TIDMSUH

RNS Number : 6768W

Sutton Harbour Group PLC

14 December 2023

14 December 2023

Sutton Harbour Group plc

("Sutton Harbour" or the "Company")

Sutton Harbour Group plc, the AIM-quoted marine and waterfront

regeneration specialist, announces its unaudited interim results

for the six-month period to 30 September 2023.

Financial Highlights

-- Gross profit GBP1.620m (6 months to 30 September 2022: gross profit GBP1.415m)

-- Loss before taxation GBP0.119m (6 months to 30 September 2022: profit before tax GBP0.223m)

-- Gross assets GBP98.859m (31 March 2023: GBP96.049m)

-- Net assets GBP58.850m (31 March 2023: GBP56.067m)

-- Net asset value per share 41.2p (31 March 2023: 43.1p)

-- Net debt GBP30.468m (31 March 2023: GBP29.259m)

-- Gearing 51.8% (31 March 2023: 52.2%)

Company Highlights

-- Completion of Harbour Arch Quay and sale of all 14 apartments

completed by early November 2023

-- Full occupancy of the newly refurbished Old Barbican Market

-- Marinas' occupancies at near capacity

-- North Quay House redevelopment programmed for 2024 delivery

-- Debt reduction strategy plan to reduce interest burden to commence in 2024

Philip Beinhaker, Executive Chairman, commented:

"In the period under review and into recent months, the Company

has delivered the construction work and full occupation of two

major projects in Sutton Harbour, both which have already added to

the quality of the local built environment and are the first

significant developments in more than a decade around Sutton

Harbour. The Company is committed to continuing with its

development programme to ensure the future quality and

sustainability of the area and delivery of medium to long term

value for investors."

For further information, please contact:

Sutton Harbour Group plc +44 (0) 1752 20 4186 Philip Beinhaker, Executive Chairman

Corey Beinhaker, Chief Operating Officer

Natasha Gadsdon, Finance Director

Strand Hanson Limited +44 (0) 20 7409 3494 James Dance

(Nominated & Financial Adviser and Broker) Richard Johnson

Executive Chairman's Statement

For the six-month period to 30 September 2023

Results and Financial position

Trading during the first six months of the financial year was

robust with gross profit up 14.4% to GBP1.620m from GBP1.415m for

the comparable period to 30 September 2022 ("H1 2022"). This

reflects continued occupancy of the marinas at near-capacity rates

and strength of the car parks and property rental activities.

Bottom line results have been materially affected by progressive

interest rate rises giving rise to the net loss for the period. The

loss before taxation for the six-month period to 30 September 2023

was GBP0.119m compared to GBP0.223m profit before taxation for H1

2022.

As at 30 September 2023, net assets were GBP58.850m (equal to

41.2 pence per share), up from GBP56.067m (equal to 43.1 pence per

share) as at 31 March 2023. The increase in net assets of GBP2.783m

is largely attributable to the issue of 12,994,407 new ordinary

shares at 22.5 pence each by way of a subscription by the Company's

major shareholder, raising gross proceeds of GBP2.9m, in May

2023.

Net Debt has increased to GBP30.468m, being GBP1.209m more than

the net debt position as at 31 March 2023 of GBP29.259m. Notable

components of this change were the GBP2.9m share subscription cash

inflow offset by GBP1.6m bank loan repayments and investments into

the active development projects. Gearing, measured as net debt as a

percentage of net assets, was broadly unchanged at 51.8% as at 30

September 2023 (31 March 2023: 52.2%).

Trading and Operations Report

During the six-month reporting period, the marinas have been

occupied at levels very close to full capacity. The Company held

prices for berthing at Sutton Harbour at the previous season's

rates as consideration to berth-holders for the disruption of the

Environment Agency's planned lock gate cill replacement works which

started after this interim reporting period. Berthing rates charged

at King Point Marina were increased by inflation and this marina's

results also reflect the new five-year lease with Princess Yachts

on improved terms. Fishing results show a slight improvement to the

comparative period with an increase in the amount of fuel sold.

Overall, contribution from the Marine trading segment was GBP0.895m

in the six-month period to 30 September 2023 (H1 2022:

GBP0.681m).

The Environment Agency is funding the costs of the lock works.

The intermittent disruption caused by these works started in early

October 2023 and will run until mid December 2023. A second 10 week

long tranche of these works will take place in early 2024. The

direct financial impact of the lock works will be accounted in the

results for the second half year and will incorporate the costs of

providing alternative landing and temporary berthing

facilities.

Starting in November 2023, selling of marina berths for the

2024/25 season has begun. Rates for King Point Marina have been

increased by inflation, whereas rates at Sutton Harbour Marina have

been increased by only a modest amount, adjusted to recognise the

ongoing lock works disruption. Rates will increase to market norms

from 2025/26. To date, sales are very encouraging showing strong

levels of berth bookings at this stage in the selling season.

During the first half of this financial year, overall results

from the Real Estate segment were slightly up on the comparative

period at GBP0.505m gross profit (2022: GBP0.480m gross profit).

These results take account of the new lettings in the newly

refurbished Old Barbican Market, countering the loss of rents from

North Quay House, the largely decanted office building now proposed

for redevelopment to a new waterfront residential development.

Occupancy of the Company's retail and industrial business space

continues to be resilient.

The Company has now secured its power requirements by way of a

capped buying strategy to avoid future power cost shocks as was

acutely experienced in the second half of the previous financial

year. Power costs have now reduced from the winter 2022/23 peak,

but are still considerably higher than pre October 2022.

Development / Regeneration

Harbour Arch Quay

The building was completed in October 2023 with sales

completions of all 14 apartments taking place by early November

2023. The development loan of GBP4.5m was repaid and the Company

has now also repaid GBP3.2m against the NatWest term loan. The

ground floor offices will be made ready for the Company to occupy

in 2024 and letting of the existing offices will then follow.

The Company is pleased to have recommenced active property

development after more than a decade's hiatus and the sales of all

units during construction demonstrates demand for high quality

property in the environment of Sutton Harbour.

Whilst the property sales achieved some of the highest prices

recorded for apartments in Plymouth, the Company expects a

construction project result just below breakeven once all costs are

finally accounted. The full accounting result will show a loss in

the second half year after taking into account all other costs

including historical site holding costs, costs of re-design and

time of Company personnel spent on the project. The Company had

projected a profitable result but encountered delays and additional

costs due to the complex ground conditions, resolution of party

wall agreements, change in fire safety regulations necessitating

some supplementary works and additional costs arising from supply

chain shortages, materials inflation and labour rate increases.

Nonetheless, the Company has now identified a team of experienced,

reliable professionals and tradespeople most suited to delivering

high quality waterfront property in this area and now has current

experience to benefit improved cost management for the delivery

programme of future projects.

Old Barbican Market

After completing the full refurbishment of this listed property

early in 2023, all three units are now occupied with national

covenant tenants whose draw to the Barbican has benefited footfall

to the area, thereby supporting other tenants and businesses, and

creating greater appeal to the wider public, both local people and

visitors. This development has demonstrated that targeted

investment can deliver the opportunity for value growth and future

sustainability of the area.

North Quay House

The next development proposed by the Company is the delivery of

a high quality 10 apartment building at North Quay House. North

Quay House is an, office building overlooking the harbour, now

largely decanted. The proposed development will incorporate retail

space and parking. Subject to planning consent and financing, this

development is programmed for delivery in 2024 and following on

from the success of Harbour Arch Quay, already has interest from

prospective apartment purchasers.

Sugar Quay

Since gaining planning consent for a single building at Sugar

Quay, the Company is working on adapting the design to enable

development in phases. This approach is more appropriate in the

current market and will allow staged financing and development at a

pace to suit absorption of the finished apartments. Additionally,

there are a number of design improvements that will be incorporated

into this proposal including provision of harbour views to

significantly more units and an improved off street unloading and

reception access. The Company expects to submit this updated

application to the Local Planning Authority later in 2024.

Former Airport Site

The planning freeze of the former airport site to protect it

against alternative use expires in March 2024. It is expected that

the Company will submit a masterplan to the Local Planning

Authority in the near future.

Financial Structure

With interest rates now expected to persist at or around current

levels (5.25% current Bank of England rate) for the immediately

foreseeable future, the Company recognises that its gearing level

is high. The Board is focused on reducing its debt level

significantly within the next year to manage debt servicing costs

down to a more comfortable level. At present the Company has

banking facilities of GBP21.7m (after having a repaid a further

GBP1.6m subsequent to this reporting period in addition to a

GBP1.6m repayment during the first half year period) secured by a

property asset portfolio valued at 31 March 2023 of GBP58.9m. The

former airport site is not included in this security figure.

The Company has therefore begun exploring options to realise the

value of some of its asset portfolio within the next year to reduce

bank debt and to provide some working capital for essential

investment into operational assets and for pre-construction project

costs. The Company has identified assets for disposal which are

more easily separable from the Group and have reached their

valuation potential from the Group's perspective. This is in line

with the Group's stated Business Plan in the last published Annual

Report. Divestment of between c.8-12% of the total asset base is

under consideration. The Company will update on divestments as and

when agreements for disposals are entered into. In due course,

acquisition and retention of strategic assets, whether bought or

developed, is expected to increase.

The Company is actively working with its current bank, NatWest,

other banks and specialist development funders to support the debt

reduction plan and future funding needs. The current banking

facility expires in December 2024. The related party loans with

Beinhaker Design Services Ltd and Rotolok (Holdings) Limited expire

in May 2024 and whilst part of the liability is expected to be

repaid at maturity, the Company is exploring options to extend

and/or convert to equity a portion of the liability.

Summary

In the period under review and into recent months, the Company

has delivered the construction work and full occupation of two

major projects in Sutton Harbour, both of which have already added

to the quality of the local built environment and are the first

significant developments in more than a decade around Sutton

Harbour. Economic conditions, changing regulations and supply side

factors have presented challenges to the development process and

there have been points that have been learned in the delivery of

both these projects which will enhance management of future

projects. With the benefit of this current experience, the Company

is committed to continuing with its development programme to ensure

the future quality and sustainability of the area and delivery of

medium to long term value for investors.

Philip Beinhaker

EXECUTIVE CHAIRMAN

Consolidated Statement of Comprehensive Income

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Revenue 4,446 4,420 8,161

Cost of Sales (2,826) (3,005) (5,915)

Gross Profit 1,620 1,415 2,246

--------------- -------------- -----------

Fair value adjustment on fixed assets

and investment property - - (1,925)

Administrative expenses (817) (729) (1,193)

Operating profit/(loss) from continuing

operations 803 686 (872)

Financial income 6 - 1

Financial expense (928) (463) (1,150)

Net financing costs (922) (463) (1,149)

(Loss)/Profit before tax from continuing

operations (119) 223 (2,021)

Taxation credit on profit from continuing

operations - (15)

(Loss)/Profit from continuing operations (119) 223 (2,036)

=============== ============== ===========

Basic loss/earnings per share (0.08p) 0.17p (1.57p)

Diluted loss/earnings per share (0.08p) 0.17p (1.57p)

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Profit from continuing operations (119) 223 (2,036)

Other comprehensive income/(expenses)

Continuing operations:

Revaluation of property, plant and

equipment - - 2,435

Deferred taxation on income and expenses

recognised directly in the consolidated

statement of comprehensive income

Effective portion of changes in fair

value of cash flow hedges - - (543)

Total other comprehensive income - - 1,892

--------------- -------------- -----------

Total comprehensive income for the

period attributable to equity shareholders (119) 223 (144)

=============== ============== ===========

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Non-current assets

Property, plant and equipment 38,432 36,224 38,540

Investment property 17,333 18,857 17,205

Inventories 13,420 13,249 13,363

--------------- -------------- -----------

69,185 68,330 69,108

--------------- -------------- -----------

Current assets

Inventories 27,005 20,779 23,749

Trade and other receivables 2,139 1,515 2,092

Cash and cash equivalents 530 991 1,095

Tax recoverable - - 5

--------------- -------------- -----------

29,674 23,285 26,941

--------------- -------------- -----------

Total assets 98,859 91,615 96,049

--------------- -------------- -----------

Current liabilities

Bank Loans 1,600 - 3,200

Other Loans 7,676 3,355 5,477

Trade and other payables 3,583 2,361 3,301

Finance lease liabilities 22 40 66

Deferred income 1,232 1,219 2,132

14,113 6,975 14,176

--------------- -------------- -----------

Non-current liabilities

Other interest-bearing loans and

borrowings 21,700 24,450 21,600

Finance lease liabilities - 118 10

Deferred government grants 646 646 646

Deferred tax liabilities 3,550 2,992 3,550

25,896 28,206 25,806

--------------- -------------- -----------

Total liabilities 40,009 35,181 39,982

--------------- -------------- -----------

Net assets 58,850 56,434 56,067

=============== ============== ===========

Issued capital and reserves attributable

to owners of the parent

Share capital 16,536 16,406 16,406

Share premium 16,744 13,972 13,972

Other reserves 24,072 22,180 24,072

Retained earnings 1,498 3,876 1,617

--------------- -------------- -----------

Total equity 58,850 56,434 56,067

=============== ============== ===========

Consolidated Statement of Changes in Equity

Share Share Revaluation Merger Hedging Retained TOTAL

capital premium reserve reserve reserve earnings

----------Other Reserves----------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 April 2023 16,406 13,972 20,201 3,871 - 1,617 56,067

Comprehensive

income/(expense)

Issue of Shares 130 2,772 - - - - 2,902

Loss for the period (119) (119)

Total comprehensive

income/(expense)

6 month period ended

30 September 2023 130 2,772 - - - (119) 2,783

-------- -------- ------------ -------- -------- --------- --------

Balance at 30 September

2023 16,536 16,744 20,201 3,871 - 1,498 58,850

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 April 2022 16,406 13,972 18,309 3,871 - 3,653 56,211

Comprehensive

income/(expense)

Issue of Shares - - - - - 223 223

Profit for the period

Total comprehensive

income/(expense)

6 month period ended

30 September 2022 - - - - - 223 223

-------- -------- ------------ -------- -------- --------- --------

Balance at 30 September

2022 16,406 13,972 18,309 3,871 - 3,876 56,434

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 October

2022 16,406 13,972 18,309 3,871 - 3,876 56,434

Comprehensive

income/(expense)

Profit for the period - - - - - (2,259) (2,259)

Other comprehensive

income/(expense)

Revaluation of

property,

plant and equipment - - 2,435 - - - 2,435

Deferred tax on

revaluation - - (543) - - - (543)

Total comprehensive

income/(expense)

6 month period ended

31 March 2023 - - 1,892 - - (2,259) (367)

-------- -------- ------------ -------- -------- --------- --------

Balance at 31 March

2023 16,406 13,972 20,201 3,871 - 1,617 56,067

-------- -------- ------------ -------- -------- --------- --------

Consolidated Cash Flow Statement

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

---- --------------- -------------- -----------

Cash generated from total operating

activities (2,989) (1,321) (2,658)

--------------- -------------- -----------

Cash flows from investing activities

Net expenditure on investment

property (128) (662) (935)

Expenditure on property, plant

and equipment (73) (24) (97)

Net cash used in investing

activities (201) (686) (1,032)

--------------- -------------- -----------

Cash flows from financing activities

Proceeds from sale of shares 2,924 - -

Expenses of share issuance (22) - -

Interest paid (922) (557) (1,009)

Loan drawdowns/(repayment of

borrowings) 699 2,667 7,263

Net finance lease (payments)/receipts (54) (82) (2,439)

Net cash generated from financing

activities 2,625 2,028 3,815

--------------- -------------- -----------

Net increase/(decrease) in cash

and cash equivalents (565) 21 125

Cash and cash equivalents at

beginning of period 1,095 970 970

Cash and cash equivalents at

end of period 530 991 1,095

=============== ============== ===========

Notes to Interim Report

General information

This consolidated interim financial information does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2023 were approved by the Board of Directors on 31 July 2023

and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified and did not contain any

statement under section 498 of the Companies Act 2006.

Copies of the Group's financial statements are available from

the Company's registered office, Sutton Harbour Office, Guy's Quay,

Sutton Harbour, Plymouth, PL4 0ES and on the Company's website

www.sutton-harbour.co.uk.

This consolidated interim financial information has not been

audited.

Basis of preparation

The consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

31 March 2023, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) and

International Financial Reporting Interpretation Committee (IFRIC)

interpretations as endorsed by the European Union, and those parts

of the Companies Acts 2006 as applicable to companies reporting

under IFRS.

Accounting policies

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

year ended 31 March 2023, as described in those annual financial

statements.

Accounting estimates and judgements

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements that are not readily apparent from other sources. Actual

results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods, if the revision affects both current and future

periods.

Segment information

Management has determined the operating segments based on the

reports reviewed by the Board of Directors that are used to make

strategic decisions.

The Board of Directors considers the business from an

operational perspective as having only one geographical segment,

with all operations being carried out in the United Kingdom.

The Board of Directors considers the performance of the

operating segments using operating profit. The segment information

provided to the Board of Directors for the reportable segments for

the period ended 30 September 2023 is as follows:

6 months to 30 Real

September 2023 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- -------

Revenue 3,221 714 511 - 4,446

Gross profit prior

to non-recurring

items 895 505 305 (85) 1,620

1,620

Unallocated:

Administrative

expenses (817)

Operating profit

from continuing

operations 803

Financial income 6

Financial expense (928)

-------

Loss before tax

from continuing

operations (119)

Taxation -

-------

Loss for the year

from continuing

operations (119)

=======

Depreciation

charge

Marine 161

Car Parking 7

Administration 13

-------

181

=======

Segment Information (continued)

6 months to

30 September Real

2022 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- -------

Revenue 3,358 644 418 - 4,420

Gross profit

prior to non-recurring

items 681 480 254 - 1,415

1,415

Unallocated:

Administrative

expenses (729)

Operating profit

from continuing

operations 686

Financial income -

Financial expense (463)

-------

Profit before

tax from continuing

operations 223

Taxation -

-------

Profit for the

year from continuing

operations 223

=======

Depreciation

charge

Marine 172

Car Parking 10

Administration 16

-------

198

=======

Segment Information (continued)

Year ended Real

31 March 2023 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- ----------

Revenue 6,016 1,374 771 - 8,161

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 974 965 449 (142) 2,246

Fair value adjustment

on fixed assets

and investment

property assets - (1,925) - - (1,925)

Unallocated:

Administrative

expenses (1,193)

Operating profit

from continuing

operations (872)

Financial income 1

Financial expense (1,150)

----------

Loss before

tax from continuing

operations (2,021)

Taxation (15)

----------

Loss for the

year from continuing

operations (2,036)

==========

Depreciation

charge

Marine 355

Car Parking 19

Administration 16

----------

390

==========

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

Segment assets:

Marine 32,663 30,747 32,956

Real estate 17,864 19,243 17,656

Car Parking 6,829 6,382 6,843

Regeneration 40,646 33,998 37,272

Total segment assets 98,002 90,370 94,727

Unallocated assets:

Property, plant and equipment 53 44 41

Trade & other receivables 274 210 185

Cash & cash equivalents 530 991 1,096

Total assets 98,859 91,615 96,049

============= ============= =========

Segment Information (continued)

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

Segment liabilities:

Marine 1,696 1,710 2,702

Real estate 425 724 415

Car Parking 110 92 100

Regeneration 2,847 1,284 2,298

------------- ------------- ---------

Total segment liabilities 5,078 3,810 5,515

Unallocated liabilities:

Bank overdraft & borrowings 30,998 27,963 30,354

Trade & other payables 382 415 562

Tax payable 1 1 1

Deferred tax liabilities 3,550 2,992 3,550

------------- ------------- ---------

Total liabilities 40,009 35,181 39,982

============= ============= =========

Unallocated assets included in total assets and unallocated

liabilities included in total liabilities are not split between

segments as these items are centrally managed.

Taxation

The Company has applied an effective tax rate of 25% (2022: 19%)

based on management's best estimate of the tax rate expected for

the full financial year and is reflected in a movement in deferred

tax.

Dividends

The Board of Directors do not propose an interim dividend (2022:

nil).

Earnings per share

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

pence pence pence

--------------- -------------- -----------

Continuing operations

Basic (loss)/earnings per share (0.08p) 0.17p (1.57p)

Diluted (loss)/earnings per

share* (0.08p) 0.17p (1.57p)

Basic Earnings per Share:

Basic earnings per share have been calculated using the loss for

the period of GBP119,000 (2022: profit GBP223,000; year ended 31

March 2023: loss GBP2,036,000). The average number of ordinary

shares in issue, excluding those options granted under the SAYE

scheme, of 140,506,216 (2022: 129,944,071; year ended 31 March

2023: 129,944,071) has been used in our calculation.

Diluted Earnings per Share:

Diluted earnings per share uses a weighted average number of

140,774,968 (2022: 130,182,220; year ended 31 March 2023) ordinary

shares after adjusting for the effects of share options in issue:

257,972 ordinary shares (2022: 237,972; year ended 31 March 2023).

If the inclusion of potentially issuable shares would decrease loss

per share, the potentially issuable shares are excluded from the

weighted average number of shares outstanding used to calculate

diluted earnings per share.

Property valuation

Freehold land and buildings and investment property have been

independently valued by Jones Lang LaSalle as at 31 March 2023, in

accordance with the Practice Statements in the Valuations Standards

(The Red Book) published by the Royal Institution of Chartered

Surveyors.

A further valuation will be commissioned for the year ending 31

March 2024, as in previous years.

Cash and cash equivalents

As at As at As at

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- ------------- ----------

Cash and cash equivalents per

balance sheet and cash flow

statement 530 991 1,095

============== ============= ==========

Cash flow statements

6 months to 6 months to Year Ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Cash flows from operating

activities

Profit/(loss) for the period (119) 223 (2,036)

Adjustments for:

Taxation - - 15

Financial income (6) - (1)

Financial expense 928 463 1,150

Fair value adjustment on fixed

assets and investment property - - 1,925

Depreciation 181 198 390

Cash generated from operations

before changes in working

capital and provisions 984 884 1,443

Increase in inventories (3,313) (1,862) (5,162)

(Increase)/decrease in trade

and other receivables (42) 304 (282)

Increase in trade and other

payables 282 359 1,421

(Decrease) in deferred income (900) (1,006) (93)

Decrease in provisions - - 15

Cash generated from operations (2,989) (1,321) (2,658)

=============== ============== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFEFEDEDSEDE

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

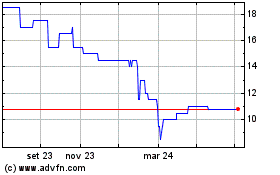

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Mar 2024 a Apr 2024

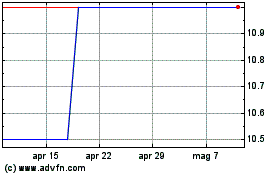

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Apr 2023 a Apr 2024