TIDMSYNT

RNS Number : 6560L

Synthomer PLC

07 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, HONG

KONG, SINGAPORE, THE UNITED ARAB EMIRATES AND THE UNITED STATES AND

ANY OTHER JURISDICTION TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NOTHING HEREIN SHALL

CONSTITUTE AN OFFERING OF ANY SECURITIES. NOTHING IN THIS

ANNOUNCEMENT SHOULD BE INTERPRETED AS A TERM OR CONDITION OF THE

RIGHTS ISSUE. ANY DECISION TO PURCHASE, SUBSCRIBE FOR, OTHERWISE

ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY NIL PAID RIGHTS, FULLY

PAID RIGHTS OR NEW ORDINARY SHARES MUST BE MADE ONLY ON THE BASIS

OF THE INFORMATION CONTAINED IN THE PROSPECTUS ONCE PUBLISHED.

COPIES OF THE PROSPECTUS WILL, FOLLOWING PUBLICATION, BE AVAILABLE

FROM THE REGISTERED OFFICE OF THE COMPANY AND ON ITS WEBSITE AT

WWW.SYNTHOMER.COM/INVESTOR-RELATIONS/, SUBJECT TO APPLICABLE LAW

AND REGULATIONS. PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION. FOR IMMEDIATE

RELEASE

7 September 2023

SYNTHOMER plc

stronger foundations to drive strategy delivery

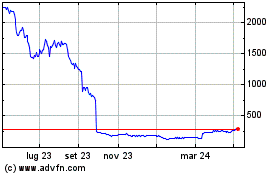

Proposed 6 for 1 Rights Issue of 140,200,818 New Ordinary Shares

at 197 pence per New Ordinary Share

and

Proposed Capital Reorganisation of 1 New Ordinary Share of 1

pence nominal value for every 20 Existing Ordinary Shares of 10

pence nominal value

Further to the announcement of its interim results for the for

the six months ended 30 June 2023, Synthomer plc ("Synthomer" or

the "Company", and together with its direct and indirect

subsidiaries, the "Group"), a leading global producer of

high-performance speciality chemical products, today announces that

it proposes to raise gross proceeds of approximately GBP276 million

by way of a rights issue (the "Rights Issue").

In conjunction with the Rights Issue, Synthomer is proposing to

implement a capital reorganisation, comprising a sub-division and

share consolidation, as described more fully below.

HIGHLIGHTS

-- The purpose of the Rights Issue is to support reduction in

the Group's leverage and provide stronger foundations to focus on

delivering its speciality solutions strategy

-- By increasing covenant headroom the Rights Issue will allow

greater focus on strategic delivery and long-term value creation in

addition to short term cash preservation, as well as a reduction of

downside risks from near-term macroeconomic uncertainty for all

stakeholders

-- At the Capital Markets Day in October 2022, Synthomer's new

management team announced its "Focus, Strengthen, Grow" strategy to

increase the speciality weighting of its portfolio and focus on

higher growth end-markets

-- Over the last 18 months, however, Synthomer has navigated an

extremely challenging market backdrop, during which time a

temporary weakness in demand across most of its end-markets and

geographies, exacerbated by supply chain disruptions and sustained

higher raw material and energy costs, has affected financial

performance

-- The Group's earnings have reduced temporarily but

significantly, and combined with the debt taken on to finance the

Eastman Acquisition announced in 2021 and completed in 2022 has

resulted in the Group's leverage increasing significantly, to 5.5x

covenant net debt, based on EBITDA as at 30 June 2023

-- Substantial and decisive management actions have been

successfully executed to preserve cash and manage debt, including

refinancing one debt facility and putting in place two other ones

to strengthen its financial liquidity position, initiating a number

of cash conservation measures, and identifying self-help

cost-saving measures and disposals of non-core businesses,

including the divestment of the Laminates, Films and Coated Fabrics

Businesses which was completed in February 2023 and which generated

total net proceeds of $269 million

-- The Board believes that the earnings power of the Group is

more than double current levels (being LTM EBITDA of GBP158m) in

the medium-term, based on a combination of executing its near-term

management actions, end-market volume recovery, and delivery of the

Group's strategy

-- Stronger foundations, supported by volume recovery, will

underpin delivery of the Group's medium-term ambitions, including

the medium-term targets set out last October: mid-single-digit

growth in constant currency over the cycle, EBITDA margins above

15% and mid-teens return on invested capital

-- The net proceeds of the Rights Issue will initially be

utilised to reduce borrowings under the Revolving Credit Facility

and provide flexibility to deliver strategy and manage balance

sheet leverage

o The Rights Issue will result in a pro forma reduction in the

covenant net debt based on EBITDA ratio from 5.5x to 3.8x as at 30

June 2023

-- On 5 September 2023, Synthomer entered into the RCF Amendment

and Extension, which will extend the Revolving Credit Facility

maturity date from 31 May 2025 to 31 July 2027 and amend total

commitments to $400 million

-- Reducing leverage further towards the 1-2x target range by

the end of 2024 remains a key priority, supported by further

divestments and increased earnings power

-- The Company's largest shareholder, Kuala Lumpur Kepong Berhad

Group (holding approximately 26.9% of the total voting rights in

the Company as at 6 September 2023, being the latest practicable

date prior to the date of this announcement), has irrevocably

committed to take up its full entitlement pursuant to the Rights

Issue and to vote in favour of the Resolutions

-- The Board believes the Rights Issue will allow the Company to

focus its resources on strategic execution and long-term value

creation for shareholders from its platforms of leading businesses

in attractive growth segments

BACKGROUND TO AND REASONS FOR THE RIGHTS ISSUE

Synthomer's portfolio has evolved over a number of years through

both organic growth and significant acquisitions, notably OMNOVA

completed in 2020 and the Eastman Acquisition completed in 2022.

Synthomer's new management team set out a refreshed strategy in

October 2022 to deliver growth and substantial margin improvement.

By increasing the speciality weighting of the Group's product

portfolio, leveraging the Group's enhanced global footprint and

reducing structural complexity within the Group, the Board believes

that the Group will become a more focused, more resilient and

higher quality speciality chemicals business in the medium-term.

Management outlined plans to deploy a more focused capital and

resource allocation framework. Portfolio rationalisation, which

aims to increase the speciality weighting of the business, is

already underway.

The Group today has many market-leading businesses in

end-markets with attractive growth prospects, however, during the

last 18 months, several factors have combined to increase

significantly the Group's leverage. Market conditions have rapidly

deteriorated, significantly, but temporarily, weakening recent

Group performance. The COVID-19 pandemic initially boosted demand

for NBR used in medical gloves but resulted in oversupply later.

Ongoing Russian military action in Ukraine has caused economic

volatility, impacting the Company's supply chain, costs, and energy

prices. High inflation and interest rate rises slowed industrial

activity and reduced demand in most of the Group's markets,

worsened by competition from Asia. The Adhesive Solutions division

faced raw material and reliability challenges, which are being

addressed by the new divisional leadership team.

Deteriorating market conditions, which followed a major

acquisition the Group announced in 2021 and completed in early

2022, predominantly financed from debt, significantly, but

temporarily, weakened recent Group earnings performance.

To navigate the current challenging environment, the Group has

taken substantial and decisive actions to preserve cash and manage

debt. Financial liquidity has been improved by refinancing credit

facilities and implementing cost-saving measures. As of 30 June

2023, Synthomer had over GBP400 million in available liquidity. A

GBP150-200 million cash management programme has been initiated,

which includes a reduction in capital expenditure, working capital

optimisation and dividend suspension. Additionally, the Group

identified GBP30 million in cost-saving measures, with GBP20

million to be realised in the second half of 2023. The strategic

divestment of its non-core Laminates and Films and Coated Fabrics

Businesses for $269 million completed in February 2023, which also

lowered the Group's net debt.

Notwithstanding the successful execution of these mitigation

actions, the Group's covenant leverage position remains elevated at

5.5x net debt, based on EBITDA as at 30 June 2023.

The Rights Issue will enable the Group to increase focus on

strategic delivery and long-term value creation in addition to

short-term cash preservation, as well as reducing the downside

risks from near-term macroeconomic uncertainty for all

stakeholders.

The Board believes that the medium-term earnings power of the

Group is more than double current levels based on a combination of

executing its near-term management actions, end-market volume

recovery and strategic delivery. These will also drive Synthomer to

become a more focused, more resilient and higher quality speciality

chemicals platform in the medium-term, with the business continuing

to target mid-single digit revenue growth, 15%+ EBITDA margin and

mid-teens return on invested capital. The Group believes that with

the stronger foundations achieved by the Rights Issue, supported by

volume recovery, will underpin the delivery of the Group's strategy

and medium-term ambitions, and thereby create long-term value.

KLK Intentions

The Company's largest shareholder, Kuala Lumpur Kepong Berhad

Group ("KLK") (which holds approximately 26.9% of the total voting

rights in the Company as at 6 September 2023, being the latest

practicable date prior to the date of this announcement), has

irrevocably committed to take up its full entitlement pursuant to

the Rights Issue and to vote in favour of the Resolutions. This

will result in KLK acquiring an aggregate of 37,676,850 New

Ordinary Shares, representing approximately 26.9% of the New

Ordinary Shares to be issued pursuant to the Rights Issue.

Directors' Intentions

Each Director who is able to participate in the Rights Issue

and/or vote at the General Meeting has confirmed in writing their

intention to take up their entitlement in full, or in part, to

subscribe for New Ordinary Shares under the Rights Issue in respect

of their respective holding of Existing Ordinary Shares and intends

to vote in favour of the Resolutions.

Prospectus

A prospectus (the "Prospectus") setting out full details of the

Rights Issue is expected to be published on Synthomer's website at

www.synthomer.com/investor-relations/ later today.

The Prospectus will be submitted to the National Storage

Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism following

publication.

The preceding summary should be read in conjunction with the

full text of the following announcement, together with the

Prospectus.

Unless the context otherwise requires, words and expressions

defined in the Prospectus shall have the same meanings in this

announcement.

Indicative summary timetable of principal events

Announcement of the Rights Issue and publication of the Prospectus 7 September 2023

General Meeting 12:30 p.m. on 25 September 2023

--------------------------------------

Record date for the Capital Reorganisation 6:00 p.m. on 25 September 2023

--------------------------------------

Admission and dealings in the Consolidated Ordinary Shares commence on the 8:00 a.m. on 26 September 2023

London Stock Exchange

--------------------------------------

Record Date for entitlements under the Rights Issue Close of business on 26 September 2023

--------------------------------------

Despatch of Provisional Allotment Letters (to Qualifying Non-CREST 27 September 2023

Shareholders only)

--------------------------------------

Consolidated Ordinary Shares marked "ex-rights" by the London Stock Exchange 8:00 a.m. on 28 September 2023

--------------------------------------

Admission of, and commencement of dealings in, Nil Paid Rights on the London

Stock Exchange; 8:00 a.m. on 28 September 2023

start of subscription period

--------------------------------------

Latest time and date for acceptance, payment in full and registration of 11:00 a.m. on 12 October 2023

renunciation of Provisional

Allotment Letters

--------------------------------------

Announcement of the results of the Rights Issue through a Regulatory By 8:00 a.m. on 13 October 2023

Information Service

--------------------------------------

Dealings in New Ordinary Shares, fully paid, commence on the London Stock 8:00 a.m. on 13 October 2023

Exchange

--------------------------------------

The Rights Issue is fully underwritten (in respect of the

Non-KLK Rights Issue Shares) by Goldman Sachs International, J.P.

Morgan Securities plc and Morgan Stanley & Co. International

plc acting as Joint Global Coordinators and Joint Bookrunners and

Citi acting as Joint Bookrunner, and (in respect of the KLK Rights

Issue Shares) by KLK. J.P. Morgan Cazenove is acting as sole

sponsor to the Company.

The person responsible for making this announcement on behalf of

Synthomer is Anant Prakash, Chief Counsel & Company

Secretary.

For further information, please contact:

Synthomer plc IR@synthomer.com

Michael Willome +44 (0) 1279 775 306

Lily Liu

Faisal Tabbah

J.P. Morgan Cazenove (Sole Sponsor, Joint Corporate Broker, Joint Bookrunner and Joint Global

Coordinator)

Richard Perelman

Alia Malik

Charles Oakes

Will Holyoak +44 (0) 20 7742 4000

---------------------

Morgan Stanley (Joint Corporate Broker, Joint Bookrunner and Joint Global Coordinator)

Andrew Foster

Shirav Patel

Alex Smart

Emma Whitehouse +44 (0) 20 7425 8000

---------------------

Goldman Sachs (Joint Bookrunner and Joint Global Coordinator)

Nick Harper

Bertie Whitehead

Clemens Tripp

Warren Stables +44 (0) 20 7774 1000

---------------------

Citi (Joint Bookrunner)

Robert Way

Sean Weissenberger

Patrick Evans

Ram Anand +44 (0) 20 7500 5000

---------------------

Teneo

Charles Armitstead +44 (0) 20 3603 5220

---------------------

IMPORTANT NOTICES

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy, fairness or completeness. The

information in this announcement is subject to change without

notice.

This announcement is not a prospectus (or a prospectus

equivalent document) but an advertisement for the purposes of the

Prospectus Regulation Rules of the Financial Conduct Authority

("FCA"). Neither this announcement nor anything contained in it

shall form the basis of, or be relied upon in conjunction with, any

offer or commitment whatsoever in any jurisdiction. Investors

should not acquire any Nil Paid Rights, Fully Paid Rights or New

Ordinary Shares referred to in this announcement except on the

basis of the information contained in the Prospectus to be

published by the Company in connection with the Rights Issue.

A copy of the Prospectus will, following publication, be

available from the registered office of the Company and on its

website at www.synthomer.com/investor-relations/. Neither the

content of the Company's website nor any website accessible by

hyperlinks on the Company's website is incorporated in, or forms

part of, this announcement. The Prospectus will provide further

details of the New Ordinary Shares, the Nil Paid Rights and the

Fully Paid Rights being offered pursuant to the Rights Issue.

This announcement (and the information contained herein) is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in, into or within the United States of

America, its territories and possessions, any State of the United

States or the District of Columbia (collectively, the "United

States"). This announcement is not an offer for sale or the

solicitation of an offer to purchase securities in the United

States. Securities may not be offered or sold in the United States

absent registration under the US Securities Act of 1933, as amended

(the "US Securities Act"), or an exemption therefrom. The Nil Paid

Rights, the Fully Paid Rights and the New Ordinary Shares have not

been and will not be registered under the US Securities Act or

under any securities laws of any state or other jurisdiction of the

United States and may not be offered, sold, pledged, taken up,

exercised, resold, renounced, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States or other jurisdiction.

There will be no public offer of the Nil Paid Rights, the Fully

Paid Rights or the New Ordinary Shares in the United States.

Subject to certain limited exceptions, Provisional Allotment

Letters have not been, and will not be, sent to, and Nil Paid

Rights have not been, and will not be, credited to the CREST

account of, any Qualifying Shareholder with a registered address in

or that is known to be located in the United States, or to holders

of the Synthomer's

American depositary shares. None of the New Ordinary Shares, the

Nil Paid Rights, the Fully Paid Rights or the Provisional Allotment

Letters, this announcement or any other document connected with the

Rights Issue has been or will be approved or disapproved by the

United States Securities and Exchange Commission or by the

securities commissions of any state or other jurisdiction of the

United States or any other regulatory authority, nor have any of

the foregoing authorities passed upon or endorsed the merits of the

offering of the New Ordinary Shares, the Nil Paid Rights or the

Fully Paid Rights, or the accuracy or adequacy of the Provisional

Allotment Letters, this announcement or any other document

connected with the Rights Issue. Any representation to the contrary

is a criminal offence in the United States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for, Nil Paid Rights, Fully Paid Rights or

New Ordinary Shares or to take up any entitlements to Nil Paid

Rights in any jurisdiction. No offer or invitation to purchase or

subscribe for, or any solicitation to purchase or subscribe for,

Nil Paid Rights, Fully Paid Rights or New Ordinary Shares or to

take up any entitlements to Nil Paid Rights will be made in any

jurisdiction in which such an offer or solicitation is unlawful.

The information contained in this announcement and the Prospectus

is not for release, publication or distribution to persons in

Australia, Canada, Hong Kong, Singapore, the United Arab Emirates

and the United States, and any other jurisdiction where the

extension or availability of the Rights Issue (and any other

transaction contemplated thereby) would breach any applicable law

or regulation, and, subject to certain exceptions, should not be

distributed, forwarded to or transmitted in or into any

jurisdiction, where to do so might constitute a violation of local

securities laws or regulations.

The distribution of this announcement, the Prospectus, the

Provisional Allotment Letter and the offering or transfer of Nil

Paid Rights, Fully Paid Rights or New Ordinary Shares into

jurisdictions other than the United Kingdom may be restricted by

law, and, therefore, persons into whose possession this

announcement, the Prospectus, the Provisional Allotment Letter

and/or any accompanying documents comes should inform themselves

about and observe any such restrictions. Any failure to comply with

any such restrictions may constitute a violation of the securities

laws of such jurisdiction. In particular, subject to certain

exceptions, this announcement, the Prospectus (once published) and

the Provisional Allotment Letters (once printed) should not be

distributed, forwarded to or transmitted in or into Australia,

Canada, Hong Kong, Singapore, the United Arab Emirates and the

United States, or any other jurisdiction where the extension or

availability of the Rights Issue (and any other transaction

contemplated thereby) would breach any applicable law or

regulation.

This announcement does not constitute a recommendation

concerning any investor's options with respect to the Rights Issue.

The price and value of securities can go down as well as up. Past

performance is not a guide to future performance. The contents of

this announcement are not to be construed as legal, business,

financial or tax advice. Each shareholder or prospective investor

should consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice.

NOTICE TO ALL INVESTORS

Each of Goldman Sachs International ("Goldman Sachs"), J.P.

Morgan Securities plc (which conducts its UK investment banking

business as J.P. Morgan Cazenove) ("J.P. Morgan Cazenove"), Morgan

Stanley & Co. International plc ("Morgan Stanley") and

Citigroup Global Markets Limited ("Citi") is authorised by the

Prudential Regulation Authority and regulated by the FCA and the

Prudential Regulation Authority in the United Kingdom. Each of

Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley and Citi is

acting exclusively for Synthomer plc and no one else in connection

with this announcement and the Rights Issue will not be responsible

to anyone other than Synthomer plc for providing the protections

afforded to its clients nor for providing advice to any person in

relation to the Rights Issue or any matters referred to in this

announcement.

None of Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley or

Citi, nor any of their respective subsidiaries, branches or

affiliates, nor any of their respective directors, officers or

employees owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley or Citi in

connection with the Rights Issue, this announcement, any statement

contained herein, or otherwise.

INFORMATION TO DISTRIBUTORS

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Requirements"),

and disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Requirements) may otherwise have with

respect thereto, the Nil Paid Rights, Fully Paid Rights and the New

Ordinary Shares have been subject to a product approval process,

which has determined that they each are: (a) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in Chapter 3 of the FCA Handbook Conduct of Business

Sourcebook; and (b) eligible for distribution through all permitted

distribution channels (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, "distributors" (for

the purposes of the UK Product Governance Requirements) should note

that: the price of the Nil Paid Rights, Fully Paid Rights and the

New Ordinary Shares may decline and investors could lose all or

part of their investment; the Nil Paid Rights, Fully Paid Rights

and the New Ordinary Shares offer no guaranteed income and no

capital protection; and an investment in the Nil Paid Rights, Fully

Paid Rights and the New Ordinary Shares is compatible only with

investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to any contractual, legal or

regulatory selling restrictions in relation to the Rights Issue.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Underwriters will only procure investors who meet

the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (i) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A, respectively, of the FCA

Handbook Conduct of Business Sourcebook; or (ii) a recommendation

to any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to, the Nil Paid

Rights, Fully Paid Rights and the New Ordinary Shares. Each

distributor is responsible for undertaking its own target market

assessment in respect of the Nil Paid Rights, Fully Paid Rights and

the New Ordinary Shares and determining appropriate distribution

channels.

FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements, including

with respect to financial information, that are based on current

expectations or beliefs, as well as assumptions about future

events. These forward-looking statements can be identified by the

fact that they do not relate only to historical or current facts.

In some cases, forward-looking statements use words such as

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "will", "may", "should", "would", "could", "is

confident", or other words of similar meaning.

None of the Company, its officers, advisers or any other person

gives any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements in this announcement will actually

occur, in part or in whole.

No undue reliance should be placed on any such statements

because they speak only as at the date of this announcement and, by

their very nature, they are subject to known and unknown risks and

uncertainties and can be affected by other factors that could cause

actual results, and the Company's plans and objectives, to differ

materially from those expressed or implied in the forward-looking

statements. No representation or warranty is made that any

forward-looking statement will come to pass. You are advised to

read the Prospectus when published and the information incorporated

by reference therein in their entirety, and, in particular, the

section of the Prospectus headed "Risk Factors", for a further

discussion of the factors that could affect the Group's future

performance and the industry in which it operates. In light of

these risks, uncertainties and assumptions, the events described in

the forward-looking statements, including statements regarding

prospective financial information, in this announcement may not

occur. In addition, even if the Group's actual results of

operations, financial condition and the development of the business

sectors in which it operates are consistent with the

forward-looking statements contained in the Prospectus, those

results or developments may not be indicative of results or

developments in subsequent periods. These statements are not fact

and should not be relied upon as being

necessarily indicative of future results, and readers of this

announcement are cautioned not to place undue reliance on the

forward-looking statements, including those regarding prospective

financial information.

No statement in this announcement is intended as a profit

forecast or estimate for any period, and no statement in this

announcement should be interpreted to mean that underlying

operating profit for the current or future financial years would

necessarily be above a minimum level, or match or exceed the

historical published operating profit or set a minimum level of

operating profit, nor that earnings or earnings per share or

dividend per share for the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share or dividend per share for

the Company.

Neither the Company nor any of the Underwriters are under any

obligation to update or revise publicly any forward-looking

statement contained within this announcement, whether as a result

of new information, future events or otherwise, other than in

accordance with their legal or regulatory obligations (including,

for the avoidance of doubt, the Prospectus Regulation Rules, the

Listing Rules, MAR, FSMA and Disclosure Guidance and Transparency

Rules). Additionally, statements of the intentions or beliefs of

the board of directors of the Company reflect the present

intentions and beliefs of the board of directors of the Company as

at the date of this announcement and may be subject to change as

the composition of the board of directors of the Company alters, or

as circumstances require.

Synthomer PLC

6 FOR 1 FULLY UNDERWRITTEN RIGHTS ISSUE TO RAISE GROSS PROCEEDS

OF APPROXIMATELY GBP276 MILLION

1. INTRODUCTION TO THE RIGHTS ISSUE

Synthomer announces today that it proposes to raise gross

proceeds of approximately GBP276 million through a Rights

Issue.

Pursuant to the Rights Issue and taking into account the Capital

Reorganisation, Synthomer is proposing to offer 6 New Ordinary

Shares for every 1 Consolidated Ordinary Share held on the Record

Date.

This is equivalent to 6 New Ordinary Shares for every 20

Existing Ordinary Shares, based on a Consolidation Ratio of 1

Consolidated Ordinary Share in substitution for every 20 Existing

Ordinary Shares.

Taking into account the Capital Reorganisation, the Rights Issue

Price represents a discount of (83.8%) to the Consolidated Closing

Price on 6 September 2023 (the last Business Day prior to the date

of this announcement), and a discount of (42.5%) to the theoretical

ex-rights price of 343 pence per Existing Ordinary Share calculated

by reference to the Consolidated Closing Price on the same

basis.

The Rights Issue is fully underwritten (in respect of the

Non-KLK Rights Issue Shares) by Goldman Sachs International, J.P.

Morgan Securities plc, Morgan Stanley & Co. International plc

and Citigroup Global Markets Limited, and (in respect of the KLK

Rights Issue Shares) by KLK.

2. BACKGROUND TO THE RIGHTS ISSUE

2.1 SYNTHOMER'S STRATEGY AND STRENGTHS

Strengths

The Directors believe that the following are among the Group's

key competitive strengths:

(i) Global speciality chemicals company with leading positions

in its markets

Synthomer is a global speciality chemicals company which is one

of the world's leading suppliers of water-based polymers, with a

number of its product types holding market-leading positions

globally, as well as more specifically in Europe, the United States

and the Middle East.

As a speciality chemicals producer, the Group channels its

technical expertise, customer and end-market knowledge to help

customers develop these and other end products. The Group's

long-term customer partners benefit from the Group's knowledge and

understanding of their technical needs, the Group's customer

service and R&D, which has allowed the Group to develop

innovative solutions which help its customers' businesses.

As of 1 January 2023, the Group reorganised its divisional

structure along three new, market focused divisions, to better

serve the Group's end-market customers, comprised of: (i) Coatings

& Construction Solutions, (ii) Adhesive Solutions and (iii)

Health & Protection and Performance Materials. The new

divisions and the production areas and markets they focus on and

serve will be described in greater detail in the Prospectus.

The Coatings & Construction Solutions and Adhesive Solutions

divisions form the core strategic growth areas of the business. The

Health & Protection and Performance Materials division includes

the NBR base business as well as the business units which were

identified as non-core as part of the strategic review in 2022.

The Group's new Coatings & Construction Solutions division

brings together a range of the Group's businesses focused on the

coatings and construction end-markets, reflecting the Group's

strategy to strengthen its position in these markets and to improve

its portfolio through sustainable innovation and customer value

propositions. It is the Group's largest division in terms of both

revenue and EBITDA contribution. The Group is one of the leading

suppliers in Europe across each of the Group's key coatings and

construction products.

The Group's Adhesive Solutions division has one of the broadest

offerings of adhesive solutions products in the industry, with

leading manufacturing positions in EMEA and the Americas across all

tackifier product groups.

The Group's Health & Protection and Performance Materials

division includes products that enhance protection and performance

in a wide range of industries. Globally, the Group is the second

largest producer of NBR latex by volume (which the Group's

customers use in the manufacturing of medical gloves).

(ii) Attractive end-markets with strong long-term growth

outlook

The Group's portfolio of products serves a wide range of

geographies and end-markets. Within its core strategic growth

markets, served by its speciality businesses, there are significant

R&D capabilities and a high level of technical expertise

required to develop the chemical products the Group produces.

The Group's R&D is driven largely by its ability to apply

technical know-how, rather than on pure research, hence making it

difficult for new and less established entrants to compete in these

markets and across these product types. Moreover, the Group

believes that it tends to not only compete within these markets on

product price but that it also competes because of the quality of

technical services that the Group provides to customers alongside

the products themselves. The Group's new product development,

innovation, technical services provision and tailored solutions add

value to customers' end products and help differentiate the Group

from other competing companies. The Group also seeks to anticipate

market trends and customer requirements as it believes this will

continue to enable it to deliver improved products with better

margins and product differentiation among customers. Overall, this

allows the Group to maintain margins and protect against low-cost

market entrants.

In its base businesses, principally comprising the NBR business,

the Group believes it is able to leverage its market leading

position and will, by strengthening cost competitiveness and

driving customer intimacy, be able to harness the long-term demand

growth expected in this market.

The Group believes its presence in the end-markets for each of

the Group's divisions is supported by favourable market dynamics.

For example, the Group's speciality businesses within the Coatings

& Construction Solutions and Adhesive Solutions divisions were

successful in passing through substantial increases in raw material

and energy costs in 2022 in most of their markets, demonstrating

the resilience of these speciality businesses over base businesses.

Both divisions sustained EBITDA margins of 12% for the year ended

31 December 2022, despite unit material costs reaching record

levels in some cases. The Group's focus on more differentiated

products and robust pricing management contributed to solid

performance in most of the Group's major businesses in 2022,

particularly in the US.

The Group's continuing revenue by division for the 12 months

ending 30 June 2023 were: Coatings & Construction Solutions

(40.3%), Adhesive Solutions (29.5%), Health & Protection and

Performance Materials (30.2%).

The Group's diversified and customer focused approach enables

the Group to address changing conditions in the end-markets of each

of the Group's divisions :

Coatings & Construction Solutions

Both coatings and construction end-markets have historically

been driven by GDP+ growth, and require specialised, highly

differentiated products with sustainability benefits. The global

market for coatings and construction is estimated to grow at a CAGR

of approximately 4% per annum from 2020 to 2025.

-- Coatings : Increasing regulatory requirements and the Group's

customers' ambitions to use more sustainable products continues to

deliver growth opportunities for water-based coatings technology,

in which the Group is a leader amongst its peers.

-- Construction : The demand for the Group's portfolio of

construction products has been driven by favourable megatrends

including accelerated urbanisation and increased chemical usage due

to the increased professionalism of the construction business. The

Group's capabilities in innovation give the Group the potential to

grow its presence in these markets and the Group has a strong

innovation pipeline across the construction end-market.

-- Energy Solutions : As a supplier of speciality wellbore

chemicals, the Group offers a wide range of solutions including

fluid loss control and sealing, emulsifiers, lubricants and

rheological modifiers for drilling fluids. The Group also offers

flow control and properties enhancement in cementing operations,

gel additives for hydraulic fracturing fluids and strengthening

agents. The Group designs polymers that meet conventional and

unconventional drilling and completion requirements.

-- Consumer Materials : This part of the Group's business

comprises fibre bonding and SBR latex for foam applications.

Adhesive Solutions

The Group's Adhesive Solutions division serves growth

end-markets such as tapes and labels, packaging, and tyres which

are underpinned by sustainability trends and with strong revenue

synergies with the Group's other divisions. The overall market

demand for adhesive solutions is estimated to grow at a CAGR of

approximately 3-4% per annum from 2022 to 2025.

Across the Adhesive Solutions division, the Group has more than

300 customers and sells products in more than 600 locations around

the world. The Group has strong relationships with many of its

customers and certain end-users, with an average customer

relationship length of approximately 15 years and in many cases

much longer than that. This helps the Group understand the needs of

customers and develop a uniquely market focused innovation

pipeline. Within Adhesive Solutions, the Group is continuing to

focus on improving asset and supply chain reliability, broadening

the Group's raw material supply and reducing working capital and

cost levels. The Group is also exploring investment opportunities,

such as through the recently committed expansion in its capacity to

deliver speciality APOs.

Health & Protection and Performance Materials

Long-term demand for health and protection products is an

important megatrend underpinning the Group's strategy in Health

& Protection. The Group is a world leader in NBR, which the

Group's customers use for glove-dipping, and the leading NBR

producer, by volume, in Europe, which the Group's customers use in

a wide range of end-markets. The Group's NBR products serve a

fast-growing market which is expected to grow at a rate of 6%+

during the coming years The Group has responded to these market

trends through significant R&D investment to drive innovation

of market leading products with strong intellectual property

protection, investment in new low-cost capacity and efficient

capacity utilisation.

In the Health & Protection and Performance Materials

division, the Group continues to work towards strengthening the

overall cost competitiveness of the Group's Malaysian supply chain

and to enhancing customer intimacy and the Group's share of demand

globally.

The price of NBR has been volatile over the past three years.

Initially, increased demand for medical gloves drove high prices

during the COVID-19 pandemic, which were then followed more

recently by historical lows, as a result of destocking by the

Group's end-users and their customers. However, underlying end

customer demand for medical gloves remains similar to pre-COVID-19

pandemic levels and the market is expected to continue to grow in

the medium-term (including as a result of urbanisation and

healthcare in emerging markets), while the impact of destocking is

expected to abate as end-users and customers make use of their

existing inventories at pre-COVID-19 rates.

(iii) Global footprint with balanced geographic exposure and

strong customer relationships

As at 30 June 2023, Synthomer has 36 sites (taking account of

announced closures) across 17 countries in the Americas, EMEA and

Asia. It has a balanced geographic exposure with 48% of revenues

for the year ended 31 December 2022 generated in Europe, 19% in

Asia, 27% in North America, and 6% in the rest of the world.

The Group served approximately 6,000 customers across the world

in the year ended 31 December 2022, including many global blue-chip

companies. The Group believes it has strong and long-term customer

relationships. The Group's customer base is widespread and well

balanced across geographies and end-markets. For the year ended 31

December 2022, the Group's largest customer represented

approximately 2% of total revenues while revenues from the Group's

twenty largest customers represented approximately 22% of total

revenues. Some examples of key customers include: 1) with respect

to Coatings & Construction Solutions - PPG Industries, Inc.,

Sherwin Williams Company, Akzo Nobel N.V., Sika AG, Proctor &

Gamble Company and Haliburton Company; 2) with respect to Adhesive

Solutions - Henkel Ltd, HB Fuller Company, Shurtape Technologies,

LLC, Pirelli & C. S.p.A. and Continental AG; and 3) with

respect to Health & Protection and Performance Materials - Top

Glove Corporation Bhd, Sappi Limited, Honeywell International,

Inc., Lanxess AG and BASF SE .

(iv) Impressive track record and pipeline of new product

development through customer focused R&D

The Group has an impressive track record and pipeline of new

product development through customer focused R&D which supports

the Group's growth potential. The Group maintains four Centres of

Excellence as part of an innovation network comprising sites across

the world. The Group's four Centres of Excellence include sites in

Germany and the US, as well as the new industry leading Asia

Innovation Centre established in 2019. For the year ended 31

December 2022, the Group invested GBP33.7 million in R&D and

launched 18 new products. These investments in R&D continue to

have a significant effect on the Group's revenues, with 20% of the

Group's sales volume for the year ended 31 December 2022 derived

from products that the Group developed in the previous five years

or with patent protection. Since 2019, the Group has filed patent

applications on 39 new inventions and registered 16 new patents.

The Group is committed to quantifying, improving and communicating

the sustainability of all the Group's activities through Global

Reporting Initiative reporting.

(v) Sustainability embedded in products and a tailwind for

future growth

Sustainability is a key trend that will drive demand from

Synthomer's customers. Regulation is driving the requirement for

cleaner, more environmentally friendly solutions, and for renewable

raw materials. The Group's portfolio is positioned to help drive

circular solutions (for example, recyclable packaging) and the

Group's high-performance water-based polymers can displace

solvent-borne polymers, leading to further demand for the Group's

products. As a market leader in water-based and emission reducing

polymers, this creates a huge opportunity for Synthomer. The Group

is targeting 60% of its new products to have sustainability

benefits by 2030.

Synthomer has a long track record of helping customers towards

their own sustainability goals. The Group's emission-reducing

solutions and lower-carbon intensity operations all make a positive

contribution towards customers' Scope 3 carbon footprints.

Synthomer's capabilities and products can help customers in

multiple areas, whether that is replacing solvent-based coatings

with water-based alternatives, developing water-based polymers and

re-dispersible powders for construction customers, or innovating

bio-based, low-carbon footprint and circular solutions for

adhesives.

(vi) Deliverable medium-term targets supporting shareholder

value creation

At Synthomer's Capital Markets Day in October 2022, the Group

laid out financial targets which will drive sustained value for

shareholders. These include:

-- Organic revenue growth: Mid-single-digit through the cycle,

supported by innovation, sustainability and end-market focus;

-- EBITDA margins: 15%+ over the medium-term, delivery of this

will be underpinned by a combination of innovation, a higher mix of

speciality products, cost leadership and operational excellence;

and

-- Return on invested capital: Mid-teens over the medium-term,

supported by stronger organic growth, higher margins and the

Company's more focused capital allocation policy.

Strategy

The Group's growth strategy is driven by global megatrends and

the Group is focused on driving sustainable growth through business

efficiency, R&D and capital investment projects.

The Group's strategy is composed of the following key

pillars:

(i) Organic growth in attractive end-markets

The Group's core strategic growth markets, comprising coatings,

construction, adhesives, and health and protection, each benefit

from robust GDP+ growth dynamics. These markets are driven by

accelerating global megatrends including accelerating urbanisation,

demographic and social change, climate change and sustainability

and shifting economic power. In October 2022, as part of its new

strategy, the Group announced a new divisional organisational

structure aligning the Group's organisation with its core markets.

This alignment of operational segments and end-markets is expected

to assist the Group in anticipating and meeting customers' needs at

pace and deliver better products with improved margin and product

differentiation.

Innovation and sustainable products, such as water-based

solutions displacing solvents in the construction, coatings and

adhesives markets, are key drivers of growth across the Group's

core markets and developing products through focused

customer-centric R&D is a key component of the Group's

strategy. For the year ended 31 December 2022, 20% of the Group's

sales volumes derived from products that the Group launched in the

previous five years. In the year ended 31 December 2022, the Group

launched 18 new products across multiple application areas.

(ii) Rigorous and consistent portfolio management to build

focused, leading positions

As part of focusing the business, the Group intends to increase

the weighting of speciality chemicals versus base chemicals in the

Group's portfolio, create a more balanced geographic exposure,

streamline operational footprint and apply more rigorous capital

allocation across the Group's businesses.

The Group's strategic review in 2022 identified its core

markets, which combine the most attractive growth prospects and

where the Group is most differentiated. The Group will focus its

resources on these segments and the new divisional structure

enables differentiated steering in the allocation of financial and

operational resources.

In addition, the Group identified a number of non-core

businesses which have limited synergies with the rest of the

Group's identified growth platforms and which are less attractive

areas for the Group to deploy its capital. In line with its

strategy, on 28 February 2023, the Group announced that it

completed the disposal of its Laminates, Films and Coated Fabrics

Businesses, which were identified as non-core businesses through

the strategic review. Moving forward, the Group will continue to

assess its strategic position in terms of disposing of non-core

businesses to rationalise the Group's portfolio, reduce complexity

and increase the Group's focus on attractive end-markets and

speciality products.

Over the medium-term, the Group's strategic plan will involve

targeted M&A to grow the business once leverage is restored to

the guided range. The Group will continue to review speciality

chemicals acquisition opportunities through both bolt-on

acquisitions and more transformational step-change strategic

transactions in adjacent chemistries and geographies, if the Group

identifies appropriate acquisition targets and believes that the

Group has sufficient balance sheet flexibility to do so at that

time.

(iii) Operational and commercial excellence in how the Group

runs the business

The Group is focused on continuous improvement across its

operations to advance production efficiency, sales effectiveness

and functional excellence while remaining committed to the Group's

sustainability standards. To achieve these aims, the Group seeks to

identify good practice in all areas of the business and ensure that

relevant learnings are disseminated across the business.

The Group aims to drive profitability through maximising the

utilisation of the Group's assets. To achieve this, the Group

focuses on identifying the root causes of production bottlenecks

and finding innovative solutions. For example, at the Sant Albano

site in Italy, the Group has reduced water extraction by 30% by

reconfiguring the borehole management process.

For decades, the Group has been a world leading supplier of

sustainable water-based polymers that avoid the use of solvents and

keep harmful volatile organic compounds out of the atmosphere. The

Group has also become a global innovator in driving the use of

water-based technology. Over the last few years, the Group has

worked hard to improve its ESG credentials while remaining

committed to driving efficiency. This can be seen with the launch

of the Group's 2030 Vision, which sets ESG targets for the Group

and a roadmap to achieve them, as well as the creation of the

Group's Executive Sustainability Steering Committee last year.

(iv) Differentiated steering to address the differentiated

positions across the Group's portfolio

The Group's new divisional structure enables differentiated

steering of the allocation of financial and operational resources,

including capital allocation. The Group intends to allocate

approximately 75% of capital to the Coatings & Construction

Solutions and Adhesive Solutions divisions and approximately 25% to

the Health & Protection and Performance Materials division over

the medium-term.

(v) Diversity, equity and inclusion and holistic people

development

Across all businesses in the Group, the Group's employees drive

strategy and deliver for all stakeholders and the Group continues

to develop them to be prepared for the opportunities and challenges

that lie ahead. To support this, the Group is implementing four

strategic employee priorities: (i) promoting holistic people

development; (ii) strengthening its leadership capability; (iii)

embracing Synthomer excellence; and (iv) establishing an innovative

workplace culture.

2.2 CHALLENGING MARKET BACKDROP AND OTHER FACTORS HAVE

SIGNIFICANTLY, BUT ONLY TEMPORARILY, WEAKENED RECENT

PERFORMANCE

Over the last 18 months, Synthomer has navigated an extremely

challenging market backdrop, during which time a temporary weakness

in demand across most of its end-markets and geographies have

significantly affected financial performance. In 2020 and 2021, the

COVID-19 pandemic created exceptional demand for NBR, used in the

manufacture of medical gloves. Since then, as a result of the

elevated inventory levels of medical gloves and new capacity added

during the COVID-19 pandemic, there has been a prolonged and

unprecedented period of oversupply, resulting in far weaker levels

of demand for NBR. The Russian military action in Ukraine

contributed further to economic volatility, with the Company

impacted by supply chain disruptions, sustained higher raw material

costs and sharp rises in the cost of energy. More recently, the

high inflation environment and resultant interest rate rises have

slowed industrial activity and led to subdued levels of demand

across most of the Group's end-markets, exacerbated by destocking

and increased competition, including from Asia, in some of

Synthomer's base chemical product ranges. Volumes have also been

adversely impacted in the Adhesive Solutions division by

constrained access to raw materials and site reliability

challenges, which the Company is in the process of resolving under

a new divisional leadership team.

As a result of these factors, the Group's earnings have reduced

temporarily but significantly, and combined with the debt taken on

to finance the Eastman Acquisition has resulted in the Group's

leverage increasing significantly, to 5.5x covenant net debt, based

on EBITDA as at 30 June 2023.

2.3 SUBSTANTIAL AND DECISIVE MANAGEMENT ACTIONS SUCCESSFULLY

EXECUTED TO PRESERVE CASH AND MANAGE DEBT IN RESPONSE

The management team and the Board have taken substantial and

decisive actions to strengthen the business and the balance sheet

to manage through this challenging period. Synthomer strengthened

its financial liquidity position, refinancing the Revolving Credit

Facility and putting in place the UKEF Facilities and the Factoring

Facilities. The Group extended covenant headroom in October 2022

and also as part of the Revolving Credit Facility refinancing in

March 2023. As at 30 June 2023, Synthomer had committed and

available liquidity of more than GBP 400 million. The Company also

initiated a GBP150-200 million cash management programme, which

included a reduction and re-prioritisation of capital expenditure,

including the downsizing or deferral of a number of growth

opportunities, working capital optimisation and a suspension of the

dividend. The Group also identified approximately GBP30 million in

'self-help' cost-saving measures on a run-rate basis in 2022, with

approximately GBP20 million remaining to be delivered during the

second half of 2023, including actions within the Adhesive

Solutions division. In line with its portfolio rationalisation

strategy, the Company also completed the disposal of the Laminates,

Films and Coated Fabrics Businesses in February 2023, generating

total net proceeds of $269 million.

On 5 September 2023, Synthomer entered into the RCF Amendment

and Extension to the Revolving Credit Facility with the RCF

Lenders, which is subject to and conditional upon, among other

things, the Company's receipt of the proceeds from the Rights

Issue. If effective, the RCF Amendment and Extension will, amongst

other matters, reduce the total commitments under the Revolving

Credit Facility from $480 million to $400 million, and extend the

maturity date from 31 May 2025 to 31 July 2027.

2.4 EARNINGS POWER OF THE GROUP IS MORE THAN DOUBLE CURRENT LEVELS IN THE MEDIUM-TERM

The Group generated GBP158 million of EBITDA in the 12 months to

June 2023 from continuing operations. This reflects reduced

industrial demand, destocking, medical glove oversupply and the

reliability issues relating to the Adhesive Resins Business. The

Board believes that the earnings power of the Group is more than

double current levels based on a combination of executing its

near-term management actions, end-market volume recovery, and

delivery of the Group's strategy. Near-term actions include

approximately GBP20 million in self-help cost savings, whilst

end-market recovery has the potential to generate more than GBP100

million in additional EBITDA across the business, as outlined

below.

While Coatings & Construction Solutions has seen encouraging

progress in the first half of 2023, led by the speciality products

within its portfolio, the Group expects further recovery potential.

The division generated average EBITDA of approximately GBP110

million per annum in 2021 and 2022. This compares to LTM EBITDA of

GBP96 million for the period ending 30 June 2023. The Group

anticipates a full recovery as demand in the division's end-markets

recovers and the destocking cycle abates.

The Adhesive Resins Business acquired from Eastman, which makes

up the majority of the Adhesive Solutions division, generated

EBITDA of approximately GBP71 million in the 12 months to June

2021. Factoring in a further approximately GBP24 million of EBITDA

from legacy Synthomer businesses that now form part of the

division, the Adhesive Solutions division generated EBITDA of

approximately GBP95 million in LTM June 2021, before the identified

run-rate acquisition costs synergies of approximately GBP23 million

per annum (approximately GBP118 million in total). This compares to

LTM EBITDA of GBP48 million for the period ending 30 June 2023.

Synthomer is highly confident that the performance of the acquired

Eastman business will improve towards these levels, as demand

recovers and destocking ends, supported by the Group's performance

improvement plan and other self-help actions (including the

executed synergy actions). The Group also continues to make

investments in capacity and other growth opportunities in certain

key speciality products, such as the recently announced expansion

of speciality amorphous polyolefins in North America, which are

also expected to drive growth.

Synthomer's NBR business, which is part of the Health &

Protection and Performance Materials division, operates in a market

where underlying end-use volume growth rates are consistent with

pre-COVID-19 pandemic levels, supported by rising hygiene standards

and increasing access to healthcare in emerging markets where the

current medical glove consumption base is low. However, production

levels have been exceptionally low due to elevated stock built up

during the COVID-19 pandemic, as well oversupply in the market as a

result of new capacity introduced in response to unprecedented

demand. Prior to the COVID-19 pandemic, the NBR business in 2018

and 2019 generated average EBITDA of approximately GBP70 million

per annum compared to LTM EBITDA of GBP5 million for the period

ending 30 June 2023. The Group has announced plans to reduce its

own NBR capacity (by approximately 20%) by consolidating production

and closing a legacy plant and notes that other participants in the

market have also begun to adjust capacity in response to current

market conditions, with the current oversupply situation therefore

expected to resolve over time. Synthomer is confident in recovery

over time towards levels achieved pre-COVID-19 pandemic as the

medical glove oversupply normalises, demand growth continues

supported by the hygiene megatrend and the supply side adjust to

post-COVID-19 pandemic conditions.

While visibility remains low, the Board believes Group volumes

reached a cyclical trough in the first half of 2023, and the Board

does not expect further demand deterioration in key end-markets in

the second half of the year.

3. STRONGER FOUNDATIONS, SUPPORTED BY VOLUME RECOVERY, WILL

UNDERPIN DELIVERY OF THE GROUP'S MEDIUM-TERM AMBITIONS

The Board believes that a reduction in Synthomer's current

elevated leverage position will enable the Group to increase focus

on strategic execution and long-term value creation in addition to

short-term cash preservation as well as reducing the downside risks

from near-term macroeconomic uncertainty for all stakeholders. This

will also ensure that the Company is well-positioned to deliver its

strategy and medium-term ambitions for profitable growth as demand

recovers. It is accordingly announcing a fully underwritten rights

issue to raise total proceeds of GBP276 million, with an

irrevocable commitment received from KLK to subscribe for their

pro-rata entitlements in full. This will increase covenant headroom

and strategic and financial flexibility, resulting in a pro forma

reduction in the covenant net debt based on EBITDA ratio from 5.5x

to 3.8x as at 30 June 2023. Reducing leverage further towards the

1-2x target range by the end of 2024 remains a key priority. This

will be supported by further divestment proceeds and earnings power

more than doubling over the medium-term through continued cost

control, volume recovery and strategic delivery.

In summary, the Board believes the Rights Issue will allow the

Company to focus its resources on strategic execution and long-term

value creation for shareholders from its platforms of leading

businesses in attractive growth segments .

4. USE OF PROCEEDS

The Rights Issue is expected to raise approximately GBP276

million in gross proceeds and approximately GBP261 million in net

proceeds (after deduction of estimated commissions, fees and

expenses). The net proceeds will initially be utilised to reduce

borrowings under the Revolving Credit Facility and provide

flexibility to deliver the Group's strategy and manage balance

sheet leverage. The Rights Issue will result in a pro forma

reduction in the covenant net debt based on EBITDA ratio from 5.5x

to 3.8x as at 30 June 2023.

5. CURRENT TRADING AND OUTLOOK

Trading in July and August was similar to the 2023 Half Year

Results, with limited visibility and subdued volumes given

challenging macro conditions. The Group's outlook for the remainder

of 2023 provided in July is reiterated: the Board does not

anticipate a material recovery in customer demand before the end of

the current year. However, the Board anticipates approximately

GBP20 million in self-help measures to be delivered mainly in the

second half of 2023. Overall, the Group remains confident of making

sequential progress in the second half relative to the first.

The Group continues to take decisive action to strengthen its

business so that it is positioned for profitable growth when demand

does begin to recover. As stated elsewhere, through the Group's

near-term actions, end market volume recovery (which alone has the

potential to improve Group EBITDA by more than GBP100 million over

time) and execution of the strategy, the Board believes the Group's

medium-term earnings power is more than double the GBP158 million

of continuing EBITDA generated over the year to the end of June

2023. Reducing leverage further toward the 1-2x target range

remains a key priority. Overall, the Board remains confident in the

Group's ability to deliver the medium-term targets set out last

October, which were mid-single-digit growth in constant currency

over the cycle, EBITDA margins above 15% and mid-teens return on

invested capital.

6. RISK FACTORS AND FURTHER INFORMATION

Shareholders should consider fully and carefully the risk

factors associated with Synthomer, as set out in the

Prospectus.

Shareholders should read the whole of the Prospectus and not

rely solely on the information set out in this announcement.

7. DIVIDS AND DIVID POLICY

In October 2022, as part of a covenant amendment process with

the Group's banking syndicates to give the Group increased

headroom, Synthomer suspended dividend payments, including the

interim dividend of 4p announced on 12 October 2022 that was due to

be paid in November 2022.

Whilst the Company will continue to prioritise reducing leverage

towards its 1-2x target range by the end of 2024 and execution of

strategy, including sustainability commitments and predominantly

organic-led growth in the near-term, it recognises the importance

of dividends for Shareholders and therefore will look to reinstate

a dividend when appropriate to do so .

8. CAPITAL REORGANISATION

The Capital Reorganisation, comprised of the Sub-division and

the Share Consolidation, is proposed in order to achieve a higher

market price for the Consolidated Ordinary Shares and, accordingly,

a more appropriate Rights Issue Price.

Under the Capital Reorganisation:

-- each Existing Ordinary Share of 10 pence nominal value will

be subdivided and converted into one Intermediate Share of 0.05

pence nominal value and 1 Deferred Share of 9.95 pence nominal

value; and

-- immediately thereafter, every 20 Intermediate Shares of 0.05

pence nominal value will be consolidated into 1 Consolidated

Ordinary Share of 1 pence nominal value.

The Existing Ordinary Shares will be consolidated such that

Shareholders will receive Consolidated Ordinary Shares on the

Consolidation Ratio of 1 Consolidated Ordinary Share in

substitution for every 20 Existing Ordinary Shares. Following

Consolidation, the Consolidated Ordinary Shares will have the same

rights as the Existing Ordinary Shares, including voting, dividend

and other rights.

The purpose of the Deferred Shares is solely to facilitate the

reduction in the nominal value of the Shares to 1 pence . The

Deferred Shares will be effectively valueless as they will carry

very limited rights, including no voting or dividend rights. The

Company has the right to acquire and then cancel the Deferred

Shares for an aggregate price of GBP0.01 and intends to exercise

this right immediately following the creation of the Deferred

Shares. Further information on the Deferred Shares will be set out

in the Prospectus.

Immediately following the implementation of the Capital

Reorganisation, the market price of a Consolidated Ordinary Share

should be approximately equal to a multiple of 20 times the market

price of an Existing Ordinary Share immediately beforehand. The

Consolidation Ratio used for the Share Consolidation has been set

by the Directors after consultation with the Underwriters. Existing

Shareholders will own the same proportion of the Company as they

did immediately prior to the implementation of the Share

Consolidation, subject only to fractional rounding.

The Closing Price of each Existing Ordinary Share on 6 September

2023 (being the last Business Day prior to the date of the

Prospectus) was 60.8 pence (as derived from the Daily Of cial List

of London Stock Exchange plc). In accordance with the Consolidation

Ratio, the Consolidated Closing Price of each Consolidated Ordinary

Share would have been 1,216 pence on that date.

The Capital Reorganisation, if approved by Shareholders, will be

made by reference to holdings of Existing Ordinary Shares on the

Company's register of members as at 6.00 p.m. on 25 September 2023

(or such other time or date as the Directors may determine).

Holdings of Existing Ordinary Shares in certi cated and uncerti

cated form will be treated as separate holdings for the purpose of

calculating entitlements under the Rights Issue. Fractions of New

Ordinary Shares will not be allotted to Qualifying Shareholders and

fractional entitlements will be rounded down to the nearest whole

number of New Ordinary Shares.

Any fractional entitlements to Consolidated Ordinary Shares

which arise will be aggregated into whole Consolidated Ordinary

Shares and sold in the market on behalf of the relevant

Shareholders. The total proceeds of the sale (net of related

expenses (including any applicable brokerage fees and commissions

and amounts in respect of related irrecoverable VAT)) will be paid

in due proportion to each of the relevant Shareholders. Any

proceeds of sale (net of related expenses (including any applicable

brokerage fees and commissions and amounts in respect of related

irrecoverable VAT)) to each of the relevant Shareholder(s) of less

than GBP5.00 will be aggregated and will accrue for the bene t of

the Company.

It is expected that dealings in the Existing Ordinary Shares

will continue until close of business on 25 September 2023 and

admission of the Consolidated Ordinary Shares to the premium

listing segment of the Of cial List and to trading on the London

Stock Exchange's main market for listed securities will become

effective at 8.00 a.m. on 26 September 2023.

If you hold Existing Ordinary Shares in certi cated form, you

will be issued with a new share certi cate in respect of your

Consolidated Ordinary Shares following the issue of Consolidated

Ordinary Shares.

With effect from Admission, share certi cates in respect of

Existing Ordinary Shares will cease to be valid. Share certi cates

in respect of Consolidated Ordinary Shares will only be issued

following the Share Consolidation. It is therefore important that,

if you hold certi cate(s) in respect of your Existing Ordinary

Shares, you retain them for the time being until share certi cates

in respect of Consolidated Ordinary Shares are despatched, which is

expected to be within 10 Business Days of Admission. On receipt of

share certi cates in respect of Consolidated Ordinary Shares, certi

cates in respect of Existing Ordinary Shares can be destroyed.

If you currently hold Existing Ordinary Shares in uncerti cated

form, it is currently expected that the Existing Ordinary Shares

under ISIN GB0009887422 will be disabled by 6.00 p.m. on the day

before Admission (which such date is currently expected to be 25

September 2023) and on or soon after 8.00 a.m. on Admission (which

is currently expected to be 26 September 2023) your CREST account

will be credited with Consolidated Ordinary Shares under ISIN

GB00BNTVWJ75. Your CREST account will also be credited with the New

Ordinary Shares (nil paid) under the Rights Issue. The ISIN for the

New Ordinary Shares will be that of the Consolidated Ordinary

Shares.

Temporary documents of title will not be issued in respect of

Consolidated Ordinary Shares and, pending despatch of de nitive

share certi cates, transfers of Consolidated Ordinary Shares held

in certi cated form will be certi ed against the register of

members.

All share certi cates will be sent by rst class post, at the

risk of the Shareholder(s) entitled thereto, to the registered

address of the relevant Shareholder (or, in the case of joint

Shareholders, to the address of the joint Shareholder whose name

stands rst in the register of members in respect of such joint

shareholding).

9. PRINCIPAL TERMS AND CONDITIONS OF THE RIGHTS ISSUE

9.1 OVERVIEW

Synthomer proposes to raise gross proceeds of approximately

GBP276 million (approximately GBP261 million after deduction of

estimated commissions, fees and expenses) by way of the Rights

Issue.

(A) PRICING

Taking into account the Capital Reorganisation, the Rights Issue

Price represents a discount of 83.8% to the Consolidated Closing

Price on 6 September 2023 (being the latest practicable date prior

to the date of this announcement), and a discount of 42.5% to the

theoretical ex-rights price of 343 pence per Existing Ordinary

Share calculated by reference to the Consolidated Closing Price on

the same basis. Upon completion of the Capital Reorganisation and

the Rights Issue, the New Ordinary Shares will represent

approximately 600% of the Company's Consolidated Ordinary Shares

that will be in issue immediately following the Share Consolidation

and approximately 85.7% of the Company's enlarged issued share

capital following the Capital Reorganisation and the Rights

Issue.

The Rights Issue Price has been set, following discussions with

major Shareholders, at the level which the Board considers

necessary to ensure the success of the Rights Issue, taking into

account the aggregate proceeds to be raised. The Board believes

that the Rights Issue Price, and the discount which it represents,

is appropriate.

(B) DILUTION

The Rights Issue will result in 140,200,818 New Ordinary Shares

being issued and, taking into account the Capital Reorganisation,

the number of Ordinary Shares being increased by approximately

600%.

If a Qualifying Shareholder does not (or is not permitted to)

take up any New Ordinary Shares under the Rights Issue, such

Qualifying Shareholder's shareholding in Synthomer will be diluted

by 85.7% as a result of the Rights Issue.