TIDMOPTI

RNS Number : 4309N

OptiBiotix Health PLC

30 September 2021

30 September 2021

OptiBiotix Health plc

("OptiBiotix" or the "Company" or the "Group")

Half Year Report

OptiBiotix Health p lc (AI M: OPTI), a life sciences busi ness d

eveloping compou n ds to tackle obesity, cardiovascular disease and

diabetes, a nnounces its results for the six months ended 30 June

2021.

Highlights

-- Strong first half of trading with sales of LP(LDL) (R) and

SlimBiome(R) of GBP1.076m, a 44.5% increase over H1:2020

-- A 59.6% increase in gross profit and 4.8% increase in gross margins

-- Sales up by 57.5% in ProBiotix division to GBP536,225 (H1 2020: GBP340,429)

-- Sales up by 35.6% in PreBiotics division to GBP539,819 (H1 2020: GBP398,271)

-- A group net trading profit of GBP110,893

-- A scalable business model growing sales and margins with a

wide portfolio of small and large partners, pharmaceutical

specialists, and established retailers building an international

brand presence

-- Growing sales with existing partners by extending product lines and territories

-- Growing sales with large partners in key strategic markets (e.g India, China, USA)

-- Commercialising next generation products including microbiome

modulators (MM's) biotherapeutics, and growing family of

SweetBiotix(R) products

-- Deals for LP (LDL) (R) /CholBiome(R) signed with Compson

Biotechnology (Taiwan), INSCOBEE INC (South Korea) and Bioscience

Marketing (Malaysia)

-- Launch of SlimBiome Metablic Support on TMall in Taiwan with MaxCare

-- Expansion of the Slimbiome containing products portfolio in

Optipharm with the Optiman brand in July 2021

-- A rrotex Pharmaceutials, Australia's largest privately owned

pharmaceutical company launched a Very Low-Calorie Diet (VLCD)

weight management product featuring SlimBiome product. This is a

new product range offered through pharmacies and online in

Australia

-- Strengthening of Board with Christopher Brinsmead CBE and

Stephen Hammond MP as non-executive Directors

-- René Kamminga joined as Chief Executive Officer of OptiBiotix

Ltd, a wholly owned subsidiary of OptiBiotix Health plc

-- Investment in SkinBioTherapeutics plc has increased from GBP

8,962,564 as of 30 December 2020, to GBP22,948,048 as of June 30

2021

-- Completion of a successful human study (awaiting

publication), in volunteers taking LP(LDL) (R) in a high

cholesterol patient group, showed substantive reductions in total

cholesterol, LDL cholesterol, and Apolipoprotein B (ApoB), a

biomarker increasingly linked to atherogenic risk

-- OptiBiotix recognised as a key player in the global

microbiome market in a number of industry reports

Stephen O'Hara, CEO of OptiBiotix, commented: "This has been

another period of progress for OptiBiotix with strong sales growth

and improving margins allowing the Group to build a recurring

revenue base providing a foundation on which to build a profitable

and valuable business. We believe new product launches in July

2021, the extension of territories with existing partners, the

prospect of agreements with large partners in key strategic

markets, and the growing realisation of our development pipeline,

allow us to look forward with confidence to further commercial

progress of the Group in the current year and beyond.

During this period, the Company made a number of additions to

the board and executive team reflecting the increased focus on

commercialising products with larger partners into high value

strategic markets which value science, clinical studies, and

intellectual property. We anticipate further additions and changes

team in-line with the continued growth and expansion of the

Group.

The Company is now in the strongest position it has ever been in

with a strong team, large and valuable intellectual property

portfolio in the rapidly growing microbiome space, multiple

clinical studies showing product safety and efficacy, recurring

orders, and a valuable asset in OptiBiotix's holding in SBTX.

With industry and consumer interest in the microbiome and gut

health growing OptiBiotix's portfolio of award winning first

generation and industry disruptive second-generation products

places it in a strong position for future growth in this exciting

area of healthcare."

This announcement contains information which, prior to its

disclosure, was considered inside information for the purposes of

the UK Market Abuse Regulation and the Directors of the Company are

responsible for the release of this announcement.

For further information, please contact:

OptiBiotix Health plc www.optibiotix.com

Neil Davidson, Chairman Contact via Walbrook

below

Stephen O'Hara, Chief Executive

Cairn Financial Advisers LLP (NOMAD) Tel: 020 7213 0880

Liam Murray / Jo Turner / Ludovico Lazzaretti

Cenkos Securities plc (Broker) Tel: 020 7397 8900

Callum Davidson / Neil McDonald

Michael Johnson / Russell Kerr (Sales)

Walbrook PR Ltd Mob: 07876 741 001

Anna Dunphy

Chairman's and Chief Executive's Statement

We are pleased to present OptiBiotix Health plc's interim

results for the six month period ended 30 June 2021.

Trading during the first six months of this year has been

strong. The Group saw sales of LP(LDL) (R) and SlimBiome(R) as an

ingredient or final product of GBP1.076m, representing a 44.5%

increase over the H1 period last year.

Each division continues to make progress with sales in ProBiotix

of GBP536,225, up 57.5% (H1 2020: GBP340,429), PreBiotics sales of

GBP539,819, up 35.6% (H1 2020: GBP398,271), and a 4.8% increase in

margins compared to the same period last year. As in previous

years, there was no substantive contribution in the period from

license or royalty payments which tend to be received in the second

half of the year. The Group believes it is in a strong position to

meet or exceed its full year sales forecast.

The strong sales growth is especially pleasing given the

continued uncertain global economic environment and challenges of

the subsequent waves of COVID-19, particularly in countries like

India and the USA, in the first six months of the year.

Strategic overview

OptiBiotix operates in the human microbiome space, an exciting

area of healthcare expected to grow at a CAGR of over 22% between

2020 and 2025 (Mordor Intelligence 2019). The Group is at a

strategic inflection point with brand recognition and growing sales

from its global network of partners from its lead first generation

products and early commercial traction with its second generation

products. First generation products were designed with a low

development risk with the aim of establishing the Group and its

products whilst second generation products are step changes in

innovation, which if successful, have a large potential upside. The

Group continues to build value through both sets of products and

its holding in separately listed SkinBioTherapeutics plc

(SBTX).

The Group is making strong progress against the aims it set out

in the first half of the year :-

I. Growing sales with existing partners by extending product

lines and territories. These include:-

a. The launch of Bioslim, a Very Low-Calorie Diet (VLCD) weight management product with Arrotex Pharmaceutials, Australia's largest privately owned pharmaceutical company and the Optiman brand containing OptiBiome in July 2021 with Optipharm.

b. The extension of Holland & Barretts SlimExpert own brand

range of SlimBiome(R) from three to eight in March 2021.

c. Territory expansion for DS-01 containing LP(LDL) (R) with

Seed Health to support their ambitious growth plans.

II. Growing sales with large partners in key strategic markets (e.g India, China, USA etc).

a. These bring volume sales, international reach, and enhance

brand credibility but take longer to negotiate given the often

lengthy due diligence process.

III. Changing the sales mix to increase sales of final products.

IV. Renegotiating costs of goods as volumes increase to gain volume discounts.

V. Commercialising its next generation products including

microbiome modulators (MM's) biotherapeutics, and its growing

family of SweetBiotix(R) products.

Our first generation products are now increasingly becoming

associated with international retail and pharmaceutical partners

and established brands, which create further interest, and demand

in other markets. As we grow sales and profitability in our first

generation products, extend our reach into new application areas

and territories, and commercialise next generation products the

scale of our opportunity enlarges. Consumer and industry interest

in the microbiome and 'gut health' is growing and its link with a

wide range of chronic illnesses is becoming more defined.

OptiBiotix is well placed to exploit this emerging opportunity with

its products and with it the potential for a significant

enhancement in the value of the Group.

Commercial Overview

The Group provided a commercial update in August (RNS: 5/8/21)

and as such this section provides a general update on areas not

previously covered. The Group is increasing brand and product

awareness in key strategic markets and has signed deals with

Compson Biotechnology (Taiwan), INSCOBEE INC (South Korea) and

Bioscience Marketing (Malaysia) - all for LP(LDL) (R) /CholBiome

(R) . These agreements have been reached to build LP LDL(R) and

CholBiome's reputation and brand awareness in Asia and open up the

potential for cross boarder e-commerce trading in China. These

agreements are complemented by the launch of SlimBiome Metablic

Support on TMall in Taiwan with MaxCare in May 2021. TMall is part

of the Alibaba group, an online platform which allows both Chinese

and international companies to sell their products in mainland

China, Hong Kong, Macau, and Taiwan, and the 3(rd) most visited

website in the world and the 1(st) most visited website in China

https://en.wikipedia.org/wiki/Tmall . These create multiple routes

of entry into the large and complex Chinese market.

We are particularly pleased with the large number of industry,

retail nominations, and awards, we have won for our products in

different territories around the world: see link

https://www.optibiotix-ir.com/content/investors/annual_report

Industry awards increase brand and product awareness which in

turn increases partners' interest, leading to OptiBiotix being

recognised as a key player in the global microbiome market in a

number of industry reports.

Investors will note the gradual migration of the Group's awards

and nominations from science to ingredients, and increasingly to

final products, as we look to provide more high value

differentiated final solutions. This focus will continue throughout

2021 and into 2022 in line with our strategy of growing LPLDL (R)

and SlimBiome (R) as ingredients brands through a business to

business (B2B) network of partners giving us the confidence to

invest in building our own brand finished product solutions (e.g.

GoFigure, CholBiome, SlimBiome Medical) with our ingredients at the

core. Sales of final product typically have higher prices and

margin increasing turnover and profitability and act as a pull

through for ingredient sale creating a dual effect. As the Group

moves towards a greater focus on direct to consumer final product

sales it will increase its investment in product marketing.

Results

OptiBiotix results for six months ended June 30 2021 are set out

below.

The results show revenue for the six months of GBP1.076m (2020:

GBP744,821) representing a 44.5% increase over the H1 period last

year and ahead of the Group's expectations for the first six months

of the year .

Each division continues to make progress with sales in ProBiotix

of GBP536,225, up 57.5% (H1 2020: GBP340,429) and PreBiotics sales

of GBP539,819, up 35.6% (H1 2020: GBP398,271) compared to the same

period last year with gross margins increasing from 39.2% to 44%.

As in previous years, there was no substantive contribution in this

period from license or royalty payments which tend to be received

in the second half of the year and increase margins. The Group has

renegotiated a number of agreements with both suppliers and

customers in H1 2021 which will impact on margins in H2 and more

substantially in full year 2022 and beyond.

Administrative expenses were GBP1,071,015 (2020: GBP896,268)

with GBP174,780 non-cash expenses representing depreciation,

amortisation and share based payment charges (2020: GBP162,840).

The increase in administrative expenses (GBP174,747) was a result

of one-off recruitment and search fees for René Kamminga, an

innovations director, a business development director for North

America, and consultancy fees for Chris Nother plus additional

staff costs (GBP52,000) for Dr Taru Jain (Business Development

Director Asia) and Aneta Zlotkowska (Head of Quality). Despite

these costs, of which GBP117,000 are not recurring, the operating

loss for the first six months of the year was GBP596,784, a small

decrease on the same period last year (2020: GBP599,194). This was

compensated for by proceeds of GBP900,936 (H1 2020: GBP746,751)

received from the disposal of shares in SkinBioTherapeutics plc

('SBTX') giving a net trading profit of GBP110,893. This figure

does not include any change in the value of the Group's SBTX

investment which has increased from GBP 8,962,564 as of 31 December

2020, to GBP22,947,992 as of June 30 2021.

As at 30 June 2021, the Group had a GBP993,014 cash balance.

Once R&D tax credits are claimed and recoverable VAT repayments

are added, the balance would be GBP1.21m.

Board and management

We continue to evolve the management team and Board in line with

the stage of the Group's development with a number of additions to

the board and executive team since the start of the year. These are

all part of a number of changes reflecting the transition of the

Group into a commercial business and increased focus on selling

final products solutions into high value markets which value

science, clinical studies, and intellectual property.

Christopher Brinsmead CBE and Stephen Hammond MP joined the

Board as non-executive directors at the start of the year bringing

senior executive experience in the pharmaceutical, healthcare, fund

management and investment banking sectors respectively. Dr Taru

Jain joined OptiBiotix's management team in March 2021 to focus on

business development and growing sales in the strategically

important Indian and Asian markets . She has over 10 years of

experience across the Indian healthcare value chain as well as

primary knowledge of the demand pattern of the prescription and

pharmacy over the counter (OTC) market.

René Kamminga joined as Chief Executive Officer ("CEO") of

OptiBiotix Ltd, a wholly owned subsidiary of OptiBiotix Health plc

in April 2021 and brings more than 25 years' experience in the sale

of speciality ingredients and products. Rene joined us from the

position of Vice President of Business Development and Chief

Commercial Officer of the Nutraceuticals division of KD Pharma

Group where he was integral in developing and delivering on a

strategy of moving the business from bulk ingredients to finished

product solutions. The appointment of Rene as CEO of OptiBiotix

Ltd, and search for a CEO of ProBiotix Health Ltd reflects the

Group's strategy in appointing experienced industry business

leaders who can take ownership of the strategy, P&L

responsibility, and development of the business into a highly

profitable and major player in the microbiome market in the years

ahead.

The Group also appointed Christopher Nother on a six-month

part-time consultancy basis to support the growth of LP(LDL) (R) in

pharma, either as an OTC product used by itself or in combination

with existing treatments (e.g. statins), or a drug biotherapeutic

in markets outside the USA. Chris identified opportunities in

taking OTC products like the CholBiome range into the high value

evidence based pharmaceutical market and continues to work for

OptiBiotix on a success fee basis.

We anticipate further additions and changes to both the

executive and non-executive team in-line with the continued growth

and expansion of the Group. These are likely to include a

development/innovations director, a business development director

for the strategically important North American market, a CEO for

ProBiotix Health, and a scientific and technical support

specialist. Aneta Zlotkowska, Head of Quality & Operations,

will be leaving us at the end of the year as the Group completes

its BRC certification.

These changes are all part of a strategy to bring in industry

leaders and specialist expertise to support the Group's growth

plans and capitalise on the opportunities created by our growing

pipeline of products.

The Group has identified the retention and attraction of key

personnel staff as a principal risk as reported in its 2020 annual

report. As interest in the microbiome grows and competitor

companies look to either acquire businesses or expertise this risk

increases. The Group has commissioned PWC to review its existing

arrangements and develop proposals to mitigate the risk and align

value creation with remuneration consistent with companies on the

AIM market at a similar stage of development.

Outlook

The Group is in a strong position to meet or exceed its full

year sales forecast as it continues to build brand awareness and

expand sales of its first-generation products whilst building the

scientific and clinical evidence base needed to de-risk its

innovative second-generation products. We are particularly pleased

with the number of partners extending their product ranges

(Optipharm, H&B) and territories (Optipharm, Seed Health) which

shows confidence in the products and brand and helps to grow a

recurring revenue base providing a foundation on which to build a

valuable and sustainable business.

The Group has a clear direction of travel in its two-stage

strategy of building brand presence and early sales of its first

generation LP(LDL) (R) and SlimBiome(R) products whilst parallel

tracking the development of its more innovative second-generation

products offering potentially larger returns. The strategy has been

designed with the divisions acting as the commercial arms of the

Group led by industry leaders focused on building sales and

profitability whilst the Group acquires and develops technologies

to build the product pipeline providing the scientific and clinical

studies, publications and regulatory approvals. Having two separate

wholly owned product legal entities within the Group plc

(OptiBiotix Limited and Probiotix Health Ltd) and a substantive

investment in a third, (SBTX), gives OptiBiotix shareholders a

position in multiple opportunities within the emerging microbiome

space. As each of these divisions grow revenues and profitability

there is potential for an independent exit or separate listing as

has been achieved with Skinbiotherapeutics plc (SBTX). As part of

this process of building financial independence of each division

and

the shift towards final product solutions we are integrating

consumer goods costs and sales into the divisional structures. This

will give a more accurate reflection of each divisions trading

position as an independent legal entity and reduce the possibility

of creating conflict between B2B and B2C partners as OptiBiotix

sells more final product solutions.

As we move through 2021, we will continue to grow revenues,

manage costs, improve margins, and invest in extending

opportunities for our first generation products markets and drive

the commercialisation of our exciting second generation products

with manufacturing and application partners. We will continue to

explore opportunities for LP(LDL) (R) in high value pharmaceutical

markets, where science and clinical studies are highly valued, and

extend its reach into new application areas. These include funding

a PhD studentship and clinical study into the role of the

microbiome in stress, anxiety, and sleep disorders with the

University of Southampton and University of Trento, and continuing

to develop applications for LPLDL(R) in dairy, which represents

over 85% of the global probiotic market. We are starting to see the

benefits of achieving FDA GRAS, with our partner in Uruguay,

Grancha Pocha, launching a yoghurt containing LPLDL(R) in H2, and

Sacco growing sales of LP(LDL) (R) with dairy customers around the

world. We see similar growth opportunities for SlimBiome(R) by

extending the range of products containing SlimBiome(R) with

existing and new partners, and leveraging our industry recognition

as an innovator in the microbiome field by developing new

applications for the health and wellbeing and the sports nutrition

market.

Internationally, having established manufacturing partners in

India, we anticipate commercial progress in this market in H2 2021,

and potentially in other key strategic markets such as China and

the USA, although these will take more time to develop fully. We

are particularly focused on large companies who are leading brands

in healthcare, hospitals, pharma, healthcare or E-commerce within

their own country, or with our second generation products on global

partners in manufacturing or producers of dairy, beverage, or

consumer products who could benefit from replacing existing sugar

or sweeteners with healthier options . The key partner

characteristics are country recognition and a network which allows

the opportunity to quickly scale up sales if the products are

successful.

The continued strong growth in our revenues in H1 2021 is

encouraging as the Group builds a recurring revenue base which is

increasing as partners launch new products, extend territories, and

build brand presence. We believe these product launches, the

extension of territories with existing partners, the prospect of

agreements with corporate partners in key strategic markets, the

continuing flow of new agreements and product launches, the growing

realisation of the development pipeline, and the strengthening of

our Board and senior management with industry expertise, allows us

to look forward with confidence to the further progress of the

Group in the current year and beyond.

As we consider the future, we are pleased to see growing

consumer and industry interest in the human microbiome presenting

us with a market opportunity that is large and expanding.

OptiBiotix has had over 100 items of coverage in industry journals,

trade magazines, feature magazines etc to the end of August 2021.

These are not always seen by investors as they are industry focused

given the B2B nature of the current business but are important in

establishing OptiBiotix and its products as innovators in the

industry and attracting partner interest. As we shift the focus

from ingredients to final product solutions we will direct our

marketing efforts at the consumer and have a number of radio

interviews planned throughout cholesterol month in October.

We are particularly pleased that a number of large partners have

identified the presence of scientific and clinical studies and an

extensive IP portfolio as key differentiating features in this

evolving market, and OptiBiotix as a priority partner as they look

to enter the microbiome space. The Group is ideally positioned to

exploit these opportunities with first generation products which

impact on major chronic lifestyle diseases, industry recognition as

a key industry player in the microbiome space, and next generation

products of SweetBiotix(R) and MM's providing a step change in

existing sugar and sweeteners and the potential to modify the

microbiome in a highly targeted way. Our family of SweetBiotix(R)

products has attracted a lot of industry interest with a US partner

bearing the costs for product manufacturing one type of

SweetBiotix(R) whilst paying annual royalty fees. This is a clear

indication of the precommercial value placed on this step change in

technology. After a number of technical challenges we were

particularly pleased to achieve progress in the first half of the

year with our MM's, which should allow us to manufacture these at

scale. This creates the potential to manufacture prebiotic products

which can change the relative abundance of specific microbial

species linked to disease. If the microbiome is the future of

healthcare then the ability to precision engineer the microbiome

and change the relative amounts of specific bacteria in a highly

targeted way is an important step in developing products which can

prevent or treat disease and/or enhance the effectiveness of

existing drug treatments.

We look forward to growing sales of first generation products as

we scale our business model and strengthen our position in this new

and exciting area of science which has the potential to

revolutionise the future of healthcare.

On behalf of everyone at OptiBiotix Health we would like to

thank our investors for their continued support and look forward to

an exciting future.

N Davidson and S O'Hara

30 September 2021

Consolidated Statement of Comprehensive Income

For the six months to 30 June 2021

6 months to 6 months to Year to

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Continuing operations GBP GBP GBP

Revenue 1,076,044 744,821 1,523,247

Cost of sales (601,813) (447,747) (643,428)

-------------- -------------- --------------

Gross Profit 474,231 297,074 879,819

Share based payments 30,144 42,762 127,248

Depreciation and amortisation 144,636 120,078 247,895

Other administrative costs 896,235 733,428 1,616,069

Administrative expenses (1,071,015) (896,268) (1,991,212)

-------------- -------------- --------------

Operating loss (596,784) (599,194) (1,111,393)

Finance income / (costs) (23,186) (64,682) (44,856)

Gain on disposal of associate - - 4,165,223

Gain on investments 14,165,501 - 2,955,739

Profit on disposal of investments 720,863 48,967 48,967

Share of loss from associate - - (303,448)

-------------- -------------- --------------

Profit/(Loss) before Income

tax 14,266,394 (614,909) 5,710,232

Income tax 2,638 9,246 91,635

-------------- -------------- --------------

Profit/(Loss) for the period 14,269,032 (605,663) 5,801,867

Other Comprehensive Income - - -

-------------- -------------- --------------

Total comprehensive income

for the period 14,269,032 (605,663) 5,801,867

Total comprehensive income

attributable to the owners

of the group 14,269,032 (605,456) 5,801,867

Non-controlling interest - (207) -

14,269,032 (605,663) 5,801,867

Earnings/(loss) per share

Basic & Diluted - pence 4 16.23p (0.70)p 6.65p

Basic & Diluted before 14.88p (0.70)p 6.07p

Profit on investment revaluation

- pence

Consolidated Statement of Financial Position

As at 30 June 2021

Notes As at As at As at

30 June 2021 30 June 2020 31 December

Unaudited Unaudited 2020

Audited

ASSETS GBP GBP GBP

Non-current assets

Intangibles 2,726,349 2,728,393 2,735,621

Property, plant & equipment - 393 -

Investments 5 22,947,992 2,395,022 8,962,564

-------------- -------------- --------------

25,674,341 5,123,808 11,698,185

-------------- -------------- --------------

CURRENT ASSETS

Inventories 86,323 112,726 184,236

Trade and other receivables 1,285,689 394,857 645,823

Current tax asset 115,772 226,194 310,435

Cash and cash equivalents 993,014 1,469,147 864,680

-------------- -------------- --------------

2,480,798 2,202,924 2,005,174

-------------- -------------- --------------

TOTAL ASSETS 28,155,139 7,326,732 13,703,359

EQUITY

Shareholders' Equity

Called up share capital 6 1,758,812 1,758,812 1,758,812

Share premium 2,537,501 2,537,501 2,537,501

Share based payment reserve 897,451 782,821 867,307

Merger relief reserve 1,500,000 1,500,000 1,500,000

Convertible Loan Note Reserve 92,712 92,712 92,712

Retained Earnings 19,328,000 (1,098,381) 5,058,968

-------------- -------------- --------------

26,114,476 5,573,465 11,815,300

Non Controlling Interest 35,782 35,576 35,782

-------------- -------------- --------------

Total Equity 26,150,258 5,609,041 11,851,082

-------------- -------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 643,489 419,916 518,995

-------------- -------------- --------------

643,489 419,916 518,995

-------------- -------------- --------------

Non - current liabilities

Deferred tax liability 558,885 548,863 561,523

Borrowings 802,507 748,912 771,759

-------------- -------------- --------------

1,361,392 1,297,775 1,333,282

-------------- -------------- --------------

TOTAL LIABILITIES 2,004,881 1,717,691 1,852,277

-------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 28,155,139 7,326,732 13,703,359

Consolidated Statement of Changes in Equity

For six months to 30 June 2021

Called Share Share-based Non Merger Retained Convertible Total

up premium Payment controlling Relief Earnings Loan note Equity

Share reserve Interest Reserve

Capital

GBP GBP GBP GBP GBP GBP GBP GBP

------------ -------------- -------------- ------------ ------------ ------------ -------- --------------

Balance at

31 December

2019 1,708,811 1,646,873 740,059 35,782 1,500,000 (492,925) 92,712 5,231,312

Loss for the

period - - - - - (605,456) - (605,456)

Issued share

during the

period 50,001 890,628 - - - - - 940,629

Share based

payment - - 42,762 - - - - 42,762

Non

Controlling

interest - - - (206) - - (206)

------------ -------------- -------------- ------------ ------------ ------------ ------------ --------------

Balance at

30 June

2020 1,758,812 2,537,501 782,821 35,576 1,500,000 (1,098,381) 92,712 5,609,041

------------ -------------- -------------- ------------ ------------ ------------ ------------ --------------

Non

Controlling

Interest - - - 206 - - - 206

Profit for

the period - - - - - 6,157,349 - 6,157,349

share based

payment - - 84,486 - - - - 84,486

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Balance at

31 December

2020 1,758,812 2,537,501 867,307 35,782 1,500,000 5,058,968 92,712 11,851,082

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Profit for

the period - - - - - 14,269,032 - 14,269,032

share based

payment - - 30,144 - - - - 30,144

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Balance at

30 June

2021 1,758,812 2,537,501 897,451 35,782 1,500,000 19,328,000 92,712 26,150,258

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Consolidated Statement of Cash Flows

For the six months to 30 June 2021

Notes 6 months 6 months Year to

to to 31 December

30 June 30 June 2020

2021 2020 Audited

Unaudited Unaudited

GBP GBP GBP

Reconciliation of loss before

income tax to cash outflow

from operations

Operating loss (596,784) (599,194) (1,111,393)

Decrease/ (Increase) in

inventories 97,913 (49,965) (121,475)

(Increase)/decrease in trade

and other

receivables (639,866) 212,451 (37,190)

(Decrease)/increase in trade

and other

payables 124,494 (141,707) (42,630)

Share Option expense 30,144 42,762 127,248

Depreciation - - 393

Amortisation of patents 144,636 120,078 247,502

Net foreign exchange differences 6,511 - 9,484

------------ ------------ ------------

Net cash outflow from operations (832,952) (415,575) (928,061)

Interest received 63 52 98

Tax received 194,663 - -

------------ ------------ ------------

Net cash outflow from operating

activities (638,226) (415,523) (927,963)

Cash flows from investing

activities

Purchase of intangible assets (134,376) (215,693) (350,345)

------------ ------------ ------------

Net cash (outflow)/inflow

from investing activities (134,376) (215,693) (350,345)

------------ ------------ ------------

Cash flows from financing

activities

Share issues - 898,004 940,629

Disposal of Investments 900,936 746,751 746,751

------------ ------------ ------------

Net cash inflow from financing

activities 900,936 1,644,755 1,687,380

------------ ------------ ------------

Increase/(decrease) in cash

and equivalents 128,334 1,013,539 409,072

Cash and cash equivalents

at beginning of year 864,680 455,608 455,608

------------ ------------ ------------

Cash and cash equivalents

at end of year 993,014 1,469,147 864,680

Notes to the Half Yearly Report

For the six months to 30 June 2021

1. General Information

Optibiotix Health Plc is a com pany incorp orated and d omiciled

in England and Wales. The com pan y 's offices are in York. The com

pany is listed on the AIM market of the Lo nd on Stock Exchange

(ticker: OPTI).

The financial information set out in this Half Yearly report

does not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. The group's statutory financial statements

for the period ended 31 December 2020, prepared under International

Financial Reporting Standards ("IFRS"), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain statements under

Sections 498(2) and 498 (3) of the Companies Act 2006.

Copies of the annual statutory accounts and the Half Yearly

report can be found on the Company's website at

http://www.optibiotix.com/ .

2. Basis of preparation and significant accounting policies

This Half Yearly report has been prepared using the historical

cost convention, on a going concern basis and in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union.

The interim financial statements have been prepared in

accordance with the accounting policies set out in the Annual

Report and Accounts for the year ended 31 December 2020.

3. Segmental Reporting

In the opinion of the directors, the Group has one class of

business, in three geographical areas being that of identifying and

developing microbial strains, compounds and formulations for use in

the nutraceutical industry. The Group sells into three highly

interconnected markets, all costs assets and liabilities are

derived from the UK location.

Revenue analysed by market

Period ended Period ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Probiotics 536,225 403,317 821,126

Functional Fibres 539,819 341,504 702,121

------------ ------------ ------------

1,076,044 744,821 1,523,247

Revenue analysed by geographical market

Period ended Period ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

UK 309,493 271,013 369,892

US 408,366 117,220 654,524

International 358,185 356,588 498,831

------------ ------------ ------------

1,076,044 744,821 1,523,247

During the reporting period one customer represented GBP408,366

(37.9%) of Group revenues. (June 2020: one customer generated

GBP108,560 representing 14.5% of Group revenues)

4. Earnings per Share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

6 Months

to Year to

30 June 6 Months to 31 December

2021 30 June 2020 2020

Unaudited Unaudited Audited

Basic

Earnings attributable

to ordinary shareholders 14,269,032 (605,663) 5,801,867

Weighted average number

of shares 87,940,601 86,379,784 87,207,703

Earnings (Loss) per-share

- pence 16.23p (0.70)p 6.65p

Diluted

Earnings attributable

to ordinary shareholders 14,269,032 (605,663) 5,801,867

Weighted average number

of shares 95,902,844 86,379,784 95,569,946

Earnings/(Loss) per-share

- pence 14.88p (0.70)p 6.07p

As at 30 June 2021 there were 7,632,907 outstanding share

options and 329,336 outstanding share warrants.

5. Investments

Available for sale investments

Carrying value GBP

At 31 December 2019 2,842,834

Revaluations 7,120,962

Share of loss (303,448)

Disposal of shares during the period (697,784)

------------

Carrying amount

At 31 December 2020 8,962,564

Revaluations 14,165,501

Disposal of shares during the period (180,073)

------------

Carrying amount

At 30 June 2021 22,947,992

6. Share Capital

Issued share capital comprises:

6 months 6 months Year to

to 30 June to 30 June 31

2021 2020 December

Unaudited Unaudited 2020

Audited

GBP GBP GBP

Ordinary shares of 2p

each

87,940,601 1,758,812 1,758,812 1,758,812

-------------- -------------- --------------

1,758,812 1,758,812 1,758,812

7. Post balance sheet events

No post balance sheet events.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEWFIUEFSESU

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

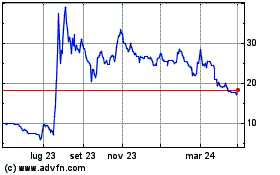

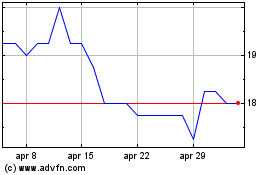

Grafico Azioni Optibiotix Health (LSE:OPTI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Optibiotix Health (LSE:OPTI)

Storico

Da Apr 2023 a Apr 2024