U.S. Dollar Dips Ahead Of Key Data

27 Novembre 2023 - 8:51AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

European session on Monday on bets that the Federal Reserve is done

hiking interest rates.

The dollar index slipped as investors looked ahead to key

inflation data from the United States and Europe due this week for

direction.

After the November FOMC minutes revealed a cautious approach to

future rate hikes, traders now await U.S. reports on new home

sales, consumer confidence, pending home sales and manufacturing

activity this week for additional clues about the outlook for

growth and interest rates.

The Commerce Department's report on personal income and spending

may be in the spotlight, as it includes readings on inflation said

to be preferred by the Federal Reserve.

The Fed's favored measure of inflation is expected to slow to

its lowest since mid-2021, reinforcing investor optimism that the

Fed is done hiking interest rates.

The U.S. GDP second estimate for the third quarter is set to be

released on Wednesday.

The Beige Book, a compilation of anecdotal evidence on economic

conditions in each of the twelve Fed districts, along with remarks

by several Federal Reserve officials, including Chair Jerome

Powell's speech on Friday, could impact the asset markets.

The greenback touched 0.6097 against the kiwi and 0.6607 against

the aussie, setting 3-1/2-month lows. The greenback is seen finding

support around 0.63 against the kiwi and 0.69 against the

aussie.

The greenback fell to a 5-day low of 148.77 against the yen and

a 6-day low of 1.0959 against the euro, off its early highs of

149.67 and 1.0926, respectively. The greenback is poised to

challenge support around 144.00 against the yen and 1.12 against

the euro.

The greenback dropped to a 2-1/2-month low of 1.2626 against the

pound and near a 3-month low of 0.8795 against the franc, reversing

from its previous highs of 1.2590 and 0.8828, respectively. The

currency is likely to locate support around 1.31 against the pound

and 0.86 against the franc.

Against the loonie, the greenback was down at 1.3622. The

greenback may locate support around the 1.34 mark.

Looking ahead, U.S. building permits and new home sales for

October are due in the New York session.

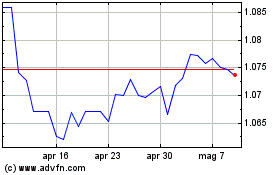

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Giu 2024 a Lug 2024

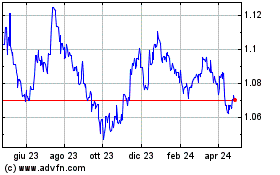

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Lug 2023 a Lug 2024