TIDMCKN

RNS Number : 5791R

Clarkson PLC

25 August 2010

25 August 2010

Clarkson PLC

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2010

Clarkson PLC ('Clarksons') is the world's leading integrated shipping services

group. Through our 27 offices on five continents we play a vital intermediary

role in the movement of the majority of commodities around the world.

Summary

· Revenue up 14% to GBP101.0m (2009: GBP88.9m) reflecting improved market

conditions in shipping as a result of increased international trade

· Operating profit increased by 62% to GBP18.8m (2009: GBP11.6m)

· Profit before taxation up 49% to GBP16.7m (2009: GBP11.2m)

· Basic earnings per share up 58% to 66.7p (2009: 42.1p)

· 6% increase in interim dividend to 17p per share (2009: 16p per share)

· The successful launch and first trade of the Container Freight Swap

Agreement, an innovative new risk management product developed by Clarkson

Securities

Andi Case, Chief Executive of Clarksons commented:

"Uncertainty remains as to the speed and sustainability of global economic and

trade growth. Nevertheless Clarksons has produced a strong set of results,

ahead of the board's expectations, for the first six months of 2010. These

results reflect the hard work that our team has undertaken."

Enquiries:

+-------------------------------------+-------------------------------------+

| Clarkson PLC | 020 7334 0000 |

+-------------------------------------+-------------------------------------+

| Andi Case, Chief Executive | |

+-------------------------------------+-------------------------------------+

| Jeff Woyda, Finance Director | |

+-------------------------------------+-------------------------------------+

| | |

+-------------------------------------+-------------------------------------+

| Hudson Sandler | 020 7796 4133 |

+-------------------------------------+-------------------------------------+

| Charlie Jack/Kate Hough | |

+-------------------------------------+-------------------------------------+

Chairman's review

Clarksons has delivered a strong performance for the first half of 2010. With

the emerging recovery in global trade, the strength of the Clarksons brand and

breadth of our operations across shipping and its related markets positioned us

well.

These improving trends were particularly evident in the dry bulk markets where

trading was better than anticipated. Across the sale and purchase markets,

whilst the availability of credit remains an obstacle for some, it was also

encouraging to see further signs of a return to buying activity.

The Clarksons team has worked hard during the first half of the year to take

advantage of these opportunities and on behalf of the board, I thank the whole

team for their continued commitment.

Bob Benton

Chairman

25 August 2010

Chief Executive's review

In the first six months of the year Clarksons operated in shipping markets

broadly stronger than that of the corresponding period in 2009. This market

backdrop, combined with increased transaction volumes in the broking division,

led to a first half result ahead of the board's expectations, albeit against

weaker comparatives in 2009. Our strategy of offering integrated global

shipping services, supported by our market leading research and analysis, was

also an important factor in the group's ability to realise revenue opportunities

and deliver a strong set of results.

Chartering markets remained volatile during the first half, but Clarksons'

breadth of offering enabled the group to benefit where freight rates improved.

We are pleased that in these market conditions, the broking teams generated

increased revenues compared to the same period in 2009. Asian demand for

commodities was a continued important feature for the market in the first half

and our growing commitment to the region continued to deliver encouraging

results.

The period also saw increased confidence in the longer term prospects of many

markets, with rising commodity prices and building costs increasing from a level

seen by many as the low point. We have seen an increase in the volume of

newbuilding contracts being placed, as well as rising prices both in newbuilding

and secondhand across most sectors, despite the continued limited availability

of debt financing. In more conventional shipping markets, it would be improved

chartering rates that would result in rising asset values but, as spot rates

have remained volatile, there has been a disconnect between the medium and

longer term period rates available and the increased asset value of vessels, as

a result of which we are experiencing a shift towards more spot and shorter term

period business.

The financial division benefited from both the first trade and the first cleared

trade of the Container Freight Swap Agreement, an innovative new risk management

product developed by Clarkson Securities. The successful launch demonstrates

the group's commitment to providing our clients with market-leading and

innovative products and solutions.

Results

Revenue of GBP101.0m (2009: GBP88.9m) reflects improved shipping markets in the

first half of the year, both in terms of chartering rates and asset values

across broking and financial activities. Administrative expenses, which

increased 6% to GBP77.7m (2009: GBP73.6m), benefited from the one-off release of

a GBP2m remuneration provision relating to business in the USA no longer

required as performance criteria were not met in full. Without this release,

administrative expenses would have risen by 8% reflecting predominantly the

increase in bonuses resulting from the improvement in profits in the first half

of 2010 compared to the same period in 2009. Operating profit increased by 62%

to GBP18.8m (2009: GBP11.6m).

Profit before taxation was GBP16.7m (2009: GBP11.2m). Basic earnings per share

were 66.7p (2009: 42.1p).

Cash and dividends

Cash balances at 30 June 2010 were GBP132.9m (31 December 2009: GBP143.2m). Net

funds, after deduction of borrowings and bonus entitlements, amount to GBP42.1m

(31 December 2009: GBP38.2m).

Reflecting the strength in the business, the board has declared an increased

interim dividend of 17p per share (2009: 16p per share) which will be paid on 1

October 2010 to shareholders on the register at the close of business on 17

September 2010.

Broking

Revenue GBP83.5m (2009: GBP70.7m)

Result GBP20.6m (2009: GBP14.4m)

The broking division has performed well, growing market share, with overall spot

revenues ahead by 51% and increased transaction volumes.

Dry Bulk: China remains the cornerstone of the dry bulk freight market,

although the revival of other economies since the beginning of the year added to

demand.

The dry bulk market was characterised by a significant increase in spot

activity, with the weighted average of spot earnings 91% higher than in the

comparative period in 2009. These levels are similar to those experienced in the

second half of 2009 and reflect a degree of uncertainty over Chinese economic

growth in the remainder of 2010. The smaller bulk carriers (<100,000dwt) have

benefited most from the shift to spot market business.

The dry bulk fleet expanded by 34m dwt or 7.4% during the first half of 2010.

Although new tonnage held back earnings in the capesize sector, strong

international coal trade to China and India mitigated most of the fleet growth

in the smaller dry bulk ships. Port congestion, and the widening imbalance

between rates of industrial growth in Asian and Western economies, added to

fleet inefficiencies and resulted in increased tonne-miles, ship-days and

freight rates.

The dry bulk markets outperformed expectations for most of the period and spot

revenues in Clarksons' dry bulk business were nearly 60% higher on increased

transaction volumes relative to the comparable period last year. The Baltic Dry

Index, having reached its peak for the period in May, has subsequently fallen

significantly. The dry bulk outlook remains uncertain.

Deep Sea: A degree of global economic recovery had a positive effect on tanker

freight earnings. Oil intensive activities, such as transportation and

industry, picked up and this improvement looks set to continue throughout the

remainder of 2010. Spot earnings in the first half improved significantly from

the lows experienced in 2009. During the first half they were between 35% and

94% higher than full year 2009 earnings for all vessel types. In addition, the

use of tankers for storage, and lower than expected deliveries of new vessels,

continued to support freight rates.

Clarksons' spot revenues were up 28% on the comparative period, with increased

transaction volumes accounting for most of this.

Specialised Products: We witnessed a number of 'green shoots' of recovery within

the specialised products marketplace. Global economic conditions improved

faster than expected and robust freight rates have steadied the market with

rates and earnings on the main arterial trade lanes remaining resilient

throughout the half.

Chemical production trends continued to shift, as substantial capacity was added

in the Middle East and China.

Clarksons' revenues and transaction volumes from specialised products once again

increased during the period.

Gas: Pressure on freight levels continued into early 2010, as a result of

reduced volumes and expansion in the fleet. Growth in LPG volumes was

constrained by weaker LNG demand and start up delays for new projects. However,

export volumes started to recover through the course of the second quarter as

new projects in Qatar and Abu Dhabi began to come on stream and as regional

pricing differentials have supported trading opportunities from Western

producers into Asia.

The Very Large Gas Carrier (VLGC), Large Gas Carrier (LGC) and Midsize sectors

all came under pressure from weaker LPG trade combined with a slow start to the

year in the ammonia market. A recovery in ammonia exports from the Former

Soviet Union (FSU) countries, stronger demand in the US and healthy import

volumes in Asia have improved prospects for the LGCs as the first half

progressed. Rates were also supported by a recovery in the fortunes of the VLGC

sector.

Whilst the market was under pressure during the first half, spot revenues were

marginally ahead of the comparative period in 2009.

Sale and Purchase: Confidence started to return to the markets, which resulted

in a firming of values across the sectors as buying activity increased. This

was despite the continued reluctance of traditional shipping banks to undertake

new projects as new sources of finance, principally from private equity and the

US investor market, were willing to step in and replace them.

Spot revenues and overall transaction volumes in both secondhand and offshore

markets together increased by around 150% over the comparable period last year.

Our success was achieved by maintaining relationships with our key clients and

also helping them take advantage of the new sources of funding. However, with

significantly quieter markets since the period-end, it may prove difficult to

repeat this performance in the second half.

Containers: Following 2009, when the container shipping markets came under

severe downward pressure on the back of a substantial contraction in trade and

continued growth in fleet capacity, there was some recovery. Trade volumes

returned to positive year-on-year growth on most routes, most significantly out

of and within Asia, and this created additional demand for containership

capacity resulting in an uplift in the containership charter market.

On average, across a selection of ship sizes, one-year containership charter

rates were up by over 80% across the first half of 2010, from the historical

lows at the end of 2009. Containership secondhand prices also benefited, with

ten-year-old prices up on average by almost 60% in the first half of 2010,

whilst trade growth has also enabled operators to reactivate the majority of the

capacity idled in 2009.

As a result, spot revenues were more than three times greater than in the first

half of 2009 on increased volumes.

Looking ahead, global container trade growth is projected to reach between 9%

and 10% for the full year 2010 with the fundamentals for the sector looking

likely to sustain improvements on last year, although risks to the

sustainability of the recovery do remain, most notably on the demand side from

the potential threat of double dip recession, levels of unemployment in the

advanced economies, and the contagion of financial problems within the European

economies.

Financial

Revenue GBP5.5m (2009: GBP7.4m)

Result GBP1.8m loss (2009: GBP1.0m loss)

Futures Broking: Our profitable derivatives business continues to grow in terms

of market share and the diversity of clients. We have been instrumental in

opening up new markets for our clients and major milestones have included the

execution of both the first bilateral and cleared contracts of the newly

launched Container Freight Swap Agreement. Container Freight Swap Agreements

provide a means of hedging freight exposure for shippers, carriers and retail

companies active in container shipping and have been developed and pioneered by

Clarkson Securities. We also continued to take market share in the iron ore

swaps market.

A significant increase in transaction volumes was partially offset by reduced

average transaction sizes, though spot revenues were up 17% relative to the

first half of 2009.

Investment Services: Clarksons are the only Middle East and North Africa expert

who can provide in-depth sector coverage, global research and investment banking

services in natural resources, shipping and energy services. During the first

half, the team worked on a number of mandates, principally from Dubai with

support from London and Houston, which are expected to generate revenue in the

second half.

Fund Management: Assets under management stabilised, although trading

conditions remain challenging, resulting in a small loss. Lower management fees

have, however, been offset by significantly reduced costs.

Research

Revenue GBP3.4m (2009: GBP3.3m)

Result GBP0.8m (2009: GBP0.8m)

Clarkson Research Services' revenues grew by 3% during the first half, supported

by continued demand for better quality and more detailed market information.

Clarkson Valuations' ship valuation service remains of particular importance to

market participants.

The re-launch of our flagship database, the Shipping Intelligence Network,

during the half has driven a 27% increase in digital data sales, as clients

continue to derive significant benefit from Clarksons' in-depth understanding of

maritime supply and demand. Consulting revenues have more than doubled, as a

result of work undertaken to assist with IPOs and specific client research. We

also published the first edition of the World Fleet Monitor, which has been well

received by our clients.

Support

Revenue GBP10.1m (2009: GBP8.9m)

Result GBP0.7m (2009: GBP0.3m)

Port and agency services continue to operate at record levels. High levels of

grain imports and exports have boosted our stevedoring business in Ipswich.

Agency activities saw increased export grain volumes and offshore activities

which offset reduced movements in other traffic, including coal imports.

Technical services revenues declined overall, though the division is currently

undertaking a major repair contract in the Far East.

The MT Hermien continued to trade under external commercial management. Ship

ownership remains non-core, and the group's intention remains to exit this

activity.

The property services division continues to operate profitably.

Current Trading and Outlook

Whilst improvements in the first half were better than expected, uncertainty

remains as to the speed and sustainability of global economic and trade growth.

Clarksons' revenues continue to be supported by our forward order book and the

US dollar. Furthermore the group remains strongly cash generative with a solid

and strengthening balance sheet.

Whilst the trends in spot business experienced since the beginning of the year

are indicative of market volatility, Clarksons' volumes are growing and the

board looks forward to the future with confidence.

Andi Case

Chief Executive

25 August 2010

Directors' responsibility statement

The directors confirm, to the best of their knowledge, that this set of interim

financial statements has been prepared in accordance with IAS 34 as adopted by

the European Union, and that the Interim Management Report herein includes a

fair review of the information required by Rules 4.2.7 and 4.2.8 of the

Disclosure and Transparency Rules of the United Kingdom's Financial Services

Authority.

The directors are responsible for the maintenance and integrity of the Interim

Report on the website in accordance with UK legislation governing the

preparation and dissemination of financial statements. Access to the website is

available from outside the UK, where comparable legislation may be different.

+------------------+------------------------------+------------------------+

| Bob Benton | Chairman | |

| | | |

+------------------+------------------------------+------------------------+

| Andi Case | Chief Executive | |

| | | |

+------------------+------------------------------+------------------------+

| James Morley | Non-Executive Director | |

| | | |

+------------------+------------------------------+------------------------+

| Martin Stopford | Executive Director | |

| | | |

+------------------+------------------------------+------------------------+

| Ed Warner | Non-Executive Director | |

| | | |

+------------------+------------------------------+------------------------+

| Paul Wogan | Non-Executive Director | |

| | | |

+------------------+------------------------------+------------------------+

| Jeff Woyda | Finance Director | |

| | | |

+------------------+------------------------------+------------------------+

25 August 2010

Independent review report to Clarkson PLC

Introduction

We have been engaged by the company to review the condensed consolidated set of

financial statements in the interim report for the six months ended 30 June

2010, which comprises the consolidated income statement, the consolidated

statement of comprehensive income, the consolidated balance sheet, the

consolidated statement of changes in equity and the consolidated cash flow

statement together with the related notes. We have read the other information

contained in the interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in the condensed

consolidated set of financial statements.

Directors' responsibilities

The interim report is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the interim report in

accordance with the Disclosure and Transparency Rules of the United Kingdom's

Financial Services Authority.

As disclosed in note 2, the annual financial statements of the group are

prepared in accordance with IFRSs as adopted by the European Union. The

condensed set of financial statements included in this interim report has been

prepared in accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed

set of financial statements in the interim report based on our review. This

report, including the conclusion, has been prepared for and only for the company

for the purpose of the Disclosure and Transparency Rules of the Financial

Services Authority and for no other purpose. We do not, in producing this

report, accept or assume responsibility for any other purpose or to any other

person to whom this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, 'Review of Interim Financial Information

Performed by the Independent Auditor of the Entity' issued by the Auditing

Practices Board for use in the United Kingdom.

A review of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is substantially less

in scope than an audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe

that the condensed consolidated set of financial statements in the interim

report for the six months ended 30 June 2010 is not prepared, in all material

respects, in accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure and Transparency Rules of the United

Kingdom's Financial Services Authority.

PricewaterhouseCoopers LLP

Chartered Accountants

London

25 August 2010

Consolidated income statement

For the half year to 30 June

+----------------+--------+--------------------+------------------+

| | Notes | 2010 | 2009 |

| | | GBPm* | GBPm* |

+----------------+--------+--------------------+------------------+

| Revenue | 3 | 101.0 | 88.9 |

+----------------+--------+--------------------+------------------+

| Cost | | (4.5) | (3.7) |

| of | | | |

| sales | | | |

+----------------+--------+--------------------+------------------+

| Trading | | 96.5 | 85.2 |

| profit | | | |

+----------------+--------+--------------------+------------------+

| Administrative | | (77.7) | (73.6) |

| expenses | | | |

+----------------+--------+--------------------+------------------+

| Operating | 3 | 18.8 | 11.6 |

| profit | | | |

+----------------+--------+--------------------+------------------+

| Share | | (0.1) | |

| of | | | - |

| losses | | | |

| of | | | |

| associates | | | |

| and joint | | | |

| ventures | | | |

+----------------+--------+--------------------+------------------+

| Finance | 4 | 0.2 | 0.7 |

| revenue | | | |

+----------------+--------+--------------------+------------------+

| Finance | 4 | (2.3) | (1.1) |

| costs | | | |

+----------------+--------+--------------------+------------------+

| Other | | 0.1 | |

| finance | | | - |

| revenue | | | |

| - | | | |

| pensions | | | |

+----------------+--------+--------------------+------------------+

| Profit | | 16.7 | 11.2 |

| before | | | |

| taxation | | | |

+----------------+--------+--------------------+------------------+

| Taxation | 5 | (4.3) | (3.3) |

+----------------+--------+--------------------+------------------+

| Profit | | 12.4 | 7.9 |

| for | | | |

| the | | | |

| period | | | |

| - | | | |

| continuing | | | |

| operations | | | |

+----------------+--------+--------------------+------------------+

| Attributable | | | |

| to: | | | |

+----------------+--------+--------------------+------------------+

| Equity | | 12.4 | 7.9 |

| holders | | | |

| of the | | | |

| parent | | | |

+----------------+--------+--------------------+------------------+

| Earnings | 6 | | |

| per | | | |

| share | | | |

+----------------+--------+--------------------+------------------+

| Basic | | 66.7p | 42.1p |

+----------------+--------+--------------------+------------------+

| Diluted | | 66.7p | 41.4p |

| | | | |

+----------------+--------+--------------------+------------------+

* Unaudited

Consolidated statement of comprehensive income

For the half year to 30 June

+------------------+--------------------+--------------------+

| | 2010 | 2009 |

| | GBPm* | GBPm* |

+------------------+--------------------+--------------------+

| Profit | 12.4 | 7.9 |

| for | | |

| the | | |

| period | | |

+------------------+--------------------+--------------------+

| Actuarial | (4.5) | (11.1) |

| loss on | | |

| employee | | |

| benefit | | |

| schemes - | | |

| net of | | |

| tax | | |

+------------------+--------------------+--------------------+

| Foreign | 1.8 | (6.0) |

| exchange | | |

| differences | | |

| on | | |

| retranslation | | |

| of foreign | | |

| operations | | |

+------------------+--------------------+--------------------+

| Foreign | (2.0) | 2.1 |

| currency | | |

| hedge - | | |

| net of | | |

| tax | | |

+------------------+--------------------+--------------------+

| Total | 7.7 | (7.1) |

| comprehensive | | |

| income/(expense) | | |

| for the period | | |

+------------------+--------------------+--------------------+

| Total | | |

| comprehensive | | |

| income/(expense) | | |

| attributable | | |

| to: | | |

+------------------+--------------------+--------------------+

| Equity | 7.7 | (7.1) |

| holders | | |

| of the | | |

| parent | | |

+------------------+--------------------+--------------------+

* Unaudited

Consolidated balance sheet

As at 30 June

+------------------+--------+--------+-------------------+----------+

| | Notes | | | 31 |

| | | | | December |

| | | 2010 | 2009 | 2009 |

| | | GBPm* | GBPm* | GBPm+ |

+------------------+--------+--------+-------------------+----------+

| Non-current | | | | |

| assets | | | | |

+------------------+--------+--------+-------------------+----------+

| Property, | | 13.9 | 15.6 | 14.6 |

| plant and | | | | |

| equipment | | | | |

+------------------+--------+--------+-------------------+----------+

| Investment | | 0.4 | 0.4 | 0.4 |

| property | | | | |

+------------------+--------+--------+-------------------+----------+

| Intangible | | 32.6 | 32.1 | 32.5 |

| assets | | | | |

+------------------+--------+--------+-------------------+----------+

| Investments | | - | 0.4 | 0.2 |

| in | | | | |

| associates | | | | |

| and joint | | | | |

| ventures | | | | |

+------------------+--------+--------+-------------------+----------+

| Trade | | 0.6 | 0.8 | 0.6 |

| and | | | | |

| other | | | | |

| receivables | | | | |

+------------------+--------+--------+-------------------+----------+

| Investments | | 14.4 | 14.6 | 14.9 |

+------------------+--------+--------+-------------------+----------+

| Deferred | | 13.5 | 6.9 | 11.6 |

| tax | | | | |

| asset | | | | |

+------------------+--------+--------+-------------------+----------+

| | | 75.4 | 70.8 | 74.8 |

+------------------+--------+--------+-------------------+----------+

| Current | | | | |

| assets | | | | |

+------------------+--------+--------+-------------------+----------+

| Trade | | 37.2 | 33.7 | 29.7 |

| and | | | | |

| other | | | | |

| receivables | | | | |

+------------------+--------+--------+-------------------+----------+

| Income | | 0.5 | 1.1 | 0.9 |

| tax | | | | |

| receivable | | | | |

+------------------+--------+--------+-------------------+----------+

| Cash | 9 | 132.9 | 122.7 | 143.2 |

| and | | | | |

| short-term | | | | |

| deposits | | | | |

+------------------+--------+--------+-------------------+----------+

| | | 170.6 | 157.5 | 173.8 |

+------------------+--------+--------+-------------------+----------+

| Current | | | | |

| liabilities | | | | |

+------------------+--------+--------+-------------------+----------+

| Interest-bearing | | - | (2.4) | - |

| loans and | | | | |

| borrowings | | | | |

+------------------+--------+--------+-------------------+----------+

| Trade | | (71.4) | (72.1) | (86.9) |

| and | | | | |

| other | | | | |

| payables | | | | |

+------------------+--------+--------+-------------------+----------+

| Income | | (5.8) | (3.6) | (3.3) |

| tax | | | | |

| payable | | | | |

+------------------+--------+--------+-------------------+----------+

| Provisions | | (0.3) | (0.3) | (0.3) |

+------------------+--------+--------+-------------------+----------+

| | | (77.5) | (78.4) | (90.5) |

+------------------+--------+--------+-------------------+----------+

| Net | | 93.1 | 79.1 | 83.3 |

| current | | | | |

| assets | | | | |

+------------------+--------+--------+-------------------+----------+

| Non-current | | | | |

| liabilities | | | | |

+------------------+--------+--------+-------------------+----------+

| Interest-bearing | 9 | (49.2) | (47.7) | (48.3) |

| loans and | | | | |

| borrowings | | | | |

+------------------+--------+--------+-------------------+----------+

| Trade | | (1.0) | (1.1) | (1.0) |

| and | | | | |

| other | | | | |

| payables | | | | |

+------------------+--------+--------+-------------------+----------+

| Provisions | | (1.2) | (1.0) | (1.1) |

+------------------+--------+--------+-------------------+----------+

| Employee | 8 | (12.8) | (6.6) | (6.9) |

| benefits | | | | |

+------------------+--------+--------+-------------------+----------+

| Deferred | | (3.3) | (2.0) | (4.0) |

| tax | | | | |

| liability | | | | |

+------------------+--------+--------+-------------------+----------+

| | | (67.5) | (58.4) | (61.3) |

+------------------+--------+--------+-------------------+----------+

| Net | | 101.0 | 91.5 | 96.8 |

| assets | | | | |

+------------------+--------+--------+-------------------+----------+

| | | | | |

+------------------+--------+--------+-------------------+----------+

| Capital | | | | |

| and | | | | |

| reserves | | | | |

+------------------+--------+--------+-------------------+----------+

| Issued | 10 | 4.7 | 4.7 | 4.7 |

| capital | | | | |

+------------------+--------+--------+-------------------+----------+

| Other | | 42.1 | 40.6 | 40.6 |

| reserves | | | | |

+------------------+--------+--------+-------------------+----------+

| Profit | | 54.2 | 46.2 | 51.5 |

| and | | | | |

| loss | | | | |

+------------------+--------+--------+-------------------+----------+

| Clarkson | | 101.0 | 91.5 | 96.8 |

| PLC | | | | |

| group | | | | |

| shareholders' | | | | |

| equity | | | | |

+------------------+--------+--------+-------------------+----------+

* Unaudited

+ Audited

Consolidated statement of changes in equity

+------------------+--------+---------+---------------+----------------+----------------+

| | | Attributable to equity holders of |

| | | the parent |

+------------------+--------+-----------------------------------------------------------+

| | Notes | Share | Other | Profit | Total |

| | | capital | reserves | and | equity |

| | | GBPm* | GBPm* | loss | GBPm* |

| | | | | GBPm* | |

+------------------+--------+---------+---------------+----------------+----------------+

| Balance | | 4.7 | 40.6 | 51.5 | 96.8 |

| at 1 | | | | | |

| January | | | | | |

| 2010 | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| Profit | | - | - | 12.4 | 12.4 |

| for | | | | | |

| the | | | | | |

| period | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| Other | | | | | |

| comprehensive | | | | | |

| income: | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | - | (4.5) | (4.5) |

| Actuarial | | | | | |

| loss on | | | | | |

| employee | | | | | |

| benefit | | | | | |

| schemes - | | | | | |

| net of | | | | | |

| tax | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | 1.8 | - | 1.8 |

| Foreign | | | | | |

| exchange | | | | | |

| differences | | | | | |

| on | | | | | |

| retranslation | | | | | |

| of foreign | | | | | |

| operations | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | (2.0) | - | (2.0) |

| Foreign | | | | | |

| currency | | | | | |

| hedge - | | | | | |

| net of | | | | | |

| tax | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| Total | | - | (0.2) | 7.9 | 7.7 |

| comprehensive | | | | | |

| (expense)/income | | | | | |

| for the period | | | | | |

| ended 30 June | | | | | |

| 2010 | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| Transactions | | | | | |

| with owners: | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | 1.5 | - | 1.5 |

| ESOP | | | | | |

| shares | | | | | |

| utilised | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | 0.2 | (0.1) | 0.1 |

| Share-based | | | | | |

| payments | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | 7 | - | - | (5.1) | (5.1) |

| Dividend | | | | | |

| paid | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

| | | - | 1.7 | (5.2) | (3.5) |

+------------------+--------+---------+---------------+----------------+----------------+

| Balance | | 4.7 | 42.1 | 54.2 | |

| at 30 | | | | | 101.0 |

| June | | | | | |

| 2010 | | | | | |

+------------------+--------+---------+---------------+----------------+----------------+

+---------------+--------+---------+---------------+----------------+----------------+

| | | Attributable to equity holders of |

| | | the parent |

+---------------+--------+-----------------------------------------------------------+

| | Notes | Share | Other | Profit | Total |

| | | capital | reserves | and | equity |

| | | GBPm* | GBPm* | loss | GBPm* |

| | | | | GBPm* | |

+---------------+--------+---------+---------------+----------------+----------------+

| Balance | | 4.7 | 43.7 | 54.0 | |

| at 1 | | | | | 102.4 |

| January | | | | | |

| 2009 | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| Profit | | - | - | 7.9 | 7.9 |

| for | | | | | |

| the | | | | | |

| period | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| Other | | | | | |

| comprehensive | | | | | |

| income: | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | - | (11.1) | (11.1) |

| Actuarial | | | | | |

| loss on | | | | | |

| employee | | | | | |

| benefit | | | | | |

| schemes - | | | | | |

| net of | | | | | |

| tax | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | (6.0) | - | (6.0) |

| Foreign | | | | | |

| exchange | | | | | |

| differences | | | | | |

| on | | | | | |

| retranslation | | | | | |

| of foreign | | | | | |

| operations | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | 2.1 | - | |

| Foreign | | | | | 2.1 |

| currency | | | | | |

| hedge - | | | | | |

| net of | | | | | |

| tax | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| Total | | - | (3.9) | (3.2) | (7.1) |

| comprehensive | | | | | |

| expense for | | | | | |

| the period | | | | | |

| ended 30 June | | | | | |

| 2009 | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| Transactions | | | | | |

| with owners: | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | (5.0) | - | (5.0) |

| ESOP | | | | | |

| shares | | | | | |

| acquired | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | 5.0 | - | |

| ESOP | | | | | 5.0 |

| shares | | | | | |

| utilised | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | - | 0.3 | |

| Profit | | | | | 0.3 |

| on | | | | | |

| ESOP | | | | | |

| shares | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | 0.8 | - | |

| Share-based | | | | | 0.8 |

| payments | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | 7 | - | - | (4.9) | (4.9) |

| Dividend | | | | | |

| paid | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

| | | - | 0.8 | (4.6) | |

| | | | | | (3.8) |

+---------------+--------+---------+---------------+----------------+----------------+

| Balance | | 4.7 | 40.6 | 46.2 | |

| at 30 | | | | | 91.5 |

| June | | | | | |

| 2009 | | | | | |

+---------------+--------+---------+---------------+----------------+----------------+

* Unaudited

Consolidated cash flow statement

For the half year to 30 June

+---------------------+--------+--------+---------+

| | Notes | 2010 | 2009 |

| | | GBPm* | GBPm* |

+---------------------+--------+--------+---------+

| Cash | | | |

| flows | | | |

| from | | | |

| operating | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Profit | | 16.7 | 11.2 |

| before | | | |

| tax | | | |

+---------------------+--------+--------+---------+

| Adjustments | | | |

| for: | | | |

+---------------------+--------+--------+---------+

| | | (2.3) | 1.3 |

| Foreign | | | |

| exchange | | | |

| differences | | | |

+---------------------+--------+--------+---------+

| | | 1.5 | 1.5 |

| Depreciation | | | |

| and | | | |

| impairment | | | |

| of property, | | | |

| plant and | | | |

| equipment | | | |

+---------------------+--------+--------+---------+

| | | 0.4 | 0.1 |

| Share-based | | | |

| payment | | | |

| expense | | | |

+---------------------+--------+--------+---------+

| | | 0.1 | |

| Share | | | - |

| of | | | |

| losses | | | |

| of | | | |

| associates | | | |

| and joint | | | |

| ventures | | | |

+---------------------+--------+--------+---------+

| | | (0.3) | (0.2) |

| Difference | | | |

| between | | | |

| ordinary | | | |

| pension | | | |

| contributions | | | |

| paid | | | |

| and | | | |

| amount | | | |

| recognised in | | | |

| the income | | | |

| statement | | | |

+---------------------+--------+--------+---------+

| | | (0.2) | (0.7) |

| Finance | | | |

| revenue | | | |

+---------------------+--------+--------+---------+

| | | (0.1) | |

| Other | | | - |

| finance | | | |

| revenue | | | |

| - | | | |

| pensions | | | |

+---------------------+--------+--------+---------+

| | | 2.3 | 1.1 |

| Finance | | | |

| costs | | | |

+---------------------+--------+--------+---------+

| | | (7.8) | 19.5 |

| (Increase)/decrease | | | |

| in trade and other | | | |

| receivables | | | |

+---------------------+--------+--------+---------+

| | | (12.9) | (64.1) |

| Change | | | |

| in | | | |

| bonus | | | |

| accrual | | | |

+---------------------+--------+--------+---------+

| | | (3.6) | (1.2) |

| Decrease | | | |

| in trade | | | |

| and | | | |

| other | | | |

| payables | | | |

+---------------------+--------+--------+---------+

| | | 0.1 | 0.1 |

| Increase | | | |

| in | | | |

| provisions | | | |

+---------------------+--------+--------+---------+

| Cash | | (6.1) | (31.4) |

| utilised | | | |

| from | | | |

| operations | | | |

+---------------------+--------+--------+---------+

| Income | | (1.3) | (8.2) |

| tax | | | |

| paid | | | |

+---------------------+--------+--------+---------+

| Net | | (7.4) | (39.6) |

| cash | | | |

| flow | | | |

| from | | | |

| operating | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Cash | | | |

| flows | | | |

| from | | | |

| investing | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Interest | | 0.2 | 0.4 |

| received | | | |

+---------------------+--------+--------+---------+

| Purchase | | (0.4) | (0.5) |

| of | | | |

| property, | | | |

| plant and | | | |

| equipment | | | |

+---------------------+--------+--------+---------+

| Dividends | | 0.1 | - |

| received | | | |

| from | | | |

| associates | | | |

| and joint | | | |

| ventures | | | |

+---------------------+--------+--------+---------+

| Net | | (0.1) | (0.1) |

| cash | | | |

| flow | | | |

| from | | | |

| investing | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Cash | | | |

| flows | | | |

| from | | | |

| financing | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Interest | | (0.8) | (1.1) |

| paid | | | |

+---------------------+--------+--------+---------+

| Dividend | 7 | (5.1) | (4.9) |

| paid | | | |

+---------------------+--------+--------+---------+

| Repayments | | - | (1.8) |

| of | | | |

| borrowings | | | |

+---------------------+--------+--------+---------+

| ESOP | | - | (5.0) |

| shares | | | |

| acquired | | | |

+---------------------+--------+--------+---------+

| Net | | (5.9) | (12.8) |

| cash | | | |

| flow | | | |

| from | | | |

| financing | | | |

| activities | | | |

+---------------------+--------+--------+---------+

| Net | | (13.4) | (52.5) |

| decrease | | | |

| in cash | | | |

| and cash | | | |

| equivalents | | | |

+---------------------+--------+--------+---------+

| Cash | | 143.2 | 184.4 |

| and | | | |

| cash | | | |

| equivalents | | | |

| at start of | | | |

| period | | | |

+---------------------+--------+--------+---------+

| Net | | 3.1 | (9.2) |

| foreign | | | |

| exchange | | | |

| differences | | | |

+---------------------+--------+--------+---------+

| Cash | | 132.9 | 122.7 |

| and | | | |

| cash | | | |

| equivalents | | | |

| at end of | | | |

| period | | | |

+---------------------+--------+--------+---------+

* Unaudited

Notes to the interim financial statements

1 Corporate information

The interim consolidated financial statements of the group for the period ended

30 June 2010 were authorised for issue in accordance with a resolution of the

directors on 25 August 2010. Clarkson PLC is a Public Limited Company

registered in England and Wales.

The interim consolidated financial statements do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006, and should be read

in conjunction with the 2009 annual financial statements. The statutory audited

accounts for the year ended 31 December 2009 have been delivered to the

Registrar of Companies in England and Wales. The Auditors' report on those

accounts was unqualified and did not contain statements under Section 498 of the

Companies Act 2006.

Copies of the interim financial statements will be circulated to all

shareholders and will be available from the registered office of the company at

St. Magnus House, 3 Lower Thames Street, London EC3R 6HE and also on

www.clarksons.com.

2 Statement of accounting policies

2.1 Basis of preparation

The interim consolidated financial statements for the period ended 30 June 2010

have been prepared in accordance with the Disclosure and Transparency Rules of

the Financial Services Authority and with IAS 34 Interim Financial Reporting as

adopted by the European Union.

The interim consolidated financial statements do not include all the information

and disclosures required in the annual financial statements, and should be read

in conjunction with the group's annual financial statements for the year ended

31 December 2009, which were prepared in accordance with IFRSs as adopted by the

European Union.

2.2 Accounting policies

The accounting policies adopted in the preparation of the interim consolidated

financial statements are consistent with those followed in the preparation of

the group's annual financial statements for the year ended 31 December 2009.

The following new standards and amendments to standards are mandatory for the

first time for the financial year beginning 1 January 2010.

· IFRS 3 (revised), 'Business combinations', and consequential amendments

to IAS 27, 'Consolidated and separate financial statements', IAS 28,

'Investments in associates', and IAS 31, 'Interests in joint ventures', are

effective prospectively to business combinations for which the acquisition date

is on or after the beginning of the first annual reporting period beginning on

or after 1 July 2009.

IFRS 3 (revised) continues to apply the acquisition

method to business combinations, but with some significant changes. For example,

the change in the treatment of acquisition-related expenses discussed in the

basis of preparation section, and any revisions to contingent cash consideration

in the period following the acquisition will be recorded in the income

statement.

· IAS 27 (revised), 'Consolidated and separate financial statements'

requires the effects of all transactions with non-controlling interests to be

recorded in equity if there is no change in control. Such transactions will no

longer result in either goodwill or in a gain or a loss being recognised. The

standard also specifies the accounting when control is lost. Any remaining

interest in the entity is re-measured to fair value, and a gain or loss is

recognised in the income statement.

The following new standards, amendments to standards and interpretations are

mandatory for the first time for the financial year beginning 1 January 2010,

but are not currently relevant for the group or have not had a material impact

on the group.

· IFRS 1 (amended), 'Additional Exemptions for First-time Adopters'.

· IFRS 2 (amendments), 'Group Cash-settled Share-based payment

transactions'.

· IFRS 5 (amendment), 'Non-current assets Held for Sale and Discontinued

Operations'.

· IAS 38 (amendment), 'Intangible Assets'.

· IAS 39 (amended), 'Financial Instruments: Recognition and Measurement -

Eligible hedged items'.

· IAS 39 (amended), 'Financial Instruments: Recognition and Measurement'.

· IFRIC 9 (amended), 'Reassessment of Embedded Derivatives'.

· IFRIC 17, 'Distributions of non-cash assets to owners'.

· IFRIC 18, 'Transfers of assets from customers'.

· Improvements to International Financial Reporting Standards 2009.

The following new standards, amendments to standards and interpretations have

been issued, but are not effective for the financial year beginning 1 January

2010 and have not been early adopted:

· IFRS 1 (amended), 'Limited Exemption from Comparative IFRS 7 Disclosures

for First-time Adopters'.

· IFRS 9, 'Financial instruments'.

· IAS 24 (revised), 'Related party disclosures'.

· IAS 32 (amendment), 'Financial Instruments: Presentation - Classification

of Rights Issues'.

· IFRIC 14 (amended), 'Prepayments of a Minimum Funding requirement'.

· IFRIC 19, 'Extinguishing Financial Liabilities with Equity Instruments'.

· Improvements to International Financial Reporting Standards 2010.

The group is yet to assess the full impact of IFRS 9, and has not yet decided

when to adopt this standard, which is not mandatory until January 2013. The

directors anticipate that the future adoption of all the other standards,

interpretations and amendments listed above will not have a material impact on

the group's financial statements.

3 Segmental information

For the half year to 30 June

+-----------------+--------+---------+---------+---------+

| | | Revenue | | Results |

+-----------------+--------+---------+---------+---------+

| Continuing | 2010 | 2009 | 2010 | 2009 |

| operations | GBPm | GBPm | GBPm | GBPm |

+-----------------+--------+---------+---------+---------+

| Broking | 83.5 | 70.7 | 20.6 | 14.4 |

+-----------------+--------+---------+---------+---------+

| Financial | 5.5 | 7.4 | (1.8) | (1.0) |

+-----------------+--------+---------+---------+---------+

| Support | 10.1 | 8.9 | 0.7 | 0.3 |

+-----------------+--------+---------+---------+---------+

| Research | 3.4 | 3.3 | 0.8 | 0.8 |

+-----------------+--------+---------+---------+---------+

| | 102.5 | 90.3 | | |

+-----------------+--------+---------+---------+---------+

| Less | (1.5) | (1.4) | | |

| property | | | | |

| services | | | | |

| revenue | | | | |

| arising | | | | |

| within | | | | |

| the | | | | |

| group | | | | |

+-----------------+--------+---------+---------+---------+

| Segment | 101.0 | 88.9 | 20.3 | 14.5 |

| revenue/results | | | | |

+-----------------+--------+---------+---------+---------+

| Head | | | (1.5) | (2.2) |

| office | | | | |

| costs | | | | |

+-----------------+--------+---------+---------+---------+

| Unallocated | | | - | (0.7) |

| foreign | | | | |

| exchange | | | | |

| differences | | | | |

+-----------------+--------+---------+---------+---------+

| Operating | | | 18.8 | 11.6 |

| profit | | | | |

+-----------------+--------+---------+---------+---------+

| Share | | | (0.1) | - |

| of | | | | |

| losses | | | | |

| of | | | | |

| associates | | | | |

| and joint | | | | |

| ventures | | | | |

+-----------------+--------+---------+---------+---------+

| Finance | | | 0.2 | 0.7 |

| revenue | | | | |

+-----------------+--------+---------+---------+---------+

| Finance | | | (2.3) | (1.1) |

| costs | | | | |

+-----------------+--------+---------+---------+---------+

| Other | | | 0.1 | - |

| finance | | | | |

| revenue | | | | |

| - | | | | |

| pensions | | | | |

+-----------------+--------+---------+---------+---------+

| Profit | | | 16.7 | 11.2 |

| before | | | | |

| taxation | | | | |

+-----------------+--------+---------+---------+---------+

| Taxation | | | (4.3) | (3.3) |

+-----------------+--------+---------+---------+---------+

| Profit | | | 12.4 | 7.9 |

| after | | | | |

| taxation | | | | |

+-----------------+--------+---------+---------+---------+

The share of losses of associates and joint ventures is as follows:

+---------+--------+--------+

| | 2010 | 2009 |

| | GBPm | GBPm |

+---------+--------+--------+

| Broking | (0.1) | - |

+---------+--------+--------+

4 Finance revenue and finance costs

For the half year to 30 June

+---------------------------------------------------------+--------+--------+

| | 2010 | 2009 |

| | GBPm | GBPm |

+---------------------------------------------------------+--------+--------+

| Finance revenue | | |

+---------------------------------------------------------+--------+--------+

| Bank interest receivable | 0.2 | 0.4 |

+---------------------------------------------------------+--------+--------+

| Gain on revaluation of fair value through profit or | - | 0.3 |

| loss investment | | |

+---------------------------------------------------------+--------+--------+

| | 0.2 | 0.7 |

+---------------------------------------------------------+--------+--------+

| | | |

+---------------------------------------------------------+--------+--------+

| Finance costs | | |

+---------------------------------------------------------+--------+--------+

| Interest-bearing loans and borrowings | 0.8 | 1.1 |

+---------------------------------------------------------+--------+--------+

| Loss on revaluation of fair value through profit or | 1.5 | - |

| loss investment | | |

+---------------------------------------------------------+--------+--------+

| | 2.3 | 1.1 |

+---------------------------------------------------------+--------+--------+

5 Taxation

Income tax expense is recognised based on management's best estimate of the

weighted average annual income tax rate expected for the full financial year.

The estimated average annual tax rate used for the year to 31 December 2010 is

25.8% (the estimated tax rate for the six months ended 30 June 2009 was 29.5%).

6 Earnings per share

Basic earnings per share amounts are calculated by dividing net profit for the

period attributable to ordinary equity holders of the parent by the weighted

average number of ordinary shares in issue during the period.

Diluted earnings per share amounts are calculated by dividing the net profit

attributable to ordinary equity holders of the parent by the weighted average

number of ordinary shares in issue during the period, plus the weighted average

number of ordinary shares that would be issued on the conversion of all the

dilutive potential ordinary shares into ordinary shares.

The following reflects the income and share data used in the basic and diluted

earnings per share computations:

+--------------+---------+---------+

| | Half | Half |

| | year | year |

| | to 30 | to 30 |

| | June | June |

| | 2010 | 2009 |

| | GBPm | GBPm |

+--------------+---------+---------+

| Earnings | 12.4 | 7.9 |

| | | |

+--------------+---------+---------+

| | | |

+--------------+---------+---------+

| | Million | Million |

+--------------+---------+---------+

| Weighted | 18.6 | 18.6 |

| average | | |

| number | | |

| of | | |

| ordinary | | |

| shares | | |

+--------------+---------+---------+

| Dilutive | - | 0.3 |

| effect | | |

| of | | |

| shares | | |

| contingently | | |

| payable on | | |

| business | | |

| combinations | | |

+--------------+---------+---------+

| Diluted | 18.6 | 18.9 |

| weighted | | |

| average | | |

| number | | |

| of | | |

| ordinary | | |

| shares | | |

+--------------+---------+---------+

7 Dividends

For the half year to 30 June

+------------+--------+--------+

| | 2010 | 2009 |

| | GBPm | GBPm |

+------------+--------+--------+

| Declared | | |

| and paid | | |

| during | | |

| the | | |

| period: | | |

+------------+--------+--------+

| Final | 5.1 | 4.9 |

| dividend | | |

| for 2009 | | |

| of 27p | | |

| per | | |

| share | | |

| (2008: | | |

| 26p per | | |

| share) | | |

+------------+--------+--------+

| Payable | | |

| (not | | |

| recognised | | |

| as a | | |

| liability | | |

| at period | | |

| end): | | |

+------------+--------+--------+

| Interim | 3.2 | 3.0 |

| dividend | | |

| for 2010 | | |

| of 17p | | |

| per | | |

| share | | |

| (2009: | | |

| 16p per | | |

| share) | | |

+------------+--------+--------+

8 Employee benefits

The group operates two defined benefit pension schemes being the Clarkson PLC

scheme and the Plowrights scheme.

As at 30 June 2010 the Clarkson PLC scheme had a deficit of GBP9.5m (31 December

2009: GBP4.2m deficit). This amount is included in full on the balance sheet as

a non-current liability; the company has recognised deferred tax on this deficit

amounting to GBP2.7m (31 December 2009: GBP1.2m). The market value of the

assets was GBP95.9m (31 December 2009: GBP98.0m) and independent actuaries have

assessed the present value of funded obligations at GBP105.4m (31 December 2009:

GBP102.2m).

Also as at 30 June 2010 the Plowrights scheme had a deficit of GBP3.3m (31

December 2009: GBP2.7m deficit). This amount is included in full on the balance

sheet as a non-current liability; the company has recognised deferred tax on

this deficit amounting to GBP0.9m (31 December 2009: GBP0.7m). The market value

of the assets was GBP23.9m (31 December 2009: GBP23.6m) and independent

actuaries have assessed the present value of funded obligations at GBP27.2m (31

December 2009: GBP26.3m).

The increase in the deficit is due to changes in the actuarial assumptions used

for inflation and the discount rate used in calculating the figures above. This

has been further affected by a decrease in the market value of the plans'

assets.

Triennial valuations for both schemes are being prepared based on the position

as at 31 March 2010.

9 Analysis of net funds

+------------------+----------+--------+-------------+--------+

| | 31 | Cash | Foreign | 30 |

| | December | flow | exchange | June |

| | 2009 | GBPm | differences | 2010 |

| | GBPm | | GBPm | GBPm |

+------------------+----------+--------+-------------+--------+

| Cash | 143.2 | (13.4) | 3.1 | 132.9 |

| and | | | | |

| short-term | | | | |

| deposits | | | | |

+------------------+----------+--------+-------------+--------+

| Non-current | (48.3) | - | (0.9) | (49.2) |

| interest-bearing | | | | |

| loans and | | | | |

| borrowings | | | | |

+------------------+----------+--------+-------------+--------+

| Net | 94.9 | (13.4) | 2.2 | 83.7 |

| funds | | | | |

+------------------+----------+--------+-------------+--------+

Net funds after deduction of bonus entitlements amount to GBP42.1m (31 December

2009: GBP38.2m).

10 Issued share capital

+-----------+---------+---------+----------+--------+--------+----------+

| Allotted, | 30 | 30 | 31 | 30 | 30 | 31 |

| issued | June | June | December | June | June | December |

| and fully | 2010 | 2009 | 2009 | 2010 | 2009 | 2009 |

| paid | Million | Million | Million | GBPm | GBPm | GBPm |

+-----------+---------+---------+----------+--------+--------+----------+

| Ordinary | | | | | | |

| shares | | | | | | |

| of 25 | | | | | | |

| pence | | | | | | |

| each: | | | | | | |

+-----------+---------+---------+----------+--------+--------+----------+

| At | 19.0 | 18.9 | 18.9 | 4.7 | 4.7 | 4.7 |

| start | | | | | | |

| of | | | | | | |

| period | | | | | | |

+-----------+---------+---------+----------+--------+--------+----------+

| Issued | - | - | 0.1 | - | - | - |

| during | | | | | | |

| the | | | | | | |

| period | | | | | | |

+-----------+---------+---------+----------+--------+--------+----------+

| At end | 19.0 | 18.9 | 19.0 | 4.7 | 4.7 | 4.7 |

| of | | | | | | |

| period | | | | | | |

+-----------+---------+---------+----------+--------+--------+----------+

11 Contingencies

From time to time the group may be engaged in litigation in the ordinary course

of business. The group carries professional indemnity insurance. There are

currently no liabilities expected to have a material adverse financial impact on

the group's consolidated results or net assets.

Since June 2006, H Clarkson & Company Limited received commissions amounting to

US$15.5m which were the subject of the claims brought against the company by the

Russian companies, Sovcomflot and Novoship. H Clarkson & Company Limited held

those monies in separate designated accounts pending determination as to who was

entitled to receive them. It became clear to the board that these monies were

rightfully payable to the Claimants and thus, as part of the settlement agreed

with the Claimants on 26 June 2008, they were released to their account. There

remain Part 20 Claims from two of the defendants that these monies are

rightfully theirs. In June 2009 a further claim was received from entities

associated with one of the defendants amounting to US$5.2m. The trial of these

claims finished on 31 March 2010 and we are waiting to receive judgment. After

taking extensive legal advice and closely reviewing the evidence the board

believes that none of the claims have any foundation whatsoever and that they

will not succeed.

12 Seasonality

The group's activities are not subject to significant seasonal variation.

13 Principal risks and uncertainties

The directors consider that the nature of the principal risks and uncertainties

which may have a material effect on the group's performance in the second half

of the year is unchanged from those identified in the Risk Management section of

the Annual Report 2009 on page 19. These include credit risk, in the form of

non-payment of invoices; liquidity risk arising from funding requirements;

foreign exchange risk from fluctuations in the US dollar to sterling exchange

rate; exposures to interest rate movements; reputational risk; and operational

risk giving rise to losses from people, systems, external influences or failed

processes.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZMGZRNDMGGZM

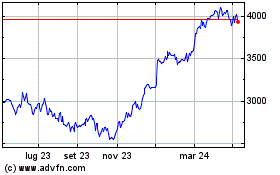

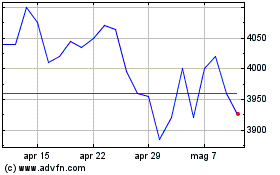

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Ott 2023 a Ott 2024