TIDMUEM

RNS Number : 3315Q

Utilico Emerging Markets Trust PLC

17 February 2023

17 February 2023

UTILICO EMERGING MARKETS TRUST PLC

(LEI Number: 2138005TJMCWR2394O39)

Publication of monthly factsheet

The latest monthly factsheet for Utilico Emerging Markets Trust

plc ("UEM" or the "Company") will shortly be available through the

Company's website at:

https://www.uemtrust.co.uk/investor-relations/factsheet-archive

Monthly commentary

PERFORMANCE

UEM's NAV total return increased by 4.1% in January, which was

behind the MSCI Emerging Markets total return Index which was up by

5.9% in Sterling terms for the period.

Markets were mostly upbeat in January, helped by improved

sentiment on China's re-opening and indications that inflation was

easing across many major economies. In the US headline CPI fell to

6.5% from 7.1%, with the Federal Bank hinting at a nearing of the

end of the rate increase cycle, helping propel the S&P 500

Index which was up by 6.2% in the month. European markets were even

stronger, with the Eurostoxx up 9.7% as the Eurozone PMI hit a

seven-month high.

EM benefitted from the risk-on environment. In China the

manufacturing PMI surprised positively at 50.1 in January, up from

47.0 in December 2022, hitting expansionary territory after four

months of sequential contraction. The service sector also jumped,

as several large cities announced that Covid virus caseloads had

peaked mid-month, prompting many to travel and socialise in the

Lunar New Year celebrations. According to the Ministry of Culture

and Tourism spending during the holiday recovered by 30% from a

year ago. Hong Kong's Hang Seng Index was up 10.4% and the Shanghai

Composite rose by 5.4% in January.

In Brazil, President Lula unsettled markets with statements on

enhancing social programs, loosening the fiscal regime and

inflation targets, and questioning the independence of the Central

Bank. Bolsanaro-supporting protesters stormed the Congress in the

country's capital. Against this turbulent backdrop, the Bovespa

still managed a 3.4% gain. Meanwhile, the markets in Mexico,

Vietnam and Korea performed strongly, with the Mexico Bolsa up

12.6%, the Ho Chi Minh Index up 10.3%, and the Kospi up 8.4%.

Indian markets notably underperformed, with the Sensex falling

2.1% in January. This was mainly due to the release of a

short-sellers research report into the Adani group companies,

alleging share price manipulation and accounting fraud. At the time

of the report UEM's only direct exposure to an Adani entity was a

small position in Adani Ports which has subsequently been

exited.

Sterling was mixed, strengthening 2.3% against the US Dollar and

1.4% versus the Indian Rupee, but weakening 1.3% against the

Brazilian Real, 4.0% versus the Chilean Peso, and 1.3% against the

Mexican Peso.

PORTFOLIO

The majority of investments in UEM's portfolio posted share

price increases during January, with one change to the top thirty

as Vamos re-entered as its share price rose by 15.7%, replacing

TAV. In Brazil there were robust share price performances for

Santos, up 12.9%, and Orizon, up 14.4%, recovering off of recent

lows. UEM's Mexican airport investments appreciated strongly, with

OMA and GAP's share prices up 14.9% and 16.1% respectively. Both

companies posted continued strong recoveries in passenger numbers,

with GAP guiding for double-digit revenue and EBITDA growth in

2023.

Elsewhere, notable performances were delivered by China Datang

Renewables, with its share price up by 11.7%, Kunlun Energy up

11.0%, and KINX up 16.1%. It was pleasing to see Inpost continue to

deliver good results, beating consensus with volumes up 23% in Q4.

Inpost's share price was up by 12.2% over the month.

Modest positive share price movements were seen elsewhere, with

FPT up 8.9%, China Gas up 7.0%, MyEG up 5.8% and CITIC Telecom up

5.3%. Only five investments in the top thirty saw share price

declines, all of which were comparatively modest - as evidenced by

the worst performance being Telelink, down by 2.2%.

During January, purchases for the portfolio totalled GBP5.8m and

realisations totalled GBP14.9m.

DEBT

UEM's bank debt declined from GBP26.1m to GBP25.2m and was drawn

as EUR 12.0m and USD 18.0m.

OTHER

UEM's share price ended January at 216.00p, up 3.3% over the

month. The discount to NAV widened slightly to 14.0% from 13.3%.

UEM bought back 75,000 shares at a price of 219.00p in the

month.

Name of contact and telephone number for enquiries:

ICM Investment Management Limited +44(0)1372 271486

Charles Jillings / Alastair Moreton

Montfort Communications

Gay Collins, Pippa Bailey +44(0)20 3770 7913

utilico@montfort.london

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKOBQBBKDFBD

(END) Dow Jones Newswires

February 17, 2023 07:50 ET (12:50 GMT)

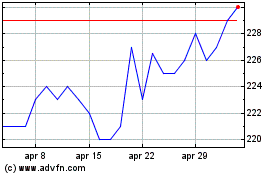

Grafico Azioni Utilico Emerging Markets (LSE:UEM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Utilico Emerging Markets (LSE:UEM)

Storico

Da Apr 2023 a Apr 2024