Agronomics Limited Announces GALY Raises US$ 33 Million in Series B Financing

04 Settembre 2024 - 8:00AM

Agronomics Limited("Agronomics"

or the "Company")

GALY Raises US$ 33 Million in Series B

Financing

Agronomics (LON:ANIC), a leading listed company

in the field of cellular agriculture, is pleased to report that its

portfolio company GALY CO. ("GALY") has announced that it has

closed an oversubscribed US$ 33 million Series B financing led by

Breakthrough Energy Ventures LLC, with additional participation

from new investors H&M Group Ventures and Industria de Diseño

Textil, S.A. (through Mundi Ventures).

Founded in 2019 with a mission to find ethical

and sustainable agricultural solutions, GALY Cotton is the

company's first product targeting conventional cotton practices.

GALY Cotton is a new material that fully replicates traditional

cotton in quality, retaining its exact attributes because it

originates from an actual plant, all while offering ESG benefits,

customisable quality and a clear roadmap to reach cost parity.

The funds from the Series B round will primarily

fuel the expansion of GALY's research and development on its

innovative cellular agriculture platform and its flagship product,

GALY Cotton, which uses 99% less water and 97% less land than

traditional cotton while emitting 77% less CO2, as it advances

towards pre-industrial quality and scale.

GALY explains that it has also secured millions

of dollars in proof-of-concept agreements with top industry players

and a 10-year, US$ 50 million offtake agreement with Suzuran

Medical Inc, a Japanese medical supplies manufacturer, for the

sourcing of GALY Cotton.

In aggregate, Agronomics has invested US$ 1.5

million in GALY across its Pre-Series A and Series A rounds.

Subject to audit, Agronomics will, as a result of this Series B

round, carry this position forward at a book value of £2.6 million

representing a MOIC of 2.2x and an IRR of 28.0%. Agronomics now

holds an equity stake of 3.3% in GALY on a fully diluted basis,

accounting for approximately 1.6% of Agronomics' last stated Net

Asset Value on 30 June 2024.

Luciano Bueno, GALY's CEO,

said:"We are thrilled to have investors who recognise the

crucial role that our climate adaptation technology will play in

our daily lives. Climate change exposes the fragility of

agricultural supply chains, and the recent rise in cocoa prices is

a stark reminder of the new normal we face. Unfortunately, it's not

a matter of 'if,' but 'when.' Soon, the world will face increased

volatility in conventional agriculture due to more frequent extreme

weather conditions. When that time comes, GALY will be ready,

better equipping our economy to withstand these shocks."

Jim Mellon, Co-Founder and

Executive Chair of Agronomics, said:"The production of

cotton accounts for the largest uses of water and pesticides of any

agricultural product, and GALY, with its biomanufacturing cotton,

is offering a sustainable solution which could reduce the

environmental burden of cotton production across multiple

industries such as medical supplies and textiles. This announcement

is an exciting milestone for GALY and we are excited to see them

enter a new stage as they scale up production and work towards

commercialisation."

To read GALY's full press release please see the

following

link:https://www.globenewswire.com/news-release/2024/09/03/2939864/0/en/GALY-Raises-33-Million-in-Oversubscribed-Series-B-Financing-to-Advance-its-Cellular-Agriculture-Platform.html

About GALY CO.Launched in 2019,

GALY is a climate tech company dedicated to developing novel

cellular agriculture products. Starting with cotton-which accounts

for 2.5% of the world's total arable land, consumes 25% of the

world's agrochemicals, requires an estimated 10,000 litres of water

per kilogram produced, and faces traceability issues due to unsafe

labour conditions-the company has successfully developed a

minimum-viable product and is working on both enhancing the

product's quality parameters and scaling up production. Recognising

the potential of its platform through its work with cotton, GALY

has expanded its foundational technology to other crops in

industries such as food and beverages, among many other

possibilities.

About AgronomicsAgronomics is a

leading London-listed company focussing on investment opportunities

within the field of cellular agriculture. The Company has

established a portfolio of over 20 companies in this rapidly

advancing sector. It seeks to invest in companies owning

technologies with defensible intellectual property that offer new

ways of producing food and materials with a focus on products

historically derived from animals. These technologies are driving a

major disruption in agriculture, offering solutions to improve

sustainability, as well as addressing human health, animal welfare

and environmental damage. This disruption will decouple supply

chains from the environment and animals and improve food security

for the world's expanding population. A full list of Agronomics'

portfolio companies is available

at https://agronomics.im/.

For further information please contact:

|

AgronomicsLimited |

BeaumontCornishLimited |

CanaccordGenuityLimited |

CavendishCapitalMarketsLimited |

PeterhouseCapitalLimited |

SECNewgate |

|

The Company |

Nomad |

Joint Broker |

Joint Broker |

Joint Broker |

Public Relations |

|

Jim MellonDenham Eke |

Roland CornishJames Biddle |

Andrew PottsHarry PardoeAlex Aylen (Head of Equities) |

Giles BallenyMichael JohnsonCharlie Combe |

Lucy WilliamsCharles Goodfellow |

Bob HuxfordAnthony Hughes |

|

+44 (0) 1624 639396info@agronomics.im |

+44 (0) 207 628 3396 |

+44 (0) 207 523 8000 |

+44 (0) 207 397 8900 |

+44 (0) 207 469 0936 |

agronomics@secnewgate.co.uk |

Nominated AdviserBeaumont Cornish Limited

("Beaumont Cornish") is the Company's Nominated Adviser and is

authorised and regulated by the FCA. Beaumont Cornish's

responsibilities as the Company's Nominated Adviser, including a

responsibility to advise and guide the Company on its

responsibilities under the AIM Rules for Companies and AIM Rules

for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

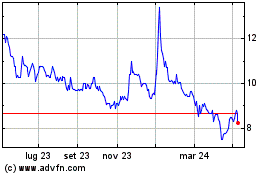

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Dic 2024 a Gen 2025

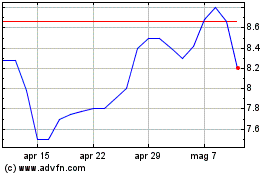

Grafico Azioni Agronomics (LSE:ANIC)

Storico

Da Gen 2024 a Gen 2025