MediaZest Plc Fundraise to raise £120,000

08 Gennaio 2024 - 8:01AM

UK Regulatory

TIDMMDZ

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) 596/2014 (AS AMENDED) AS IT FORMS PART OF THE DOMESTIC LAW

OF THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS

AMENDED). UPON PUBLICATION OF THIS ANNOUNCMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

8 January 2024

MediaZest Plc

("MediaZest", the "Company" or the "Group"; AIM: MDZ)

Fundraise to raise £120,000

MediaZest (AIM: MDZ), the creative audio-visual company, is pleased to announce

that it has raised a total of £120,000 (before expenses) by means of a Fundraise

(the "Fundraise") via the issue of 300,000,000 ordinary shares of 0.01p in the

capital of the Company (the "Ordinary Shares") to new and existing investors

(the "Fundraise Shares") at a price of 0.04 pence per Fundraise Share (the

"Issue Price").

The Fundraise comprises a placing (the "Placing"), which was undertaken by the

Company's sole broker Hybridan LLP, and a subscription (the "Subscription") for

Fundraise Shares, details of which are set out below.

Details of the Fundraise

The Company has raised £120,000 (before expenses), via the Placing of

250,000,000 Fundraise Shares and a Subscription to certain private investors for

50,000,000 Fundraise Shares, each at the Issue Price.

The Subscription and Placing are subject to standard terms and conditions and

are also each conditional upon the other. The Fundraise is also conditional upon

the admission of the Fundraise Shares to trading on AIM ("Admission").

The Issue Price represents a discount of approximately 6 per cent. to the

closing middle market price of 0.0425 pence per Ordinary Share on 5 January

2024, being the latest practicable date prior to the date and time of this

Announcement.

Use of Proceeds

The net proceeds of the Fundraise will be deployed as follows:

· investment in business development including marketing and sales

recruitment;

· to support growth of the Company's Dutch subsidiary to exploit new

opportunities in the EU; and

· to provide the Group with additional working capital.

Current Trading

The Company continues to sign regular repeat work on projects - often on a store

by store or dealership by dealership basis. The value of MediaZest's annualised

recurring revenue contracts has increased, with contracts currently running at

around £700k per year on an annualised basis, some of which are multi-year

deals. In addition, new European installations are predominantly geared towards

strong recurring revenue streams and 3-year deals.

The operational business has multiple long term blue-chip clients, which are

primed for future growth. The Company is experiencing expanding markets in the

key sectors in which it operates and believes it has an opportunity to build a

best in class roll up business, attractive to larger players in the medium term.

The Dutch subsidiary, which was established in December 2022, is already

delivering projects and EU project orders were received in excess of ?500,000 in

calendar year 2023.

Application for Admission

The Fundraise Shares will be credited as fully paid and will rank pari passu in

all respects with the existing Ordinary Shares, including the right to receive

any dividends and other distributions declared on or after the date on which

they are issued.

Application for the Admission of the Fundraise Shares has been made and it is

expected that Admission will be effective on or around 8.00 am on 10 January

2024.

Geoff Robertson, CEO of MediaZest plc, commented: "We are delighted to have

raised these additional funds from new and existing investors, to invest in

business development and to support growth of the Company's Dutch subsidiary. At

the end of 2023, we had multiple large-scale projects in deployment or

negotiation and over the last 12 months we have seen that the maturing market in

digital signage is opening up opportunities to consolidate. Moreover, the

opportunity to grow in Europe through our new subsidiary has been exceeding our

initial expectations.

As we head into 2024, we believe we are well positioned to prosper in each of

the key markets in which we operate, seeing growth as follows; Retail focusing

on better stores with enhanced digital experiences; Automotive by providing

solutions as the industry transitions to EV and digital sales models; and the

Corporate Office market as hybrid working continues to evolve by helping it to

manage a greater reliance on audio visual technologies."

Total voting rights

Following Admission, the Company's total issued share capital will comprise of

1,696,425,774 Ordinary Shares. The Company does not hold any Ordinary Shares in

treasury. Therefore, the total number of Ordinary Shares with voting rights in

the Company will be 1,696,425,774. This figure may be used by shareholders in

the Company as the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to their interest

in, the share capital of the Company following Admission.

Enquiries:

Geoff Robertson 0845 207 9378

Chief Executive Officer

MediaZest Plc

David Hignell/Adam Cowl 020 3470 0470

Nominated Adviser

SP Angel Corporate Finance LLP

Claire Noyce 020 3764 2341

Broker

Hybridan LLP

Notes to Editors:

About MediaZest

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest was

admitted to the London Stock Exchange's AIM market in February 2005. For more

information, please visit www.mediazest.com

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

January 08, 2024 02:01 ET (07:01 GMT)

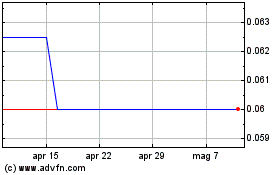

Grafico Azioni Mediazest (LSE:MDZ)

Storico

Da Mar 2024 a Apr 2024

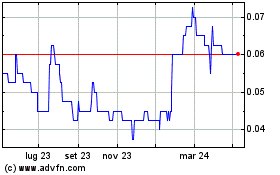

Grafico Azioni Mediazest (LSE:MDZ)

Storico

Da Apr 2023 a Apr 2024