TIDMSYNT

RNS Number : 5883N

Synthomer PLC

28 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, HONG

KONG, SINGAPORE, THE UNITED ARAB EMIRATES AND THE UNITED STATES AND

ANY OTHER JURISDICTION TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NOTHING HEREIN SHALL

CONSTITUTE AN OFFERING OF ANY SECURITIES. NOTHING IN THIS

ANNOUNCEMENT SHOULD BE INTERPRETED AS A TERM OR CONDITION OF THE

RIGHTS ISSUE. ANY DECISION TO PURCHASE, SUBSCRIBE FOR, OTHERWISE

ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY NIL PAID RIGHTS, FULLY

PAID RIGHTS OR NEW ORDINARY SHARES MUST BE MADE ONLY ON THE BASIS

OF THE INFORMATION CONTAINED IN THE PROSPECTUS. PLEASE SEE THE

IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

SYNTHOMER PLC

ADMISSION OF NIL PAID RIGHTS

28 September 2023

Synthomer plc (the " Company ") announces that, pursuant to the

Rights Issue announced on 7 September 2023, 140,200,818 New

Ordinary Shares will be admitted, nil paid, to listing on the

premium segment of the Official List of the FCA and will be

admitted, nil paid, to trading on London Stock Exchange plc's main

market for listed securities at 8.00 a.m. today.

The Record Date for entitlements under the Rights Issue was the

close of business on 26 September 2023. Provisional Allotment

Letters have been posted to Qualifying Non-CREST Shareholders

(other than, subject to certain limited exceptions, Qualifying

Non-CREST Shareholders with registered addresses, or who are

resident or located, in any of the Excluded Territories). CREST

stock accounts of Qualifying CREST Shareholders (other than,

subject to certain limited exceptions, Qualifying CREST

Shareholders with registered addresses, or who are resident or

located, in any of the Excluded Territories) are expected to be

credited with Nil Paid Rights in as soon as practicable after 8.00

a.m. today.

Capitalised terms used but not otherwise defined in this

announcement have the meanings shall have the meanings set out in

the Prospectus, which is available on the Company's website at:

https://www.synthomer.com/investor-relations/ .

For further information, please contact:

Synthomer plc IR@synthomer.com

Michael Willome +44 (0) 1279 775 306

Lily Liu

Faisal Tabbah

J.P. Morgan Cazenove (Sole Sponsor, Joint Corporate Broker, Joint Bookrunner and Joint Global

Coordinator)

Richard Perelman

Alia Malik

Charles Oakes

Will Holyoak +44 (0) 20 7742 4000

---------------------

Morgan Stanley (Joint Corporate Broker, Joint Bookrunner and Joint Global Coordinator)

Andrew Foster

Shirav Patel

Alex Smart

Emma Whitehouse +44 (0) 20 7425 8000

---------------------

Goldman Sachs (Joint Bookrunner and Joint Global Coordinator)

Nick Harper

Bertie Whitehead

Clemens Tripp

Warren Stables +44 (0) 20 7774 1000

---------------------

Citi (Joint Bookrunner)

Robert Way

Sean Weissenberger

Patrick Evans

Ram Anand +44 (0) 20 7500 5000

---------------------

Teneo

Charles Armitstead +44 (0) 20 3603 5220

---------------------

IMPORTANT NOTICES

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy, fairness or completeness. The

information in this announcement is subject to change without

notice.

This announcement is not a prospectus (or a prospectus

equivalent document) but an advertisement for the purposes of the

Prospectus Regulation Rules of the Financial Conduct Authority ("

FCA "). Neither this announcement nor anything contained in it

shall form the basis of, or be relied upon in conjunction with, any

offer or commitment whatsoever in any jurisdiction. Investors

should not acquire any Nil Paid Rights, Fully Paid Rights or New

Ordinary Shares referred to in this announcement except on the

basis of the information contained in the Prospectus published by

the Company in connection with the Rights Issue.

A copy of the Prospectus is available from the registered office

of the Company and on its website at

www.synthomer.com/investor-relations/. Neither the content of the

Company's website nor any website accessible by hyperlinks on the

Company's website is incorporated in, or forms part of, this

announcement. The Prospectus provides further details of the New

Ordinary Shares, the Nil Paid Rights and the Fully Paid Rights

being offered pursuant to the Rights Issue.

This announcement (and the information contained herein) is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in, into or within the United States of

America, its territories and possessions, any State of the United

States or the District of Columbia (collectively, the " United

States "). This announcement is not an offer for sale or the

solicitation of an offer to purchase securities in the United

States. Securities may not be offered or sold in the United States

absent registration under the US Securities Act of 1933, as amended

(the " US Securities Act "), or an exemption therefrom. The Nil

Paid Rights, the Fully Paid Rights and the New Ordinary Shares have

not been and will not be registered under the US Securities Act or

under any securities laws of any state or other jurisdiction of the

United States and may not be offered, sold, pledged, taken up,

exercised, resold, renounced, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States or other jurisdiction.

There will be no public offer of the Nil Paid Rights, the Fully

Paid Rights or the New Ordinary Shares in the United States.

Subject to certain limited exceptions, Provisional Allotment

Letters have not been, and will not be, sent to, and Nil Paid

Rights have not been, and will not be, credited to the CREST

account of, any Qualifying Shareholder with a registered address in

or that is known to be located in the United States, or to holders

of the Synthomer's American depositary shares. None of the New

Ordinary Shares, the Nil Paid Rights, the Fully Paid Rights or the

Provisional Allotment Letters, this announcement or any other

document connected with the Rights Issue has been or will be

approved or disapproved by the United States Securities and

Exchange Commission or by the securities commissions of any state

or other jurisdiction of the United States or any other regulatory

authority, nor have any of the foregoing authorities passed upon or

endorsed the merits of the offering of the New Ordinary Shares, the

Nil Paid Rights or the Fully Paid Rights, or the accuracy or

adequacy of the Provisional Allotment Letters, this announcement or

any other document connected with the Rights Issue. Any

representation to the contrary is a criminal offence in the United

States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for, Nil Paid Rights, Fully Paid Rights or

New Ordinary Shares or to take up any entitlements to Nil Paid

Rights in any jurisdiction. No offer or invitation to purchase or

subscribe for, or any solicitation to purchase or subscribe for,

Nil Paid Rights, Fully Paid Rights or New Ordinary Shares or to

take up any entitlements to Nil Paid Rights will be made in any

jurisdiction in which such an offer or solicitation is unlawful.

The information contained in this announcement and the Prospectus

is not for release, publication or distribution to persons in

Australia, Canada, Hong Kong, Singapore, the United Arab Emirates

and the United States, and any other jurisdiction where the

extension or availability of the Rights Issue (and any other

transaction contemplated thereby) would breach any applicable law

or regulation, and, subject to certain exceptions, should not be

distributed, forwarded to or transmitted in or into any

jurisdiction, where to do so might constitute a violation of local

securities laws or regulations.

The distribution of this announcement, the Prospectus, the

Provisional Allotment Letter and the offering or transfer of Nil

Paid Rights, Fully Paid Rights or New Ordinary Shares into

jurisdictions other than the United Kingdom may be restricted by

law, and, therefore, persons into whose possession this

announcement, the Prospectus, the Provisional Allotment Letter

and/or any accompanying documents comes should inform themselves

about and observe any such restrictions. Any failure to comply with

any such restrictions may constitute a violation of the securities

laws of such jurisdiction. In particular, subject to certain

exceptions, this announcement, the Prospectus (once published) and

the Provisional Allotment Letters (once printed) should not be

distributed, forwarded to or transmitted in or into Australia,

Canada, Hong Kong, Singapore, the United Arab Emirates and the

United States, or any other jurisdiction where the extension or

availability of the Rights Issue (and any other transaction

contemplated thereby) would breach any applicable law or

regulation.

This announcement does not constitute a recommendation

concerning any investor's options with respect to the Rights Issue.

The price and value of securities can go down as well as up. Past

performance is not a guide to future performance. The contents of

this announcement are not to be construed as legal, business,

financial or tax advice. Each shareholder or prospective investor

should consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice.

NOTICE TO ALL INVESTORS

Each of Goldman Sachs International (" Goldman Sachs "), J.P.

Morgan Securities plc (which conducts its UK investment banking

business as J.P. Morgan Cazenove) (" J.P. Morgan Cazenove "),

Morgan Stanley & Co. International plc (" Morgan Stanley ") and

Citigroup Global Markets Limited (" Citi ") is authorised by the

Prudential Regulation Authority and regulated by the FCA and the

Prudential Regulation Authority in the United Kingdom. Each of

Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley and Citi is

acting exclusively for Synthomer plc and no one else in connection

with this announcement and the Rights Issue will not be responsible

to anyone other than Synthomer plc for providing the protections

afforded to its clients nor for providing advice to any person in

relation to the Rights Issue or any matters referred to in this

announcement.

None of Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley or

Citi, nor any of their respective subsidiaries, branches or

affiliates, nor any of their respective directors, officers or

employees owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Goldman Sachs, J.P. Morgan Cazenove, Morgan Stanley or Citi in

connection with the Rights Issue, this announcement, any statement

contained herein, or otherwise.

INFORMATION TO DISTRIBUTORS

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the " UK Product Governance Requirements "),

and disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Requirements) may otherwise have with

respect thereto, the Nil Paid Rights, Fully Paid Rights and the New

Ordinary Shares have been subject to a product approval process,

which has determined that they each are: (a) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in Chapter 3 of the FCA Handbook Conduct of Business

Sourcebook; and (b) eligible for distribution through all permitted

distribution channels (the " Target Market Assessment ").

Notwithstanding the Target Market Assessment, "distributors" (for

the purposes of the UK Product Governance Requirements) should note

that: the price of the Nil Paid Rights, Fully Paid Rights and the

New Ordinary Shares may decline and investors could lose all or

part of their investment; the Nil Paid Rights, Fully Paid Rights

and the New Ordinary Shares offer no guaranteed income and no

capital protection; and an investment in the Nil Paid Rights, Fully

Paid Rights and the New Ordinary Shares is compatible only with

investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to any contractual, legal or

regulatory selling restrictions in relation to the Rights Issue.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Underwriters will only procure investors who meet

the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (i) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A, respectively, of the FCA

Handbook Conduct of Business Sourcebook; or (ii) a recommendation

to any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to, the Nil Paid

Rights, Fully Paid Rights and the New Ordinary Shares. Each

distributor is responsible for undertaking its own target market

assessment in respect of the Nil Paid Rights, Fully Paid Rights and

the New Ordinary Shares and determining appropriate distribution

channels.

FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements, including

with respect to financial information, that are based on current

expectations or beliefs, as well as assumptions about future

events. These forward-looking statements can be identified by the

fact that they do not relate only to historical or current facts.

In some cases, forward-looking statements use words such as

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "will", "may", "should", "would", "could", "is

confident", or other words of similar meaning.

None of the Company, its officers, advisers or any other person

gives any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements in this announcement will actually

occur, in part or in whole.

No undue reliance should be placed on any such statements

because they speak only as at the date of this announcement and, by

their very nature, they are subject to known and unknown risks and

uncertainties and can be affected by other factors that could cause

actual results, and the Company's plans and objectives, to differ

materially from those expressed or implied in the forward-looking

statements. No representation or warranty is made that any

forward-looking statement will come to pass. You are advised to

read the Prospectus when published and the information incorporated

by reference therein in their entirety, and, in particular, the

section of the Prospectus headed "Risk Factors", for a further

discussion of the factors that could affect the Group's future

performance and the industry in which it operates. In light of

these risks, uncertainties and assumptions, the events described in

the forward-looking statements, including statements regarding

prospective financial information, in this announcement may not

occur. In addition, even if the Group's actual results of

operations, financial condition and the development of the business

sectors in which it operates are consistent with the

forward-looking statements contained in the Prospectus, those

results or developments may not be indicative of results or

developments in subsequent periods. These statements are not fact

and should not be relied upon as being necessarily indicative of

future results, and readers of this announcement are cautioned not

to place undue reliance on the forward-looking statements,

including those regarding prospective financial information.

No statement in this announcement is intended as a profit

forecast or estimate for any period, and no statement in this

announcement should be interpreted to mean that underlying

operating profit for the current or future financial years would

necessarily be above a minimum level, or match or exceed the

historical published operating profit or set a minimum level of

operating profit, nor that earnings or earnings per share or

dividend per share for the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share or dividend per share for

the Company.

Neither the Company nor any of the Underwriters are under any

obligation to update or revise publicly any forward-looking

statement contained within this announcement, whether as a result

of new information, future events or otherwise, other than in

accordance with their legal or regulatory obligations (including,

for the avoidance of doubt, the Prospectus Regulation Rules, the

Listing Rules, MAR, FSMA and Disclosure Guidance and Transparency

Rules). Additionally, statements of the intentions or beliefs of

the board of directors of the Company reflect the present

intentions and beliefs of the board of directors of the Company as

at the date of this announcement and may be subject to change as

the composition of the board of directors of the Company alters, or

as circumstances require.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ALSUVRBRORUKUAR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

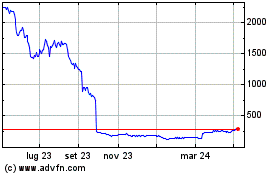

Grafico Azioni Synthomer (LSE:SYNT)

Storico

Da Mar 2024 a Apr 2024

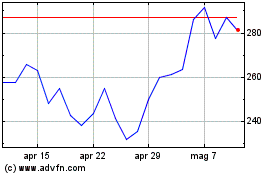

Grafico Azioni Synthomer (LSE:SYNT)

Storico

Da Apr 2023 a Apr 2024