VIRBAC: Building on the momentum of the second half of 2023, strong first-quarter revenue growth of +10.8% at constant exchange rates

16 Aprile 2024 - 5:45PM

VIRBAC: Building on the momentum of the second half of 2023, strong

first-quarter revenue growth of +10.8% at constant exchange rates

|

KEY FIGURES |

|

Revenue1st quarter

2024 €345.7M |

Growth at constant exchange rates and

scope1 +9.7% of

which companion animals +16.2%farm

animals

+1.2% |

Growth at constant exchange

rates +10.8% |

Overall

change +9.8% |

1growth at constant exchange rates and scope

corresponds to organic growth of sales, excluding exchange rate

variations, by calculating the indicator for the financial year in

question and the indicator for the previous financial year on the

basis of identical exchange rates (the exchange rate used is the

previous financial year’s), and excluding change in scope, by

calculating the indicator for the financial year in question on the

basis of the scope of consolidation for the previous financial

year

Quarterly consolidated

revenueFirst-quarter revenue amounted to €345.7 million, up

+9.8% at actual exchange rates compared to the same period in 2023.

Adjusted for the unfavorable impact arising from exchange rate

fluctuations, revenue growth for the period reached +10.8%. The

integration of Globion (acquisition in India closed in November

2023) contributed to growth by +1.1 points. Excluding acquisitions

and at constant exchange rates, our revenue growth was +9.7%.

Buoyed by stronger momentum in the animal health market, this

remarkable progression was driven firstly by an estimated ~6.4

points growth contribution from volumes, and to a lesser extent, by

a more modest price effect, due in particular to the slowdown in

inflation.

All our regions posted solid performances, led

by Europe, where revenue rose by +12.5% at constant exchange rates,

thanks primarily to strong sales momentum in the companion animal

segment in Central and Eastern Europe countries (+34.9% at constant

exchange rates), with notable performances in Turkey, Poland and

the Czech Republic. In Northern Europe (+23.8% at constant exchange

rates), the UK and Ireland benefited from new product launches to

record strong sales growth in the farm animal segment. Double-digit

growth in Spain contributed to Southern Europe’s trend (+8.8% at

constant exchange rates), while France (+7.9% at constant exchange

rates) continued to benefit from increased demand for our petfood

range. Our subsidiary in the United States (+28.4% at constant

exchange rates) achieved the Group's strongest growth, benefiting

both from growth in our companion animal ranges, especially dental

and mobility products; and from a favorable basis of comparison, as

the start of 2023 was marked by distributors' destocking effect.

Latin America’s countries (+1.4% at constant exchange rates) posted

a more mixed performance: following on the momentum initiated in

the second half of 2023, driven by demand for aquaculture

parasiticides, strong growth in Chile (+28.5% at constant exchange

rates) offset the temporary downturn in the ruminant segment in

Brazil, while sales in Mexico and Central America remained stable

(+0.8% at constant exchange rates). Lastly, the Asia/Pacific region

closed the quarter with growth of +5.5% at constant exchange rates,

driven mainly by India (+18.1% at constant exchange rates) and

Southeast Asia’s countries (+15.6% at constant exchange rates),

counterbalancing the downtrend in Australia and New Zealand (-7.8%

and -11.5% respectively at constant exchange rates), both penalized

by an unfavorable basis for comparison, the first part of 2023

having been marked by a very favorable agricultural context

(climate, prices and herd stock increases) as well as sales linked

to deferred orders.

In terms of species, the companion animal

segment posted strong growth of +16.2% at constant exchange rates

and scope, driven by the good momentum of our dental, dermatology,

petfood and specialty product ranges, while our dog/cat vaccine

range returned to growth following increase in our production

capacity. The farm animal segment recorded growth of +1.2% at

constant exchange rates and scope (+4.1% at constant exchange

rates), mainly thanks to Aquaculture (+44.4% at constant exchange

rates) and products for pig and poultry species, linked to the

acquisition of Globion. These increases offset the slight temporary

decrease in the ruminant segment (-3.4% at constant exchange

rates).

2024 OutlookIn 2024, at constant exchange

rates and scope, we expect a growth in revenue estimated at this

stage to be between 4% and 6% as well as a ratio of “current

operating income before depreciation of assets resulting from

acquisitions” (Ebit adjusted) to “revenue” around 15%. In addition,

the contribution to 2024 revenue growth resulting from recent

acquisitions (Globion in India, closed in November 2023, and

Sasaeah in Japan, closed in April 2024) is estimated at around +5

points. Lastly, excluding acquisitions, our cash position is

expected to improve by €30 million, given the acceleration of our

efforts in R&D and considering expected investments over the

period, estimated to be around €100 million.

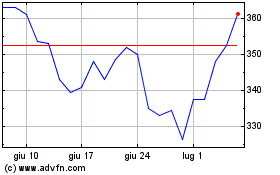

Grafico Azioni Virbac (EU:VIRP)

Storico

Da Dic 2024 a Gen 2025

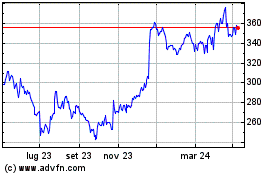

Grafico Azioni Virbac (EU:VIRP)

Storico

Da Gen 2024 a Gen 2025