TIDMANTO

RNS Number : 9163Z

Antofagasta PLC

17 January 2024

Q4 2023 PRODUCTION REPORT

delivering increased production in 2023, entering a new phase of

growth

Antofagasta plc CEO, Iván Arriagada said: "2023 was a year of

significant progress, and we are pleased to be moving forward into

the next phase of development and growth for our Company. In 2023,

we recorded another strong year of safety performance, with no

fatalities and a reduction in lost time injury rates. We have

delivered a year of robust operational performance in 2023, with

production increasing by 2% and net cash costs in line

year-on-year, with our strong cost discipline and increased output

of by-products offsetting industry-wide cost inflation. Production

in 2024 is expected to increase to 670-710,000 tonnes of copper, as

previously announced, with guidance for net cash costs set at

$1.60/lb.

"On growth, we are finalising the delivery of the Phase 1

Expansion Project at Los Pelambres, which will help to maintain

this asset's future production. Underpinning our future growth, we

recently announced the approval of the Centinela Second

Concentrator Project, which will provide an additional 170,000

copper-equivalent tonnes of production into an increasingly

constrained global market for copper.[1]

"In line with our strategy of prioritising exploration and

investment in the Americas, in December we disclosed our investment

in Buenaventura[2], reflecting the potential we see in

Buenaventura's asset portfolio and the highly prospective geology

of Peru.

"With the delivery of projects and announcement of a new phase

of investment in growth, our Company is well-positioned for the

future. Copper prices continued to show stability in 2023 and we

believe in copper's fundamental role in the energy transition and

electrification, which will support long-term pricing."

HIGHLIGHTS

PRODUCTION

-- Group copper production in Q4 2023 was 191,500 tonnes, 10%

higher than Q3 2023, primarily related to production increases at

both Los Pelambres and Centinela.

-- Group copper production for the full year was 660,600 tonnes,

2% higher than the previous year, with an increasing contribution

from Los Pelambres, as the Phase 1 Expansion Project ramps up.

-- Gold production for the full year 2023 was 209,100 ounces,

18% higher than 2022 due to higher gold grades at Centinela. Gold

production of 65,500 in Q4 represents a 14% increase compared to

the previous quarter, with this increase driven by higher gold

grades at Centinela.

-- Molybdenum production for the full year 2023 was 11,000

tonnes, representing a 13% increase year-on-year due to higher

throughput rates at Los Pelambres and higher recoveries at

Centinela. Molybdenum production in Q4 2023 fell by 9% to 2,900

tonnes, primarily due to lower recoveries at Centinela.

CASH COSTS

-- Cash costs before by-product credits in Q4 2023 were

$2.07/lb, 9% lower than the previous quarter due to higher

production across the Group and lower costs in Q4 at all our

operations.

-- Cash costs before by-product credits in full year 2023 were

$2.31/lb, 5% higher than the prior year, primarily due to local

inflation, appreciation of the Chilean peso and the conclusion of a

number of 3-year labour agreements.

-- Net cash costs in Q4 2023 were $1.50/lb, 2% higher than in

the previous quarter, with lower cash costs before by-products

offset by lower by-product credits, related to lower molybdenum

production and pricing.

-- Net cash costs for the full year 2023 were $1.61/lb, in line

with 2022 and ahead of guidance for the year, reflecting a balance

of higher underlying cash costs before by-products, alongside

higher production and pricing for by-products.

GROWTH PROJECTS UPDATE

-- The Company announced the approval of the Centinela Second

Concentrator in late December 2023, which is a growth project that

is expected to add 170,000 tonnes of copper-equivalent

production[3] to the Company's portfolio. The project is expected

to deliver a reduction in Centinela's overall net cash costs,

moving it towards the first quartile on the global cost curve, due

to a greater emphasis on modern technologies and by-products, and

economies of scale. The capital cost estimate for this project is

$4.4 billion, which will be financed by a combination of project

finance (c.60%) and direct funding (c.40%) from Centinela's

shareholders (Antofagasta plc and Marubeni Corporation). Critical

path works began immediately after announcement, with full

construction expected to commence after definitive project finance

documents have been executed during Q1 2024. In parallel, the

Company is reviewing a potential outsourcing of Centinela's water

supply, the impact of which is not included in capital cost

estimate referenced above. For further details, please see the

press release and presentation provided on the Company's website

(www.antofagasta.co.uk/).

-- Following the commissioning of the Phase 1 desalination plant

for Los Pelambres, the successful ramp up towards this facility's

instantaneous design capacity of 400 litres per second is nearing

completion, with an average output of approximately 307 litres per

second during December 2023 (Q3 2023: 248 litres per second).

-- The fourth concentrator line at Los Pelambres is successfully

completing its commissioning phase, with an additional two million

tonnes of ore processed as of the end of the year.

-- In November 2023, the Environmental Impact Assessment (EIA)

was approved for the project to double the size of the Los

Pelambres' desalination plant to an instantaneous design capacity

of 800 litres per second, as well as replacing the concentrate

pipeline and the construction of certain planned enclosures at the

El Mauro tailings storage facility. This work represents one part

of the Los Pelambres Phase 2 Expansion Project, approval of which

will be considered by the Board of Directors during Q1 2024.

-- The Company continues to progress test work on its patented

Cuprochlor-T technology for the leaching of primary sulphides,

which has now achieved recovery rates of more than 70% after 220

days. The Company is now evaluating the feasibility of advancing

this technology across other mining operations, including third

parties.

-- In December 2023, the Company announced an investment to

acquire beneficial ownership of approximately 19% of the

outstanding shares of Compañía de Minas Buenaventura S.A.A.

("Buenaventura"). Buenaventura is Peru's largest, publicly traded

precious and base metals company and a major holder of mining

rights in Peru, with the Company's investment in line with its

strategy of prioritising exploration and investment in the

Americas.

2024 GUIDANCE

-- As previously announced, Group production in 2024 is expected

to be 670-710,000 tonnes of copper. Output of by-products is

expected to be 195-215,000 ounces of gold and 11.0-12.5 tonnes of

molybdenum. The expected increase in copper production in 2024

principally reflects the addition of the Los Pelambres Phase 1

Expansion Project in 2023, with increased water availability and

ore processing capacity expected in 2024.

-- Group cash costs in 2024 before by-product credits are

expected to be $2.25/lb, in line with 2023, with the positive

impact of higher production balanced by a short-term reduction in

ore grades at Los Pelambres.

-- Group net cash costs in 2024 are expected to be $1.60/lb,

with by-product credits expected to remain in line

year-on-year.

-- In 2024, consolidated Group capital expenditure, which

excludes Zaldívar, is expected to be $2.7 billion, with sustaining

and mine development expenditure broadly in line year-on-year, and

as development expenditure commences on the Centinela Second

Concentrator (not including any potential reduction in capital

expenditures as a result of the process to outsource Centinela's

water supply) and other growth projects at Los Pelambres and

Centinela.

SAFETY AND SUSTAINABILITY

-- The Group continues to prioritise the safety of its

workforce, achieving a strong performance in safety metrics during

2023, with no fatalities during the year (2022: zero) and the

Group's lost time injury frequency rate (LTIFR) of 0.62

representing a 26% reduction year-on-year. Recent safety highlights

within the Group include the completion of more than 39 million

hours worked to date on the Los Pelambres Phase 1 Expansion Project

with a LTIFR of less than 1.0, and our Transport Division reducing

its incidence rate for lost time injuries by more than 50% in 2023,

resulting in a LTIFR of 0.9 (2022: 2.2).

-- In June 2023, Zaldívar submitted an EIA application to extend

its mining and water environmental permits through to 2051. This

includes a proposal to develop the primary sulphide ore deposit and

extend the current life of mine at an estimated investment over the

mine life of $1.2 billion. It also includes a plan to change the

mine's water source from the local aquifer to either seawater or

water provided by third parties. This will follow a transition

period during which the current continental water extraction permit

is extended from 2025 to 2028. In parallel, the Company has

submitted a Declaration of Environmental Impact ("DIA") to align

the expiry date of Zaldivar's current mining permit (2024) to the

current water permit (2025).

-- Considering the continuing drought in central Chile and the

recent changes in the Water Code, discussions have continued during

the quarter with stakeholders in the Choapa Valley about water

distribution arrangements in the area, following an agreement being

reached with local communities in 2023. The relevant water

authority has continued in the process of reviewing this proposal.

This ongoing process involves no material change to the

availability of continental water at Los Pelambres.

LEGISLATIVE

-- In December 2023, Chileans voted to reject a proposed

constitution, and as a result the country will now continue with

the existing constitution, which has been in place for several

decades.

OTHER

-- During Q4 2023, the Company concluded three-year labour

agreements with two workers unions at Centinela.

-- In 2024, the Company has one labour agreement scheduled to

expire during the year, which is an agreement with a worker's union

at Centinela (due to expire in November 2024).

-- In November 2023, Twin Metals Minnesota (TMM) appealed the

September 2023 order issued by a District Court in the United

States, which dismissed the claims filed by TMM that challenged the

administrative actions that resulted in the rejection of its

preference right lease applications, the cancellation of its

federal leases 1352 and 1353 and the rejection of its Mine Plan of

Operations for the Maturi Deposit in Minnesota. This action is

pending.

GROUP PRODUCTION AND CASH COSTS Year to Date Q4 Q3

--------------------- ------ ------

2023 2022 % 2023 2023 %

------------------------------------- ------ ------ ----- ------ ------ ------

Copper production kt 660.6 646.2 2.2 191.5 173.6 10.3

Copper sales kt 667.2 642.5 3.8 213.4 158.4 34.7

Gold production koz 209.1 176.8 18.3 65.5 57.4 14.1

Molybdenum production kt 11.0 9.7 13.4 2.9 3.2 (9.4)

------------------------------ ------ ------ ------ ----- ------ ------ ------

Cash costs before by-product

credits (1) $/lb 2.31 2.19 5.5 2.07 2.27 (8.8)

Net cash costs (1) $/lb 1.61 1.61 - 1.50 1.47 2.0

------------------------------ ------ ------ ------ ----- ------ ------ ------

(1) Cash cost is a non-GAAP measure used by the mining industry

to express the cost of production in US dollars per pound of copper

produced.

Investors - London Media - London

Rosario Orchard rorchard@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Robert Simmons rsimmons@antofagasta.co.uk Telephone +44 20 7404 5959

Telephone +44 20 7808 0988

Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Register on our website to receive our email alerts at the

following address:

https://www.antofagasta.co.uk/investors/news/email-alerts/

LinkedIn

MINING OPERATIONS

Los Pelambres

Copper production at Los Pelambres during Q4 2023 was 90,700

tonnes, 12% higher than in the previous quarter due to higher

throughput rates, in line with the ramp up of the Phase 1 Expansion

Project. Copper sales in Q4 2023 benefitted from adverse weather

conditions at the Company's port, which pushed shipments from

September to October 2023.

For the full year 2023, copper production was 300,300 tonnes, 9%

higher than the prior year. This increase was driven by increased

throughput rates in 2023, which resulted from increasing

availability of water from the Company's desalination plant as it

successfully completes its ramp up, and additional ore processing

capacity provided by the fourth concentrator line that is nearing

the end of its commissioning phase. Molybdenum production in Q4

2023 was 2,300 tonnes, representing a 4% reduction on the previous

quarter due to lower grades. Full year molybdenum production was

8,100 tonnes, representing a 13% increase year-on-year, which was

the result of higher throughput rates.

Cash costs before by-product credits in Q4 were $1.79/lb, 5%

lower than in the previous quarter. For the full year cash costs

before by-product credits were $1.92/lb, 4% higher than in 2022.

The key drivers behind this increase in 2023 are appreciation of

the Chilean peso, local inflation, and the conclusion of 3-year

labour agreements, partially offset by higher production and lower

input costs. Net cash costs for the quarter were $1.27/lb, 34%

higher than in Q3 2023, with this increase driven primarily by

reduced by-product credits, for the reasons outlined above. For the

full year, net cash costs were $1.14/lb, 4% higher than in 2022,

reflecting a similar increase in the underlying cash costs and

higher production and pricing for molybdenum.

Following the commissioning of the Phase 1 desalination plant

for Los Pelambres, the ramp up towards this facility's

instantaneous design capacity of 400 litres per second continues,

with an average output of approximately 307 litres per second

during December 2023 (Q3 2023: 248 litres per second). The fourth

concentrator line at Los Pelambres is nearing the successful

completion of its commissioning phase, with an additional two

million tonnes of ore processed as of the end of the year.

Major maintenance is scheduled in Q1 and Q4 2024, which is

factored into full year guidance.

LOS PELAMBRES Year to Date Q4 Q3

---------------------- ------ ------

2023 2022 % 2023 2023 %

-------------------------------------- ------ ------ ------ ------ ------ -------

Daily ore throughput kt 152.4 136.9 11.3 185.5 164.1 13.0

Copper grade % 0.62 0.64 (3.1) 0.61 0.61 -

Copper recovery % 89.3 89.3 - 89.7 89.2 0.6

Copper production kt 300.3 275.0 9.2 90.7 81.1 11.8

Copper sales kt 299.0 271.2 10.3 100.8 69.1 45.9

------------------------------- ------ ------ ------ ------ ------ ------ -------

Molybdenum grade % 0.017 0.017 - 0.016 0.017 (5.9)

Molybdenum recovery % 85.5 85.6 (0.1) 85.0 84.6 0.5

Molybdenum production kt 8.1 7.2 12.5 2.3 2.4 (4.2)

Molybdenum sales kt 8.1 6.8 19.1 2.3 2.1 9.5

Gold grade g/t 0.038 0.042 (9.5) 0.030 0.041 (26.8)

Gold recovery % 69.0 70.0 (1.4) 76.4 63.7 19.9

Gold production koz 43.3 43.1 0.5 11.8 11.9 (0.8)

Gold sales koz 42.1 42.3 (0.5) 12.4 9.3 33.3

------------------------------- ------ ------ ------ ------ ------ ------ -------

Cash costs before by-product

credits (1) $/lb 1.92 1.84 4.3 1.79 1.88 (4.8)

Net cash costs (1) $/lb 1.14 1.10 3.6 1.27 0.95 33.7

------------------------------- ------ ------ ------ ------ ------ ------ -------

(1) Includes tolling charges of $0.25/lb in Q4 2023, $0.24/lb in

Q3 2023, $0.23/lb in FY 2023 and $0.18/lb FY 2022.

Centinela

During Q4 2023, total copper production was 68,900 tonnes, 8%

higher than the previous quarter, with production of both cathodes

and copper concentrates contributing higher production volumes.

Sales of copper in concentrate in Q4 2023 benefitted from adverse

weather conditions at the Company's port, which pushed shipments

from September to October 2023. Total copper production for the

full year was 242,000 tonnes, 2% lower than last year but in line

with the Company's original guidance given for 2023. This reduction

in output reflects lower ore grades at Centinela Cathodes, which

was partially offset by higher ore grades at Centinela

Concentrates.

Concentrate production for the quarter was 45,700 tonnes, 7%

higher than in Q3, due to elevated processing throughput rates,

copper grades and recoveries. For the full year, copper in

concentrate production was 162,700 tonnes, 9% higher than in 2022,

reflecting a combination of higher ore grades and copper

recoveries, with the concentrator operating in line with its design

capacity.

Cathode production during the quarter was 23,200 tonnes, 10%

higher than the previous quarter, primarily as a result of higher

copper grades and recoveries. Full year copper cathode production

was 79,300 tonnes, 19% lower than in 2022 due to lower copper

grades, offset by higher throughput rates.

Gold production for the quarter was 53,600 ounces, 18% higher

than the previous quarter on higher gold grades. For the full year,

gold production was 165,800 ounces, 24% higher than in 2022 due to

higher gold grades (which are positively correlated to copper

grades). Molybdenum production fell by 25% in Q4 2023, reflecting

lower molybdenum recoveries. Full year production of molybdenum

reached 2,900 tonnes - a record for Centinela, with this

year-on-year increase of 21% reflecting higher molybdenum

recoveries during the year.

Cash costs before by-product credits in Q4 2023 were $2.19/lb,

14% lower than in the previous quarter, reflecting higher

production volumes of both concentrates and cathodes during the

quarter, in addition to lower input costs during the period. Cash

costs before by-product credits for the full year were $2.57/lb, 5%

higher than in 2022 due to lower copper production, the conclusion

of 3-year labour agreements and higher contractor costs related to

mining.

In Q4 by-product credits decreased by 10c/lb compared with Q3,

which relates to lower molybdenum production and pricing, which was

partially offset by higher gold output and pricing. For the full

year, by-product credits were $0.94/lb, 25c/lb higher than in 2022

due to higher production and pricing of both gold and

molybdenum.

Net cash costs in Q4 were $1.30/lb, 16% lower than in the

previous quarter due to higher copper production and the reasons

stated above related to lower cash costs before by-products. During

the full year net cash costs were $1.63/lb, 12c/lb lower than 2022

due to higher by-product credits.

In 2024, the labour agreement with a worker's union expires in

November.

In line with previous years, major maintenance is scheduled in

Q1 and Q3 2024, which is factored into full year guidance.

CENTINELA Year to Date Q4 Q3

----------------------- ------ ------

2023 2022 % 2023 2023 %

------------------------------------- ------ ------ ------- ------ ------ -------

CONCENTRATES

Daily ore throughput kt 107.4 108.9 (1.4) 111.7 109.5 2.0

Copper grade % 0.52 0.49 6.1 0.55 0.53 3.8

Copper recovery % 83.2 80.5 3.4 84.1 82.8 1.6

Copper production kt 162.7 149.3 9.0 45.7 42.8 6.8

Copper sales kt 166.9 148.6 12.3 52.3 43.1 21.3

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.013 0.013 - 0.011 0.011 -

Molybdenum recovery % 66.7 56.9 17.2 58.4 67.8 (13.9)

Molybdenum production kt 2.9 2.4 20.8 0.6 0.8 (25.0)

Molybdenum sales kt 3.0 2.4 25.0 0.6 0.9 (33.3)

Gold grade g/t 0.21 0.17 23.5 0.26 0.22 18.2

Gold recovery % 66.6 65.0 2.5 66.8 67.2 (0.6)

Gold production koz 165.8 133.7 24.0 53.6 45.5 17.8

Gold sales koz 162.8 132.3 23.1 59.0 45.4 30.0

------ ------ ------- ------ ------ -------

CATHODES

Daily ore throughput kt 58.3 55.0 6.0 64.3 65.6 (2.0)

Copper grade % 0.53 0.69 (23.2) 0.56 0.51 9.8

Copper recovery % 67.0 66.2 1.2 71.0 64.0 10.9

Copper production - heap

leach kt 75.6 94.2 (19.7) 22.5 20.2 11.4

Copper production - total

(1) kt 79.3 98.2 (19.2) 23.2 21.1 10.0

Copper sales kt 81.0 97.5 (16.9) 23.1 20.9 10.5

------------------------------ ------ ------ ------ ------- ------ ------ -------

Total copper production kt 242.0 247.5 (2.2) 68.9 63.8 8.0

Cash costs before by-product

credits (2) $/lb 2.57 2.44 5.3 2.19 2.54 (13.8)

Net cash costs (2) $/lb 1.63 1.75 (6.9) 1.30 1.55 (16.1)

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes production from ROM material

(2) Includes tolling charges of $0.17/lb in Q4 2023, $0.18/lb in

Q3 2023, $0.17/lb in FY 2023 and $0.14/lb FY 2022.

Antucoya

During Q4 production was 21,600 tonnes, 18% higher than the

previous quarter, which was largely due to throughput increasing to

a new record of 93,500 tonnes per day. Copper sales in Q4 2023

benefitted from adverse weather conditions at the Company's port,

which pushed shipments from September to October 2023. Production

for the full year was 77,800 tonnes, 1.8% lower than last year due

to a combination of marginally lower ore grades and recoveries. The

plant continues to operate in line with its design throughput.

Costs during the full year were 5% higher at $2.63/lb,

reflecting local inflation, appreciation of the Chilean peso,

higher consumption rates of sulphuric acid in line with

expectations, with lower input costs serving to partially offset

these effects. During the quarter, cash costs were $2.44/lb,

compared to $2.65/lb in Q3, with this reduction due to the increase

in copper production during the quarter, lower sulphuric acid

consumption rates and depreciation of the Chilean peso, offset by

higher unit prices for sulphuric acid.

Major maintenance scheduled to take place in Q1 and Q2 2024,

with this factored into full year guidance.

ANTUCOYA Year to Date Q4 Q3

-------------------- ----- -----

2023 2022 % 2023 2023 %

----------------------------- ----- ----- ------ ----- ----- ------

Daily ore throughput kt 88.6 89.4 (0.9) 93.5 81.5 14.7

Copper grade % 0.33 0.34 (2.9) 0.34 0.34 -

Copper recovery % 67.9 69.0 (1.6) 68.9 67.8 1.6

Copper production kt 77.8 79.2 (1.8) 21.6 18.3 18.0

Copper sales kt 78.4 80.8 (3.1) 25.3 15.7 61.1

---------------------- ------ ----- ----- ------ ----- ----- ------

Cash costs $/lb 2.63 2.50 5.2 2.44 2.65 (7.9)

---------------------- ------ ----- ----- ------ ----- ----- ------

Zaldívar

During the quarter attributable production at Zaldívar was

10,300 tonnes of copper, broadly in line with the previous quarter,

which was the result of a balance between lower recoveries and

higher ore processing rates. Attributable copper production for the

year was 40,500 tonnes, 9% lower than in 2022 mainly due to lower

ore processing rates, which were partially mitigated by improved

recoveries during the year.

Cash costs for the full year were $2.95/lb, 23% higher than the

previous year's costs due to lower production, local inflation,

increased costs for maintenance and utilisation of stocks from the

prior period. During the quarter, cash costs were $2.91/lb compared

to $2.98/lb in Q3, with costs reflecting a balance of a reduction

of inventory during the quarter, higher sulphuric acid consumption

rates and higher input costs, with the prior period including costs

associated with the conclusion of a 3-year labour agreement.

Major maintenance scheduled in Q1 and Q3 2024 is included in

full year guidance.

ZALDÍVAR Year to Date Q4 Q3

--------------------- ----- -----

2023 2022 % 2023 2023 %

---------------------------------- ----- ----- ------- ----- ----- ------

Daily ore throughput kt 35.0 40.4 (13.4) 38.1 36.5 4.4

Copper grade % 0.79 0.79 - 0.82 0.82 -

Copper recovery % 57.6 54.0 6.7 52.1 57.7 (9.7)

Copper production - heap

leach (1) kt 28.5 31.9 (10.7) 7.5 7.2 4.2

Copper production - total

(1,2) kt 40.5 44.5 (9.0) 10.3 10.4 (1.0)

Copper sales (1) kt 41.9 44.4 (5.6) 11.9 9.7 22.7

Cash costs $/lb 2.95 2.39 23.4 2.91 2.98 (2.3)

----- ----- ----- -----

(1) Group's 50% share

(2) Includes production from secondary leaching

Transport Division

Total transport volumes in 2023 were in line with 2022,

maintaining the record volume set of 7.1 million tonnes in both

years. In Q4 2023, transport volumes were 1.7 million tonnes, 5%

lower than the previous quarter due to adverse weather conditions

at the port and lower demand due to maintenance at a client's

operation.

Within the Transport Division, the Company concluded on a total

of seven 3-year labour agreements during the year, with no further

negotiations until 2026.

TRANSPORT Year to Date Q4 Q3

---------------------- ------ ------

2023 2022 % 2023 2023 %

-------------------------------- ------ ------ ------ ------ ------ -------

Rail kt 5,381 5,368 0.2 1,333 1,374 (3.0)

Road kt 1,729 1,741 (0.7) 398 453 (12.1)

Total tonnage transported kt 7,110 7,109 0.0 1,731 1,828 (5.3)

------ ------ ------ ------

Commodity prices, exchange rates and other

Year to Date Q4 Q3

---------------------- ------ ------

2023 2022 % 2023 2023 %

------ ------ ------ ------ ------

Copper

Market price $/lb 3.85 4.00 (3.8) 3.70 3.79 (2.4)

Realised price $/lb 3.89 3.84 1.3 3.84 3.77 1.9

---------------- ------ ------ ------ ------ ------ ------ --------

Gold

Market price $/oz 1,942 1,800 7.9 1,974 1,929 2.3

Realised price $/oz 1,990 1,801 10.5 2,060 1,898 8.5

---------------- ------ ------ ------ ------ ------ ------ --------

Molybdenum

Market price $/lb 24.2 18.7 29.4 18.6 23.7 (21.5)

Realised price $/lb 22.0 20.8 5.8 13.1 25.3 (48.2)

---------------- ------ ------ ------ ------ ------ ------ --------

Exchange rates

per

Chilean peso $ 839 872 (3.8) 896 853 5.0

---------------- ------ ------ ------ ------ ------ ------ --------

Spot commodity prices for copper, gold and molybdenum as at 31

December 2023 were $3.84/lb, $2,062/oz and $20.0/lb respectively,

compared with $3.73/lb, $1,871/oz and $22.5/lb as at 30 September

2023 and $3.80/lb, $1,824/oz and $31.8/lb as at 31 December

2022.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $58.3 million, positive

$5.3 million and negative $46.8 million respectively.

The provisional pricing adjustments for copper, gold and

molybdenum for the year to date were positive $81.3 million,

positive $9.2 million and negative $77.2 million respectively.

Depreciation, amortisation and loss on disposals

For the full year 2023, depreciation, amortisation and loss on

disposals will be approximately $1.25 billion.

Tax

The full year effective tax rate in 2023 is expected to be

approximately 35%.

2024 Guidance

Los Pelambres Centinela Antucoya Zaldívar Group

-------------- ---------- ---------

Production

670 -

Copper kt 335 - 350 225 - 240 75 - 80 35 - 40 710

195 -

Gold koz 45 - 55 150 - 160 215

Molybdenum kt 8.5 - 9.5 2.5 - 3.0 11.0 -

12.5

------------------------ ------ -------------- ---------- --------- -------------- -------

Grade

Copper % 0.56 0.54 0.34 0.66 -

------------------------ ------ -------------- ---------- --------- -------------- -------

Cash costs

Cash costs before

by-product credits(1) $/lb 2.05 2.30 2.50 2.95 2.25

Net cash costs (1,

2) $/lb 1.35 1.45 2.50 2.95 1.60

------------------------ ------ -------------- ---------- --------- -------------- -------

(1) Assumed CLP/USD exchange rate of 850.

(2) Includes by-product credits at a gold price of $ 1,900 /oz

and a molybdenum price of $ 18 /lb.

As previously announced, Group production in 2024 is expected to

be 670-710,000 tonnes of copper. Output of by-products is expected

to be 195-215,000 ounces of gold and 11.0-12.5 tonnes of

molybdenum. The expected increase in copper production in 2024

principally reflects the addition of the Los Pelambres Phase 1

Expansion Project in 2023, with increased water availability and

ore processing capacity expected in 2024.

Group cash costs in 2024 before by-product credits are expected

to be $2.25/lb, in line with 2023, with the positive impact of

higher production balanced by a short-term reduction in ore grades

at Los Pelambres.

Group net cash costs in 2024 are expected to be $1.60/lb, with

by-product credits expected to remain in line year-on-year.

In 2024, consolidated Group capital expenditure, which excludes

Zaldívar, is expected to be $2.7 billion, as sustaining and mine

development expenditure broadly in line year-on-year, and as

development expenditure commences on the Centinela Second

Concentrator (not including any potential reduction in capital

expenditures as a result of the process to outsource Centinela's

water supply) and other growth projects at Los Pelambres and

Centinela.

_____________________________________________________________________________________________

Cautionary Statement

This announcement contains certain forward-looking statements.

All statements other than historical facts are forward-looking

statements. Examples of forward-looking statements include, without

limitation, those regarding the Group's strategy, plans, objectives

or future operating or financial performance, reserve and resource

estimates, commodity demand and trends in commodity prices, growth

opportunities, and any assumptions underlying or relating to any of

the foregoing. Words such as "intend", "aim", "project",

"anticipate", "estimate", "plan", "believe", "expect", "may",

"should", "will", "continue" and similar expressions identify

forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors that are beyond the

Group's control. Given these risks, uncertainties and assumptions,

actual results, performance or achievements could differ materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements, which apply only as at

the date of this report. These forward-looking statements are based

on numerous assumptions regarding the Group's present and future

business strategies and the environment in which the Group will

operate in the future. Important factors that could cause actual

results, performance or achievements to differ from those in the

forward-looking statements include, but are not limited to: natural

events, global economic and financial conditions (which may affect

our business, results of operations or financial condition);

various political, economic, legal, regulatory, social and other

risks and uncertainties across jurisdictions in which the Group

operates; changes to mining concessions or the imposition of new

mining royalties, or changes to existing mining royalties in the

jurisdictions in which the Group operates; the Group's ability to

comply with the extensive body of regulations governing the mining

industry, as well as the need to manage relationships with local

communities; the ongoing effects of the global COVID-19 pandemic;

demand, supply and prices for copper and other long-term commodity

price assumptions (as they materially affect the timing and

feasibility of future projects and developments); trends in the

copper mining industry and conditions of the international copper

markets; the effect of currency exchange rates on commodity prices

and operating costs; the availability and costs associated with

mining inputs and labour; operating or technical difficulties in

connection with mining or development activities; risks, hazards

and/or events and conditions inherent to the mining industry, which

may affect our operations or facilities; employee relations;

climate change as well as the effects of extreme weather

conditions; the outcome of any litigation arbitration, regulatory

or administrative proceedings to which the Group is and may be

subject in the future; and actions and activities of governmental

authorities, including changes to laws, regulations or

taxation.

Except as required by applicable law, rule or regulation, the

Group does not undertake any obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Past performance cannot be

relied on as a guide to future performance.

No statement in this announcement is intended as a profit

forecast or estimate for any period. No statement in this

announcement should be interpreted to indicate a particular level

of profit and, as a consequence, it should not be possible to

derive a profit figure for any future period from this report.

[1] Production average over an initial 10-year period.

[2] Compañía de Minas Buenaventura S.A.A.

[3] Production average over an initial 10-year period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLBFMTTMTBBTRI

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

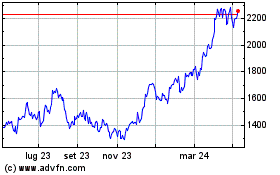

Grafico Azioni Antofagasta (LSE:ANTO)

Storico

Da Dic 2024 a Gen 2025

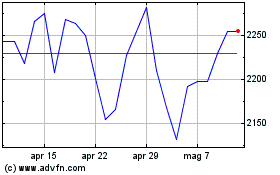

Grafico Azioni Antofagasta (LSE:ANTO)

Storico

Da Gen 2024 a Gen 2025