TIDM88E

RNS Number : 6961V

88 Energy Limited

11 August 2022

This announcement contains inside information

11 August 2022

88 Energy Limited

PLACEMENT TO RAISE A$14.9M

Highlights

-- Share placement commitments to raise A$14.9 million gross proceeds.

-- Issue price of A$0.009 per share represents a 18.2% discount

to last closing price of A$0.011 (9 August 2022) and a 18.9%

discount to the VWAP on the ASX for the ten calendar days to 9

August 2022.

-- Funds to be directed towards the planned Icewine East 2023

exploration well targeting 1.03 billion bbls of oil*, in addition

to new ventures opportunities and working capital.

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to advise that it has successfully

completed a bookbuild to domestic and international institutional

and sophisticated investors to raise A$14.9 million (equivalent to

GBP8.59m) before costs (the Placement ). This is to be achieved

through the issue of 1,655,555,556 fully paid ordinary shares in

the Company (the New Ordinary Shares ) at an issue price of A$0.009

(equivalent to GBP0.0052) per New Ordinary Share) (the Placement

Price ).

The funds raised under the Placement together with the Company's

existing cash reserves (A$6.1 million (equivalent to GBP3.52m) as

at 31 July 2022), are to be used to fund the planned Icewine East

well long lead, pre-planning and permitting activities including

planning for a flow test program, contingencies, new ventures

portfolio expansion opportunities, and working capital.

The Company is continuing to advance its planning for an Icewine

East well in 2023, which is designed to include at least one flow

test in the 4 reservoir targets, the subject of the recent Icewine

East maiden and independently certified, total Prospective Resource

estimate of 1.03 billion barrels of oil*. The resource estimate is

the result of a period of review of an extensive data suite that

included seismic data, logs from Icewine-1 and nearby wells

adjacent to the Icewine East acreage, in addition to the recently

completed petrophysical analysis and mapping.

The continuing interpretation of the Franklin Bluff's 3D

seismic, including AVO analysis to define 'sweet spots' in each of

the plays targeted, will assist with determining optimal future

exploration and appraisal drilling locations in the Icewine East

acreage.

88 Energy Managing Director, Ashley Gilbert, commented:

"Completion of this placement ensures 88 Energy is now funded to

pursue securing long lead items and progress pre-planning and

permitting for its planned Icewine East exploration well and flow

test scheduled for 2023, which is targeting an estimated 1.03

billion bbls of oil*. The Icewine East acreage has been de-risked

by the recent and ongoing Pantheon drilling and flow tests on their

adjacent acreage, as well as data from the Icewine-1 well logs and

the recently leased Franklin Bluffs 3D data set.

*Gross mean total prospective resources. Refer to ASX announcement on 10 August 2022

for

further details and refer to Cautionary Statement .

This work substantially increases our confidence in unlocking

the potential of the Icewine East acreage, and the Company looks

forward to updating shareholders on our planned exploration well in

2023."

"88 Energy has also been actively assessing multiple new venture

opportunities across the asset life cycle to expand our portfolio

of assets and opportunity types. We are targeting assets that are

complementary to the existing portfolio and provide shareholders

with exposure to additional value creation potential."

Euroz Hartleys Limited acted as Sole Lead Manager and Sole

Bookrunner to the Placement. Cenkos Securities Plc is acting as 88

Energy's Nominated Adviser and Sole Broker to the Placement in the

United Kingdom. Inyati Capital Pty Ltd (Inyati) acted as Co-Manager

to the Placement. Commission for the Placement was 6% (plus GST) of

total funds raised across Euroz Harleys Limited, Inyati Capital Pty

Ltd and Cenkos Securities Plc. In addition, the Company will issue

90,000,000 Unlisted Options (exercisable at $0.02 on or before the

date which is 3 years from the date of issue) in total to the

managers of the Placement. The Broker Options will be subject to

shareholder approval.

The issue of the 1,655,555,556 New Ordinary Shares is not

subject to shareholder approval as the issuance will fall within

the Company's placement capacity pursuant to ASX Listing Rule 7.1.

The New Ordinary Shares will rank pari passu with the existing

ordinary shares in the Company, with DVP settlement scheduled for

19 August 2022 and allotment 22 August 2022. Application has been

made for the New Ordinary Shares to be admitted to trading on AIM.

It is expected that admission of the New Ordinary Shares to trading

on AIM will occur at 8.00 a.m. on 22 August 2022.

Following the issue of the New Ordinary Shares, the Company will

have 18,265,762,962 ordinary shares on issue, all of which have

voting rights. The figure of 18,265,762,962 ordinary shares may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or change their interest in, the Company.

As referenced in the quote from the Managing Director above, the

Company notes that it is continually in discussions with various

parties with respect to new venture opportunities across the asset

life cycle to expand its portfolio of assets and opportunities.

Such potential opportunities are not announced until such time as

the Company has agreed the material commercial and legal terms with

the relevant counterparty or counterparties, and customary due

diligence is completed. Until the material commercial and legal

terms have been agreed and due diligence completed, there can be no

guarantee that such discussions, whether or not they have been

disclosed, will lead to the announcement or completion of a binding

agreement.

Cautionary Statement : The estimated quantities of petroleum

that may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons.

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 37

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document. Dr

Staley has reviewed the information and supporting documentation

referred to in this announcement and considers the resource and

reserve estimates to be fairly represented and consents to its

release in the form and context in which it appears. His academic

qualifications and industry memberships appear on the Company's

website and both comply with the criteria for "Competence" under

clause 3.1 of the Valmin Code 2015. Terminology and standards

adopted by the Society of Petroleum Engineers "Petroleum Resources

Management System" have been applied in producing this document

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSFWSWFEESEFA

(END) Dow Jones Newswires

August 11, 2022 03:20 ET (07:20 GMT)

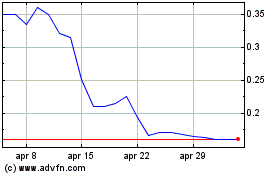

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024