TIDMSTOB

RNS Number : 8406E

Stobart Group Limited

16 May 2013

16 May 2013

Stobart Group Limited

("Stobart" or "the Group")

Results for the year ended 28 February 2013

Stobart Group (Stobart), a leading provider of multi-modal

Transport and Distribution, Estates, Air and Biomass services, and

Infrastructure and Civil Engineering, today announces its results

for the year ended 28 February 2013.

Group Overview

-- After a pivotal year, the Group is on track with its four

year strategy (2011-15) to create shareholder value

-- Investment programme nearly complete

-- Group is moving into optimisation phase - focus is turning to

selective realisations and cash generation

-- Objectives include improved communication with shareholders and other key stakeholders

Financial Highlights

-- Group revenue from continuing operations was GBP572.4m (2012: GBP491.7m)

-- Underlying operating profit* was GBP44.9m (2012: GBP40.1m)

-- Underlying profit before tax** was GBP32.5m (2012: GBP35.4m)

-- Final dividend of 4.0p (2012: 4.0p) per share payable on 5

July 2013, making a total for the year of 6.0p (2012: 6.0p)

-- Profit before tax and discontinued operations increased to GBP36.0m (2012: GBP29.2m)

-- Earnings per share from continuing operations of 9.0p (2012: 8.5p)

-- Loss on discontinued operation of GBP13.4m (2012: GBP0.3m)

-- Net cash generated from continuing operations GBP41.4m (2012: GBP59.0m)

-- Group property assets at GBP347.2m (2012: GBP327.0m)

-- Net Debt is GBP216.4m (2012: GBP166.0m)

Divisional underlying profit summary

2013 2012

GBPm GBPm GBPm GBPm

------------------------------------- ------- ------- ------ ------

Underlying operating profit* 44.9 40.1

Finance costs, finance income

and share based payments (12.4) (4.7)

Operation based divisions

Transport & Distribution 29.7 27.7

Biomass 4.0 1.2

Infrastructure & Civil Engineering 3.2 4.4

Asset based divisions

Air (0.7) (0.4)

Estates 6.5 12.4

Central costs and eliminations (10.2) (9.9)

Underlying profit before

tax** 32.5 35.4

Separately disclosed items 3.5 (6.2)

------------------------------------- ------- ------- ------ ------

Profit before tax and discontinued

operations 36.0 29.2

------------------------------------- ------- ------- ------ ------

* Underlying operating profit is a non GAAP measure shown on the

Income Statement which includes one-off and non-cash items.

** Underlying profit before tax comprises the underlying

operating profit of GBP44.9m (2012: GBP40.1m) less share based

payments of GBP1.2m (2012: GBP0.4m) less finance costs of GBP12.0m

(2012: GBP6.3m) plus finance income of GBP0.8m (2012: GBP2.0m).

Operational Highlights by Division

Transport and Distribution

-- Improved profits increased to GBP29.7m in tough market

-- Tesco work secured by 3 year contract from 1 March 2013

equivalent to over GBP500m of revenue over duration

-- Acquisition of Autologic Holdings in August 2012 for GBP12.4m

and disposal of non-core Vehicle Services operation for GBP11.0m -

enhances Pan-European offering and will create further synergy

benefits during new financial year

-- Loss making Chilled Pallet Network closed, but other profitable Chilled operations retained

Estates

-- Good return on investment from Estates division of 26%

-- Successful integration of Moneypenny portfolio

Air

-- Airport passenger run rate currently over 800,000 per annum

-- Secured 4(th) Southend-based aircraft for 2013 with likely

increase of around 250,000 passengers per year

-- Designated London's 6(th) airport by IATA

-- Investment in Airport near completion with final

infrastructure spend during 2013 to accommodate around 5 million

passengers

Biomass

-- New long-term Biomass supply contracts commenced with future revenue of over GBP140m

Infrastructure and Civil Engineering

-- Core profits of over GBP3m

-- Continued value-added services on internal projects

Chairman

-- As indicated on 2 April this year Avril Palmer-Baunack

yesterday (15 May) resigned as Non-Executive Chairman. Paul

Orchard-Lisle, a Non-Executive Director at Stobart Group since May

2011, has assumed the role on an interim basis while the search for

a new Non-Executive Chairman is completed

Andrew Tinkler, Chief Executive Officer, said:

"Despite a turbulent year and a tough economic environment, our

continuing operating businesses have produced a profit from

continuing operations ten per cent up on last year and have again

given us a good return on investment.

We are now at a pivotal point in our four year plan and with our

investment programme nearly complete we are moving into our value

optimisation phase. Through our property assets we will be looking

to return cash into the business, while our Air and Biomass

businesses are poised to deliver further value enhancement.

Our management team is now focused on realising value from the

investments made over the last few years."

Enquiries:

Stobart Group +44 1925 605 400

Andrew Tinkler, Chief Executive Officer

Ben Whawell, Chief Financial Officer

Influence Associates +44 20 7287 9610

Stuart Dyble/James Andrew

Lansons Communications +44 7979 692287

Tony Langham +44 20 7294 3617

tonyl@lansons.com

Chairman's Statement

The Group's trading performance over the last year enables me to

present a positive report. We remain focussed on delivering

substantial shareholder value in accordance with the development

plans agreed in 2011, and the ongoing proper governance of the

business.

Trading Results

Group turnover rose from GBP491.7m to GBP572.4m and the

underlying profit before tax was GBP32.5m compared with GBP35.4m in

the previous year. Group profit before tax before discontinued

operations for the year was GBP36.0m compared with GBP29.2m in the

previous year. The discontinuation of the chilled transport network

led to a loss after tax of GBP13.4m (2012: GBP0.3m) in the year. A

more detailed analysis of the Group and Divisional trading results

follows in the Chief Executive's Report and the Operational &

Financial Review.

The Board

There have been a number of Board changes over the past year

including Jesper Kjaedegaard stepping down at last year's AGM,

William Stobart's reappointment to the Board in September 2012 and

in January 2013, David Beever resigned from the Board to devote

time to his other interests. Following the acquisition of the

Autologic business in August 2012, Avril Palmer-Baunack was

appointed an Executive Director and Deputy Chief Executive. On 21

January 2013 she was appointed Executive Chairman, replacing Rodney

Baker-Bates. Mr Baker-Bates remains a Non-Executive Director of the

Group. Ms Palmer-Baunack resigned as Executive Chairman on 2 April

2013 and left the Group on 15 May 2013. Alan Kelsey resigned as a

Non-Executive Director on 23 April 2013. I was appointed Interim

Non-Executive Chairman on 15 May 2013 following Ms Palmer-Baunack's

departure from the Group on that date. In April, the Board

initiated a search, supported by consultants, for a new

Non-Executive Chairman. We have been pleased by the interest shown

in the appointment and expect to make an announcement in the near

future. We also anticipate the appointment of one or more new

Non-Executive Directors to support in the next stage of our

strategy.

The Board recognises fully that it has been tasked with

delivering enhanced shareholder value in accordance with the

strategy that we outlined at the time of the capital raising in May

2011. Our operating divisions are all performing well and are on

track to deliver returns in line with the overall strategic plan.

Our Board continuously reviews divisional performance alongside

market conditions to make sure that we make the right strategic

decisions for each of our businesses.

Dividend

An interim dividend of 2.0p was paid on 7 December 2012. The

Board is proposing a final dividend of 4.0p per ordinary share,

giving a total dividend for the year of 6.0p.

Outlook

The Group continues to respond robustly to the ongoing and

challenging economic conditions. Whilst issues in the Chilled

Transport network and the absence of disposals in Estates

marginally held back the performance at the half year, at the end

of the year Transport & Distribution and Biomass were ahead of

last year. This was matched with the maturing of investments at

London Southend Airport and the continued internal value delivered

by our Infrastructure & Civil Engineering division.

Our underlying core Transport & Distribution business is

strong and Biomass is growing year on year within a relatively new

sector whose speed of growth has been arguably hindered by the slow

pace of Government Renewable Obligation legislation. Stobart Air

has made great headway in establishing its initial key user base,

predominantly through our excellent partnership with easyJet. Our

strong and diverse property portfolio already delivers an

attractive income return. We will however take market led

opportunities to realise its capital value.

With the investment phase of our four year strategy

substantially complete our focus now moves to optimising

performance and delivering maximum value for shareholders from the

excellent base that we have built.

Paul Orchard-Lisle

Chief Executive's Report

We are at a pivotal moment in the delivery of our four year

strategic plan that we set out in March 2011. With the investment

phase now largely complete we are moving into the optimisation

phase, realising the value in our divisions and delivering strong

returns for our shareholders.

Our stated strategy of investment in businesses with high future

growth potential followed by a two to three year period of value

maximisation is on track. We understand fully that there are a

number of ways that we can deliver return on our investment.

Further, we know that a critical factor in maximising returns will

be to get the timing of our actions right. Earlier this year, the

Executive team, together with certain Board members, reviewed our

strategy and confirmed that it is the right one for the Group.

Matched with our commitment to sound governance, we will not be

diverted from our long-term plan to maximise returns by short-term

distractions. As we discussed last year, key in our ability to

achieve this for shareholders will be our ability to continue to

have the right people, in the right place with the right skills -

and at the right time. We are making sure we have that team in

place and we will continue to invest in our people through the year

to keep them focussed and on track.

It has been a busy year. The discontinuance of the Chilled

pallet consolidation business was complex in some ways for us, but

overall our Transport & Distribution business has had a hugely

positive year, further enhanced by the acquisition of Autologic in

August.

This performance was matched with exciting and rewarding

developments at London Southend Airport where we welcomed over

700,000 travellers through the airport during the period. This has

been predominantly as a result of our burgeoning and highly

successful partnership with easyJet. While costs have been slightly

higher than expected as we took on more staff costs at start-up, we

are very pleased with the development of the airport and our

position in the London marketplace, with passengers recently voting

us best performing airport for customer satisfaction.

As a result of our specialised offering of renewable fuel supply

and transportation, our Biomass business is now in pole position to

secure a significant proportion of this quickly developing market

as the legislative approvals come through.

The Estates division has had an active year and has delivered

strong results with the Moneypenny investment property portfolio

now fully integrated into the Group and with a plan for each

property. Going forward we will be looking to realise value in the

most mature assets which will contribute both cash and reduce Group

debt sooner than expected.

Overall the Group is well underway with the implementation of

our four year plan. All the building blocks are in place and the

investment phase is largely complete. We now move into the

optimisation and delivery phase to unlock the inherent value in our

business portfolio for the benefit of our shareholders.

Stobart Transport & Distribution

Transport & Distribution remains our largest operating

division. Our ability to continue to develop and implement leading

systems and processes has enabled us to remain competitive in a

challenging environment and we continue to work to increase our

already sector-leading fleet utilisation rates. We constantly

strive to improve performance, increase our levels of customer

service excellence and stay alert to opportunities to help our

customers improve efficiency levels through implementing multimodal

solutions.

In last year's Annual Report & Accounts we explained the

benefits of our Time Based Planning system. As we use the system

more we are better able to exploit its capabilities and thereby

improve its effectiveness in our business and the efficiency of our

operations.

Our ability to track each delivery and the elapsed time for each

stage of that delivery enables us to monitor the factors driving

our costs in detail, highlighting areas where we can, and do,

improve efficiencies. We collaborate with our customers as partners

in a business operation to improve performance and drive

efficiencies for the benefit of both their business and ours.

It is through our deployment of powerful analytical tools across

the business that we were able to spot firstly the opportunity to

reorganise the Ambient transport network and, secondly, establish

the need to restructure the Chilled business, which has led to the

discontinuance of the Chilled pallet consolidation business.

A year ago, we outlined our plans to restructure the Chilled

business that was originally acquired through the acquisition of

Innovate in 2008 at low cost out of Administration. We envisaged

the closure of two depots and a total restructuring charge in the

28 February 2013 Accounts of some GBP8.0m. As we began to implement

the proposed restructuring following our detailed and ongoing

analysis, it became apparent that this small load, multiple pick

and drop business, which was principally undertaken for producers

rather than retailers, was too unpredictable for a large scale

operation.

We carefully considered whether there was a way in which we

could re-engineer the business processes to reduce the imbalance in

part-loaded running and the incidence of small drops. Unfortunately

our analysis showed that we simply could not make this business

profitable at the rates that our customers were prepared to pay. As

a consequence, we decided to close the Chilled pallet consolidation

business. The loss in the year including closure costs was

GBP13.4m. This closure has not affected the chilled movements we

undertake for our supermarket customers which continue to operate

as part of the main Transport & Distribution business, or

within the warehousing operation that we acquired from Innovate,

which continues to perform well.

Stobart Rail Freight and Ports continue to operate well with

steady growth in both areas. This is demonstrated by the increasing

use of rail for our FMCG grocery traffic, creating both cost

savings for customers whilst helping them to achieve carbon

reduction targets. Our expertise in road-to-rail modal shift

enables us to intelligently assist customers, providing innovative

solutions for their logistical requirements. A typical example is

the supply of stock to central London convenience stores through a

rail facility at Euston Station.

In August 2012 we acquired Autologic Holdings plc for a cash

consideration of GBP12.4m. Autologic operated two distinct

businesses, Vehicle Distribution (transport) and Vehicle Services

(workshops and storage) in the UK, Benelux and Czech Republic. In

January 2013 we disposed of the non-core Vehicle Services business

for GBP11.0m. However, we retain the freehold site at Portbury,

which is used in this division, and currently lease it to the

purchasers. The Vehicle Distribution business has been re-branded

Stobart Automotive, forming a new business unit within our

Transport & Distribution division. During the new financial

year we expect to deliver savings and synergies from aligning this

business unit with others in the division.

We plan to bring the Autologic transporter fleet up to the

standards of the rest of our fleet. The reaction of customers to

this acquisition has been extremely positive and we are now

rolling-out the re-branding of the transporter fleet alongside the

introduction of new systems and technologies.

As ever, the sustainability of any one of our transport or

distribution operations is critical to both our customers and

ourselves. To that end, we work tirelessly to reduce the

environmental impact of our activities, not only by adopting the

latest low emission trucks, but also by optimising their driven

miles.

Stobart Estates

The Estates division has had a busy year and has delivered

strong results against the backdrop of a very challenging property

market. The Moneypenny investment property portfolio acquired in

2012 has now been fully integrated into the Group and a strategy is

being implemented to maximise the exit value of each property. A

number of asset management initiatives, including lease and rent

review negotiations, have been undertaken in the year. These have

been the key factors in the uplift in the value of the portfolio in

the year of GBP5.2m.

The development of 37 Soho Square into high-end residential

units is due for completion in June 2013. The first two sales at

this property are contracted off-plan for a total of GBP5.7m which

is extremely encouraging. Although the challenging market has meant

that disposals have been slightly slower than anticipated, the

division has nevertheless achieved three sales to date at a higher

than expected profit. It is also worth noting that the division

achieves a high income return, pending sales.

Key milestones have also been achieved elsewhere, including the

completion of the Holiday Inn development at London Southend

Airport and the gaining of planning consent for the redevelopment

of Carlisle Airport and a biomass plant at Widnes.

With the management structure and strategy currently in place,

the Board is confident that the Estates division will continue to

deliver strong results in the medium term.

Infrastructure & Civil Engineering

The Infrastructure & Civil Engineering division has played a

significant role in the development of London Southend Airport. It

will continue to do so with the extension to the passenger terminal

and other projects where we can use this division to drive value.

This will also be the case with the development programme at

Carlisle Airport which is expected to commence in 2013. Planning

consent has been obtained for the biomass plant at Widnes and this

too will be a project undertaken by the division. We are

considering a number of different funding options for these

developments.

External work, principally in the rail sector, continues and

looking forward, a number of significant infrastructure projects

have been announced by Network Rail and by Government. With our

well known and well proven ability to find creative and highly cost

effective civil engineering solutions, we are ideally placed to

competitively tender and secure new contracts.

Stobart Air

It has been a landmark year for London Southend Airport (LSA),

which is now officially recognised as London's sixth airport. We

extended our partnership with easyJet and by the end of the year we

expect to serve 15 easyJet destinations. It is our aim to increase

further the number of destinations available in response to the

recognition by both passengers and carriers of LSA's convenient

location and the benefits offered by its rail link to central

London.

Our relationship with Aer Arran, trading as Aer Lingus Regional

under a ten year franchise agreement, provides us with an

unrivalled opportunity to capitalise swiftly and highly

cost-effectively on the London to North America routes via Dublin.

We increased our holding in Aer Arann to 45% to drive volume into

LSA. This should deliver significant revenue and profit through the

airport helping to improve its value. Our next phase is to use the

airline to start new routes out of LSA with focus on Spring

2014.

The current passenger terminal extension, which is the last

phase of our significant investment in this operating asset. With

the investment phase now completed we move to the optimisation

phase to realise the inherent value in the airport. This will

enable us to continue to offer an excellent passenger experience

and build route numbers and volumes up towards our maximum capacity

of around five million per annum.

I am pleased to report that easyJet has settled in well and that

they have now taken the decision to bring the planned siting of

their fourth aircraft at Southend forward to June this year, 12

months ahead of schedule.

After a fairly lengthy process, we have finally secured planning

consent for the development of Carlisle Airport. The consented

development includes warehousing and distribution infrastructure,

runway refurbishment and associated developments. We are currently

understanding route and carrier planning for Carlisle Airport and

are aiming to capitalise on the business potential for London-bound

traffic, as well as providing an exclusive new in-bound route for

some of the Lake District's 40 million visitors each year.

Stobart Biomass

Demand for Biomass products is set to increase over the next two

years as Biomass-fuelled power plants, which are currently in the

confirmed planning or building phase, become operational. Robust

industry intelligence informs us that the Biomass product market

for existing and planned power plants totals 3.1m tonnes per annum.

This volume is split between those plants currently operational at

0.2m tonnes, in-build at 0.4m tonnes and 2.5m tonnes for plants in

pre-build phase. These predicted volumes evidence the opportunity

for growth.

This year we have already commenced supply on a number of

significant contracts, with several additional contacts already

confirmed for the coming year. Our comprehensive business offering

of fuel source and supply, matched with premier logistics

capability, means that we are well placed to increase our rate of

growth through 2013.

The strategic fit with the Group is strong with transport being

such a vital ingredient in the Biomass business. This has the added

benefit of expected margins in excess of our standard transport

business.

The Brand

The Stobart brand is an important asset to the Group and it is

important to reinforce the levels of quality and service that our

brand stands for and underlines. Its status reassures our customers

and partners that they are working with a business that takes time

to understand their needs, a business that develops innovative and

cost-effective solutions and delivers the highest quality. Our

positive brand image also plays an extremely important role in

building employee loyalty. Our team are happy and proud to work as

part of Stobart Group; we recognise their support and reward it by

helping every one of them to reach their full potential within the

business.

More recently we have leveraged the brand to make big savings on

insurance and legal costs by taking these functions in-house and we

are now offering these services externally under the Stobart

name.

We are on track. We know how important it is to deliver strong

return and this is now our focus. We will continue to communicate

with you through the year and look forward to sharing further good

news.

Andrew Tinkler

Operational and Financial Review

Results

Group revenue from continuing operations increased to GBP572.4m

from GBP491.7m in the previous year. Underlying profit before tax

was GBP32.5m compared with GBP35.4m in 2012 and recorded profit

before tax and discontinued operations rose to GBP36.0m from

GBP29.2m in 2012. A breakdown of the divisional profit before tax

is set out below.

Divisional underlying profit summary

2013 2012

GBPm GBPm GBPm GBPm

--------------------------------- ------- ------- ------ ------

Underlying operating profit 44.9 40.1

Finance costs, finance

income and share based

payments (12.4) (4.7)

Operation based divisions

Transport & Distribution 29.7 27.7

Biomass 4.0 1.2

Infrastructure & Civil

Engineering 3.2 4.4

Asset based divisions

Air (0.7) (0.4)

Estates 6.5 12.4

Central costs and eliminations (10.2) (9.9)

Underlying profit before

tax 32.5 35.4

Separately disclosed items 3.5 (6.2)

--------------------------------- ------- ------- ------ ------

Profit before tax and

discontinued operations 36.0 29.2

--------------------------------- ------- ------- ------ ------

The prior year figures have been restated to classify the

chilled transport pallet network business as a discontinued

operation and for completion of the accounting for the acquisition

of WADI Properties Limited in accordance with accounting

standards.

Autologic Holdings plc

The Group acquired 100% of the share capital of Autologic

Holdings plc on 10 August 2012 for GBP13.0m including fees. This

business contributed revenue of GBP69.4m and underlying profit

before tax of GBP1.4m since acquisition.

On 21 January 2013 the Group disposed of the non-core UK Vehicle

Services business for cash proceeds of GBP11.0m realising a profit

on disposal of GBP8.5m.

Earnings per share

Basic earnings per share from continuing operations increased to

9.0p (2012: 8.5p) and total basic earnings per share were 5.1p

(2012: 8.4p).

Taxation

The tax charge on continuing operations of GBP5.1m (2012:

GBP1.4m) is at an effective rate of 14.2% (2012: 4.9%). The

effective rate has been reduced by GBP2.3m due to the impact of the

change in corporation tax rate on the deferred tax balances and by

GBP2.2m due to the impact of the profit on disposal of the Vehicle

Services division being non-taxable.

Discontinued operation

During the second half of the year the Group decided to

discontinue the chilled transport pallet network business. The

revenue from this discontinued activity was GBP45.0m (2012:

GBP60.2m) and the loss after tax was GBP13.4m (2012: GBP0.3m). This

has been shown separately in the consolidated income statement and

the prior year figures have been restated for consistency. We do

not expect further significant costs in relation to this business

in the current year.

Statement of Financial Position

We have a strong balance sheet with net assets of GBP462.1m

(2012: GBP471.0m). The net asset position was reduced by GBP9.5m

through the purchase of treasury shares during the year.

Non-current assets

Property, plant and equipment increased to GBP312.2m (2012:

GBP280.6m) principally due to the capital developments at London

Southend Airport and at our Widnes site along with inclusion of the

Autologic assets.

Investments in associates and joint ventures has increased to

GBP16.1m (2012: GBP1.1m) following the additional investment in the

restructured Aer Arann business and related aircraft financing

company as well as increases in the value of property interests

held. GBP7.1m of this investment is yet to be paid in cash.

Investment properties were carried at GBP89.5m (2012: GBP98.5m)

after sales of 3 properties in the year whilst there were valuation

uplifts of GBP5.2m on others.

Intangible assets increased to GBP286.2m (2012: GBP281.5m)

following the acquisition of Autologic Holdings plc in the year.

Included in intangible assets are our valuable brand names,

trademarks and designs.

Funding

The net debt of the Group has increased to GBP216.4m (2012:

GBP166.0m). This is principally due to capital expenditure at

London Southend Airport of GBP23.0m, the acquisition of Autologic

Holdings plc of GBP15.4m including fees and overdraft acquired, the

purchase of treasury shares of GBP9.5m and joint venture

investments totaling GBP7.0m. The net debt includes a new three

year GBP20.0m committed revolving credit facility (drawn at

GBP10.0m), and a new twelve month rolling GBP90.0m invoice

discounting facility (drawn at GBP16.4m). There is also a new two

year GBP3.2m property loan acquired on the Autologic

transaction.

These new facilities further diversify the Group's funding base

and provide additional standby liquidity and a balance of

maturities complementing the existing 2020 facility with M&G UK

Companies Financing Fund (drawn at GBP100.0m) and the 2017

Moneypenny bank loan (drawn at GBP77.3m).

The finance lease liabilities have increased to GBP39.0m

(2012:GBP28.8m) largely due to finance leases acquired with

Autologic.

The gearing ratio* is 46.8% (2012: 35.3%) and the gearing ratio

ignoring fleet financing* is 38.4% (2012: 29.1%).

The Group tracks cash flow headroom and covenants on a rolling

12 month basis to ensure any issues are identified at an early

stage.

*Gearing ratio: The gearing ratio is calculated as a percentage

of net debt to net assets. The gearing ratio ignoring fleet

financing is a percentage of net debt (excluding obligations under

finance leases and hire purchase contracts) to net assets.

Cashflow

Cash generated from continuing operations was GBP41.4m (2012:

GBP59.0m). The decrease is due to timing of working capital

movements, in particular the late payment of a single supplier

payment of GBP6.6m in the prior year but paid on time in the

current year. Operating cash outflow from discontinued operations

was GBP9.5m.

Cash outflow for capital expenditure in the year totalled

GBP45.2m (2012: GBP93.4m). This includes development expenditure at

London Southend Airport of GBP23.0m mainly for the new hotel and

terminal extension. Other capex includes GBP10.6m for commercial

vehicles, GBP5.8m further development at the Widnes multimodal

site, which was partly funded by a Grant, and GBP3.1m for

development of 37 Soho Square.

Cash received from disposal of property, plant and equipment was

GBP23.4m (2012: GBP44.8m). This principally relates to disposals of

commercial vehicles and a property at 22 Soho Square, London. Cash

inflow from disposal of assets held for sale of GBP11.7m relates

mainly to the disposal of the units held in One Plantation Place

Unit Trust.

Interest paid in cash totalled GBP12.9m (2012: GBP4.4m). The

increase from the prior year is due to the interest on the loan

against the Moneypenny portfolio and also in the prior year

interest was capitalised during the significant building period at

London Southend Airport. Interest received totalled GBP0.7m (2012:

GBP2.0m).

Dividends paid totalled GBP20.9m (2012: GBP17.6m) reflecting an

increased number of shares but the same annual dividend rate of 6p

(2012: 6p).

Dividends

The Board proposes a final dividend of 4p (2012: 4p) bringing

the total dividend for the year to 6p (2012: 6p). Subject to

approval of shareholders the final dividend will be payable to

investors on record on 24 May 2013 with an Ex-dividend date of 22

May 2013 and will be paid on 5 July 2013. A scrip dividend

alternative will also be made available.

Ben Whawell

Consolidated Income Statement

For the year to 28 February 2013

Restated

2013 2012

GBP'000 GBP'000

Continuing operations

Revenue 572,412 491,673

----------------------------------- ---------- ----------

Operating expenses - underlying (534,173) (463,711)

Share of post tax profits

of associates and joint ventures 997 500

Gain in value of investment

properties 5,173 500

Profit on sale and leaseback

transaction - 5,385

Profit on disposal of/gain

in value of assets held for

sale 495 5,740

----------------------------------- ---------- ----------

Underlying operating profit 44,904 40,087

Share based payments (1,244) (391)

Profit on disposal of business 8,511 -

Credit for business purchase - 821

New territory and new business

set up costs (1,020) (3,415)

Transaction costs (2,759) (1,816)

Restructuring costs (793) (1,592)

Amortisation of acquired

intangibles (381) (222)

----------------------------------- ---------- ----------

Profit before interest and

tax 47,218 33,472

Finance costs (11,963) (6,279)

Finance income 777 1,980

----------------------------------- ---------- ----------

Profit before tax 36,032 29,173

Tax (5,101) (1,441)

----------------------------------- ---------- ----------

Profit from continuing operations 30,931 27,732

Discontinued operation

Loss from discontinued operation,

net of tax (13,409) (276)

----------------------------------- ---------- ----------

Profit for the year 17,522 27,456

----------------------------------- ---------- ----------

Profit attributable to:

Owners of the company 17,519 27,456

Non-controlling interests 3 -

----------------------------------- ---------- ----------

Profit for the year 17,522 27,456

----------------------------------- ---------- ----------

Earnings per share - continuing

operations

Basic 9.02p 8.53p

Diluted 8.98p 8.52p

------------------------------- ------ ------

Earnings per share

Basic 5.11p 8.44p

Diluted 5.09p 8.43p

------------------ ------ ------

Consolidated Statement of Comprehensive Income

For the year to 28 February 2013

Restated

2013 2012

GBP'000 GBP'000

---------------------------------------- -------- --------

Profit for the year 17,522 27,456

Exchange differences on translation

of foreign operations 559 (293)

Cash flow hedge 476 (456)

Revaluation of property, plant and

equipment 781 -

Defined benefit plan actuarial gains 649 -

Tax on items relating to components

of other comprehensive income (414) 114

---------------------------------------- -------- --------

Other comprehensive income / (expense)

for the year, net of tax 2,051 (635)

Total comprehensive income for the

year 19,573 26,821

---------------------------------------- -------- --------

Total comprehensive income attributable

to:

---------------------------------------- -------- --------

Owners of the company 19,570 26,821

---------------------------------------- -------- --------

Non-controlling interests 3 -

---------------------------------------- -------- --------

Total comprehensive income for the

year 19,573 26,821

---------------------------------------- -------- --------

Consolidated Statement of Financial Position

As at 28 February 2013

Restated

2013 2012

GBP'000 GBP'000

Non-current Assets

Property, plant

and equipment

* Land and buildings 247,497 228,447

* Plant and machinery 32,118 20,746

* Fixtures, fittings and equipment 5,338 4,845

* Commercial vehicles 27,215 26,591

---------------------------------------------- ----------------- ---------

312,168 280,629

Investment in associates

and joint ventures 16,086 1,100

Investment property 89,526 98,453

Intangible assets 286,214 281,523

Other investments 7 10

Other receivables 4,930 4,111

708,931 665,826

---------------------------- ------- -------

Current Assets

Inventories 4,251 2,494

Corporation tax 1,338 -

Trade and other receivables 128,869 105,648

Cash and cash equivalents 32,488 31,044

Assets of disposal

groups classified

as held for sale 10,700 7,790

---------------------------- ------- -------

177,646 146,976

---------------------------- ------- -------

Total Assets 886,577 812,802

---------------------------- ------- -------

Non-current Liabilities

Loans and borrowings 215,707 179,241

Defined benefit pension

scheme 4,794 -

Other liabilities 21,348 16,861

Deferred tax 26,905 29,159

268,754 225,261

---------------------------- ------- -------

Current Liabilities

Trade and other payables 122,542 97,709

Loans and borrowings 33,194 17,852

Corporation tax - 1,020

155,736 116,581

---------------------------- ------- -------

Total Liabilities 424,490 341,842

---------------------------- ------- -------

Net Assets 462,087 470,960

---------------------------- ------- -------

Consolidated Statement of Financial Position, Continued

As at 28 February 2013

Restated

2013 2012

GBP'000 GBP'000

---------------------------------- -------- --------

Capital and reserves

Issued share capital 35,397 35,397

Share premium 300,788 300,788

Foreign currency exchange reserve (212) (771)

Reserve for own shares held by

employee benefit trust (386) (488)

Hedge reserve (1,032) (1,423)

Revaluation reserve 781 -

Retained earnings 126,748 137,457

Group Shareholders' Equity 462,084 470,960

Non-controlling interest 3 -

---------------------------------- -------- --------

Total Equity 462,087 470,960

---------------------------------- -------- --------

Consolidated Statement of Changes in Equity

Reserve

for

Foreign Own

Issued Currency Shares

Share Share Exchange held Hedge Revalua-tion Retained Non-controlling Total

capital Premium Reserve by EBT Reserve Reserve Earnings Total interests Equity

---------------- -------- -------- --------- -------- -------- ------------- --------- --------- ---------------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

March

2012 as

previously

reported 35,397 300,788 (771) (488) (1,423) - 139,203 472,706 - 472,706

Prior period

adjustment - - - - - - (1,746) (1,746) - (1,746)

---------------- -------- -------- --------- -------- -------- ------------- --------- --------- ---------------- ---------

Restated

balance

at 1 March

2012 35,397 300,788 (771) (488) (1,423) - 137,457 470,960 - 470,960

Profit for the

year - - - - - - 17,519 17,519 3 17,522

Other

comprehensive

income for the

year - - 559 - 391 781 320 2,051 - 2,051

---------------- -------- -------- --------- -------- -------- ------------- --------- --------- ---------------- ---------

Total

comprehensive

income/expense

for

the year - - 559 - 391 781 17,839 19,570 3 19,573

Employee

benefit

trust shares

vested - - - 102 - - - 102 - 102

Share based

payment

credit - - - - - - 1,544 1,544 - 1,544

Tax on share

based

payment - - - - - - 278 278 - 278

Purchase of

treasury

shares - - - - - - (9,519) (9,519) - (9,519)

Dividends - - - - - - (20,851) (20,851) - (20,851)

---------------- -------- -------- --------- -------- -------- ------------- --------- --------- ---------------- ---------

Balance at 28

February

2013 35,397 300,788 (212) (386) (1,032) 781 126,748 462,084 3 462,087

---------------- -------- -------- --------- -------- -------- ------------- --------- --------- ---------------- ---------

For the year to 28 February 2013

Consolidated Statement of Changes in Equity

For the year to 29 February 2012

Reserve

for

Foreign Own

Issued Currency Shares Restated

Share Share Exchange held Hedge retained Restated

capital Premium Reserve by EBT Reserve Earnings Total

--------------------- --------- --------- ---------- -------- --------- ---------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March

2011 26,517 181,168 (478) (663) (1,081) 126,246 331,709

Profit for the

year - - - - - 27,456 27,456

Other comprehensive

expense for the

year - - (293) - (342) - (635)

--------------------- --------- --------- ---------- -------- --------- ---------- ---------

Total comprehensive

income/(expense)

for the year - - (293) - (342) 27,456 26,821

Proceeds on share

issues 8,880 124,969 - - - - 133,849

Share issue costs - (5,349) - - - - (5,349)

EBT shares vested - - - 175 - - 175

Share based payment

credit - - - - - 886 886

Tax on share based

payment credit - - - - - 447 447

Dividends - - - - - (17,578) (17,578)

--------------------- --------- --------- ---------- -------- --------- ---------- ---------

Balance at 29

February 2012 35,397 300,788 (771) (488) (1,423) 137,457 470,960

--------------------- --------- --------- ---------- -------- --------- ---------- ---------

Consolidated Cash Flow Statement

For the year to 28 February 2013

Restated

2013 2012

GBP'000 GBP'000

---------------------------------------- -------- --------

Cash generated from continuing

operations 41,395 58,992

Cash outflow from discontinued

operations (9,483) (1,354)

Income taxes paid (3,707) (2,191)

---------------------------------------- -------- --------

Net cash flow from operating activities 28,205 55,447

Acquisition of subsidiaries and

other businesses - net of cash

acquired (16,676) (9,602)

Disposal of subsidiaries - net

of cash disposed 13,088 -

Purchase of property, plant and

equipment (45,202) (93,400)

Proceeds from the sale of property,

plant and equipment 23,353 44,786

Proceeds from disposal of assets

held for sale 11,727 -

VAT outflow in relation to sale

and leaseback of property in prior

year (4,583) -

Net loans advanced to associates

and joint ventures (7,038) (1,925)

Interest received 673 1,980

---------------------------------------- -------- --------

Net cash flow from investing activities (24,658) (58,161)

---------------------------------------- -------- --------

Issue of ordinary shares less cost

of issue - 114,527

Dividend paid on ordinary shares (20,851) (17,578)

Proceeds from new finance leases 18,489 14,469

Repayment of capital element of

finance leases (16,173) (30,753)

Proceeds from new borrowings 38,626 2,028

Repayment of borrowings (16,852) (17,273)

Purchase of treasury shares (9,519) -

Proceeds from grant 3,000 -

Interest paid (12,936) (4,359)

Other finance costs (819) -

Net cash flow from financing activities (17,035) 61,061

---------------------------------------- -------- --------

(Decrease) / increase in cash and

cash equivalents (13,488) 58,347

Cash and cash equivalents at beginning

of year 26,401 (31,946)

---------------------------------------- -------- --------

Cash and cash equivalents at end

of year 12,913 26,401

---------------------------------------- -------- --------

Cash (includes GBP12.7m restricted

cash) 32,488 31,044

Overdraft (19,575) (4,643)

---------------------------------------- -------- --------

Cash and cash equivalents at end

of year 12,913 26,401

---------------------------------------- -------- --------

Accounting Policies

Basis of Preparation and statement of compliance

The accounting policies have been consistently applied to all

the years presented, unless otherwise stated.

The financial information set out in this preliminary

announcement is derived from but does not constitute the Group's

statutory accounts for the year ended 28 February 2013 and year

ended 29 February 2012 and, as such, does not contain all

information required to be disclosed in the financial statements

prepared in accordance with International Financial Reporting

Standards ("IFRS"). The financial information has been extracted

from the Group's audited consolidated statutory accounts upon which

the auditors issued an unqualified opinion.

The preliminary announcement has been prepared on the same basis

as the accounting policies set out in the previous year's financial

statements, except as noted below.

The financial statements of the Group are also prepared in

accordance with the Companies (Guernsey) Law 2008.

Stobart Group Limited is a Guernsey registered company. The

Company's ordinary shares are traded on the London Stock

Exchange.

The financial statements have been prepared on a Going Concern

basis.

The Group's business activities, together with factors likely to

affect its future performance and position, are set out in the

Chief Executive Officer's Report and the financial position of the

Group, its cash flows and funding are set out in the Operational

and Financial Review.

The Group has considerable financial resources, together with

contracts with a number of customers and suppliers. The financial

forecasts show that borrowing facilities are adequate such that the

Group can operate within these facilities and meet its obligations

when they fall due for the foreseeable future. As a consequence,

the Directors believe that the Group is well placed to manage its

business risks successfully despite the current economic

climate.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the forseeable future. Accordingly, the

financial statements have been prepared on a going concern

basis.

Restatement of 29 February 2012 Financial Information

The results of the Chilled transport business for the year to 29

February 2012 have been restated as discontinued operations. This

is required by IFRS 5 to be consistent with the treatment in the

current year.

The accounting for the acquisition of WADI Properties Limited in

the prior year has been amended to revise the provisional

assessment of fair values at acquisition and to reflect the agreed

position as set out in the completion accounts. This is a hindsight

adjustment to acquisition fair values as permitted by IFRS 3.

Separately disclosed items

On 21 January 2013, the Group disposed of the non-core UK

Vehicle Services business of Stobart Automotive for GBP11.0m. This

business had been acquired in August 2012 as part of the

acquisition of Autologic Holdings plc. The profit on disposal of

GBP8.5m has been included in profit on disposal of business in the

income statement.

New territory and new business set up costs of GBP1.0m (2012:

GBP3.4m) comprise costs of investing in new major territories or

significant areas of business to commence or accelerate development

of our business presence. These costs include establishment costs,

legal and professional fees, losses and certain staff and training

costs. The current year costs were in relation to the development

of the major new businesses at London Southend Airport. The prior

year exceptional costs were in relation to the development of

businesses in Ireland and also at London Southend Airport.

Transaction costs comprise the costs of making investments in

new businesses or costs of financing transactions that are not

permitted to be debited to the cost of investment or as issue

costs. These costs include the costs of any aborted

transactions.

Restructuring costs comprise costs of major integration plans

and other business reorganisation and restructuring undertaken by

management. Costs include cost rationalisation, brand

harmonisation, site closure costs, certain short term duplicated

costs, directly related management time, asset write downs and

other costs related to the reorganisation and integration of

acquired and new businesses. These are principally expected to be

one-off in nature.

Segmental information

The operating segments within continuing operations are Stobart

Transport & Distribution, Stobart Estates, Stobart

Infrastructure & Civil Engineering, Stobart Air and Stobart

Biomass.

The Stobart Transport & Distribution segment specialises in

contract logistics including road

haulage, rail freight, ports handling and warehousing.

The Stobart Estates segment specialises in management,

development and realisation of land and buildings assets.

The Stobart Infrastructure & Civil Engineering segment

specialises in delivering internal and external infrastructure and

development projects including rail network operations.

The Stobart Air segment specialises in operation of commercial

airports.

The Stobart Biomass segment specialises in supply of sustainable

biomass for the generation

of renewable energy.

The Executive Directors are regarded as the Chief Operating

Decision Maker (CODM). The

Directors monitor the results of its business units separately

for the purposes of making

decisions about resource allocation and performance assessment.

The main segmental profit

measures are earnings before interest, tax, depreciation and

amortisation and also profit

before tax both shown before separately disclosed items.

Income taxes, non-fleet finance costs and certain central costs

are managed on a Group basis and are not allocated to operating

segments. These costs are included in adjustments and

eliminations.

Period ended Stobart Stobart

28 February Transport Infrastructure

2013 & Stobart & Civil Stobart Stobart Adjustments

Distribution Estates Engineering Air Biomass and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Revenue

External 514,419 15,580 11,062 14,938 16,402 11 572,412

Internal 2,753 1,234 19,800 - - (23,787) -

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Total revenue 517,172 16,814 30,862 14,938 16,402 (23,776) 572,412

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Depreciation (9,908) (1,448) (1,469) (921) (109) (824) (14,679)

Share of profit

of associates

and joint

ventures 126 203 - - - (441) (112)

Reversal of

write downs

of assets - 1,109 - - - - 1,109

Gain in value

of investment

properties - 5,173 - - - - 5,173

Profit on

disposal of/gain

on property

asset held

for sale - 495 - - - - 495

Share based

payments - - - - - (1,244) (1,244)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Segment EBITDA 40,923 17,084 4,876 441 4,132 (9,117) 58,339

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Segment PBT 29,692 6,524 3,157 (673) 3,953 (10,179) 32,474

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Credit for

business purchase -

Profit on

disposal of

business 8,511

New territory

and new business

set-up costs (1,020)

Transaction

costs written

off (2,759)

Restructuring

costs

Amortisation (793)

of acquired

Intangibles (381)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Profit before

tax 36,032

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Assets

Equity accounted

investments 625 2,412 - - - 13,049 16,086

Additions

to non-current

assets 13,634 5,825 590 23,021 1,020 139 44,229

Operating

assets 406,305 356,191 13,550 25,465 60,804 24,262 886,577

Operating

liabilities (181,744) (171,776) (14,672) (26,846) (4,804) (24,648) (424,490)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Net assets 224,561 184,415 (1,122) (1,381) 56,000 (386) 462,087

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Period ended Restated

29 February Stobart Stobart

2012 Transport Infrastructure

Restated & Stobart & Civil Stobart Stobart Adjustments Restated

Distribution Estates Engineering Air Biomass and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

External 454,604 6,708 13,128 8,792 8,404 37 491,673

Internal 4,627 - 44,048 - - (48,675) -

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Total revenue 459,231 6,708 57,176 8,792 8,404 (48,638) 491,673

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Depreciation (13,918) (224) (1,066) (258) (63) (178) (15,707)

Share of

profit of

associates

and joint

ventures - - - - 100 - 100

Reversal

of write

downs of

assets - 400 - - - - 400

Profit on

disposal

of sale and

leaseback

transaction - 5,385 - - - - 5,385

Gain on property

asset held

for sale - 5,740 - - - - 5,740

Share based

payment - - - - - (391) (391)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Segment EBITDA 44,312 13,605 5,641 (167) 1,297 (9,285) 55,403

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Segment PBT 27,673 12,405 4,387 (436) 1,170 (9,802) 35,397

Credit for

business

purchase 821

New territory

business

set-up costs (3,415)

Transaction

costs written

off (1,816)

Restructuring

costs (1,592)

Amortisation

of acquired

intangibles (222)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Profit before

tax 29,173

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Assets

Equity accounted

investments - 8,890 - - - - 8,890

Additions

to non-current

assets 15,410 69,333 4,260 3,289 102 318 92,712

Operating

assets 417,835 307,855 15,245 11,139 54,326 6,402 812,802

Operating

liabilities (164,349) (115,880) (18,703) (24,460) (2,110) (16,340) (341,842)

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Net assets 253,486 191,975 (3,458) (13,321) 52,216 (9,938) 470,960

------------------ -------------- ---------- ---------------- --------- --------- ------------------ ----------

Inter-segment revenues are eliminated on consolidation.

Included in adjustments and eliminations are central costs of

GBP8,421,000 (2012: GBP5,440,000), intra-group profit of

GBP1,758,000 (2012: GBP2,589,000) and other costs attributable to

internal capital developments not capitalised in the Group accounts

of GBPnil (2012: GBP1,773,000).

Also included in adjustments and eliminations are central assets

and liabilities excluding assets and liabilities where it has been

deemed appropriate to allocate to an operating segment.

Dividends

Dividends Paid on Ordinary Shares

2013 2013 2012 2012

Rate Rate

p GBP'000 p GBP'000

------------------------ ---- ------- ---- -------

Final dividend for 2012

paid 6 July 2012 4.0 13,921 - -

Interim dividend paid

7 December 2012 2.0 6,930 - -

Final dividend for 2011

paid 7 July 2011 - - 4.0 10,607

Interim dividend paid

9 December 2011 - - 2.0 6,971

------------------------ ---- ------- ---- -------

Dividends paid 6.0 20,851 6.0 17,578

------------------------ ---- ------- ---- -------

A final dividend of 4.0p per share totalling GBP14,158,435 was

declared on 16 May 2013 and subject to approval of shareholders

will be paid on 5 July 2013. This is not recognised as a liability

as at 28 February 2013.

Business combinations

Acquisitions in the year ended 28 February 2013

Acquisition of Autologic Holdings plc

On 10 August 2012 the Group acquired 100% of the voting rights

of Autologic Holdings plc ("Autologic"), an AIM listed company

based in the United Kingdom and a leading provider of distribution

and technical services to the automotive industry. The business has

now been rebranded as Stobart Automotive and is included in the

Transport & Distribution segment.

The provisional fair value of the identifiable assets and

liabilities of Autologic as at the date of acquisition have been

identified as follows:

Provisional

fair value Previous

recognised carrying

on acquisition value

GBP'000 GBP'000

---------------- ----------

Property, plant and equipment 22,957 18,795

Goodwill - 21,934

Investments in associates

and joint ventures 452 452

Intangible assets: customer

relationships 1,407 121

Cash and cash equivalents 3,502 3,502

Trade and other receivables 31,878 31,795

Inventories 947 947

Trade payables (12,504) (12,504)

Other payables and deferred

income (21,169) (17,628)

Loans and borrowings (15,657) (14,305)

Pension scheme liabilities (5,846) (5,102)

Deferred tax 1,101 1,705

----------

Net assets 7,068 29,712

Goodwill arising on acquisition 5,380

----------------

Total consideration 12,448

----------------

The total cost of the combination was GBP12.4m and was comprised

of cash consideration. There was no contingent consideration as

defined in IFRS 3 'Business Combinations' in connection with this

acquisition.

The primary reason for the acquisition was to enter a new market

for the Group. The goodwill of GBP5.4m is deemed to be attributable

to the acquired significant presence in the automotive sector, the

value of the existing management structure and workforce within

Autologic and the efficiencies, costs reductions and economies of

scale expected to be derived from combining Autologic with the

existing operations of the Group. None of the goodwill generated on

acquisition is expected to be deductible for tax purposes, although

GBP1.0m of the pre-existing goodwill in the Autologic group remains

deductible for tax.

The fair value of the acquired identifiable intangible assets in

respect of customer relationships of GBP1.4m represents

management's assessment of the value of the existing contractual

and non-contractual relationships.

Transaction costs related to the acquisition of GBP0.6m have

been recognised as an expense in the Consolidated Income

Statement.

Acquisitions in the year ended 29 February 2012

Acquisition of WADI Properties Limited

On 28 February 2012 the Group acquired the entire issued share

capital of WADI Properties Limited. WADI Properties Limited is an

unlisted company registered in the United Kingdom and is the

holding company for a number of companies whose principal activity

is property investment. Transaction costs related to the

acquisition of GBP1,044,000 were recognised as an expense in

transaction costs written off in the Consolidated Income

Statement.

The fair value of the identifiable assets and liabilities of

WADI Properties Limited at the date of acquisition were as

follows:

Fair value

recognised

on acquisition

(restated)

GBP'000

Investment properties 89,943

Property, plant and equipment 2,037

Trade and other receivables 1,151

Cash and cash equivalents 207

Trade payables (157)

Other payables and deferred income (2,717)

Corporation tax (153)

Loans and borrowings (87,692)

Deferred tax 11,448

----------------

Net assets acquired 14,067

Excess of fair value of net assets

acquired over cost (821)

----------------

Total consideration 13,246

----------------

The net assets and the provision for deferred consideration

recognised in the provisional acquisition accounting to 29 February

2012 were both based on a provisional assessment of fair values,

due to the proximity of the acquisition to the Group's year end and

also the incomplete status of the completion accounts process.

The assessment of fair values and the completion accounts

process were both concluded in the year, which resulted in the

following adjustments:

-- A reduction of GBP1,150,000 in the fair value of one of the investment properties acquired

-- A reduction in trade and other receivables acquired of GBP53,000

-- An increase in other payables acquired of GBP13,000

-- A reduction in the corporation tax liability of GBP572,000

-- An increase in the deferred tax asset of GBP294,000

In concluding the completion accounts process, the outstanding

completion accounting issues were also resolved from the disposal

of Moneypenny Limited and Westbury Schools Limited by Stobart Group

Limited (then Westbury Property Fund) to WADI Properties Limited,

in September 2007. The outcome of this process is a reduction of

GBP1,017,000 in the consideration paid by WADI Properties Limited

to Stobart Group Limited in September 2007. This amount is owed to

WADI Properties Limited and has been incorporated into the

completion accounts process for the purchase of WADI Properties

Limited by Stobart Group outlined above.

As a result of the resolution of these outstanding completion

accounts issues, additional consideration of GBP1,396,000 has

become payable. The total consideration of GBP13,246,000 comprised

the initial share consideration of GBP6,700,000 and the cash

consideration of GBP6,546,000. The initial share consideration was

satisfied by the issue of 5,399,742 ordinary shares at a fair value

of GBP1.24 each. This share price was the market price at the date

of acquisition.

The excess of the fair value of the assets and liabilities

acquired over the cost of the acquisition represents a bargain

purchase and has been recognised in the income statement, presented

as 'credit for business purchase'. As a result of the above

adjustments the credit for business purchase has been restated to

GBP821,000.

Financial assets and liabilities

2013 2012

Loans and borrowings GBP'000 GBP'000

--------------------------------------------------------------- -------- --------

Non-current

Fixed rate

- Obligations under finance leases

and hire purchase contracts 27,181 15,750

- Loan notes 3,745 7,779

- Bank loans 68,659 74,828

Variable rate:

- Obligations under finance leases

and hire purchase contracts 379 2,402

- Bank loans 115,743 78,482

215,707 179,241

--------------------------------------------------------------- -------- --------

Current

Fixed rate

- Obligations under finance leases

and hire purchase contracts 10,353 9,293

- Bank loans 1,400 -

Variable rate:

* Obligations under finance lease and hire purchase

contracts 1,120 1,404

- Overdrafts 3,156 4,643

- Invoice Discounting Facility 16,418 -

- Bank loans 747 2,512

--------------------------------------------------------------- -------- --------

33,194 17,852

--------------------------------------------------------------- -------- --------

Total loans and borrowings 248,901 197,093

Cash 32,488 31,044

--------------------------------------------------------------- -------- --------

Net Debt 216,413 166,049

--------------------------------------------------------------- -------- --------

The obligations under finance leases and hire purchase contracts

are taken out with various lenders at fixed or variable interest

rates prevailing at the inception of the contracts.

The bank loans at the year end include a GBP100m variable rate

group finance arrangement due for repayment in the following

proportions; 25% May 2018, 25% May 2019 and 50% May 2020. This

facility is subject to a number of financial and non financial

covenants. The Group currently have a committed offer from the

lender for certain amendments to these covenants, which it is in

the company's control to accept, and which the directors are

currently considering. Also included in bank loans is a GBP77.3m

property loan. The property loan is due for repayment in quarterly

installments ending April 2017. This loan has fixed and variable

elements of GBP72.3m (2012: GBP74.8m) and GBP5.0m (2012: GBP12.9m)

respectively at 28 February 2013. The bank loans also include

GBP10m drawn on a GBP20m variable rate committed revolving credit

facility with facility end date of Feb 2016.

Included in cash is GBP12.7m which is held in an asset proceeds

account and as at 29 February 2013 its use was restricted to

reinvestment in new property assets or repayment of the property

loan.

The overdraft facility is secured on working capital and bears

interest at 2.25% above the Bank of England base rate.

The variable rate invoice discounting facility is secured on

receivables.

The loan notes were issued in connection with the acquisition of

Stobart Biomass Products Limited on 19 May 2011 and are repayable

on 23 May 2014.

The Group was in compliance with financial covenants throughout

the year and the previous year.

Notes to the consolidated cash flow statement

Restated

Cash generated from continuing 2013 2012

operations GBP'000 GBP'000

---------------------------------------- --------- ----------

Profit before tax on continuing

operations 36,032 29,173

Adjustments to reconcile profit

before tax to net cash flows

Non-cash:

Movement in unrealised gain on

revaluation of investment properties (5,173) (500)

Realised profit on sale of property,

plant and equipment (866) (7,902)

Share of post tax profits of associates

& joint ventures accounted for

using the equity method (997) (100)

Profit on disposal of business (8,511) -

Profit on disposal of assets held

for sale (495) (5,740)

Reversal of writedown of loan

to joint venture - (400)

Depreciation of property, plant

and equipment 14,679 15,707

Finance income (777) (1,980)

Interest expense 11,963 6,279

Release of grant income (199) -

Non-operating transaction costs 2,759 -

Amortisation of intangible assets 381 222

Credit for business purchase - (821)

Share option charge 1,406 391

Working capital adjustments:

(Increase)/decrease in inventories (1,909) 151

(Increase)/decrease in trade and

other receivables (1,535) 2,197

(Decrease)/increase in trade and

other payables (5,363) 22,315

Cash generated from continuing

operations 41,395 58,992

---------------------------------------- --------- ----------

Related Parties

Relationships of Common Control or Significant Influence

WADI Properties Limited was formerly owned by WA Developments

International Limited, a company owned by W A Tinkler and W Stobart

who are significant shareholders, directors and key management of

the Group. On 28 February 2012, WADI Properties Limited was

acquired by the group for a total consideration of GBP13.2m.

WA Developments International Limited is owned by W A Tinkler

and W Stobart. The Group made purchases totalling GBP78,000 (2012:

GBP72,000) from and sales totalling GBP537,000 (2012: GBP282,000)

to WA Developments International Limited. GBP990,000 (2012:

GBP789,000) was due from and GBP340,000 (2012: GBP404,000) was due

to WA Developments International Limited at the year end.

VLL Limited is a subsidiary of WA Developments International

Limited. During the year, the Group made sales of GBP17,000 (2012:

GBP57,000) and made purchases of GBP826,000 (2012: GBP569,000)

relating to the provision of passenger transport from VLL Limited.

GBP193,000 (2012: GBP86,000) was owed to the Group at the year end

and GBP100,000 (2012: GBPnil) was owed by the Group to VLL Limited

at the year end.

During the year the Group made purchases of GBP550,000 (2012:

GBP652,000) from Ast Signs Limited, a company in which W Stobart

holds a 27% shareholding. A balance of GBP61,000 (2012: GBP189,000)

was owed by the Group at the year end.

Associates and Joint Ventures

The Group had loans outstanding from its joint venture interest,

Convoy Limited of GBP2,132,000 (2012: GBP2,132,000) at the year end

of which GBPnil (2012: GBP1,053,000) has been provided for.

The Group had loans outstanding from its joint venture interest,

Westbury Fitness Hull Limited of GBP471,000 (2012: GBP471,000) at

the year end of which GBP471,000 (2012: GBP471,000) has been

provided for.

The Group had loans outstanding from its joint venture interest

Westar Limited of GBP1,995,000 (2012: GBP2,022,000) of which

GBP1,995,000 (2012: GBP1,922,000) has been provided for.

The Group had loans outstanding from companies within its joint

venture interest, Everdeal Holdings Limited of GBP3,031,000 (2012:

GBP4,111,000) at the year end.

The Group had loans outstanding from its associate interest,

Shuban Power Limited of GBP1,570,000 (2012: GBPnil) at the year

end.

The Group had loans outstanding from its joint venture interest,

Stobart Barristers Limited of GBP306,000 (2012: GBPnil) at the year

end. During the year, the Group made purchases of GBP80,000 (2012:

GBPnil) of which GBP54,000 (2012: GBPnil) was owed at the year

end.

The Group made sales of GBP49,000 (2012: GBPnil) and purchases

of GBP11,000 (2012: GBPnil) to its joint venture interest,

Transport Service Klingels Willems NV of which GBP154,000 (2012:

GBPnil) was owed to and GBP94,000 (2012: GBPnil) owed by the Group

at the year end.

The Group made sales of GBP1,684,000 (2012: GBPnil) and

purchases of GBP2,000 (2012: GBPnil) to its joint venture interest,

Vehicle Logistics Corporation BV of which GBP368,000 (2012: GBPnil)

was owed to the Group at the year end.

Post Balance Sheet Events

There are no post balance sheet events that require disclosure

in the accounts.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR AFMTTMBMBMPJ

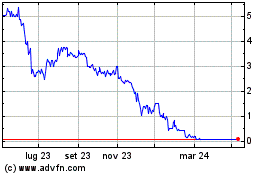

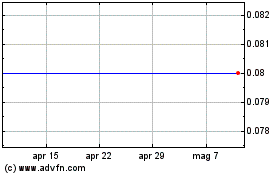

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Ago 2023 a Ago 2024