TIDMTRP

RNS Number : 2590B

Tower Resources PLC

30 September 2022

30 September 2022

Tower Resources plc

Interim Results to 30 June 2022

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM-listed oil and gas company with its focus on Africa,

announces its Interim Results for the six months ended 30 June

2022.

HIGHLIGHTS

-- January 2022 - Placing of 576,923,077 new ordinary shares at

0.26p to raise GBP1.5 million (gross), with the Company's Chairman

and CEO, Jeremy Asher, subscribing for 9,615,384 new Ordinary

Shares in the Placing for GBP25,000 ;

-- February 2022 - Announcements by the National Petroleum

Corporation of Namibia, Shell Namibia Upstream B.V. and

QatarEnergy, regarding the drilling success of the Graff-1 well on

PEL 39 with discoveries in both its primary and secondary targets,

proving a working petroleum system for light oil in the Orange

Basin, offshore Namibia, and analysis by the Company of the

implications for its own Namibian blocks;

-- May 2022 - The Cameroon Minister of Mines, Industry and

Technological Development (MINMIDT) granted a further extension of

the First Exploration Period of the Thali PSC to 11 May 2023.

-- June 2022 - Tower Resources Cameroon SA executed a term sheet

with BGFI Bank Group, the largest bank group in Central Africa, for

a medium term loan of CAF 4.42 billion (equivalent to approximately

US$7.1 million) as partial financing of the NJOM-3 well on the

Thali block in Cameroon. The loan would cover around 40% of the

US$18 million well cost, with a further amount in excess of 25%

already having been paid for by TRCSA, and the balance of 35% of

the cost of the well also to be funded by TRCSA.

POST REPORTING PERIOD EVENTS

-- August 2022 - Placing of 857,142,286 new ordinary shares at

0.175p to raise GBP1.5 million (gross) with the Company's Chairman

and CEO, Jeremy Asher, subscribing for 142,857,143 new Ordinary

Shares in the Placing for GBP250,000;

-- August 2022 - Issue of 11,200,000 Ordinary shares in the

Company to Bedrock Drilling Ltd in lieu of fees to the value of

GBP25,200.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill + 44 20 3470

Caroline Rowe 0470

Novum Securities Ltd

Joint Broker

Jon Bellis + 44 20 7399

Colin Rowbury 9400

Panmure Gordon (UK) Limited

Joint Broker

John Prior + 44 20 7886

Hugh Rich 2500

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE SIX

MONTHSED 30 JUNE 2022

Dear Shareholder,

The first six months of 2022 have seen our Company making

significant progress in a volatile environment, and against a

backdrop of encouraging drilling results in Namibia. The more

active market for rigs and services has presented both benefits and

challenges: a number of stacked rigs have been put back into

service, but several of these have been pulled into other markets

and others are still finalising work sequences, while lead times

for services have increased. This means that we have yet to

finalise our rig selection and timing for the NJOM-3 well, as we

need to fit our single-well requirement in with other companies'

multi-well plans. This may still result in a spud before year-end,

but is more likely to be in the New Year; however there are a

number of options available to us, and therefore we still expect to

get the well underway in good time.

We have also made progress with the financing of the NJOM-3

well. We received and agreed a non-binding term sheet for around

US$7 million of debt financing from BGFI, the largest bank in

Cameroon, in June, and BGFI tell us that they are still expecting

to have their board's binding approval and draft documentation in

September (today) or shortly after. In the meantime, we also

received a non-binding term sheet for around US$10 million of debt

financing from another bank, the Cameroon branch of one of the

largest and oldest banks on the African continent, which we are

presently reviewing. However we proceed, the final agreement will

of course be subject to, inter alia, the execution of definitive

documents.

In South Africa, we have watched closely the litigation in

respect of Shell's proposed seismic survey. Our understanding is

that the South African court found what appear to be deficiencies

in the process by which Shell and their partners had conducted

Environmental Impact Assessments ("EIA") prior to the survey. Our

current view is that this should not prevent conducting of the

intended survey over the deepwater lead in our Algoa-Gamtoos block,

that we and operator NewAge have identified on trend with

TotalEnergies' Brulpadda and Luiperd discoveries in the Outeniqua

basin. However, it does emphasise how critical the correct EIA

process is. We believe that our deepwater area is less

environmentally sensitive than the area that was subject to the

recent controversy, and shareholders will recall that we have

already conducted seismic data acquisition in this block closer to

shore. Nevertheless, it is now even clearer than before that the

EIA and planning process cannot be rushed, which we believe the

Petroleum Authority of South Africa also understands.

Given the scale of the potential prize in the Shallow and Deep

sections of the Deepwater Slope and the Deepwater Basin Floor fan

in our Algoa-Gamtoos block, comprising some 1.4 billion boe of

pMean unrisked recoverable resources, we certainly plan to push

ahead with the acquisition and processing of 3D seismic data over

these leads, to firm up a drillable prospect, before entering the

final exploration period of the Algoa-Gamtoos license.

In Namibia, we are in the process of completing the initial

phase of basin modelling work on our PEL96 license, and will be

sharing publicly what we can of that work in the coming weeks. The

focus of this preliminary phase has been on analysing the spatial

distribution of the source rocks, hydrocarbon generative kitchens

and migration pathways in the southern and central area of the

license, serving the numerous leads we had already identified in

the Dolphin Graben. We turned to this area first because in the

past less work had been done there, due to the interest that we and

our previous partners understandably showed in the giant geological

structures in the more western portion of the license area.

However, we now feel that the Dolphin Graben warrants more detailed

charge modelling work to understand the hydrocarbon generation and

migration history in this area, because of the recent drilling

success in the southern Namibian offshore, and also the Wingat-1

and Murombe-1 wells having encountered well-developed source rocks

in the Walvis Basin as well.

Shareholders may recall that the source rocks encountered in the

Wingat-1 and Murombe-1 wells were rich in organic carbon, and in

the oil window, and both wells recovered 38 - 42 oil to surface;

and that the well 1911/15-1 on our own block also encountered

source rocks and oil shows. It now appears that the Lower

Cretaceous source rocks extend all the way from the Orange Basin,

where TotalEnergies and Shell have had their recent successes, up

to the Walvis Basin, as we discussed in our announcement in

February. Therefore, the current phase of work identifies the

potential of these source rocks to provide oil to the various

structural closures and potential stratigraphic traps, of similar

geometry to those encountered in the recent Orange basin

discoveries, identified in the Dolphin Graben area. Our previous

analysis identified several structural closures with individual

examples ranging up to 686 million boe in potential recoverable

resources, and this is the analysis that we are updating now.

However, we still need to continue basin modelling work on the

other potential source rocks and potential generative kitchens

where significant volumes of oil could have potentially been

generated and expelled in the license area. These have the

potential to feed the giant structural closures on the license

area, to the West and North. Therefore the basin modelling over the

rest of the license area will remain a work in progress for a few

more months.

We are working on a multi-client program to acquire the 3D

seismic data required for our final prospect evaluation and

prioritisation on PEL96, which is tentatively scheduled to begin in

Q4 2023. To this end, we have authorised initial expenditure on an

EIA in respect of this proposed program.

In summary, we are continuing to make progress in Cameroon and

Namibia; and despite the legal issues Shell has faced in South

Africa we are confident that we can still move forward there,

albeit with caution. We want to drill as soon as we can in Cameroon

in particular, and this continues to be our immediate priority.

Jeremy Asher

Chairman and Chief Executive

30 September 2022

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Six months ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

Note $ $

-------------------------------------------- ----- ------------------ --- -----------------

Revenue - -

Cost of sales - -

-------------------------------------------- ----- ------------------ --- -----------------

Gross profit - -

Other administrative expenses (520,416) (429,463)

VAT provision - 519,912

-------------------------------------------- ----- ------------------ --- -----------------

Total administrative expenses (520,416) 90,449

Group operating loss (520,416) 90,449

Finance expense (1,711) (129,907)

-------------------------------------------- ----- ------------------ --- -----------------

Loss for the period before taxation (522,127) (39,458)

Taxation - -

-------------------------------------------- ----- ------------------ --- -----------------

Loss for the period after taxation (522,127) (39,458)

-------------------------------------------- ----- ------------------ --- -----------------

Other comprehensive income - -

-------------------------------------------- ----- ------------------ --- -----------------

Total comprehensive expense for the period (522,127) (39,458)

-------------------------------------------- ----- ------------------ --- -----------------

Basic loss per share (USc) 3 (0.03c) (0.11c)

-------------------------------------------- ----- ------------------ --- -----------------

Diluted loss per share (USc) 3 (0.03c) (0.11c)

-------------------------------------------- ----- ------------------ --- -----------------

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 2021 31 December 2021

(unaudited) (audited)

Note $ $

----------------------------------- ----- -------------- -----------------

Non-current assets

Exploration and evaluation assets 4 29,566,534 28,780,391

----------------------------------- ----- -------------- -----------------

29,566,534 28,780,391

Current assets

Trade and other receivables 5 10,966 8,239

Cash and cash equivalents 95,082 10,227

----------------------------------- ----- -------------- -----------------

106,048 18,466

Total assets 29,672,582 28,798,857

----------------------------------- ----- -------------- -----------------

Current liabilities

Trade and other payables 6 1,629,751 2,336,336

Borrowings 7 12,357 13,801

----------------------------------- ----- -------------- -----------------

1,642,108 2,350,137

Non-current liabilities

Borrowings 7 35,625 46,548

----------------------------------- ----- -------------- -----------------

35,625 46,548

Total liabilities 1,677,733 2,396,685

----------------------------------- ----- -------------- -----------------

Net assets 27,994,849 26,402,172

----------------------------------- ----- -------------- -----------------

Equity

Share capital 8 18,272,712 18,264,803

Share premium 8 150,616,116 148,747,595

Retained losses (140,893,979) (140,610,226)

----------------------------------- ----- -------------- -----------------

Total shareholders' equity 27,994,849 26,402,172

----------------------------------- ----- -------------- -----------------

Signed on behalf of the Board of Directors

Jeremy Asher

Chairman and Chief Executive

30 September 2022

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share (1) Share-based Retained Total

capital premium payments losses

reserve

$ $ $ $ $

At 1 January 2021 18,254,040 145,343,446 8,187,337 (149,813,573) 21,971,250

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 5,521 1,767,869 - - 1,773,390

Shares issued on settlement of third-party

fees 273 88,330 - - 88,603

Share issue costs - (92,046) - - (92,046)

Share based payment charges - - 206,221 - 206,221

Total comprehensive income for the period - - - (39,458) (39,458)

At 30 June 2021 18,259,834 147,107,599 8,393,558 (149,853,031) 23,907,960

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 4,882 2,070,374 - - 2,075,256

Shares issued on settlement of third-party

fees 87 21,738 - - 21,825

Share issue costs - (452,116) - - (452,116)

Share based payment charges - - 762,490 - 762,490

Transfer to retained losses - - (6,272,250) 6,272,250 -

Total comprehensive expense for the period - - - 86,757 86,757

At 31 December 2021 18,264,803 148,747,595 2,883,798 (143,494,024) 26,402,172

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 7,909 2,048,242 - - 2,056,151

Shares issued on settlement of third-party - - - - -

fees

Shares issue costs - (179,721) - - (179,721)

Total comprehensive income for the period - - 238,374 (522,127) (283,753)

At 30 June 2022 18,272,712 150,616,116 3,122,172 (144,016,151) 27,994,849

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

(1) The share-based payment reserve has been included within the

retained loss reserve and is a non-distributable reserve.

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Six months ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

Note $ $

----------------------------------------------------------------------- ----- ------------------ -----------------

Cash outflow from operating activities

Group operating (loss) / profit for the period (520,416) 90,449

Share-based payments 9 238,374 206,221

Finance costs (1,201) (769)

----------------------------------------------------------------------- ----- ------------------ -----------------

Operating cash flow before changes in working capital (283,243) 295,901

Increase in receivables and prepayments (2,727) (14,470)

Decrease in trade and other payables (706,585) (539,234)

----------------------------------------------------------------------- ----- ------------------ -----------------

Cash used in operating activities (992,555) (257,803)

----------------------------------------------------------------------- ----- ------------------ -----------------

Investing activities

Exploration and evaluation costs 4 (786,143) (861,881)

Net cash used in investing activities (786,143) (861,881)

----------------------------------------------------------------------- ----- ------------------ -----------------

Financing activities

Cash proceeds from issue of ordinary share capital net of issue costs 8 1,876,430 1,769,947

Repayment of borrowing facilities (6,433) (501,154)

Repayment of interest on borrowing facilities (676) (35,142)

Effects of foreign currency movements on borrowing facilities (5,769) 1,010

----------------------------------------------------------------------- ----- ------------------ -----------------

Net cash from financing activities 1,863,553 1,234,660

----------------------------------------------------------------------- ----- ------------------ -----------------

Increase in cash and cash equivalents 84,855 114,976

Cash and cash equivalents at beginning of period 10,227 10,054

----------------------------------------------------------------------- ----- ------------------ -----------------

Cash and cash equivalents at end of period 95,082 125,030

----------------------------------------------------------------------- ----- ------------------ -----------------

NOTES TO THE INTERIM FINANCIAL INFORMATION

1. Accounting policies

a) Basis of preparation

This interim financial report, which includes a condensed set of

financial statements of the Company and its subsidiary undertakings

("the Group"), has been prepared using the historical cost

convention and based on International Financial Reporting Standards

("IFRS") including IAS 34 'Interim Financial Reporting' and IFRS 6

'Exploration for and Evaluation of Mineral Reserves', as adopted by

the United Kingdom ("UK").

The condensed set of financial statements for the six months

ended 30 June 2022 is unaudited and does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. They

have been prepared using accounting bases and policies consistent

with those used in the preparation of the audited financial

statements of the Company and the Group for the year ended 31

December 2021 and those to be used for the year ending 31 December

2022. The comparative figures for the half year ended 30 June 2021

are unaudited. The comparative figures for the year ended 31

December 2021 are not the Company's full statutory accounts but

have been extracted from the financial statements for the year

ended 31 December 2021 which have been delivered to the Registrar

of Companies and the auditors' report thereon was unqualified and

did not contain a statement under sections 498(2) and 498(3) of the

Companies Act 2006.

This half-yearly financial report was approved by the Board of

Directors on 30 September 2022.

b) Going concern

The Group will need to complete its farm-out and/or another

asset-level transaction within the coming months, or otherwise

raise further funds, in order to meet its liabilities as they fall

due, particularly with respect to the forthcoming drilling

programme in Cameroon. The Directors believe that there are a

number of options available to them through either, or a

combination of, capital markets, farm-outs or asset disposals with

respect to raising these funds. There can, however, be no guarantee

that the required funds may be raised, or transactions completed

within the necessary timeframes, which raises uncertainty as to the

application of going concern in these accounts. Having assessed the

risks attached to these uncertainties on a probabilistic basis, the

Directors are confident that they can raise sufficient finance in a

timely manner and therefore believe that the application of going

concern is both appropriate and correct.

2. Operating segments

The Group has two reportable operating segments: Africa and Head

Office. Non-current assets and operating liabilities are located in

Africa, whilst the majority of current assets are carried at Head

Office. The Group has not yet commenced production and therefore

has no revenue. Each reportable segment adopts the same accounting

policies. In compliance with IAS 34 'Interim Financial Reporting'

the following table reconciles the operational loss and the assets

and liabilities of each reportable segment with the consolidated

figures presented in these Financial Statements, together with

comparative figures for the period-ended 30 June 2021.

Africa Head Office Total

Six months Six months Six months Six months Six months Six months

ended ended ended ended ended ended

30 June 2022 30 June 2021 30 June 2022 30 June 30 June 2022 30 June 2021

2021

$ $ $ $ $ $

-------------- ------------- ------------- -------------- ------------ -------------- --------------

Loss by

reportable

segment 22,076 (65,611) 500,051 105,069 522,127 39,458

Total assets

by

reportable

segment (1) 29,592,742 27,954,857 79,840 135,531 29,672,582 28,090,388

-------------- ------------- ------------- -------------- ------------ --------------

Total

liabilities

by

reportable

segment (2) (1,359,118) (2,384,500) (318,615) (1,797,928) (1,677,733) (4,182,428)

-------------- ------------- ------------- -------------- ------------ -------------- --------------

(1) Carrying amounts of

segment assets exclude

investments in

subsidiaries.

(2) Carrying

amounts of

segment

liabilities

exclude

intra-group

financing.

3. Loss per ordinary share

Basic & Diluted

30 June 2022 31 December 2021

(unaudited) (audited)

$ $

--------------------------------------------------------------------- --- -------------- ------------------

(Loss) / profit for the period (522,127) 47,299

Weighted average number of ordinary shares in issue during the period 1,857,595,225 1,865,280,160

Dilutive effect of share options outstanding - 35,416,521

Fully diluted average number of ordinary shares during the period 1,857,595,225 1,900,696,681

(Loss) / profit per share (USc) (0.03c) 0.00c

-------------------------------------------------------------------------- -------------- ------------------

4. Intangible Exploration and Evaluation (E&E) assets

Exploration and evaluation assets Goodwill Total

Period-ended 30 June 2022 $ $ $

---------------------------------- ------------ -------------

Cost

At 1 January 2022 100,788,853 8,023,292 108,812,145

Additions during the period 786,143 - 786,143

At 30 June 2022 101,574,996 8,023,292 109,598,288

------------------------------- ---------------------------------- ------------ -------------

Amortisation and impairment

At 1 January 2022 (72,008,462) (8,023,292) (80,031,754)

At 1 January and 30 June 2022 (72,008,462) (8,023,292) (80,031,754)

------------------------------- ---------------------------------- ------------ -------------

Net book value

At 30 June 2022 29,566,534 - 29,566,534

At 31 December 2021 28,780,391 - 28,780,391

------------------------------- ---------------------------------- ------------ -------------

In accordance with the Group's accounting policies and IFRS 6

the Directors' have reviewed each of the exploration license areas

for indications of impairment. Having done so, based on the

financial constraints on the Group, and specific issues associated

with each license it was concluded that a full ongoing impairment

was only necessary in the case of the Zambian licenses 40 and 41,

the circumstances of which have not changed since previous

reporting period.

The additions during the period represent Cameroon $618k (2021:

$587k), $54k in South Africa (2021: $197k) and $115k in Namibia

(2021: $77k). The focus of the Group's activities during this

period has been on preparing for and acquiring inventory and

services with respect to the anticipated drilling of the Njonji-3

appraisal well alongside ongoing subsurface evaluation in

Namibia.

5. Trade and other receivables

30 June 2022 31 December 2021

(unaudited) (audited)

$ $

----------------------------- -------------- ------------------

Trade and other receivables 10,966 8,239

----------------------------- -------------- ------------------

Trade and other receivables comprise prepaid expenditures.

6. Trade and other payables

30 June 2022 31 December 2021

(unaudited) (audited)

$ $

--------------------------------- -------------- ------------------

Trade and other payables 289,950 272,627

Work programme-related accruals 1,191,825 1,847,575

Other accruals 128,583 144,160

VAT payable 19,393 71,974

1,629,751 2,336,336

--------------------------------- -------------- ------------------

The future ability of the Group to recover UK VAT has been

confirmed by the Upper Tier Tribunal in its judgement in favour of

the Company on 20 May 2021 and is no longer the subject of a

dispute with HMRC.

Work programme-related accruals of $1.2 million (2021: $1.8

million) comprise $422k with respect to Cameroon (2021: $1.1

million) and $769k with respect to South Africa (2021: $723k).

7. Borrowings

Group

30 June 2022 31 December 2021

(unaudited) (audited)

$ $

-------------------------------------------- -------------- ------------------

Principal balance at beginning of period 59,532 1,338,726

Amounts drawn down during the period - -

Amounts repaid during the period (6,433) (1,278,451)

Currency revaluations at year end (5,695) (743)

-------------------------------------------- -------------- ------------------

Principal balance at end of period 47,404 59,532

Financing costs at beginning of year 818 (7,026)

Changes to financing costs during the year - 47,383

Interest expense 510 99,997

Interest paid (676) (139,516)

Currency revaluations at year end (74) (20)

-------------------------------------------- -------------- ------------------

Financing costs at the end of the year 577 818

Carrying amount at end of period 47,982 60,349

-------------------------------------------- -------------- ------------------

Current 12,357 13,801

Non-current 35,625 46,548

Repayment dates Group

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

-------------------------------------------- -------------- ------------------

Due within 1 year 12,357 13,801

Due within years 2-5 35,625 46,548

Due in more than 5 years - -

47,982 60,349

-------------------------------------------- -------------- ------------------

During the period, the Group and Company entered into no new

facilities (2021: $nil).

On 21 January 2021, the Company repaid in full the $500k loan

facility with Shard Merchant Capital Ltd. The terms of the Shard

Facility included the issue of 31,446,541 attached three-year

warrants at a strike price of 0.6 pence and 5,761,198 shares to

pre-pay interest charged at 12% per annum. The loan was secured by

a fixed and floating charge over the Company's assets in favour of

Shard Merchant Capital Ltd. The repayment of the loan included

facility transaction costs of $35k.

On 4 March 2021, the Pegasus Petroleum Limited loan facility, to

which Jeremy Asher is a controlling party, was extended to the end

of November 2021. Consideration for the extension comprised an

increase in the production-based payments, the amount depending on

whether the loan would be repaid by 15 July or only in November

2021. Additionally, simple interest would accrue at 12% per annum

pro rata, commencing on 4 March 2021, and would only be paid at the

end of the facility period. The 15 July date was subsequently

extended to 20 August 2021, with the production-based payments

effectively limited to 3.75% of the Contractor share of revenues

from the production sharing contract, net of the Government share

and net of all Petroleum Taxes, and the facility was fully repaid

on 20 August 2021.

8. Share capital

30 June 2022 31 December 2021

(unaudited) (audited)

$ $

--------------------------------------------------------------- --- -------------- ------------------

Authorised, called up, allotted and fully paid

2,686,095,669 (2021: 2,109,172,592) ordinary shares of 0.001p 18,272,712 18,264,803

-------------------------------------------------------------------- -------------- ------------------

The share capital issues during the period are summarised

below:

Number of shares Share capital at nominal value Share premium

Ordinary shares $ $

------------------------- ----------------- ------------------------------- --------------

At 1 January 2022 2,109,172,592 18,264,803 148,747,595

Shares issued for cash 576,923,077 7,909 2,048,242

Share issue costs - - (179,721)

At 30 June 2022 2,686,095,669 18,272,712 150,616,116

------------------------- ----------------- ------------------------------- --------------

9. Share-based payments

In the Statement of Comprehensive Income the Group recognised the following charge in respect 30 June 2022 31 December 2021

of its share-based payment plan:

(unaudited) (audited)

------------------------------------------------------------------------------------------------

$ $

------------------------------------------------------------------------------------------------ -------------- ------------------

Share-based payment charges incurred on incentivisation of staff included within administrative

expenses (158,101) (153,039)

Share-based payment charges incurred on incentivisation of consultants included within

administrative

expenses (34,417) (11,066)

Share-based payment charges recharged to subsidiary undertakings on incentivisation of staff

and consultants (14,861) (42,116)

Share-based payment charges incurred on shares issued for cash (30,995) -

(238,374) (206,221)

------------------------------------------------------------------------------------------------ -------------- ------------------

Share-based payment charges incurred on issue of options and warrants as part of loan financing

facilities included within finance expense - (28,183)

Total share-based payment plan charges for the period (238,374) (234,404)

------------------------------------------------------------------------------------------------ -------------- ------------------

Options

Details of share options outstanding at 30 June 2022 are as

follows:

Number in issue

--------------------------- ----------------

At 1 January 2022 244,000,000

Awarded during the period -

Lapsed during the period -

--------------------------- ----------------

At 30 June 2022 244,000,000

----------------------------- ----------------

Date of grant Number in issue Option price (p) Latest exercise date

--------------- ---------------- ----------------- ---------------------

24 Jan 19 70,000,000 1.250 24 Jan 24

18 Dec 20 86,000,000 0.450 18 Dec 25

01 Apr 21 88,000,000 0.450 01 Apr 26

244,000,000

--------------- ---------------- ----------------- ---------------------

These options vest in the beneficiaries in equal tranches on the

first, second and third anniversaries of grant.

Warrants

Details of warrants outstanding at 30 June 2022 are as

follows:

Number in issue

At 1 January 2022 806,635,644

Awarded during the period 44,239,618

Lapsed during the period (92,212,000)

At 30 June 2022 758,663,262

----------------------------- ----------------

Date of grant Number in issue Warrant price (p) Latest exercise date

--------------- ---------------- ------------------ ---------------------

09 Nov 17 31,853,761 1.000 09 Nov 22

01 Jan 18 2,542,372 1.000 01 Jan 23

01 Apr 18 2,083,333 1.500 01 Apr 23

01 Jul 18 2,272,726 1.780 30 Jun 23

01 Oct 18 4,687,500 1.575 30 Sep 23

24 Jan 19 19,999,999 1.200 23 Jan 24

16 Apr 19 90,000,000 1.000 14 Apr 24

30 Jun 19 4,285,714 1.000 28 Jun 24

30 Jul 19 3,000,000 1.000 28 Jul 24

15 Oct 19 191,365,084 1.000 13 Oct 24

31 Mar 20 49,816,850 0.200 30 Mar 25

29 Jun 20 19,719,338 0.350 28 Jun 25

28 Aug 20 78,616,352 0.600 28 Aug 23

01 Oct 20 10,960,907 0.390 30 Sep 25

01 Dec 20 4,930,083 0.375 30 Nov 25

31 Dec 20 12,116,316 0.450 30 Dec 25

01 Apr 21 16,998,267 0.450 31 Mar 26

01 Jul 21 24,736,149 0.250 30 Jun 26

14 Jan 21 128,205,128 0.650 14 Jan 23

01 Oct 21 16,233,765 0.425 30 Sep 26

01 Jan 22 17,329,020 0.425 01 Jan 27

13 Jan 22 7,058,824 0.425 12 Jan 27

01 Apr 22 19,851,774 0.263 01 Apr 27

758,663,262

--------------- ---------------- ------------------ ---------------------

10. Subsequent events

1 July 2022: Issue of warrants in lieu of GBP30,000 (in

aggregate) of Directors fees to Paula Brancato (3,366,248

warrants), Mark Enfield (3,366,248 warrants), and Jeremy Asher

(6,732,496 warrants) in settlement of fees due for the period from

1 July 2022 to 30 September 2022. The warrants are exercisable at a

strike price of 0.295 pence, which is the same as the closing share

price of 0.295 pence per share on 30 June 2022. The warrants are

exercisable for a period of 5 years from the date of issue.

2 August 2022: Placing and subscription for approximately

857,142,286 new ordinary shares of 0.001 pence each raising gross

proceeds of GBP1,499,999 at a price of 0.175 pence per Placing

Share. The Company also issued a broker warrant in favour of Novum

granting it the right to acquire 10,588,228 ordinary shares for a

period of two years at a price of 0.425p per share. While the

financing discussions in respect of the NJOM-3 well are concluded,

the funds have been raised in preparation for the drilling of the

NJOM-3 well, including payments on account of services associated

with the well, and for working capital purposes via the Placing and

subscription. A small portion of the funds raised will also be used

to advance the Company's other 2022 work programs in Namibia and

South Africa, including the basin modelling work currently underway

on the Company's Namibian license PEL 96.

16 August 2022: Grant of Options under Annual Long Term

Incentive Plan over a total of 148 million new ordinary shares in

the capital of the Company were awarded at an exercise price of

0.30 pence per ordinary share, being a premium of 48% over the

closing price of the Shares on that day. The Options will vest in

three equal tranches being 12, 24 and 36 months respectively after

issue and will expire, if not previously exercised, on the fifth

anniversary of their issue, and will be governed by the terms of

the Company's existing share option scheme. The award of options

under the Long-Term Incentive plan is an annual event, which

normally takes place in the first quarter of each year, but was

delayed in 2022 due to a closed period and other factors.

30 August 2022: Issue of 11,200,000 Ordinary shares in the

Company to Bedrock Drilling Ltd on 27 August 2022 in lieu of fees

to the value of GBP25,200. The Company has issued shares in lieu of

fees on previous occasions to Bedrock Drilling, which provides well

project management, well engineering services and drilling

consultancy services to Tower's operations on the Thali block,

offshore Cameroon, both to reduce cash costs and above all to align

long term incentives with our well management team.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LLMBTMTMTTLT

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

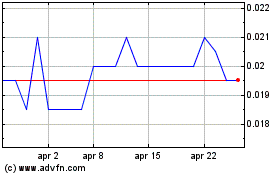

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024