TIDMJAN

RNS Number : 3637E

Jangada Mines PLC

29 June 2023

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

29 June 2023

Jangada Mines plc ('Jangada' or 'the Company')

Final Results

Jangada Mines plc, a natural resources development company with

interests in Brazil and elsewhere, is pleased to announce its

audited results for the year ended 31 December 2022. The Annual

Report & Accounts will today be made available on the Company's

website and posted to Shareholders, where appropriate. The Company

will shortly be posting out its Notice of AGM to Shareholders and a

further announcement will be made in this regard.

GROUP STRATEGIC REPORT

INTRODUCTION

Jangada was incorporated as an acquisition vehicle for the

purposes of acquiring mining concerns in Brazil.

The Company has subsequently focused its strategy on investing

in mining assets with clear economic, geological, and environmental

objectives. At the balance sheet date, the Company acted as a

holding company for its subsidiary undertaking, VTF Mineração Ltda,

which owns 100% of the Pitombeiras Vanadium Project and

additionally the Company held investments in ValOre Metals Corp,

Fodere Titanium Limited and Blencowe Resources Limited and a loan

receivable from KEFI Gold and Copper PLC, which was converted to an

equity investment after the year end.

The financial statements are presented in thousands of US

Dollars ($'000). The financial statements have been prepared in

accordance with the requirements of applicable law and UK-adopted

International Accounting Standards ('UK IAS').

REVIEW OF THE BUSINESS

Pitombeiras Vanadium Project

During the year under review, the Company maintained its 100%

ownership of the Pitombeiras Vanadium Project ('Pitombeiras' or

'the Project'), located in the state of Ceará, Brazil.

Further and as announced on 21 April 2022, the Company provided

an updated technical report ('Technical Report') with the inclusion

of the titanium component at its 100%-owned Pitombeiras Vanadium

Titano-Magnetite ('VTM') Project ('the Project') in Ceará State,

Brazil. The Technical Report was prepared by Brazilian based GE21

Consultoria Mineral ('GE21') and is compliant with National

Instrument 43-101 ('NI 43-101'). The Technical Report supersedes

the Preliminary Economic Assessment ('PEA') published in 2021. The

financial figures include the production of vanadium

pentoxide('V2O5') concentrate and titanium dioxide (' TiO2') and

are summarised below:

-- US$96.5 million NPV @ 8% discount rate

-- 100.3% post-tax IRR

-- US$415.2 million total gross revenue

-- US$145.9 million post-tax, undiscounted operating cash flow

-- Post-tax payback period of 13 months

-- US$18.45 million CAPEX (US$2.25 million for TiO2)

-- US$1.26 per tonne mined average operating cost

-- US$19.39 per tonne of Fe V2O5 concentrate processed average operating cost

-- US$12.48 per tonne of TiO2 processed average operating cost

Subsequent to the release of the Technical Report, the Company

evaluated financing options to progress development but given the

uncertainty of markets that prevailed throughout 2022, and have

continued into 2023, no plans have yet been finalised.

As announced on 13 April 2023, tests were carried out regarding

the extraction of high-grade TiO2 and V2O5 from the Project. The

tests were carried out by Zambian consulting firm, YCS Sustainable

Solutions Limited, utilising the proprietary technology developed

by Fodere Titanium Limited, in which Jangada holds a 7.78%

interest. The work is part of the Company's strategy to optimise

the value of the Project by applying innovative processing

technology while also improving its Environmental, Social and

Governance ('ESG') credentials.

Five samples, delivered by Jangada from various locations at

Pitombeiras, were crushed, homogenised, and milled. The samples

were then subjected to magnetic separation. Preliminary test works

concentrated the Fe2O3, TiO2 and V2O5 with all upgrading well and

excellent recovery and purity rates reported, the highest recovery

rates being 86.73% TiO2, 91.19% Fe2O3, and 95.88% V2O5.

The Directors note that there is an ongoing court case in

respect of a land ownership dispute where the Pitombeiras project

is located. The Group is not party to the lawsuit, and as such

cannot be held liable from any claim arising from the case. The

disputed ownership represents approximately 25% of the land covered

by the mining license granted to the Group. The Group is authorised

to develop its activities where the disputed land is located and

has already conducted mineral research, exploration reports and has

requested an extension of the Exploration Permit period, which has

been granted by the National Mining Agency (Agencia Nacional de

Minería). The Directors believe there to be no material impact on

the operations of the Group, or the ongoing exploration at

Pitombeiras.

ValOre Metals Corp

As announced in August 2019, the Company divested its 100%

interest in Pedra Branca Brasil Mineração Ltda, the entity that

held the Pedra Branca Project in Brazil, to ValOre Metals Corp

(TSX-V:VO). The consideration received on the divestment was

CAD$3,000,000 alongside the issue of 25,000,000 ValOre common

shares to Jangada (of which 22,000,000 shares were received on

completion and 3,000,000 deferred consideration shares were

received over three years).

During the year, the Company sold part of the investment in

ValOre to support its working capital requirements, allowing it to

progress the development of Pitombeiras, including the technical

reports and identification of a NI 43-101 compliant resource. At

the end of the reporting year, the Company held 1,000,000 shares

representing a 0.58% interest in ValOre's share capital.

Fodere Titanium Limited

As previously announced, the Company has made a strategic

investment in Fodere Titanium Limited ("Fodere"), which continues

to make excellent progress as it focuses on the production of

titanium dioxide and vanadium from waste materials. Its highly

energy efficient technology maximises resource recovery, improves

processing effectiveness, reduces costs compared to regular

processing routes and, minimises waste to improve environmental

credentials and enhance corporate ESG performance.

Its pilot plant in South Africa is due to be operational in late

2023 targeting the production of concentrates including titanium

dioxide, vanadium pentoxide along with alumina oxide and magnesium

sulphate as by-products. Jeffry N. Quinn, the former head of

Tronox, an international vertically integrated producer of titanium

dioxide and inorganic chemicals, has joined the board of Fodere as

a Director.

One of the Company's Non-Executive Directors, Nick von

Schirnding, is Chairman of Fodere.

At the end of the reporting year, the Company held 1,774 shares

being a 7.78% interest in Fodere's share capital.

Blencowe Resources PLC

Blencowe is advancing its Orom-Cross graphite project in Uganda

where a Definitive Feasibility Study is on track to complete by the

end of the year. The Project has a JORC resource of 24.5Mt @ 6.0%

TCG based on drilling undertaken on less than 5% of the project

area, part of which already benefits from a 21-year mining licence.

The estimate of graphite is 2-3 billion tonnes. A Pre-Feasibility

Study reported a Net Present Value of US$482m based on the existing

14-year mine life and outlined capex to first production of US$62m,

average EBITDA of US$100m per annum and a return of US$1.1bn in

free cash over the 14-year life.

Metallurgical testwork reported concentrate grades consistently

ranging between 95-98%, which are battery grade. Further testing is

underway in the USA and China and international funding

negotiations are on-going. During the year, the Company purchased

16,550,000 shares in Blencowe Resources PLC (LSE: BRES)

('Blencowe') and paid GBP652,250 (USD 789,000) at GBP0.04 per share

and received a further 7,625,000 warrants with an exercise price of

GBP0.08 per share and expiry date of 31 October 2025. Blencowe

holds a portfolio of key battery metals projects located in

northern Uganda, see blencoweresourcesplc.com. Following a period

of due diligence, the directors assessed that the Blencowe assets

were being substantially undervalued by the market and we

considered the investment to be a short to medium-term value

accretive opportunity with exposure to both the graphite and nickel

sulphide markets and consistent with Jangada's strategy of being

involved in the development of "battery metals".

At the end of the reporting year, the Company held 20,050,000

shares being a 10.2% interest in Blencowe's share capital.

KEFI Gold and Copper PLC

During the year, the Company advanced an unsecured loan

receivable of GBP200,000 (USD 242,000) to KEFI Gold and Copper Plc

('KEFI') for working capital requirements. The loan receivable is

short-term in nature and carries a fixed rate of interest at

25%.

Post year end, the loan has been repaid in full by way of the

issue of 35,714,285 shares in KEFI, equating to a holding currently

of 0.756%.

Financial Results

The progress during the financial year of advancing the

Pitombeiras project resulted in the Group incurring an Operating

Loss from Continuing Operations of $0.9 million (2021: profit of

$0.1 million). Overall, the reported Total Comprehensive Loss

attributable to the Group for the reporting year was $1.3 million

(2021: $0.3 million).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

Other Income

(Loss)/gain on fair value of investment (270) 340

Profit on disposal of investment 68 1,743

Interest from short term loans 62 -

---------------------- -------------

Total Other Income (140) 2,083

Directors' remuneration 9 (355) (379)

Share based payments - directors 9 - (533)

Impairment of investments 13 - (211)

Foreign exchange gain 223 31

Administration expenses (663) (895)

---------------------- -------------

Operating (loss)/profit from continuing

operations (935) 96

Finance expense 6 (1) (4)

(Loss)/profit before tax (936) 92

Tax expense 7 - -

---------------------- -------------

(Loss)/profit from continuing operations (936) 92

Other comprehensive income:

Items that will or may be reclassified

to profit or loss:

Currency translation differences arising

on translation of foreign operations (392) (354)

Total comprehensive loss attributable

to owners of the parent (1,328) (262)

====================== =============

(Loss)/profit per share from (loss)/profit

from continuing operations attributable Cents Cents

to the ordinary equity holders of the

Company during the year

- Basic (cents) 8 (0.36) 0.04

- Diluted (cents) 8 (0.36) 0.04

(Loss)/profit per share attributable

to the ordinary equity holders of the Cents Cents

Company during the year

- Basic (cents) 8 (0.36) 0.04

- Diluted (cents) 8 (0.36) 0.04

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2022

As at As at

31 December 31 December

2022 2021

Assets $'000 $'000

Non-current assets

Exploration and evaluation assets 11 1,210 1,019

Property, plant and equipment 4 4

Investments 13 2,081 1,331

3,295 2,354

Current assets

Other receivables 14 302 450

Cash and cash equivalents 1,397 3,589

1,699 4,039

Total assets 4,994 6,393

============= =============

Liabilities

Current liabilities

Trade payables 21 6

Accruals and other payables 15 113 53

------------- -------------

Total liabilities 134 59

Issued capital and reserves attributable

to owners of the parent

Share capital 16 135 135

Share premium 16 5,959 5,959

Translation reserve (754) (362)

Option reserve 17 709 734

Fair value reserve 38 38

Retained earnings (1,227) (170)

------------- -------------

Total equity 4,860 6,334

------------- -------------

Total equity and liabilities 4,994 6,393

============= =============

COMPANY BALANCE SHEET

AS AT 31 DECEMBER 2022

As at As at

31 December 31 December

2022 2021

Assets $'000 $'000

Non-current assets

Investment in subsidiary 12 1,602 1,502

Investments 13 2,081 1,331

3,683 2,833

Current assets

Other receivables 14 302 450

Cash and cash equivalents 1,363 3,499

------------- -------------

1,665 3,949

------------- -------------

Total assets 5,348 6,782

============= =============

Liabilities

Current liabilities

Trade payables 16 6

Accruals and other payables 15 113 53

------------- -------------

Total liabilities 129 59

Issued capital and reserves attributable

to owners of the parent

Share capital 16 135 135

Share premium 16 5,959 5,959

Translation reserve (1,556) (880)

Option reserve 17 709 734

Retained earnings (28) 775

------------- -------------

Total equity 5,219 6,723

------------- -------------

Total equity & liabilities 5,348 6,782

============= =============

The loss for the year under review for the parent company,

Jangada Mines plc, was $682,168 (2021: profit of $165,681). As

permitted under Section 408 of the Companies Act 2006, no Income

Statement or Statement of Comprehensive Income is presented for the

parent company.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2022

Year ended Year ended

31 December 31 December

2022 2021

Cash flows from operating activities $'000 $'000

(Loss)/profit before tax (936) 92

Add back:

Depreciation 1 -

Cash proceeds on sale of investment (68) -

Cash proceeds on sale of subsidiary - (1,743)

Non-cash interest from short term loans (62) -

Fair value loss/(gain) in investments 270 (228)

Non-cash exchange differences (223) (31)

Non-cash share option charge - 683

Non-cash shares issued in lieu of fees - (58)

Non-cash impairment of investments - 211

Decrease in other receivables 20 (104)

Decrease in trade and other payables 75 70

Net cash flows used in operating activities (923) (1,108)

------------- -------------

Investing activities

Development of exploration and evaluation

assets (74) (468)

Purchase of plant, property and equipment - (3)

Sale of shares in investments 150 3,870

Purchase of shares in investments (870) (741)

Advance of loan receivable (246) -

Net cash inflows (used in)/from investing

activities (1,040) 2,658

------------- -------------

Financing activities

Share capital issue - 1,520

Exercise of options - 70

Cancellation of options 17 (102) -

Net cash flows from financing activities (102) 1,590

------------- -------------

Net movement in cash and cash equivalents (2,065) 3,140

------------- -------------

Cash and cash equivalents at beginning

of year 3,589 513

Movements in foreign exchange (127) (64)

Cash and cash equivalents at end of

year 1,397 3,589

============= =============

COMPANY CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2022

Year ended Year ended

31 December 31 December

2022 2021

Cash flows from operating activities $'000 $'000

(Loss)/profit before tax (682) 165

Cash proceeds on sale of investment (68) -

Cash proceeds on sale of subsidiary - (1,743)

Non-cash interest from short term (62) -

loans

Fair value loss/(gain) in investments 270 (228)

Non-cash exchange differences (383) (31)

Non-cash share option charge - 683

Non-cash shares issued in lieu

of fees - (58)

Non-cash impairment of investments - 211

Decrease in other receivables 20 (99)

(Increase)/decrease in trade and

other payables 70 52

Net cash flows used in operating

activities (835) (1,048)

------------- -------------

Investing activities

Sale of shares in investments 150 3,870

Purchase of shares in investment (870) (741)

Advance of loan receivable (246) -

------------- -------------

Net cash flow (used in)/from investing

activities (966) 3,129

------------- -------------

Financing activities

Share capital issue - 1,520

Cost of issuing share capital - 70

Increase in related party borrowings (101) (690)

Cancellation of options 17 (102) -

Net cash (used in)/from financing

activities (203) 900

------------- -------------

Net movement in cash and cash

equivalents (2,004) 2,981

------------- -------------

Cash and cash equivalents at beginning

of year 3,499 447

Movements in foreign exchange (132) 71

Cash and cash equivalents at end

of year 1,363 3,499

============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Share Share Translation Fair Option Retained Total

Value

capital premium reserve reserve reserve earnings equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000

As at 1 January 2021 126 4,389 (8) 38 - (262) 4,283

Comprehensive loss

for the year

Profit for the year - - - - - 92 92

Other comprehensive

income - - (354) - - - (354)

-------- -------- ------------ -------- -------- --------- --------

Total comprehensive

loss for the year - - (354) - - 92 (262)

Transactions with

owners

Shares issued 8 1,732 - - - - 1,740

Share issue costs charged

to share premium - (232) - - - - (232)

Share options exercised 1 70 - - - - 71

Share options issued - - - - 734 - 734

-------- -------- ------------ -------- -------- --------- --------

Total transactions

with owners 9 1,570 - - 734 - 2,313

As at 31 December

2021 135 5,959 (362) 38 734 (170) 6,334

======== ======== ============ ======== ======== ========= ========

Comprehensive loss

for the year

Loss for the year - - - - - (936) (936)

Other comprehensive

income - - (392) - - - (392)

-------- -------- ------------ -------- -------- --------- --------

Total comprehensive

loss for the year - - (392) - - (936) (1,328)

Transactions with

owners

Share options surrendered - - - - (25) (121) (146)

Share options expensed - - - - - - -

-------- -------- ------------ -------- -------- --------- --------

Total transactions

with owners - - - - (25) (121) (146)

As at 31 December

2022 135 5,959 (754) 38 709 (1,227) 4,860

======== ======== ============ ======== ======== ========= ========

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Share Share Translation Option Retained Total

equity

capital Premium reserve reserve earnings attributable

to owners

$'000 $'000 $'000 $'000 $'000 $'000

As at 1 January 2021 126 4,389 30 - 610 5,155

Comprehensive loss

for the year

Profit for the year - - - - 165 165

Other comprehensive

income - - (910) - - (910)

-------- ---------- ------------ -------- --------- -------------

Total comprehensive

income for the year - - (910) - 165 (745)

Transactions with

owners

Share issued 8 1,732 - - - 1,740

Share issue costs

charged

to share premium - (232) - - - (232)

Share options

exercised 1 70 - - - 71

Share options issued - - - 734 - 734

-------- ---------- ------------ -------- --------- -------------

Total transactions

with owners 9 1,570 - 734 - 2,313

As at 31 December

2021 135 5,959 (880) 734 775 6,723

======== ========== ============ ======== ========= =============

Comprehensive loss

for the year

Loss for the year - - - - (682) (682)

Other comprehensive

income - - (676) - - (676)

------------ ------ ------------ -------- --------- -------------

Total comprehensive

loss for the year - - (676) - (682) (1,358)

Transactions with

owners

Share options

surrendered - - - (25) (121) (146)

Share options - - - - - -

expensed

------------ ------ ------------ -------- --------- -------------

Total transactions

with owners - - - (25) (121) (146)

As at 31 December

2022 135 5,959 (1,556) 709 (28) 5,219

============ ====== ============ ======== ========= =============

NOTES TO THE FINANCIAL STATEMENTS

For the YEAR ended 31 December 2022

General information

1.

The Company is a public limited company limited by shares,

incorporated in England and Wales on 30 June 2015 with the

registration number 09663756 and with its registered office at

Eastcastle House 27-28, Eastcastle Street, London W1W 8DH, United

Kingdom.

The nature of the Company's operations and its principal

activities are set out in the Strategic Report and the Report of

the Directors on pages 4 and 15 respectively in the Annual Report

& Accounts.

Accounting policies

2.

Basis of preparation and going concern basis

These financial statements have been prepared on a historical

cost basis in accordance with UK-adopted International Accounting

Standards and applicable law, in line with International Financial

Reporting Standards (IFRS) and IFRIC interpretations issued by the

International Accounting Standards Board (IASB) adopted by the

European Union and in accordance with applicable UK Law. The

adoption of all of the new and revised Standards and

Interpretations issued by the IASB and the IFRIC of the IASB that

are relevant to the operations and effective for annual reporting

periods beginning on 1 July 2019 are reflected in these financial

statements.

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income, and expenses. The estimates and

associated assumptions are based on historical experience and

factors that are believed to be reasonable under the circumstances,

the results of which form the basis of making judgements about

carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these

estimates.

The consolidated financial information is presented in United

States Dollars ($).

The functional currency of the subsidiary, VTF Mineração Ltda is

Brazilian Real. The functional of the Company is British Pounds

Sterling (GBP). Amounts are rounded to the nearest thousand

($'000), unless otherwise stated.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Changes in accounting estimates may be necessary if

there are changes in the circumstances on which the estimate was

based, or as a result of new information or more experience. Such

changes are recognised in the period in which the estimate is

revised.

The Group's business activities together with the factors likely

to affect its future development, performance and position are set

out on pages 4 to 15. In addition, note 4 to the Financial

Statements includes the Group's objectives, policies and processes

for managing its capital; its financial risk management objectives;

details of its financial instruments and its exposure to credit and

liquidity risk.

The Financial Statements have been prepared on a going concern

basis. Although the Group's assets are not generating revenues and

an operating loss has been reported from its continued operations,

the Directors consider that the Group has sufficient funds to

undertake its operating activities for a period of at least the

next 12 months including any additional expenditure required in

relation to its current exploration projects. The Group has cash

reserves which are considered sufficient by the Directors to fund

the Group's committed expenditure both operationally and on its

exploration project for the foreseeable future. However, as

additional projects are identified and the Pitombeiras project

moves towards production, additional funding will be required.

As discussed in the Directors' report, the directors do not

consider there to be a material uncertainty, which may cast doubt

about the Group and Company's ability to continue as a going

concern. Given the proceeds from the sale of the Pedra Branca

project and based on the Group's planned expenditure on the

Pitombeiras vanadium deposit and the Group's working capital

requirements, the Directors have a reasonable expectation that the

Group will have adequate resources to meet its capital requirements

for the foreseeable future. For that reason, the Directors have

concluded that the financial statements should be prepared on a

going concern basis.

Changes in a ccounting principles and a doption of new and

revised s tandards

In the year ended 31 December 2022, the Directors have reviewed

all the new and revised Standards issued that are relevant to the

Group's operations and effective for the current reporting

period.

The Directors have also reviewed all new Standards and

Interpretations that have been issued but are not yet effective for

the year ended 31 December 2022. As a result of this review the

Directors have determined that there is no impact, material or

otherwise, of the new and revised Standards and Interpretations on

the Group's business and, therefore, no change is necessary to the

Group accounting policies.

New and amended accounting standards and interpretations have

been published but are not mandatory. The Group has decided against

early adoptions of these standards and has determined the potential

impact on the financial statements from the adoption of these

standards and interpretations is not material to the Group.

Basis of Consolidation

Subsidiaries

The subsidiaries are consolidated from the date of acquisition,

being the date on which the Group obtains control, and continues to

be consolidated until the date that such control ceases. The

Company has control over a subsidiary if all three of the following

elements are present:

-- Power over the investee,

-- exposure to variable returns from the investee, and

-- the ability of the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The financial information of the subsidiary is prepared for the

same reporting year as the parent company, using consistent

accounting policies and is consolidated using the acquisition

method. Intra-group balances and transactions, including unrealised

profits arising from intra-group transactions, have been

eliminated. Unrealised losses are eliminated unless the transaction

provides evidence of an impairment of the asset transferred.

Business combinations

The acquisition method of accounting is used to account for

business combinations by the Group. The consideration transferred

for the acquisition of a business is the fair value of the assets

transferred, liabilities incurred, and the equity interests issued

by the Group. The consideration transferred includes the fair value

of any asset or liability resulting from a contingent consideration

arrangement.

Acquisition related costs are expensed as incurred. Identifiable

assets acquired and liabilities and contingent liabilities assumed

in a business combination are measured at their fair values at the

acquisition date. A business is an integrated set of activities and

assets that is capable of being conducted and managed for the

purpose of providing a return in the form of dividends, lower

costs, or other economic benefits.

A business consists of inputs and processes applied to those

inputs that have the ability to create outputs that provide a

return to the Company and its shareholders.

A business need not include all of the inputs and processes that

were used by the acquiree to produce outputs if the business can be

integrated with the inputs and processes of the Company to continue

to produce outputs.

If the integrated set of activities and assets is in the

exploration and development stage, and thus, may not have outputs,

the Company considers other factors to determine whether the set of

activities and assets is a business. Those factors include, but are

not limited to, whether the set of activities and assets:

-- Has begun planned principal activities;

-- Has employees, intellectual property and other inputs and

processes that could be applied to those inputs;

-- Is pursuing a plan to produce outputs; and

-- Will be able to obtain access to customers that will purchase the outputs.

Foreign currency

Transactions entered into by the Group in a currency other than

the currency of its primary economic environment in which it

operates (the "functional currency") are recorded at the rates

ruling when the transactions occur. Foreign currency monetary

assets and liabilities are translated at the rates ruling at the

reporting date. Exchange differences are taken to the Statement of

Comprehensive Income.

Financial instruments

Financial instruments are measured as set out below. Financial

instruments carried on the statement of financial position include

cash and cash equivalents, trade and other receivables,

investments, trade and other payables and loans to group

companies.

Financial instruments are initially recognised at fair value

when the group becomes a party to their contractual arrangements.

Transaction costs directly attributable to the instrument's

acquisition or issue are included in the initial measurement of

financial assets and financial liabilities, except financial

instruments classified as at fair value through profit or loss

('FVTPL'). The subsequent measurement of financial instruments is

dealt with below.

Financial assets and financial liabilities are recognised on the

Group's balance sheet when the Group becomes party to the

contractual provisions of the instrument.

Fair value

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. All assets and

liabilities, for which fair value is measured or disclosed in the

Financial Statements, are categorised within the fair value

hierarchy, described as follows, based on the lowest-level input

that is significant to the fair value measurement as a whole:

Level 1 - quoted (unadjusted) market prices in active markets

for identical assets or liabilities;

Level 2 - valuation techniques for which the lowest-level input

that is significant to the fair value measurement is directly or

indirectly observable; and

Level 3 - valuation techniques for which the lowest-level input

that is significant to the fair value measurement is

unobservable.

Financial assets

All the Group's financial assets are held within a business

model whose objective is to collect contractual cash flows which

are solely payments of principals and interest and therefore

classified as subsequently measured at amortised cost. Group's

financial assets include cash and cash equivalents, Company's

financial assets include cash and other receivables. The Group

assesses on a forward-looking basis, the expected credit losses,

defined as the difference between the contractual cash flows and

the cash flows that are expected to be received.

Impairment provisions for receivables from related parties and

loans to related parties are recognised based on a forward-looking

expected credit loss model. The methodology used to determine the

amount of the provision is based on whether there has been a

significant increase in credit risk since initial recognition of

the financial asset. For those where the credit risk has not

increased significantly since initial recognition of the financial

asset, twelve month expected credit losses along with gross

interest income are recognised. For those for which credit risk has

increased significantly, lifetime expected credit losses along with

the gross interest income are recognised. For those that are

determined to be credit impaired, lifetime expected credit losses

along with interest income on a net basis are recognised.

Financial liabilities

Financial liabilities are classified as either financial

liabilities at fair value through profit and loss (FVTPL) or as

other financial liabilities. The Group derecognises financial

liabilities when, and only when, the Group's obligations are

discharged or cancelled, or they expire.

Financial liabilities are classified at FVTPL when the financial

liability is either held for trading or it is designated at FVTPL.

A financial liability is classified as held for trading if it has

been incurred principally for the purpose of repurchasing it in the

near term or is a derivative that is not a designated or effective

hedging instrument.

Financial liabilities at FVTPL are measured at fair value, with

any gains or losses arising on changes in fair value recognised in

profit or loss. The net gain or loss recognised in profit or loss

incorporates any interest paid on the financial liability.

Other financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs and are

subsequently measured at amortised cost using the effective

interest method, with interest expense recognised on an effective

yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability, or, where

appropriate, a shorter period, to the net carrying amount on

initial recognition.

Exploration and evaluation assets

Costs capitalised in respect of the Group's development and

production assets are required to be assessed for impairment under

the provisions of IAS 36. Such an estimate requires the Group to

exercise judgement in respect of the indicators of impairment and

in respect of inputs used in the models which are used to support

the carrying value of the assets.

Such inputs include costs of exploration work, studies, field

costs, government fees and the associated support costs. The

directors concluded there were no impairment indicators in the

current year. Therefore, no impairment to the carrying value of the

Pitombeiras asset was considered necessary.

Costs incurred prior to obtaining the legal rights to explore an

area are expensed immediately to the Statements of Profit or Loss

and Other Comprehensive Income. Only material expenditures incurred

after the acquisition of a licence interest are capitalised.

Share Options - estimates and assumptions

The fair value of options and warrants granted to directors and

others in respect of services provided is recognised as an expense

in the Statement of Comprehensive Income with a corresponding

increase in equity reserves.

Taxation

The charge for current tax is based on the taxable income for

the year. The taxable result for the year differs from the result

as reported in the statement of comprehensive income because it

excludes items which are not assessable or disallowed and it

further excludes items that are taxable and deductible in other

years. It is calculated using tax rates that have been enacted or

substantially enacted by the statement of financial position

date.

Investments

Investments are carried at fair value. Deferred tax assets and

liabilities are recognised where the carrying amount of an asset or

liability in the audited consolidated balance sheet differs from

its tax base. Recognition of deferred tax assets is restricted to

those instances where it is probable that taxable profit will be

available against which the difference can be utilised.

The amount of the asset or liability is determined using tax

rates that have been enacted or substantively enacted by the

reporting date and are expected to apply when the deferred tax

liabilities/(assets) are settled/(recovered).

Deferred tax assets and liabilities are offset when the Company

has a legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority.

3. Critical accounting estimates and judgements

The preparation of the Financial Statements in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the end of the

reporting year and the reported amount of expenses during the year.

Actual results may vary from the estimates used to produce these

Financial Statements.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Significant items subject to such judgements and estimates

include, but are not limited to:

Judgements

The Directors have considered the criteria of IFRS 6 regarding

the impairment of exploration and evaluation assets and have

decided based on this assessment that there is no basis to impair

the carrying value of its exploration assets in respect to the

Pitombeiras project (2022: $1,210,000, 2021: $1,019,000) at this

time.

Estimates and assumptions

Share based payments

Share options issued by the Group relates to the Jangada Plc

Share Option Plan. The grant date fair value of such options is

calculated using a Black-Scholes model whose input assumptions are

derived from market and other internal estimates. The key estimates

include volatility rates and the expected life of the options,

together with the likelihood of non-market performance conditions

being achieved. Refer note 17.

On exercise or cancellation of share options and warrants, the

proportion of the share-based payment reserve relevant to those

options and warrants is transferred from other reserves to the

accumulated deficit. On exercise, equity is also increased by the

amount of the proceeds received. The fair value is measured at

grant date charged in the accounting year during which the option

and warrants becomes unconditional.

The fair value of options and warrants are calculated using the

Black-Scholes model, taking into account the terms and conditions

upon which the options and warrants were granted. Vesting

conditions are non-market and there are no market vesting

conditions. These vesting conditions are included in the

assumptions about the number of options and warrants that are

expected to vest. At the end of each reporting year, the Company

revises its estimate of the number of options and warrants that are

expected to vest. The exercise price is fixed at the date of grant

and no compensation is due at the date of grant. Where equity

instruments are granted to

persons other than employees, the statement of comprehensive

income is charged with the fair value of the goods and services

received. Please refer to note 17.

Company - Application of the expected credit loss model

prescribed by IFRS 9

IFRS 9 requires the Parent company to make assumptions when

implementing the forward-looking expected credit loss model. This

model is required to be used to assess the intercompany loan

receivables from the company's Brazilian subsidiaries for

impairment.

Arriving at the expected credit loss allowance involved

considering different scenarios for the recovery of the

intercompany loan receivables, the possible credit losses that

could arise and the probabilities for these scenarios. The

following was considered; the exploration project risk for

Pitombeiras, positive NPV of the Pitombeiras project as

demonstrated by the Feasibility Study, ability to raise the finance

to develop the projects, ability to sell the projects, market and

technical risks relating to the project. The Directors therefore

considered that there was no impairment of the subsidiary loan

(2021: nil).

Financial instruments - Risk Management

4.

The Company is exposed through its operations to the following

financial risks:

-- Credit risk;

-- Liquidity risk;

-- Fair value measurement risk; and

-- Foreign exchange risk.

Credit risk

Credit risk arises from cash and cash equivalents and

outstanding receivables. The Group maintains cash and short-term

deposits with a variety of credit worthy financial institutions and

considers the credit ratings of these institutions before investing

in order to mitigate against the associated credit risk.

The Group's exposure to credit risk amounted to $1,699,000

(2021: $4,039,000). Of this amount, $1,397,000 represents the

Group's cash holdings (2021: $3,589,000).

The directors monitor the utilisation of the credit limits

regularly and at the reporting date does not expect any losses from

non-performance by the counterparties.

Liquidity risk

In keeping with similar sized mining exploration groups, the

Group's continued future operations depend on the ability to raise

sufficient working capital through the issue of equity share

capital. The Group monitors its cash and future funding

requirements through the use of cash flow forecasts.

The Company's policy is to ensure that it will always have

sufficient cash to allow it to meet its liabilities when they

become due.

In common with all other businesses, the Company is exposed to

risks that arise from its use of financial instruments.

Fair value measurement risk

The following tables detail the Group's assets and liabilities

measured or disclosed at fair value using a three-level hierarchy,

based on the lowest level of input that is significant to the

entire fair value measurement, being:

- Level 1: Quoted prices (unadjusted) in active markets for

identical assets or liabilities that the entity can access at the

measurement date

- Level 2: Inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either directly

or indirectly

- Level 3: Unobservable inputs for the asset or liability

Level Level Level

1 2 3 Total

As at 31 December 2022 $'000 $'000 $'000 $'000

Assets

Investments - At FVTPL 1,233 848 - 2,081

----- ----- ----- -----

Total assets 1,233 848 - 2,081

----- ----- ----- -----

Level Level Level

1 2 3 Total

As at 31 December 2021 $'000 $'000 $'000 $'000

Assets

Investments - At FVTPL 451 880 - 1,331

----- ----- ----- -----

Total assets 451 880 - 1,331

----- ----- ----- -----

There were no transfers between levels during the financial

year.

Foreign exchange risk

The Group operates internationally and is exposed to foreign

exchange risk arising from various currency exposures, primarily

with respect to the Brazilian Real, US Dollar and the Pound

Sterling.

Foreign exchange risk arises from future commercial

transactions, recognised assets and liabilities and net investments

in foreign operations that are denominated in a foreign currency.

The Group holds a proportion of its cash in GBP and Brazilian Reals

to hedge its exposure to foreign currency fluctuations and

recognises the profits and losses resulting from currency

fluctuations as and when they arise. The volume of transactions is

not deemed sufficient to enter forward contracts.

The Group's financial instruments are

set out below:

As at As at

31 December 31 December

2022 2021

$'000 $'000

Financial assets

Cash and cash equivalents 1,397 3,589

Other receivables 302 450

Investments - At FVTPL 2,081 1,331

------------ ------------

Total financial assets 3,780 5,370

============ ============

As at As at

31 December 31 December

2022 2021

$'000 $'000

Financial liabilities

Trade payables 21 6

Accruals and other payables 113 53

Total financial liabilities 134 59

============ ============

As at As at

31 December 31 December

2022 2021

$'000 $'000

US Dollar - -

Brazilian Real 4 1

Pound Sterling 130 58

------------ ------------

134 59

============ ============

The potential impact of a 10% movement in the exchange rate of

the currencies to which the Group is exposed is shown below:

2022 2021

$'000 $'000

Foreign currency risk sensitivity analysis

Brazilian Real

Strengthened by 10% - -

Weakened by 10% - -

Pound Sterling

Strengthened by 10% 269 351

Weakened by 10% (329) (429)

Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern, to provide

returns for shareholders and to enable the Group to continue its

exploration and evaluation activities. The Group has only

short-term trade payables and accruals at 31 December 2022 and

defines capital based on the total equity of the Group. The Group

monitors its level of cash resources available against future

planned exploration and evaluation activities and may issue new

shares to raise further funds from time to time.

There were no changes in the Company's approach to capital

management during the year. The Company is not subject to

externally imposed capital requirements.

General objectives, policies and processes

The board of directors has overall responsibility for the

determination of the Company's risk management objectives and

policies. The overall objective of the board is to set policies

that seek to reduce risk as far as possible without unduly

affecting the Company's competitiveness and flexibility.

Principal financial instruments

The principal financial instrument used by the Company, from

which financial instrument risk arises, is related party

borrowings.

Segment information

5.

The Company evaluates segmental performance on the basis of

profit or loss from operations calculated in accordance with IFRS

8. In the Directors' opinion, the Group only operates in one

segment being mining services. All non-current assets have been

generated in Brazil.

Finance expense

6.

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

Interest expense (1) (4)

Total finance expense (1) (4)

============= ================

Tax expense

7.

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

(Loss)/profit on ordinary activities before

tax (936) 92

------------- -----------

(Loss)/profit on ordinary activities multiplied

by standard rate of corporation tax in the

UK of 19% (2021: 19%) (178) 17

Effects of:

Unrelieved tax losses carried forward 178 (17)

Total tax charge for the year - -

============= ===========

Factors that may affect future tax charges

Apart from the losses incurred to date and the fact that from

April 2023 the UK corporation tax rate has risen to 25%, there are

no factors that may affect future tax charges. At the year end,

$3,939,000 (2021: $5,571,000) of cumulative estimated unrelieved

tax losses arose in Brazil and the United Kingdom, which could be

utilised in the foreseeable future.

8. Loss per share

31 December 31 December

2022 2021

$'000 $'000

(Loss)/profit for

the year (936) 92

================== ==================

2022 2021

Weighted average number of shares (basic &

diluted) 258,602,032 254,618,055

================== ==================

(Loss)/earnings per share - basic & diluted

(US 'cents) (0.36) 0.04

=========== ===== ==================

There have been no transactions involving ordinary shares or

potential ordinary shares that would significantly change the

number of ordinary shares or potential ordinary shares outstanding

between the reporting date and the date of completion of these

financial statements.

9. Staff costs and directors' remuneration

Staff costs, including directors' remuneration, were as

follows:

Monetary Share

remuneration Options(1) Total Total

Year ended Year ended Year ended Year ended

31 December 31 December 31 December 31 December

2022 2022 2022 2021

$'000 $'000 $'000 $'000

B K McMaster 222 - 222 469

L M F De Azevedo 74 - 74 316

N K von Schirnding 59 - 59 127

355 - 355 912

============= ============= ============= =============

(1 - Refer to note 17 for options details.)

Excluding directors, there was one member of staff during the

year ended 31 December 2022 (2021: one). Excluding directors'

remuneration, staff costs during the year were salaries $27,000

(2021: $5,000), social security $5,000 (2021: $1,000), other

benefits $nil (2021: $nil). As at the year end, $30,000 (2021:

$20,000) of Director's Remuneration for L M F De Azevedo was

accrued but not yet settled.

10. Auditor's remuneration

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

Fees payable to the Company's auditor and its

associates for the audit of the Company's annual

accounts 52 34

Fees payable for other services:

- High level review of interim financial statements 2 -

------------- -------------

Total auditor remuneration 54 34

============= =============

11. Exploration and evaluation assets

As at As at

31 December 31 December

2022 2021

$'000 $'000

Cost and net book value

At beginning of year 1,019 550

Expenditure capitalised during

the year 191 469

------------- -------------

Cost and net book value at

31 December 1,210 1,019

============= =============

The Directors have concluded that there are no impairment

indicators at the year end. Further details can be found in Note 2:

Accounting policies - Exploration and evaluation assets.

Investment in subsidiary

12.

As at As at

31 December 31 December

2022 2021

Company $'000 $'000

Shares in subsidiary 1 1

Contribution to capital 1,601 1,501

Total 1,602 1,502

============ ==================

The Directors have conducted an impairment review and are

satisfied that the carrying value of $1,602,000 is reasonable and

no impairment is necessary (2021: US$ nil).

Investments - At FVTPL

13.

As at As at

31 December 31 December

2022 2021

$'000 $'000

Investment in ValOre Metals Corp 203 215

Investment in Fodere Titanium Limited 976 1,091

Investment in Blencowe Resources Plc 1,030 236

Investment in Axies Ventures Limited 60 -

Impairment in Investments (188) (211)

------------ ------------------

Carrying amount of investments 2,081 1,331

============ ==================

During the year, the Company received the fifth and sixth

tranches of 500,000 Deferred Consideration Shares in ValOre Metals

Corp in February 2022 and August 2022. Currently, the Company has a

0.58% interest in ValOre's share capital. The investment is carried

at fair value with any changes recognised through profit and

loss.

The Company holds shares in the share capital of Fodere Titanium

Limited, which is a United Kingdom registered minerals technology

company which has developed innovative processes for the titanium,

vanadium, iron and steel industries. Currently, the Company has a

7.78% interest in Fodere's share capital. The investment is carried

at fair value with any changes recognised through profit and loss

and this has resulted in the Company recognising an impairment loss

in the investment of $nil (2021: $211,000), which has been

recognised as an expense in the statement of comprehensive income.

Movements in the investment during the year are the effects of

foreign exchange translations.

During the year, the Company purchased a further 16,550,000

shares in Blencowe Resources Plc, which it paid GBP652,250 (USD

789,000) at GBP0.04 per share and received a further 7,625,000

warrants with an exercise price of GBP0.08 per share and expiry

date of 31 October 2025. At the end of the year, the Company had a

10.2% interest in Blencowe's share capital, which is a United

Kingdom registered natural resources company focused on the

development of the Orom-Cross Graphite Project in Uganda. The

investment is carried at fair value with any changes recognised

through profit and loss.

The Group measures these Investments at fair value, using a

three-level hierarchy, based on the lowest level of input that is

significant to the entire fair value measurement. Further details

are available in Note 4: Financial Instruments - Risk

Management.

Other receivables

14.

Group Group Company Company

As at As at As at As at

31 December 31 December 31 December 31 December

2022 2021 2022 2021

$'000 $'000 $'000 $'000

Current

Other receivables - 20 - 20

Accrued income - 430 - 430

Loan receivable 302 - 302 -

Total other receivables 302 450 302 450

============= ============= ============= ===============

Accrued income totalling $nil (2021: $430,000) relating to the

disposal of Pedra Branca being nil (2021: 1,000,000) Deferred

Consideration Shares in ValOre with fair value determined to be

$nil (2021: $430,000) at the balance sheet date.

During the year, the Company advanced an unsecured loan

receivable of GBP200,000 (USD 242,000) to KEFI Gold and Copper Plc

for working capital requirements. The loan receivable is short-term

in nature and carries a fixed rate of interest at 25%. Post year

end, the loan has been repaid in full by the issue of 35,714,285

shares in KEFI as noted earlier in this report.

15. Accruals and other payables

Group Group Company Company

As at As at As at As at

31 31 31 December 31

December December 2022 December

2022 2021 2021

$'000 $'000 $'000 $'000

Current

Accruals 83 33 83 33

Amounts owed to Directors 30 20 30 20

Total accruals and other

payables 113 53 113 53

========== ========== ============= ==========

16. Share capital

31 December 2022 31 December 2021

Share Share Share Share

Issued Capital premium Issued Capital premium

Number $'000 $'000 Number $'000 $'000

At beginning

of the year ordinary

shares of 0.04p

each: 258,602,032 135 5,959 242,113,144 126 4,389

============ ========= ========= ============ ========= ============

19 February 2021:

shares issued

as part of placement - - - 13,888,888 8 1,732

30 March 2021:

shares issued

upon exercise

of options - - - 2,600,000 1 70

Share issue costs

charged to share

premium - - - - - (233)

At 31 December:

ordinary shares

of 0.04p each: 258,602,032 135 5,959 258,602,032 135 5,959

============ ========= ========= ============ ========= ============

Ordinary shares

Ordinary shares have the right to receive dividends as declared

and, in the event of a winding up of the Company, to participate in

the proceeds from sale of all surplus assets in proportion to the

number of and amounts paid up on shares held. Ordinary shares

entitle their holder to one vote, either in person or proxy, at a

meeting of the Company.

Share options and warrants

17.

Year ended Year ended

Average 31 December Average 31 December

exercise 2022 exercise 2021

price per Number price per Number

share option of share option of

$ options $ options

At the beginning of the

year - 37,844,444 - 9,000,000

Warrants issued 19 February

2021 - - 0.09 694,444

Surrendered share options

3 March 2021 - - 0.02 (250,000)

Share Options exercised

30 March 2021 - - 0.02 (2,600,000)

Share warrants issued

10 August 2021 - - 0.08 1,000,000

Share options issued 10

August 2021 - - 0.08 30,000,000

Share options surrendered

17 January 2022 0.02 (3,000,000) - -

At the end of the year 34,844,444 37,844,444

-------------- ------------- -------------- -------------

On 17 January 2022, the Company entered into an agreement

whereby an option holder agreed to surrender 3,000,000 options,

with a grant date of 1 December 2019 and an expiry date of 1

December 2024 with an exercise price GBP0.02 per option share, for

consideration of GBP 105,000 (USD$129,354). The amounts were

payable in 15 equal monthly instalments of GBP 7,000 (USD$8,624).

On the same date the options were cancelled by the Company. As at

the date of this report 12 of the monthly instalments have been

paid in the current reporting year and the remaining 3 instalments

were paid in the subsequent reporting year.

As at As at

31 December 31 December

2022 2021

$'000 $'000

Share based payments reserve

At beginning of year 734 -

Share based payments surrendered (25) -

Share based payments expense(1) - 734

----------------------- -------------

Closing balance at 31 December 709 734

======================= =============

(1) For the year ended 31 December 2022, the Directors have

estimated that the vesting conditions related to 20,250,000

director and employee options cannot be achieved. Therefore, $nil

(2021: $0.7m) expense has been recognised in the Statement of

Comprehensive Income.

Share options and warrants outstanding at the end of the year

have the following expiry date and exercise prices:

Share options/warrants Share options/warrants

31 December 31 December 2021

Exercise price 2022

Grant date Expiry date GBP

1 December 30 November

2019 2024 0.02 3,150,000 6,150,000

19 February 19 February

2021 2024 0.09 694,444 694,444

10 August

2021 10 August 2025 0.08 31,000,000 31,000,000

The fair value at grant date is independently determined using

an adjusted form of the Black Scholes Model that takes into account

the exercise price, the term of the option, the impact of dilution

(where material), the share price at grant date and expected price

volatility of the underlying share, the expected dividend yield,

the risk-free interest rate for the term of the option and the

correlations and volatilities of the peer group companies. In

addition to the inputs in the table above, further inputs as

follows:

The model inputs for the 694,444 broker warrants granted for

consulting services during the year included:

(a) warrants are granted for no consideration and vested

warrants are exercisable for a year of three years after the grant

date: 19 February 2021.

(b) expiry date: 19 February 2024.

(c) share price at grant date: 9.6 pence.

(d) expected price volatility of the company's shares: 70.24%.

(e) risk-free interest rate: 0.70%.

The model inputs for the 30,000,000 director and Brazilian

employee options and 1,000,000 third party warrants granted for

consulting services during the year included:

(a) 30,000,000 options are granted and split into two Tranches,

whereby 20,250,000 tranche A options have vesting conditions linked

to performance and 9,750,000 Tranche B options vest

immediately.

(b) Tranche A is split further with 9,450,000 options vesting

once all necessary permits required to commence production are

received and then a further 10,800,000 options vest upon

commencement of production at the Pitombeiras Vanadium Project.

(c) The 9,450,000 options have a vesting period of two years

from grant date and the 10,800,000 options have a vesting period of

three years from the grant date.

(d) 1,000,000 warrants are granted for no consideration and

vested warrants are exercisable for a period of three years after

the grant date: 10 August 2021.

(e) expiry date: 10 August 2025.

(f) share price at grant date: 8.0 pence.

(g) expected price volatility of the company's shares: 70.24%.

(h) risk-free interest rate: 0.591%.

18. Subsidiary

The details of the subsidiaries of the Company, which have been

included in these consolidated financial statements are:

Name Country of Proportion

incorporation of ownership

interest

VTF Mineração Ltda. Brazil 99.99%

Jangada Services Plc United Kingdom 100.00%

Allexcite Enterprises Pty

Ltd Australia 100.00%

19. Related party transactions

During the year the Company entered into the following

transactions with related parties.

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

Garrison Capital (UK) Limited:

Purchases made on Company's behalf and

administrative fees expensed during the

year - 20

Nicholas von Schirnding:

Investment in Fodere Titanium Limited

of which Nicolas von Schirnding is the

Chairman - 490

FFA Legal Ltda:

Legal and accountancy services expensed

during year 89 90

============= =============

FFA Legal Ltda is a related party to the Group due to having a

director in common with Group companies. At the year-end they were

owed $nil (2021: $nil).

Harvest Minerals Limited is a related party to the Group due to

having directors in common with Group companies. At the year-end

they held 1,250,000 options (2021: 1,250,000), which were acquired

from various option holders on 3 March 2021 at an aggregate sum of

GBP77,000 (USD$107,175).

Directors' remuneration is disclosed within note 9.

20. Subsequent Events

In May 2023, the Company purchased an additional 2,000,000

shares in Blencowe Resources PLC and paid GBP0.05 per share. The

Company also received 1,000,000 warrants with an exercise price of

GBP0.08 per share and expiry date of 23 May 2026.

At the year end, the Company had a loan receivable from KEFI

Gold and Copper Plc ("KEFI") for $0.25 million, which was

subsequently converted post year end into 35,714,285 shares in KEFI

and is a liquid investment on the London Stock Exchange.

There have been no other significant subsequent events since the

reporting date.

21. Ultimate controlling party

The Directors consider that the Company has no single

controlling party.

**ENDS**

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) info@jangadamines.com

Strand Hanson Limited Ritchie Balmer Tel: +44 (0)20 7409 3494

(Nominated & Financial James Spinney

Adviser)

Tavira Securities Jonathan Evans Tel: +44 (0)20 7100 5100

Limited

(Broker)

St Brides Partners Ana Ribeiro jangada@stbridespartners.co.uk

Ltd Isabel de Salis

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLMATMTATMIJ

(END) Dow Jones Newswires

June 29, 2023 02:02 ET (06:02 GMT)

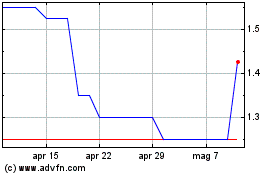

Grafico Azioni Jangada Mines (LSE:JAN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Jangada Mines (LSE:JAN)

Storico

Da Apr 2023 a Apr 2024