Banco Santander S.A. Capital reduction (buy-back programme shares) (2331T)

16 Marzo 2023 - 12:18PM

UK Regulatory

TIDMBNC

RNS Number : 2331T

Banco Santander S.A.

16 March 2023

Banco Santander, S.A. (the "Bank" or "Banco Santander" ) , in

compliance with the Securities Market legislation, hereby

communicates the following:

OTHER RELEVANT INFORMATION

Banco Santander reduces its share capital by 2.03% to cancel

the shares acquired in the share buy-back programme carried out

between November 2022 and January 2023 in the context of the

shareholder remuneration applicable to the results of financial

year 2022.

On 1 February 2023, the board of directors of Banco Santander

resolved to implement the Bank's share capital reduction through

a cancellation of own shares approved at the Bank's ordinary

general shareholders' meeting held on 1 April 2022 on second

call under item 7 D of the agenda (the "Capital Reduction"),

subject to obtaining the relevant regulatory authorization.

On 15 March 2023, the European Central Bank granted the authorisation

required to implement the Capital Reduction in accordance with

applicable regulations.

Consequently, Banco Santander's share capital has been reduced

by EUR 170,203,286 through the cancellation of 340,406,572 own

shares, each with a nominal value of EUR 0.50. The share capital

resulting from the Capital Reduction implementation has been

set at EUR 8,226,997,506, represented by 16,453,995,012 shares

with a nominal value of EUR 0.50 each, all of them of the same

class and series.

The purpose of the Capital Reduction is the cancellation of the

Bank's own shares, contributing to the remuneration of the Bank's

shareholders by increasing the profit per share, a consequence

which is inherent to the decrease in the number of shares. The

Capital Reduction does not involve the return of contributions,

since the Bank is the owner of the cancelled shares, having acquired

them within the framework of the share buy-back programme, the

beginning and termination of which Banco Santander properly notified

to the market through the notice of inside information published

on 21 November 2022 with registration number 1669 and the notice

of other relevant information published on 1 February 2023 with

registration number 20244, respectively.

A reserve for amortised capital has been funded with a charge

to the share premium reserve for an amount equal to the nominal

value of the cancelled shares (i.e. EUR 170,203,286), which may

only be used under the same conditions as those required for

the reduction of the share capital, in accordance with article

335 c) of the Spanish Companies Law. Consequently, in accordance

with article 335 c) of the Spanish Companies Law, the Bank's

creditors are not afforded the right of opposition referred to

in article 334 of the Spanish Companies Law.

For purposes of the provisions of Section 411 of the Spanish

Companies Law and in accordance with Additional Provision One

of Law 10/2014 of 26 June on the organisation, supervision and

solvency of credit institutions, it is hereby stated for the

record that, as the Bank is a credit institution and the other

requirements set forth in the aforementioned Additional Provision

are met, the consent of the bondholder syndicates for the outstanding

debenture and bond issues is not required for the implementation

of the reduction.

The announcements of the Capital Reduction will be published

in the Official Gazette of the Spanish Commercial Registry and

on the Bank's corporate website ( www.santander.com ) in the

coming days.

Thereafter, the public deed regarding the corporate resolutions

on the Capital Reduction and amendment of the Bank's By-laws

will be granted and subsequently registered with the Commercial

Registry of Santander. In addition, the delisting of the 340,406,572

cancelled shares from the Spanish and foreign stock exchanges

or stock markets on which the Bank's shares are listed, and the

cancellation of the book-entry records of the cancelled shares

before the competent bodies will both be requested.

Boadilla del Monte (Madrid), 16 March 2023

IMPORTANT INFORMATION

Non-IFRS and alternative performance measures

This document contains financial information prepared according

to International Financial Reporting Standards (IFRS) and taken

from our consolidated financial statements, as well as alternative

performance measures (APMs) as defined in the Guidelines on Alternative

Performance Measures issued by the European Securities and Markets

Authority (ESMA) on 5 October 2015, and other non-IFRS measures.

The APMs and non-IFRS measures were calculated with information

from Grupo Santander; however, they are neither defined or detailed

in the applicable financial reporting framework nor audited or

reviewed by our auditors.

We use these APMs and non-IFRS measures when planning, monitoring

and evaluating our performance. We consider them to be useful

metrics for our management and investors to compare operating

performance between periods.

Nonetheless, the APMs and non-IFRS measures are supplemental

information; their purpose is not to substitute IFRS measures.

Furthermore, companies in our industry and others may calculate

or use APMs and non-IFRS measures differently, thus making them

less useful for comparison purposes.

For further details on APMs and Non-IFRS Measures, including

their definition or a reconciliation between any applicable management

indicators and the financial data presented in the consolidated

financial statements prepared under IFRS, please see the 2022

Annual Report on Form 20-F filed with the U.S. Securities and

Exchange Commission (the SEC) on 1 March 2023, as well as the

section "Alternative performance measures" of the annex to the

Banco Santander, S.A. (Santander) 2022 Annual Report, published

as Inside Information on 28 February 2023. These documents are

available on Santander's website (www.santander.com). Underlying

measures, which are included in this document, are non-IFRS measures.

The businesses included in each of our geographic segments and

the accounting principles under which their results are presented

here may differ from the businesses included and local applicable

accounting principles of our public subsidiaries in such geographies.

Accordingly, the results of operations and trends shown for our

geographic segments may differ materially from those of such

subsidiaries.

Not a securities offer

This document and the information it contains does not constitute

an offer to sell nor the solicitation of an offer to buy any

securities.

Past performance does not indicate future outcomes

Statements about historical performance or growth rates must

not be construed as suggesting that future performance, share

price or results (including earnings per share) will necessarily

be the same or higher than in a previous period. Nothing in this

document should be taken as a profit and loss forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CARFQLFFXXLFBBZ

(END) Dow Jones Newswires

March 16, 2023 07:18 ET (11:18 GMT)

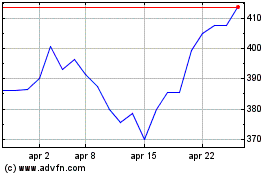

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Apr 2024 a Mag 2024

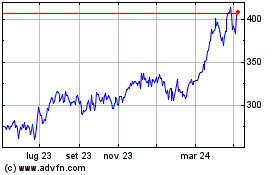

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Mag 2023 a Mag 2024