RM Infrastructure Income PLC Net Asset Value(s)

17 Maggio 2024 - 8:00AM

RNS Regulatory News

RNS Number : 8173O

RM Infrastructure Income PLC

17 May 2024

|

RM Infrastructure Income

Plc

|

|

|

|

("RMII" or the

"Company")

|

|

|

|

LEI:

213800RBRIYICC2QC958

|

|

|

|

Net Asset

Value

|

NAV Performance

The NAV % Total Return for April

2024 was 0.39%, which takes the NAV % Total Return to 0.17% over

the past six months, and 2.63% over the past 12 months.

The NAV as at 30th April

2024 was 88.06 pence per Ordinary Share, which was 0.34 pence

higher than at 31st March 2024. This overall gain

comprised positive interest income of 0.51 pence per Ordinary

Share, net of expenses, and a decrease in portfolio valuations of

0.16 pence per Ordinary Share led by discount rate

movements.

As disclosed in the 2023 Annual

Report the audited year-end NAV of December 2023 was adjusted to

88.88 pence per Ordinary Share from its unaudited NAV of 90.35

pence per Ordinary Share. This adjustment was predominantly an

outcome of an accounting treatment at year end of 1.33 pence per

Ordinary Share accrual to account for forecasted liquidation

expenses. As a result of this year-end adjustment, the respective

NAVs for the months of January 2024, February 2024 and March 2024

have been readjusted accordingly

Portfolio Activity

As at 30th April 2024,

the Company's invested portfolio had an aggregate nominal

outstanding of circa £100.6 million across 30 investments. The

average yield was 11.61%, with a weighted average loan life

remaining of circa 1.23 years10. Overall, the portfolio

is 95% invested in private market assets and 5% in public

bonds.

Including post period end

transactions, investment loan ref 98 prepaid c.£0.4m, or c.55% of

its outstanding balance. This is a positive outcome for

Shareholders as this is RMII's longest-dated investment loan which

therefore reduces the tail-end of the portfolio.

During the reporting period, the

Company agreed a 3-month extension to the maturity dates of

investment loans Ref 66 & 67 to enable the borrower to

negotiate with the lending group about an exit strategy.

Current cash balance stands at circa

£10m of which circa £6m will be retained by the Company largely to

fund committed facilities which have yet to be drawn.

The Board is currently forecasting

the 1st return of capital to occur during

H2-2024.

|

|

|

|

The Company also announces that the

Monthly Report for the period to 30th April 2024 is now

available to be viewed on the Company website:

|

|

https://rm-funds.co.uk/rm-infrastructure-income/rm-funds-investor-monthly-fact-sheets-2/

|

|

|

|

END

|

|

|

|

For further information, please

contact:

|

|

RM

Capital Markets Limited - Investment

Manager

|

|

James Robson

|

|

Thomas Le Grix De La

Salle

|

|

Tel: 0131 603 7060

|

|

|

|

FundRock Management Company (Guernsey) Limited

- AIFM

|

|

Chris Hickling

|

|

Dave Taylor

|

|

Tel: 01481 737600

|

|

|

|

Apex Listed Companies Services (UK) Ltd

- Administrator and Company Secretary

|

|

Jenny Thompson

|

|

|

|

Tel: 07767102572

|

|

|

|

Singer Capital Markers Advisory LLP - Financial Adviser and Broker

|

|

James Maxwell

|

|

Asha Chotai

|

|

Tel: 020 7496 3000

|

|

|

|

|

|

About RM Infrastructure Income

|

|

|

|

RM Infrastructure Income Plc ("RMII"

or the "Company") is a closed-ended investment trust established to

invest in a portfolio of secured debt instruments.

|

|

|

|

The Company aims to generate

attractive and regular dividends through loans sourced or

originated by the Investment Manager with a degree of inflation

protection through index-linked returns where appropriate. Loans in

which the Company invests are predominantly secured against assets

such as real estate or plant and machinery and/or income streams

such as account receivables.

|

|

|

|

For more information, please

see

|

|

https://rm-funds.co.uk/rm-infrastructure-income/

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVBQLLFZELBBBL

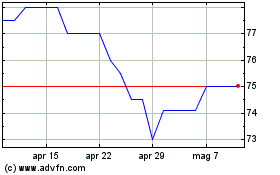

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Gen 2024 a Gen 2025