15.0

Tax payments

(1.4)

(61.8)

+60.4

Net flows on other non-current income and

expenses

(6.2)

-

-6.2

Free Cash-Flow

(7.6)

(99.0)

+91.4

Other proceeds/disposals

3.2

0.3

+3.0

OCEANE conversion impact on Financial

debt

-

50.8

-50.8

Conversion differences and others

9.8

(5.9)

+15.7

Other Cash flow

13.0

45.2

-32.2

Total cash flow for the period

5.4

(53.8)

+59.2

Closing net financial debt (September

30)

(644.3)

(590.5)

-53.8

A Ratio (Net debt/EBITDA)

1.90

1.57

0.33

Balance sheet

As of September 30 (in €m)

2024

2023

Non-current assets

1,029.0

1,023.4

Current assets

2,344.6

2,520.3

o/w inventories

1,973.0

1,839.3

o/w Cash and equivalent

48.6

277.6

Total Assets

3,373.5

3,543.7

Shareholders’ equity

1,899.8

1,778.2

Non-current liabilities

585.4

758.5

o/w Long-term financial debt

511.4

691.5

Current Liabilities

888.3

1,006.9

o/w Short-term financial debt

181.5

176.6

Total Liabilities and Shareholders’

equity

3,373.5

3,543.7

Definitions of alternative

performance indicators

Due to rounding, the sum of values presented in this document

may differ from totals as reported. Such differences are not

material.

Rémy Cointreau’s management process is based on the following

alternative performance indicators, selected for planning and

reporting purposes. The Group’s management considers that these

indicators provide users of the financial statements with useful

additional information to help them understand the Group’s

performance. These alternative performance indicators should be

considered as supplementing those included in the consolidated

financial statements and the resulting movements.

Organic growth in sales and Current Operating Profit

Organic growth is calculated excluding the impact of exchange

rate fluctuations, acquisitions and disposals. This indicator

serves to focus on Group performance common to both financial

years, which local management is more directly capable of

measuring.

The impact of exchange rates is calculated by converting sales

and Current Operating Profit for the current financial year using

average exchange rates (or, for Current Operating Profit, the

hedged exchange rate) from the previous financial year.

For acquisitions in the current financial year, sales and

Current Operating Profit of acquired entities are not included in

organic growth calculations. For acquisitions in the previous

financial year, sales and Current Operating Profit of acquired

entities are included in the previous financial year; however, they

are only included in current year organic growth calculations with

effect from the anniversary date of the acquisition.

For significant disposals, data is post-application of IFRS 5,

under which results of entities disposed of are systematically

reclassified under “Net earnings from discontinued operations”.

Indicators “excluding non-recurring items”

The two items set out below constitute key indicators for

measuring recurring business performance, since they exclude

significant items which, by virtue of their unusual nature, cannot

be considered inherent to the Group’s ongoing performance:

- Current Operating Profit consists of operating profit

before other non-recurring operating income and expenses.

- Net profit attributable to the Group excluding non-recurring

items consists of net profit attributable to the Group adjusted

to exclude other non-recurring operating income and expenses,

associated tax effects, profit from deconsolidated, divested and

discontinued operations and the contribution from dividends paid in

cash.

Gross operating profit (EBITDA)

This measure, which is used in particular to calculate certain

ratios, equates to Current Operating Profit less amortization and

depreciation expenses on intangible assets and property, plant and

equipment for the period, expenses arising from stock option plans,

and dividends received from associates during the period.

Net debt

Net financial debt as defined and used by the Group is equal to

the sum of long- and short-term financial debt and accrued

interest, less cash and cash equivalents.

About Rémy Cointreau

All around the world, there are clients seeking exceptional

experiences; clients for whom a wide range of terroirs means a

variety of flavors. Their exacting standards are proportional to

our expertise – the finely-honed skills that we pass down from

generation to generation. The time these clients devote to drinking

our products is a tribute to all those who have worked to develop

them. It is for these men and women that Rémy Cointreau, a

family-owned French Group, protects its terroirs, cultivates

exceptional multi-centenary spirits and undertakes to preserve

their eternal modernity. The Group’s portfolio includes 14 singular

brands, such as the Rémy Martin and LOUIS XIII cognacs, and

Cointreau liqueur. Rémy Cointreau has a single ambition: becoming

the world leader in exceptional spirits. To this end, it relies on

the commitment and creativity of its 1,943 employees and on its

distribution subsidiaries established in the Group’s strategic

markets. Rémy Cointreau is listed on Euronext Paris.

Regulated information in connection with this

press release can be found at www.remy-cointreau.com

________________________ 1 Asia-Pacific 2 Europe, Middle East

and Africa 3 Wholesalers’ sales to retailers

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241127761623/en/

Investor relations: Célia d’Everlange /

investor-relations@remy-cointreau.com Media relations:

Mélissa Lévine / press@remy-cointreau.com

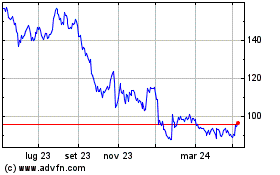

Grafico Azioni Remy Cointreau (EU:RCO)

Storico

Da Gen 2025 a Feb 2025

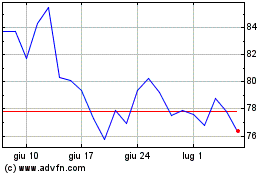

Grafico Azioni Remy Cointreau (EU:RCO)

Storico

Da Feb 2024 a Feb 2025