TIDMAGR

RNS Number : 1490Z

Assura PLC

10 January 2024

10 January 2024

Assura plc

Trading Update

For the third quarter ending 31 December 2023

Assura plc ("Assura"), the leading primary care property

investor and developer, today announces its Trading Update for the

third quarter to 31 December 2023.

Jonathan Murphy, CEO, said:

"Assura has delivered another quarter of disciplined activity to

further enhance our growing portfolio, with our market-leading

position and strong balance sheet seeing us well-placed for the

long-term.

"Alongside completing two asset enhancement projects in the

period, we continued to leverage our proven track record and market

expertise to respond to distinct challenges and provide quality

capacity for services in a community setting. We see opportunities

to respond to this healthcare challenge by developing for private

providers, working directly with NHS Trusts and mental health

services as well as bringing our expertise to the Irish market.

"We completed a state-of-the-art cancer treatment centre in

Guildford which will provide highly advanced oncology treatments to

both NHS and private patients; and moved on site to double the size

of our community care centre in Castlebar, Ireland - a market for

which we have three schemes in our immediate development

pipeline.

"The need for high-quality, sustainable healthcare buildings in

a community setting is unabated, and Assura remains best-placed to

meet the demands of an ageing population and growing pressures on

the health system at a time when one-third of the UK's current GP

estate is in need of replacement."

Disciplined investment activity further enhancing our attractive

and resilient portfolio

-- Portfolio of 612 properties across the UK and Ireland with an

annualised rent roll of GBP148.6 million

-- Successful completion of GBP30 million state-of-the-art

cancer care facility in Guildford, increasing capacity for

treatment of NHS and private patients in the area

-- Moved on site with significant development project in

Castlebar, Ireland doubling the size of the facility to create an

Enhanced Community Care Centre as well as substantially improving

sustainability performance targeting operational energy usage

intensity of 55 kWh/m(2)

-- Disposed of one property for GBP1.2 million

-- Completed two asset enhancement capital projects (total spend

GBP4.9 million), including large extension project at Wantage

Health Centre (increasing capacity, refurbishing the existing space

and upgrading the building to EPC B)

-- 46 rent reviews settled in the quarter, covering GBP3.8

million of existing rent and generating an uplift of GBP0.6

million

-- EPC improvement programme continues: 17 properties upgraded

to EPC B in the quarter, 58% of portfolio now at EPC B or

better

Pipeline of emerging opportunities for strategic expansion and

further growth

-- Currently on site with nine developments; these have a

remaining spend over the next 18 months of GBP36 million of a total

cost of GBP91 million (September 2023: 10 on site, GBP114 million

total cost)

-- Immediate development pipeline of four schemes (UK: one,

Ireland: three), where we would normally expect to be on site

within 12 months; total cost of GBP28 million (September 2023:

four, GBP25 million). We continue to experience delays on pipeline

schemes in the UK as we negotiate to ensure rents appropriately

reflect the current cost of construction.

-- On site with five asset enhancement capital projects (total

spend of GBP2.7 million over the next 12 months); pipeline of 17

asset enhancement capital projects (projected spend GBP10.6

million) over the next two years

-- 43 lease re-gears covering GBP8.1 million of existing rent roll in the current pipeline

Robust financial position and strong balance sheet

-- A- (stable outlook) credit rating from Fitch Ratings affirmed in January 2024

-- Weighted average interest rate unchanged at 2.30% (September

2023: 2.30%); all drawn debt on fixed rate basis

-- Weighted average debt maturity of 6.25 years, no refinancing

on drawn debt due until October 2025. Over 50% of drawn debt

matures beyond 2030, with our longest maturity debt at our lowest

rates

-- Revolving credit facility refinanced as previously announced,

increasing to GBP200 million, reducing the overall cost and adding

sustainability-linked KPIs

-- Net debt of GBP1,214 million on a fully unsecured basis with

cash and undrawn facilities of GBP238 million

- ENDS -

Assura plc Tel: 016 1 515 2043

Jayne Cottam, CFO E mail: Investor@assura.co.uk

David Purcell, Investor Relations

Director

FGS Global Tel: 0207 251 3801

Gordon Simpson Email: Assura@fgsglobal.com

Grace Whelan

Notes to Editors

Assura plc is a national healthcare premises specialist and UK

REIT based in Altrincham, UK - caring for more than 600 primary

healthcare buildings, from which over six million patients are

served.

A constituent of the FTSE 250 and the EPRA* indices, as at 30

September 2023, Assura's portfolio was valued at GBP2.7

billion.

At Assura, we BUILD for health. Assura builds better spaces for

people and places, invests in skills and inspires new ways of

working, and unlocks the power of design and innovation to deliver

lasting impact for communities - aiming for six million people to

have benefitted from improvements to and through its healthcare

buildings by 2026.

Assura is leading for a sustainable future, targeting net zero

carbon across its portfolio by 2040.

Further information is available at www.assuraplc.com

Assura plc LEI code: 21380026T19N2Y52XF72

*EPRA is a registered trademark of the European Public Real

Estate Association.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLDLIIAIIS

(END) Dow Jones Newswires

January 10, 2024 02:00 ET (07:00 GMT)

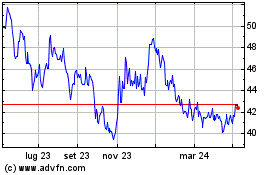

Grafico Azioni Assura (LSE:AGR)

Storico

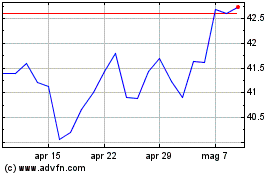

Da Mar 2024 a Apr 2024

Grafico Azioni Assura (LSE:AGR)

Storico

Da Apr 2023 a Apr 2024