TIDMEME

RNS Number : 1640X

Empyrean Energy PLC

18 December 2023

Empyrean Energy PLC / Index: AIM / Epic: EME / Sector: Oil &

Gas

18 December 2023

Empyrean Energy PLC ("Empyrean" or the "Company")

Interim Results

Empyrean Energy (EME: AIM), the oil and gas development company

with interests in China, Indonesia and the United States, is

pleased to provide its Interim Report for the six months ended 30

September 2023.

Highlights

Reporting period

Block 29/11, Pearl River Mouth Basin, China (EME 100%)

-- Joint regional oil migration study with CNOOC team conducted

to map oil migration from the proven source rock south-west of

Block 29/11 that charges the four CNOOC oil discoveries

(immediately west of Block 29/11 and Topaz) and extends this into

Block 29/11 to map these potential migration pathways to Topaz.

Comprehensive study also included potential migration pathways from

a new source/kitchen identified by Empyrean 3D data.

-- Simultaneous 3D seismic inversion project being conducted in

two phases to firstly assess whether light oil pay in the target

reservoir can be discriminated from a water bearing reservoir by

seismic inversion and secondly to invert the entire 3D seismic data

to generate several datasets for the elastic properties. These

datasets will be analysed for high grading the Topaz prospect.

-- Drill Preparation of the Topaz prospect is ongoing such that

should funding become available, operations can commence within the

favourable weather window.

Duyung PSC Project, Indonesia (EME 8.5%)

-- Key Terms agreed for Long-Term Gas Sales Agreement between

Conrad subsidiary, WNEL, operator of the Duyung PSC, and Sembcorp

Gas Pte Ltd. The parties are in the process of finalising a

definitive gas sales agreement

-- Conrad engaged a global investment bank to lead a farm-down

process for the divestment of a portion of its interest in the

Duyung Production Sharing Contract. Bids are expected to be

received by the end of CY 2023.

-- Mako is one of the largest gas discoveries in the West Natuna

Sea and the largest undeveloped resource in the area.

Corporate

-- Placement to raise US$1.88 million (GBP1.52 million) completed in May 2023.

-- Convertible Loan Note Debt restructured to reduce face value

of the note and secure extended moratorium on interest.

For further information please visit www.empyreanenergy.com or

contact the following:

Empyrean Energy plc

Tom Kelly Tel: +61 8 6146 5325

Cavendish Capital Markets Limited (Nominated Advisor and

Broker)

Neil McDonald Tel: +44 (0) 20 7397

8900

Pearl Kellie

First Equity Limited (Joint Broker)

Jason Robertson Tel: +44 (0) 20 7330

1883

Chairman's Statement

In China, planning and further de-risking work is currently

being finalised with the aim to ultimately drill the Topaz prospect

in 2024. These activities, largely focused on oil migration into

Topaz, are expected to be completed in the immediate future.

In Indonesia, Empyrean was very pleased to see agreement reached

between the operator of Mako and a major gas utility in September

and also that the agreement was endorsed by the Government of

Indonesia's petroleum upstream regulator. The focus of the parties

is now on converting this significant milestone into a binding gas

sales agreement.

The existing terms reached will be welcomed by those parties

currently participating in the sell down process to fund the

development of the Mako gas field and Empyrean expects an update

shortly on this process. The macro environment for gas in

South-East Asia, and Singapore in particular, is expected to

continue trending favourably with the region transitioning from

coal to gas as the preferred energy source.

On the corporate front, the Company successfully raised funds in

May and was pleased to renegotiate the Convertible Note at the same

time. The Company continues to assess other financing and strategic

alternatives to provide it with additional working capital as and

when required, including through the sale or partial sale of

existing assets, through joint ventures of existing assets, as well

as further equity funding.

I would like to thank the Board, management and staff for their

perseverance during the year and we all now eagerly await good news

from Indonesia before our attention turns to the targeted drilling

of the Topaz Prospect in China.

Patrick Cross

Non-Executive Chairman

18 December 2023

Operational Review

China Block 29/11 Project (100% WI)

Background

Block 29/11 is located in the prolific Pearl River Mouth Basin,

offshore China approximately 200km Southeast of Hong Kong. The

acquisition of this block heralded a new phase for Empyrean when it

became an operator with 100% of the exploration rights of the

permit during the exploration phase of the project. In the event of

a commercial discovery, CNOOC will have a back in right to 51% of

the permit.

Jade Prospect Drill Program

In April 2022, the Company commenced the drilling of the LH

17-2-1 well to test the first of the three prospects noted above,

the Jade Prospect in Block 29/11, offshore China.

On 10 April 2022 LH 17-2-1 spudded and on 27 April 2022 reached

final total depth of 2,849 metres in Zhuhai Sandstone formation.

The interpretation from LWD and mud logging data indicated no oil

pay in the target reservoir which was confirmed by wireline logs.

The Company successfully operated an offshore exploration and

drilling program without any operational or environmental

issues.

Post Jade Well Analysis and Implications for Topaz Prospect

Following the Jade drilling program, comprehensive post well

analysis by Empyrean and CNOOC confirmed the Jade well intersected

carbonate reservoir as prognosed with better parameters than

pre-drill estimates with total thickness of 292m and porosity in

the range of 25 to 27%. In addition, the Jade well penetrated thick

and effective regional seal facies and the reservoir top was

encountered within the depth conversion range. These parameters

have now been more confidently mapped across Empyrean's 3D data

set.

The Jade well failed due to lack of access to effective

migration pathways. Given oil migration to the Topaz Prospect is

now identified as the key risk, the Company's pre drill exploration

efforts are focusing on mitigating this risk. Reservoir, seal and

trap validity of the Topaz prospect have been enhanced by the Jade

well data.

Entering of Second Phase of Exploration

Being able to combine excellent quality 3D seismic data with the

confirmed well data and post well analysis has resulted in the

improved validity of the Topaz prospect as a robust and large

drilling target (approximately 891 million barrels in place (P10)

per below table). Based on post drill technical evaluation, and

CNOOC-assisted migration pathways assessment, Empyrean decided to

enter the second phase of exploration and drill the larger Topaz

prospect, which is targeted to occur in 2024.

Block 29/11 Oil in place (MMbbl) audited by GCA

Prospect P90 P50 P10 Mean GCoS

Topaz 211 434 891 506 30%

---- ---- ---- ----- -----

Pearl 38 121 302 153 15%

---- ---- ---- ----- -----

Current Activities

Empyrean is conducting two further key technical projects that

capitalise on the excellent quality 3D seismic acquired by the

Company over the permit, shared regional 3D seismic that CNOOC has

and additional physical well data of both Empyrean and CNOOC.

These projects are designed to help address and mitigate the

remaining primary geological risk at Topaz - oil migration into the

Topaz trap.

Firstly, joint with CNOOC, Empyrean is completing a regional oil

migration study. CNOOC bring excellence in basin modelling

expertise along with crucial regional data that augments the data

Empyrean has on Block 29/11. The regional data includes

temperature, pressure, timing of oil maturation, and successful oil

migration pathway mapping. The project will map oil migration from

the proven source rock south west of Block 29/11 that charges the

four CNOOC oil discoveries (immediately west of Block 29/11 and

Topaz) and extend this into Block 29/11 and map these migration

pathways to Topaz.

In addition, similar work will be conducted from a new

source/kitchen located entirely within Block 29/11 and oil

migration pathways will be mapped to Topaz. This project is

expected to be completed in the immediate future.

Secondly, Empyrean is conducting a 3D simultaneous seismic

inversion project focussing on Topaz. This project is utilising the

oil properties, reservoir temperature, reservoir pressure and water

salinity data from CNOOC oil discovery wells combined with

reservoir porosity and mineralogical data from Empyrean well logs

and core to maximise the effectiveness of the inversion project

outcomes.

This project is being conducted in two phases. The aim of Phase

I is to assess whether an oil bearing reservoir case can be

distinguished from water bearing reservoir in the elastic property

domain of seismic inversion. Phase 2 involves inverting the entire

3D seismic data and will generate several datasets for the elastic

properties. These datasets will be analysed for high grading the

Topaz prospect.

The 3D seismic inversion project is expected to be completed in

the immediate future.

Cautionary Statement: The volumes presented in this announcement

are STOIIP estimates only. A recovery factor needs to be applied to

the undiscovered STOIIP estimates based on the application of a

future development project. The subsequent estimates, post the

application of a recovery factor, will have both an associated risk

of discovery and a risk of development. Further exploration,

appraisal and evaluation is required to determine the existence of

a significant quantity of potentially movable hydrocarbons.

Duyung PSC, Indonesia (8.5% WI)

Background

In April 2017, Empyrean acquired a 10% shareholding in WNEL from

Conrad Petroleum (now Conrad Asia Energy Ltd), which held a 100%

Participating Interest in the Duyung Production Sharing Contract ("

Duyung PSC") in offshore Indonesia and is the operator of the

Duyung PSC. The Duyung PSC covers an offshore permit of

approximately 1,100km2 in the prolific West Natuna Basin. The main

asset in the permit is the Mako shallow gas field that was

discovered in 2017, and comprehensively appraised in 2019.

In early 2019, both the operator, Conrad, and Empyrean divested

part of their interest in the Duyung PSC to AIM-listed Coro Energy

Plc. Following the transaction, Empyrean's interest reduced from

10% to 8.5% interest in May 2020, having received cash and shares

from Coro.

During October and November 2019, a highly successful appraisal

drilling campaign was conducted in the Duyung PSC. The appraisal

wells confirmed the field-wide presence of excellent quality gas in

the intra-Muda reservoir sands of the Mako Gas Field.

Revised Plan of Development

In September 2022, Empyrean announced that the partners in the

Duyung PSC have approved the revised PoD and have secured alignment

with SKK Migas on the plan. The PoD was then submitted to the

Indonesian Ministry of Energy and Mineral Resources for approval,

which was duly received in November 2022, marking a major milestone

on the pathway to developing this significant pipeline quality

methane gas resource. This allowed the operator Conrad to focus on

its stated objective of working with the Government of Indonesia to

complete GSA negotiations at the earliest opportunity.

The revised Mako PoD is based on field Contingent Resources of

297 billion cubic feet (net attributable to 100% of the Duyung PSC

Joint Venture) and a daily production of 120 MMscf/d, consistent

with the GCA competent persons report dated 26 August 2022, details

of which were also announced by the Company on 9 September 2022.

The Mako Gas Project resource is currently the largest undeveloped

gas field in South Natuna Sea.

Current Activities

In September 2023 Empyrean announced that Conrads wholly owned

subsidiary, West Natuna Exploration Ltd ("WNEL") has signed

non-binding key terms with Sembcorp Gas Pte Ltd, a Singapore based

major gas buyer, that have been endorsed by SKK Migas - the

petroleum upstream regulator in Indonesia ("SKK Migas"), for a

first long-term gas sales agreement for the Mako gas field. The

Terms Agreement for the supply of gas from the Natuna Sea underpins

the commercial development of the Mako gas field providing secure

and reliable gas that is less carbon intensive than LNG. The key

terms relate to approved gas production from Mako commencing in

2025 until the end of the Duyung PSC in 2037 for a total sales gas

volume (100%) of c 293 Bcf with potential to increase to c 392 Bcf

(100%). Gas sales will be priced against Brent oil.

The joint venture is now focused on finalising a gas sales

agreement.

Conrad continues to advance the sell down process with a global

investment bank in order to fund the development of Mako. Bids are

expected to be received by the end of calendar year 2023.

The Mako Gas Field is located close to the West Natuna pipeline

system and gas from the field can be marketed to buyers in both

Indonesia and in Singapore.

Multi Project Farm-in in Sacramento Basin, California (25%-30%

WI)

There were no significant activities conducted during the year

however the Company will continue to work with its joint venture

partners in reviewing and assessing any further technical and

commercial opportunities as they relate to the project.

The information contained in this report was completed and

reviewed by the Company's Executive Director (Technical), Mr

Gajendra (Gaz) Bisht, who has over 34 years' experience as a

petroleum geoscientist.

Definitions

2C: Contingent resources are quantities of petroleum estimated,

as of a given date, to be potentially recoverable from known

accumulations by application of development projects, but which are

not currently considered to be commercially recoverable. The range

of uncertainty is expressed as 1C (low), 2C (best) and 3C

(high).

Bcf: Billions of cubic feet

MMbbl : Million Barrels of Oil

*Cautionary Statement: The estimated quantities of oil that may

potentially be recovered by the application of a future development

project relates to undiscovered accumulations. These estimates have

both an associated risk of discovery and a risk of development.

Further exploration, appraisal and evaluation is required to

determine the existence of a significant quantity of potentially

movable hydrocarbons.

Gajendra (Gaz) Bisht M.Sc. (Tech) in Applied Geology

Executive Director (Technical)

18 December 2023

Statement of Comprehensive Income

For the Period Ended 30 September 2023

Year

Ended

6 Months to 30 31 March

September (unaudited) (audited)

-----------

2023 2022 2023

Notes US$'000 US$'000 US$'000

Revenue - - -

----------- ------------ -----------

Administrative expenditure

Administrative expenses (233) (201) (382)

Compliance fees (76) (121) (263)

Directors' remuneration (197) (186) (362)

Foreign exchange differences 52 388 197

Impairment - exploration and

evaluation assets 3 (2) (22,097) (17,030)

Total administrative expenditure (456) (22,217) (17,840)

Operating loss (456) (22,217) (17,840)

Finance income/(expense) 20 (1,888) (2,955)

Loss from continuing operations

before taxation (436) (24,105) (20,795)

Tax expense in current period (1) (1) (1)

----------- ------------ -----------

Loss from continuing operations

after taxation (437) (24,106) (20,796)

----------- ------------ -----------

Total comprehensive loss

for the year (437) (24,106) (20,796)

=========== ============ ===========

Loss per share from continuing

operations (expressed in cents)

* Basic 2 (0.06)c (3.22)c (2.71)c

* Diluted 2 (0.06)c (3.22)c (2.71)c

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Financial Position

As at 30 September 2023

Year

Ended

6 Months to 30 31 March

September (unaudited) (audited)

-----------

2023 2022 2023

Notes US$'000 US$'000 US$'000

Assets

Non-Current Assets

Exploration and evaluation

assets 3 11,181 4,417 10,635

Total non-current assets 11,181 4,417 10,635

Current Assets

Trade and other receivables 24 50 38

Cash and cash equivalents 636 800 83

------------ ----------- -----------

Total current assets 660 850 121

Liabilities

Current Liabilities

Trade and other payables 2,203 2,160 4,224

Provisions 159 140 159

Convertible loan notes 4 5,621 3,258 4,076

Derivative financial liabilities - 722 -

Total current liabilities 7,983 6,280 8,459

Net Current Liabilities (7,323) (5,430) (8,338)

------------ ----------- -----------

Net Assets/(Liabilities) 3,858 (1,013) 2,297

============ =========== ===========

Shareholders' Equity

Share capital 5 2,664 2,170 2,170

Share premium reserve 46,744 45,319 45,319

Warrant and share based payment

reserve 79 598 73

Retained losses (45,629) (49,100) (45,265)

------------ ----------- -----------

Total Equity 3,858 (1,013) 2,297

============ =========== ===========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Cash Flows

For the Period Ended 30 September 2023

Year Ended

6 Months to 30 31 March

September (unaudited) (audited)

------------------------- -----------

2023 2022 2023

Notes US$'000 US$'000 US$'000

Operating Activities

Payments for operating activities (433) (591) (1,126)

Net cash outflow from operating

activities (433) (591) (1,126)

Investing Activities

P ayments for exploration and

evaluation (860) (1,045) (1,227)

Net cash outflow from investing

activities (860) (1,045) (1,227)

Financing Activities

Issue of ordinary share capital 1,905 2,268 2,268

Proceeds from exercise of warrants - 233 233

Payment of finance costs (29) (8) (8)

Payment of equity issue costs (30) (76) (76)

------------ ----------- -----------

Net cash inflow from financing

activities 1,846 2,417 2,417

Net increase/(decrease) in cash

and cash equivalents 553 781 64

Cash and cash equivalents at

the start of the year 83 19 19

Forex loss on cash held - - -

------------ ----------- -----------

Cash and cash equivalents at

the end of the period 636 800 83

============ =========== ===========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Changes in Equity

For the Period Ended 30 September 2023

Share Share Warrant Retained Total

Capital Premium and SBP Loss Equity

Reserve Reserve

US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 April

2022 1,809 41,285 576 (24,994) 18,676

========= ========= ========= ========= =========

Loss after tax for

the period - - - (24,106) (24,106)

Total comprehensive

loss for the period - - - (24,106) (24,106)

--------- --------- --------- ---------

Contributions by and

distributions to owners

Shares and warrants

issued 307 1,961 - - 2,268

Equity issue costs 49 1,921 - - 1,970

Share-based payment

expense 5 228 - - 233

Share-based payment

expense - - 22 - 22

--------- --------- --------- --------- ---------

Total contributions

by and distributions

to owners 361 4,034 22 - 4,417

--------- --------- --------- --------- ---------

Balance at 30 September

2022 2,170 45,319 598 (49,100) (1,013)

========= ========= ========= ========= =========

Balance at 1 April

2022 1,809 41,285 576 (24,994) 18,676

========= ========= ========= ========= =========

Loss after tax for

the year - - - (20,796) (20,796)

Total comprehensive

loss for the year - - - (20,796) (20,796)

--------- --------- --------- ---------

Contributions by and

distributions to owners

Shares and warrants

issued 307 1,961 - - 2,268

Partial conversion

of convertible note 49 1,921 - - 1,970

Exercise/expiry of

warrants 5 228 (525) 525 233

Equity issue costs - (76) - - (76)

Issue of placement - - - - -

warrants

Share-based payment

expense - - 22 - 22

Total contributions

by and distributions

to owners 361 4,034 (503) 525 4,417

Balance at 1 April

2023 2,170 45,319 73 (45,265) 2,297

========= ========= ========= ========= =========

Loss after tax for

the period - - - (437) (437)

--------- --------- --------- --------- ---------

Total comprehensive

loss for the period - - - (437) (437)

--------- --------- --------- --------- ---------

Contributions by and

distributions to owners

Shares and warrants

issued 483 1,450 - - 1,934

Exercise/expiry of

warrants - - (73) 73 -

Equity issue costs - (58) - - (58)

Share-based payment

expense 11 33 79 - 123

Total contributions

by and distributions

to owners 494 1,425 6 73 1,998

--------- --------- --------- ---------

Balance at 30 September

2023 2,664 46,744 79 (45,629) 3,858

========= ========= ========= ========= =========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Notes to the Financial Statements

For the Period Ended 30 September 2023

Basis of preparation

The Company's condensed interim financial statements for the six

months ended 30 September 2023 have been prepared in accordance

with International Financial Reporting Standards ("IFRS") as

adopted by the United Kingdom and Companies Act 2006. The principal

accounting policies are summarised below. The financial report is

presented in the functional currency, US dollars and all values are

shown in thousands of US dollars (US$'000). The financial

statements have been prepared on a historical cost basis and fair

value for certain assets and liabilities. The same accounting

policies, presentation and methods of computation are followed in

these financial statements as were applied in the Company's latest

audited financial statements for the year ended 31 March 2023.

The financial information for the period ended 30 September 2023

does not constitute the full statutory accounts for that period.

They have not been reviewed by the Company's auditor. The Annual

Report and financial statements for the year ended 31 March 2023

have been filed with the Registrar of Companies. The independent

auditor's report on the Annual Report and financial statements was

unqualified and did not contain a statement under Section 498(2) or

498(3) of the Companies Act 2006, but did draw attention to a

material uncertainty relating to going concern.

Nature of business

The Company is a public limited company incorporated and

domiciled in England and Wales. The address of the registered

office is 2(nd) Floor, 38-43 Lincoln's Inn Fields, London, WC2A

3PE. The Company is in the business of financing the exploration,

development and production of energy resource projects in regions

with energy hungry markets close to existing infrastructure. The

Company has typically focused on non-operating working interest

positions in projects that have drill ready targets that

substantially short cut the life-cycle of hydrocarbon projects by

entering the project after exploration concept, initial exploration

and drill target identification work has largely been

completed.

Going concern

The Company's principal activity during the period has been the

development of its exploration projects. The Company had a cash

balance of US$0.64 million at 30 September 2023 (31 March 2023:

US$0.83 million) and made a loss after income tax of US$0.44

million (31 March 2023 loss of US$20.80 million).

The Directors have prepared cash flow forecasts for the Company

covering the period to 31 December 2024 and these demonstrate that

the Company will require further funding within the next 12 months.

In June 2022, the Company entered into an agreement with CNOOC to

drill an exploration well on the Topaz prospect in China, by 12

June 2024, which includes a payment of US$250,000 to CNOOC. It is

estimated that the cost of drilling this well would be

approximately US$12 million. The Directors note that if the well

commitment is not met in the timeframe advised then either a

renegotiation of the commitment timing will be required or the

licence could be relinquished.

In May 2023 US$1.9 million was raised through an equity

placement for the completion of joint regional oil migration and 3D

seismic inversion studies at Topaz, ongoing prospect, licensing

fees and permit costs, post Jade well consultancy, analysis and

residual exploration costs, front-end engineering design ("FEED"),

studies and surveys at Mako - including gas processing and export

gas tie in at the Kakap KF Platform and for general working capital

requirements.

The Company has also renegotiated the terms of the Convertible

Note as detailed in the AIM announcement dated 30 May 2023. The

Convertible Note is secured by a senior first ranking charge over

the Company, including its 8.5% interest in the Duyung PSC and Mako

Gas Field.

However, in order to meet the well commitment at Topaz and also

to meet the repayment terms of the Convertible Note, the Company is

required to raise further funding either through equity or the sale

of assets and as at the date of this report the necessary funds are

not in place. The Directors are however optimistic that the full

funding commitments for the Topaz well and the repayment of the

Convertible Note will be met, having a successful track record of

equity (and debt) and in particular with the prospect of monetising

its interest in Mako through the current sell down process.

It is the belief of the Board that there are likely value

catalysts throughout the next 12 months leading up to the intend

drilling of the Topaz Prospect in 2024 - including maximising the

value of its interest at the Mako Gas field through the current

sell down process and the completion of the GSA and also through

the conclusion of important de-risking activities currently being

conducted prior to the drilling of the Topaz Prospect.

The Directors have therefore concluded that it is appropriate to

prepare the Company's financial statements on a going concern

basis, however, in the absence of additional funding being in place

at the date of this report, these conditions indicate the existence

of a material uncertainty which may cast significant doubt over the

Company's ability to continue as a going concern and, therefore,

that it may be unable to realise its assets and discharge its

liabilities in the normal course of business.

The financial statements do not include the adjustments that

would result if the Company was unable to continue as a going

concern.

Note 1. Segmental Analysis

The Directors consider the Company to have three geographical segments,

being China (Block 29/11 project), Indonesia (Duyung PSC project)

and North America (Sacramento Basin project), which are all currently

in the exploration and evaluation phase. Corporate costs relate

to the administration and financing costs of the Company and are

not directly attributable to the individual projects. The Company's

registered office is located in the United Kingdom.

Details China Indonesia USA Corporate Total

US$'000 US$'000 US$'000 US$'000 US$'000

30 September 2023

Revenue from continued operations - - - - -

Segment result

Unallocated corporate expenses - - - (454) (454)

-------- ---------- -------- ---------- --------

Operating loss - - - (454) (454)

Finance income/(expense) - - - 20 20

Impairment of oil and gas

properties - - (2) - (2)

Loss before taxation - - (2) (434) (436)

Tax expense in current period - - - (1) (1)

-------- ---------- -------- ---------- --------

Loss after taxation - (2) (435) (437)

-------- ---------- -------- ---------- --------

Total comprehensive loss for

the financial period - (2) (435) (437)

======== ========== ======== ========== ========

Segment assets 6,104 5,077 - - 11,181

Unallocated corporate assets - - - 660 660

-------- ---------- -------- ---------- --------

Total assets 6,104 5,077 - 660 11,841

======== ========== ======== ========== ========

Segment liabilities - - - - -

Unallocated corporate liabilities - - - 7,983 7,983

-------- ---------- -------- ---------- --------

Total liabilities - - - 7,983 7,983

---------------------------------- -------- ---------- -------- ---------- --------

Details China Indonesia USA Corporate Total

US$'000 US$'000 US$'000 US$'000 US$'000

30 September 2022

Revenue from continued - - - - -

operations

Segment result

Unallocated corporate expenses - - - (120) (120)

--------- ---------- -------- ---------- ---------

Operating loss - - - (120) (120)

Finance expense - - - (1,888) (1,888)

Impairment of oil and gas

properties (22,069) - (28) - (22,097)

Loss before taxation (22,069) - (28) (1,888) (24,105)

Tax expense in current period - - - (1) (1)

--------- ---------- -------- ---------- ---------

Loss after taxation (22,069) - (28) (2,009) (24,106)

--------- ---------- -------- ---------- ---------

Total comprehensive loss for

the financial period (22,069) - (28) (2,009) (24,106)

========= ========== ======== ========== =========

Segment assets - 4,417 - - 4,417

Unallocated corporate assets - - - 850 850

--------- ---------- -------- ---------- ---------

Total assets - 4,417 - 850 5,267

========= ========== ======== ========== =========

Segment liabilities - - - - -

Unallocated corporate

liabilities - - - 6,280 6,280

--------- ---------- -------- ---------- ---------

Total liabilities - - - 6,280 6,280

-------------------------------- --------- ---------- -------- ---------- ---------

Details China Indonesia USA Corporate Total

US$'000 US$'000 US$'000 US$'000 US$'000

31 March 2023

Unallocated corporate expenses - - - (810) (810)

--------- --------------- --------- -------- ---------

Operating loss - - - (810) (810)

Finance expense - - - (2,955) (2,955)

Impairment of oil and gas properties (16,998) - (32) - (17,795)

Cyber fraud loss - - - - (1,981)

Loss before taxation (16,998) - (32) (3,765) (20,795)

Tax expense in current year - - - (1) (1)

--------- --------------- --------- -------- ---------

Loss after taxation (16,998) - (32) (3,766) (20,796)

--------- --------------- --------- -------- ---------

Total comprehensive loss for

the financial year (16,998) - (32) (3,766) (20,796)

========= =============== ========= ======== =========

Segment assets 5,958 4,677 - - 10,635

Unallocated corporate assets - - - 121 121

--------- --------------- --------- -------- ---------

Total assets 5,958 4,677 - 121 10,756

========= =============== ========= ======== =========

Segment liabilities - - - - -

Unallocated corporate liabilities - - - 8,459 8,459

--------- --------------- --------- -------- ---------

Total liabilities - - - 8,459 8,459

-------------------------------------- --------- --------------- --------- -------- ---------

Note 2. Loss Per Share

The basic loss per share is derived by dividing the loss after

taxation for the period attributable to ordinary shareholders by

the weighted average number of shares on issue being 904,491,535

(2022: 747,642,305).

Year Ended

6 Months to 30 September 31 March

(unaudited) (audited)

=================================== ====================

2023 2022 2023

Loss per share from continuing

operations

Loss after taxation from continuing US$(437,000) US$(24,106,000) US$(20,796,000)

operations

Loss per share - basic (0.06)c (3.22)c (2,71)c

Loss after taxation from continuing

operations adjusted for dilutive US$(437,000) US$(24,106,000) US$(20,796,000)

effects

Loss per share - diluted (0.06)c (3.22)c (2,71)c

For the current and prior financial periods the exercise of the

options is anti-dilutive and as such the diluted loss per share is

the same as the basic loss per share. Details of the potentially

issuable shares that could dilute earnings per share in future

periods are set out in Note 5.

Note 3. Oil and Gas Properties: Exploration and Evaluation

Year Ended

6 Months to 30 September 31 March

(unaudited) (audited)

=========================== ===========

2023 2022 2023

US$'000 US$'000 US$'000

Balance brought forward 10,635 24,907 24,907

Additions(a) 548 1,607 2,758

Impairment(b)(c)(d) (2) (22,097) (17,030)

------------ ------------- -----------

Net book value 11,181 4,417 10,635

============ ============= ===========

(a) The Company was awarded its permit in China in December

2016. Block 29/11 is located in the Pearl River Mouth Basin,

offshore China. Empyrean is operator with 100% of the exploration

right of the Permit during the exploration phase of the project. In

May 2017, the Company acquired a working interest in the Sacramento

Basin, California. Empyrean entered into a joint project with

ASX-listed Sacgasco Limited, to test a group of projects in the

Sacramento Basin, California, including two mature, multi-TcF gas

prospects in Dempsey (EME 30%) and Alvares (EME 25%) and also

further identified follow up prospects along the Dempsey trend (EME

30%). Please refer to the Operational Review for further

information on exploration and evaluation performed during the

period.

(b) Empyrean and its China Block 29/11 partner CNOOC, along with

its technical service providers CNOOC Enertech and COSL, completed

significant pre-drilling operational, technical and permitting work

throughout the 2022 financial year to enable to safe drilling,

although ultimately unsuccessful drilling of the Jade prospect in

April 2022. As a result of the unsuccessful well at Jade, Empyrean

provided for impairment against Jade prospect costs and the dry

hole costs associated with the Jade drilling program, together

being US$17.0 million as at 31 March 2023. Post-well analysis at

Jade however has confirmed reservoir quality is better than

pre-drill estimates with regional seal confirmed and the depth

conversion approach validated. As a part of post-well evaluation,

CNOOC geochemical and basin modelling experts together with

Empyrean have interpreted the critical elements of effective

regional oil migration pathways-leading to positive implications

for the Topaz prospect, and ultimately the decision to proceed with

the second phase of exploration at Block 29/11, being the drilling

of the Topaz Prospect before June 2024.

(c) While the Company will continue to work with its joint

venture partners in reviewing and assessing any further technical

and commercial opportunities as they relate to the Sacramento Basin

project, particularly in light of strong gas prices for gas sales

in the region, it has not budgeted for further substantive

exploration expenditure. The Company has continued to fully impair

the carrying value of the asset at 30 September 2023.

(d) In light of current market conditions, little or no work has

been completed on the Riverbend or Eagle Oil projects in the period

and no substantial project work is forecast for either project in

2022/23 whilst the Company focuses on other projects. Whilst the

Company maintains legal title it has continued to fully impair the

carrying value of the asset at 30 September 2023.

Project Operator Working 2023 2022

Interest Carrying Carrying

Value Value

US$'000 US$'000

Exploration and evaluation

China Block 29/11 Empyrean Energy 100%* 6,104 -

Sacramento Basin Sacgasco 25-30% - -

Duyung PSC Conrad 8.5% 5,077 4,417

Riverbend Huff Energy 10% - -

Eagle Oil Pool Development Strata-X 58.084% - -

---------- ----------

11,181 4,417

========== ==========

*In the event of a commercial discovery, and subject to the Company

entering PSC, CNOOC Limited will have a back in right to 51% of

the permit. As at the date of these financial statements no commercial

discovery has been made.

Note 4. Convertible Loan Notes

Year Ended

6 Months to 30 September 31 March

(unaudited) (audited)

=========================== ===========

2023 2022 2023

US$'000 US$'000 US$'000

(a) Convertible Loan Note -

Original

Opening balance - 4,125 4,125

Conversions - (1,970) (1,970)

Costs of finance - 121 121

Foreign exchange gain - (133) (133)

Extinguishment on substantial

modification - (2,143) (2,143)

Convertible Loan Note - Original - - -

============= ============ ===========

(b) Convertible Loan Note -

Modification 1

Opening balance 4,076 - -

Recognition of modified liability

1 - 2,637 2,637

Loss on substantial modification - 1,369 1,369

Costs of finance - (268) 185

Foreign exchange loss/(gain) 12 (480) (115)

Extinguishment on substantial (4,088) - -

modification

Total Convertible Loan Note

- Modification 1 - 3,258 4,076

============= ============ ===========

(c) Convertible Loan Note -

Modification 2

Opening balance - - -

Recognition of modified liability 6,544 - -

2

Gain on substantial modification (845) - -

Costs of finance (29) - -

Foreign exchange gain (49) - -

Total Convertible Loan Note 5,621 - -

- Modification 2

----------------------------------- ------------- ------------

(a) In December 2021, the Company announced that it had entered

into a Convertible Loan Note Agreement with a Melbourne-based

investment fund (the "Lender"), pursuant to which the Company

issued a convertible loan note to the Lender and received gross

proceeds of GBP4.0 million (the "Convertible Note").

(b) As announced in May 2022, the Company and the Lender then

amended the key repayment terms of the Convertible Note, which at

that time included the right by the Lender to redeem the

Convertible Note within 5 business days of the announcement of the

results of the Jade well at Block 29/11. The face value of the loan

notes was reset to GBP3.3m with interest to commence and accrue at

GBP330,000 per calendar month from 1 December 2022.

(c) In May 2023, it was announced that the Company and the

Lender have, in conjunction with and conditional upon the

completion of the Subscription, now reached agreement on amended

key terms to the Convertible Note to allow the sales process for

Mako to complete. The key terms of the amendment are as

follows:

1. The parties have agreed a moratorium of accrual interest on

the Convertible Note until 31 December 2023 - interest will accrue

thereafter at a rate of 20% p.a.;

2. The conversion price on the Convertible Note has been reduced from 8p to 2.5p per Share;

3. The face value of the Convertible Note has been reduced from

GBP5.28m (accrued to the end of May 2023) to GBP4.6 million (to be

repaid from Empyrean's share of the proceeds from Mako sell down

process); and

4. Empyrean will pay the Lender 15% of the proceeds from its

share in the Mako sell down process.

Note 5. Share Capital

Year Ended

6 Months to 30 September 31 March

(unaudited) (audited)

=========================== ============

2023 2022 2023

US$'000 US$'000 US$'000

985,470,767 (2022: 788,431,892 ) ordinary

shares of 0.2p each 2,664 2,170 2,170

------------- ------------ ------------

2023 2022 2023

No. No. No.

Fully Paid Ordinary Shares of 0.2p

each - Number of Shares

At the beginning of the reporting

period 788,431,892 646,070,780 646,070,780

Shares issued during the period:

* Placements 189,753,783 121,750,001 121,750,001

4,397,592 - -

* Salary sacrifice shares

2,887,500 - -

* Advisor shares

* Partial conversion of Convertible Note - 18,750,000 18,750,000

* Exercise of warrants - 1,861,111 1,861,111

------------- ------------ ------------

Total at the end of the reporting

period 985,470,767 788,431,892 788,431,892

---------------------------------------------------- ------------- ------------ ------------

2023 2022 2023

US$'000 US$'000 US$'000

Fully Paid Ordinary Shares of 0.2p

each - Value of Shares

At the beginning of the reporting

period 2,170 1,809 1,809

Shares issued during the period:

* Placements 476 307 307

11 - -

* Salary sacrifice shares

7 - -

* Advisor shares

* Partial conversion of Convertible Note - 49 49

* Exercise of warrants - 5 5

-------- -------- --------

Total at the end of the reporting

period 2,664 2,170 2,170

---------------------------------------------------- -------- -------- --------

The Companies Act 2006 (as amended) abolishes the requirement

for a company to have an authorised share capital. Therefore, the

Company has taken advantage of these provisions and has an

unlimited authorised share capital.

Each of the ordinary shares carries equal rights and entitles

the holder to voting and dividend rights and rights to participate

in the profits of the Company and in the event of a return of

capital equal rights to participate in any sum being returned to

the holders of the ordinary shares. There is no restriction,

imposed by the Company, on the ability of the holder of any

ordinary share to transfer the ownership, or any of the benefits of

ownership, to any other party.

Share options and warrants

The number and weighted average exercise prices of share

options and warrants are as follows:

6 Months to 30 6 Months to 30 September

September 2023 (unaudited) 2022 (unaudited)

============================= ================================

Weighted Weighted

Average Number Average Number

Exercise of Options Exercise Of Options

Price and Warrants Price and Warrants

2023 2023 2022 2022

Outstanding at the beginning

of the period GBP0.137 6,558,333 GBP0.116 65,890,916

Issued during the period GBP0.017 12,833,333 - -

Cancelled during the period GBP0.137 (6,558,333) GBP0.113 (53,413,139)

Exercised during the period - - GBP0.096 (1,861,111)

----------- ---------------- -------------- ----------------

Outstanding at the end of

the period GBP0.017 12,833,333 GBP0.131 10,616,666

=========== ================ ============== ================

Valuation and assumptions of options and warrants at 30 September

2023

Incentive Incentive Advisor

Warrants Warrants Warrants

Number of options remaining 5,000,000 5,000,000 2,833,333

Grant date 29/05/23 29/05/23 29/05/23

Expiry date 30/05/26 30/05/26 30/05/24

Share price GBP0.010 GBP0.010 GBP0.010

Exercise price GBP0.015 GBP0.020 GBP0.015

Volatility 100% 100% 100%

Option life 3.00 3.00 1.00

Expected dividends - - -

Risk-free interest rate (based on national

government bonds) 4.45% 4.45% 4.45%

------------------------------------------- ---------- ---------------- -----------

The options and warrants outstanding at 30 September 2023 have

an exercise price in the range of GBP0.015 to GBP0.02 (2022: GBP0.075

to GBP0.18) and a weighted average remaining contractual life

of 2.22 years (2022: 0.57 years). None of the outstanding options

and warrants at 30 September are exercisable at period end.

Note 6. Events After the Reporting Date

Significant events post reporting date were as follows:

No matters or circumstances have arisen since the end of the

financial period which significantly affected or could

significantly affect the operations of the Company, the results of

those operations, or the state of affairs of the Company in future

financial years.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVLFLLTLIV

(END) Dow Jones Newswires

December 18, 2023 06:34 ET (11:34 GMT)

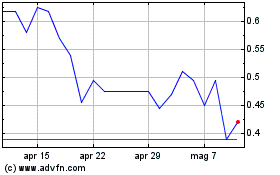

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Empyrean Energy (LSE:EME)

Storico

Da Nov 2023 a Nov 2024