U.S. Dollar Jumps Ahead Of Key U.S. Economic Data

08 Ottobre 2024 - 5:41PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Tuesday, as traders pared bets on aggressive

Federal Reserve interest-rate cuts and awaited minutes of the

Federal Reserve's latest policy meeting scheduled for

Wednesday.

The CPI data, due on Thursday, could provide more clues on the

Fed's rate path.

The annual inflation is expected to ease to 2.3 percent from 2.5

percent.

After Friday's upbeat jobs data, traders now expect only a

quarter-point cut in interest rates at the Federal Reserve's next

policy announcement on November 7, with a small chance that the

policy rate stays unchanged.

Data from the Commerce Department showed that the U.S. trade

deficit narrowed in the month of August.

The trade deficit shrank to $70.4 billion in August from a

revised $78.9 billion in July.

Economists had expected the trade deficit to decrease to $70.6

billion from the $78.8 billion originally reported for the previous

month.

The greenback edged up to 0.8584 against the franc, 148.35

against the yen and 1.0960 against the euro, off its early 4-day

lows of 0.8530, 147.34 and 1.0996, respectively. The currency is

seen finding resistance around 0.89 against the franc, 150.00

against the yen and 1.08 against the euro.

The greenback rebounded to 1.3075 against the pound. The

currency is poised to challenge resistance around the 1.29

level.

The greenback climbed to near a 2-month high of 1.3675 against

the loonie. Immediate resistance for the currency is seen around

the 1.38 level.

The greenback was up against the kiwi, at 0.6123. This may be

compared to an early nearly 4-week high of 0.6107. The currency is

likely to locate resistance around the 0.60 level.

In contrast, the greenback was trading at 0.6741 against the

aussie, down from an early fresh 3-week low of 0.6769. If the

greenback falls further, it is likely to test support around the

0.70 region.

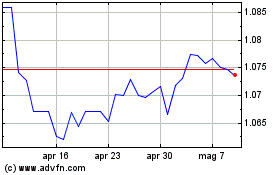

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Ott 2024 a Nov 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Nov 2023 a Nov 2024