Euro, Pound Climb On Soaring Oil Prices

03 Aprile 2023 - 10:57AM

RTTF2

The euro and the pound appreciated against their major

counterparts in the European session on Monday, as a surprise

decision by major oil producers to cut oil production sparked a

rally in oil prices.

Oil prices jumped after Saudi Arabia and other major oil

producers said they will cut production by 1.15 million barrels per

day from May until the end of the year.

The OPEC said the production cut was a "precautionary" move

aimed at supporting the stability of the oil market.

The surge in oil prices overshadowed optimism over a slowdown in

the Federal Reserve's preferred measure of core inflation in

February.

Brent crude oil recorded a jump of over 6%, rising $4.91 to

$84.8 per barrel.

The euro rose to 144.88 against the yen, 1.0871 against the

greenback and 0.9955 against the franc, from an early 4-day low of

143.62, 1-week low of 1.0788 and a 6-day low of 0.9903,

respectively. The euro may find resistance around 149.00 against

the yen, 1.10 against the greenback and 1.05 against the franc.

The euro climbed to 1.4649 against the loonie and 1.7399 against

the kiwi, off an early more than 2-week low of 1.4578 and a 5-day

low of 1.7299, respectively. Next near term resistance for the

currency is likely seen around 1.48 against the loonie and 1.76

against the kiwi.

In contrast, the euro fell sharply against the aussie, touching

nearly a 2-week low of 1.6078. If the euro weakens further, 1.59 is

possibly seen as its next support level.

The pound edged up to 1.2371 against the greenback and 164.85

against the yen, reversing from its previous 1-week low of 1.2274

and a 4-day low of 163.42, respectively. The currency is seen

facing resistance around 1.27 against the greenback and 168.00

against the yen.

The pound advanced to 0.8779 against the euro and 1.1339 against

the franc, up from an early low of 0.8806 and a 6-day low of

1.1253, respectively. The currency is poised to find resistance

around 0.86 against the euro and 1.15 against the franc.

Looking ahead, U.S. ISM manufacturing PMI for March and

construction spending for February are set for release in the New

York session.

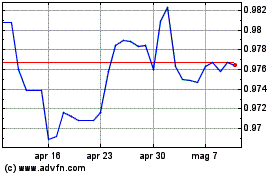

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

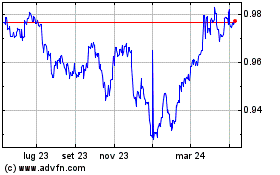

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024