TIDMAPEO

RNS Number : 1965X

abrdn Private Equity Opp Trst plc

19 December 2023

abrdn Private Equity Opportunities Trust plc

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

19 December 2023

abrdn Private Equity Opportunities Trust plc ("APEO" or "the

Company") announces its estimated net asset value ("NAV") at 30

November 2023

-- Estimated NAV at 30 November 2023 was 761.4 pence per share

(estimated NAV at 31 October 2023 was 767.6 pence per share), a

0.8% decrease from the month of October

-- Excluding new investments, 95.9% by value of portfolio dated

30 September 2023 (estimated NAV at 31 October 2023 was 100.0%

dated 30 June 2023)

-- APEO received GBP16.2 million of distributions from fund

investments and paid GBP0.8 million of drawdowns to existing

commitments during the month of November

-- APEO re-invested into Procemsa, a vitamins and food

supplements CDMO, via a new single-asset secondary transaction

-- Outstanding commitments of GBP661.9 million at 30 November 2023

-- Liquid resources (cash balances plus undrawn credit

facilities) were GBP 231.7 million as at 30 November 2023

APEO's valuation policy for private equity funds and

co-investments is based on the latest valuations reported by the

managers of the funds and co-investments in which the Company has

interests. In the case of APEO's valuation at 30 November 2023,

excluding new investments, 95.9% by value of the portfolio

valuations were dated 30 September 2023. The value of the portfolio

is therefore generally calculated as the 30 September 2023

valuation, adjusted for subsequent cashflows over the period to 30

November 2023.

This is an update from the estimated NAV at 31 October 2023,

whereby 100.0% of the portfolio valuations, excluding new

investments, were dated 30 June 2023, adjusted for subsequent

cashflows over the period to 31 October 2023.

Estimated NAV

At 30 November 2023, APEO's estimated NAV was 761.4 pence per

share (estimated net assets GBP1,170.6 million), representing a

0.8% per share decrease from the estimated NAV at 31 October 2023

of 767.6 pence per share (estimated net assets GBP1,180.1 million).

The 6.2 pence decrease in NAV per share reflected losses arising

primarily from a 1.1% depreciation in the euro versus sterling and

a 4.3% depreciation in the dollar versus sterling during November,

partially offset by a 1.1% constant currency uplift in the

valuation of investments as at 30 September 2023.

The 1.1% constant currency quarterly uplift in the valuation of

investments from the reported estimated NAV at 30 September 2023

was due to a broad increase across the portfolio. APEO's primary

fund, secondary and co-investment portfolios increased 0.9%, 0.5%

and 2.1% in constant currency respectively over the quarter. In

terms of underlying portfolio companies, there was notable

quarterly valuation uplifts of Wundex (wound care management

business), Uvesco (regional grocer), SportPursuit (Online sports

and activity products retailer) and Action (non-food discount

retailer) driven largely by earnings growtth.

Drawdowns and distributions

APEO received GBP16.2 million of distributions from fund

investments and paid GBP0.8 million of drawdowns to existing

commitments during the month of November.

Distributions in the month generated realised gains and income

of GBP13.0 million and largely related to the full sales of Messer

Industries (industrial gas business) by CVC Capital Partners VII

and Nomios (provider of cybersecurity solutions, managed security

services and secure networking solutions) by IK Partners Fund VIII.

Furthermore, Permira Fund V also sold down its final listed shares

in LegalZoom (provider of online legal technology and services),

following the IPO of the business in 2021.

Investment activity

APEO re-invested EUR6.9 million into Procemsa, a vitamins and

food supplements CDMO. This investment will be made into a new

single-asset vehicle called Procemsa Build-Up SCSp.and includes an

undrawn commitment of EUR1.5 million to fund future inorganic

growth. Procemsa was previously held in the APEO portfolio through

the fund investment in Investindustrial Growth I.

Commitments

The Company had GBP661.9 million of outstanding commitments at

30 November 2023. The Manager believes that around GBP95.8 million

of the Company's existing outstanding commitments are unlikely to

be drawn.

Credit facility and cash balances

The Company has a GBP300.0 million syndicated revolving credit

facility provided by The Royal Bank of Scotland International

Limited, Societe Generale and State Street Bank International GmbH,

and it expires in December 2025. The Company drew a total of GBP6.0

million from the facility during the month of November, increasing

the total drawn balance to GBP99.1 million at 30 November 2023. The

remaining undrawn balance of the facility at 30 November 2023 was

therefore GBP200.9 million.

In addition, the Company had cash balances of GBP30.8 million at

30 November 2023 . Liquid resources, calculated as the total of

cash balances and the undrawn balance of the credit facility, were

therefore GBP231.7 million as at 30 November 2023.

Update from the Manager

"We are delighted that the portfolio has continued to grow in

terms of constant currency valuation during the quarter to 30

September 2023. This means that the APEO portfolio has seen quarter

on quarter constant currency valuation growth across all four

quarters of the Company's 2023 financial year (to 30 September

2023) and continues APEO's record of providing annual NAV growth to

its shareholders in every year since 2010*.

As we look forward, there are indications in the market that

private equity M&A activity could begin to pick up in 2024 from

the relatively low levels seen in 2023. If this does indeed happen,

APEO stands to benefit from increased exit activity in its

portfolio, both in terms of distributions and potentially NAV

growth (given the valuation uplifts that are typically seen on

exits).

However, the Manager continues to employ a cautious approach and

plan for a more challenging market backdrop. In that context, we

are pleased to see a strong month of net distribution activity from

fund investments during November and take comfort in APEO's balance

sheet position, with liquid resources of GBP231.7 million available

to help navigate any adverse market conditions that may lie

ahead."

*Based on NAV Total Return

Future announcements

The Company is expecting to announce its annual results on or

around 31 January 2023. Further details on the valuation of the

portfolio as at 30 September 2023 will be provided at that

time.

The Company is expecting to announce its estimated NAV at 31

December 2023 on or around 15 January 2024.

Additional detail about APEO's NAV and investment

diversification can be found on APEO's website. Neither the

contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website is incorporated

into, or forms part of, this announcement.

For further information please contact Alan Gauld at abrdn

Capital Partners LLP (0131 528 4424)

Notes:-

abrdn Private Equity Opportunities Trust plc is an investment

company managed by abrdn Capital Partners LLP, the ordinary shares

of which are admitted to listing by the UK Listing Authority and to

trading on the Stock Exchange and which seeks to conduct its

affairs so as to qualify as an investment trust under sections

1158-1165 of the Corporation Tax Act 2010.

The Company intends to release regular estimated NAV updates

around ten business days after each month end. A breakdown of

APEO's portfolio can be obtained in the latest monthly factsheet,

which is published on APEO's website at:

www.abrdnpeot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEASAPFSLDFFA

(END) Dow Jones Newswires

December 19, 2023 02:00 ET (07:00 GMT)

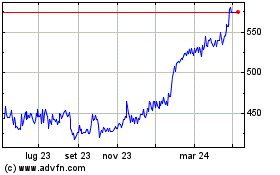

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Nov 2023 a Nov 2024