TIDMFAN

RNS Number : 7435O

Volution Group plc

05 October 2023

Thursday 5 October 2023

VOLUTION GROUP PLC

Preliminary Full Year Results for the year ended 31 July

2023

Strong performance; confident of further progress in the year

ahead

Volution Group plc ("Volution" or "the Group" or "the Company",

LSE: FAN), a leading international designer and manufacturer of

energy efficient indoor air quality solutions, today announces its

audited financial results for the 12 months ended 31 July 2023.

RESULTS SUMMARY

2023 2022 Movement

------------------------------------ ----- ----- --------

Revenue (GBPm) 328.0 307.7 6.6%

Adjusted operating profit (GBPm) 69.9 64.9 7.7%

Adjusted operating margin (%) 21.3% 21.1% 0.2pp

Adjusted profit before tax (GBPm) 65.1 60.9 6.8%

Adjusted basic EPS (pence) 25.8 24.0 7.5%

Reported operating profit (GBPm) 57.1 50.8 12.4%

Reported profit before tax (GBPm) 48.8 47.2 3.4%

Reported basic EPS (pence) 19.0 18.1 5.0%

Adjusted operating cash flow (GBPm) 75.7 50.4 50.2%

Dividend per share (p) 8.0 7.3 9.6%

------------------------------------ ----- ----- --------

The Group uses some alternative performance measures to manage

and assess the underlying performance of the business. These

measures include adjusted operating profit, adjusted profit before

tax, adjusted EPS, adjusted operating cash flow, net debt and net

debt (excluding lease liabilities). A definition of all the

adjusted and non-GAAP measures is set out in the glossary of terms

in note 25 to the condensed consolidated financial statements. A

reconciliation to reported measures is set out in note 2 to the

condensed consolidated financial statements.

FINANCIAL HIGHLIGHTS

-- Revenue up 6.6% with organic growth of 4.6% at constant

currency (cc). 60% of r evenue now comes from non-UK customers

-- Adjusted operating margin up 20bps to 21.3%, all three regions above 21%

-- Adjusted basic EPS of 25.8p, up 7.5% and ahead of consensus,

CAGR of 12.7% since IPO in 2014. Reported basic EPS up 5.0%

-- Strong cash generation with adjusted operating cash flow of

GBP75.7m (2022: GBP50.4m), cash conversion of 106% (2022: 76%)

-- Closing leverage (excluding lease liabilities) was 0.8x,

after spending ca. GBP30m on acquisitions during the year, leaving

us well placed to continue to acquire attractive ventilation

businesses

-- Total proposed dividend for the year increased by 9.6% to 8.0

pence per share (2022: 7.3 pence) reflecting the strong performance

and confidence in year ahead

OPERATIONAL HIGHLIGHTS

-- Operating margins increased despite inflationary pressures,

with continued good price discipline, robust cost control and good

factory efficiency

-- GBP29.7m invested in two European acquisitions:

o VMI (France), initial consideration of GBP7.9m. Provides

Volution with direct access to the French market, one of the

largest ventilation markets in Europe

o I-Vent (Slovenia and Croatia), initial consideration of

GBP21.7m. Further extends our product portfolio and European market

leadership in decentralised residential heat recovery

-- Post year end, completed the acquisition of DVS (New

Zealand), a direct-to-consumer supplier of whole home residential

ventilation systems, for upfront consideration of GBP8.5m

-- Successfully launched exciting new products in the year

including our new Vent-Axia Econiq range of centralised heat

recovery units

HEALTHY AIR, SUSTAINABLY

-- Excellent progress against our key sustainability targets:

o 76.2% of plastic used in own manufacturing facilities from

recycled sources (2022: 67.2%), as we continue to develop

innovative strategies to increase the utilisation and availability

of recycled plastic materials

o 70.1% of revenue from low-carbon, energy saving products

(2022: 66.1%), of which 33.8% (2022: 30.1%) was from heat recovery

ventilation systems

-- Reduction of 9.8% in our carbon intensity, to 11.1t CO2e per

GBPm of revenue (2022: 12.3t)

Commenting on the Group's performance, Ronnie George, Chief

Executive Officer, said:

"Through continued successful execution of our sustainable

growth model, we have delivered a strong set of results in a year

of significant headwinds. The Group's resilience is underpinned by

our strong local brands, our increasingly wide geographic end

market diversity and the greater proportion of our revenue

generated from the refurbishment market. Exceptional customer

service provided by dedicated and committed local teams, and an

agile and focused approach to fulfilling customer needs, has

delivered another successful year for the Group."

"Whilst we are mindful of the impact of higher interest rates on

consumer confidence and new build construction, the regulatory

changes in our local markets continue to drive demand for our

innovative and well-positioned low carbon product technologies. In

addition, our three new acquisitions completed in the last six

months; our ongoing focus on operational excellence; and the depth

of experience and commitment across our local teams provides

resilience and gives us confidence of making further progress in

the year ahead."

-Ends-

For further information:

Enquiries:

Volution Group plc

Ronnie George, Chief Executive Officer +44 (0) 1293 441501

Andy O'Brien, Chief Financial Officer +44 (0) 1293 441536

FTI Consulting +44 (0) 203 727 1340

Richard Mountain

Susanne Yule

A meeting for analysts will be held at 9:30am GMT today,

Thursday 5 October 2023, at the offices of Berenberg, 60

Threadneedle Street, London EC2R 8HP. Please contact

FTI_Volution@fticonsulting.com to register to attend or for

instructions on how to connect to the meeting via conference

facility.

A copy of this announcement and the presentation given to

analysts will be available on our website www.volutiongroupplc.com

on Thursday 5 October 2023.

Volution Group plc Legal Entity Identifier:

213800EPT84EQCDHO768.

Note to Editors:

Volution Group plc (LSE: FAN) is a leading international

designer and manufacturer of energy efficient indoor air quality

solutions. Volution Group comprises 22 key brands across three

regions:

UK: Vent-Axia, Manrose, Diffusion, National Ventilation,

Airtech, Breathing Buildings, Torin-Sifan.

Continental Europe: Fresh, PAX, VoltAir, Kair, Air Connection,

inVENTer, Ventilair, ClimaRad, rtek, ERI, VMI, I-Vent

Australasia: Simx, Ventair, Manrose, DVS.

For more information, please go to: www.volutiongroupplc.com

Cautionary statement regarding forward-looking statements

This document may contain forward-looking statements which are

made in good faith and are based on current expectations or

beliefs, as well as assumptions about future events. You can

sometimes, but not always, identify these statements by the use of

a date in the future or such words as "will", "anticipate",

"estimate", "expect", "project", "intend", "plan", "should", "may",

"assume" and other similar words. By their nature, forward-looking

statements are inherently predictive and speculative and involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. You should not place

undue reliance on these forward-looking statements, which are not a

guarantee of future performance and are subject to factors that

could cause our actual results to differ materially from those

expressed or implied by these statements. The Company undertakes no

obligation to update any forward-looking statements contained in

this document, whether as a result of new information, future

events or otherwise.

CHAIRMAN'S STATEMENT

In this, my first statement as Chair of Volution, I am pleased

to report another strong year of progress. The Group has continued

to demonstrate the strength of its business model and strategy,

achieving revenue growth of 6.6%, an adjusted operating margin of

21.3% with excellent cash generation during the year.

Volution is a business with a strong purpose and one that has an

excellent track record of delivering value to all stakeholders. A

key differentiator for Volution amongst its peers is the increase

of industry regulation designed to make indoor air cleaner and

decarbonise buildings. It is this regulation that has continued to

be a key driver of Volution's growth this year, particularly in the

UK public sector, where improving poor quality housing has become a

legal requirement. It will also provide Volution with considerable

resilience in a market where current high interest rates have had

an adverse impact on new build construction levels and consumer

confidence.

Whilst macroeconomic challenges continue, Volution's performance

has demonstrated the strength and resilience of its business model,

supported by our broad geographic and product diversity.

Strategy

The three strategic pillars of the Group are organic growth,

value-adding acquisitions and operational excellence. These

strategic pillars, together with a focus on sustainability, provide

the platform for the implementation of the Group's purpose, to

provide "Healthy Air, Sustainably". Solid progress was made during

the year with good organic growth, whilst the acquisition of VMI,

based in France, and I-Vent, based in Slovenia and Croatia, has

further strengthened the Group's geographic and product

diversification. The Group also acquired DVS in New Zealand, which

was completed shortly after the year end.

Performance and results

Group revenue increased to GBP328.0 million (2022: GBP307.7

million) whilst adjusted operating profit was up 7.7% at GBP69.9

million (2022: GBP64.9 million), representing a margin of 21.3%

(2022: 21.1%). Reported profit before tax increased to GBP48.8

million (2022: GBP47.2 million).

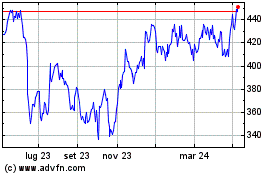

The Group's adjusted earnings per share was 25.8 pence,

representing an increase over the prior year of 1.8 pence, up 7.5%.

The compound annual growth rate of adjusted earnings per share

since IPO in 2014 is 12.7%, demonstrating consistent delivery of

double-digit earnings growth over the period. Basic earnings per

share for the year was 19.0 pence (2022: 18.1 pence).

Adjusted operating cash flow was GBP75.7 million (2022: GBP50.4

million), and we spent GBP29.7 million, net of cash acquired, on

two acquisitions during the year. As a result, net debt excluding

lease liabilities at the year-end remained largely unchanged at

GBP58.1 million (2022: GBP60.8 million).

Dividends

Recognising our strong performance in the year and our continued

confidence in the business, the Board has recommended a final

dividend of 5.5 pence per share, giving a total dividend for the

financial year of 8.0 pence per share (2022: 7.3 pence per share),

an increase of 9.6% on the previous year. This is in line with our

ambition to progressively grow dividends each year. The resulting

adjusted earnings dividend cover for the year was 3.2x (2022:

3.3x).

Subject to approval by shareholders at the Annual General

Meeting on 13 December 2023, the final dividend will be paid on 19

December 2023 to shareholders on the register at 24 November

2023.

Environment, social and governance (ESG) objectives

Volution is committed to high standards of corporate

responsibility, sustainability and employee engagement and

continues to focus on its contribution to a more sustainable world

through its operations, culture and ventilation solutions. The

Group aims to give full consideration to the long-term impact of

all business operations, which means that, wherever feasible, our

products and services are sustainably sourced.

The disclosures in our Sustainability Report, including our TCFD

disclosure, have been further developed this year to provide a

better understanding of our Scope 3 emissions and the carbon

footprint of our products. In addition, the Company has received an

improved AA rating from MSCI, following improvements in Volution's

decarbonisation initiatives - one of the benchmarks for ESG

ratings. We are very proud of our London Stock Exchange Green

Economy Mark, first received in 2021.

Our people & culture

As a Board, we understand the importance of building engagement

and a good corporate culture. We regularly monitor the company

culture and seek opportunities throughout the year to engage with

colleagues across the Group. Claire Tiney, our designated

Non-Executive Director for workforce engagement, continues to

participate in two Group-wide Employee Forum events each year,

enabling in-depth insights to be brought to the Board on the views,

opinions and focus areas of our people. A Group-wide workforce

engagement survey will be launched later this year and as a Board

we look forward to the further insights that this will afford

us.

Safety at work is always central to everything we do, and the

Group remains focused on a zero-harm ambition. I am pleased to

report good progress in the area of Health and Safety, although we

saw a small increase in the reportable accident rate compared to

last year, and the Company remains fully committed to further

strengthening the health and safety culture across all our

businesses.

Our talented people across the global business are at the heart

of our continued success and essential in the execution of Group

strategy. I am grateful to all Volution colleagues for their

commitment and contribution. I would like to welcome our new

colleagues from VMI, I-Vent and DVS to the Volution Group.

Board changes

Paul Hollingworth retired as Chairman of the Board on 23 June

2023, having served on the Volution Board for nine years. I was

delighted to be appointed as Paul's successor and would like to

thank Paul for his leadership and contribution to Volution during

his tenure. I would also like to thank my Board colleagues for

their assistance in ensuring a smooth and orderly succession

process.

As part of the succession process, I stepped down from the role

of Audit Chair and, on 23 June 2023, we were pleased to welcome

Jonathan Davis to the Board as an Independent Non-Executive

Director and Chair of the Audit Committee. With his strong

financial and accounting expertise and extensive public company and

international experience, I am confident that Jonathan will make a

strong contribution to the Board.

Governance

The Group is committed to high levels of corporate governance,

in line with its status as a company with a premium listing on the

Main Market of the London Stock Exchange and as a member of the

FTSE 250. We are fully compliant with the 2018 edition of the UK

Corporate Governance Code.

As a Board we are responsible to the Company's shareholders for

delivering sustainable shareholder value over the long term through

effective management and good governance. As Non-Executive

Chairman, my role is to provide strong leadership to enable the

Board to operate effectively and collegiately. As a Board, it is

our view that open, thorough, and robust discussion around key

strategic matters, risks and opportunities faced by the Group is

central to reaching our strategic goals, including with regard to

our acquisition strategy. We are fortunate to have a diverse range

of business experience on the Board, enabling rigorous and

productive discussions.

Nigel Lingwood

Chairman

4 October 2023

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The results we achieved this year are a clear demonstration of

Volution's strengths as we benefited from our market leading

positions, our wide geographic and end market diversity and our

ability to upsell our products supported by industry regulations.

We estimate that almost 70% of Group revenue is focused on the

refurbishment, maintenance and improvement market ("RMI"),

typically more resilient than new build markets in difficult

economic times. Against a backdrop of high inflation, rising

interest rates, and a slowdown in activity in some of our end

markets, we were still able to achieve organic growth of 5.1%.

Furthermore, our relentless focus on operational excellence,

including strong pricing discipline, robust cost control, value

engineering initiatives and good factory efficiency enabled us to

expand our adjusted operating margin to 21.3%.

Our organic growth was supplemented by our continued focus on

acquiring strong local brands with attractive market positions,

this activity remains a key tenet of Volution's growth strategy.

During the year we were delighted to acquire two businesses, VMI in

France and I-Vent in Slovenia, with a third business, DVS Proven

Systems, acquired post year-end. These acquisitions provide the

Group with increased resilience by broadening its geographic reach

and giving it access to attractive new markets. They also bring

with them innovative low carbon product solutions to further expand

our portfolio.

Volution is a leader in the international heating, ventilation

and air conditioning market and our purpose is to provide "Healthy

Air, Sustainably". Since listing in 2014 we have delivered

consistent revenue and profit growth and strong operating cash

flow. It is this consistent cash generation which underpins our

ability to acquire businesses, which further increases our already

broad geographic market, and we maintain an active pipeline of

potential targets.

As we continue to grow organically, and complement our market

positions with new acquisitions, our management "bench strength" is

of critical importance to our success. During the year we further

strengthened our team including hiring a new Operations Director,

for our UK businesses and commencing a Managing Director search

process for our ClimaRad business in the Netherlands. I am pleased

to say that we will be holding our fourth Management Development

Programme later this year and I know from experience how important

this programme is for retaining and enhancing our talent pool.

As previously reported, the wider supply chain difficulties

experienced by the industry in recent years have now subsided. In

response to these earlier difficulties, Volution took steps to

mitigate any disruption, thus ensuring we had excellent product

availability for our customers throughout this period. This early

action served us, and our customers, well and has resulted in an

increase in our competitive advantage. There are numerous examples

where we have made local market share gains due to strong customer

relationships and apparent gaps in competitor product availability.

The local teams are focused on consolidating these opportunities in

the year ahead.

Our Markets

Volution's revenues are weighted towards the refurbishment

market which now accounts for around two-thirds of sales, with the

balance focused on new build applications. Both new build and

refurbishment activities are increasingly regulated, with the

former seeing an accelerated change as local economies focus more

readily on reducing carbon emissions from new buildings.

The rapid rise in interest rates has had an adverse impact on

new build construction levels and consumer confidence during the

year. Whilst we are seeing lower overall unit construction output

in new residential and commercial projects, ever tightening

regulations (focusing on lowering carbon emissions) is supporting

demand for Volution's innovative and value adding low carbon

solutions, where typically the average unit value is significantly

higher than the traditional ventilation solution that it

replaces.

Demand in the refurbishment market has been supportive during

the year, particularly in the UK where we saw demand in public

refurbishment RMI benefiting from the heightened awareness of

health risks associated with mould and condensation. Private RMI

proved very resilient.

We believe that ventilation refurbishment is far less

discretionary than other product categories in buildings. Post the

pandemic, we have noticed that there is a more pressing need to

replace ventilation products, compared to other elements of

refurbishment that can be postponed indefinitely. We have also seen

the unintended consequences of home occupiers reducing heating

temperatures during the winter months in response to higher energy

prices. This leads to lower temperatures in the dwelling which

propagates the risk of mould and condensation problems with air

holding significantly more moisture when cold, than at higher

temperatures. This too makes the requirement for ensuring good

ventilation more pressing.

To deliver on net zero commitments, Governments must address our

buildings which, in Europe, are responsible for around 40% of our

energy use and 36% of our carbon emissions. Our technology provides

solutions to avoid some of those emissions, and increasing

regulation is the key driver. This year we have provided more

insight in the Annual Report into the regulatory position in each

of our key geographies, covering both air quality and energy

efficiency. Our local teams and our trade associations continue to

ensure our voices are heard as the regulations provide strong

tailwinds supporting the adoption of higher value ventilation

solutions.

Results

The Group delivered revenue of GBP328.0 million (2022: GBP307.7

million), an increase of 6.6% (6.1% cc), with organic growth of

5.1% (4.6% cc) and inorganic growth from the two acquisitions in

the year, as well as the full year effect of the acquisition in the

prior year, of 1.5%. Adjusted operating margins increased from

21.1% in the prior year to 21.3%, a strong performance in the face

of much higher inflation than in previous years. Reported profit

before tax was GBP48.8 million (2022: GBP47.2 million), an increase

of 3.4%.

Sustainability

Good progress was achieved with our sustainability initiatives.

Recycled plastics content in our own production increased

substantially in the year to 76.2% of total consumption. A

significant proportion of the Group's injection moulding and PVC

extrusion production takes place at our Reading facility in the UK

and I am proud of the way in which the team developed innovative

strategies in the year to increase the utilisation and availability

of recycled plastic materials. This is a great example of a cross

functional initiative and whilst we still have some way to go to

achieve the 90% target by the end of our financial year 2025, the

increase from under 60% in 2021 provides a good trajectory towards

the target. Utilising recycled materials is also a significant

commercial advantage for our customers with many new projects

requiring a minimum recycled content in the supply of materials and

we are keen to assist in the more circular economy for the supply

of products into buildings.

Revenue from our low-carbon products has increased to 70.1% in

the year, well ahead of this year's target of 65.6%, and two years

ahead of our target of 70% by the end of 2025. We expect the growth

in our low carbon product solutions to continue to be ahead of the

growth of more traditional products. The recent acquisitions of VMI

in France and I-Vent in Slovenia will positively assist our metric

in the year ahead as they already have a high concentration of

their revenue from low carbon solutions.

Our Sustainability Committee, comprising of our senior

leadership team and our non-executive director, Amanda Mellor, met

twice in the year, where we reviewed progress against our published

targets and key initiatives for the years ahead.

Strategy

Organic Growth

We delivered organic growth of 5.1% (4.6% cc) driven by

increases in both price and volume.

Volution has a long-term target to consistently deliver annual

organic growth in the range of 3-5%. We have again delivered

organic growth at the top end of the range, despite the more

difficult trading environment in the year. As in previous years,

our more vertically integrated business model, our intentional

approach to holding a higher component inventory and our resulting

excellent service levels have helped us to deliver this growth.

Across the Group there have been notable market share gains

directly attributable to superior service levels.

An acceleration of regulatory support; the impact of higher

energy costs; and our strong local brands, managed by local,

motivated, and empowered teams, have enabled us to deliver an above

market growth performance. Our strapline, "Healthy Air,

Sustainably", which we introduced in 2020, resonates strongly

across the Group.

Acquisitions

We completed two acquisitions in the year. In April we announced

the completion of the acquisition of Ventilairsec (VMI) for an

initial consideration of GBP7.9 million (EUR9.0 million), net of

cash acquired. VMI, based in Nantes, France, designs and

manufactures a range of residential ventilation systems focused on

a low carbon positive input ventilation technology known as "VMI".

The acquisition provides Volution with direct access to the French

market, one of the largest ventilation markets in Europe. Our

position in France, whilst currently quite small, is eminently

scalable in the years ahead. A new managing director was recruited

and a successful handover from the owner has already been

completed. We are confident that our wider ranging ventilation

solutions from across the Group can assist the local team to grow

more rapidly in the period ahead.

The VMI acquisition included an earn-out payment of up to EUR5

million, which will be calculated on the basis of the EBIDTA for

the year ended 31 December 2023.

In June 2023 we completed the acquisition of I-Vent for an

initial consideration of GBP21.7 million (EUR25.2 million), net of

cash acquired, with further contingent consideration of up to EUR15

million based on stretching growth targets for the financial

results for the three years up to and including 31 December 2025.

I-Vent, based in Slovenia and Croatia, designs, manufactures, and

supplies residential ventilation systems, primarily focused on

decentralised heat recovery. Similar to the technology in InVENTer,

Germany, we see complementarity in the respective ranges and our

teams are already working out how we can utilise the increased

strength in our product portfolio to optimise our offering.

Post year end we also completed the acquisition of DVS (Proven

Systems Ltd) in New Zealand. DVS supplies directly to consumers and

installs a range of energy-efficient centralised ventilation

systems, incorporating positive input, heat recovery, heat

transfer, and heating and cooling solutions. Their products can be

installed in both new and existing properties and are sold under

the DVS Home Ventilation brand. DVS will be integrated into our

Australasian business and provides an additional sales channel to

supply low carbon solutions.

Operational excellence

Maintaining our long-term adjusted operating margin at, or

above, 20% is an important objective for Volution. In the year we

delivered a 20bps margin improvement to 21.3% in the face of

significant inflationary pressures across materials, labour, and

infrastructure costs. Delivering a consistently strong operating

profit margin is the culmination of many smaller initiatives across

the entire business. Pricing discipline, long term supply chain

partnerships, focus on value engineering and operational efficiency

initiatives and good investment in new moulding, extrusion and

other plant and equipment in 2023, helped underpin our margin.

People

A key highlight of the year was a full return to normal working

practices post the pandemic. Our Group is now truly international,

and the ability to freely visit all facilities was a tremendous

boost. During the year we held more employee engagement meetings

than in our recent past. I am privileged to lead such a diverse and

talented organisation and the feedback from the people in our local

companies is hugely enriching and invaluable to our decision-making

processes.

I was delighted to observe lots of examples of cross border

co-operation on so many levels. Our technical and procurement

resources are managed functionally and provide Volution with a

significant resource to support our local operating companies to

outperform their local competitors. Enhancing collaboration across

these and other working groups is key to our success.

We also held two group wide employee engagement and

communication meetings, also attended by Claire Tiney,

Non-Executive Director, and chair of the Remuneration Committee,

with specific focus on sustainability at one meeting and product

development and innovation at the other.

Retention and development of our talented teams is key to our

success. Since 2012 we have successfully run three management

development programmes across the Group. We are now planning a

fourth programme for late October 2023. This current cohort will

consist of eighteen high potential managers from all geographic and

functional areas of the Group. I am very much looking forward to

the programme kick-off, and I also know how excited the

participants are to be involved. A look back at the first three

management development programmes reveals a retention rate of over

70%.

I believe we have a strong culture of success at Volution, but

also a culture where our teams work closely together and have a lot

of fun in providing "Healthy Air, Sustainably".

Outlook

Through continued successful execution of our sustainable growth

model, we have delivered a strong set of results in a year of

significant headwinds. The Group's resilience is underpinned by our

strong local brands, our increasingly wide geographic end market

diversity and the greater proportion of our revenue generated from

the refurbishment market. Exceptional customer service provided by

dedicated and committed local teams, and an agile and focused

approach to fulfilling customer needs, has delivered another

successful year for the Group.

Whilst we are mindful of the impact of higher interest rates on

consumer confidence and new build construction, the regulatory

changes in our local markets continue to drive demand for our

innovative and well-positioned low carbon product technologies. In

addition, our three new acquisitions completed in the last six

months; our ongoing focus on operational excellence; and the depth

of experience and commitment across our local teams provides

resilience and gives us confidence of making further progress in

the year ahead.

Ronnie George

Chief Executive Officer

4 October 2023

Regional Review

United Kingdom

2023 2022 Change (cc)

Market sector revenue GBPm GBPm %

-------------------------------------- ------- ------ ------------

UK

Residential 89.7 75.1 19.5

Commercial 30.2 31.0 (2.8)

Export 12.1 11.7 1.7

OEM 24.1 25.9 (8.0)

-------------------------------------- ------- ------ ------------

Total UK Revenue 156.1 143.7 8.3

-------------------------------------- ------- ------ ------------

Adjusted operating profit 35.3 29.3 20.6

-------------------------------------- ------- ------ ------------

Adjusted operating profit margin (%) 22.6 20.4 2.2pp

-------------------------------------- ------- ------ ------------

Reported operating profit 28.1 22.3 26.2

-------------------------------------- ------- ------ ------------

The UK delivered the standout performance of the year with

strong revenue and profit growth. UK revenues increased from

GBP143.7 million to GBP156.1 million, an 8.6 % increase (8.3% at

cc), building on good organic growth delivered in the prior year.

The UK saw strong demand in Residential RMI, particularly in the

public sector. Alongside this, exceptional customer service, an

agile and focused team, and residential market share gains helped

deliver this excellent performance. Adjusted operating profit

increased from GBP29.3 million to GBP35.3 million with a

significant increase in the adjusted operating margin at 22.6% up

220 bps from 20.4% in the prior year. The organisational changes

made in the prior year bedded in well delivering a more agile and

responsive outcome across the business. Revenue growth accelerated

in the second half of the year, and we are well placed to deliver

further progress in the year ahead. Although high inflation and

rises in interest and mortgage rates are stifling new construction

activity, Volution's overall market demand continues to be

underpinned by regulatory and wider consumer awareness of the

importance of indoor air quality.

Residential

Sales in our Residential market sector were GBP89.7 million

(2022: GBP75.1 million), an impressive organic growth of 19.5%,

building on last year's strong organic growth. Moreover, we saw an

acceleration of growth in the second half.

In residential new build we delivered another year of revenue

growth supported by the increasing penetration of energy efficient

ventilation technology in new house construction. In June 2022

revisions to Part F and Part L of the Building Regulations provided

increasing support for low carbon energy efficient ventilation

systems for new house building. Those changes inevitably take time

to impact demand for low carbon solutions, as existing construction

sites at the time of the regulatory change will continue to be

constructed to the original plan. During the year we certainly

benefited from these new changes, but we expect to see a greater

proportion of new houses being built with more efficient technology

in the year ahead. New account wins have assisted us to grow market

share and our exceptional levels of customer service and full

product availability to customers, at all times, have set us apart

from the competition. Whilst we are confident that regulatory

changes in 2022, and further changes to the Future Homes Standard

planned for 2025 (delivering buildings that are net zero ready)

will underpin sales of new technology solutions, the new build

market faces significant challenge from the effects of high

interest and mortgage rates. Housing starts reduced considerably in

the year and will result in fewer completions in the period ahead.

This will inevitably result in some moderation of demand for energy

efficient ventilation systems. Nevertheless, the medium to long

term drivers of demand remain compelling. During the year we made

iterative changes to our leading ranges of energy efficient

ventilation solutions. Our UK ventilation brands provide the widest

product range and solutions and are well supported by new

investment in injection moulding and extrusion capacity to

safeguard our excellent levels of customer service and

availability.

The awareness and understanding of the importance of good

quality ventilation in delivering healthy air inside buildings is

now widespread. The strong demand we experienced for our

refurbishment solutions through the pandemic has continued, which

validates our view that ventilation refurbishment is far less

discretionary than other types of building refurbishment.

Our residential refurbishment category in the UK was the fastest

growing area across the entire Group. Our high end, aesthetically

attractive, near silent, comprehensively controlled, private

refurbishment solutions continued to deliver good growth in the

year.

Across our Vent-Axia, National Ventilation and Manrose brands,

we have strong links to our important professional and retail

distribution routes to market. We value our distribution customer

relationships very highly and the sales teams worked very hard

during the year to help educate and train these outlets on the

important aspects of the ventilation industry and our market

leading solutions.

We have a simple but relentless approach to providing excellent

stock availability and customer service, at the centre of which is

first class relationships with our suppliers and customers. The

Group has the largest UK ventilation sales force supporting

customer needs.

Public housing refurbishment demand was very strong in the year.

On 9 February 2023, the Government tabled amendments to the Social

Housing (Regulation) Bill to introduce 'Awaab's Law', which will

require all landlords to investigate and fix reported hazards in

their homes within a specified time frame, or rehouse tenants where

a home cannot be made safe. 'Awaab's Law', was put in place

following the death of a young boy who died due to exposure to

black mould in his socially managed home which had 'inadequate

ventilation". This sad event has further emphasised the importance

of refurbishment in this market sector. As a result, we witnessed a

sharp increase in demand for energy efficient ventilation solutions

and this delivered accelerated revenue growth in the second half of

the year.

Volution has been well placed to support these vital

refurbishment needs. In the 2022 Annual Report we explained how we

were utilising our innovative decentralised heat recovery product

solutions from other parts of the Group to support the UK social

housing ambition to deliver their 2030 net zero carbon targets. In

the year we have been successful in supplying decentralised heat

recovery ventilation solutions to projects that require a further

step up in their ventilation needs following a more structural

refurbishment of the dwelling. Greater air tightness through

insulation, an obvious and important upgrade as part of a low

carbon refurbishment, then warrants heat recovery ventilation to

recover energy and keep fuel bills low. The fuel poverty crisis in

the UK resulted in greater mould and condensation risks during the

last winter, due to the unintended consequence of turning down

heating thermostats to save costs. Colder air temperatures means

less moisture can be held in the air; the resultant issue is water

droplets forming at lower temperatures which leads to greater

condensation and mould. The impact of 'Awaab's Law', the lower

property temperatures, and consumers investigating how to solve

their condensation problems, resulted in a significant increase in

demand for "Positive Input Ventilation" technologies. Utilising our

strong relationships with our distribution customers, we were able

to ensure that contractors could source the exact products they

required to service this strong demand. During the latter part of

2023 we further enhanced our product range and have ensured that

our customers are well placed to service the expected strong market

demand in the year ahead.

Commercial

Sales in our UK Commercial sector were GBP30.2 million (2022:

GBP31.0 million), an organic decline of 2.8%. Volution has a

relatively small share of the larger commercial ventilation market,

albeit with a leading share in the niche area of fan coil

ventilation. The year finished strongly, and saw an increase in

second half revenue, following a decline in the first half.

Excellent progress with our enhanced range of fan coil ventilation

enabled us to make good progress with the supply of products to the

main market of new London commercial offices. Whilst the commercial

office market has generally been more subdued, we are seeing a

growing trend and need for more desirable working environments.

Employees are demanding brighter, more energy efficient work places

and we see a good pipeline of work for both new build and

refurbishment needs for fan coil units. During the year we

completed key new developments for products that provide commercial

heat recovery or commercial heat recycling. This delivered some

success in the second half of the year and puts us in a stronger

position to gain market share in the year ahead. Our investment in

more advanced metal cutting capability at our Dudley facility

provides the capacity to support any increase in

demand.

Export

Sales in our UK Export sector were GBP12.1 million (2022:

GBP11.7 million), an organic growth rate of 1.7% at constant

currency. Export revenues had declined in the first half of the

year, largely due to a significant customer de-stocking exercise,

but performed well in the second half, growing at close to 10% on a

constant currency basis. Our long-term collaborative relationship

with our distributor in Eire delivered another year of growth and

given the stronger Irish housing market, we see good underpinning

of demand for energy efficient heat recovery solutions in the year

ahead.

OEM

Third party Sales in our OEM sector were disappointing at

GBP24.1 million (2022: GBP25.9 million), an organic decline of 8.0%

at constant currency. This was linked to a reduction in customer

demand for motorised impellers utilised in products focusing on the

new build market. However we delivered a significant increase in

the internal supply of our EC3 motorised impellers in the year with

several new initiatives underway to capture more of our internal

needs in the year ahead. A huge strength of the Group is the

vertical integration of moulding, extrusion, and component supply

capability and this has been particularly beneficial in recent

years where we have faced supply chain challenges. Our strategic

intention is to greater utilise our OEM capability to capture more

of the internal demand. This initiative is particularly relevant as

we foresee ongoing weakness of demand for motorised impellers due

to more subdued end market demand for new construction.

Continental Europe

Change

2023 2022 (cc)

Market sector revenue GBPm GBPm %

-------------------------------------- ----------- ------------- --------------

Continental Europe

Central Europe 75.4 65.1 12.7

Nordics 49.1 53.3 (5.7)

-------------------------------------- ----------- ------------- --------------

Total Continental Europe revenue 124.5 118.4 4.4

-------------------------------------- ----------- ------------- --------------

Adjusted operating profit 28.4 29.6 (4.0)

-------------------------------------- ----------- ------------- --------------

Adjusted operating profit margin (%) 22.8 25.0 (2.2)pp

-------------------------------------- ----------- ------------- --------------

Reported operating profit 25.1 23.2 7.9

-------------------------------------- ----------- ------------- --------------

Our Continental Europe revenues increased from GBP118.4 million

to GBP124.5 million, growth of 4.4% at constant currency, within

which organic growth was 0.6% on a constant currency basis. The

sector benefited from the acquisition of VMI in April 2023, I-Vent

in June 2023 and the full-year effect of the acquisition of ERI in

September 2021. Adjusted operating profit was down 4.0% at GBP28.4

million versus a prior year of GBP29.6 million. The adjusted

operating profit margin declined in the year by 220bps to 22.8%,

partly due to the dilutionary impact of the acquisitions, but also

due to the changing mix of revenues with both the higher margin

Nordic and German market revenues declining at a higher rate than

the growth areas such as ERI in North Macedonia.

Central Europe

Sales in the Central Europe region grew 12.7% at constant

currency to GBP75.4 million compared to the prior year of GBP65.1

million. Organic revenue growth was 5.9% on a constant currency

basis, with inorganic growth coming from the acquisition of VMI,

I-Vent and the full-year effect of the acquisition of ERI.

Revenues in Germany in the second half of the year were much

weaker than the prior year. Unlike the usual 70%/30% Group wide

split of revenues between refurbishment and new build, we have a

high concentration of German revenue focused on the new build

market. New build construction was much weaker in the second half

of the year, coupled with inconsistencies around government

subsidies supporting low carbon technologies. Germany has been a

strong contributor to our organic growth since 2019 and a revenue

decline in the year was unusual. In recent months we have refocused

our selling efforts on the significant refurbishment opportunities

in the market. Germany, alongside every other country is working

out how to achieve its net zero carbon targets. Local government is

now providing more clarity on subsidies for various low carbon

technologies, and we had some good successes towards the end of the

year. Strong pricing management, excellent cost controls and some

innovative new product solutions enabled us to maintain our local

gross margins. Whilst the new build outlook remains fragile, the

medium-term dynamic of heat recovery technology demand in Germany,

both in new build and increasingly in refurbishment, remains

compelling.

In the Netherlands, ClimaRad delivered strong organic growth,

accelerating in the second half of the year. Our "total cost of

ownership" model is reaping significant dividends as we demonstrate

the substantial savings that a ClimaRad decentralised heat recovery

system can deliver in a structural refurbishment. The Netherlands

market is one of the most progressive in Europe with a focus on

decarbonising buildings and an established approach to the future

ban of gas boiler installations in the new build market.

This is a hugely supportive change in the market increasing the

utilisation of heat pump technology and an increased investment in

greater insulation for residential buildings. This positions our

decentralised heat recovery technology in ClimaRad very well. The

project orderbook remains strong and we remain confident that we

will make further inroads in the market with our compelling

solution in the year ahead.

In Belgium we delivered organic growth, however, the

introduction of our new extended range of higher airflow heat

recovery systems was delayed until the end of the financial year

2023. Our Econiq range of heat recovery is the culmination of a

significant product development investment, and our new application

software technology will materially aid commissioning and an

improved user experience. Whilst a much later than planned

introduction to the market, we are excited about the opportunity to

regain lost share in the new financial year.

Nordics

Sales in the Nordics region were GBP49.1 million (2022: GBP53.3

million), an organic decline of 5.7% at constant currency compared

to the previous year. The Nordics market was especially challenging

in the second half of the year with weaker demand and significant

customer destocking resulting in a revenue decline. Strong pricing

discipline in the Nordics, a moderating of input cost inflation,

and the increasing benefits of our new production facility in

Växjö, helped us to maintain a strong gross margin performance.

Customer de-stocking is largely completed and whilst the local

markets, as with all of our markets, are grappling with the higher

cost of borrowing, we believe that demand reached its low point in

H2 2023. Our Nordic activities are weighted around 65% to

refurbishment, which is similar to the rest of the Group, the

balance being new build construction. Whilst new build markets are

likely to continue to be subdued whilst interest rates remain at

elevated levels, we continue to exploit opportunities in

refurbishment for higher value adding solutions such as the

significant growth in decentralised heat recovery from a low start

point. Volution is the European leader for the supply of

decentralised heat recovery in residential buildings and this is a

key area of focus for the period ahead.

Acquisitions

Energy Recovery Industries ("ERI"), a leading provider of

aluminium heat exchanger cells for heat recovery applications

delivered another year of strong revenue growth. In line with our

original investment plan to increase our manufacturing capacity in

North Macedonia and boost efficiency, we have also invested in new

equipment during the year enabling us to shorten lead times and

deliver efficiency benefits which further enhanced our operating

profit margin. The long-term growth drivers for heat recovery

ventilation are strong and we plan to make further investments to

enhance our manufacturing facility and capacity in the year

ahead.

In April 2023 we acquired VMI in France. Whilst a relatively

small player in the French market we are delighted to now have a

structural presence in this important market. VMI has an

experienced and passionate team of ventilation experts and coupled

with the access to our wider portfolio of existing and new product

developments we see an opportunity to deliver good organic growth

in the French market. Specialising in energy efficient positive

input ventilation technology, VMI will benefit from enhancing its

product range and new customer relationships.

In June 2023 we completed the acquisition of I-Vent, a provider

of decentralised heat recovery ventilation systems in Slovenia and

Croatia. The acquisition gives the Group access to fast growing new

markets, and I-Vent's innovative Low Carbon product solutions will

further enrich our Group's expansive product portfolio,

particularly in decentralised heat recovery. Retro-fitting heat

recovery into existing residential dwellings is a key strategic

focus for the Group across Europe. With the majority of existing

revenue arising in Slovenia, the Croatian market position, although

much smaller, provides potentially a faster growing opportunity due

to our lower market penetration.

Australasia

2023 2022 Change (cc)

Market sector revenue GBPm GBPm %

-------------------------------------- ------ ------ ------------

Total Australasia revenue 47.4 45.6 3.6

-------------------------------------- ------ ------ ------------

Adjusted operating profit 11.3 9.9 13.9

-------------------------------------- ------ ------ ------------

Adjusted operating profit margin (%) 23.9 21.8 2.1pp

-------------------------------------- ------ ------ ------------

Reported operating profit 10.7 8.8 22.0

-------------------------------------- ------ ------ ------------

Sales in our Australasia region were GBP47.4 million, with

organic growth of 3.6% at constant currency. Adjusted operating

margins improved to 23.9% versus 21.8% in the prior year. Following

a period of substantial organic growth in Australia, organic growth

rates moderated in the year as expected. Pricing discipline and

excellent cost control enabled us to further increase operating

profit margins to 23.9% a significant improvement over the prior

year.

Simx in New Zealand delivered a good performance. Revenue has

increased beyond the high levels of previous years when demand had

been boosted by the Healthy Homes Act. New Zealand has a structural

demand for additional new residential construction, however, as

with other markets, higher interest and mortgage costs are stifling

demand. Similar to the wider group, our revenue focus is

predominantly refurbishment led and we continue to see

opportunities to introduce more innovative technology to this

market.

The post year end acquisition of DVS Proven Systems, completed

on 4 August 2023, further strengthens our position in the

residential "Smart Vent" market. With DVS Proven Systems' unique

consumer focused approach to ventilation in the local market, we

see huge potential to increase sales our value-added solutions.

Through direct consumer marketing, we are confident that we can

encourage greater penetration of both central and de-central heat

recovery systems in New Zealand.

In Australia we continue to make good progress and the launch of

our Sky Fan DC range of ceiling fans was particularly successful in

the year. We launched our Manrose brand into the DIY sector in the

year and we plan to extend this range in the coming months. Ventair

has been part of the Group since 2019 and we are delighted that

over four years after the successful introduction to the Group we

have secured a long-term agreement with the founder and other

members of the senior team, so we can continue to work together to

further grow our market penetration in Australia. Important

elements of our success are the key supplier relationships that we

have fostered since the business was founded and the increasing

strength of the local team, which is well positioned to capitalise

on these relationships.

FINANCIAL REVIEW

Volution delivered another strong financial performance for the

year, with good organic revenue growth, adjusted operating margins

maintained ahead of our 20% target, and robust growth in adjusted

EPS (up 7.5% to 25.8 pence) despite the adverse impacts of higher

interest rates on our financing costs.

I am also pleased to report that the Group delivered an

excellent cash generation performance, with a working capital net

inflow of GBP2.8 million (2022: GBP17.7 million outflow)

contributing to a cash conversion for the year of 106%, well above

our stated 90% target.

Reported and adjusted results

Reported Adjusted(1)

-------------------------------------- ---------- ----------- --------

Year ended Year ended

Year ended Year ended 31 July 31 July

31 July 2023 31 July 2022 Movement 2023 2022 Movement

--------------------------- ------------- ------------- -------- ---------- ----------- --------

Revenue (GBPm) 328.0 307.7 6.6% 328.0 307.7 6.6%

EBITDA (GBPm) 78.3 74.2 5.5% 79.3 73.9 7.4%

Operating profit (GBPm) 57.1 50.8 12.4% 69.9 64.9 7.7%

Net finance costs (GBPm) 6.4 2.0 216.7% 4.8 3.4 44.1%

Profit before tax (GBPm) 48.8 47.2 3.4% 65.1 60.9 6.8%

Basic EPS (p) 19.0 18.1 5.0% 25.8 24.0 7.5%

Dividend per share (p) 8.0 7.3 9.6% 8.0 7.3 9.6%

Operating cash flow (GBPm) 74.7 50.8 47.1% 75.7 50.4 50.2%

Net debt (GBPm)(2) 89.3 85.8 (3.5) 89.3 85.8 (3.5)

ROIC (%) 27.4% 28.8% (1.4)pp 27.4% 28.8% (1.4)pp

--------------------------- ------------- ------------- -------- ---------- ----------- --------

(1) The Group uses some alternative performance measures to

track and assess the underlying performance of the business. These

measures include adjusted operating profit, adjusted profit before

tax, adjusted EPS, adjusted operating cash flow, net debt and net

debt (excluding lease liabilities). The reconciliation of the

Group's reported profit before tax to adjusted measures of

performance is summarised in the table below and in detail in note

2 to the consolidated financial statements. For a definition of all

the adjusted and non-GAAP measures, please see the glossary of

terms in note 25 to the consolidated financial statements.

(2) Net debt, excluding lease liabilities of GBP31.2 million

(2022: GBP25.0 million) would be GBP58.1 million (2022: GBP60.8

million).

Good organic growth, particularly in the UK

Revenue for the year to 31 July 2023 was GBP328.0 million, up

6.6% (2022: GBP307.7 million) within which organic growth accounted

for 4.6% (cc) and inorganic growth 1.5%, with a benefit of 0.5%

from currency translation impacts.

Our strongest performing region was the UK (up 8.3%), with

residential revenue very strong (up 19.5%) fuelled by high public

RMI demand as housing providers and tenants became increasingly

aware of the health risks associated with mould and condensation.

Private RMI also performed well underpinned by both price and

volume increases and demonstrating the less "discretionary" nature

of our RMI demand. Our more challenging sectors in the UK were in

OEM and Commercial, though the latter did return to growth in the

second half of the year.

A more mixed picture in Continental Europe saw us report organic

revenue growth (cc) of 0.6%. Good performances in ClimaRad and ERI

were offset by challenging market conditions in Germany and the

Nordics, linked to weak new build residential markets, and in the

case of Germany to the withdrawal of some previously available

subsidy programs for energy efficiency investments. Inorganic

growth in Continental Europe (3.8%) reflected one month of ERI

revenue in September 2022, and then the impact of our new

acquisitions in France and Slovenia towards the end of the second

half.

Australasia revenue grew 3.6% (cc) after a number of years of

very strong growth, a solid performance given relatively subdued

market conditions and weaker consumer confidence levels.

Adjusted operating margin of 21.3%

Adjusted operating profit increased by 7.7% in the year to

GBP69.9 million (2022: GBP64.9 million). The increase of GBP5.0

million in adjusted operating profit consisted of GBP4.3 million

from organic growth, GBP0.5 million from acquisitions, and GBP0.2

million from favourable currency movements.

Inflationary cost pressures on materials diminished through the

year. This contrasted with the picture for staff costs, property

costs and other categories of overhead costs which continued to

experience inflationary pressures. Coupled with good factory

performance, efficient customer service and continued judicious

selling price management, this enabled us to deliver a 60bps

improvement in gross margins to 48.4% (2022: 47.8%) and a 20bps

improvement in adjusted operating margin to 21.3% (2022:

21.1%).

Adjusted profit before tax of GBP65.1 million was 6.8% higher

than 2022 (GBP60.9 million). Reported profit before tax was GBP48.8

million (2022: GBP47.2 million) and is after charging:

-- GBP11.1 million in respect of amortisation of intangible assets (2022: GBP14.5 million);

-- GBP1.7 million (2022: credit of GBP0.4 million) of other

costs of business combinations, of which:

-- GBP1.0 million relates to costs associated with business

combinations (2022: GBP0.2 million); and

-- GBP0.7 million in respect of contingent consideration in ERI

(2022: reduction GBP0.6 million)

-- GBP1.6 million loss due to the fair value measurement of

financial instruments (2022: gain of GBP1.4 million); and

-- GBP1.9 million re-measurement of future consideration

relating to ClimaRad (2022: GBP1.0 million).

Higher financing costs

Despite leverage (excl. leases) remaining below 1.0x at both the

half year and the full year as a result of our strong cash

generation, the Group's adjusted financing costs nevertheless

increased by 44.1% to GBP4.8 million (2022: GBP3.4 million) as a

consequence of the significant increase in bank base rates through

the period. Our weighted average interest rates on gross debt in

the year was 4.44% (2022: 2.02%).

Year ended 31 July 2023 Year ended 31 July 2022

------------------------------- -------------------------------

Adjusted Adjusted

Reported Adjustments results Reported Adjustments results

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------------- -------- ----------- -------- -------- ----------- --------

Revenue 328.0 -- 328.0 307.7 -- 307.7

---------------------------------- -------- ----------- -------- -------- ----------- --------

Gross profit 158.9 -- 158.9 147.1 -- 147.1

Administration and distribution

costs excluding the costs

listed below (89.0) -- (89.0) (82.2) -- (82.2)

Amortisation of intangible

assets acquired through

business combinations (11.1) 11.1 -- (14.5) 14.5 --

Contingent consideration(1) (0.7) 0.7 -- 0.6 (0.6) --

Costs of business combinations(2) (1.0) 1.0 -- (0.2) 0.2 --

---------------------------------- -------- ----------- -------- -------- ----------- --------

Operating profit 57.1 12.8 69.9 50.8 14.1 64.9

Re-measurement of financial

liability 0.1 -- 0.1 (0.6) -- (0.6)

Re-measurement of future

consideration(3) (1.9) 1.9 -- (1.0) 1.0 --

Net loss on financial instruments

at FV(4) (1.6) 1.6 -- 1.4 (1.4) --

Other net finance costs (4.9) -- (4.9) (3.4) -- (3.4)

---------------------------------- -------- ----------- -------- -------- ----------- --------

Profit before tax 48.8 16.3 65.1 47.2 13.7 60.9

Income tax (11.3) (3.0)(5) (14.3) (11.5) (2.1) (13.6)

---------------------------------- -------- ----------- -------- -------- ----------- --------

Profit after tax 37.5 13.3 50.8 35.7 11.6 47.3

---------------------------------- -------- ----------- -------- -------- ----------- --------

Notes

1. GBP0.7 million in respect of a contingent consideration in

ERI (2022: reduction of GBP0.6 million).

2. GBP1.0 million relates to costs associated with business

combinations (2022: GBP0.2 million).

3. GBP1.9 million re-measurement of future consideration

relating to the business combination of ClimaRad (2022: GBP1.0

million).

4. GBP1.6 million loss was due to the fair value measurement of

financial instruments (2022: gain of GBP1.4 million).

5. GBP3.0 million tax adjustment relates to the tax on the adjusted items above.

Currency impacts

Aside from Sterling, the Group's key trading currencies for our

non-UK businesses are the Euro, representing approximately 25% of

Group revenues, Swedish Krona (approximately 9%), New Zealand

Dollar (approximately 7%) and Australian Dollar (approximately 7%).

We do not hedge the translational exchange risk arising from the

conversion of the results of overseas subsidiaries, although we do

denominate some of our borrowings in our non-sterling trading

currencies, which offsets some of the translation risk relating to

net assets.

The average rates of sterling versus our principal non-sterling

trading currencies are shown in the table below.

Average Average

rate rate

2023 2022 Movement

Euro 1.149 1.182 (2.8)%

Swedish Krona 12.802 12.229 4.7%

New Zealand

Dollar 1.965 1.952 0.7%

Australian

Dollar 1.803 1.825 (1.2)%

--------------- -------- -------- --------

The Group had Euro denominated borrowings as at 31 July 2023 of

GBP79.4 million (2022: GBP71.9 million) and Swedish Krona

denominated borrowings of GBPnil million (2022: GBP2.4 million).

The Sterling value of these foreign currency denominated loans, net

of cash, increased by GBP1.3 million as a result of exchange rate

movements (2022: decreased by GBP0.9 million).

Transactional foreign exchange exposures arise principally in

the form of US Dollar denominated purchases from our suppliers in

China. We aim to purchase a substantial proportion of our expected

requirements approximately twelve months forward, and as such, we

have forward currency contracts in place for approximately 85% of

our forecast average forward requirements for the 2024 financial

year (approximately $19 million).

Earnings per share

Our adjusted basic earnings per share for the year was 25.8

pence (2022: 24.0 pence) and our reported basic earnings per share

for the year was 19.0 pence (2022: 18.1 pence).

High returns on invested capital (ROIC)

Strong profit and cash generation is a key focus of Volution's

financial model, and we look to allocate our capital to investments

(both organic and inorganic) that further underpin the future

growth of the business and create value for our shareholders.

Over recent years we have reported our return on acquisition

investment (ROAI) KPI, measuring our success at generating returns

from our inorganic growth strategy. We are pleased to introduce a

new financial KPI in this year's annual report, Return on Invested

Capital (ROIC), measuring the returns for the Group as a whole.

We believe ROIC is not only helpful for shareholders to monitor

the returns generated by Volution on an ongoing basis, but another

metric which helps demonstrate the underlying quality of the

business versus our global peers and its ability to generate

shareholder value.

Whilst we will continue to monitor and report the performance of

individual acquisitions as they reach the three-year measurement

point, we believe that the ROIC will provide a more comprehensive

overall measure and so this will be adopted in our KPIs.

The Group's ROIC (pre-tax) for the financial year was 27.4%,

measured as adjusted operating profit for the year divided by

average net assets adding back net debt, acquisition related

liabilities, and historic goodwill and acquisition related

amortisation charges (net of the associated deferred tax). The

measure also excludes the goodwill and intangible assets arising

from the original transaction that created the Group when it was

bought out via a leveraged buy-out transaction by private equity

house Towerbrook Capital Partners in 2012.

Our ROIC of 27.4% for financial year 2023 is slightly lower than

the prior year's 28.8%, as a result of the timing of acquisitions.

Our main acquisition in the prior year (ERI) generated 11 months of

operating profit in 2022 relative to two-thirds of the associated

invested capital being included in the net assets as a result of

our three-point average methodology. By contrast our two

acquisitions in this financial year were both towards the end of

the financial year and so had a very modest contribution to our

operating profit. The timing impact of the acquisitions was partly

offset by a benefit from both organic growth and operating margin

expansion.

Importantly, our ROIC of 27.4% is significantly ahead of the

Group's estimated pre-tax Weighted Average Cost of Capital of 10%.

Volution continues to have exciting plans for growth, both through

organic and inorganic investment. Although, at the time of entry to

the Group, acquisitions will be dilutive to ROIC, our track record

of improving the returns post acquisition, coupled with continued

organic growth, mean we are confident of maintaining Group ROIC

above 20% over the medium term while continuing to invest to grow

the business.

Taxation

Our reported effective tax rate for the year was 23.4% (2022:

24.4%), the decrease of 1.0pp was driven by favourable business mix

effect, increase in Patent Box relief and lower non-deductible

items, offsetting the impact of the increase in UK Corporation Tax

rate from 19% to 25%. The reduction in effective adjusted tax rate

to 21.9% (2022: 22.4%) is lower than the reduction in reported

effective tax rates primarily due to non-taxable contingent

consideration. Our reported effective tax rate for the year was

23.2% (2022: 24.4%).

We expect our medium-term underlying effective tax rate to be in

the range of 22% to 25% of the Group's adjusted profit before tax,

depending on the business mix and the profile of acquisitions.

Capital allocation priorities

Volution aims to deliver strong financial returns and cash

generation. Our capital allocation priorities, which remain

unchanged, are:

-- Investment for organic growth, including through capital

expenditure, product development and innovation, and ongoing

development of our people

-- Value-adding acquisitions; and

-- Regular returns to shareholders through dividends.

Strong cash generation and balance sheet

Volution's asset light business model and operations are

strongly cash generative. Underpinned by a working capital inflow

of GBP2.8 million in the year (2022: outflow of GBP17.7 million),

the Group delivered a strong adjusted operating cash flow of

GBP75.7 million (2022: GBP50.4 million). Group cash conversion,

defined as adjusted operating cash flow as a percentage of adjusted

earnings before interest, tax and amortisation (see the glossary of

terms in note 25 to the consolidated financial statements) was 106%

(2022: 76%).

A summary of the year's cash flow is shown in the tables below,

with the principal outflows being in relation to acquisitions

(GBP30.7 million including acquisitions and associated fees),

dividends (GBP14.8 million) and tax paid (GBP14.0 million). Capital

expenditure for the year was GBP7.8 million (2022: GBP6.9 million),

focussed on new product development spend of GBP2.3 million and

operational and capacity enhancements totalling GBP1.2 million in

North Macedonia (ERI), Bosnia (ClimaRad) and the UK. There was also

further investment in IT and our vehicle fleets which we are

progressively transitioning to hybrid vehicles.

Net debt at 31 July 2023 was GBP89.3 million (2022: GBP85.8

million), and is set out in the table below. With low leverage

(excluding finance leases) of 0.8x at 31 July 2023 (2022: 0.9x),

our strong balance sheet and reliable high levels of cash

conversion give us significant capability for future growth

investment.

Value adding acquisitions

Acquisition spend in the year net of cash acquired was GBP29.7

million (2022: GBP24.4 million). We completed two acquisitions,

Ventilairsec (VMI) in France, and I-Vent based in Slovenia and

Croatia. We agreed a further acquisition, DVS Proven Systems (New

Zealand), which was completed shortly after the year end.

VMI, based in Nantes, France, was acquired for an initial

consideration of GBP7.9 million (EUR9.0 million), net of cash

acquired. VMI designs and manufactures a range of residential

ventilation systems focused on a low carbon positive input

ventilation approach. The acquisition provides Volution with direct

access to the French market, one of the largest ventilation markets

in Europe. The VMI acquisition included an earn-out payment of up

to EUR5 million Euros, which will be calculated on the basis of the

EBITDA for the year ended 31 December 2023.

In June 2023 we completed the acquisition of I-Vent for an

initial consideration of GBP21.7 million (EUR25.2 million), net of

cash acquired, with further contingent consideration of up to EUR15

million based on stretching growth targets for the financial

results for the three years up to and including 31 December 2025.

I-Vent, based in Slovenia and Croatia, designs, manufactures and

supplies residential ventilation systems, primarily focused on

decentralised heat recovery.

Movements in net debt position for the year ended 31 July

2023 2022

GBPm GBPm

---------------------------------------------------- ------ ------

Opening net debt 1 August (85.8) (79.2)

---------------------------------------------------- ------ ------

Movements from normal business operations:

Adjusted EBITDA1 79.3 73.9

Movement in working capital 2.8 (17.7)

Share-based payments 1.4 1.1

Capital expenditure (7.8) (6.9)

---------------------------------------------------- ------ ------

Adjusted operating cash flow: 75.7 50.4

- Interest paid net of interest received (3.7) (2.7)

- Income tax paid (14.0) (12.2)

- Cash flow relating to business combination costs (1.0) (0.2)

- Dividend paid (14.8) (13.3)

- Purchase of own shares (1.8) (1.9)

- FX on foreign currency loans/cash (3.1) 0.7

- Issue costs of new borrowings (0.3) (0.3)

- IFRS 16 payment of lease liabilities (4.5) (3.2)

- IFRS 16 decrease/(increase) in lease liabilities (6.2) 0.5

Movements from business combinations:

- Business combination of subsidiaries, net of cash

acquired (29.7) (16.5)

- Contingent consideration relating to Ventair from

operating activities - (3.2)

- Contingent consideration relating to Ventair from

investing activities - (0.9)

- Business combination of subsidiaries, debt repaid (0.1) (3.8)

---------------------------------------------------- ------ ------

Closing net debt 31 July (89.3) (85.8)

---------------------------------------------------- ------ ------

(1) A reconciliation of the Group's reported profit before tax

to adjusted measures of performance are shown in detail in note 2

to the consolidated financial statements.

Reconciliation of Bank debt to Net debt

2023 2022

GBPm GBPm

--------------------------------------- ------ ------

Bank debt (79.4) (74.3)

--------------------------------------- ------ ------

Cash 21.3 13.5

--------------------------------------- ------ ------

Net debt (excluding lease liabilities) (58.1) (60.8)

--------------------------------------- ------ ------

Lease liabilities (31.2) (25.0)

--------------------------------------- ------ ------

Net debt (89.3) (85.8)

--------------------------------------- ------ ------

Reconciliation of adjusted operating cash flow

2023 2022

GBPm GBPm

----------------------------------------------------- ----- -----

Net cash flow generated from operating activities 68.5 41.7

----------------------------------------------------- ----- -----

Net capital expenditure (7.8) (6.9)

UK and overseas tax paid 14.0 12.2

Contingent consideration relating to the acquisition

of Ventair - 3.2

Cash flow relating to business combination costs 1.0 0.2

----------------------------------------------------- ----- -----

Adjusted operating cash flow 75.7 50.4

----------------------------------------------------- ----- -----

Funding facilities and liquidity

In December 2022, the Group exercised the option to extend its

GBP150 million multicurrency "Sustainability Linked Revolving

Credit Facility", together with an additional accordion of up to

GBP30 million, by a period of twelve months. The maturity date of

the facility is now 2 December 2025.

As at 31 July 2023, the Group had GBP70.6 million of undrawn,

committed bank facilities (2022: GBP75.7 million) and GBP21.3

million of cash and cash equivalents on the consolidated statement

of financial position (2022: GBP13.5 million).

Returns to shareholders

Adjusted earnings per share increased by 7.5% to 25.8 pence

(2022: 24.0 pence). The Board is recommending a final dividend of

5.5 pence which, together with an interim dividend paid of 2.5