VIRBAC: 2023 ANNUAL RESULTS

- Revenue up 4.9%, enabling

market share gains despite difficulties in 2023

- 2023 operating

profitability1 at an all-time

high of 23.2% of revenue

- Up 0.4 points compared to

2022

- Strong

momentum expected in 2024

- Expected revenue growth of

4% to 6% at constant exchange rates and scope

- Operating

profitability1 expected to rise

by 0,5 point

|

CONSOLIDATED FIGURES AS OF DECEMBER 31in millions of

€ |

|

2023 |

2022restated6 |

2023/2022 change |

|

|

Revenue |

1 246.9 |

1 216.2 |

+2.5% |

|

| |

|

|

|

|

|

Change at constant exchange rates and scope2 |

|

|

+4.9% |

|

|

Current operating profit, before R&D and amortization

of assets arising from acquisitions |

287.1 |

276.9 |

+3.7% |

|

|

Change at constant exchange rates |

|

|

+6.8% |

|

|

as a % of revenueas a % of revenue at constant rates |

23.0%23.2% |

22.8% |

|

|

|

Current operating profit, before amortization of assets

arising from acquisitions3 |

188.1 |

186.6 |

+0.8% |

|

|

as a % of revenueas a % of revenue at constant rates |

15.1%15.3% |

15.3% |

|

|

|

Amortization of intangible assets from acquisitions |

3.3 |

3.7 |

|

|

|

Current operating income |

184.9 |

182.8 |

+1.1% |

|

|

Non-recurring (expenses) and income |

-0.9 |

-3.3 |

|

|

|

Operating income |

184.0 |

179.5 |

+2.5% |

|

|

Consolidated net income |

121.1 |

121.3 |

-0.2% |

|

|

Including net income - Group share |

121.3 |

121.9 |

|

|

|

Shareholders’ equity - Group share |

900.3 |

839.6 |

+7.2% |

|

|

Net cash4 |

52.4 |

79.4 |

-34.0% |

|

|

Operating cash flow before interest and

taxes5 |

235.1 |

229.9 |

+2.3% |

|

1ratio of current operating income before

R&D and depreciation of assets arising from acquisitions to

revenue2change at constant exchange rates and scope corresponds to

the organic growth of sales, excluding exchange rate variations, by

calculating the indicator for the financial year in question and

the indicator for the previous financial year on the basis of

identical exchange rates (the exchange rate used is the one from

the previous financial year), and excluding change in scope, by

calculating the indicator for the financial year in question on the

basis of the scope of consolidation for the previous financial

year. It should be noted that the impact on revenue growth

resulting from the integration of GS Partners (acquisition of our

distributor in the Czech Republic closed in May) and Globion

(acquisition in India closed in November), representing only 0.3

points of growth, is considered non-material and therefore

consolidation scope was not restated3current operating income,

before depreciation of assets arising from acquisitions, reflects

current income adjusted for the impact of allowances for

depreciation of intangible assets resulting from acquisition

transactions4net cash corresponds to current (€47.7 million) and

non-current (€40.7 million) financial liabilities as well as a

lease obligation related to the application of IFRS 16 (€35.1

million), less the cash position and cash equivalents (€175.9

million) as published in the statement of financial

position5operating cash flow corresponds to operating income

(€184.0 million) restated for items having no impact on the cash

position and impacts related to disposals. The following items are

adjusted: fixed asset depreciation and impairments (€46.7 million),

provisions for risks and charges (€1.6 million), provisions related

to employee benefits (-€0.6 million), and other expenses and income

without any impact on the cash position (€1.4 million), and impacts

related to disposals (+€2.0 million)6non-material impact of

restatement linked to IAS 12 amendment relating to deferred tax

assets and liabilities - see full note in the half-year financial

report

The accounts were audited by the statutory

auditors and examined by the board of directors on March 15, 2023.

The report of the statutory auditors is in the process of being

issued. The statements and detailed presentation of annual income

are available on the corporate site at corporate.virbac.com.

Thanks to the exceptional commitment of

our teams around the world, we achieved annual revenue of €1,246.9

million, compared with €1,216.2 million, representing an

overall change of +2.5% compared with the same period in 2022, and

a +4.9% growth at constant exchange rates. The impact on revenue

growth resulting from the integration of GS Partners (acquisition

of our distributor in the Czech Republic closed in May) and Globion

(acquisition in India closed in November) is only 0.3 points.

Excluding these two acquisitions, growth at constant rates would

have been +4.6%. Against a backdrop of normalizing market growth,

this performance demonstrates the resilience of our business model,

which was significantly challenged by two intrinsic and unfavorable

one-off effects during the year. As a reminder, these were a

temporary limitation of our production capacities for companion

animal vaccines, and a cyber attack on June 19 which forced us to

shut down plants for several weeks. In terms of geography, Europe

(+5.8% at constant rates) and Asia/Pacific (+4.0% at constant

rates) remain the main areas driving our organic growth momentum

over the year. Growth in Europe was mainly driven by France (+6.9%

at constant rates), Northern Europe and Southern Europe

(respectively +4.0% and +4.9% at constant rates), as well as by

Turkey, where business volume more than doubled compared with 2022.

In Asia/Pacific, the main contributors were India (+6.1% at

constant rates), followed by Australia and New Zealand

(respectively +4.9% and +6.7% at constant rates), offsetting the

drop observed in China (-10.8% at constant rates), while business

in Southeast Asia remained stable. In Latin America (+4.9% at

constant rates), we observed very good growth dynamics in all our

subsidiaries (with double digit growth in Mexico and Brazil), with

the exception of Chile which, despite a significant rebound in the

second half (+20% at constant exchange rates), posted a drop for

the full year due to a sharp decline in the first half (-32% at

constant exchange rates), especially in antibiotics. Our revenue in

the United States rose by +3.5% at constant rates, despite a

year-long distributors’ destocking effect.

Current operating income before

depreciation of assets arising from acquisitions amounted

to €188.1 million, up compared to 2022 (€186.6 million). Boosted by

an estimated ~+5% price effect coupled with a more favorable

product mix, our organic growth led to an increase of gross margin

in absolute value. Our operating expenses increased in line with

our sales growth. This increase is visible in personnel costs, due

to the impact of salary increases and the strengthening of

organizations. The significant increase in R&D expenditures

reflects our commitment to accelerate investments in this crucial

area. Our operating margin continues to improve: at the end of

December 2023 and at constant exchange rates, before R&D and

amortization of assets arising from acquisitions, our current

operating profit ratio to revenue is up by 0.4 points to reach a

record level of 23.2%.

Consolidated net income was

€121.1 million, stable compared with the same period in 2022. Net

financial expenses increased by €6.7 million due to the

depreciation of certain currencies as well as, to a lesser extent,

a rising cost of net financial debt. Conversely, the tax charge

decreased in absolute terms, reflecting a base effect (2022 had

recorded non-recurring tax provisions) as well as a favorable

country-mix effect in 2023.

Net income - Group

share amounted to €121.3 million in 2023, stable

compared with the previous year (€121.9 million).

On the financial front, our net

cash position stood at €52.4 million at the end of December 2023,

compared to €79.4 million at the end of December 2022. This

decrease of our net cash position over the year is mainly due to an

increase in our capital expenditure, with, among others, the

closing of two acquisitions (GS Partners and Globion) for around

€55 million7, as well as the impact of the share buyback program

for around €20 million.

OutlookIn 2024, at constant

exchange rates and scope, we expect a ratio of “current operating

income before depreciation of assets resulting from acquisitions”

(Ebit adjusted) to “revenue” around 15% with growth in revenue

estimated at this stage to be between 4% and 6%. As announced in

our previous communications, this level of profitability takes into

account a deliberate further acceleration in our R&D

investments, representing nearly +0.5 points as a percentage of

revenue compared with 2023. We reaffirm our ambition to achieve an

Ebit adjusted ratio of 20% by 2030: in this respect, we plan over

the next few years to gradually restore our R&D investments to

the Group's normative and historical level, with a ratio of R&D

investments to revenue around 2.0 percentage points below 2024

level.

In addition, excluding any acquisitions, our

cash position is expected to improve by €30 million, given the

expected investments over the period, estimated to be around €100

million and considering the acceleration of our efforts in

R&D.

Finally, at the next shareholders' general

meeting, a net dividend per share of €1.32 will be recommended for

distribution for the 2023 fiscal year.

7includes net cash of acquired companies

ANALYSTS’ PRESENTATION –

VIRBAC

We will hold an

analysts meeting on Wednesday, March 20, 2024 at 2:30 p.m. (Paris

time - CET) in the Édouard VII Business Center’s auditorium, 23

square Edouard VII 75009 Paris (France).

Participants may

arrive 15 minutes before the start of the meeting.

You may also attend

the meeting using the webcast (audio + slides) available via the

link below.

Information for

participants:

Webcast access link:

https://bit.ly/42gMcGl

This access link is

available on the corporate.virbac.com site, under the heading

“Public releases.” This link allows participants to access the live

and/or archived version of the webcast.

You will be able to

ask questions via chat (text) directly during the webcast or after

watching the replay via the following email address:

finances@virbac.com.

A lifelong commitment to animal

healthAt Virbac, we provide innovative solutions to

veterinarians, farmers and animal owners in more than 100 countries

around the world. Covering more than 50 species, our range of

products and services enables us to diagnose, prevent and treat the

majority of pathologies. Every day, we are committed to improving

the quality of life of animals and to shaping the future of animal

health together.

Virbac: Euronext Paris - subfund A - ISIN code:

FR0000031577/MNEMO: VIRPFinancial Affairs department: tel. 04 92 08

71 32 - finances@virbac.com - corporate.virbac.com

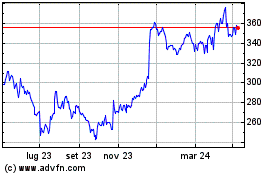

Grafico Azioni Virbac (EU:VIRP)

Storico

Da Dic 2024 a Gen 2025

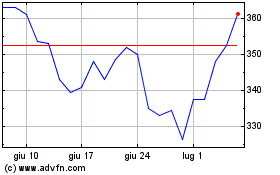

Grafico Azioni Virbac (EU:VIRP)

Storico

Da Gen 2024 a Gen 2025