TIDMFAN

RNS Number : 5741G

Volution Group plc

20 July 2023

Thursday 20 July 2023

Volution Group plc

Pre-close Trading Update for the Financial Year ending 31 July

2023

Continued good progress; EPS ahead of consensus; new acquisition

in New Zealand

Volution Group plc ("Volution" or "the Group" or "the Company",

LSE: FAN), a leading international designer and manufacturer of

energy efficient indoor air quality solutions, today releases a

scheduled Pre-close Trading Update for the financial year ending 31

July 2023 ("FY23" or the "Period").

Good progress; expect adjusted EPS ahead of current market

consensus

Volution has continued to make good progress in the Period and

the Board expects adjusted earnings per share to be towards the top

end of current market forecasts (see note 1).

Good overall organic growth; strong UK performance offsets some

weaker market areas

We are expecting Group organic revenue growth on a constant

currency basis of approximately 5%, despite a challenging

macro-economic backdrop in which the rapid rise in interest rates

has adversely impacted new build construction levels and consumer

confidence. Within this:

-- The UK has delivered our highest rate of organic growth, with

residential revenue performing particularly strongly. Public

refurbishment RMI has benefited from increasing demand arising from

the heightened awareness of health risks associated with mould and

condensation; private RMI demand has proved resilient whilst also

delivering well on price; and new build revenue has benefited from

key account wins and regulatory underpinnings

-- Continental Europe has softened in the second half of the

year with Germany in particular affected by a contraction of new

build activity and the Nordics impacted by both new build weakness

and some earlier, but now completed, destocking in the

refurbishment market. By contrast ClimaRad and ERI have continued

to perform strongly

-- Revenue growth in Australasia has slowed this year after a

number of years of very strong growth.

Strong Group operating margins maintained at c.21%

Whilst material input cost inflation has eased in the year,

inflationary pressures have continued with rising labour costs and

pressures on overhead costs such as facility rent and rates. Strong

pricing discipline along with robust cost control, value

engineering initiatives and good factory efficiency continue to

underpin our operating margin, which is expected to be c. 21% for

FY23.

Two exciting European acquisitions completed

We completed two acquisitions in the year, I-Vent in

Slovenia/Croatia and VMI in France, investing a total of EUR35

million upfront with a potential future contingent consideration of

up to EUR20 million based on stretching growth targets.

Third acquisition; scheduled to complete early in new financial

year

We have signed an agreement to acquire DVS (Proven Systems Ltd)

in New Zealand for initial consideration of NZ$18 million (c.GBP8.7

million) with potential contingent consideration of up to NZ$9

million based on stretching future earnings targets. The

transaction, which has recently received competition authority

approval, is due to complete in August 2023. DVS is a

direct-to-consumer supplier of home ventilation systems, focusing

on mechanical ventilation with heat recovery (MVHR). For the year

ended 31 March 2023, DVS reported unaudited revenues of NZ$18

million and profit before tax of NZ$2 million.

Financial position remains strong

We are expecting a strong year of cash generation, underpinned

by good working capital management, with operating cash conversion

(note 2) expected to be above our targeted level of 90% and

leverage at 31 July 2023 below 1.0x with ample headroom for

continued M&A.

Ronnie George, Volution Chief Executive Officer, commented:

"Volution has delivered another year of good progress against a

backdrop of difficult end markets, again demonstrating the

robustness of our business model and the benefit of the Group's

diverse geographic and end market positioning. Whilst higher

interest rates, leading to higher mortgage rates, are dampening new

build construction demand, RMI, which accounts for approximately

70% of Group revenue, has proved resilient enabling us to deliver

Group organic growth of c.5%.

"The Group's structural growth drivers remain supportive and,

although general end market sentiment is weaker, we continue to see

high levels of interest in our wide range of low carbon ventilation

solutions, driven by consumer awareness of the importance of indoor

air quality, and the regulatory back drop focused on decarbonising

buildings."

Full year results

The full year results for the year ending 31 July 2023 will be

announced on Thursday 5 October 2023.

-ends-

For further information:

Volution Group plc

Ronnie George, Chief Executive

Officer +44 (0) 1293 441501

Andy O'Brien, Chief Financial

Officer +44 (0) 1293 441536

+44 (0) 203 727

FTI Consulting 1340

Richard Mountain

Susanne Yule

Note:

1. The Board believes current market forecasts for the year

ending 31 July 2023 to be adjusted earnings per share in the range

of 23.7p to 25.6p with a consensus of 24.4p

2. Cash conversion defined as: Adjusted operating cash flow /

(Adjusted operating profit + amortisation). Leverage defined as

adjusted EBITDA divided by net debt (excl. IFRS16 liabilities)

Volution Group plc Legal Entity Identifier:

213800EPT84EQCDHO768.

Note to Editors:

Volution Group plc (LSE: FAN) is a leading international

designer and manufacturer of energy efficient indoor air quality

solutions. Volution Group comprises 21 key brands across three

regions:

UK: Vent-Axia, Manrose, Diffusion, National Ventilation,

Airtech, Breathing Buildings, Torin-Sifan.

Continental Europe: Fresh, PAX, VoltAir, Kair, Air Connection,

Rtek, inVENTer, Ventilair, ClimaRad, ERI Corporation, VMI,

I-Vent.

Australasia: Simx, Ventair, Manrose.

For more information, please go to: www.volutiongroupplc.com

Cautionary statement regarding forward-looking statements

This document may contain forward-looking statements which are

made in good faith and are based on current expectations or

beliefs, as well as assumptions about future events. You can

sometimes, but not always, identify these statements by the use of

a date in the future or such words as "will", "anticipate",

"estimate", "expect", "project", "intend", "plan", "should", "may",

"assume" and other similar words. By their nature, forward-looking

statements are inherently predictive and speculative and involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. You should not place

undue reliance on these forward-looking statements, which are not a

guarantee of future performance and are subject to factors that

could cause our actual results to differ materially from those

expressed or implied by these statements. The Company undertakes no

obligation to update any forward-looking statements contained in

this document, whether as a result of new information, future

events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKCBPABKDQOD

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

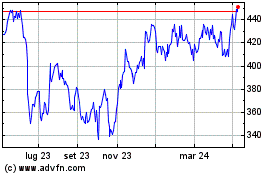

Grafico Azioni Volution (LSE:FAN)

Storico

Da Mar 2024 a Apr 2024

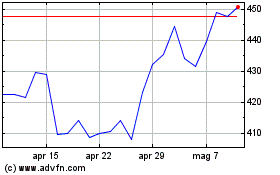

Grafico Azioni Volution (LSE:FAN)

Storico

Da Apr 2023 a Apr 2024