TIDMSYNT

RNS Number : 6466L

Synthomer PLC

07 September 2023

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY

JURISDICTION WHERE IT IS UNLAWFUL

TO DISTRIBUTE THIS ANNOUNCEMENT. THIS ANNOUNCEMENT IS FOR

INFORMATION PURPOSES ONLY AND IS NOT AN OFFER TO PURCHASE OR A

SOLICITATION OF AN OFFER TO SELL ANY SECURITIES.

Synthomer plc

Interim results for the six months ended 30 June 2023

Resilient performance given subdued demand environment

Constant

Six months ended 30 June H1 2023 H1 2022 Change currency(1)

----------------------------------------- ------- ------- -------- ------------

GBPm GBPm % %

Continuing operations(*)

Revenue 1,075.3 1,228.3 (12.5) (14.7)

------- ------- -------- ------------

Coatings & Construction Solutions

(CCS) 55.1 80.3 (31.4) (33.4)

Adhesive Solutions (AS)** 15.6 34.5 (54.8) (55.7)

Health & Protection and Performance

Materials (HPPM) 11.3 59.2 (80.9) (78.4)

Corporate (10.0) (11.2) (10.7) (11.6)

------- ------- -------- ------------

EBITDA(2) 72.0 162.8 (55.8) (56.0)

EBITDA % of revenue 6.7% 13.3%

Underlying(3) operating profit

(EBIT) 23.4 125.3 (81.3) (80.6)

------- ------- -------- ------------

Statutory operating (loss)/profit

(EBIT) (8.8) 113.8

------- -------

Results from continuing and discontinued

operations*

Underlying(3) (loss)/profit before

tax (6.7) 114.7

------- -------

Statutory profit before tax 16. 7 115.5

------- -------

Underlying(3) EPS (p) (1.1) 19.0

------- -------

Basic EPS (p) (2. 6 ) 18.3

------- -------

Free Cash Flow(4) 18.8 (62.0)

------- -------

Net debt(5) 795.8 992.8

----------------------------------------- ------- ------- -------- ------------

* The Laminates, Films and Coated Fabrics business sold on 28

February 2023, which contributed revenue of GBP28.0m and EBITDA of

GBP2.5m in H1 2023 (FY 2022: GBP201.2m and GBP15.9m respectively),

is classed as a discontinued operation throughout this

announcement.

** H1 2022 included a three month contribution from the adhesive

resins acquisition which completed in April 2022.

Speciality businesses drive a resilient trading performance,

given the subdued macro demand environment

- Robust pricing and strong focus on margins mitigate impact of

substantially lower volumes vs H1 2022, driven by destocking,

subdued end-market demand and increased competition in some base

chemical products

- Volume improvement relative to Q4 2022 in all divisions, led

by Coatings & Construction Solutions

- Q2 2023 continuing EBITDA stronger than Q1 2023

Further decisive actions to preserve cash and manage debt,

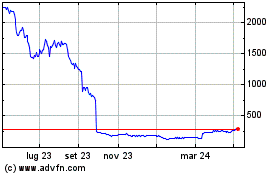

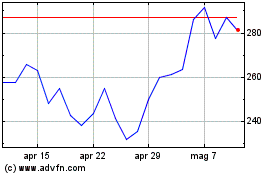

foundations to be strengthened with proposed GBP276m rights issue

announced separately today and revolving credit facility extension

to July 2027

- $268.5m of cash proceeds from divestment of Laminates, Films and Coated Fabrics businesses

- GBP150-200m cash management programme underway across the Group

- Operational reliability improvement programme in Adhesive

Solutions ongoing, with further savings identified in addition to

acquisition synergies; together with other cost savings, Group on

track for c.GBP20m in self-help initiatives in H2 2023

- Net debt GBP795.8m (FY 2022: GBP1,024.9m) as at 30 June 2023,

with net debt:EBITDA on a leverage covenant basis of 5.5 times and

committed liquidity of more than GBP400m

- Proposed GBP276m fully underwritten rights issue announced

separately to support reduction in leverage and allow greater focus

on delivering speciality solutions strategy

- $400m revolving credit facility (RCF) extension to July 2027

inter-conditional with rights issue

Progress on strategic evolution to become a more focused,

resilient, higher quality speciality chemicals business

- All divisions making good progress against key priorities

- Improved speciality portfolio weighting, better balanced

geographical footprint and more streamlined with 7 sites divested

or to close (half of target) in less than 12 months

Continued progress on innovation and sustainability

objectives

- Near-term greenhouse gas (GHG) emissions reduction targets

approved by the Science Based Targets initiative (SBTi)

- Innovation, sustainability prioritisation approach updated and

supply chain management projects underway to assist transition to a

low carbon future

Current trading and outlook

Trading in July and August was similar to H1 2023, with limited

visibility and subdued volumes given challenging macro conditions.

The Group's outlook for the remainder of 2023 provided in July is

reiterated: the Board does not anticipate a material recovery in

customer demand before the end of the current year. However, we

anticipate c.GBP20m in self-help measures to be delivered mainly in

H2. Overall the Group remains confident of making sequential

progress in the second half relative to the first.

The Group continues to take decisive action to strengthen our

business so that it is positioned for profitable growth when demand

does begin to recover. Through our near-term actions, end market

volume recovery (which alone has the potential to improve Group

EBITDA by more than GBP100m over time) and execution of our

strategy, we believe the Group's medium term earnings power is more

than double the GBP158m of continuing EBITDA generated over the

year to the end June 2023. Reducing leverage further towards 1-2x

target range by end of 2024 remains a key priority. Overall we

remain confident in the Group's ability to deliver the medium-term

targets set out last October, which were mid-single-digit growth in

constant currency over the cycle, EBITDA margins above 15% and

mid-teens return on invested capital.

Commenting, Synthomer CEO Michael Willome said:

"Whilst these results reflect the difficult demand environment

across most of our end markets and geographies, we are encouraged

by areas of significant progress. In particular, our Coatings &

Construction Solutions division saw promising EBITDA growth versus

the second half of 2022, and many of our speciality businesses

grew, testament to our strategy to increase our focus and

investment on these parts of the portfolio. All divisions have made

progress against their strategic priorities as we continue to

reposition Synthomer to deliver on its medium term ambitions,

supported by anticipated volume recovery in the coming years.

The proposed rights issue will allow us to reduce our leverage

towards our medium term target and increase our focus on strategic

execution to drive long term value. We are confident that

Synthomer's medium-term earnings power is more than double our

EBITDA performance over the last twelve months, driven by improved

market conditions, operational and commercial excellence and our

ongoing strategic evolution to become a true speciality chemicals

business."

Further information:

Investors: Faisal Tabbah, Vice President Investor Relations Tel: +44 (0) 1279 775 306

Media: Charles Armitstead, Teneo Tel: +44 (0) 7703 330 269

The Company will host a meeting for analysts and investors at

9:00am BST today at the Royal Society of Chemistry, Burlington

House, Piccadilly, London W1J 0BA. The meeting will also be webcast

at www.synthomer.com , please follow links to the financial

calendar on the investor relations page to register.

Notes

(1.) Constant currency revenue and profit measures retranslate

current year results using the prior year's average exchange

rates.

(2.) Operating profit before depreciation, amortisation and Special Items.

(3.) Underlying performance excludes Special Items unless otherwise stated.

(4.) Free Cash Flow is defined as the movement in net debt

before financing activities, foreign exchange and the cash impact

of Special Items, asset disposals and business combinations.

(5.) Cash and cash equivalents together with short and long-term borrowings.

Legal Entity Identifier (LEI): 213800EHT3TI1KPQQJ56.

Classification as per DTR 6 Annex 1R: 1.2.

Synthomer plc is a leading supplier of high-performance,

speciality polymers and ingredients for coatings, construction,

adhesives, and healthcare end markets. Headquartered in London, UK

and listed there since 1971, we employ around 4,400 employees

across nearly 40 locations across Europe, USA and Asia. With more

than 6,000 customers and GBP2.4bn in continuing revenue in 2022,

our three divisions are aligned to our end markets which play an

important role in global megatrends including urbanisation, climate

change, and economic and demographic shifts. In Coatings &

Construction Solutions, our tailored solutions enhance the

sustainability and performance of a range of products such as

architectural and masonry coatings, mortar modification, fibre

bonding, waterproofing and flooring, while our energy solutions

promote drilling stability in the challenging operating

environments of the oil and gas industry. Adhesive Solutions is a

leading supplier of products that bond, modify and compatibilise

surfaces and components for a range of end markets including tapes

and labels, packaging, hygiene, tyres and plastics. In Health &

Protection and Performance Materials we are a world-leading

supplier of water-based polymers for medical gloves and a major

European manufacturer of high-performance binders, foams and other

products for a range of niche applications. Our purpose is creating

innovative and sustainable solutions for the benefit of customers

and society. Around 20% of our sales volumes are from new and

patent protected products. At our innovation hubs in the UK,

Germany, Malaysia and Ohio, USA we collaborate closely with our

customers to develop new products tailored to their needs while

also minimising environmental impact. We are working to embed

sustainability in everything we do; we have reduced our scope 1 and

2 carbon footprint by one third since 2019, and our 2030

decarbonisation targets have been approved by the Science Based

Targets initiative as being in line with what the latest climate

science says is necessary to meet the goals of the Paris Agreement.

Since 2021 we have held the London Stock Exchange Green Economy

Mark, which recognises green technology businesses making a

significant contribution to a more sustainable, low-carbon economy.

Find us at www.synthomer.com , @Synthomer_Group on Twitter or

search for Synthomer on LinkedIn.

CHIEF EXECUTIVE OFFICER'S REVIEW

Resilient trading performance given the macro environment

As disclosed in our July update, Synthomer's performance during

the first half was broadly consistent with our expectations at the

time of the Group's Full Year results in March. Challenging

macroeconomic conditions continued to affect demand across most of

our end-markets and geographies throughout the period, exacerbated

by prolonged customer destocking and increased competition in some

of our base chemical product ranges. Whilst this unprecedented

environment meant Group volumes were substantially lower than the

first half of 2022, they have stabilised overall relative to the

second half of the year, and robust pricing as raw material prices

moderate and our strong focus on margins helped to mitigate the

impact. This was especially evident in Coatings & Construction

Solutions as well as the other speciality, higher growth areas of

our business, which are proving to be the most resilient and

benefiting from our differentiated focus and investment. Continuing

Group revenues were GBP1,075.3m (H1 2022: GBP1,228.3m, H2 2022:

GBP1,155.6m) with Continuing Group EBITDA at GBP72.0m (H1 2022:

GBP162.8m, H2 2022: GBP86.4m) whilst total Group earnings per share

was (1.1p) (H1 2022: 19.0p, H2 2022: 1.6p).

Stronger foundations for sustainable future growth

We have continued to take decisive actions to successfully

manage debt and preserve cash, with reductions in capital

expenditure, working capital and costs across the Group. The

divestment of our Laminates, Films and Coated Fabrics businesses

which forms part of our strategy to increase the speciality

weighting of our portfolio to c.70% of Group revenues in due

course, was completed in February. The transaction realised $268.5m

of cash proceeds after transaction expenses (including $3.2m

received in July 2023 and a further $5m receivable in 2024) which

have been used to reduce leverage. As at 30 June 2023, net debt was

GBP795.8m (December 2022: GBP1,024.9m), with net debt: EBITDA on a

covenant basis of 5.5 times and committed liquidity of more than

GBP400m.

After careful evaluation, we have separately announced today a

fully underwritten rights issue to raise gross proceeds of

approximately GBP276 million. It will support reduction in our

leverage and provide stronger foundations to focus on delivering

our strategy and long term value creation in addition to short term

cash preservation, as well as reducing the downside risks from

near-term macroeconomic uncertainty for all stakeholders. By

providing stronger foundations, the rights issue will ensure that

Synthomer is well-positioned to deliver on its medium term

ambitions in the coming years. The Board believes that the earnings

power of the Group is more than double our last twelve month

EBITDA, which will be driven by a combination of end-market

recovery, operational and commercial execution and strategic

delivery, further supporting our medium term growth, margin and

returns targets. We have also signed an RCF amendment

inter-conditional with the rights issue, which adjusts its amount

to $400m and its maturity to July 2027. The rights issue will

increase covenant headroom and strategic and financial flexibility,

resulting in a pro forma reduction in the covenant net debt based

on EBITDA ratio from 5.5x to 3.8x as at 30 June 2023. Reducing

leverage further towards our 1-2x target range by the end of 2024

remains a key priority. This will be supported by further

divestment proceeds and earnings power more than doubling over the

medium-term through continued cost control, volume recovery and

strategic delivery.

The rights issue (and a related capital reorganisation) is

conditional on, among other things, the passing of a number of

resolutions by shareholders at a general meeting, which is

scheduled to take place at 12:30 p.m. on 25 September 2023. Our

largest shareholder, Kuala Lumpur Kepong Bhd, with 26.9% of the

issued share capital, has irrevocably committed to take up their

full rights and to vote in favour of all of the resolutions at the

meeting.

All divisions making good progress against key priorities

In the period we have continued to make good progress against

the strategy we announced in October 2022. Our ambition is to

become a more focused, more resilient, higher quality speciality

chemicals platform in the medium term, with growth driven by our

strong market positions in speciality areas that are aligned to

long term growth megatrends and where we believe we can win. To

achieve this, the business was reorganised at the start of 2023, to

focus on three attractive end markets: coatings and construction,

adhesives, and health and protection. Encouragingly, all divisions

have continued to make good progress against their key strategic

priorities during the first half.

In Construction & Coatings Solutions, H1 EBITDA was GBP55.1m

(H1 2022: GBP80.3m), significantly ahead of the GBP40.5m we

delivered in H2 2022, with Q2 improving over Q1 including some

seasonal benefit, largely driven by the speciality portfolio with a

progressive improvement in Coatings and Energy Solutions in

particular. Pricing retention was good given the reduction in raw

material costs. Strong cost control helped to offset higher energy

costs and lower capacity utilisation and we have initiatives

underway to further enhance our efficiency and simplify production,

such as the closure of a small Texas production site in the second

half. We are strengthening our organic growth capability by

aligning the division to our end-markets and improving the

geographical balance whilst continuing to invest in innovation and

our customer proposition.

In Adhesive Solutions, H1 EBITDA declined to GBP15.6m (H1 2022:

GBP34.5m, H2 2022: GBP32.7m) because of the weak demand amplified

by destocking as well as reliability issues. We saw more resilient

pricing and volumes from our speciality products in the division

relative to base products, which are experiencing greater

competition. Whilst most raw material costs began to moderate this

was offset by supply chain disruption and low reliability at some

sites, as well as higher energy costs. We have expanded several of

the original acquisition synergy workstreams with a dedicated

'self-help' programme under the new management team targeting

improved operational reliability and cost efficiency. Within these

programmes, we are also continuing to capture revenue synergies

following our acquisition of this business last year as well as

leveraging our range of leading positions in speciality adhesives

in US and Europe. We have also reprioritised capital expenditure to

broaden raw material supply as well as to expand capacity in

certain high growth areas, notably in amorphous polyolefins

(APOs).

In Heath & Protection and Performance Materials, EBITDA was

significantly lower at GBP11.3m (H1 2022: GBP59.2m, H2 2022:

GBP22.7m), largely reflecting the prolonged oversupply situation

that has followed the exceptional period of demand for medical

gloves during the COVID-19 pandemic. Whilst the underlying demand

for medical gloves continues to be robust, with stock levels

remaining high and additional capacity added to the market during

the pandemic we do not expect current low production levels of

Nitrile Butadiene Latex (NBR) to abate before the end of 2023. As a

result, we have announced plans to close our Kluang facility in

Malaysia and transfer its production to other plants. Our

Performance Materials businesses are also experiencing lower

volumes due to the end market environment and have seen some

pressure on pricing as raw material prices started to moderate. We

have increased our focus on cost efficiency and process

optimisation to mitigate this.

Our non-core portfolio rationalisation programme continued to

progress during the period. Two divestment processes are currently

underway, and our project to separate SBR for coatings and

construction from our paper and carpet operations is progressing

well.

Innovation and sustainability underpinnings

In July, Synthomer's near-term greenhouse gas (GHG) emissions

reduction targets were approved by the Science Based Targets

initiative (SBTi). The targets covering GHG emissions from

Synthomer's operations (Scopes 1 and 2) are consistent with levels

required to meet the goals of the Paris Agreement to keep warming

to 1.5degC, according to the SBTi. Synthomer's target for GHG

emissions from its value chain (Scope 3) also meet the SBTi's

criteria for ambitious value chain goals, meaning they are in line

with current best practice. (Synthomer has committed to the

reduction of absolute Scope 1 and 2 GHG emissions by 46.2%, and

absolute scope 3 GHG emissions by 27.5%, by 2030 from a 2019 base

year). In the period we have also reviewed and updated our

innovation, sustainability and prioritisation scoring criteria to

align with our deepening understanding of the sustainability risks

and opportunities across our business, and begun a number of

projects focused on our supply chain to assist our transition to a

low carbon future. I am pleased to report that our new and

protected products metric increased in the period to 21.5% and

remains above our long-term target of at least 20% of sales.

Strengthening our executive team

On 1 May 2023, Stephan Lynen joined Synthomer as President of

our Adhesive Solutions division and a member of the Executive

Leadership. Stephan has more than 25 years of leadership experience

in the chemical industry, principally at Clariant, the global

speciality chemicals company, where he became Chief Financial

Officer in April 2020 having previously led several of its

businesses, including its Additives unit for almost four years.

Outlook

Trading in July and August was similar to H1 2023, with limited

visibility and subdued volumes given challenging macro conditions.

The Group's outlook for the remainder of 2023 provided in July is

reiterated: the Board does not anticipate a material recovery in

customer demand before the end of the current year. However, we

anticipate c.GBP20m in self-help measures to be delivered mainly in

H2. Overall the Group remains confident of making sequential

progress in the second half relative to the first.

The Group continues to take decisive action to strengthen our

business so that it is positioned for profitable growth when demand

does begin to recover. Through our near-term actions, end market

volume recovery (which alone has the potential to improve Group

EBITDA by more than GBP100m over time) and execution of our

strategy, we believe the Group's medium-term earnings power is more

than double the GBP158m of continuing EBITDA generated over the

year to the end June 2023. Reducing leverage further towards 1-2x

target range by end of 2024 remains a key priority. Overall we

remain confident in the Group's ability to deliver the medium-term

targets set out last October, which were mid-single-digit growth in

constant currency over the cycle, EBITDA margins above 15% and

mid-teens return on invested capital.

Michael Willome

Chief Executive Officer

DIVISIONAL REVIEW - CONTINUING OPERATIONS

Coatings & Construction Solutions (CCS)

CCS is achieving robust pricing and margins, with improved

trading performance over the period compared with the second half

of 2022 despite cautious customer buying behaviour, with Q2

improving over Q1 including some seasonal benefit, largely driven

by the speciality portfolio. In line with our strategy, CCS

recently implemented several actions to broaden geographic and

customer penetration which will strengthen organic growth and

increase market share over time, while enhancing margins.

Under our new divisional structure implemented from 1 January

2023, CCS comprises the majority of the former Functional Solutions

division, the Speciality Additives and Powder Coatings businesses

from the Industrial Specialities division as well as the

consumer-focused Foams business from the Performance Elastomers

division.

Constant

Six months ended 30 June H1 2023 H1 2022 Change currency(1)

------------------------------ ------- ------- ------ ------------

GBPm GBPm % %

Revenue 451.6 548.9 (17.7) (20.9)

Volumes (ktes) 280.6 343.5 (18.3)

EBITDA 55.1 80.3 (31.4) (33.4)

EBITDA % of revenue 12.2% 14.6%

Operating profit - underlying 41.5 66.8 (37.9) (39.7)

Operating profit - statutory 27.4 51.7 (47.0)

------------------------------ ------- ------- ------ ------------

(1) Underlying constant currency revenue and profit retranslate

current year results using the prior year's average exchange

rates.

Performance

Divisional revenue decreased by 20.9% in constant currency to

GBP451.6m (H1 2022: GBP548.9m, H2 2022: GBP447.2m), principally

driven by an 18.3% reduction in volume compared with the strong H1

2022 period. This reflects more cautious buying behaviour from our

customers due to relatively subdued end-user demand. This has been

particularly noticeable in our Construction and Consumer Materials

markets in the period, with Coatings more robust and Energy

Solutions continuing to enjoy strong end-user demand growth.

Compared with the second half of 2022, sequential volumes have

improved modestly and margins improved as a result of good pricing

retention given the period-on-period reductions in raw material

input prices. Together with strong cost control, this significantly

mitigated the impact of lower revenues and higher energy costs as

hedges rolled off on the EBITDA performance of GBP55.1m (H1 2022:

GBP80.3m, H2 2022: GBP40.5m) in the period.

Strategy

In line with the new corporate strategy, CCS is focusing on

strengthening organic growth capacity through a number of steps

which increase its alignment with strategic end market

opportunities. For example, the commercial teams have been

reorganised to ensure key account management of top global

customers and a stronger emphasis on marketing to new regional

players. These initiatives will enable penetration into North

American, Middle Eastern and Asian markets, building on our strong

market positions in European markets. In the period we also began a

modest investment to enhance coatings capacity in the Middle

East.

Greater alignment with customers is also driving efforts to

enhance the differentiation and hence the resilience and margin

opportunity of the CCS product portfolio, in particular by

innovating to enhance the sustainability benefits or other pillars

of the value proposition for our customers. For example, in Energy

Solutions we are working towards deploying our leading wellhead

management technologies for carbon capture and storage (CCS)

applications.

We also progressing a number of asset optimisation projects,

improving cost control and capacity management through our

Synthomer excellence programmes. For example, a modification of one

of our speciality additives processes at our site in Ghent

dramatically reduced catalyst use through a modest increase in

cycle time, resulting in substantial raw material and energy

efficiencies as well as carbon emissions savings. Shortly after the

period end, we announced plans to exit a small production site in

Texas.

Adhesive Solutions (AS)

The performance of AS in the period continues to reflect the

lower volume environment as well as the previously disclosed

operational reliability and supply chain challenges in the adhesive

resins business, acquired from Eastman on 1 April 2022. We expect

our reliability and performance improvement measures to have a

positive impact in the second half of the year, despite continued

demand weakness.

Under our new divisional structure, the core of AS comprises the

adhesive resins business acquired in 2022, together with adhesive

dispersions and Lithene businesses which were previously part of

Synthomer's portfolio in Functional Solutions and Industrial

Solutions respectively.

Constant

Six months ended 30 June H1 2023 H1 2022(1) Change currency(2)

------------------------------ ------- ---------- ------ ------------

GBPm GBPm % %

Revenue 310.0 223.8 +38.5 +36.1

Volumes (ktes) 125.6 96.5 +30.2

EBITDA 15.6 34.5 (54.8) (55.7)

EBITDA % of revenue 5.0% 15.4%

Operating profit - underlying 1.4 27.2 (94.9) (94.5)

Operating (loss)/profit -

statutory (12.3) 17.3 n/m

------------------------------ ------- ---------- ------ ------------

(1) H1 2022 included a three month contribution from the adhesive resins acquisition.

(2) Underlying constant currency revenue and profit retranslate

current year results using the prior year's average exchange

rates.

Performance

Divisional revenue was GBP310.0m (H1 2022: GBP223.8m, H2 2022:

GBP349.1m) an increase of 36.1% in constant currency compared with

the prior year period, reflecting the inclusion of the adhesive

resins acquisition for the whole period compared with for one

quarter in the 2022 comparative period. On a like-for-like basis,

volumes were approximately 1.6% lower than in H2 2022, reflecting

some stabilisation of the subdued demand environment amplified by

customer destocking and challenges fulfilling customer orders due

to the previously disclosed reliability issues. Within the

division, speciality products including Lithene, amorphous

polyolefins (APOs) and pure monomer resins (PMR) were more

resilient in both volume and pricing terms, while more base

chemical products particularly for the tapes, labels, packaging and

plastics markets experienced increased global competition in the

period, affecting volume and price.

Divisional EBITDA of GBP15.6m (H1 2022: GBP34.5m, H2 2022:

GBP32.7m) principally reflects higher energy costs, the supply

chain and reliability challenges in the acquired adhesive resins

business, as well as the volume and pricing effects noted above,

partially mitigated by moderating raw material prices.

Strategy

The core priority of the division is improving operational

reliability and cost efficiency of the acquired adhesive resins

operations. A performance improvement project team has been put in

place under the leadership of the new divisional president who

joined in May. The goal is to drive rapid progress in procurement,

supply chain and logistics reliability, as well as to improve cost

efficiency, net working capital and data management. Having

executed most of the synergy actions identified with the

acquisition, the team continues to work on further 'self-help'

actions which are expected to be implemented over the next twelve

months as part of the division's performance improvement

programme.

The division is also implementing the new corporate strategy

alongside the performance improvement programme. Relationship

management, and hence opportunities to capture revenue synergies,

have been reorganised over the combined legacy Synthomer and

adhesive resins customer base. The division has also recently

committed to expand our speciality amorphous polyolefins capacity

in North America to support growth in this region.

Health & Protection and Performance Materials (HPPM)

In HPPM, the challenging medical glove market dynamics which

followed the unprecedented activity during the pandemic continue.

In line with previous indications, we do not expect low nitrile

butadiene rubber (NBR) production levels to abate before the end of

2023. We continue to focus on capacity management and cost

control.

Under our new divisional structure, HPPM consists of the

majority of the former Performance Elastomers and Industrial

Specialities divisions as well as the Acrylate Monomers business.

This included our Laminates & Films and Coated Fabrics

businesses, which were subsequently divested on 28 February

2023.

Six months ended 30 June Constant

(continuing) H1 2023 H1 2022 Change currency(1)

-------------------------- ------- ------- ------ ------------

GBPm GBPm % %

Revenue 313.7 455.6 (31.1) (32.2)

Volumes (ktes) 276.9 385.1 (28.1)

EBITDA 11.3 59.2 (80.9) (78.4)

EBITDA % of revenue 3.6% 13.0%

Operating (loss)/profit -

underlying (5.8) 45.1 n/m n/m

Operating (loss)/profit -

statutory (6.9) 44.2 n/m

-------------------------- ------- ------- ------ ------------

(1) Underlying constant currency revenue and profit retranslate

current year results using the prior year's average exchange

rates.

Performance

Divisional revenue was GBP313.7m (H1 2022: GBP455.6m, H2 2022:

GBP359.3m), principally driven by a 28.1% reduction in volume

compared with the exceptional H1 2022 period.

The exceptional global demand for NBR to manufacture gloves at

the height of the COVID-19 pandemic has given way since mid-2022 to

a substantial period of destocking and oversupply for our Health

& Protection business. In addition, Chinese glove manufacturers

also raised output in 2022, putting additional strain on glove

prices and plant utilisation of glove producers in Malaysia and

elsewhere. Combined these factors resulted in a 31.4% decline in

NBR volumes compared with the prior period. While underlying

end-customer demand for medical gloves remains similar to pre-COVID

levels and we see favourable growth trends in the medium term, the

current overhang between capacity and demand for NBR is not

expected to abate before the end of 2023. Sequentially, volumes

show indications of stabilising, with H1 2023 NBR volumes only 6.0%

lower than H2 2022.

Volumes in our Performance Materials portfolio, including for

paper, carpet, acrylic monomers, antioxidants and compounds were

also down by 26.3% against H1 2023. This was driven in large part

by lower demand exacerbated by destocking, with these businesses

experiencing greater pricing pressure as raw material prices

moderate than the more speciality parts of the Group portfolio.

Again the trend has moderated sequentially with volumes in

Performance Materials recording only a (1.7)% decline against H2

2022.

As a predominantly base chemicals division, the effect of lower

volumes on HPPM earnings was significant, with divisional EBITDA

reducing to GBP11.3m (H1 2022: GBP59.2m, H2 2022: GBP22.7m) in the

period.

Strategy

In Health & Protection, our focus under the new strategy has

been on improving cost efficiency across our value chain and

enhancing our overall value proposition to customers. As part of

this effort we have increased our investment in customer intimacy.

This has assisted us in monitoring demand and market flows at a

challenging point in the cycle, but more importantly in optimising

our alignment with key customers' needs. This supports our goals to

strengthen overall cost competitiveness for the Malaysia supply

chain while also delivering process innovation to lower energy

consumption and carbon footprint for our customers and ourselves.

We have also increased our focus on building relationships with

potential new customers, including in the USA and China. Our NBR

plant utilisation rates have improved modestly compared with the

last quarter of 2022, and we aim to improve this further through

plans announced in August 2023 to decommission our Kluang, Malaysia

facility, which will reduced our NBR capacity by approximately 20%.

We are working closely with customers to smoothly transfer grades

to our other plants.

Over the last year we have also revised our innovation and

capital expenditure plans across the division, in accordance with

our differentiated steering strategic pillar, to focus on our most

differentiated products or opportunities, such as the thinner glove

materials, bio-based acrylate monomers or to support opportunities

in other niches, such as materials with novel properties for 3D

printing.

Our non-core portfolio rationalisation programme continued to

progress during the period. Two divestment processes are currently

underway, and our project to separate SBR for coatings and

construction from our paper and carpet operations is progressing

well.

Safety

The Group delivered a strong safety performance in the period

based on key industry lagging indicators, with both the Recordable

Case Rate (RCR) and Process safety event rate (PSER) ahead of our

targets and prior year levels. However the health and safety of our

employees is a key priority and there is always more to do to

improve our processes and preparedness. An important programme in

the period has been further developing our use of leading

indicators, including near-miss reporting, across the Group. Both

lagging and leading data are used to track and analyse for trends

and are a key feed into our SHE improvement plans.

Our work to align our new sites with our standards over a

three-year cycle continues to make progress. For example, in the

last twelve months all former OMNOVA and Eastman sites have

completed their integration into our database tools for accident

and incident reporting, as well as the electronic management of

change system.

Six months ended 30 June (continuing) H1 2023 H1 2022 Change

--------------------------------------- ------- ------- ----------

RCR per 100,000 hours for employees Absolute

and contractors

CCS 0.20 0.38 (0.18)

AS(1) 0.30 0.00 +0.30

HPPM 0.00 0.10 (0.10)

--------------------------------------- ------- ------- ----------

Continuing Group 0.13 0.22 (0.09)

--------------------------------------- ------- ------- ----------

PSER per 100,000 hours for employees Absolute

and contractors

CCS 0.10 0.14 (0.04)

AS(1) 0.14 0.27 (0.13)

HPPM 0.05 0.10 (0.05)

--------------------------------------- ------- ------- ----------

Continuing Group 0.09 0.13 (0.04)

--------------------------------------- ------- ------- ----------

(1) H1 2022 data for AS reflects the April-June period which

included the acquired Adhesive Solutions business.

FINANCIAL REVIEW

Group revenue, EBITDA and operating profit - continuing

operations

Revenue for the continuing Group of GBP1,075.3m (H1 2022:

GBP1,228.3m) decreased by 14.7% in constant currency compared with

the prior year period, with the contribution of the acquired

adhesive resins business and a small benefit from robust price/mix

partially offsetting a 17.2% reduction in volume compared with the

first half of 2022. This was driven by destocking, subdued levels

of demand across most of our end markets and increased competition

in some of our base chemical product ranges. Sequentially however,

Group volumes modestly increased by 2.2% relative to the second

half of the year. EBITDA for the continuing Group was GBP72.0m (H1

2022: GBP162.8m) in the period, with robust pricing and a strong

focus on margins partially mitigating the challenging volume

environment. Depreciation and amortisation in the period increased

to GBP48.6m (H1 2022: GBP37.5m), reflecting the non-current assets

acquired in the adhesive resins acquisition, resulting in

underlying operating profit for the continuing Group of GBP23.4m

(H1 2022: GBP125.3m).

Six months ended 30 June Continuing Total

2023, GBPm CCS AS HPPM Corp. operations Dis-continued Group

-------------------------- ----- ------ ----- ------ ----------- ------------- -------

Revenue 451.6 310.0 313.7 - 1,075.3 28.0 1,103.3

EBITDA 55.1 15.6 11.3 (10.0) 72.0 2.5 74.5

EBITDA % of revenue 12.2% 5.0% 3.6% 6.7% 8.9% 6.8%

Operating profit/(loss)

- underlying 41.5 1.4 (5.8) (13.7) 23.4 2.5 25.9

Operating profit/(loss)

- statutory 27.4 (12.3) (6.9) (17.0) (8.8) 64.5 55.7

-------------------------- ----- ------ ----- ------ ----------- ------------- -------

Six months ended 30 June Continuing Total

2022, GBPm CCS AS HPPM Corp. operations Dis-continued Group

------------------------------ ----- ----- ----- ------ ----------- ------------- -------

Revenue 548.9 223.8 455.6 - 1,228.3 106.1 1,334.4

EBITDA 80.3 34.5 59.2 (11.2) 162.8 10.3 173.1

EBITDA % of revenue 14.6% 15.4% 13.0% 13.3% 9.7% 13.0%

Operating profit - underlying 66.8 27.2 45.1 (13.8) 125.3 6.7 132.0

Operating profit - statutory 51.7 17.3 44.2 0.6 113.8 3.2 117.0

------------------------------ ----- ----- ----- ------ ----------- ------------- -------

Full year ended 31 December Continuing Total

2022, GBPm CCS AS HPPM Corp. operations Dis-continued Group

------------------------------ ----- ------- ----- ------ ----------- ------------- -------

Revenue 996.1 572.9 814.9 - 2,383.9 201.2 2,585.1

EBITDA 120.8 67.2 81.9 (20.7) 249.2 15.9 265.1

EBITDA % of revenue 12.1% 11.7% 10.1% 10.5% 7.9% 10.3%

Operating profit - underlying 94.1 44.5 50.6 (26.7) 162.5 8.7 171.2

Operating profit - statutory 62.8 (126.1) 47.2 (4.4) (20.5) (6.0) (26.5)

------------------------------ ----- ------- ----- ------ ----------- ------------- -------

Special Items - continuing operations

The following items of income and expense have been reported as

Special Items - continuing operations and have been excluded from

EBITDA and other underlying metrics:

Six months ended 30 June H1 2023 H1 2022 FY 2022

----------------------------------------- ------- ------- -------

GBPm GBPm GBPm

Amortisation of acquired intangibles (24.3) (19.5) (44.8)

Restructuring and site closure costs (6.6) (4.5) (19.2)

Acquisition costs and related gains (1.3) (6.5) (6.5)

Sale of business - 0.3 (0.3)

Regulatory fine - release of provision - 18.7 21.5

Impairment charge - - (133.7)

Total impact on operating loss/profit (32.2) (11.5) (183.0)

Fair value movement on unhedged interest

rate derivatives (1.8) 15.8 25.1

Loss on extinguishment of financing

facilities (4.6) - -

Total impact on loss/profit before

taxation (38.6) 4.3 (157.9)

Taxation Special Items - - 3.6

Taxation on Special Items (4.9) (4.6) 39.3

----------------------------------------- ------- ------- -------

Total impact on loss/profit for

the period - continuing operations (43.5) (0.3) (115.0)

----------------------------------------- ------- ------- -------

Amortisation of acquired intangibles increased in H1 2023,

reflecting amortisation of the customer lists, patents, trademarks

and trade secrets that arose on the acquisition of the adhesive

resins business. The intangible assets arising on the acquisition

are being amortised over a period of 8-20 years mainly dependent on

the characteristics of the customer relationships.

Restructuring and site closure costs in H1 2023 comprise a

GBP2.4m charge in relation to the ongoing integration of the

acquired adhesive resins business, and a further GBP4.2m in

relation to enacting the new strategy and realignment of the

business into its new divisions effective 1 January 2023.

Acquisition costs and related gains of GBP1.3m in H1 2023 relate

to the adhesive resins acquisition.

In July 2018 the Group entered into swap arrangements to fix

euro interest rates on the full value of the then EUR440m committed

unsecured revolving credit facility. The fair value movement of the

unhedged interest rate derivatives relates to the movement in the

mark-to-market of the swap in excess of the Group's current

borrowings.

In March 2023 the Group successfully refinanced its existing

bank loan facilities. All amounts outstanding on the existing

$260million term loan, $300 million term loan and EUR460 million

revolving credit facility were subsequently repaid and the

facilities were cancelled. All capitalised debt issue costs

relating to these term loans and facilities were written off

leading to a loss on extinguishment of GBP4.6 million.

Taxation on Special Items mainly relates to the amortisation of

acquired intangibles.

Discontinued operations

On 28 February 2023, the Group completed the sale of its

Laminates, Films and Coated Fabrics businesses to Surteco North

America, Inc. following satisfaction of the conditions to the

transaction announced on 13 December 2022. The final cash proceeds

received at completion amounted to $260.3m after transaction

expenses, with $3.2m received in July 2023 and a further $5m

receivable in cash on the 13-month anniversary of completion. The

net cash proceeds have been used to reduce the Group's debt. The

Laminates, Films and Coated Fabrics businesses are reported as

discontinued operations in these results.

In the period GBP36.3m of Special Items - discontinued

operations (H1 2022: GBP(3.5)m) were recognised, comprising a

GBP62.0m gain on the sale of the Laminates Films and Coated Fabrics

businesses, and GBP(25.7)m in charges, primarily relating to the

utilisation of acquired US tax attributes and the current tax

charge on the disposal of the Laminates, Films and Coated Fabrics

businesses.

Finance costs

Six months ended 30 June H1 2023 H1 2022 FY 2022

----------------------------------------- ------- ------- -------

GBPm GBPm GBPm

Net interest payable (30.8) (15.8) (43.2)

Net interest expense on defined benefit

obligation (1.1) (0.8) (1.2)

Interest element of lease payments (0.7) (0.7) (1.4)

----------------------------------------- ------- ------- -------

Finance costs - underlying (32.6) (17.3) (45.8)

Fair value movement on unhedged interest

rate derivatives (1.8) 15.8 25.1

Loss on extinguishment of financing

facilities (4.6) - -

Finance costs - statutory (39.0) (1.5) (20.7)

----------------------------------------- ------- ------- -------

Underlying finance costs increased to GBP(32.6)m (H1 2022:

GBP(17.3)m) and comprise interest on the Group's financing

facilities, interest rate swaps, amortisation of associated debt

costs and IAS 19 pension interest costs in respect of our defined

benefit pension schemes. The rise in the net interest payable

mainly reflects the additional debt utilised to finance the

adhesive resins acquisition as well as higher base rates. The Group

recognised as Special Items a total of GBP6.4m in finance costs

relating to interest rate derivative contracts and extinguishment

of financing facilities, as described above.

Non-controlling interest

The Group continues to hold 70% of Revertex (Malaysia) Sdn Bhd

and its subsidiaries. These entities form a relatively minor part

of the Group, so the impact on underlying performance from

non-controlling interests is not significant.

Taxation

The Group's underlying effective tax rate for H1 2023 was 22.0%

(H1 2022: 22.5%; FY 2022: 22.5%), representing the best estimate of

the annual effective corporate income tax rate expected for FY

2023. We estimate the rate by applying the expected corporate

income tax rate for each tax jurisdiction in which we operate.

Earnings per share

Earnings per share is calculated based on the average number of

shares in issue during the year. The weighted average number of

shares for H1 2023 was 467,241,000 (H1 2022: 467,314,000).

Underlying earnings per share is (1.1) pence for the period,

down from 19.0 pence in H1 2022, reflecting the lower earnings

relative to the prior period. The statutory earnings per share is

(2.6) pence (H1 2022: 18.3 pence).

Currency

The Group presents its consolidated financial statements in

sterling and conducts business in many currencies. As a result, it

is subject to foreign currency risk due to exchange rate movements,

which affect the Group's translation of the results and Underlying

net assets of its operations. To manage this risk, the Group uses

foreign currency borrowings, forward contracts and currency swaps

to hedge non-sterling net assets, which are predominantly

denominated in euros, US dollars and Malaysian ringgits.

In H1 2023 the Group experienced a translation headwind of

GBP1.4m on EBITDA, with average FX rates against our three

principal currencies of EUR1.1414, $1.2336 and MYR 5.4969 to the

pound.

Given the global nature of our customer and supplier base, the

impact of transactional foreign exchange can be very different from

translational foreign exchange. We are able to partially mitigate

the transaction impact by matching supply and administrative cost

currencies with sales currencies. To reduce volatility which might

affect the Group's cash or income statement, the Group hedges net

currency transaction exposures at the point of confirmed order,

using forward foreign exchange contracts. The Group's policy is,

where practicable, to hedge all exposures on monetary assets and

liabilities.

Cash performance

The following table summarises the movement in net debt and is

in the format used by management:

Six months ended 30 June H1 2023 H1 2022 FY 2022

--------------------------------------- --------- ------- ---------

GBPm GBPm GBPm

Opening net debt (1,024.9) (114.2) (114.2)

Underlying operating profit (excluding

joint ventures) 25.2 131.4 169.5

Movement in working capital 11.9 (128.0) 19.1

Depreciation of property, plant and

equipment 44.8 37.5 86.0

Amortisation of other intangible

assets 3.8 3.6 7.9

Share-based payments charge 1.1 1.1 0.7

Capital expenditure (33.9) (33.2) (90.8)

--------------------------------------- --------- ------- ---------

Business cash flow 52.9 12.4 192.4

Net interest paid (24.7) (13.9) (38.2)

Tax paid (4.5) (49.3) (65.6)

Pension funding (5.7) (11.5) (21.3)

Dividends received from joint ventures 0.8 0.3 1.9

--------------------------------------- --------- ------- ---------

Free Cash Flow 18.8 (62.0) 69.2

Cash impact of restructuring and

site closure costs (10.8) (10.4) (25.9)

Cash impact of acquisition costs (4.4) 2.1 1.7

Cash impact of mark to market 12.1 - -

Proceeds on sale of business 206.1 0.3 0.3

Purchase of business (8.3) (759.6) (759.6)

Repayment of principal portion of

lease liabilities (5.8) (4.7) (10.1)

Dividends paid - - (99.5)

Foreign exchange and other movements 21.4 (44.3) (86.8)

--------------------------------------- --------- ------- ---------

Movement in net debt 229.1 (878.6) (910.7)

--------------------------------------- --------- ------- ---------

Closing net debt (795.8) (992.8) (1,024.9)

--------------------------------------- --------- ------- ---------

Underlying operating profit in the period reduced to GBP25.2m

reflecting the trading performance described above. The net working

capital inflow of GBP11.9m in the first half of the year was as a

result of the receivables financing facility, active inventory and

account management and moderating raw materials pricing, partially

offset by seasonality and activity levels.

In order to manage the significant increase in working capital

requirements over the last year and optimise cash generation, the

Group put in place two-year, non-recourse receivables financing

facilities in December 2022 for a maximum aggregate amount of

EUR200m. Factored receivables assigned under the facilities

amounted to GBP139.2m net at 30 June 2023 (31 December 2022:

GBP82.7m net). Under the facilities, the risks and rewards of

ownership are transferred to the assignees. The tenor of the

facility was subsequently extended to 31 May 2025.

Depreciation and amortisation of other intangibles increased due

to the adhesive resins non-current assets acquired. Capital

expenditure was GBP33.9m (H1 2022: GBP33.2m), principally for the

Pathway Programme systems transformation project, recurring SHE and

sustenance expenditure. The Group continues to anticipate

c.GBP75-85m in capital expenditure for FY 2023.

Interest paid increased to GBP24.7m reflecting the adhesive

resins acquisition debt and higher base rates. Net tax paid

decreased to GBP4.5m reflecting lower payments on account due to

reduced operating profit and refunds of prior year overpaid

taxes.

The cash impact of Special Items including restructuring and

site closure costs and acquisition costs and related gains was an

outflow of GBP(23.5)m.

Group debt is denominated in sterling, euros and dollars. Both

the euro and the dollar weakened relative to sterling during H1

2023, leading to a foreign exchange gain in net debt.

Financing and liquidity

At 30 June 2023, net debt was GBP795.8m (FY 2022: GBP1,024.9m),

with the reduction principally reflecting proceeds received from

the divestment of the Laminates, Films and Coated Fabrics

businesses. As at 30 June 2023 committed borrowing facilities

principally comprised: a $480m RCF (maturing in May 2025),

five-year EUR520m 3.875% senior loan notes (maturing July 2025) and

UK Export Finance (UKEF) facilities of EUR288m and $230m (maturing

in October 2027). At 30 June 2023, the UKEF facilities were fully

drawn and GBP130.0m was drawn under the RCF. The Group's net debt:

EBITDA for the purposes of the leverage ratio covenant increased

from 3.7x at 31 December 2022 to 5.5x at 30 June 2023, due

primarily to lower EBITDA over the preceding twelve month period,

partially offset by lower net debt, as described elsewhere.

On 5 September 2023, the Group entered into an RCF amendment and

extension agreement, which is subject to and conditional upon the

successful outcome of the rights issue. If effective, the agreement

will reduce the RCF commitment to $400m and extend the maturity

date to 31 July 2027, amongst other matters.

The new RCF and the UKEF facilities are subject to one leverage

ratio covenant. For prudence in light of current market conditions,

this has been set at 6x in June 2023, 5x in December 2023, 4.25x in

June 2024, 3.5x in December 2024, 3.5x in June 2025 and 3.25x

thereafter. The Group expects net financing costs of approximately

GBP60-65m in FY 2023 as a result of the higher net debt and other

changes to the Group's financing arrangements, reducing to

approximately GBP45-50m in 2024 assuming the rights issue is

successfully completed.

The Group's pro forma committed liquidity at 30 June 2023,

including the net impact of both the rights issue of GBP276m less

fees and the reduction of the RCF to $400m, is in excess of

GBP640m.

Balance sheet

Net assets of the Group decreased by 7% to GBP963.3m, mainly

reflecting the GBP12.4m loss for the period and a loss of GBP54.3m

on translation of foreign currency.

Provisions

The Group provisions balance decreased to GBP46.9m compared with

a balance of GBP54.0m as at 31 December 2022, mainly reflecting

cash utilisation of GBP5.6m in the period, most notably in relation

to the Marl and Villejust site rationalisation.

During 2022, the European Commission concluded its investigation

into styrene monomer purchasing practices, and the final settlement

amount of GBP38.5m was transferred to other payables. Subsequently

the Group has concluded an agreement with the EU to pay the

settlement amount in January 2024.

Going Concern

As described in Note 1, the Group has undertaken a detailed

going concern assessment of the Group. The downside scenario,

outlining the impact of a severe but plausible adverse case,

results in a breach of the Group's existing debt covenants within

12 months of approval of the interim financial statements. The key

mitigating action represents the rights issue, and the Directors

are confident that the proceeds from the rights issue alone are

sufficient to avoid the forecast debt covenants breach in the

downside scenario. This means that the outcome of the shareholder

vote on 25 September 2023, and the successful completion of the

Rights Issue, represents a material uncertainty within the Group's

going concern basis of preparation. This material uncertainty is

referenced in the external auditors' Independent Review Report on

page 31. Notwithstanding the material uncertainty explained above,

the Directors have formed the judgment that it is appropriate to

prepare the interim financial statements on the

going concern basis.

Consolidated income statement

for the six months ended 30 June 2023

30 June 2023 (unaudited) 30 June 2022 (unaudited)

------------------------------ ---------------------------------

Underlying Special Underlying Special

performance items IFRS performance items IFRS

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------- ------------- ------- ------- ------------ ------- ---------

Continuing operations

Revenue 1,075.3 - 1,075.3 1,228.3 - 1,228.3

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

Company and subsidiaries operating

profit before Special Items 22.7 - 22.7 124.7 - 124.7

Amortisation of acquired intangibles - (24.3) (24.3) - (19.5) (19.5)

Restructuring and site closure

costs - (6.6) (6.6) - (4.5) (4.5)

Acquisition costs and related

gains - (1.3) (1.3) - (6.5) (6.5)

Sale of business - - - - 0.3 0.3

Regulatory Fine - release of

provision - - - - 18.7 18.7

Company and subsidiaries operating

profit 22.7 (32.2) (9.5) 124.7 (11.5) 113.2

Share of joint ventures 0.7 - 0.7 0.6 - 0.6

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

Operating profit/(loss) 23.4 (32.2) (8.8) 125.3 (11.5) 113.8

----------------------------------------- ------------- ------- -------

Interest payable (35.8) - (35.8) (16.1) - (16.1)

Interest receivable 5.0 - 5.0 0.3 - 0.3

Fair value (loss)/gain on unhedged

interest rate derivatives - (1.8) (1.8) - 15.8 15.8

Loss on extinguishment of financing

facilities - (4.6) (4.6) - - -

Net interest expense on defined

benefit obligations (1.1) - (1.1) (0.8) - (0.8)

Interest element of lease payments (0.7) - (0.7) (0.7) - (0.7)

Finance costs (32.6) (6.4) (39.0) (17.3) 15.8 (1.5)

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

(Loss)/profit before taxation (9.2) (38.6) (47.8) 108.0 4.3 112.3

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

Taxation 1.5 (4.9) (3.4) (25.7) (4.6) (30.3)

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

(Loss)/profit for the period

from continuing operations (7.7) (43.5) (51.2) 82.3 (0.3) 82.0

Profit/(loss) for the period

from discontinued operations

attributable to the equity

holders of the parent 2.5 36.3 38.8 6.6 (3.5) 3.1

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

(Loss)/profit for the period (5.2) (7.2) (12.4) 88.9 (3.8) 85.1

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

(Loss)/profit attributable

to non-controlling interests (0.1) (0.2) (0.3) 0.3 (0.6) (0.3)

(Loss)/profit attributable

to equity holders of the parent (5.1) (7.0) (12.1) 88.6 (3.2) 85.4

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

(5.2) (7.2) (12.4) 88.9 (3.8) 85.1

---------------------------------------- ------------- ------- ------- ------------ ------- ---------

Earnings per share

- Basic from continuing operations (1.6)p (9.3)p (10.9)p 17.5p 0.1p 17.6p

- Diluted from continuing operations (1.6)p (9.3)p (10.9)p 17.5p - 17.5p

- Basic (1.1)p (1.5)p (2.6)p 19.0p (0.7)p 18.3p

- Diluted (1.1)p (1.5)p (2.6)p 18.9p (0.7)p 18.2p

----------------------------------------- ------------- ------- ------- ------------ ------- ---------

Consolidated income statement

for the six months ended 30 June 2023 (continued)

Year ended 31 December

2022 (audited)

--------------------------------

Underlying Special

performance items IFRS

GBPm GBPm GBPm

------------------------------------- ------------ ------- ---------

Continuing operations

Revenue 2,383.9 - 2,383.9

-------------------------------------- ------------ ------- ---------

Company and subsidiaries operating

profit before Special Items 160.8 - 160.8

Amortisation of acquired intangibles - (44.8) (44.8)

Restructuring and site closure

costs - (19.2) (19.2)

Acquisition costs and related

gains - (6.5) (6.5)

Sale of business - (0.3) (0.3)

Regulatory Fine - release of

provision - 21.5 21.5

Impairment charge - (133.7) (133.7)

-------------------------------------- ------------ ------- ---------

Company and subsidiaries operating

profit 160.8 (183.0) (22.2)

Share of joint ventures 1.7 - 1.7

-------------------------------------- ------------ ------- ---------

Operating profit/(loss) 162.5 (183.0) (20.5)

-------------------------------------- ------------ ------- ---------

Interest payable (44.8) - (44.8)

Interest receivable 1.6 - 1.6

Fair value gain on unhedged

interest rate derivatives - 25.1 25.1

Net interest expense on defined

benefit obligations (1.2) - (1.2)

Interest element of lease payments (1.4) - (1.4)

Finance costs (45.8) 25.1 (20.7)

-------------------------------------- ------------ ------- ---------

Profit/(loss) before taxation 116.7 (157.9) (41.2)

-------------------------------------- ------------ ------- ---------

Taxation (27.6) 42.9 15.3

-------------------------------------- ------------ ------- ---------

Profit/(loss) for the year

from continuing operations 89.1 (115.0) (25.9)

Profit/(loss) for the year

from discontinued operations

attributable to the equity

holders of the parent 7.8 (14.9) (7.1)

-------------------------------------- ------------ ------- ---------

Profit/(loss) for the year 96.9 (129.9) (33.0)

-------------------------------------- ------------ ------- ---------

Profit/(loss) attributable

to non-controlling interests 0.5 (1.0) (0.5)

Profit/(loss) attributable

to equity holders of the parent 96.4 (128.9) (32.5)

-------------------------------------- ------------ ------- ---------

96.9 (129.9) (33.0)

------------------------------------- ------------ ------- ---------

Earnings per share

- Basic from continuing operations 19.0p (24.4)p (5.4)p

- Diluted from continuing operations 18.9p (24.3)p (5.4)p

- Basic 20.6p (27.6)p (7.0)p

- Diluted 20.6p (27.6)p (7.0)p

-------------------------------------- ------------ ------- ---------

Consolidated statement of comprehensive income

for the six months ended 30 June 2023

30 June 2023 (unaudited) 30 June 2022 (unaudited)

--------------------------------- ---------------------------------

Equity Equity

holders holders

of the Non-controlling of the Non-controlling

parent interests Total parent interests Total

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------- -------- --------------- ------ -------- --------------- ------

(Loss)/profit for the period (12.1) (0.3) (12.4) 85.4 (0.3) 85.1

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Actuarial gains 3.3 - 3.3 46.8 - 46.8

Tax relating to components

of other comprehensive income (0.7) - (0.7) (10.5) - (10.5)

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Total items that will not

be reclassified to profit or

loss 2.6 - 2.6 36.3 - 36.3

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Exchange differences on translation

of foreign operations (53.5) (0.8) (54.3) 68.0 0.8 68.8

Exchange differences recycled

on sale of business (0.5) - (0.5) - - -

Fair value (loss) / gain on

hedged interest derivatives (0.1) - (0.1) 4.0 - 4.0

Gains on net investment hedges

taken to equity (2.2) - (2.2) 6.5 - 6.5

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Total items that may be reclassified

subsequently to profit or loss (56.3) (0.8) (57.1) 78.5 0.8 79.3

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Other comprehensive (expense)

/ income for the period (53.7) (0.8) (54.5) 114.8 0.8 115.6

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Total comprehensive (expense)/

income for the period (65.8) (1.1) (66.9) 200.2 0.5 200.7

-------------------------------------- -------- --------------- ------ -------- --------------- ------

Year ended 31 December

2022 (audited)

---------------------------------

Equity

holders

of the Non-controlling

parent interests Total

GBPm GBPm GBPm

------------------------------------- -------- --------------- ------

Loss for the year (32.5) (0.5) (33.0)

-------------------------------------------- -------- --------------- ------

Actuarial gains 34.1 - 34.1

Tax relating to components

of other comprehensive income (11.6) - (11.6)

-------------------------------------------- -------- --------------- ------

Total items that will not

be reclassified to profit or

loss 22.5 - 22.5

-------------------------------------------- -------- --------------- ------

Exchange differences on translation

of foreign operations 95.9 0.8 96.7

Fair value gain on hedged interest

derivatives 9.7 - 9.7

Gains on net investment hedges

taken to equity 2.4 - 2.4

-------------------------------------------- -------- --------------- ------

Total items that may be reclassified

subsequently to profit or loss 108.0 0.8 108.8

-------------------------------------------- -------- --------------- ------

Other comprehensive income

for the year 130.5 0.8 131.3

-------------------------------------------- -------- --------------- ------

Total comprehensive income

for the year 98.0 0.3 98.3

-------------------------------------------- -------- --------------- ------

Consolidated statement of changes in equity

for the six months ended 30 June 2023

Total

Hedging equity

Capital & holdings

Share Share redemption translation Retained of the Non-controlling Total

capital premium reserve reserve earnings parent interests Equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- --------- --------- ------------ ------------- ---------- ---------- ----------------- ---------------

At 1 January

2023 46.7 620.0 0.9 75.9 273.5 1,017.0 14.0 1,031.0

Loss for the

period - - - - (12.1) (12.1) (0.3) (12.4)

Other

comprehensive

(expense)/

income

for the period - - - (56.3) 2.6 (53.7) (0.8) (54.5)

----------------- --------- --------- ------------ ------------- ---------- ---------- ----------------- ---------------

Total

comprehensive

expense for

the

period - - - (56.3) (9.5) (65.8) (1.1) (66.9)

Share-based

payments - - - - (0.8) (0.8) - (0.8)

----------------- --------- --------- ------------ ------------- ---------- ---------- ----------------- ---------------

At 30 June 2023

(unaudited) 46.7 620.0 0.9 19.6 263.2 950.4 12.9 963.3

----------------- --------- --------- ------------ ------------- ---------- ---------- ----------------- ---------------

Total

Hedging equity

Capital & holdings

Share Share redemption translation Retained of the Non-controlling Total

capital premium reserve reserve earnings parent interests Equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ -----------

At 1 January

2022 46.7 620.0 0.9 (32.1) 383.8 1,019.3 13.7 1,033.0

Profit / (loss)

for the period - - - - 85.4 85.4 (0.3) 85.1

Other

comprehensive

income for the

period - - - 78.5 36.3 114.8 0.8 115.6

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ -----------

Total

comprehensive

income for the

period - - - 78.5 121.7 200.2 0.5 200.7

Dividends - - - - (99.5) (99.5) - (99.5)

Share-based

payments - - - - 0.1 0.1 - 0.1

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ -----------

At 30 June 2022 1 ,

(unaudited) 46.7 620.0 0.9 46.4 406.1 120.1 14.2 1 , 134.3

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ -----------

Total

Hedging equity

Capital & holdings

Share Share redemption translation Retained of the Non-controlling Total

capital premium reserve reserve earnings parent interests Equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ ---------

At 1 January

2022 46.7 620.0 0.9 (32.1) 383.8 1,019.3 13.7 1,033.0

Loss for the

year - - - - (32.5) (32.5) (0.5) (33.0)

Other

comprehensive

income for the

year - - - 108.0 22.5 130.5 0.8 131.3

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ ---------

Total

comprehensive

income /

(expense) 108

for the year - - - .0 (10.0) 98.0 0.3 98.3

Dividends - - - - (99.5) (99.5) - (99.5)

Share-based

payments - - - - (0.8) (0.8) - (0.8)

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ ---------

At 31 December

2022

(audited) 46.7 620.0 0.9 75.9 273.5 1,017.0 14.0 1,031.0

----------------- ---------- ---------- ------------ ------------- ----------- ---------- ------------------ ---------

Consolidated balance sheet

as at 30 June 2023

30 June 30 June 2022 31 December

2023 (unaudited) (unaudited) 2022 (audited)

----------------- -------------------- -----------------

GBPm GBPm GBPm

--------------------------------- ----------------- -------------------- -----------------

Non-current assets

Goodwill 464.5 662.1 480.8

Acquired intangible assets 476.6 560.1 523.6

Other intangible assets 66.7 54.1 60.9

Property, plant and equipment 722.0 763.9 753.6

Deferred tax assets 25.0 21.2 50.3

Defined benefit asset 11.5 14.2 5.9

Investment in joint ventures 7.6 7.9 8.1

---------------------------------- ----------------- -------------------- -----------------

Total non-current assets 1,773.9 2 , 083.5 1,883.2

---------------------------------- ----------------- -------------------- -----------------

Current assets

Inventories 374.5 508.2 407.9

Trade and other receivables 262.7 548.0 271.6

Current tax assets 26.4 - 34.3

Cash and cash equivalents 232.9 262.5 227.7

Derivative financial instruments 11.4 13.4 26.7

Assets classified as held for

sale - - 196.2

---------------------------------- ----------------- -------------------- -----------------

Total current assets 907.9 1 , 332.1 1,164.4

---------------------------------- ----------------- -------------------- -----------------

Total assets 2,681.8 3,415.6 3,047.6

---------------------------------- ----------------- -------------------- -----------------

Current liabilities

Borrowings (33.9) (22.3) (18.5)

Trade and other payables (442.9) (618.2) (460.8)

Lease liabilities (11.1) (9.6) (10.6)

Current tax liabilities (24.7) (24.0) (33.6)

Dividends payable - (99.5) -

Provisions for other liabilities

and charges (15.2) (59.6) (13.7)

Liabilities classified as held

for sale - - (45.5)

Total current liabilities (527.8) (833.2) (582.7)

---------------------------------- ----------------- -------------------- -----------------

Non-current liabilities

Borrowings (994.8) (1,233.0) (1,234.1)

Trade and other payables (0.4) (1.0) (0.4)

Lease liabilities (47.0) (38.2) (34.9)

Deferred tax liabilities (42.7) (74.3) (44.9)

Retirement benefit obligations (74.1) (83.4) (79.3)

Provisions for other liabilities

and charges (31.7) (18.2) (40.3)

---------------------------------- ----------------- -------------------- -----------------

Total non-current liabilities (1,190.7) (1,448.1) (1,433.9)

---------------------------------- ----------------- -------------------- -----------------

( 2,281.3

Total liabilities (1,718.5) ) (2,016.6)

---------------------------------- ----------------- -------------------- -----------------

Net assets 963.3 1 , 134.3 1,031.0

---------------------------------- ----------------- -------------------- -----------------

Equity

Share capital 46.7 46.7 46.7

Share premium 620.0 620.0 620.0

Capital redemption reserve 0.9 0.9 0.9

Hedging and translation reserve 19.6 46.4 75.9

Retained earnings 263.2 406.1 273.5

---------------------------------- ----------------- -------------------- -----------------

Equity attributable to equity

holders of the parent 950.4 1 , 120.1 1,017.0

Non-controlling interests 12.9 14.2 14.0

---------------------------------- ----------------- -------------------- -----------------

Total equity 963.3 1 , 134.3 1,031.0

---------------------------------- ----------------- -------------------- -----------------

Consolidated cash flow statement

for the six months ended 30 June 2023

Six months ended Six months ended Year ended 31

30 June 2023 30 June 2022 December 2022

(unaudited) (unaudited) (audited)

------------------ ------------------ ----------------

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------- -------- -------- -------- -------- ------- -------

Operating

Cash generated from operations

(Note 5) 78.0 25.8 237.7

- Interest received 5.0 0.3 1.6

- Interest paid (29.0) (13.5) (38.4)

- Interest element of lease

payments (0.7) (0.7) (1.4)

Net interest paid (24.7) (13.9) (38.2)

- UK corporation tax paid (3.0) - -

- Overseas corporate tax

paid (1.5) (49.3) (65.6)

Total tax paid (4.5) (49.3) (65.6)

---------------------------------- -------- -------- -------- -------- ------- -------

Net cash inflow/(outflow)

from operating activities 48.8 (37.4) 133.9

---------------------------------- -------- -------- -------- -------- ------- -------

Investing

Dividends received from

joint ventures 0.8 0.3 1.9

Purchase of property, plant

and equipment and other

intangible assets (33.9) (33.2) (90.8)

Purchase of business (8.3) (759.6) (759.6)

Net proceeds from sale

of business (Note 11) 206.1 0.3 0.3

---------------------------------- -------- -------- -------- -------- ------- -------

Net cash inflow/(outflow)

from investing activities 164.7 (792.2) (848.2)

---------------------------------- -------- -------- -------- -------- ------- -------

Financing

Dividends paid - - (99.5)

Settlement of equity-settled

share-based payments (0.3) (1.0) (1.5)

Repayment of principal

portion of lease liabilities (5.8) (4.7) (10.1)

Repayment of borrowings (556.3) (13.2) (207.6)

Proceeds of borrowings 345.4 564.9 733.2

Net cash (outflow)/inflow

from financing activities (217.0) 546.0 414.5

---------------------------------- -------- -------- -------- -------- ------- -------