TIDMVID

RNS Number : 0585U

Videndum PLC

21 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA,

SWITZERLAND, SOUTH KOREA, ISRAEL, SOUTH AFRICA, JAPAN, SINGAPORE

AND THE UNITED STATES AND ANY OTHER JURISDICTION WHERE TO DO SO

WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF

SUCH JURISDICTION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE OR

FORM PART OF A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT.

NOTHING HEREIN SHALL CONSTITUTE OR FORM PART OF ANY OFFER,

INVITATION OR RECOMMATION TO PURCHASE, SELL OR SUBSCRIBE FOR ANY

SECURITIES IN ANY JURISDICTION. NOTHING IN THIS ANNOUNCEMENT SHOULD

BE INTERPRETED AS A TERM OR CONDITION OF THE CAPITAL RAISING.

NOTHING CONTAINED HEREIN SHALL FORM THE BASIS OF OR BE RELIED UPON

IN CONNECTION WITH, OR ACT AS AN INDUCEMENT TO ENTER INTO, ANY

INVESTMENT ACTIVITY. ANY DECISION TO PURCHASE, SUBSCRIBE FOR,

OTHERWISE ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY NEW ORDINARY

SHARES MUST BE MADE ONLY ON THE BASIS OF THE INFORMATION CONTAINED

IN AND INCORPORATED BY REFERENCE INTO THE PROSPECTUS ONCE

PUBLISHED. COPIES OF THE PROSPECTUS WILL, FOLLOWING PUBLICATION, BE

AVAILABLE FROM THE REGISTERED OFFICE OF THE COMPANY AND ON ITS

WEBSITE AT WWW.VIDUM.COM, SUBJECT TO APPLICABLE LAW AND

REGULATIONS. PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS

ANNOUNCEMENT.

21 November 2023

VIDUM PLC

Completion of Bookbuild for Firm Placing and Placing

Further to its announcement yesterday in relation to a Capital

Raising (the " Capital Raise Announcement "), Videndum plc (the "

Company ") is pleased to announce the completion of the Bookbuild

for the Firm Placing and conditional Placing of Open Offer

Shares.

Defined terms in this announcement shall have the meaning

ascribed to them in the Capital Raise Announcement unless otherwise

specified.

Pursuant to the Firm Placing and Placing and Open Offer, a total

of 46,870,787 New Ordinary Shares will be issued at the Offer Price

of 267 pence per New Ordinary Share (subject to the conditions

noted below), raising gross proceeds of approximately GBP125

million. The Offer Price of 267 pence per New Ordinary Share

represents a discount of 3.3% to the Closing Price of 276 pence per

Ordinary Share on 20 November 2023.

The New Ordinary Shares will rank pari passu in all other

respects with the Ordinary Shares currently in issue.

Result of the Firm Placing and the Placing

28,122,472 New Ordinary Shares (" Firm Placed Shares ") have

been placed under the Firm Placing. 18,748,315 New Shares ("

Placing Shares ") have been placed under the Placing, subject to

clawback to satisfy valid applications by Qualifying Shareholders

under the terms of the Open Offer. The Firm Placed Shares are not

subject to clawback and are not part of the Placing and Open

Offer.

Open Offer

The Open Offer will open today with Qualifying Shareholders

having an Open Offer Entitlement of 2 Open Offer Shares for every 5

Existing Ordinary Shares registered in the name of the relevant

Qualifying Shareholder on the Record Date (and so in proportion to

any other Existing Ordinary Shares then held) on the terms and

subject to the conditions set out in the Prospectus (and in the

case of Qualifying Non-CREST Shareholders, the Application Form

which will accompany the Prospectus). Open Offer Entitlements are

expected to be credited to stock accounts in CREST (for Qualifying

CREST Shareholders only) as soon as practicable after 8.00 a.m. on

22 November 2023. The Open Offer is expected to close at 11:00 a.m.

on 6 December 2023.

Further details on the Open Offer are included in the

Prospectus.

Related Party Transactions

Major Shareholders

Alantra is a related party of the Company for the purposes of

the Listing Rules as it is a substantial shareholder of the Company

which is entitled to exercise, or control the exercise of, 21.14%

of the votes able to be cast at general meetings of the Company (as

at the Latest Practicable Date).

The maximum amount to be paid by Alantra for the New Ordinary

Shares to be issued pursuant to the Capital Raising is

approximately GBP30 million. Accordingly, the issue of such New

Ordinary Shares to Alantra is a transaction of sufficient size to

require Shareholder approval under the Listing Rules as Alantra is

a related party, which will be sought at the General Meeting

(Alantra and its affiliates will not vote on this resolution).

The rules regarding related party transactions under paragraphs

11.1.7R to 11.1.10R of the Listing Rules do not apply to any New

Ordinary Shares issued to Alantra as a result of it taking up its

Open Offer Entitlements. Such rules are, however, applicable to any

New Ordinary Shares issued to Alantra pursuant to the Firm Placing

and Placing, the maximum amount to be paid by Alantra for such New

Ordinary Shares being approximately GBP30 million.

Directors

Each Director is a related party of the Company for the purposes

of the Listing Rules. In connection with the Capital Raising, each

of the Directors has agreed to subscribe for additional Ordinary

Shares, which amount to 459,167 Ordinary Shares in aggregate, at

the Offer Price, pursuant to direct subscription agreements with

the Company, conditional upon Admission.

The subscriptions by the Directors pursuant to the Director and

Senior Management Subscriptions are exempt in each case from the

rules regarding related party transactions under chapter 11 of the

Listing Rules due to the size of each Director and Senior

Management Subscription relative to the Company's market

capitalisation. None of the Directors intend to take part in either

the Firm Placing or the Placing and Open Offer.

The Prospectus has been published by Videndum plc and will be

sent to Shareholders that have elected to receive hard copies of

such shareholder documentation as soon as practicable and a copy is

available on the Company's website at

https://videndum.com/investors/proposed-equity-raise/ .

For further information, please contact:

Videndum plc

Stephen Bird, Group Chief Executive

Andrea Rigamonti, Group Chief Financial Officer

Jennifer Shaw, Group Communications Director +44 (0)20 8332 4602

N.M. Rothschild & Sons Limited (Sponsor and Financial Adviser)

Ravi Gupta

John Byrne

Shannon Nicholls

Ricky Paul +44 (0) 20 7280 5000

---------------------

Jefferies International Limited (Joint Global Coordinator and Joint Bookrunner)

Ed Matthews

Lee Morton

Will Soutar +44 (0)20 7029 8000

---------------------

Investec plc (Joint Global Coordinator and Joint Bookrunner)

David Flin

Ben Griffiths

Will Brinkley +44 (0) 20 7597 5970

---------------------

MHP Group (Communications Adviser)

Tim Rowntree

Ollie Hoare

Robert Collett-Creedy +44 (0) 7817 458 804

Christian Harte +44 (0) 7736 464 749

---------------------

Important notices

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy, fairness or completeness. The

information in this announcement is subject to change without

notice.

This announcement is not a prospectus (or a prospectus

equivalent document) but an advertisement for the purposes of the

Prospectus Regulation Rules of the FCA. Neither this announcement

nor anything contained in it shall form the basis of, or be relied

upon in conjunction with, any offer or commitment whatsoever in any

jurisdiction. Investors should not acquire any New Ordinary Shares

referred to in this announcement except on the basis of the

information contained in the Prospectus to be published by the

Company in connection with the Capital Raising.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement. The Prospectus will

provide further details of the New Ordinary Shares being offered

pursuant to the Capital Raising.

This announcement (and the information contained herein) is not

for release, publication, transmission, forwarding or distribution,

directly or indirectly, in whole or in part, in, into or within the

United States of America, its territories and possessions, any

State of the United States or the District of Columbia

(collectively, the " United States "). This announcement is for

information purposes only and is not intended to constitute, and

should not be construed as, an offer to sell or issue, or a

solicitation of any offer to purchase, subscribe for or otherwise

acquire, securities in the United States. Securities may not be

offered or sold in the United States absent registration under the

US Securities Act of 1933, as amended (the " US Securities Act "),

or an exemption therefrom. The New Ordinary Shares have not been

and will not be registered under the US Securities Act or under any

securities laws of any state or other jurisdiction of the United

States and may not be offered, sold, pledged, taken up, exercised,

resold, renounced, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from, or in a transaction not

subject to, the registration requirements of the US Securities

Act and in compliance with any applicable securities laws of any

state or other jurisdiction of the United States. No public

offering of the New Ordinary Shares has been or will be made in the

United States. Subject to certain limited exceptions, Application

Forms have not been, and will not be, sent to, and Open Offer

Entitlements have not been, and will not be, credited to the CREST

account of, any Qualifying Shareholder with a registered address in

or that is known to be located in the United States. None of the

New Ordinary Shares, Open Offer Entitlements, Application Forms,

this announcement or any other document connected with the Capital

Raising has been or will be approved or disapproved by the United

States Securities and Exchange Commission or by the securities

commissions of any state or other jurisdiction of the United States

or any other regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the New Ordinary Shares, or the accuracy or adequacy of the

Application Forms, this announcement or any other document

connected with the Capital Raising. Any representation to the

contrary is a criminal offence in the United States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for New Ordinary Shares or to take up any

entitlements to New Ordinary Shares in any jurisdiction. No offer

or invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for New Ordinary Shares or to take up any

entitlements to New Ordinary Shares will be made in any

jurisdiction in which such an offer or solicitation is unlawful.

The information contained in this announcement and the Prospectus

is not for release, publication or distribution to persons in

Australia, Canada, Switzerland, South Korea, Israel, South Africa,

Japan, Singapore and the United States, and any other jurisdiction

where the extension or availability of the Capital Raising (and any

other transaction contemplated thereby) would breach any applicable

law or regulation, and, subject to certain exceptions, should not

be distributed, forwarded to or transmitted in or into any

jurisdiction, where to do so might constitute a violation of local

securities laws or regulations.

The distribution of this announcement, the Prospectus, the

Application Form and the offering or transfer of New Ordinary

Shares into jurisdictions other than the United Kingdom may be

restricted by law, and, therefore, persons into whose possession

this announcement, the Prospectus, the Application Form and/or any

accompanying documents comes should inform themselves about and

observe any such restrictions. Any failure to comply with any such

restrictions may constitute a violation of the securities laws of

such jurisdiction. In particular, subject to certain exceptions,

this announcement, the Prospectus (once published) and the

Application Forms (once printed) should not be distributed,

forwarded to or transmitted in or into Australia, Canada,

Switzerland, South Korea, Israel, South Africa, Japan, Singapore

and the United States, or any other jurisdiction where the

extension or availability of the Capital Raising (and any other

transaction contemplated thereby) would breach any applicable law

or regulation.

Recipients of this announcement and/or the Prospectus should

conduct their own investigation, evaluation and analysis of the

business, data and property described in this announcement and/or

the Prospectus. This announcement does not constitute a

recommendation concerning any investor's options with respect to

the Capital Raising. The price and value of securities can go down

as well as up. Past performance is not a guide to future

performance. The contents of this announcement are not to be

construed as legal, business, financial or tax advice. Each

shareholder or prospective investor should consult his, her or its

own legal adviser, business adviser, financial adviser or tax

adviser for legal, financial, business or tax advice.

Notice to all investors

Rothschild & Co is authorised and regulated by the FCA in

the United Kingdom. Rothschild & Co is acting exclusively for

Videndum plc and no one else in connection with this announcement

and the Capital Raising will not be responsible to anyone other

than Videndum plc for providing the protections afforded to its

clients nor for providing advice to any person in relation to the

Capital Raising or any matters referred to in this

announcement.

Investec Bank plc (" IBP ") is authorised in the United Kingdom

by the Prudential Regulation Authority and regulated by the FCA and

the Prudential Regulation Authority in the United Kingdom. Investec

Europe Limited (trading as Investec Europe) (" IEL "), acting as

agent on behalf of IBP in certain jurisdictions in the EEA (IBP and

IEL together hereafter referred to as " Investec "), is regulated

in Ireland by the Central Bank of Ireland. Jefferies is authorised

and regulated by the FCA in the United Kingdom. Investec and

Jefferies are acting exclusively for Videndum plc and no one else

in connection with this announcement and the Capital Raising and

will not be responsible to anyone other than Videndum plc for

providing the protections afforded to its clients nor for providing

advice to any person in relation to the Capital Raising or any

matters referred to in this announcement.

None of the Banks, nor any of their respective subsidiaries,

branches or affiliates, nor any of their respective directors,

officers or employees owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Rothschild & Co, Investec or Jefferies in

connection with the Capital Raising, this announcement, any

statement contained herein, or otherwise.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by the Banks, nor any of their respective

subsidiaries, branches, affiliates or agents as to, or in relation

to, the accuracy or completeness of this announcement or any other

information made available to or publicly available to any

interested party or its advisers, whether written, oral or in a

visual or electronic form, and howsoever transmitted or made

available, and any liability therefore is expressly disclaimed.

None of the information in this announcement has been independently

verified or approved by the Banks or any of their respective

affiliates.

The Joint Global Co-ordinators, in accordance with applicable

legal and regulatory provisions, may engage in transactions in

relation to the New Ordinary Shares and/or related instruments for

their own account for the purpose of hedging their underwriting

exposure or otherwise. In connection with the Capital Raising, the

Joint Global Co-ordinators and any of their respective affiliates,

acting as investors for their own accounts may acquire New Ordinary

Shares as a principal position and in that capacity may retain,

acquire, subscribe for, purchase, sell, offer to sell or otherwise

deal for their own accounts in such New Ordinary Shares and other

securities of the Company or related investments in connection with

the Capital Raising or otherwise. Accordingly, references in this

announcement to the New Ordinary Shares being issued, offered,

subscribed, acquired, placed or otherwise dealt in should be read

as including any issue, offer, subscription, acquisition, placing

or dealing by each of the Joint Global Co-ordinators and any of

their respective affiliates acting as investors for their own

accounts. In addition, certain of the Joint Global Co-ordinators or

their respective affiliates may enter into financing arrangements

(including swaps or contracts for difference) with investors in

connection with which such Joint Global Co-ordinators (or their

respective affiliates) may from time to time acquire, hold or

dispose of New Ordinary Shares.

In the event that the Joint Global Co-ordinators acquire New

Shares which are not taken up by Qualifying Shareholders (as

defined in the Prospectus), the Joint Global Co-ordinators may

co-ordinate disposals of such shares in accordance with applicable

law and regulation. Except as required by applicable law or

regulation, the Joint Global Co-ordinators and their respective

affiliates do not propose to make any public disclosure in relation

to such transactions.

Information to distributors

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the " UK Product Governance Requirements "),

and disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Requirements) may otherwise have with

respect thereto the New Ordinary Shares have been subject to a

product approval process, which has determined that they each are:

(a) compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each as defined in Chapter 3 of the FCA

Handbook Conduct of Business Sourcebook; and (b) eligible for

distribution through all permitted distribution channels (the "

Target Market Assessment "). Notwithstanding the Target Market

Assessment, "distributors" (for the purposes of the UK Product

Governance Requirements) should note that: the price of the New

Ordinary Shares may decline and investors could lose all or part of

their investment; the New Ordinary Shares offer no guaranteed

income and no capital protection; and an investment in the New

Ordinary Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such

an investment and who have sufficient resources to be able to bear

any losses that may result therefrom. The Target Market Assessment

is without prejudice to any contractual, legal or regulatory

selling restrictions in relation to the Capital Raising.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Joint Global Co-ordinators will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (i) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A, respectively, of the FCA

Handbook Conduct of Business Sourcebook; or (ii) a recommendation

to any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to, the New Ordinary

Shares. Each distributor is responsible for undertaking its own

target market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCXBLLLXFLBFBV

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

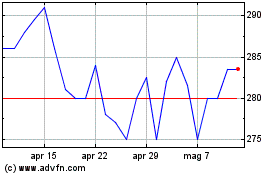

Grafico Azioni Videndum (LSE:VID)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Videndum (LSE:VID)

Storico

Da Nov 2023 a Nov 2024