Banco Santander S.A. Covered Bonds: interest rate replacement (2871Y)

03 Maggio 2023 - 12:38PM

UK Regulatory

TIDMBNC

RNS Number : 2871Y

Banco Santander S.A.

03 May 2023

Banco Santander, S.A. (the " Issuer " or the " Bank "), in

compliance with the Securities Market legislation, hereby

communicates the following:

OTHER RELEVANT INFORMATION

Within the current interest rate benchmark reform framework, and

in connection with the two Bank issuances listed in Annex I of this

notice (the " Issuances "), the Issuer has carried out a process to

gather the consent from each and every investor of those Issuances

for the purpose of: (i) replacing the reference interest rate "USD

LIBOR" currently applied to those Issuances with the Secured

Overnight Financing Rate - "SOFR", with the necessary adjustments

detailed below, following the recommendations published by the

Committee on Alternative Reference Rates ("ARRC"), and (ii)

including the relevant supplementary robust clauses ("fallbacks")

in the documentation of Issuances, given the possibility of a SOFR

discontinuation.

In particular, the following modifications have been made to the

Issuances:

- With regard to Series 3, the current interest rate is replaced

with SOFR Compound 6 months (as defined in the Final Conditions

attached) plus a margin of 0.92826% payable semi-annually. Once the

consent of 100% of the holders has been received, the first

interest payment date affected by the modification will be 17(th)

October, 2023.

- With regard to Series 4, the current interest rate is replaced

with SOFR Compound 6 months (as defined in the Final Conditions

attached) plus a margin of 0.53826% payable semi-annually. Once the

consent of 100% of the holders has been received, the first

interest payment date affected by the modification will be 4(th)

September, 2023.

New Final Conditions applicable to Series 3 and 4 are attached

to this notice as Annex II.

Likewise, it is hereby stated that all the necessary

communications have been made to the relevant bodies.

The foregoing is hereby disclosed as other relevant information

for all relevant purposes.

Boadilla del Monte (Madrid), 3 May 2023.

ANNEX I

- "Issuance of Banco Santander, S.A. Internationalization Covered Bonds Series 3 - April 2027" ("Emisión de Cédulas de Internacionalización Banco Santander, S.A. Serie 3 - Abril 2027"), with ISIN code ES0413900657 , for an amount of three thousand eight hundred million dollars (USD 3,800,000,000), whose Final Conditions were filed with the Spanish National Securities Market Commission on 21 April 2020 (the " Series 3 ").

- "Issuance of Banco Santander, S.A. Internationalization Covered Bonds Series 4 - March 2026" ("Emisión de Cédulas de Internacionalización Banco Santander, S.A. Serie 4 - Marzo 2026"), with ISIN code ES0413900707 , for an amount of one billion dolars (USD 1,000,000,000), whose Final Conditions were filed with the Spanish National Securities Market Commission on 4 March 2021 (the " Series 4 ").

ANNEX II

New Final Conditions applicable to Series 3

New Final Conditions applicable to Series 4

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCAJMMTMTJMBIJ

(END) Dow Jones Newswires

May 03, 2023 06:38 ET (10:38 GMT)

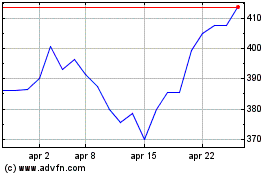

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Nov 2024 a Dic 2024

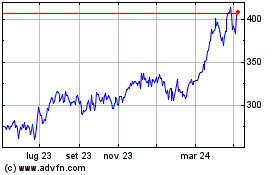

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Dic 2023 a Dic 2024