TIDMEBOX TIDMBOXE

RNS Number : 6429V

Tritax EuroBox PLC

05 December 2023

Full-year results for

the year ended

30 September 2023

05 December 2023

Delivered good progress on our strategic priorities of growing

income, lowering the cost ratio and paying a fully covered

dividend. Portfolio valuation stable over H2, with good momentum in

the disposal programme expected to reduce leverage further.

Full-year 2023 key figures

Financial performance

================================== ================ =============== =============

12 months to: 30 September 30 September Change

2023 2022

Rental income EUR68.1m EUR57.9m 17.6%

Adjusted earnings per share

(EPS)(1) 5.51 cents 4.24 cents 30.0%

Basic EPS(1) (27.68) cents 7.28 cents n/a

Dividend per share 5.00 cents 5.00 cents -

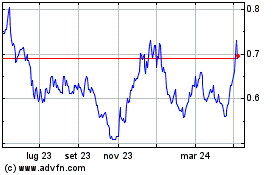

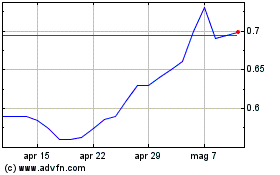

Total Return (22.5)% 6.0% (28.5) pts

Portfolio value(2) EUR1,561.9m EUR1,765.6m (14.5)%

EPRA net tangible assets (NTA)

per share EUR1.02 EUR1.38 (26.1)%

IFRS NAV per share EUR0.99 EUR1.32 (25.0)%

Loan to value (LTV) ratio(3) 46.4% 35.2% 11.2 pts

Annualised rental income(4) EUR76.3m EUR74.3m 2.7%

================================== ================ =============== =============

Operational performance

================================== ================ =============== =============

30 September 30 September 31 March

2023 2022 2023

FY23 FY22 H1 23

Like-for-like rental growth(5) 4.5% 3.6% 2.8%

Rent collection 100% 100% 100%

Weighted average unexpired 7.9 years 8.0 years 7.9 years

lease term(6)

EPRA vacancy rate 5.5% 0.3% 5.4%

Adjusted EPRA cost ratio(7) 24.2% 29.5% 25.6%

Average cost of debt 1.3% 1.5% 1.2%

Like-for-like estimated rental

value (ERV) growth(8) 6.5% 8.2% 3.4%

================================== ================ =============== =============

Chairman's commentary

Robert Orr, Chairman of Tritax EuroBox plc, commented:

"Over the past 12 months we have made good progress on

delivering the strategic priorities we outlined a year ago. We have

generated strong rental income growth and our cost ratio is now

within our target range. This improved operational performance has

led to a substantial increase in adjusted earnings and a fully

covered dividend for the year.

"We have not been immune to the rapid increase in interest

rates, which has adversely impacted our portfolio valuation over

the year. However, the marginal decline in the second half and

pricing of recent sales broadly in line with book values, indicates

some market stabilisation. Further planned disposals are expected

to reduce leverage as we move through 2024.

"While mindful of the ongoing challenging geo-political and

macro-economic backdrop, our high-quality portfolio and strong

customer base mean the Company remains well placed to benefit from

the structural tailwinds and favourable underlying market dynamics

in the European logistics sector."

FY23 full-year results overview

Rental income growth and cost efficiencies supporting higher

Adjusted Earnings and a covered dividend

-- Rental income of EUR68.1 million, up 17.6%, reflecting the

full-year effect of prior year acquisitions, rent indexations,

asset management and development activity.

-- Like-for-like(5) rental growth was 4.5% (7.8% including new

income from the Barcelona and Strykow extensions).

-- Adjusted EPRA Cost Ratio(7) of 24.2% (FY22: 29.5%), in line

with our target range of 20-25%, benefiting from higher income and

lower management fee.

-- Adjusted EPS of 5.51 cents, up 30%.

-- Dividend per share of 5.00 cents was 110.2% covered by Adjusted EPS for the full year.

Investment portfolio let to strong customers on long-term,

inflation-linked leases

-- Portfolio value(2) of EUR1,561.9 million (FY22: EUR1,765.6

million), with 12-month like-for-like reduction of 14.5% primarily

due to significant outward yield shift across the sector, partly

offset by rental growth. H2 FY23 valuation decline of 0.3%.

-- Despite a good operational performance, the fall in portfolio

value led to a decline in NTA to EUR1.02 (FY22: EUR1.38) and a

negative Total Return of 22.5% (FY22: 6.0%).

-- Portfolio reversion of 17.6% or EUR13.4 million, reflecting a

like-for-like increase in portfolio ERV of 6.5%.

-- 97% of leases subject to annual rental increases, with 81% linked to inflation.

-- Increase in EPRA vacancy rate to 5.5% (FY22: 0.3%) reflecting

the completion of speculative forward fundings in Sweden and Italy,

and a lease expiry in Poland, partially offset by new lettings.

Asset management, indexation and development adding EUR6.3

million to annualised rental income (4)

-- Completed two pre-let developments and four speculative

forward fundings, adding 224,763 sqm of new space.

-- Completed a 109,083 sqm extension in Barcelona, adding EUR2.3

million to annual rent, and commenced an 8,841 sqm extension in

Poland, increasing the annual rent by EUR0.5 million.

-- Commenced a 23,000 sqm speculative development in Oberhausen,

Germany; completion targeted for July 2024.

-- Signed three new leases totalling EUR4.3 million of annual

rent, an increase of EUR0.6 million above previous rent or

guarantees.

-- Sales of asset in Hammersbach in August for c.EUR65 million

and, post period end, two assets in Bochum and Malmö for c.EUR47

million and c.EUR28 million respectively. All three were either

broadly in line or above book value, and aligned with our stated

disposal strategy.

-- Ongoing integration of ESG objectives into operational

business, including completion of two solar PV installations,

adding a total of 2.8 MW to the portfolio, with a further six

projects in progress.

Robust balance sheet with low cost of debt

-- 100% of debt with fixed rates or caps, with an average cost of debt of 1.30% for FY23.

-- 3.5-year weighted maturity, with earliest refinancing in Q4 2025.

-- EUR172.5 million of undrawn debt facilities as at year end.

-- Loan to value (LTV) ratio(3) of 46.4% remains higher than we

would like, with the disposal proceeds offset by the portfolio

valuation decline, development capital expenditure and other

working capital effects.

-- Covenant headroom with LTV(3) of 46.4% and interest cover of

4.8x, versus covenants of 65% and 1.5x.

-- Taking into account the post-period-end disposals at Bochum

and Malmö, the pro-forma LTV decreases to 44.0%.

Notes

1 See note 12 to the condensed financial statements for

reconciliation.

2 Valuation under IFRS (excluding rental guarantees), this

includes assets held for sale.

3 As per KPI definition.

4 Contracted rent, on an annualised basis, at the reporting

date. Including rental guarantees and licence fee.

5 Excluding extensions at Barcelona and Strykow. Including

extensions, like-for-like rental growth is 7.8%.

6 Weighted average unexpired lease term to break is 7.9 years

and weighted average unexpired lease term to expiry is 9.6

years.

7 Including licence fee income and rental guarantees.

8 Like-for-like ERV growth for 12 months for FY23 and FY22 and

for six months for H1 23.

Presentation for investors and analysts

A Company presentation for analysts and investors will take

place via a live webcast at 09.00am (GMT) today. To view the live

webcast, please register via this link:

Tritax EuroBox plc - Full-year results 2023

Analysts and investors will also be able to listen to the event

via a moderated conference call using the following details:

Phone number: +44 (0) 33 0551 0200

Participant access: quote ' Tritax Full Year Results

The presentation will also be accessible on-demand later in the

day from the Company website:

tritaxeurobox.co.uk/investors/results-and-presentations/ .

Further information

Tritax EuroBox plc

+44 (0) 20 8051 5070

Phil Redding - CEO

Mehdi Bourassi - CFO

Charles Chalkly - Investor Relations

Kekst CNC (Media enquiries)

Tom Climie / Guy Bates

+44 (0) 7760 160 248 / +44 (0) 7581 056 415

tritax@kekstcnc.com

Notes:

Further information on the Company is available at:

tritaxeurobox.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

Chairman's statement

Over the past 12 months we have made good progress on delivering

the strategic priorities we outlined a year ago. Rental income has

increased by 17.6% and our Adjusted EPRA Cost Ratio at 24.2% is now

within our target range. This improved operational performance has

led to a 30.0% increase in Adjusted Earnings and the dividend

110.2% covered for the full year. In addition, we expect our

ongoing disposal programme to reduce our loan to value ratio

towards our preferred percentage range in the low 40s in the year

ahead.

Supportive structural trends throughout our five-year

history

The past year marked the fifth anniversary of Tritax EuroBox

plc, a five-year period that has seen consistently supportive

underlying occupier market fundamentals against, more recently, a

significant change in economic and investment market

conditions.

Since its IPO in 2018, the combination of positive structural

demand drivers and the constrained supply of modern warehouse space

has generated strong rental growth across European logistics

markets. These strong market fundamentals attracted considerable

amounts of capital into the sector, further encouraged by

supportive debt markets, leading to a corresponding decline in

property yields and increase in capital values.

More recently, in response to central banks sharply raising

interest rates to combat higher levels of inflation, property

yields have shifted upwards to reflect the higher cost of capital,

with asset values subsequently falling. Following an extended

period of benign economic conditions, these fluctuations are a

reminder that real estate markets are inherently cyclical in

nature.

Despite these market swings, the Company's strategy - and its

delivery - has remained consistent. Over the past five years, we

have focused on assembling a portfolio of best-in-class, modern

logistics assets that are mission-critical to our customers, with

leading ESG credentials, and concentrated in major distribution

corridors in key European markets. Our approach, based on the

ownership and management of a stabilised portfolio of core assets,

with a carefully managed exposure to value-add and development

risk, enables the Company to deliver income growth consistently

through the economic cycle.

Our high-quality portfolio remains well placed to capitalise on

structural drivers

The portfolio is now valued at EUR1.56 billion with a rent roll

of EUR76.3 million and home to 35 customers, including

multi-national organisations such as Mango, Amazon, Puma and Lidl.

The assets are let on primarily long-term leases with annual

uplifts linked to inflation, generating predictable and regular

growth in rental income, which serves to support the fully covered

dividend paid to Shareholders.

We remain of the view that the positive tailwinds from

structural demand drivers will continue to benefit the Company for

some time to come. The impact of increasing online shopping

penetration, the need to build greater resilience into supply

chains, and the aim of reducing the environmental impact of

distribution operations will continue to generate strong demand for

high-quality, sustainable warehouse space. The portfolio remains

well positioned to benefit from these trends.

That said, we are also cognisant of the changing market context

and the challenges this presents. While the central focus of our

strategy remains constant, aimed at harnessing these supportive,

long-term structural drivers, we have adapted our priorities to

ensure the business remains appropriately positioned in this

altered and evolving environment.

Over the past 12 months the Company has focused on capturing the

income growth opportunities embedded within the existing portfolio,

improving operational efficiency, growing earnings to deliver a

covered dividend, and taking action to maintain a strong balance

sheet position through selected disposals. During the period, good

progress has been made on these priorities and we remain on track

to achieve our objectives.

Financial performance driven by good progress on our strategic

priorities

Rental income increased to EUR68.1 million per annum (FY22:

EUR57.9 million) and like-for-like rental growth was 4.5% (7.8% if

new income from completed extensions is included). The Company also

continued to benefit from the revised Investment Management

Agreement that reduced the Manager fees payable by the Company,

with the Adjusted EPRA Cost Ratio declining to 24.2% from 29.5%

over the year. These activities contributed to a 30.0% increase in

Adjusted EPS to 5.51 cents (FY22: 4.24 cents).

We declared quarterly dividends totalling 5.00 cents per share

for the period, in line with the previous year. The dividend was

110.2% covered by Adjusted EPS.

However, the Company continues to be affected by the decline in

asset values that is impacting the entire European logistics

sector. The portfolio was independently valued by CBRE at

EUR1,561.9 million at the period end (FY22: EUR1,765.6 million),

representing a like-for-like valuation reduction of 14.5% for the

full year. Signs of stabilisation are emerging, with a deceleration

in the rate of decline from a reduction of 14.7% in H1 to a fall of

0.3% in H2. This resulted in EPRA NTA per share of EUR1.02, down

26% (FY22: EUR1.38).

One of the key priorities of the business is to maintain balance

sheet strength. Earlier in the year we commenced a programme of

planned disposals to lower the Company's leverage and in August

announced the sale of an asset in Hammersbach (Germany) for c.EUR65

million. Post period end, we announced the sales of assets in

Bochum (Germany) for c.EUR47 million and in Malmö (Sweden) for

c.EUR28 million. Bochum was broadly in line with valuation and

Malmö was significantly ahead. These transactions brought gross

sales signed so far to c.EUR139 million.

However, the LTV of 46.4% (pro forma 44.0% post the Bochum and

Malmö disposals) remains above where we would like it to be at this

point in the cycle. This is due to the lower portfolio valuation,

capital expenditure on developments and movements in working

capital offsetting the benefit of the sales proceeds. Further

disposals are planned in the months ahead.

The Company continues to benefit from a low average cost of debt

of 1.30% due to the fixed or capped rates on all its borrowings and

is not exposed to any near-term refinancings. In the medium term,

the Company expects to refinance the RCF and the bond ahead of

their respective maturities in October 2025 and June 2026.

Advancement of our ESG strategy and solar PV installations

During the year, we have made good progress with our ESG

strategy, with several initiatives announced over the past 12

months. At the Interim Results in May we launched our new ESG

targets. These include an accelerated commitment to achieve net

zero carbon across all aspects of our business by 2040, rather than

the previously stated 2050 target.

Our targets, which will be reviewed annually, will help drive

further improvement for the benefit of our stakeholders and help us

to keep pace with the evolving regulatory and market environment.

This will ensure our approach is evidence- and data-led, and that

we accurately measure and disclose our impact.

We have increased the renewable electricity generated by solar

schemes on our assets, with our portfolio's generating capacity now

10.3 MW across arrays on eight buildings. We have made good

progress on our plans to increase this further over the coming

year, with applications submitted to commence schemes on three

further assets, which would add an extra c.9 MW of capacity. In

addition, there are three other projects in the pipeline.

As previously reported, we held the first meeting of our ESG

Board Committee, chaired by the Board ESG Champion, Eva -- Lotta

Sjöstedt. This provides a dedicated forum for the Board and

representatives of the Manager to oversee and review the progress

in delivering our ESG objectives.

Also reported earlier in the year, we reviewed the Board and

Committee composition and announced Sarah Whitney's appointment as

Senior Independent Director (SID) with effect from 6 December 2022.

Sarah has taken on the role from Keith Mansfield, who continues to

make an important contribution as a Non-Executive Director and

Chair of the Audit & Risk Committee.

In February 2023, the Management Engagement Committee approved

the appointment of CBRE as the Company's independent valuer,

replacing JLL. The position had been held by JLL since the

Company's IPO in 2018 and the Board felt a rotation of this

important role was appropriate at this time.

Outlook

The past 12 months have been characterised by a challenging

geo-political and macro-economic backdrop. This has adversely

impacted property investment markets and occupier sentiment across

Europe. However, inflation in Continental Europe is now on a

downward trajectory and interest rates are forecast to have peaked.

This increased visibility is leading to signs of stabilisation in

asset values, as demonstrated by the marginal fall in our portfolio

valuation over the second half of the financial year and recently

completed disposals broadly in line with book values.

While we expect investors to remain cautious and transaction

volumes relatively low in the near term, we anticipate the positive

structural drivers and strong market fundamentals of the logistics

sector will support investor appetite and liquidity as we move

through 2024.

In addition, while take-up of warehouse buildings has fallen

over the past nine months, the availability of modern, sustainable

logistics space remains low and the potential for a material supply

increase limited. We expect these dynamics to keep vacancy rates at

low levels and support positive rental growth, albeit at more

normalised levels versus the very high rates seen recently.

The Board remains confident that the high-quality portfolio and

strong customer base means the Company is well placed to benefit

from the structural tailwinds and favourable underlying market

dynamics that will continue to support the performance of the

European logistics sector.

Despite the challenging market environment during the past year,

the Company has delivered good progress on the strategic priorities

set out 12 months ago. The Board continues to believe the focus on

driving earnings, paying a fully covered dividend, and maintaining

balance sheet strength through the ongoing programme of disposals,

remains appropriate and will deliver value to Shareholders in the

long term.

Our market

Structural drivers continue to support the occupier market

Our market is characterised by strong occupier demand, limited

supply of available space in core markets and high barriers to

developing new assets in prime locations. These favourable market

dynamics are supporting rental growth, with vacancy rates remaining

low.

Good rental growth across core Continental European markets

Structural trends such as digitalisation and online retail

growth are being amplified by growing urbanisation. In tandem,

supply chains are evolving as organisations seek improved

resilience and reliability, and demands for sustainability are

increasing, driven by shifting stakeholder and societal

expectations, including the emergence of circular economies. These

themes are continuing to shape the demand-supply dynamics of the

logistics sector.

Long-term demand drivers

Global events such as the Covid-19 pandemic and recent

heightened geopolitical risk have accelerated demand in the short

term. Over the longer term, demand is being driven by three

underlying factors:

1) Growth of e-commerce: Warehouse space is fundamental to both

successfully fulfilling e-commerce sales and doing so at a cost

that allows companies to operate profitably. Companies typically

require large, flexible, modern and well-located properties to

deliver orders and manage returns rapidly and efficiently .

2) Creating resilient supply chains: Companies are reinforcing

their supply chains to ensure their efficiency and resilience to

external shocks. Measures used to do this include adopting the

latest supply chain planning tools; reviewing manufacturing

locations and transportation networks; and holding more critical

stock closer to customers and end-users.

3) Drive towards more sustainable real estate and operations:

Companies are looking for their logistics real estate to help meet

their ESG objectives. In addition to reducing their environmental

impacts - through incorporating clean energy generation, low-carbon

technologies, and energy efficiencies - occupiers want a workspace

that promotes employee wellbeing to help them attract and retain

staff. Meanwhile, decarbonising transportation has driven increased

demand for features such as EV charging points .

We believe these trends will continue to favour the modern,

high-quality and well-located buildings we own.

High barriers to development in prime markets

The availability of logistics space in many prime sub-markets

continues to be limited, and the barriers to developing new

warehouses in attractive locations remain high. These barriers

include:

1) Availability of land: Sourcing new sites for assets continues

to become more difficult. 95%[1] of developers highlight it as an

issue, up from 76% in 2022.

2) Difficulty securing planning consents: Developers are also

finding it increasingly difficult to obtain permission to develop

land. 83% underlined the length of the zoning/permit process as an

important restriction, while 82% note that increased ESG

requirements are an important issue when seeking permission for a

development1 .

3) Increased finance and construction costs: Raw material and

labour cost inflation has eased, but development costs overall

remain elevated. Increased finance costs are a further burden that

negatively impact potential development profitability.

Real estate market fundamentals and investment markets

Take-up has moderated across European markets

2023 has seen a healthy level of demand for warehouse space

across Europe despite the challenging macroeconomic backdrop.

Take-up for the 12 months to Q3 2023 totalled 20.7 million sqm,

down 24% year-on-year but in line with pre-Covid-19 levels[2]. The

demand adjustment seen this year reflects a normalisation to more

typical, pre-pandemic levels of activity.

The uncertain market environment has impacted occupier

decision-making, as evidenced by the 2023 Savills/EuroBox European

Logistics Real Estate Census. Rising costs remain a key concern and

39% of respondents suggested they have scaled back or delayed

decisions by one to two years. Leasing volumes also continue to be

impacted by ongoing constraints around the availability of

well-located, high-quality logistics buildings.

Despite these challenges, a wide range of occupiers continue to

commit to new logistics buildings. Retailer, e-commerce, and

manufacturing companies all continued to evolve their warehouse

network and 3PLs have been particularly active in the year. 3PLs

continue to lease properties to satisfy demand driven by their

customers' outsourcing logistics requirements and need to hold

higher levels of buffer stock ([3]) , as well as new business

opportunities such as facilitating the return, repair, and reuse of

goods. Our letting at Dormagen, Germany was evidence of the latter,

where the occupier is using our building to process returns and

repairs of household appliances.

Supply remains constrained in core markets

Development completions slowed to 17.6 million sqm in the 12

months to Q3 2023, down from 19.5 million sqm in the year to Q3

2022. Completions have dropped particularly sharply in Germany,

where year-on-year new supply is down 30% and completions are below

pre-pandemic levels(2) . The limited availability of land,

particularly for very large sites, and challenges associated with

securing planning are especially evident across many of Europe's

core logistics sub-markets. For example, in the Netherlands less

than 50% of new supply in the last 12 months has been delivered

into its nine principal sub-markets(2) .

While pockets of excess speculative development have emerged,

these are typically outside of the main logistics hubs where

availability remains very low. Furthermore, the supply pipeline

across Europe continues to reduce as developers reassess

opportunities in light of the evolving market environment and

higher cost of capital. Looking ahead, this is likely to continue

the mismatch between available supply and occupier requirements in

many of the best locations. These requirements include a heightened

focus on ESG features, energy efficiency and generation, and the

technical building features required to operate more efficient,

productive and resilient supply chains.

Low vacancy in many core logistics markets continues to support

rental growth

Pan-European vacancy remains low by historical standards at just

3.6%(2) . An increasingly diverse picture is, however, beginning to

emerge. While vacancy has ticked up at an aggregate level, it

remains below 3%(2) in countries such as Germany, the Netherlands,

and Belgium. Furthermore, many core logistics sub-markets have

vacancy levels below the national average, which continues to limit

the options for occupiers looking for new space in the most

attractive markets.

A combination of healthy demand and still-constrained supply in

the best locations has contributed to further rental traction in

many sub-markets across Europe. Prime headline rents have risen by

8% on average [4] and, across the year, almost every major

sub-market has experienced rental growth.

While the near-term outlook will continue to be impacted by the

volatile macroeconomic backdrop, we believe the ongoing structural

trends underpinning demand and supply barriers in the best

locations will lead to attractive levels of rental growth in our

markets over the medium term.

Stabilisation of capital markets through the second half of the

year

Transaction activity totalled EUR11.7 billion in Q1-Q3 2023,

down 58%(2) versus the same period in 2022. That said, quarterly

deal volumes have remained relatively flat through 2023(2) despite

central banks continuing to raise interest rates, further impacting

the cost of capital. Lower logistics deal volumes also reflect the

trend across the wider real estate market, which continues to

adjust to the higher cost of capital and return requirements that

currently exists. Logistics real estate accounted for 19% of all

real estate deal volumes year to date which is consistent with

recent years, and up significantly from pre-Covid-19 levels which

were typically around 12%(2) .

A steady flow of transactions continues to provide pricing

discovery, but many buildings have reversionary potential because

of the healthy recent rental growth, which leases have often failed

to fully capture. Pricing for these assets may therefore not

directly reflect the market values reported by CBRE and others

which are a best estimate for a prime, rack-rented building.

Prime yields, as reported by CBRE, have adjusted higher over the

past 18 months but recent quarters have seen increasing signs of

stabilisation. Since March 2023, yields have moved out by 10bps or

fewer in Germany, the Netherlands, and France. Peripheral markets

have seen yields shift by between 20bps and 40bps over the same

period.

The rapid adjustment in yields has helped keep logistics real

estate pricing broadly in line with other asset classes and prices

have stabilised over recent quarters. While the near-term outlook

will continue to be heavily influenced by the macro trends that

currently dominate, we continue to believe logistics real estate

remains a compelling area for investment.

Manager's report

At the start of the financial year, we set out four key

priorities: to capture income growth opportunities embedded within

the existing portfolio; to improve operational efficiencies to

lower the cost ratio; to combine these activities to drive forward

earnings per share and deliver a fully covered dividend for the

year; and to underpin these activities by maintaining a strong

balance sheet position.

Over the past 12 months, the Company has made good progress on

delivering these strategic priorities despite the more challenging

macro-economic and property market backdrop experienced in

Continental Europe throughout the period.

During the year, the effect of sharply higher interest rates

continued to impact investment markets in the form of increased

yields, lower asset values and subdued transaction volumes. Most of

the value adjustments were experienced in the first half of the

financial year, with the modest declines in the second half

reflecting the relatively rapid adjustments already taken and

greater visibility emerging in the macro-economic environment.

In contrast to previous property cycles, occupational market

fundamentals have remained robust, with most markets characterised

by low levels of available modern warehouse space. While occupiers

have become more cautious in response to the challenging economic

conditions, the sector continues to be supported by long-term

structural drivers, low vacancy rates and a limited pipeline of

supply.

The high-quality nature of our assets has enabled the Company to

navigate these tougher market conditions. The property portfolio we

have curated provides resilience through the market cycle and

delivers income growth over the long term. This resilience and

income growth potential are produced by combining high-quality

assets (modern buildings with excellent ESG credentials, located in

sought-after distribution hubs and corridors), with attractive

income characteristics (let on long leases to strong customers with

annual rental uplifts linked to inflation).

Delivering on our strategic priorities

The focus over the past 12 months has been on driving

improvements in operational performance, with a key part of this

being the capture of income growth opportunities embedded within

the existing property portfolio. During the period we successfully

completed several initiatives across a broad spectrum of asset

management, development and leasing activities, which delivered

both new income growth and enhanced capital values.

Over the year, the in-house team, in conjunction with our

locally based asset management and development partners, secured

EUR3.6 million per annum of new rental income, which also

positively impacted corresponding asset valuations. The in-built

uplifts from the index-linked and fixed uplift structures of our

leases produced EUR2.3 million of new rental income, and

represented a significant driver of growth in annualised rental

income, which increased to EUR76.3 million (FY22: EUR74.3 million).

The like-for-like increase in rental income was 4.5% (7.8%

including the extensions in Barcelona and Strykow).

We have also delivered enhancements in operational efficiency,

including the full-year impact of the revised Investment Management

Agreement, effective from August 2022. These improvements

contributed to a reduction in the Adjusted EPRA Cost Ratio to 24.2%

from 29.5% in the prior year. Our Adjusted EPRA Cost Ratio is now

in line with our pan-European peers and within our target range of

20-25%. We continue to pursue opportunities to reduce the cost base

to enable us to move towards our longer-term aspiration of being at

the lower end of this range.

The combination of higher rental income and lower operational

costs, together with full-year contributions from the completion of

building extensions and developments, resulted in a 30% increase in

Adjusted Earnings Per Share to 5.51 cents. The Company has declared

quarterly dividends totalling 5.00 cents in the period, resulting

in dividend cover of 110.2% and the delivery of a fully covered

dividend for the year.

Underpinning these priorities is our objective to maintain a

strong balance sheet position, encompassing the appropriate

management of our cost of debt, available liquidity and metrics

including LTV and net debt/EBITDA.

The Company continues to benefit from a low average cost of debt

of 1.30%, maintained through fixed and capped rates, no

refinancings until Q4 2025 and EUR172.5 million of undrawn

facilities in its RCF. In addition, there remains significant

headroom to LTV ratio and interest cover ratio (ICR) covenants in

the Company's debt agreements.

In response to the elevated LTV ratio reported in our Interim

Results announcement in May, we outlined a disposal programme aimed

at generating proceeds of at least EUR150 million over 12-18

months. The recycled capital would be used to lower debt levels,

fund opportunities within the existing portfolio and maintain our

investment grade credit rating.

We announced the first sale in this disposal programme in

August, comprising a modern warehouse building in Hammersbach, near

Frankfurt in Germany, for c.EUR65 million, which was broadly in

line with book value. However, at 46.4% the LTV ratio remains

higher than we would like, with the beneficial impact of the

disposal being offset by a decline in the portfolio valuation,

development capital expenditure and working capital movements.

Post period end, we also announced the disposal of a second

asset in Germany, at Bochum, for c.EUR47 million and an asset in

Sweden, at Malmö, for c.EUR28 million. These brought the cumulative

total gross sale proceeds from the disposals to c.EUR139 million,

decreasing the pro forma LTV ratio to 44.0% and showing further

progress against our target. We aim to lower the LTV ratio towards

our preferred percentage range in the low 40s over 6 to 12 months

through our ongoing programme of disposals.

In the medium term, the Company expects to refinance the RCF and

the bond ahead of their respective maturities in October 2025 and

June 2026. Our expectation is for the refinanced debt facilities to

be lower than the current amount, albeit at a higher rate to

reflect a likely higher interest rate environment.

Valuation performance

The sharp increase in interest rates and higher cost of capital

has led to a rapid adjustment in asset values over the past 12-18

months and continues to affect investor sentiment and transaction

volumes across the European logistics sector. However, strong

underlying structural drivers, supportive market fundamentals and

rebased asset pricing are attracting investors back to the sector,

with investment activity and asset values showing signs of

stabilisation.

The Company's portfolio valuation declines have reflected these

market trends, with an increase in property yields first

manifesting in the second half of FY22, a greater impact seen in

the first half of FY23, followed by a more modest adjustment at the

latest valuation date at the end of September 2023.

The property portfolio was valued by the Company's independent

valuer, CBRE, at EUR1,561.9 million as at 30 September 2023

compared with EUR1,765.6 million at 30 September 2022. The

valuation declined by 14.5% on a like-for-like basis during the

period, driven by the outward yield shift across the portfolio

partly offset by asset management gains and rental growth. This

included a decline of 0.3% in the second half as signs of

stabilisation emerged. As at 30 September 2023, the portfolio net

initial yield was 4.4% (30 September 2022: 3.8%), with the

equivalent yield at 4.9% (30 September 2022: 3.9%).

In contrast to the weaker investment markets, the continued

strength of occupier markets is reflected in like-for-like rental

growth of 4.5% (7.8% including the Barcelona and Strykow

extensions) and ERV growth of 6.5% over the year, continuing the

positive momentum seen in the prior year.

As at 30 September 2023, the portfolio's ERV (which is the rent

the valuer estimates the portfolio should generate if all buildings

were leased at current market levels) was EUR84.5 million (30

September 2022: EUR81.2 million). As a result, the portfolio

reversion has increased to EUR13.4 million or 17.6% (30 September

2022: EUR7.1 million or 9.5%), and the reversionary yield has

increased to 5.3% from 4.2% on 30 September 2022.

Portfolio strategy and composition

Our portfolio strategy is based on a long-term investment

approach and the goal to generate income-orientated returns with

the ability to capture capital growth over time. We seek to deliver

this strategy through combining a disciplined approach to capital

allocation and proactive asset management and customer engagement,

with enhancing ESG performance central to all our activities.

Our portfolio composition is based on the following

characteristics:

-- diversified by:

- geography, but with the objective of each country having the

appropriate critical mass to enable advantages of scale to be

captured;

- building size, but with a focus on larger-scale warehouses

that facilitate operational efficiencies and where existing and

potential supply is limited; and

- customer and business sector, but with a focus on large, multi-national organisations;

-- displaying an appropriate balance between:

- stabilised, income producing assets; and

- exposure to opportunities to create value through asset

management and development activities;

-- highly efficient:

- let on long leases to strong companies; and

- incorporating in-built, inflation-linked rent escalators;

-- with market-leading ESG credentials:

- reducing the environmental impact of our own and our customers' operations;

- making a meaningful difference to people and communities across our geographies; and

- seeking green lease clauses, which commit customers to using

buildings sustainably, along with an obligation to share resource

usage data.

At the year end, the portfolio comprised 23 high-quality

warehouse assets, diversified by location, building size and

customer sector, plus one building under construction and one plot

of land. The assets are modern, with 89% of the portfolio built in

the past 10 years, located across Belgium, Germany, Italy, the

Netherlands, Poland, Spain and Sweden, and are relatively large,

with 65% of the portfolio in excess of 50,000 sqm (the average size

being 66,000 sqm).

To deliver an attractive level of return with an appropriate

level of risk, our portfolio combines core, stabilised assets with

a managed exposure to development and land. The exposure to

development and value-add activities is managed dynamically to be

aligned with investment and occupational market conditions. With

the external environment becoming more challenging over the past 12

months, we have sought to reduce portfolio exposure to speculative

development risk and to focus on capturing income growth and value

from the existing stabilised portfolio.

The stabilised assets provide the portfolio's core income,

comprise the majority of the portfolio and reflect the relatively

low-risk positioning of the Company.

Exposure to development activity provides the potential for

capturing higher returns with the forward funding of pre-let

developments representing the lower end of the risk spectrum and

the funding of speculative developments the higher end. Typically,

but not in all cases, rental guarantees will be agreed with our

developer-partners to provide protection from potential void

periods following the completion of the building. Speculative

development offers the opportunity to capture higher market rental

levels than appraised levels or the additional rental growth that

may have occurred through the construction phase of the

development.

Asset type (as a % of portfolio FY22

value) FY23

=================================== ======= =======

Stabilised assets 99% 93%

----------------------------------- ------- -------

Pre-let forward funding 0% 5%

Speculative forward funding 1% 2%

Development assets 1% 7%

=================================== ======= =======

Total 100% 100%

----------------------------------- ------- -------

The stabilised assets combine to form a highly efficient

portfolio, reinforced by four distinct characteristics.

Specifically, the assets are let:

i) On long leases

At the period end, the portfolio Weighted Average Unexpired

Lease Term to expiry was 9.6 years (FY22: 9.3 years) and the

Weighted Average Unexpired Lease Term to the first break was 7.9

years (FY22: 8.0 years).

Lease duration (as a % of passing FY22

rent) FY23

===================================== ======= =======

0 - 5 years 24% 29%

5 - 10 years 35% 38%

>10 years 41% 33%

===================================== ======= =======

Total 100% 100%

------------------------------------- ------- -------

ii) To a high-quality customer base

Across the portfolio, the Company has 35 customers operating in

a range of business sectors. Many of the Company's customers are

multi-billion Euro businesses, including some of the world's

best-known companies, underpinning the security of the portfolio's

rental income.

Customer (as a % of passing FY22

rent) FY23

=============================== ======= =======

Mango 14% 11%

Amazon 9% 9%

Puma 8% 8%

Lidl 8% 7%

Wayfair 8% 8%

Action Logistics 6% 6%

Rhenus 6% 6%

Cummins 5% 5%

Clipper 4% -

OVS 3% 3%

Other 29% 37%

=============================== ======= =======

Total 100% 100%

------------------------------- ------- -------

iii) With annual rental uplifts

The majority of the Company's leases contain indexation

provisions offering significant inflation protection and regular

uplifts in income. Rental uplifts are either linked to local

inflation measures or fixed at an agreed rate, with the increases

usually taking place annually.

Indexation (as a % of passing FY22

rent) FY23

================================= ======= =======

CPI uncapped 52% 54%

CPI - capped/other 29% 26%

Fixed 16% 17%

None 3% 3%

================================= ======= =======

Total 100% 100%

--------------------------------- ------- -------

iv) With structurally low vacancies

The EPRA vacancy at the period end was 5.5% (FY22: 0.3%). This

increase was the result of the completion of two speculative

forward fundings at Rosersberg (Sweden) and Settimo Torinese

(Italy) that remain unlet (but covered by rental guarantees), and

the take-back of 22,213 sqm at Strykow. This was partially offset

by lettings at Dormagen (Germany) and half of the development in

Settimo Torinese (Italy).

Strong ESG credentials

Our customers require the ESG performance of the buildings they

occupy to be aligned with their own ESG commitments and targets.

The ESG credentials of our buildings play an important role in

attracting and retaining high-quality occupiers to the portfolio

and also enable our customers to meet the expectations of their

stakeholders. We have a clear ESG strategy focused on working

collaboratively with our customers to jointly deliver enhanced

building performance including carbon reduction, wellbeing and

biodiversity.

The ESG performance of our buildings and alignment with our net

zero carbon pathway are key considerations in determining the

future value and liquidity of our assets. The Company holds a four

Green Star rating from GRESB and EPRA Gold for its Sustainability

Best Practices Recommendations submission.

ESG credentials (as a % of FY22

passing rent) FY23

================================ ======= =======

EPC rating & green building

certification 35% 28%

EPC rating 45% 52%

Green building certification 6% 5%

Unrated 14% 15%

================================ ======= =======

Total 100% 100%

-------------------------------- ------- -------

A proactive approach to asset management

A fundamental part of how we deliver our portfolio strategy is

our proactive approach to asset management. This is focused on

extracting income growth and value uplifts from the opportunities

embedded within the existing portfolio.

Our asset management operations are led by an experienced

in-house team, giving us scope to take a direct and active role in

the strategic asset management of the portfolio and strengthen

relationships with our customers. The in-house team works closely

and collaboratively with our locally based partners and also draws

on the specialist skills within the wider Tritax Group, such as

supply chain, ESG and power expertise, to help formulate our future

asset management plans.

We undertake a thorough bottom-up review of all our assets on a

biannual basis. This enables us to determine the value-maximising

strategy for each property and to review expected returns. In

conjunction with this, a top-down assessment is undertaken to

ensure the portfolio is optimally positioned to capture

efficiencies and to benefit from the positive structural tailwinds

that continue to drive the Continental European logistics

sector.

This process informs our asset recycling strategy by

highlighting those assets where, for example, we have completed our

asset management plans and maximised value or where forecast ESG

performance is not aligned with our overall portfolio objectives.

It also identifies markets where we expect performance to be less

strong or where we have a sub-scale position and gaining sufficient

scale in an appropriate timescale will be challenging. Such assets

will be identified for disposal, enabling us to recycle the capital

into higher returning opportunities or reduce balance sheet

leverage.

Delivering our portfolio objectives

We set ourselves four key portfolio objectives for the year:

1. Capture income growth opportunities embedded in the existing portfolio.

2. Complete ongoing development projects and de-risk rental

guarantees by securing new customers for unlet space.

3. Commence a disposal programme to maintain our balance sheet

strength, and recycle proceeds into reducing debt levels and

funding existing opportunities within the portfolio.

4. Progress agreements with our customers and secure necessary

permits to enable the installation of roof-mounted PV panels on

selected assets.

We have made good progress over the period on all these

objectives.

Objective 1: Capture income growth

We have successfully completed several asset management

initiatives during the period, including:

Asset management

Asset, location initiative Detail

==================== =================== ==========================================================

Barcelona, Extension Completion of a 109,083 sqm extension in November

Spain 2022, which has increased annualised rental income

by EUR2.3 million.

Strykow, Poland Extension Commencement of a new extension for our customer

and lease Arvato, together with an 11-year re-gear of its

re-gear existing lease. The extension was completed at

a yield on cost of 7.2%, increasing the annualised

rental income by EUR0.5 million upon completion.

Dormagen, Letting Completion of a new 10-year lease to GXO at a

Germany rent 17.8% ahead of the underwritten rental guarantee,

converting the rental guarantee into a lease

and increasing the annualised rental income by

an additional EUR0.5 million.

Settimo Torinese, Letting Letting of unit one of the 28,287 sqm speculatively

Italy developed asset, with rent in line with ERV and

consistent with the development funding underwrite.

The six-year green lease to an Italian logistics

specialist includes a further six-year extension

option and includes annually reviewed inflation-linked

uplifts.

Bochum, Germany Letting Letting of unit three at the four-unit prime

asset to a German specialist catering equipment

company, with a seven-year lease 35% above the

current passing rent.

==================== =================== ==========================================================

Objective 2: Complete development projects and de-risk rental

guarantees

We made good progress with the development programme during the

period, completing six forward-funded developments, totalling

224,763 sqm and producing EUR14.6 million per annum in rental

income (EUR11.2 million leased to customers and EUR3.4 million

subject to rental guarantees).

Portfolio

Asset, location activity Detail

==================== ================= ==========================================================

Roosendaal, Development The second and third units (Phase 1B and 2) totalling

the Netherlands completion 65,276 sqm of this forward funded development

(pre-let) pre-let to Lidl were completed in December 2022

and February 2023 respectively. The units generate

annualised rental income of EUR3.2 million.

Rosersberg Development Completed the speculative forward funding development

I, Sweden completion of 13,181 sqm in January 2023, producing annualised

(speculative) rental income of EUR1.1 million through a rental

guarantee, which expires in February 2024. We

are in discussion with potential tenants at rents

above the levels of the rental guarantees.

Dormagen, Development Completed speculative forward funding of 36,434

Germany completion sqm in March 2023, with a 10-year lease signed

(speculative) with GXO in early May, 17.8% ahead of the underwritten

rental guarantee.

Settimo Torinese, Development Practical completion reached in June 2023 of

Italy completion this speculative forward funding of 28,287 sqm,

(speculative) with half the space leased to an Italian logistics

specialist in August 2023. The total scheme has

an ERV of EUR1.3 million.

Bönen, Development Practical completion reached in June 2023 of

Germany completion this forward funded development of 63,753 sqm,

(pre-let) pre-let to Rhenus at an annualised rent of EUR4.3

million.

Rosersberg Development Practical completion reached in July 2023 of

II, Sweden completion this 17,832 sqm speculative forward funding,

(speculative) producing annualised rental income of EUR1.6

million through a rental guarantee, which expires

in August 2024.

Oberhausen, Construction Construction commenced on this two-unit, 23,243

Germany commenced sqm speculative forward funding in July 2023,

(speculative) which has the potential to produce annualised

rental income of EUR2.0 million when fully let.

Practical completion is targeted for Q3 2024

and we are targeting a DGNB Platinum certification.

==================== ================= ==========================================================

The Company owns two further land plots with potential for

building extensions at Wunstorf, Germany, where the existing

building can be extended by 10,000 sqm, and at Geiselwind, Germany,

where capacity exists for a 42,000 sqm extension.

Objective 3: Commence disposal programme and recycle

proceeds

In the Interim Results announcement in May we outlined our

intention to undertake asset disposals of at least EUR150 million

over the following 12-18-month period to reduce the Company's debt

levels and to fund existing opportunities from within the

portfolio. Further to this, and in line with our bi-annual

portfolio review process, in August we announced the disposal of an

asset in Hammersbach (Germany) for c.EUR65 million. This reflected

a net initial yield of 4.45%, broadly in line with the book

valuation of the property, and represented a good first step in our

disposal programme.

Post period end, we announced the sale of a second asset, in

Bochum (Germany), for c.EUR47 million, reflecting a net initial

yield of 4.88%. We also announced the sale of an asset in Malmö for

c.EUR28 million. The sale of the three assets generated gross sale

proceeds of c.EUR139 million, with further sales expected during

2024.

Objective 4: Increase the solar PV generating capacity of the

portfolio

During the year, we continued to progress initiatives to

increase the generation of renewable energy by the installation of

roof-mounted solar panels on our assets. We increased the solar PV

generating capacity of our portfolio to 10.3 MW (FY22: 7.5 MW),

with rooftop solar arrays now installed on eight of our assets.

In addition, we have made applications to commence schemes on

three assets in Germany and are in negotiations with the customers

to agree new Purchasing Power Agreements (PPAs) for those projects.

These assets have been chosen due to their large roof areas, long

unexpired lease terms, sufficient roof load-bearing capacity and

positive, ongoing discussions with the respective customers. The

forecast installation of these projects is Q3 2024 and would add a

further c.9 MW to our portfolio's generating capacity, taking the

total level to over 19 MW.

The intention is to maintain a rolling programme of feasibility

studies to support a phased delivery of installations, in

collaboration with our customers. Our aspiration is to install two

to three solar schemes each year as we look to enhance the

portfolio and support customers with their energy requirements and

ESG ambitions.

Evolving our ESG strategy

At the heart of our asset management approach is our commitment

to an ambitious ESG strategy. This comprises targets across four

areas, comprising sustainable buildings; climate and carbon; nature

and wellbeing; and social value. These are aimed at driving social,

environmental and economic value for our customers, partners,

investors and the wider society.

In 2020 we set a range of ESG targets for the period 2020-2023.

One of our key priorities for 2022 was to establish a clear

baseline from which to launch our new updated ESG targets. These

targets reflect our four principal ambitions for the ESG

performance of the Company, which are summarised as:

1. Our ESG strategy and performance criteria to fundamentally

underpin the investment philosophy of the Company.

2. Our portfolio and our assets to be net zero carbon.

3. Our portfolio to have a positive impact on our climate and the natural world.

4. The social value which our portfolio delivers to make a

meaningful difference to people and communities across our

geographies.

Most notable within these targets is an enhanced commitment to

achieve net zero carbon (as defined by the UK Green Building

Council) across all aspects of our business by 2040, rather than

our previously stated 2050 target. These targets will be reviewed

annually against our KPIs and updated as required.

Theme Target KPI FY23 progress

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Sustainable The Company did

buildings * 100% of all asset due diligence uses Tritax ESG due * % utilisation of enhanced ESG due diligence framework not purchase

diligence framework any buildings

during the

financial

year. We

commenced the

development

of the

Oberhausen

asset, for

which we are

targeting a DGNB

Platinum

certification.

In

addition, the

Manager revised

its due

diligence

processes

to ensure ESG

factors,

including

climate risks,

are

systematically

considered

pre-acquisition.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

The Company

* Produce and implement low-carbon baseline development * Production and % utilisation of low-carbon engaged a

specification on all new projects specification third-party

consultant to

measure the

* % circularity certified materials embodied carbon

associated

with its

* % projects undertaking a whole-life performance forward-funded

analysis developments

in Rosersberg

(Sweden) and

Oberhausen

(Germany).

The reduction to

a GRESB score

of 84/100 (FY22:

88/100) was

due to an

increase in

energy

consumption. The

Company is

seeking to

mitigate this

through

its renewable

energy and

customer

engagement

programme.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Climate The Company

and carbon * Produce and disclose updated net zero carbon pathways * Annual review of pathway and emissions finalised and

disclosed its

updated net

o Scope 1 and scope * % carbon risk incorporated into each asset management zero targets and

2 - 2025 plan is integrating

o Scope 3 (construction) emissions'

- 2030 reduction across

o Scope 3 (remainder * 1.5degC Paris decarbonisation pathway alignment the portfolio.

of material emissions) We are

- 2040 continuously

* Science-Based Targets initiative (SBTi) alignment (or reviewing

equivalent) changes in

market best

practice,

including

evolutions in

the

SBTi building

sector guidance.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

The Company

* Integrate physical climate risk mitigation across * % climate risk incorporated into each asset updated its

asset lifecycle management plan portfolio-wide

physical climate

risk assessment,

* Portfolio TCFD alignment and conducted a

vulnerability

assessment on

assets exposed

to natural

hazards.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Nature Baseline data

and * Year-on-year annual increase in biodiversity for * % increase in biodiversity against 2022 baseline collection

wellbeing standing assets methodology

agreed.

Implemented

biodiversity

improvement

measures on

several assets

including in

Belgium and

Poland.

New

developments:

continued

enhancement of

ESG development

specification,

including

integration

of biodiversity

measures.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Assessed all

* Year-on-year increased provision of wellbeing * % increase in provision against 2022 baseline buildings

enhancements to developments and standing assets currently

without a green

building

certification

against the

BREEAM In-Use

certification

scheme,

including

the Health &

Wellbeing

criteria.

Increasing

customer

engagement,

primarily

through site

visits.

New electric

vehicle (EV)

charging

stations

installed

at three assets.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Social The Manager is

value * Publish community investment structure * Set-up and operation of community investment developing

structure a community

investment

* Further integrate ESG criteria into supply chain structure

procurement processes, both for upstream and * % utilisation of due diligence framework for to oversee the

downstream suppliers social value

workstream.

The Manager

undertook a

review

of the property

management

agreement, with

key focus

on ESG services.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

The Company

* Continue support for the Company's main charity * Level of financial and non-financial contributions donated

GBP25,000

to The Mission

to Seafarers

- continuing the

Company's

three-year

partnership with

the charity.

-------------- ------------------------------------------------------------------ ------------------------------------------------------------ -----------------

Financial Review

FY23 progress summary

What we said we would do

A year ago, we highlighted three key financial objectives:

1. cover the dividend;

2. reduce the Adjusted EPRA Cost Ratio; and

3. manage leverage and maintain a robust balance sheet.

What we achieved

The dividend is 110.2% covered for the financial year, an

increase from 84.8% in FY22. This was the result of higher income,

driven by development completions, asset management and indexation,

together with lower costs, primarily from a reduction in management

fees.

The Adjusted EPRA Cost Ratio has reduced to 24.2% for FY23 from

29.5% in FY22. The ratio improved through the year, with an

Adjusted EPRA Cost Ratio of 22.8% in the six months to September

2023. Our aim is to remain in our target range of 20-25%.

Despite a solid start to our programme of disposals, the LTV

ratio has increased to 46.4% as at 30 September 2023 and remains

higher than we would like at this point of the cycle. The increase

was a result of valuation declines, ongoing development expenditure

and movements in working capital, offsetting the sale proceeds.

Post period-end, we have made further good progress with our

disposal programme, which has generated gross proceeds of c.EUR139m

to date including the disposals of Bochum for c.EUR47 million and

Malmö for c.EUR28 million. Taking account of the Bochum and Malmö

disposals, the pro forma LTV ratio is 44.0%. Further disposals have

been identified and we remain confident of achieving our target LTV

percentage of low 40s over the next 6 to 12 months.

What to expect next

We will look to maintain a covered dividend and the Adjusted

EPRA Cost Ratio within the 20-25% range.

We will seek additional disposals to reduce debt and deliver a

lower LTV ratio, showing a trajectory towards our preferred level.

In the medium term, we expect to refinance the RCF and the bond

ahead of their respective maturities in October 2025 and June

2026.

Portfolio valuation

The portfolio was independently valued by CBRE as at 30

September 2023, in accordance with the RICS Valuation - Global

Standards. The portfolio's total value at the year end was

EUR1,561.9 million (30 September 2022: EUR1,765.6 million),

reflecting a like-for-like valuation decrease of 14.5%, including a

decline of 0.3% in the second half. The Valuation NEY increased by

100 bps over the past 12 months and 10 bps over the past six

months, with this outward yield shift only partially offset by

like-for-like ERV growth of 6.5% over the year.

Financial results

Income

Rental income for the year was EUR68.1 million (FY22: EUR57.9

million), up 17.6%. The growth was primarily the result of

acquisitions during 2022, rent indexations and our asset management

initiatives, including the Mango extension in Barcelona. On a

12-month like-for-like basis, total annualised rental income was

4.5% higher (or 7.8% higher when including the Barcelona and

Strykow extensions).

As at 30 September 2023, the annualised rental income was

EUR76.3 million (FY22: EUR74.3 million), including EUR3.4 million

annualised rental guarantees. With the recent completion of most of

our developments, we expect the share of rental guarantees as a

percentage of total income to decrease materially in 2024, with

most of these rental guarantees converted into IFRS income as

customers take occupation of available warehouse space and leases

commence.

Costs

The Company's operating and administrative costs were EUR16.4

million (FY22: EUR18.2 million), which primarily comprised:

-- the Management Fee payable to the Manager of EUR5.5 million (FY22: EUR7.9 million);

-- the Company's running costs, including accounting, tax and audit; and

-- the Directors' fees.

The EPRA Cost Ratio for the financial year (inclusive of vacancy

cost) was 27.4% (FY22: 41.3%). The Adjusted EPRA Cost Ratio was

24.2% (FY22: 29.5%), including rental guarantees received.

The lower cost ratio was primarily the result of the change in

the Investment Management Agreement last year, that lowered the fee

payable by the Company to the Manager. This was implemented on 6

October 2022, and backdated to be effective from 1 August 2022.

Investment Management Agreement fees

Effective 1 August 2022 Previously

NAV Value Fee NAV value Fee

=================== ======== ================== ========

<EUR1 billion 1.00% <EUR0.5 billion 1.30%

>EUR0.5 billion

>EUR1 billion 0.75% <=EUR2 billion 1.15%

>EUR2 billion 1.00%

=================== ======== ================== ========

The total cost of debt (net of income earned on interest rate

derivatives) for the year was EUR10.1 million (FY22: EUR8.7

million), reflecting an attractive average cost of debt of 1.30%

(FY22: 1.22%). This is the result of all debt facilities during the

year being fixed or hedged, with no refinancing maturities before

Q4 2025.

Post period end, we renewed some of our interest rate caps

expiring in October 2023. We bought a EUR40 million portion with a

two-year maturity co-terminus with the remaining term of the RCF

and a EUR40 million portion to match our short-term RCF requirement

pending the full execution of the disposal programme. Reflecting

current financing conditions, the weighted average strike price of

these caps is 2.72% (previously 0.65%). Looking ahead to FY24, we

expect the total cost of debt to be in the range of 1.25% and

1.50%, subject to drawdowns on the RCF.

The Group made a consolidated loss before tax for the period of

EUR243.0 million (FY22: gain of EUR76.6 million), primarily due to

the decrease in the portfolio valuation, as outlined above.

The income taxation charge for the year was 2.5% (FY22: 2.3%).

The charge is primarily incurred in the local jurisdictions in

which the Company invests. As an HMRC approved investment trust,

the Company is exempt from UK corporation tax on its chargeable

gains. The Company is also exempt from UK corporation tax on

dividend income received, whether from UK or non-UK companies,

provided the dividends fall within one of the exempt classes under

the Corporation Tax Act 2009.

The corporation tax rate in future periods will depend primarily

on the jurisdictions where the Company owns the property assets,

given the differing tax rates across Continental Europe. The

Company does not use any structures designed to artificially reduce

its tax liabilities and looks to pay the appropriate level of tax

where it is due.

Earnings Per Share

Basic Earnings Per Share for the year was negative 27.68 cents

(FY22: 7.28 cents), with the decrease versus the prior year

reflecting the adverse valuation movement through FY23. EPRA EPS,

which excludes valuation movements, was 5.66 cents (FY22: 2.58

cents). Adjusted Earnings, which include rental guarantees, were

EUR44.5 million (FY22: EUR34.2 million), resulting in Adjusted EPS

of 5.51 cents (FY22: 4.24 cents). More information about the

calculation of basic, EPRA and Adjusted EPS can be found in Note 12

to the Financial Statements.

Net assets

The IFRS NAV per share at the year-end was EUR0.99 (30 September

2022: EUR1.32). The EPRA NTA per share at the year-end was EUR1.02

(30 September 2022: EUR1.38). The Board recognises the 42% discount

to EPRA NTA, as at 30 September 2023. The valuation of investment

property is the main driver of the EPRA NTA, and was determined by

CBRE as independent valuer. The Board is satisfied that the

valuation exercise was performed in accordance with RICS Valuation

- Global Standards. As such, the Board has full confidence in the

level of EPRA NTA disclosed in the financial statements at the

reporting date. More information on EPRA's net asset valuation

metrics can be found in the EPRA Performance Measures section.

Debt financing

At the year end, the Company had total debt drawn of EUR777

million. This resulted in an LTV ratio of 46.4% (30 September 2022:

35.2%), with EUR172.5 million available undrawn debt. Taking into

account the recently announced disposals at Bochum and Malmö, the

pro forma LTV ratio decreases to 44.0%. Further disposals are

planned during 2024 to reduce the LTV towards our preferred level

of low 40s.

The Company's financing is insulated from any near-term

increases in interest rates, with no maturities before Q4 2025 and

100% of its total drawn debt either fixed or benefiting from

interest rate caps limiting the rise in Euribor to 2.72%.

Post period-end activity

On 29 November 2023, the Company agreed a lease at its two-unit

asset in Settimo Torinese, Italy.

On 30 November 2023, the Company exchanged on the sale of its

asset at Bochum, Germany, and the redevelopment site at Malmo,

Sweden.

Related party transactions

Transactions with related parties included the Management Fee

paid to the Manager and the Directors' fees.

Alternative Investment Fund Manager (AIFM)

The Company is an Alternative Investment Fund within the meaning

of the AIFMD and has appointed the Manager as its AIFM. The Manager

is authorised and regulated by the Financial Conduct Authority as a

full scope AIFM.

Dividends

The Company has declared the following dividends in respect of

the year:

Amount per

Declared share In respect of Paid/to be paid

================== ============= ============================= ===================

1 October to 31 December

9 February 2023 1.25 cents 2022 14 March 2023

18 May 2023 1.25 cents 1 January to 31 March 2023 23 June 2023

8 August 2023 1.25 cents 1 April to 30 June 2023 8 September 2023

1 July to 30 September

5 December 2023 1.25 cents 2023 12 January 2024

================== ============= ============================= ===================

The total dividend for the year was 5.00 cents per share or

EUR40.3 million (FY22: EUR40.3 million) and was 110.2% covered by

Adjusted Earnings (FY22: 84.8%).

Key Performance Indicators

Set out below are the key performance indicators we use to track

our strategic progress.

KPI and definition Our progress in FY23 Performance

(for the year ended

30 September)

================================================================================================ =================================================================================================== ======================

1. Dividend per share Our policy is to pay an attractive and progressive dividend, with a minimum payout of 85% 2023: 5.00 cents

Dividends paid to shareholders and declared in relation to the period. of Adjusted Earnings. per share

While keeping the Dividend per share unchanged from the prior year, the earnings growth from 2022: 5.00 cents

the business supported the dividend being fully covered for the year. per share

------------------------------------------------------------------------------------------------ --------------------------------------------------------------------------------------------------- ----------------------

2. Total Return (TR) The return calculated from the dividends paid has been more than offset by the decline in 2023: (22.5)%

valuation, which was driven by inflation and the resulting impacts on interest rates.

Total Return measures the change in the EPRA Net Tangible Assets (EPRA NTA) over the period 2022: 6.0%

plus dividends paid.

------------------------------------------------------------------------------------------------ --------------------------------------------------------------------------------------------------- ----------------------

3. Basic Net Asset Value Inflation and the resulting impacts on interest rates have been the key drivers of this 2023: EUR795.6

Net asset value in IFRS GAAP. valuation million (EUR0.99

movement, which could not be fully offset by strong market rental growth and indexation. per share)

2022: EUR1,065.8

million (EUR1.32

per share)

------------------------------------------------------------------------------------------------ --------------------------------------------------------------------------------------------------- ----------------------

4. Adjusted earnings Adjusted Earnings increased by 30.0% in the year, reflecting the full-year impact on rental EUR44.5 million

EPRA earnings, adjusted to include licence fees and rental guarantees receivable on forward income from acquisitions in the prior year and a 10% decrease in administrative expenses. (5.51 cents per

funded development assets and for other earnings not supported by cash flows. share)

EUR34.2 million

(4.24 cents per

share)