RM Infrastructure Income PLC Net Asset Value(s) (7643Z)

16 Gennaio 2024 - 8:00AM

UK Regulatory

TIDMRMII TIDMTTM

RNS Number : 7643Z

RM Infrastructure Income PLC

16 January 2024

RM Infrastructure Income Plc

("RMII" or the "Company")

LEI: 213800RBRIYICC2QC958

Net Asset Value

On 20 December 2023, at General Meeting shareholders approved

the implementation of the Managed Wind-down of the Company as

further described in the Circular published on 30 November 2023.

Accordingly, at that time the Company's investment objective

was restated as follows: "The Company aims to conduct an orderly

realisation of the assets of the Company, to be effected in a

manner that seeks to achieve a balance between returning cash

to Shareholders promptly and maximising value."

NAV & Share Price Performance

The Company's NAV % Total Return for the month of December was

1.80%, which brings the NAV % Total Return for the quarter to

1.59%.

The NAV % Total Return over the last twelve months was 4.83%

and inception to date (ITD) 43.85%.

The Ordinary Share NAV as at 31(st) December 2023 was 90.35 pence

per share. This monthly NAV return of 0.003 pence per share arose

primarily from the ex-dividend effect of the 1.625 pence per

Ordinary Share dividend for the period Q3 2023, declared and

paid in December 2023. Otherwise, there was positive interest

income, net of expenses, of 0.556 pence per share and an increase

in portfolio valuations of 1.07 pence per share.

Summary for December 2023 (pence

per share)

Net interest income +0.556p

Change in portfolio

valuations +1.072p

Payment of Dividend

(Q4 2023) -1.625p

Net NAV Movement +0.003p

------------------------- ---------

Since inception, the portfolio's valuation approach has been

based around fair value where the independent third-party valuation

agent looks at observable pricing for similar sectors and values

the assets based upon where comparables are valued. This incorporates

the broader market returns as well as any idiosyncratic risks.

Through review of the latest iteration of the extant IPEV guidelines

and discussions with the Company's valuation agent and a review

of industry practice in light of the change in guidelines, the

Company has now moved to a valuation process that is driven by

a yield-based methodology. This change has given an uplift to

the portfolio valuation over the month.

Market Update

Government bonds saw a big reversal in the final quarter with

5-year yields moving from 4.6% to 3.45% over the quarter and

this was the same picture across the gilt curve. Credit spreads

moved in from 450 to end the year at 310 in ITRX Crossover index.

So overall it was an exceptional quarter for fixed income products.

Total Return (%)

1yr 3yr 5yr

-------------------------- -------

RM Infrastructure Income

NAV 4.83% 18.44% 32.17%

RM Infrastructure Income

Share Price -4.63% 7.66% 7.28%

S&P European Leveraged

Loan Index 5.16% -1.50% -1.40%

iShares Core Corp Bond

UCITS ETF GBP 8.53% -14.85% 3.09%

------- -------- -------

Portfolio Update

The Investment Manager remains confident with regards to the

low interest rate sensitivity of the portfolio. This is largely

driven by its short average duration, which is currently 1.69

years. The weighted average yield of the portfolio has increased

to 10.91% at the end of the reporting period, a widening in yield

of 53bps versus September 2023 or 176bps versus same period last

year.

We outline below the key investment activities for Q4 2023:

New Investments:

Given the outcome of the Board's strategic review and the resulting

Shareholder-approved managed wind down of the Company, there

will be no new investments (save for drawdowns against committed

facilities) unless the Board considers that doing so will maximise

returns to Shareholders in the timeframe in which the Company

will otherwise be dealing with the managed wind down.

Material Repayments:

* Healthcare, Ref #82: GBP5m

* Healthcare, Ref #83: GBP2.8m

* Accommodation, Ref #84: GBP4m

In addition, during the reporting quarter, the Company claimed

against its CBILS guarantee for investment loans Ref #78 and

Ref #89, successfully recovering GBP4.4m in aggregate, in line

with book values. Proceeds of said guarantee payment receipts

have been utilised in repayment of the Company's outstanding

leverage.

The Company is also expecting prepayment at par of investment

loan Ref #71 during the month of January 2024.

As disclosed in December 2023, the Company has Investment loans

(Ref #58, #80, #92 and #79) junior secured against and / or exposed

to the Virgin Clyde Street Hotel in the city-centre of Glasgow,

Scotland. The senior secured lender has initiated an administration

process to recover value with the hotel now being closed. The

Company's total nominal outstanding balance in respect of said

loans is circa GBP15m, with investment loans Ref #80, #92 and

#79 (or circa 83% of nominal outstanding) underwritten via the

Coronavirus Business Interruption Loan Scheme ("CBILS") and /

or the Recovery Loan Scheme ("RLS) which benefit from a partial

contractual government-backed guarantee. CBILS and RLS related

investment loans have all been marked at their guarantee level,

and as a result, RM does not foresee any further write downs

of these loans. We are currently forecasting CBILS and RLS claims

being made towards the end of H2-2024 with funds being received

in December 2024 - this has been factored in the Portfolio's

duration workings. Investment loan Ref #58 benefits from a valuable

additional 3(rd) party security package and has therefore been

valued accordingly by the valuation agent.

Finally, the Company has been pursuing a legal claim against

the former main contractor of investment loan Ref #68, a wholly

owned 79 beds student accommodation located in the city centre

of Coventry-UK, since September 2022 via an adjudication process.

On the 2(nd) of January 2024, RMII was successfully awarded circa

GBP1.2m by the adjudicator (or circa 1 pence per Ordinary Share),

with circa 90% of said sums now having been received in cleared

funds. Following a lengthy legal process, it is very pleasing

to be able to deliver a positive value accretive outcome for

Shareholders.

All leverage facilities were fully repaid during the reporting

quarter with the Company now completely ungeared. Current cash

balance sits at circa GBP9m. The Company will seek to hold circa

GBP6m in unrestricted cash reserves to fund undrawn committed

facilities and other Company-related working capital requirements.

This is expected to start decreasing in Q2-2024 as and when undrawn

committed facilities are utilised.

The Company also announces that the Monthly Report for the period

to 31 December 2023 is now available to be viewed on the Company

website:

https://rm-funds.co.uk/rm-infrastructure-income/rm-funds-investor-monthly-fact-sheets-2/

END

For further information, please contact:

RM Capital Markets Limited - Investment Manager

James Robson

Thomas Le Grix De La Salle

Tel: 0131 603 7060

FundRock Management Company (Guernsey) Limited - AIFM

Chris Hickling

Dave Taylor

Tel: 01481 737600

Apex Listed Companies Services (UK) Ltd - Administrator and

Company Secretary

Jenny Thompson

Tel: 07767102572

Singer Capital Markers Advisory LLP - Financial Adviser and

Broker

James Maxwell

Asha Chotai

Tel: 020 7496 3000

About RM Infrastructure Income

RM Infrastructure Income Plc ("RMII" or the "Company") is a closed-ended

investment trust established to invest in a portfolio of secured

debt instruments.

The Company aims to generate attractive and regular dividends

through loans sourced or originated by the Investment Manager

with a degree of inflation protection through index-linked returns

where appropriate. Loans in which the Company invests are predominantly

secured against assets such as real estate or plant and machinery

and/or income streams such as account receivables.

For more information, please see

https://rm-funds.co.uk/rm-infrastructure-income/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKELFFZFLLBBQ

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

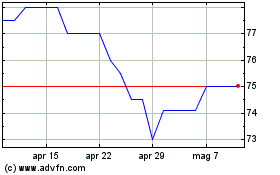

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Nov 2023 a Nov 2024