TIDMANIC

RNS Number : 2567S

Agronomics Limited

03 November 2023

3 November 2023

Agronomics Limited

("Agronomics" or the "Company")

Net Asset Value calculation as of 30 September 2023

Agronomics Limited (AIM:ANIC), the leading listed company

focused on the field of cellular agriculture, announces that its

unaudited Net Asset Valuation ("NAV") per share calculation as at

closing on 30 September 2023 was 16.48 pence per share, a 4%

increase from 15.80 pence per share on 30 June 2023. Net Assets

were GBP164 million, including investments of GBP140 million and

uninvested cash and short-term deposits of GBP24 million.

The share price of 9.80 pence at the 30 September 2023 close

represented a discount of 40% to the 30 September 2023 NAV per

share. The average discount to the prevailing NAV per share over

the last 12-month period was 39%. Under IFRS, the Company's

unquoted investments are generally carried at cost or the most

recent priced funding round.

Richard Reed, Chairperson of Agronomics, commented:

"We are delighted by the significant progress made by our

portfolio during the quarter, successfully closing a number of

funding rounds at a time when wider venture capital funding is

challenging as the result of macro-economic uncertainty.

Highlights included a EUR30 million funding round for cultivated

meat company Meatable, led by Agronomics alongside a new investor,

Invest-NL. The UK-based Clean Food Group also completed a GBP2.3

million funding round to commercialise its fermentation-derived

palm oil. In addition, Liberation Labs is also making significant

progress in its US$ 75 million fundraise to help construct its

facility, enabling precision fermentation at a commercial

scale.

These successes highlight the industry-leading quality of the

companies within our portfolio, and we look forward to their

continued growth and commercial development.

Agronomics continues to have a strong cash balance and has no

intention to raise capital, while trading at a discount to

NAV."

Financing

During the quarter ended 30 September 2023, the Company received

notification of warrants being exercised. A total of 1,836 new

ordinary shares were issued following the warrant exercise, for

proceeds of GBP547.11. These funds, together with existing cash

resources, will be utilised to provide finance for opportunities

within the field of cellular agriculture, both by supporting

existing companies, as well as identifying new opportunities in

which to invest.

On 22 September 2023, the Company announced that it will execute

a discretionary on-market share Buyback Programme for an aggregate

amount of up to GBP3 million, with the Buyback Programme having a

term of 6 months commencing on 2 October 2023. The Company intends

to cancel repurchased shares, unless used to cover obligations

under share-based remuneration arrangements.

Investment review

On 9 August 2023, portfolio company Meatable completed a

successful EUR30 million Series B financing round, with Agronomics

investing EUR4 million. Agronomics also received 200 warrants,

exercisable at any time in the next five years. The funding round

was co-led with New Agrarian Company Limited. Subject to audit,

Agronomics' total investment in Meatable will be carried at GBP11.8

million, including an unrealised gain of GBP3.9 million, which

represents a gross IRR of 22.31%.

On 14 August 2023, the Company invested GBP0.7 million in

fermentation-derived palm oil company Clean Food Group Limited

("CFG"), as part of their GBP2.3 million Pre-Series A funding

round. Notable co-investors include industrial food specialists

Doehler Group and Alianza Team. Subject to audit, Agronomics will

carry this position in its accounts at a book value of GBP6.97

million, including an unrealised gain on cost of GBP5.37 million,

an IRR of 385%. Capital raised from this pre-series round will

enable CFG to accelerate the scale-up of its technology platform,

ahead of the planned completion of its Series A funding next year

to further develop its technology for production at a commercial

scale, with the funds supporting the construction of a new

manufacturing facility in the UK.

Unaudited to 30

September 2023

GBP

Current Assets

Investments 139,970,567

Uninvested cash and deposits 23,643,167

Trade and other receivables 257,475

Current Liabilities

Trade and other creditors (154,339)

----------------

Net Assets 163,716,870

Capital and Reserves

Share capital 993

Share premium 134,481,912

Retained earnings 29,233,965

----------------

Net assets 163,716,870

Shares in Issue 993,153,870

Net Asset Value per 16.48 pence

share

The quoted investments within the portfolio are valued under

IFRS at bid price.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

For further information please contact:

Agronomics Beaumont Canaccord Cavendish Peterhouse SEC Newgate

Limited Cornish Genuity Limited Securities Capital

Limited Plc Limited

The Company Nomad Joint Broker Joint Joint Public Relations

Broker Broker

========== ================= ============= =============== ===========================

Richard Reed Roland Andrew Potts Giles Lucy Williams Bob Huxford

Denham Eke Cornish Harry Rees Balleny Charles George Esmond

James Alex Aylen Michael Goodfellow Anthony Hughes

Biddle (Head of Johnson Alice Cho

Equities)

========== ================= ============= =============== ===========================

+44 (0) 1624 +44 (0) +44 (0) +44 (0)

639396 207 628 +44 (0) 207 397 207 469

info@agronomics.im 3396 207 523 8000 8900 0936 agronomics@secnewgate.co.uk

========== ================= ============= =============== ===========================

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKZMGMNZLGFZM

(END) Dow Jones Newswires

November 03, 2023 03:05 ET (07:05 GMT)

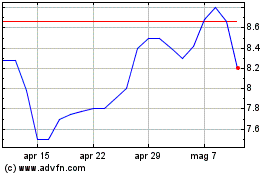

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Mar 2024 a Apr 2024

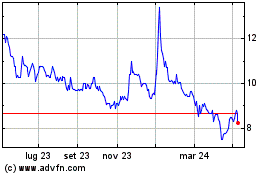

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Apr 2023 a Apr 2024