Swiss Franc Falls Ahead Of U.S. Jobs Data

05 Maggio 2023 - 8:30AM

RTTF2

The Swiss franc was lower against its major counterparts in the

European session on Friday, as European shares rose ahead of the

release of key US jobs data that is likely to show a cooling in the

labor market.

Economists expect a job growth of 180,000 in April, down from an

increase of 236,000 jobs in the previous month. The jobless rate is

expected to tick up to 3.6 percent from 3.5 percent in May.

Optimism that the Federal Reserve is likely to pause its policy

tightening in June fueled risk appetite.

Amid concerns over economic growth and a recent banking crisis,

market participants expect that the Fed will be forced to cut rates

by July.

The FTSE100 rose 0.27 percent, DAX climbed 0.24 percent and the

CAC 40 was up by 0.22 percent.

The franc fell to more than a 3-week low of 1.1258 against the

pound and a 1-week low of 150.19 against the yen, from its early

highs of 1.1107 and 151.66, respectively. The franc is seen finding

support around 1.14 against the pound and 144.00 against the

yen.

The franc weakened to a 3-day low of 0.9849 against the euro and

a 2-day low of 0.8931 against the dollar, off its early highs of

0.9738 and 0.8834, respectively. The next possible support for the

franc is seen around 1.00 against the euro and 0.90 against the

dollar.

Looking ahead, U.S. and Canadian jobs data for April, as well as

U.S. consumer credit for March will be out in the New York

session.

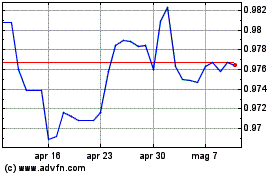

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

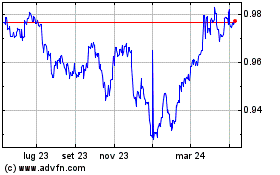

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024