TIDMFCSS

FIDELITY CHINA SPECIAL SITUATIONS PLC

Half-Yearly results for the six months ended 30 September 2023 (unaudited)

Financial Highlights:

· Fidelity China Special Situations PLC reported a Net Asset Value (NAV)

return of -10.9% compared to the -10.3% return of the Benchmark Index in the six

months ended 30 September 2023.

· The share price return was -12.9% during the same period.

· Despite market sentiment, robust stock picking in the consumer discretionary

and health care sectors proved rewarding.

· The Portfolio Manager believes valuations remain compelling in historic and

absolute terms.

Recent Announcement

· Fidelity China Special Situations PLC [FCSS] has agreed heads of terms with

abrdn China Investment Company Limited [ACIC] in respect of a proposed

combination of ACIC with FCSS. Following the transaction, the enlarged FCSS

would continue to be managed in accordance with its existing investment

objective and policy by FIL Investment Management (Hong Kong) Limited with Dale

Nicholls continuing as the named portfolio manager. Please refer to the stock

exchange announcement released at 7am on 28 November 2023 for further details.

Contacts

For further information, please contact:

Smita Amin

Company Secretary

FIL Investments International

01737 836347

Portfolio Manager's Half-Yearly Review

Macro and market backdrop

At the beginning of the current financial year, it was already becoming clear

that the hoped-for boost from the lifting of China's zero-Covid policy was going

to be less straightforward than anticipated. Rather than seeing an immediate

improvement, the economic outlook has remained uncertain, and this has led to

high levels of volatility in the stock market. However, the policy backdrop has

remained supportive, with the Chinese authorities returning to market-friendly

rhetoric and stepping up efforts to roll out an array of stimulus measures to

boost consumption and revive the economy since the July Politburo meeting.

The property sector has continued to cause concern both domestically and

internationally, with tighter lending conditions leading to increased stress on

some highly leveraged privately-owned property developers. Policy support has

focused on the slowing residential market and lagging consumer sentiment, with

initiatives such as the easing of mortgage conditions, the loosening of the

definition of a `first home' and allowing lower minimum down payment ratios for

both first and second homeowners - all in an effort to support underlying demand

for property. On the fiscal side, the government's ongoing focus on quality

rather than quantity of economic growth, along with stretched local government

finances, has meant that the trend of large-scale and leverage-fuelled

infrastructure projects is likely to have run its course.

A sustained improvement in domestic regulation towards favouring the private

sector or a sustained stabilisation of key geopolitical relationships would

likely initiate a gradual rerating of Chinese stocks. We see positive signs of

Beijing nurturing high-end manufacturing and encouraging foreign participation.

A case in point is Xi Jinping's announcement during the recent BRI Forum that

China will terminate all restrictions for foreign participation in

manufacturing.

One of the principal reasons why the post-Covid reopening fell flatter than

expected was that consumer confidence has remained muted. The factors driving

this include weak business confidence, particularly on the back of well

-publicised job cuts at the big tech companies, and youth unemployment

headlines. Weakness in the property market is also likely playing a part given

the significant weight of property on the consumer balance sheet. On the

positive side, Chinese citizens are sitting on record amounts of savings and the

assumption had been that they would be keen to travel and spend as soon as they

were able to do so. The recent `Golden Week' holiday saw domestic tourism

rebound to pre-pandemic levels, although overseas travel remains below trend.

Despite the mixed signals, however, we believe consumption will likely continue

to be the prime driver of the recovery, supported by factors such as the move

towards urbanisation, which supports rising consumer purchasing power. While

this trend may have slowed down during Covid, it remains clearly intact, and the

overall levels of urbanisation still significantly lag levels seen in the West.

The rise of the Chinese consumer has long been a major theme for Fidelity China

Special Situations, as evidenced by more than 40% of the portfolio held in

consumer stocks.

Performance and portfolio review

Chinese equities have experienced extreme volatility over the past six months,

erasing the gains since the market's recent peak at the start of 2023. The

initial euphoria around China's reopening was short-lived, as investor sentiment

and consumer confidence were both adversely affected by subdued macroeconomic

data and renewed stress on the financial and real estate sectors since the

second quarter. Against this uncertain backdrop, the Company's NAV declined by

10.9% in the six-month reporting period to 30 September 2023, slightly more than

the MSCI China Index (the Benchmark Index) which was down by 10.3%. The

Company's share price fell by 12.9% over the same period, reflecting a widening

of the discount to NAV. (All performance data on a total return basis.)

While an overweight exposure to financials and materials detracted from

performance during the period, robust stock picking in the consumer

discretionary and health care sectors proved rewarding.

Within the consumer area, some of the initial beneficiaries of reopening in

discretionary spending continued to post attractive gains. Holdings in Hisense

Home Appliances Group, the branded variety retailer MINISO and Lao Feng Xiang, a

leading jewellery retailer, all made gains, supported by their solid execution

and positive structural growth outlooks. These gains were partially offset by

the position in China Tourism Group Duty Free, which declined amid weaker-than

-expected consumer confidence.

Elsewhere in the consumer discretionary space, shares in automobile parts

manufacturer Intron Technology also declined on the back of disappointing

results. However, we believe that structural tailwinds in China's auto sector

toward electrification continue to underpin its long-term outlook.

Within the health care sector, WuXi AppTec Group - one of our largest holdings

on both an absolute basis and relative to the Benchmark Index - contributed

positively to performance. It is a leading biopharma contract development and

manufacturing company and reported upbeat financial results. Its shares were

also supported by the hype around glucagon-like peptide 1 (GLP-1) drugs for

weight-loss, spurred on by ground-breaking results from a recent clinical study.

The position in biotech company HUTCHMED China also advanced on the back of

better-than-expected results. Cost-saving initiatives made a meaningful

contribution to its earnings, and it has no near-term funding needs as it has

adequate cash to fund its upcoming research and development (R&D) pipeline.

Moreover, shares in the China-focused and Japan listed drug developer GNI Group

were supported by results that were in line with expectations. It revised its

revenue and profit guidance upwards after receiving an upfront licence payment

from Astellas for its US subsidiary Cullgen.

In contrast, not holding NetEase and Li Auto held back returns relative to the

Benchmark Index. Shares of NetEase advanced amid easing industry crackdowns and

resilient demand in the gaming sector. The company has benefited from its recent

better-than-expected game blockbusters in China. Electric vehicle manufacturers

trended upwards on the back of the recent announcement of an extended tax break

on renewable automobile purchases. Thus, not holding Li Auto, one of China's

largest pure-play electric vehicle companies, weighed on relative returns.

Within financials, the position in credit facilitator Lufax Holding declined as

it released subdued results. Tightening lending criteria, driven by weakness in

China's macroeconomic backdrop, has led to a decline in new loans which poses a

near-term headwind to the company's earnings. Nonetheless, Lufax remains

substantially undervalued and provides significant upside potential given its

leading position in online lending to small and medium-sized enterprises (SMEs)

and attractive valuations.

ESG and engagement

We continue to develop our sustainability ratings system and processes to meet

the ever-evolving landscape of investing through an ESG lens. Before

highlighting our most recent updates, we believe it is important to reiterate

why we have institutionalised sustainability into our investment process. There

are three layers to our approach. The first is a foundation of robust

sustainable investing practices that helps to build sustainable financial

futures. The second layer is made up of different modules that will evolve to

meet dynamic requirements - building digital tools to support effective

analysis, integration, and the reporting of sustainability in our investment

process. The final layer is how we communicate our process externally (such as

meetings and engagement with companies' management teams).

We equally believe our proprietary ratings add value to third-party ESG research

while adhering to our fundamental investment philosophy. Too often, different

ESG research providers reach different conclusions on the same companies, due to

different underlying methodologies and judgements on materiality. Furthermore,

by using an average, we feel that the `overall' score used by others can mask a

complex set of underlying `E', `S' and `G' factors.

When dealing with so-called "less sustainable" companies, one can engage with

them to help implement effective change or exclude them entirely from

portfolios. We believe that the former has much greater potential to positively

impact future generations as well as returns over the long-term (opportunities),

particularly if an investor is willing to exert influence and help companies to

improve their ESG trajectory.

With all that said, it is important to note that the Company is not an `ESG

fund' that aims to only invest in those companies dedicated to delivering

positive ESG impacts. Rather, we integrate ESG considerations into our

investment process to mitigate sustainability risks, which can have negative

implications for share prices as well as for people and the planet. Below is an

example of one of our recent engagements with a company in the portfolio to help

them - and therefore us - to manage sustainability risks.

TENCENT HOLDINGS: ENGAGEMENT CASE STUDY

Tencent's ESG team proactively initiated a meeting with Fidelity which is in

itself encouraging. The meeting was wide-ranging and covered `E', `S' and `G'

factors. From an environmental perspective, Tencent has a goal of full carbon

neutrality by 2030. It is only one of the few technology, media and telecom

(TMT) company globally (and the first in China) to have received a Science-Based

Target-initiative (SBTi) approved greenhouse gas ("GHG") reduction target,

behind Microsoft. During the meeting, we discussed comprehensive GHG

disclosures, including Scope 3 emissions (the last of the three groups of

targets required to achieve net zero and covering areas such as employee travel

and new headquarter constructions). The company has started to look into the

potential for Scope 3 emissions reduction, although the actual change will

happen in the medium rather than the short-term.

On the social aspect, Tencent recognises previous controversies related to

Diversity, Equity and Inclusion (DEI) and has proactively made steady progress

towards gender equity at board and company levels. We reiterated Fidelity's

policy requiring a minimum of 30% female representation at the board level.

Following the appointment of a female non-executive director, the board of

Tencent has increased the ratio of female directors to 22.2% and intends to

raise this percentage further.

From a governance perspective, we recommended that the company should consider

greater disclosure on data privacy. Overall, we were impressed to see the

incremental progress Tencent is making in improving its ESG practices.

Current portfolio positioning

On a relative basis, at the reporting period end we were most overweight the

Benchmark Index in the industrials, health care, consumer discretionary and

information technology sectors. We were most underweight in utilities, energy

and communication services.

A notable change to the portfolio during the period was a significant decrease

in exposure to the consumer discretionary sector, triggered mostly by profit

taking. The proceeds of these sales have been deployed to increase our

allocation in consumer staples, materials and energy sectors.

In information technology, we trimmed our holding in Alibaba Group and initiated

a position (which we have since increased) in PDD Holdings, which is the third

largest e-commerce platform in China and shows outstanding efficiency in supply

chain management and cost control. This competitive edge allows the company to

offer very competitive pricing, driving continuous gains in market share. This

same edge is helping PDD to expand internationally via its Temu brand,

leveraging China's supply chain to meet offshore demand. Currently, Temu is

still loss-making due to its significant investment in the user acquisition

phase, so in the near-term the expansion is a drag on PDD's profits. However,

over the long-term, we believe there is good potential for significant value to

be created in this business, and therefore, the stock offers great upside

potential when profitability improves, and the market takes a more positive view

of the sustainability of its earnings.

Elsewhere in the consumer space, the positions in MINISO and Lao Feng Xiang were

sold to lock in profits which we recycled into better priced opportunities

elsewhere. For example, we purchased a new position in online video platform

operator iQiyi. It offers an attractive valuation and we believe there is good

potential for the competitive environment to improve.

Within the energy sector, we initiated a new position in integrated offshore oil

services provider China Oilfield Services, which is 50% owned by the national

oil company CNOOC. The company provides leading drilling services in China,

while its well service business is also starting to gain market share overseas.

We see favourable supply and demand dynamics in the mid-term and the valuations

are very compelling.

Premium growth in the life insurance market was negatively impacted during Covid

and the recovery has been muted. However, we still see good long-term potential

in the Chinese insurance market given the relatively low levels of penetration.

Capitalising on the weakness in stock prices, we increased our stake in China's

second largest life insurer (by premium income), Ping An Insurance Company of

China. This is a high-quality company that looks attractively valued as the

overall weakness in the life insurance industry bottoms out. The purchase was

funded by selling the entire position in China Pacific Insurance after its

valuation moved upwards, with upside being increasingly priced in.

Within the real estate sector, we initiated a new position in the state-owned

developer China Overseas Land & Investment ("COLI"), given its favourable risk

-reward profile following the recent market correction and policy easing

expectations for the sector. Against the backdrop of the ongoing property

downturn, we believe that leading state-owned players with low funding costs are

well placed to survive and to continue gaining market share, while cash-strapped

private developers with high levels of leverage are likely to struggle. COLI has

been excellent in controlling construction costs and enjoys the lowest funding

costs in the industry thanks to its prudent balance sheet. This absolute cost

advantage enables COLI to have the highest core net profit margin among its

peers.

We also added to building materials companies in the property value chain.

Beijing Oriental Yuhong Waterproof Technology is a long-term market share gainer

amid fast consolidation in the waterproof industry. As the construction

downcycle goes on, hundreds of small building materials companies have exited

the market. Yuhong, however, is likely to maintain and expand its market leading

position. Meanwhile, its shares are trading well below intrinsic value given the

extreme bearish market sentiment towards the property sector, presenting an

attractive balance of risk and reward.

We have outlined our five largest holdings below.

Gearing

We continue to believe that the judicious use of gearing can be accretive to

long-term capital and income returns, allowing us the opportunity to capitalise

on the volatility in the Chinese market. Gearing is primarily deployed using

contracts for difference, which are relatively low-cost and represent a flexible

way of increasing investment exposure, along with a fixed term loan. At the

start of the period under review, net gearing was 21.1% which rose to 25.0% by

the end of September.

Outlook

After a spell of increased uncertainty over China's growth trajectory as it

emerged from Covid lockdowns, the mood music has moved to a slightly more

positive tone in recent weeks. Regulatory concerns are now less relevant, and

the narrative again focuses more on growth. While a 5% annual GDP growth target

seems largely on track, we believe the current backdrop reflects a more measured

growth outlook going into 2024.

In the face of a problematic property market in China, the refinancing

conditions for property developers will likely remain challenging in the near

-term despite more supportive policies. However, this is not detrimental to all

property developers. While we do not expect a significant property rebound given

the structural challenges, home prices are showing signs of resilience,

especially in top tier cities. Ultimately, the existing divergence between

various developers could be magnified further. The indiscriminate sell-off so

far this year has caused some mispricing and this provides an opportunity for

active investors who can successfully identify the leading players who are most

likely to benefit from lower funding costs and can gain market share, while cash

-strapped developers struggle.

While economic challenges and geopolitical risks remain, policy direction

towards regulatory loosening is clear. We have already seen action taken to

boost consumer confidence, such as tax breaks on the purchase of electric

vehicles and lower mortgage requirements for home buyers. Although job and wage

cuts have clearly hurt consumer confidence, we have the sense that the worst is

behind us from our discussions with companies. Over the longer-term, improved

corporate earnings could be a key driver for investor confidence to return.

China is at a different point in the economic cycle to many Western countries.

Rising interest rates and inflation in the West have meant tightening central

bank policies aimed at slowing economies down, whereas the opposite is the case

in China. Inflation has not been a problem, and the authorities are taking a

more stimulative approach to boost growth.

At the same time, valuations in the Chinese equity market - barring some post

-Covid reopening beneficiaries in the consumer discretionary space - remain very

compelling both in historic and absolute terms and compared to some other major

markets. The low level of valuations is despite a corporate earnings outlook

that compares well to most other large markets. Clearly, a lot of pessimism over

the economy appears priced in.

It is widely recognised that the long-term plan of the Chinese government is to

seek to reduce the economy's reliance on investment and property and pivot away

from some of the country's traditional growth drivers towards high-end

manufacturing and domestic consumption. The pace of innovation in China remains

strong, primarily led by private enterprises in sectors such as industrials and

health care. Globally, leading companies have emerged in areas such as electric

vehicles and renewable energy. These are factors contributing to consolidation

trends across a range of sectors, many of which remain very fragmented. While

overseas investors may focus on the impact on China of de- globalisation and

`near-shoring' of industry, the corollary to this is an increasing preference

among Chinese consumers for Chinese brands, resulting in domestic companies

taking ever greater market share in what remains one of the world's largest

markets.

We have spent much time discussing the economic backdrop in China, which has

clearly been challenging. What we feel is often missed are the stories of great

individual companies executing well in industries where they have strong growth

potential, but whose valuations are dragged down by the macro headlines and the

general negative sentiment that we have discussed above. We believe that stock

prices follow earnings in the long-term. Provided their earnings growth comes

through, the upside potential is significant. Our team on the ground is focused

on selecting the winners that will deliver, and that is where we are directing

the Company's capital.

Dale Nicholls

Portfolio Manager

28 November 2023

Spotlight on the Top Five Holdings as at 30 September 2023

The top five holdings comprise 24.7% of the Company's Net Assets.

Industry Communication Services

Tencent Holdings

% of Net Assets 10.1%

Tencent Holdings has a market leading position in social networking in China and

has enriched the user experience and benefits from a sizeable user base. As

China's internet user growth slows and the internet industry focuses

increasingly on monetisation, Tencent is one of the best positioned companies

because of its very sticky user base and strong ecosystem which should lead to

overall margin expansion. An improving government tone towards mobile gaming and

an acceleration of new game approvals since early 2023 and strong domestic game

pipelines should underpin growth in Tencent's gaming segment.

Industry Consumer Discretionary

Pony.ai (unlisted)

% of Net Assets 3.9%

The Toyota backed autonomous vehicle technology company, Pony.ai presents

significant growth potential as a market leader in an emerging new industry that

will transform traditional ways of transportation. The company plans to

commercialise autonomous driving for all sizes of vehicles and to operate on

both ridesharing and delivery service networks.

Industry Consumer Discretionary

Alibaba Group Holding

% of Net Assets 3.8%

Alibaba Group holds a leading position in the e-commerce market. Its core e

-commerce categories, including apparel and makeup, will benefit from a recovery

in consumption and pent-up demand in China. It has a comprehensive ecosystem

that has superior breadth and depth and is the foundation of its loyal merchant

and consumer base which supports its pricing power. Alibaba announced in March

2023 that it will split the company into six businesses in a move designed to

unlock shareholder value and foster market competitiveness.

Industry Healthcare

Wuxi AppTec Group

% of Net Assets 3.5%

WuXi AppTec Group is a leading biotech contract research and manufacturing

("CDMO/CMO") company and one of the dominant global platforms in terms of sales.

It is a long-term compounder and is expected to benefit from global

pharmaceutical industry growth and continued research & development (R&D)

investment by pharmaceutical companies. The continued outsourcing trend from in

-house production to CDMO companies, particularly in China, also underpins its

position. WuXi has established a robust talent pool with strong technical skills

which has helped to drive a loyal and sticky client base.

Industry Consumer Discretionary

PDD Holdings

% of Net Assets 3.4%

PDD Holdings is the third largest e-commerce platform by GMV in China, with

outstanding efficiency in supply chain management and cost control. With its

unique traffic distribution method, PDD is able to offer the cheapest version of

products and continuously gains market share. The company is also expanding

internationally via a new shopping app called Temu by leveraging domestic supply

chains in order to meet offshore demand. PDD's profit has recently been impacted

by its heavy investment during its user acquisition phase, however, Temu offers

great upside potential given the significant user growth being seen.

Twenty Largest Holdings as at 30 September 2023

The Asset Exposures shown below measure the exposure of the Company's portfolio

to market price movements in the shares, equity linked notes and convertible

bonds owned or in the shares underlying the derivative instruments. The Fair

Value is the value the portfolio could be sold for and is the value shown on the

Balance Sheet. Where a contract for difference ("CFD") is held, the fair value

reflects the profit or loss on the contract since it was opened and is based on

how much the share price of the underlying shares has moved.

Asset Fair

Exposure Value

£'000 %1 £'000

Long Exposures - shares unless otherwise

stated

Tencent Holdings (shares and long CFDs)

Internet, mobile and telecommunications 114,086 10.1 63,568

service provider

Pony.ai (unlisted)

Developer of artificial intelligence and 43,774 3.9 43,774

autonomous driving technology solutions

Alibaba Group Holding (shares and long

CFD)

e-commerce group 43,596 3.8 20,175

WuXi AppTec Group (long CFDs)

Pharmaceutical, biopharmaceutical and 39,292 3.5 210

medical device outsourcing provider

PDD Holdings (long CFD)

e-commerce group 38,981 3.4 (145)

DJI International (unlisted)

Manufacturer of drones 30,266 2.7 30,266

China Life Insurance (long CFDs)

Insurance company 29,533 2.6 444

Ping An Insurance Company of China (long

CFD)

Provider of insurance, banking and 29,355 2.6 (1,540)

investment products

Chime Biologics Convertible Bond

(unlisted)

Contract Development and Manufacturing 28,583 2.5 28,583

Organization

Venturous Holdings (unlisted)

Investment company 27,970 2.5 27,970

HollySys Automation Technologies

Provider of automation control system 26,772 2.4 26,772

solutions

Hisense Home Appliances Group

Developer, manufacturer and distributor 26,252 2.3 26,252

of household appliances

Crystal International Group

Clothing manufacturer 26,056 2.3 26,056

China Foods (shares and long CFD)

Processor and distributor of food and 25,536 2.2 2,389

beverages

ByteDance (unlisted)

Technology company 25,411 2.2 25,411

ERA (shares and equity linked notes)

Manufacturer of plastic valves and 23,066 2.0 23,066

fittings

Postal Savings Bank of China

Commercial retail bank 22,684 2.0 22,684

Sinotrans (shares and long CFDs)

Logistics, storage and terminal services 22,617 2.0 10,803

provider

HUTCHMED China

Biopharmaceutical company 21,476 1.9 21,476

Autohome

Online portal for automobile buyers 19,692 1.7 19,692

--------- --------- ---------

------ ------ ------

Twenty largest long exposures 664,998 58.6 417,906

Other long exposures 919,047 81.0 722,879

--------- --------- ---------

------ ------ ------

Total long exposures before hedges (151 1,584,045 139.6 1,140,785

companies)

========= ========= =========

Less: hedging exposures

Hang Seng Index (future) (104,963) (9.2) 629

Hang Seng China Enterprises Index (47,347) (4.2) 327

(future)

--------- --------- ---------

------ ------ ------

Total hedging exposures (152,310) (13.4) 956

========= ========= =========

Total long exposures after the netting 1,431,735 126.2 1,141,741

of hedges

========= ========= =========

Short exposures

Short CFDs (2 holdings) 13,656 1.2 (844)

--------- --------- ---------

------ ------ ------

Gross Asset Exposure2 1,445,391 127.4

========= =========

Portfolio Fair Value3 1,140,897

Net current liabilities (excluding (6,421)

derivative instruments)

---------

------

Net Assets 1,134,476

=========

1Asset Exposure is expressed as a percentage of Net Assets.

2Gross Asset Exposure comprises market exposure to investments of £1,147,456,000

plus market exposure to derivative instruments of £297,935,000.

3Portfolio Fair Value comprises investments of £1,147,456,000 plus derivative

assets of £3,739,000 less derivative liabilities of £10,298,000.

Interim Management Report

Unlisted Investments

The Company can invest up to 15% of its Net Assets plus Borrowings in unlisted

companies which carry on business, or have significant interests, in China. The

limit is applied at the time of purchase of the investment. The unlisted space

in China allows the Portfolio Manager to take advantage of the faster growth

trajectory of earlier stage companies before they potentially become listed on

the public markets. This can offer excellent opportunities for patient and long

-term investors.

As at 30 September 2023, the Company had 12.8% of Net Assets plus Borrowings in

six unlisted investments (31 March 2023: 13.6% of Net Assets plus Borrowings in

nine unlisted investments). In the reporting period, the following companies

listed on the Hong Kong Stock Exchange: Beisen on 13 April 2023; Cutia

Therapeutics on 12 June 2023; and Tuhu Car on 26 September 2023.

The unlisted investments in the Company's portfolio are assessed regularly by

Fidelity's dedicated Fair Value Committee ("FVC") with advice from Kroll, a

third-party valuation specialist, and also the Fidelity analysts who look after

these companies. In addition, Fidelity has an unlisted investments specialist

focused on Chinese unquoted companies. The FVC meets monthly to consider the

valuation of the unlisted investments. However, the unlisted investments are

monitored on a daily basis for trigger events such as funding rounds or news of

fundamentals which may require the FVC to adjust the valuation price as soon as

the relevant Fidelity analyst has been consulted. Kroll undertake a detailed

review of each of the unlisted investments on a quarterly basis. The FVC

provides regular updates to the Board so that it has oversight of the valuation

process. The Board also receives details of any price changes made outside of

the normal quarterly cycle.

Twice yearly, ahead of the Company's interim and its year end, the Audit and

Risk Committee has meetings whereby it receives a detailed presentation from the

FVC, Kroll and Fidelity's unlisted specialist in order to satisfy itself that

the unlisted investments are carried at an appropriate value at the balance

sheet date. The external Auditor attends the unlisted valuations meeting held

ahead of the Company's year end.

The basis of the valuation of the unlisted investments is set out in Notes 2 (e)

and 2 (l) of the Accounting Policies which can be found on pages 65 to 68 of the

Annual Report for the year ended 31 March 2023.

Gearing

The Board continues to believe that the judicious use of gearing (a benefit of

the investment trust structure) can be accretive to long-term capital and income

returns, although being more than 100% invested does mean that the NAV and share

price may be more volatile and can accentuate losses in a falling market. Net

gearing at the period end was 25.0% compared to 21.1% as at 31 March 2023.

The Company renewed its loan facility with Scotiabank Europe PLC for

US$100,000,000 on 14 February 2023 for a period of one year at a fixed interest

annual rate of 6.335%. It is the Board's intention not to renew this facility at

maturity.

Discount Management

The Board believes that investors are best served when the share price trades

close to its NAV per share. However, the Board recognises that the share price

is affected by the interaction of supply and demand in the market based on

investor sentiment towards China, as well as the performance of the Company's

portfolio. A discount control mechanism is in place whereby the Board seeks to

maintain the Company's discount in single digits in normal market conditions.

Until May 2023, shares repurchased were held in Treasury. However, once shares

held in Treasury equated to 15% of the issued share capital, shares repurchased

since then have been cancelled. Shareholders authorised the Directors to buyback

up to 14.99% of the Company's shares at the last Annual General Meeting.

To combat tricky and volatile market conditions during the reporting period, the

Board undertook active discount management, the primary purpose of which was,

and remains, the intent to reduce discount volatility. Despite this

intervention, the Company's discount widened from 9.0% at the start of the

reporting period to end the period at 12.0%. Over the six months, the Board

authorised the repurchase of 11,801,337 shares into Treasury and for

cancellation at a cost of £25,895,000, representing 2.1% of the issued share

capital of the Company. These share repurchases have benefited remaining

shareholders as the NAV per share has been increased by purchasing shares at a

discount. Subsequent to the period end and up to latest practicable date, the

Company has repurchased 5,397,163 shares for cancellation.

Ongoing Charge

The Ongoing Charge (the costs of running the Company) for the six months ended

30 September 2023 was 0.99% (31 March 2023: 0.98%). The variable element of the

management fee was a charge of 0.20% (31 March 2023: 0.20%). Therefore, the

Ongoing Charge including the variable element for the reporting period was 1.19%

(31 March 2023: 1.18%).

Board of Directors

In the announcement made by the Company on 20 July 2023 with the results of its

Annual General Meeting ("AGM"), it was noted that Gordon Orr received less than

80% of the votes cast in favour of his re-election, which was predominantly the

result of a large shareholder's view on his being over boarded. Whilst it is

felt that Mr Orr was able to devote, and was in fact devoting, sufficient time

to the business of the Company, following further discussions since the AGM, the

Board confirms that Mr Orr will step down from one of his board positions by 1

January 2024. His number of directorships is therefore expected to have reduced

ahead of the Company's next Annual General Meeting.

Principal and Emerging Risks

The Board, with the assistance of the Manager (FIL Investments Services (UK)

Limited), has developed a risk matrix which, as part of the risk management and

internal controls process, which identifies the key existing and emerging risks

and uncertainties faced by the Company.

The Board considers that the principal risks and uncertainties faced by the

Company continue to fall into the following risk categories: geopolitical;

market and economic (including currency risk); operational (including those of

third-party service providers); investment performance (including gearing risk);

variable interest entity structures; climate change; discount management;

unlisted securities; environmental, social and governance (ESG); key person;

cybercrime and information security; business continuity; and tax and regulatory

risks. Information on each of these risks is given in the Strategic Report

section of the Annual Report on pages 28 to 32 for the year ended 31 March 2023

which can be found on the Company's pages of the Manager's website at

www.fidelity.co.uk/china.

While the principal risks and uncertainties are the same as those at the last

year end, the uncertainty continues to be heightened by the ongoing global

implications of the Russia and Ukraine conflict, conflict in the Middle East,

continuing tensions between China and the US, tensions with Taiwan. Western

sanctions on China on capital and trade flows and from the economic outlook

remaining challenging. The quantum of risks continues to change and the Board

remains vigilant in monitoring the risks.

Climate change continues to be a key emerging issue, as well as a principal

risk, confronting asset managers and their investors. The Board notes that the

Manager has integrated ESG considerations, including climate change, into the

Company's investment process. The Board will continue to monitor how this may

impact the Company as a risk to investment valuations and potentially to

shareholder returns.

Investors should be prepared for market fluctuations and remember that holding

shares in the Company should be considered to be a long-term investment. Risks

are partially mitigated by the investment trust structure of the Company which

means that no forced sales need to take place to deal with any redemptions.

Therefore, investments in the Company's portfolio can be held over a longer time

horizon.

The Manager has appropriate business continuity and operational plans in place

to ensure the continued provision of services, including investment team key

activities of portfolio managers, analysts and trading/support functions. It

reviews its operational resilience strategies on an ongoing basis and continues

to take all reasonable steps in meeting its regulatory obligations and to assess

operational risks, the ability to continue operating and the steps it needs to

take to serve and support its clients, including the Board.

The Company's other third-party service providers also have similar measures to

ensure that business disruption is kept to a minimum.

Transactions with the Manager and Related Parties

The Manager has delegated the Company's investment management to FIL Investment

Management (Hong Kong) Limited and the role of company secretary to FIL

Investments International. Transactions with the Manager and related party

transactions with the Directors are disclosed in Note 15 to the Financial

Statements below.

Going Concern Statement

The Directors have considered the Company's investment objective, risk

management policies, liquidity risk, credit risk, capital management policies

and procedures, the nature of its portfolio and its expenditure and cash flow

projections. The Directors, having considered the liquidity of the Company's

portfolio of investments (being mainly securities which are readily realisable),

the projected income and expenditure and the loan facility agreement, are

satisfied that the Company is financially sound and has adequate resources to

meet all of its liabilities and ongoing expenses and can continue in operational

existence for a period of at least twelve months from the date of this Half

-Yearly Report.

This conclusion takes into account the Board's assessment of the ongoing risks

as outlined above.

Accordingly, the Financial Statements of the Company have been prepared on a

going concern basis.

By Order of the Board

FIL Investments International

28 November 2023

Directors' Responsibility Statement

The Disclosure and Transparency Rules ("DTR") of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

a)the condensed set of Financial Statements contained within this Half-Yearly

Report has been prepared in accordance with the International Accounting

Standards 34: Interim Financial Reporting; and

b)the Portfolio Manager's Half-Yearly Review and the Interim Management Report

above, include a fair review of the information required by DTR 4.2.7R and

4.2.8R.

The Half-Yearly Report has not been audited or reviewed by the Company's

Independent Auditor.

The Half-Yearly Report was approved by the Board on 28 November 2023 and the

above responsibility statement was signed on its behalf by Mike Balfour,

Chairman.

FINANCIAL STATEMENTS

Income Statement for the six months ended 30 September 2023

Six Year

Six

months ended 31

months

ended 30 March

ended 30

September 2023

September

2023 audited

2022

unaudited

unaudited

Notes Revenue Capital Total Revenue Capital

Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000

£'000 £'000 £'000 £'000

Revenue

Investment 4 22,274 - 22,274 32,704 -

32,704 27,786 - 27,786

income

Derivative 4 9,709 - 9,709 11,566 -

11,566 9,925 - 9,925

income

Other 4 800 - 800 409 - 409

145 - 145

income

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Total 32,783 - 32,783 44,679 -

44,679 37,856 - 37,856

income

========= ========= ========= ========= =========

========= ========= ========= =========

Losses on - (119,622) (119,622) - (6,912)

(6,912) - (52,166) (52,166)

investments

at

fair

value

through

profit or

loss

(Losses)/gai - (36,505) (36,505) - 14,971

14,971 - (88,129) (88,129)

ns

on

derivative

instruments

Foreign - (1,975) (1,975) - 8,167

8,167 - 13,614 13,614

exchange

(losses)/gai

ns

Foreign - (1,013) (1,013) - (4,814)

(4,814) - (13,800) (13,800)

exchange

losses on

bank loans

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Total 32,783 (159,115) (126,332) 44,679 11,412

56,091 37,856 (140,481) (102,625)

income

and

(losses)/gai

ns

========= ========= ========= ========= =========

========= ========= ========= =========

Expenses

Investment 5 (1,293) (5,056) (6,349) (3,012) (11,715)

(14,727) (1,544) (6,002) (7,546)

management

fees

Other (669) (3) (672) (1,097) (4)

(1,101) (486) - (486)

expenses

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Profit/(loss 30,821 (164,174) (133,353) 40,570 (307)

40,263 35,826 (146,483) (110,657)

)

before

finance

costs and

taxation

Finance 6 (3,426) (10,279) (13,705) (3,956) (11,869)

(15,825) (1,256) (3,770) (5,026)

costs

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Profit/(loss 27,395 (174,453) (147,058) 36,614 (12,176)

24,438 34,570 (150,253) (115,683)

)

before

taxation

Taxation 7 (1,177) 383 (794) (1,149) -

(1,149) (1,476) 433 (1,043)

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Profit/(loss 26,218 (174,070) (147,852) 35,465 (12,176)

23,289 33,094 (149,820) (116,726)

)

after

taxation

for the

period

========= ========= ========= ========= =========

========= ========= ========= =========

Earnings/(lo 8 5.43p (36.06p) (30.63p) 7.05p (2.42p)

4.63p 6.45p (29.22p) (22.77p)

ss)

per

ordinary

share

========= ========= ========= ========= =========

========= ========= ========= =========

The Company does not have any income or expenses that are not included in the

profit/(loss) after taxation for the period. Accordingly, the profit/(loss)

after taxation for the period is also the total comprehensive income for the

period and no separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Income Statement of the

Company. The revenue and capital columns are supplementary and presented for

information purposes as recommended by the Statement of Recommended Practice

issued by the AIC.

All the profit/(loss) and total comprehensive income is attributable to the

equity shareholders of the Company. There are no minority interests.

No operations were acquired or discontinued in the period and all items in the

above statement derive from continuing operations.

Statement of Changes in Equity for the six months ended 30 September 2023

Notes Share Share Capital Other Capital

Revenue Total

capital premium redemption reserve reserve

reserve equity

£'000 account reserve £'000 £'000

£'000 £'000

£'000 £'000

Six months

ended 30

September

2023

(unaudited)

Total equity 5,710 211,569 917 186,794 877,782

55,649 1,338,421

at 31

March 2023

Repurchase 13 - - - (6,965) - -

(6,965)

of ordinary

shares into

Treasury

Repurchase 13 (89) - 89 (18,930) - -

(18,930)

of ordinary

shares for

cancellation

(Loss)/profit - - - - (174,070)

26,218 (147,852)

after

taxation for

the period

Dividend 9 - - - - -

(30,198) (30,198)

paid to

shareholders

--------- --------- ---------- --------- --------- --

------- ---------

------ ------ ----- ------ ------ --

---- ------

Total equity 5,621 211,569 1,006 160,899 703,712

51,669 1,134,476

at 30

September

2023

========= ========= ========= ========= =========

========= =========

Year ended

31 March

2023

(audited)

Total equity 5,710 211,569 917 244,043 889,958

48,424 1,400,621

at 31

March 2022

Repurchase 13 - - - (57,249) - -

(57,249)

of ordinary

shares into

Treasury

(Loss)/profit - - - - (12,176)

35,465 23,289

after

taxation for

the year

Dividend 9 - - - - -

(28,240) (28,240)

paid to

shareholders

--------- --------- ---------- --------- --------- --

------- ---------

------ ------ ----- ------ ------ --

---- ------

Total equity 5,710 211,569 917 186,794 877,782

55,649 1,338,421

at 31

March 2023

========= ========= ========= ========= =========

========= =========

Six months

ended 30

September

2022

(unaudited)

Total equity 5,710 211,569 917 244,043 889,958

48,424 1,400,621

at 31

March 2022

Repurchase 13 - - - (23,532) - -

(23,532)

of ordinary

shares into

Treasury

(Loss)/profit - - - - (149,820)

33,094 (116,726)

after

taxation for

the period

Dividend 9 - - - - -

(28,240) (28,240)

paid to

shareholders

--------- --------- ---------- --------- --------- --

------- ---------

------ ------ ----- ------ ------ --

---- ------

Total equity 5,710 211,569 917 220,511 740,138

53,278 1,232,123

at 30

September

2022

========= ========= ========= ========= =========

========= =========

Balance Sheet as at 30 September 2023

Company number 7133583

Notes 30.09.23 31.03.23 30.09.22

unaudited audited unaudited

£'000 £'000 £'000

Non-current assets

Investments at fair value 10 1,147,456 1,318,764 1,256,604

through profit or loss

--------- --------------- ---------------

------

Current assets

Derivative instruments 10 3,739 22,313 15,978

Amounts held at futures 24,438 34,813 66,612

clearing houses and

brokers

Other receivables 11 10,390 11,939 44,391

Cash at bank 51,258 72,943 11,551

--------- --------------- ---------------

------

89,825 142,008 138,532

========= ========= =========

Current liabilities

Derivative instruments 10 (10,298) (20,892) (34,150)

Bank loan (81,870) (80,857) (89,843)

Other payables 12 (10,637) (20,602) (37,900)

Bank overdraft - - (1,120)

--------- --------------- ---------------

------

(102,805) (122,351) (163,013)

--------- --------------- ---------------

------

Net current (12,980) 19,657 (24,481)

(liabilities)/assets

========= ========= =========

Net assets 1,134,476 1,338,421 1,232,123

========= ========= =========

Equity attributable to

equity shareholders

Share capital 13 5,621 5,710 5,710

Share premium account 211,569 211,569 211,569

Capital redemption 1,006 917 917

reserve

Other reserve 160,899 186,794 220,511

Capital reserve 703,712 877,782 740,138

Revenue reserve 51,669 55,649 53,278

--------- --------------- ---------------

------

Total equity 1,134,476 1,338,421 1,232,123

========= ========= =========

Net asset value per 14 238.07p 274.08p 244.47p

ordinary share

========= ========= =========

Cash Flow Statement for the six months ended 30 September 2023

Six Year Six months

months ended ended

ended 31 March 30 September

30 2023 2022

September audited unaudited

2023 £'000 £'000

unaudited

£'000

Operating activities

Cash inflow from investment income 18,806 30,352 24,344

Cash inflow from derivative income 8,129 11,484 9,648

Cash inflow from other income 800 409 145

Cash outflow from Directors' fees (125) (195) (95)

Cash outflow from other payments (7,337) (15,638) (8,143)

Cash outflow from the purchase of (315,682) (429,715) (215,661)

investments

Cash outflow from the purchase of (1,910) (7,957) (3,966)

derivatives

Cash outflow from the settlement of (152,776) (485,760) (215,801)

derivatives

Cash inflow from the sale of 356,034 480,407 231,473

investments

Cash inflow from the settlement of 132,953 510,263 189,426

derivatives

Cash inflow/(outflow) from amounts held 10,375 (2,593) (34,392)

at futures clearing houses and brokers

--------- --------- ---------------

------ ------

Net cash inflow/(outflow) from 49,267 91,057 (23,022)

operating activities before servicing

of finance

========= ========= =========

Financing activities

Cash outflow from bank loan, collateral (2,561) (2,242) (1,190)

and overdraft interest paid

Cash outflow from CFD interest paid (11,245) (12,099) (2,741)

Cash outflow from short CFD dividends - (254) (254)

paid

Cash outflow from the repurchase of (7,095) (57,119) (21,409)

ordinary shares into Treasury

Cash outflow from the repurchase of (17,878) - -

ordinary shares for cancellation

Cash outflow from dividends paid to (30,198) (28,240) (28,240)

shareholders

--------- --------- ---------------

------ ------

Cash outflow from financing activities (68,977) (99,954) (53,834)

========= ========= =========

Decrease in cash at bank (19,710) (8,897) (76,856)

Cash at bank at the start of the period 72,943 73,673 73,673

Effect of foreign exchange movements (1,975) 8,167 13,614

--------- --------- ---------------

------ ------

Cash at bank at the end of the period 51,258 72,943 10,431

========= ========= =========

Represented by:

Cash at bank 51,258 72,943 11,551

Bank overdraft - - (1,120)

--------- --------- ---------------

------ ------

51,258 72,943 10,431

========= ========= =========

Notes to the Financial Statements

1 Principal Activity

Fidelity China Special Situations PLC is an Investment Company incorporated in

England and Wales with a premium listing on the London Stock Exchange. The

Company's registration number is 7133583 and its registered office is Beech

Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey KT20 6RP. The Company

has been approved by HM Revenue & Customs as an Investment Trust under Section

1158 of the Corporation Tax Act 2010 and intends to conduct its affairs so as to

continue to be approved.

2 Publication of Non-statutory Accounts

The Financial Statements in this Half-Yearly Report have not been audited or

reviewed by the Company's Independent Auditor and do not constitute statutory

accounts as defined in section 434 of the Companies Act 2006 (the "Act"). The

financial information for the year ended 31 March 2023 is extracted from the

latest published Financial Statements of the Company. Those Financial Statements

were delivered to the Registrar of Companies and included the Independent

Auditor's Report which was unqualified and did not contain a statement under

either section 498(2) or 498(3) of the Act.

3 ACCOUNTING POLICIES

(i) Basis of Preparation

These Half-Yearly Financial Statements have been prepared in accordance with UK

-adopted International Accounting Standard 34: Interim Financial Reporting and

use the same accounting policies as set out in the Company's Annual Report and

Financial Statements for the year ended 31 March 2023. Those Financial

Statements were prepared in accordance with UK-adopted International Accounting

Standards ("IFRS") in conformity with the requirements of the Companies Act

2006, IFRC interpretations and, as far as it is consistent with IFRS, the

Statement of Recommended Practice: Financial Statements of Investment Trust

Companies and Venture Capital Trusts ("SORP") issued by the Association of

Investment Companies ("AIC") in July 2022.

(ii) Going Concern

The Directors have a reasonable expectation that the Company has adequate

resources to continue in operational existence for a period of at least twelve

months from the date of approval of these Financial Statements. Accordingly, the

Directors consider it appropriate to adopt the going concern basis of accounting

in preparing these Financial Statements. This conclusion also takes into account

the Board's assessment of the ongoing risks as disclosed in the Going Concern

Statement above.

4 Income

Six months Year Six months

ended ended ended

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

£'000 £'000 £'000

Investment income

Overseas dividends 22,274 31,949 27,030

Overseas scrip - 755 756

dividends

--------------- --------------- ---------------

22,274 32,704 27,786

========= ========= =========

Derivative income

Dividends received on 9,405 11,282 9,849

long CFDs

Interest received on 304 284 76

CFDs

--------------- --------------- ---------------

9,709 11,566 9,925

========= ========= =========

Other income

Interest received on 800 409 145

collateral and

deposits

--------------- --------------- ---------------

Total income 32,783 44,679 37,856

========= ========= =========

Special dividends of £1,458,000 have been recognised in capital during the

period (year ended 31 March 2023: £1,155,000 and six months ended 30 September

2022: £nil).

5 Investment Management Fees

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30

September 2023

(unaudited)

Investment management 1,293 3,879 5,172

fee - base

Investment management - 1,177 1,177

fee - variable

--------------- --------------- ---------------

1,293 5,056 6,349

========= ========= =========

Year ended 31 March

2023 (audited)

Investment management 3,012 9,037 12,049

fee - base

Investment management - 2,678 2,678

fee - variable

--------------- --------------- ---------------

3,012 11,715 14,727

========= ========= =========

Six months ended 30

September 2022

(unaudited)

Investment management 1,544 4,632 6,176

fee - base

Investment management - 1,370 1,370

fee - variable

--------------- --------------- ---------------

1,544 6,002 7,546

========= ========= =========

FIL Investment Services (UK) Limited (a Fidelity group company) is the Company's

Alternative Investment Fund Manager ("the Manager") and has delegated portfolio

management to FIL Investment Management (Hong Kong) Limited ("the Investment

Manager").

The base investment management fee for the period from 1 April to 30 June 2023

was charged at an annual rate of 0.90% on the first £1.5 billion of net assets,

reducing to 0.70% of net assets over £1.5 billion. Since 1 July 2023, it has

been charged at an annual reduced rate of 0.85% on the first £1.5 billion of net

assets and has remained unchanged at 0.70% on net assets over £1.5 billion.

In addition, there is a +/-0.20% variable fee based on the Company's NAV per

share performance relative to the Company's Benchmark Index measured daily over

a three-year rolling basis. In the event of outperformance against the Benchmark

Index, the maximum fee that the Company would pay overall is 1.05% (1.10% until

30 June 2023) on net assets up to £1.5 billion and reducing to 0.85% (0.90%

until 30 June 2023) on net assets over £1.5 billion. If the Company

underperforms, then the overall fee can fall as low as 0.65% (0.70% until 30

June 2023) on net assets up to £1.5 billion and reducing to 0.50% on net assets

over £1.5 billion.

Fees are payable monthly in arrears and are calculated on a daily basis. The

base investment management fee has been allocated 75% to capital reserve in

accordance with the Company's accounting policies.

6 Finance Costs

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30

September 2023

(unaudited)

Interest on bank loan 642 1,927 2,569

and overdrafts

Interest paid on CFDs 2,784 8,352 11,136

Dividends paid on short - - -

CFDs

--------------- --------------- ---------------

3,426 10,279 13,705

========= ========= =========

Year ended 31 March 2023

(audited)

Interest on bank loan 663 1,989 2,652

and overdrafts

Interest paid on CFDs 3,230 9,689 12,919

Dividends paid on short 63 191 254

CFDs

--------------- --------------- ---------------

3,956 11,869 15,825

========= ========= =========

Six months ended 30

September 2022

(unaudited)

Interest on bank loan, 309 927 1,236

collateral and

overdrafts

Interest paid on CFDs 884 2,652 3,536

Dividends paid on short 63 191 254

CFDs

--------------- --------------- ---------------

1,256 3,770 5,026

========= ========= =========

Finance costs have been allocated 75% to capital reserve in accordance with the

Company's accounting policies.

7 Taxation

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30

September 2023

(unaudited)

UK corporation tax 383 (383) -

Overseas taxation 794 - 794

charge

--------------- --------------- ---------------

Taxation charge for the 1,177 (383) 794

period

========= ========= =========

Year ended 31 March

2023 (audited)

UK corporation tax - - -

Overseas taxation 1,149 - 1,149

charge

--------------- --------------- ---------------

Taxation charge for the 1,149 - 1,149

year

========= ========= =========

Six months ended 30

September 2023

(unaudited)

UK corporation tax 433 (433) -

Overseas taxation 1,043 - 1,043

charge

--------------- --------------- ---------------

Taxation charge for the 1,476 (433) 1,043

period

========= ========= =========

8 Earnings/(Loss) per Ordinary Share

Six months Year Six months

ended ended ended

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

Revenue earnings per 5.43p 7.05p 6.45p

ordinary share

Capital loss per (36.06p) (2.42p) (29.22p)

ordinary share

--------------- --------------- ---------------

Total (30.63p) 4.63p (22.77p)

(loss)/earnings per

ordinary share

========= ========= =========

The earnings/(loss) per ordinary share is based on the profit/(loss) after

taxation for the period divided by the weighted average number of ordinary

shares held outside Treasury during the period, as shown below:

£'000 £'000 £'000

Revenue profit after 26,218 35,465 33,094

taxation for the period

Capital loss after (174,070) (12,176) (149,820)

taxation for the period

--------------- --------------- ---------------

Total (loss)/profit after (147,852) 23,289 (116,726)

the taxation for the

period

========= ========= =========

Number Number Number

Weighted average number of 482,649,498 503,045,428 512,714,728

ordinary shares held outside of

Treasury

========== ========== ==========

9 Dividend Paid to Shareholders

Six Year Six months

months ended ended

ended 31.03.23 30.09.22

30.09.23 audited unaudited

unaudited £'000 £'000

£'000

Dividend of 6.25 pence per ordinary 30,198 - -

share paid for the year ended 31 March

2023

Dividend of 5.50 pence per ordinary - 28,240 28,240

share paid for the year ended 31 March

2022

--------- --------- ---------------

------ ------

30,198 28,240 28,240

========= ========= =========

No dividend has been declared for the six months ended 30 September 2023 (six

months ended 30 September 2022: £nil).

10 Fair Value Hierarchy

The Company is required to disclose the fair value hierarchy that classifies its

financial instruments measured at fair value at one of three levels, according

to the relative reliability of the inputs used to estimate the fair values.

Classification Input

Level 1 Valued using quoted prices in active markets for identical

assets

Level 2 Valued by reference to inputs other than quoted prices

included in level 1 that are observable (i.e. developed using

market data) for the asset or liability, either directly or

indirectly

Level 3 Valued by reference to valuation techniques using inputs that

are not based on observable market data

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset. The valuation techniques used by the Company are as disclosed in

the Company's Annual Report for the year ended 31 March 2023 (Accounting

Policies Notes 2 (e), (l) and (m) on pages 65 to 68). The table below sets out

the Company's fair value hierarchy:

30 September 2023 (unaudited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 915,517 45,802 186,137 1,147,456

Derivative instrument assets 956 2,783 - 3,739

--------- --------- --------- ---------

------ ------ ------ ------

916,473 48,585 186,137 1,151,195

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument - (10,298) - (10,298)

liabilities

--------- --------- --------- ---------

------ ------ ------ ------

Financial liabilities at fair

value

Bank loan - (81,790) - (81,790)

========= ========= ========= =========

31 March 2023 (audited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 1,081,458 44,428 192,878 1,318,764

Derivative instrument assets 2,492 19,821 - 22,313

--------- --------- --------- ---------

------ ------ ------ ------

1,083,950 64,249 192,878 1,341,077

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument (7,271) (13,621) - (20,892)

liabilities

--------- --------- --------- ---------

------ ------ ------ ------

Financial liabilities at fair

value

Bank loan - (81,092) - (81,092)

========= ========= ========= =========

30 September 2022 (unaudited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 981,880 45,681 229,043 1,256,604

Derivative instrument assets 8,453 7,525 - 15,978

--------- --------- --------- ---------

------ ------ ------ ------

990,333 53,206 229,043 1,272,582

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument - (32,930) (1,220) (34,150)

liabilities

--------- --------- --------- ---------

------ ------ ------ ------

Financial liabilities at fair

value

Bank loan - (89,421) - (89,421)

========= ========= ========= =========

The table below sets out the movements in level 3 investments during the period:

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

£'000 £'000 £'000

Level 3 investments at 192,878 194,650 194,650

the beginning of the

period

Transfers into level 3 at 17,316 - -

cost1

Transfers out of level 3 (11,758) (9,971) (9,971)

- at cost2

Unrealised gains (12,299) 8,199 44,364

recognised in the Income

Statement

--------------- --------------- ---------------

Level 3 investments at 186,137 192,878 229,043

the end of the period

========= ========= =========

1Financial instruments are transferred into level 3 on the date they are

suspended, delisted or if they have not traded for thirty days.

2Financial instruments are transferred out of level 3 when they become listed.

No income has been recognised from the unlisted investments during the period

(year ended 31 March 2023 and six months ended 30 September 2022: £nil). No

additional disclosures have been made in respect of the unlisted investments as

the underlying financial information is not publicly available.

11 Other Receivables

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

£'000 £'000 £'000

Amounts receivable on 3,788 10,135 639

settlement of

derivatives

Securities sold for 703 148 40,746

future settlement

Accrued income 5,768 1,513 2,691

Taxation recoverable 12 13 225

Other receivables 119 130 90

--------------- --------------- ---------------

10,390 11,939 44,391

========= ========= =========

12 Other Payables

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

£'000 £'000 £'000

Amounts payable on 5,175 4,731 31,855

settlement of

derivatives

Securities purchased 1,624 12,402 1,213

for future settlement

Investment management 974 1,266 1,206

fees payable

Accrued expenses 944 1,096 551

Amounts payable for the 1,052 - -

cancellation of shares

Amounts payable for the - 130 2,123

repurchase of shares

Finance costs payable 868 977 952

--------------- --------------- ---------------

10,637 20,602 37,900

========= ========= =========

13 Share Capital

30 31 March 30

September 2023 September

2023 audited 2022

unaudited unaudited

Number of £'000 Number of £'000 Number of

£'000

shares shares shares

Issued,

allotted and

fully

paid

Ordinary

shares of 1

pence

each held

outside of

Treasury

Beginning of 488,325,628 4,884 513,957,409 5,140 513,957,409

5,140

the period

Ordinary (2,900,696) (29) (25,631,781) (256) (9,953,633)

(100)

shares

repurchased

into

Treasury

Ordinary (8,900,641) (89) - - - -

shares

repurchased

for

cancellation

----------- ---------- ------------ ---------- ----------- --

--------

------ ------- ----- ------- ------ --

-----

End of the 476,524,291 4,766 488,325,628 4,884 504,003,776

5,040

period

========== ========== ========== ========== ==========

==========

Ordinary

shares of 1

pence

each held in

Treasury*

Beginning of 82,728,852 826 57,097,071 570 57,097,071

570

the period

Ordinary 2,900,696 29 25,631,781 256 9,953,633

100

shares

repurchased

into

Treasury

----------- ---------- ------------ ---------- ----------- --

--------

------ ------- ----- ------- ------ --

-----

End of the 85,629,548 855 82,728,852 826 67,050,704

670

period

========== ========== ========== ========== ==========

==========

Total share 5,621 5,710

5,710

capital

========== ==========

==========

*The ordinary shares held in Treasury carry no rights to vote, to receive a

dividend or to participate in a winding up of the Company.

During the period, the Company repurchased 2,900,696 (year ended 31 March 2023:

25,631,781 and six months ended 30 September 2022: 9,953,633) ordinary shares

into Treasury. The cost of repurchasing these shares of £6,965,000 (year ended

31 March 2023: £57,249,000 and six months ended 30 September 2022: £23,532,000)

was charged to the Other Reserve.

The Company also repurchased 8,900,641 (year ended 31 March 2023 and six months

ended 30 September 2022: nil shares) ordinary shares for cancellation. The cost

of repurchasing these shares of £18,930,000 (year ended 31 March 2023 and six

months ended 30 September 2022: £nil) was charged to the Other Reserve.

14 Net Asset Value per Ordinary Share

The calculation of the net asset value per ordinary share is based on the

following:

30.09.23 31.03.23 30.09.22

unaudited audited unaudited

Net assets £1,134,476,000 £1,338,421,000 £1,232,123,000

Ordinary shares held 476,524,291 488,325,628 504,003,776

outside of Treasury

Net asset value per 238.07p 274.08p 244.47p

ordinary share

========= ========= =========

It is the Company's policy that shares held in Treasury will only be reissued at

net asset value per ordinary share or at a premium to net asset value per

ordinary share and, therefore, shares held in Treasury have no dilutive effect.

15 Transactions with the Managers and Related Parties

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management to FIL Investment Management

(Hong Kong) Limited. Both companies are Fidelity group companies.

Details of the current fee arrangements are given in Note 5 above. During the

period, management fees of £6,349,000 (year ended 31 March 2023: £14,727,000 and

six months ended 30 September 2022: £7,546,000) were payable to Fidelity.

Fidelity also provides the Company with marketing services. The total amount

payable for these services was £132,000 (year ended 31 March 2023: £263,000 and

six months ended 30 September 2022: £58,000). Amounts payable at the Balance

Sheet date are included in other payables and are disclosed in Note 12 above.

At the date of this report, the Board consisted of six non-executive Directors

(as shown in the Half-Yearly Report) all of whom are considered to be

independent by the Board. None of the Directors has a service contract with the

Company.

The Chairman receives an annual fee of £52,000, the Audit and Risk Committee

Chairman receives an annual fee of £43,500, the Senior Independent Director

receives an annual fee of £41,000 and each other Director receives an annual fee

of £34,500. The following members of the Board hold ordinary shares in the

Company at the date of this report: Mike Balfour 65,000 shares, Alastair Bruce

43,800 shares, Vanessa Donegan 10,000 shares, Georgina Field 2,250 shares,

Gordon Orr nil shares and Edward Tse nil shares.

The financial information contained in this Half-Yearly Results Announcement

does not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The financial information for the six months ended 30

September 2023 and 30 September 2022 has not been audited or reviewed by the

Company's Independent Auditor.

The information for the year ended 31 March 2023 has been extracted from the

latest published audited financial statements, which have been filed with the

Registrar of Companies, unless otherwise stated. The report of the Auditor on

those financial statements contained no qualification or statement under

sections 498(2) or (3) of the Companies Act 2006.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

A copy of the Half-Yearly Report will shortly be submitted to the National

Storage Mechanism and will be available for inspection at

www.morningstar.co.uk/uk/NSM

The Half-Yearly Report will also be available on the Company's website at

www.fidelity.co.uk/china where up to date information on the Company, including

daily NAV and share prices, factsheets and other information can also be found.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 29, 2023 02:01 ET (07:01 GMT)

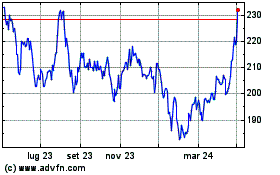

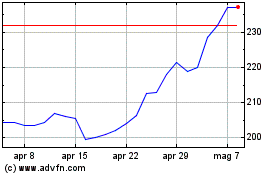

Grafico Azioni Fidelity China Special S... (LSE:FCSS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Fidelity China Special S... (LSE:FCSS)

Storico

Da Mag 2023 a Mag 2024