TIDMMDZ

30 June 2023

MediaZest Plc

("MediaZest", the "Company" or "Group"; AIM: MDZ)

Unaudited Interim Results for the six months ended 31 March 2023

MediaZest, the creative audio-visual company, announces its unaudited interim

results for the six months ended 31 March 2023 (the "Period").

MediaZest's interim results are set out below, with comparisons to the same

period in the previous year, as well as to MediaZest's audited results for the

year ended 30 September 2022.

CHAIRMAN'S STATEMENT

Introduction

The Board presents the consolidated unaudited results for the six months ended

31 March 2023 for MediaZest plc and its wholly owned subsidiary company

MediaZest International Ltd ("MDZI") (together the "Group").

Financial Review

* Revenue for the Period was £1,054,000, down 25% (2022: £1,402,000) due to

delays to client projects, subsequently happening in the second half of the

financial year.

* Gross profit was down by 21% accordingly to £599,000 (2022: £756,000).

* Gross margin rose to 57% (2022: 54%) with a greater percentage of revenue

generated from higher margin managed services than from hardware sales.

* Administrative expenses before depreciation and amortisation were £747,000,

an increase of 21% (2022: £618,000) due to inflationary pressures and

increased marketing spend.

* EBITDA was a loss of £148,000 (2022: profit of £138,000).

* Net loss for the period after taxation was £260,000 (2022: profit of £

40,000).

* The basic and fully diluted loss per share was 0.0186 pence (2022: profit

per share 0.029 pence).

* Cash and cash equivalents at 31 March 2023 were £10,000 (2022: £46,000).

Operational Review

Following a strong improvement during the financial year ended 30 September

2022, macro-economic uncertainty and operational changes at key clients had a

profound impact on the Group's performance during the Period, particularly in

the first quarter of calendar year 2023. This resulted in delays to a major

client roll out project whilst design format changes were made, a slower than

expected conclusion of deals in progress and hesitation over projects from new

clients, all of which led to a drop in revenue in the Period compared to H1

2022. The Board believes the latter two issues are related to customer concerns

regarding general market conditions, including inflationary pressures.

Subsequent to the Period, these issues appear to have eased somewhat and the

second half of the Group's financial year is expected to show a significant

improvement compared to the first half. In particular, the major client roll

out has now restarted, some significant projects are expected to close in the

run up to the summer period and several new clients have now placed orders.

Margins continue to be robust with the mix of services offered and also reduced

project revenues resulting in a greater percentage of gross profit coming from

recurring revenue contracts, which typically have lower direct cost of sales.

The Board continues to keep a close eye on costs, however inflationary

pressures and additional investment in the sales and marketing process have led

to increases in costs during the Period, compared to the first six months of

the prior year.

Client Work in the Period

The Company's long-term client base remains consistent and continues to

generate new opportunities. During the Period, the Group provided digital

signage solutions to another tranche of stores between October and December

2022 for long-standing client, Pets at Home, and continued to deliver new

dealership experiences for Hyundai. MediaZest also continues to provide and

expand its ongoing professional services in support of projects with these

clients.

The Group added a new large global automotive client during the Period,

providing solutions in one European territory which it expects to expand to

further substantial work in the coming months.

MediaZest also completed work on additional Lululemon Athletica stores as it

continues to work with the Group across Europe. A notable project was the new

flagship store in Paris on the Champs Elysees which featured LED screens behind

the main cashdesk, internal digital signage and a 'transparent' LED in one

window. Other long-term clients such as Ted Baker, Halfords Autocentres, and

Post Office continued to utilise professional services provided by MediaZest,

including software licences, content management, support and maintenance. As

such, the Group continues to have good visibility over recurring revenue

streams which remained consistent.

Engagements with new clients began including Rank Foundation and Wren Kitchens

and the Group continued to develop its relationships with recently won clients

such as Vodafone, with new projects completed and additional opportunities

under discussion.

The business development team has been supplemented and continues to identify

and work on new client projects. The Group has focussed on marketing during the

period to generate new opportunities and garner new clients.

Financing

Due to the strong results delivered in the prior year to 30 September 2022 and

improvement in business subsequent to the six months to 31 March 2023,

additional equity fundraising was again not required in the period.

The Group issued £150,000 of Convertible Loan Notes in August 2020 with a 3

year term. £20,000 of these will be repaid in August 2023, and the Group is in

discussion with the holders of the balances regarding potentially extending or

renewing these instruments. The Group will update on these discussions in due

course.

Outlook

The Board believes the outlook for the remainder of the financial year is

encouraging. Projects delayed from the first half of the year have now

commenced and some are completed, and that is expected to be reflected in

improving financial results in the second half of the financial year.

MediaZest continues to seek new opportunities in Europe which has been an area

showing significant potential for the Group. In the Period, the Board

established an office in the Netherlands to better facilitate project delivery

and logistics and to capitalise on these new opportunities within the EU. The

first project delivered via this subsidiary is already underway.

Recurring revenue streams have been robust and the Company continues to target

the growth of these, in addition to new client wins.

At a strategic level, the Board believes adding scale to the current

operational business via an acquisition or acquisitions would unlock

shareholder value. The Group continues to evaluate potential targets in the

market that may be suitable, with considerable effort going into this

workstream over the most recent months.

Whilst the three markets in which the Group primarily operates - Retail,

Automotive and Corporate - are seeing strong long term demand, the Board

remains mindful of macro-economic headwinds in the coming months, already seen

in the first quarter of the calendar year. As such, the Group continues to

monitor and control the cost base carefully, whilst balancing the growth of the

business and continuing to seek additional clients and projects.

Lance O'Neill

Chairman

29 June 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHSED 31

MARCH 2023

Unaudited Unaudited Audited

6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept

22

Note £'000 £'000 £'000

Continuing Operations

Revenue 1,054 1,402 2,820

Cost of sales (455) (646) (1,321)

Gross profit 599 756 1,499

Administrative expenses before (747) (618) (1,279)

depreciation and amortisation

EBITDA (148) 138 220

Administrative expenses - (31) (32) (63)

depreciation & amortisation

Operating (Loss)/profit (179) 106 157

Finance costs (81) (66) (145)

(Loss)/profit before taxation (260) 40 12

Taxation - - -

(Loss)/profit for the period and (260) 40 12

total comprehensive loss / income

for the period attributable to the

owners of the parent

(Loss)/earning per ordinary 0.1p

(2022:0.01p) share

Basic 2 (0.0186) 0.0029p 0.0009

Diluted 2 (0.0186) 0.0029p 0.0009

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2023

Unaudited Unaudited Audited

2 6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept

22

Note £'000 £'000 £'000

ASSETS

NON CURRENT ASSETS

Goodwill 2,772 2,772 2,772

Owned

Property, plant and equipment 51 27 34

Right of use

Property, plant and equipment 60 105 83

2,883 2,904 2,889

CURRENT ASSETS

Inventories 117 137 121

Trade and other receivables 301 545 674

Cash and other equivalents 4 10 46 45

428 728 840

TOTAL ASSETS 3,311 3,632 3,729

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 3,656 3,656 3,656

Share premium 5,244 5,244 5,244

Share options reserve 146 146 146

Retained earning (8,065) (7,777) (7,805)

TOTAL EQUITY 981 1,269 1,241

LIABILITIES

NON CURRENT LIABILITIES

Financial liabilities - borrowings

Interest Bearing loans and 70 255 83

borrowings

CURRENT LIABILITIES

Trade and other payables 991 983 1,101

Financial liabilities - borrowings

Interest bearing loans and 1,269 1,125 1,304

borrowings

2,260 2,108 2,405

TOTAL LIABILITIES 2,330 2,363 2,488

TOTAL EQUITY AND LIABILITIES 3,311 3,632 3,729

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED 31 MARCH

2023

Share Share Share Retained Total

Capital Premium Option Earnings equity

Reserve

£'000 £'000 £'000 £'000 £'000

Balance at 30 September 3,656 5,244 146 (7,817) 1,229

2021

Profit for the period - - - 40 40

Total comprehensive - - - 40 40

profit for the period

Balance at 31 March 2022 3,656 5,244 146 (7,777) 1,269

Loss for the period - - - (28) (28)

Total comprehensive loss - - - (28) (28)

for the period

Balance at 30 September 3,656 5,244 146 (7,805) 1,241

2022

Loss for the period - - - (260) (260)

Total comprehensive loss - - - (260) (260)

for the period

Balance at 31 March 2023 3,656 5,244 146 (8,065) 981

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE SIX MONTHSED 31 MARCH 2023

Unaudited Unaudited Audited

6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept

22

Note £'000 £'000 £'000

Cash flows from operating activities

Cash from operating activities 3 119 (129) (24)

Taxation - - -

Net cash generated by/(used in) 119 (129) (24)

operating activities

Cash flows used in investing

activities

Purchase of property, plant and (25) (19) (35)

equipment

Net cash from investing activities (25) (19) (35)

Cash flow from financing activities

Other loans payments (4) (5) 1

Shareholder loan receipts 88 145 15

Shareholder loan repayments - (80) -

Bounce back loan repayments (5) (5) (10)

Invoice financing (repayments)/ (168) 61 98

receipts

Lease liability payments (12) (23) (46)

Interest paid (28) (19) (74)

Net cash (used in) / generated from (129) 74 (16)

financing activities

(Decrease) in cash and cash (35) (74) (75)

equivalents

Cash and cash equivalents at 45 120 120

beginning of period

Cash and cash equivalents at end of 10 46 45

period

NOTES TO THE FINANCIAL INFORMATION

1. Basis of Preparation

The Group's annual financial statements are prepared in accordance with UK

adopted International Accounting Standards and, accordingly, the consolidated

six-month financial information in this report has been prepared on the same

basis. The financial statements have been prepared under the historical cost

convention.

The International Accounting Standards are subject to amendment and

interpretation by the International Accounting Standards Board (IASB). The

financial information has been prepared on the basis of international

accounting standards expected to be applicable as at 30 September 2023.

This interim report does not comply with IAS 34 "Interim Financial Reporting"

as permissible under the AIM Rules for Companies.

Going Concern

The Directors have considered financial projections based upon known future

invoicing, existing contracts, pipeline of new business and the number of

opportunities it is currently working on. These projections reflect the

improvement in business post period end, as noted in the review above, and the

associated improvement in financial results and therefore cash generation in

the second half of the financial year ended 30 September 2023.

In addition, these forecasts have been considered in the light of the ongoing

challenges in the global economy as a result of inflationary pressures, the

legacy of the Covid-19 pandemic, war in Ukraine, consequences of the UK Brexit

agreement, and previous experience of the markets in which the Group operates

and the seasonal nature of those markets.

These forecasts indicate that the Group will generate sufficient cash resources

to meet its liabilities as they fall due over the next 12-month period from the

date of this interim announcement.

As a result, the Directors consider that it is appropriate to draw up the

financial information on a going concern basis.

Accordingly, no adjustments have been made to reflect any write downs or

provisions that would be necessary should the Group prove not to be a going

concern, including further provisions for impairment to goodwill and

investments in Group companies.

The operating business, MediaZest International Limited, retains long term

relationships with major clients and is developing further large clients and

continues to win new project business. As such the Board believes the long term

outlook for the group is positive and no impairment is necessary to the

carrying value of this asset

Non-statutory accounts

The financial information contained in this document does not constitute

statutory accounts within the meaning of Section 434 of the Companies Act 2006

("the Act").

The statutory accounts for the year ended 30 September 2022 have been filed

with the Registrar of Companies. The report of the auditors on those statutory

accounts was unqualified and did not contain a statement under section 498(2)

or 498(3) of the Companies Act 2006.

The financial information for the six months to 31 March 2023 has not been

audited.

1. Earnings per Share

Unaudited Unaudited Audited

6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept 22

(Loss)/profit after tax (260) 40 12

Weighted average number of 1,396,425,774 1,396,425,774 1,396,425,774-

shares

Basic earnings per share (0.0186) 0.0029p 0.0009

(pence)

Diluted earnings per share (0.0186) 0.0029p 0.0009

(pence)

The diluted loss per share is identical to that used for basic loss per share

as the options are "out of the money" and therefore anti-dilutive.

3. Cash from operating activities

Unaudited Unaudited Audited

6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept 22

(Loss)/profit after tax (260) 40 12

Depreciation/amortisation 31 32 63

charge

Finance Costs 81 18 145

Decrease/(increase) in 4 (13) 29

inventories

(Decrease) in payables (110) (62) (13)

Decrease /(Increase) in 373 (144) (260)

receivables

Cash from operating activities 119 (129) (24)

4. Cash and cash equivalents

Unaudited Unaudited Audited

6 months 6 months 12 months

31 Mar 23 31 Mar 22 30 Sept

22

Cash in hand 10 46 45

5. Subsequent events

There were no significant subsequent events.

6. Distribution of the interim report

Copies of the interim report will be available to the public from the Company's

website, www.mediazest.com, and from the Company Secretary at the Company's

registered address at Unit 9, Woking Business Park, Albert Drive, Woking,

Surrey, GU21 5JY.

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed

in accordance with the Company's obligations under Article 17 of MAR.

Enquires

Geoff Robertson 0845 207 9378

Chief Executive Officer

MediaZest Plc

David Hignell/Adam Cowl 020 3470 0470

Nominated Adviser

SP Angel Corporate Finance LLP

Claire Noyce 020 3764 2341

Broker

Hybridan LLP

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest

was admitted to the London Stock Exchange's AIM market in February 2005. For

more information, please visit www.mediazest.com

END

(END) Dow Jones Newswires

June 30, 2023 02:00 ET (06:00 GMT)

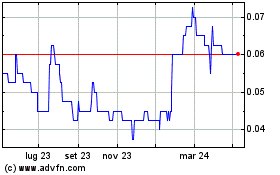

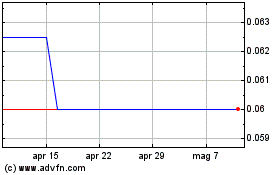

Grafico Azioni Mediazest (LSE:MDZ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mediazest (LSE:MDZ)

Storico

Da Apr 2023 a Apr 2024